Borrowing crvUSD from the crvUSD vault on Morpho

Links

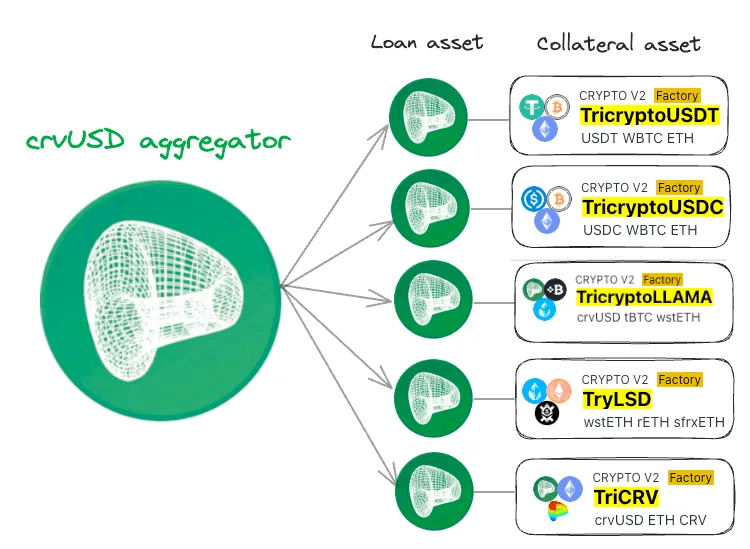

The crvUSD MetaMorpho vault has some unique features that may not be immediately intuitive for new users, so this guide should serve as a basic introduction to leveraging Curve TriCrypto LPs from the vault markets. This step-by-step guide will cover each collateral type comprising the vault markets. The steps described below will involve acquiring the LP collateral token, leveraging on Morpho, monitoring position health, and claiming rewards.

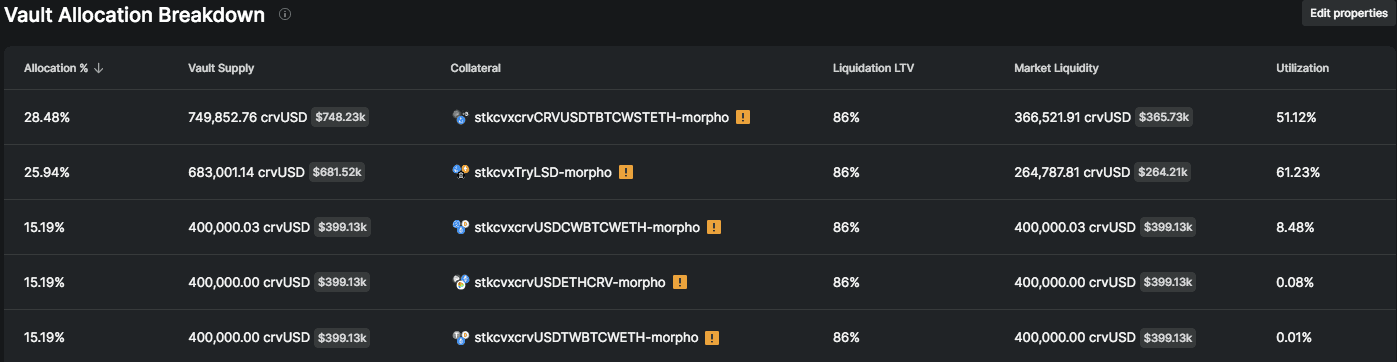

An overview of the vault markets is available on the crvUSD vault page on the Morpho UI. From there, additional analytics related to the vault are available along with analytics related to specific markets.

Source: Morpho crvUSD Vault | Date: June 25, 2024

#TricryptoLLAMA Market

-

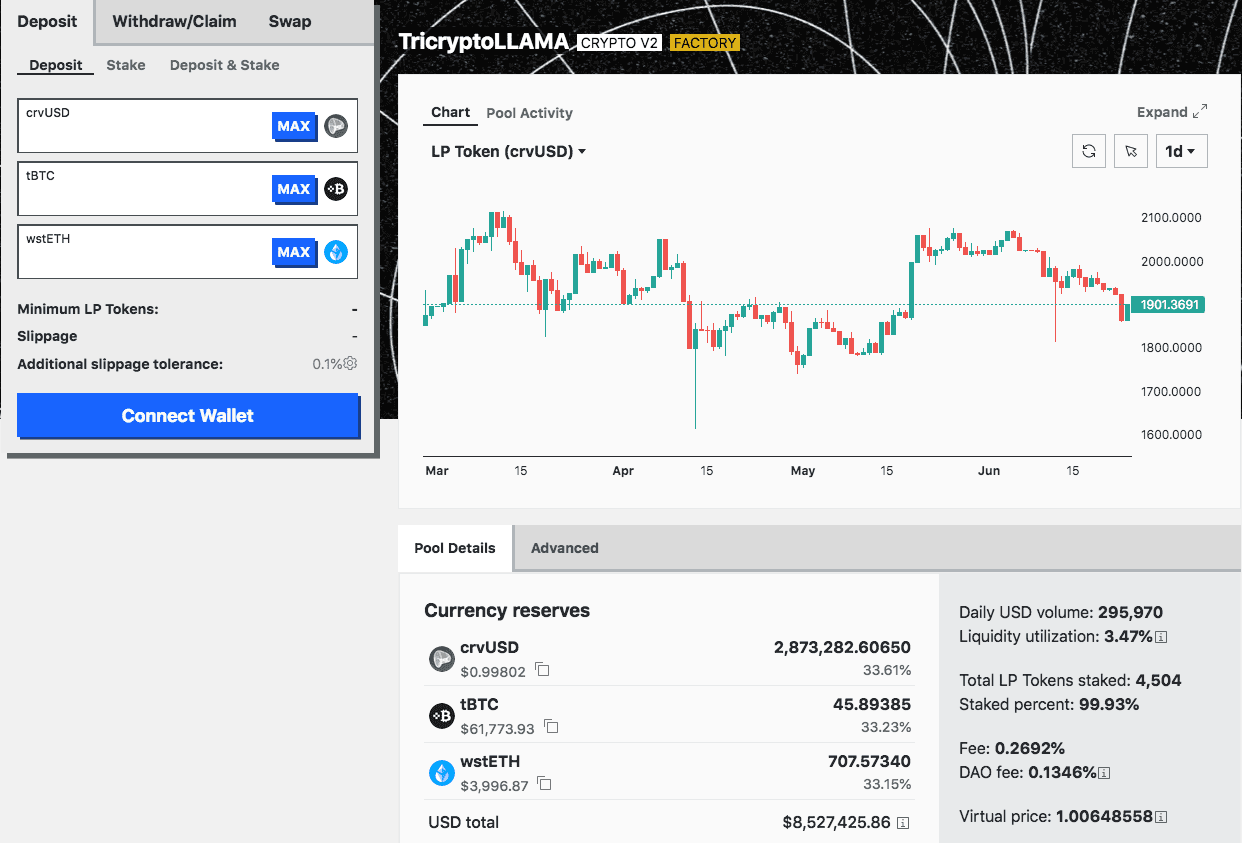

#Acquire TricryptoLLAMA Curve LP

TricryptoLLAMA is a Curve Tricrypto LP composed of crvUSD, tBTC, and wstETH. Users can acquire the LP by visiting the Curve pool page below and depositing any or all of the constituent tokens. Supply tokens in balanced proportion to minimize slippage upon deposit. The LP will accrue value from swap fees as traders swap the underlying tokens in the pool. Note that this pool uses the CryptoSwap algorithm, which concentrates liquidity around an internal pool oracle price. Since the pool consists of non-correlated assets, the relative balance of underlying tokens may change over time as asset prices change.

Note that you should hold the unstaked TricryptoLLAMA LP token. If you already have exposure to the LP and have staked it to the Curve gauge or deposited it to one of the reward boosting services (e.g. Convex, StakeDAO), you need to unstake the LP.

Source: TricryptoLLAMA pool page | Date: 6/25/2024

-

#Supply LP to Morpho TricryptoLLAMA Market and Borrow crvUSD

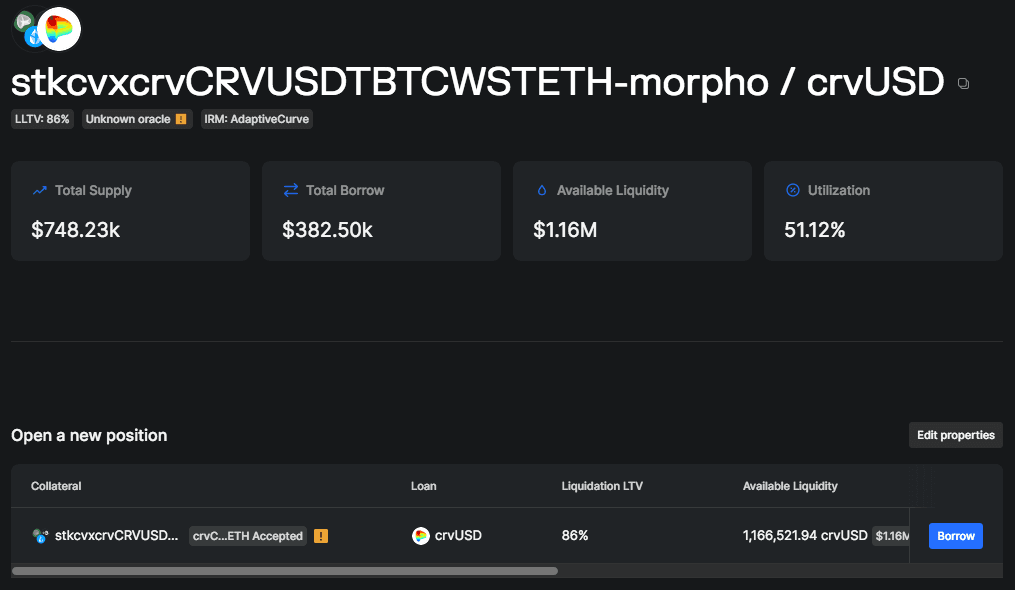

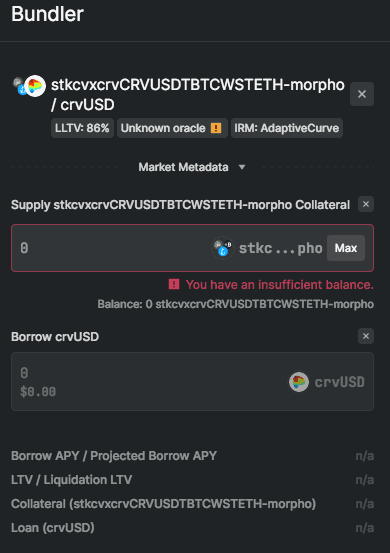

Visit the Morpho UI at the market shown below to deposit your Curve LP and borrow crvUSD. Simply select "borrow" in the "Open a new position" menu and you will be prompted to supply some quantity of the LP and borrow some quantity of crvUSD.

Source: Morpho TricryptoLLAMA market | Date: 6/25/2024

Your borrow APY, LTV/LLTV, collateral amount, and loan amount will be displayed below based on your selection.

-

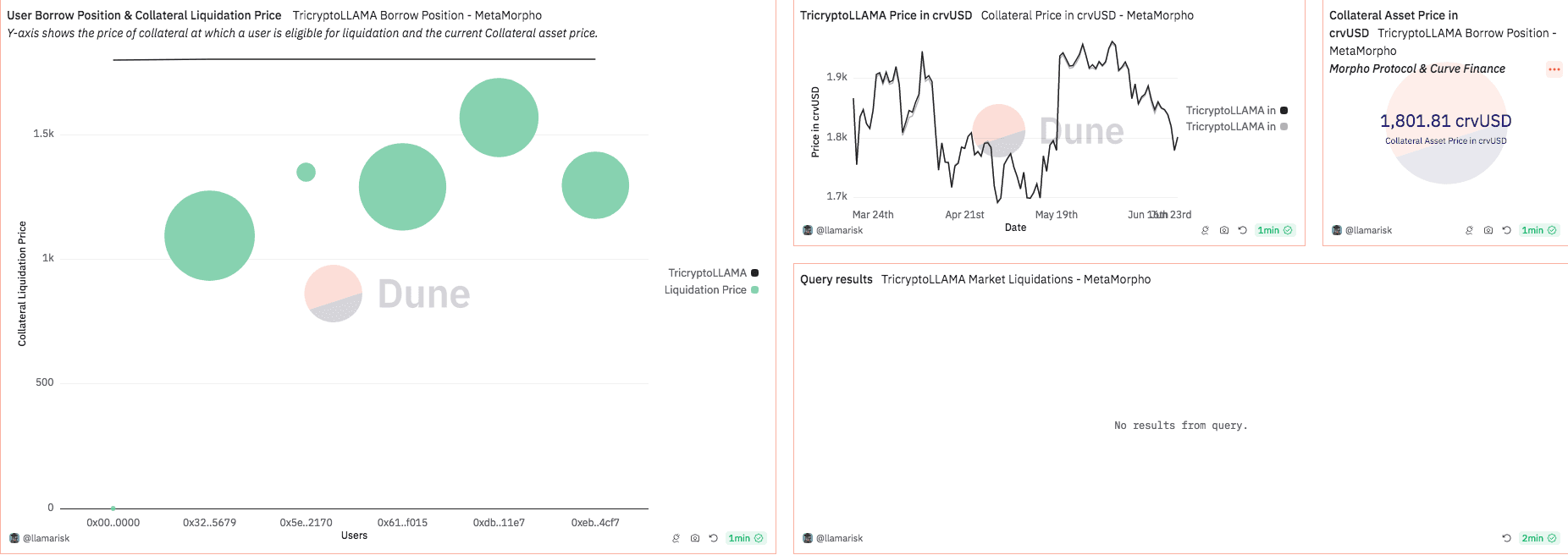

#Monitor your Position on the Dune Dashboard

We supply a dashboard with insights into the TricryptoLLAMA market interactions, including LTV, oracle, and liquidation data which may not be readily available elsewhere. Data on this dashboard may be useful for visualizing the health of your position.

Source: Dune TricryptoLLAMA Analytics | Date: June 25, 2024

-

#Claim rewards on Convex

A unique feature of the Morpho crvUSD markets is that your collateral is automatically deposited into Convex under the hood. This allows your collateral to earn CRV and CVX rewards in addition to usual swap fees while you leverage your LP position. Visit the Convex UI to claim rewards. Rewards do not expire and can be claimed at any time. Note that the Morpho claim menu is only available when your connected address has claimable rewards from Morpho.

Source: Convex Claims | Date: June 25, 2024

#TryLSD Market

-

#Acquire TryLSD Curve LP

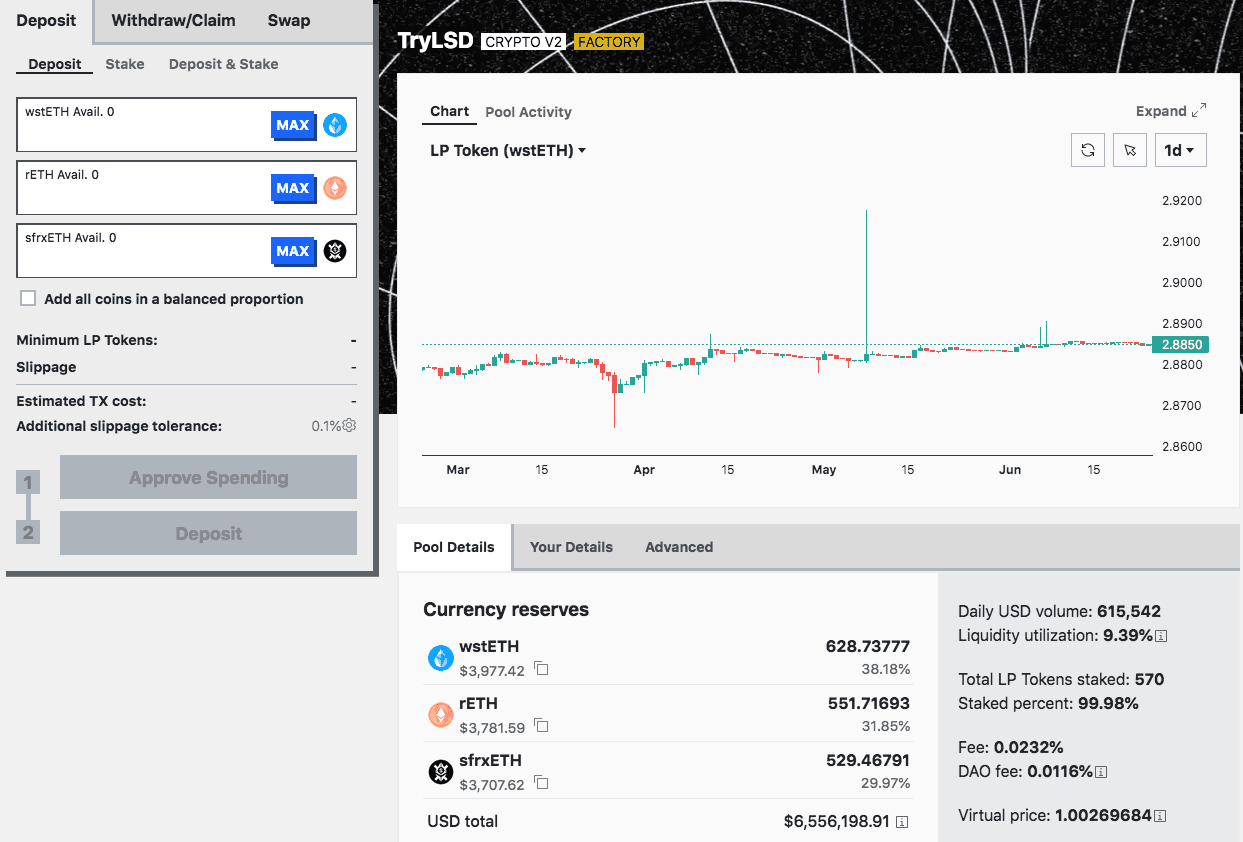

TryLSD is a Curve Tricrypto LP composed of wstETH, rETH, and sfrxETH. Users can acquire the LP by visiting the Curve pool page below and depositing any or all of the constituent tokens. Supply tokens in balanced proportion to minimize slippage upon deposit. The LP will accrue value from swap fees as traders swap the underlying tokens in the pool. Note that this pool uses the CryptoSwap algorithm, which concentrates liquidity around an internal pool oracle price. Although the pool consists of correlated assets, the relative balance of underlying tokens may change over time and users are exposed to all underlying tokens.

Note that you should hold the unstaked TryLSD LP token. If you already have exposure to the LP and have staked it to the Curve gauge or deposited it to one of the reward boosting services (e.g. Convex, StakeDAO), you need to unstake the LP.

Source: TryLSD pool page | Date: 6/25/2024

-

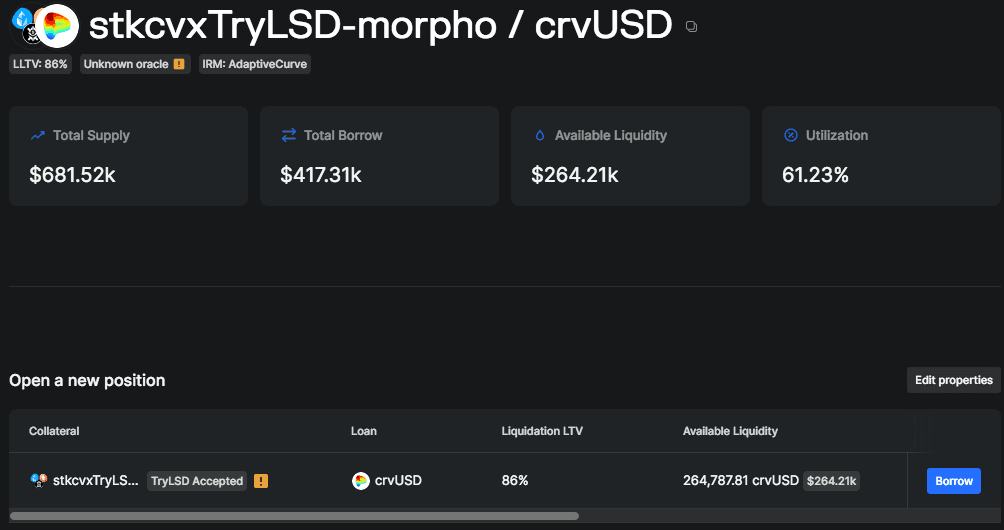

#Supply LP to Morpho TryLSD Market and Borrow crvUSD

Visit the Morpho UI at the market shown below to deposit your Curve LP and borrow crvUSD. Simply select "borrow" in the "Open a new position" menu and you will be prompted to supply some quantity of the LP and borrow some quantity of crvUSD.

Source: Morpho TryLSD market | Date: 6/25/2024

Your borrow APY, LTV/LLTV, collateral amount, and loan amount will be displayed below based on your selection.

-

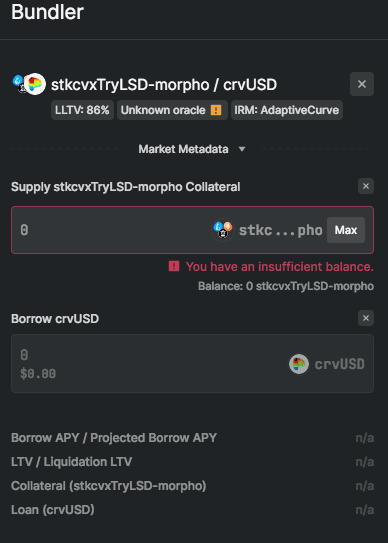

#Monitor your Position on the Dune Dashboard

We supply a dashboard with insights into the TryLSD market interactions, including LTV, oracle, and liquidation data which may not be readily available elsewhere. Data on this dashboard may be useful for visualizing the health of your position.

Source: Dune TryLSD Analytics | Date: June 25, 2024

-

#Claim rewards on Convex

A unique feature of the Morpho crvUSD markets is that your collateral is automatically deposited into Convex under the hood. This allows your collateral to earn CRV and CVX rewards in addition to usual swap fees while you leverage your LP position. Visit the Convex UI to claim rewards. Rewards do not expire and can be claimed at any time. Note that the Morpho claim menu is only available when your connected address has claimable rewards from Morpho.

Source: Convex Claims | Date: June 25, 2024

#TricryptoUSDC Market

-

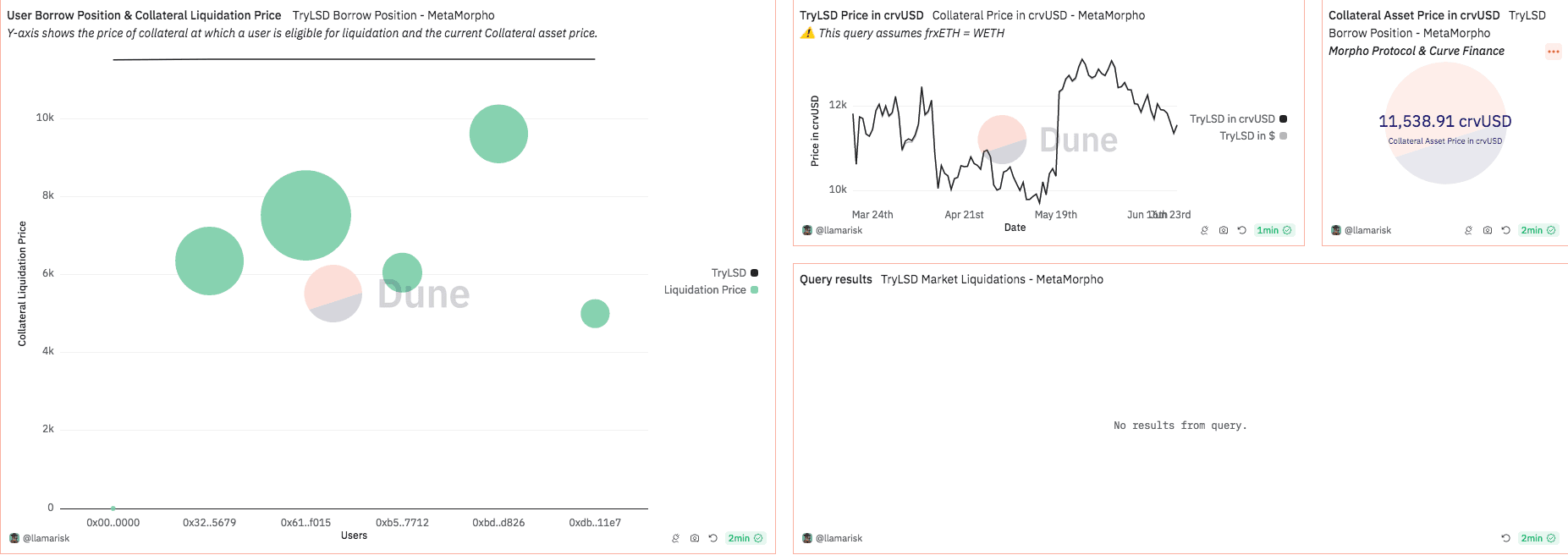

#Acquire TricryptoUSDC Curve LP

TricryptoUSDC is a Curve Tricrypto LP composed of USDC, WBTC, and WETH. Users can acquire the LP by visiting the Curve pool page below and depositing any or all of the constituent tokens. Supply tokens in balanced proportion to minimize slippage upon deposit. The LP will accrue value from swap fees as traders swap the underlying tokens in the pool. Note that this pool uses the CryptoSwap algorithm, which concentrates liquidity around an internal pool oracle price. Since the pool consists of non-correlated assets, the relative balance of underlying tokens may change over time as asset prices change.

Note that you should hold the unstaked TricryptoUSDC LP token. If you already have exposure to the LP and have staked it to the Curve gauge or deposited it to one of the reward boosting services (e.g. Convex, StakeDAO), you need to unstake the LP.

Source: TricryptoUSDC pool page | Date: 6/25/2024

-

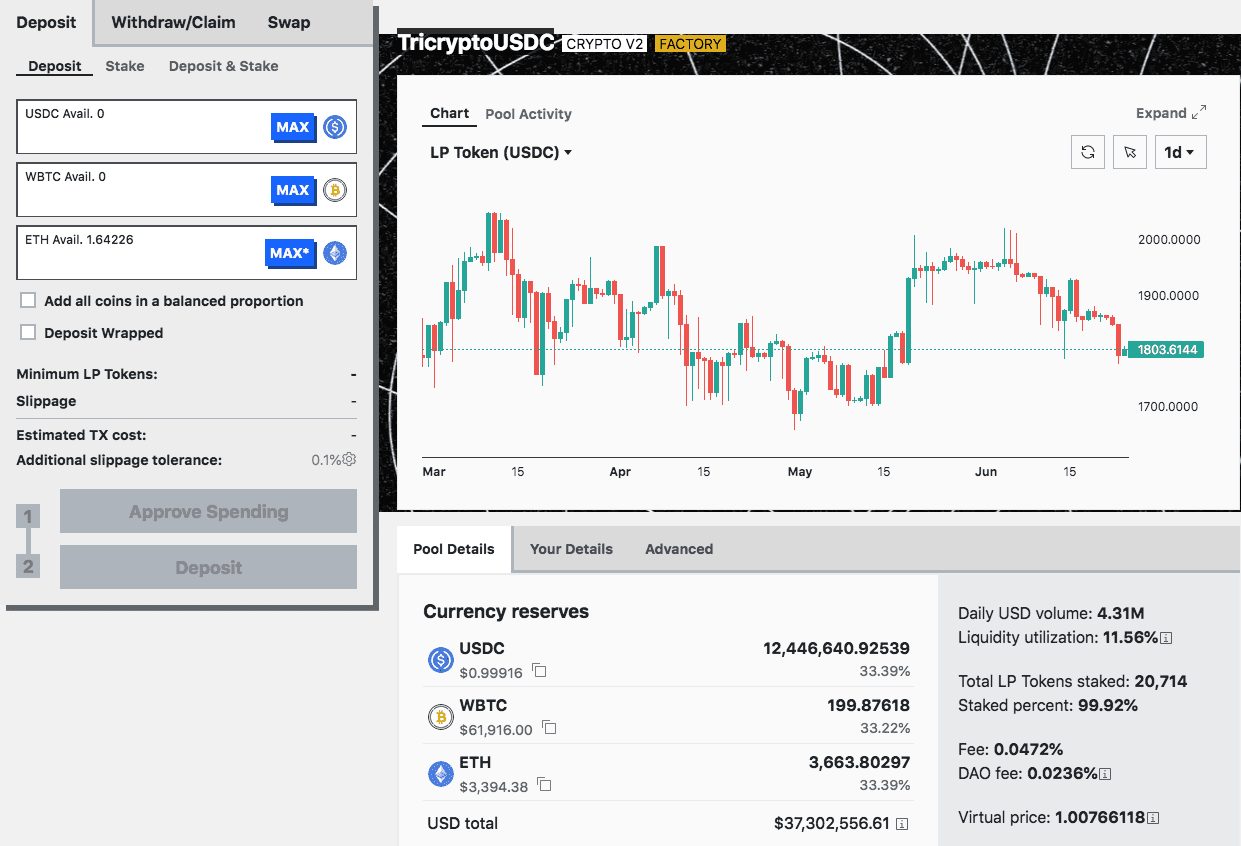

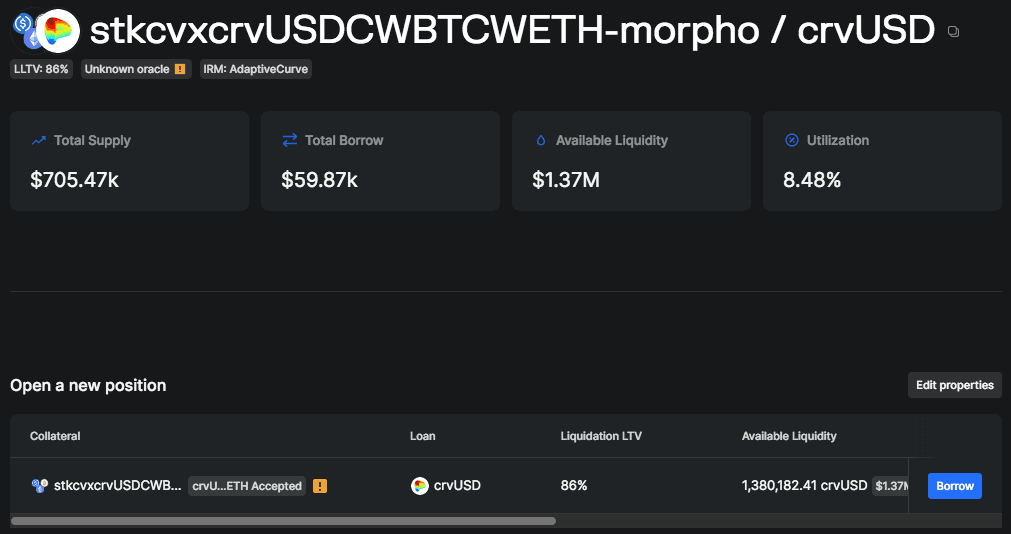

#Supply LP to Morpho TricryptoUSDC Market and Borrow crvUSD

Visit the Morpho UI at the market shown below to deposit your Curve LP and borrow crvUSD. Simply select "borrow" in the "Open a new position" menu and you will be prompted to supply some quantity of the LP and borrow some quantity of crvUSD.

Source: Morpho TricryptoUSDC market | Date: 6/25/2024

Your borrow APY, LTV/LLTV, collateral amount, and loan amount will be displayed below based on your selection.

-

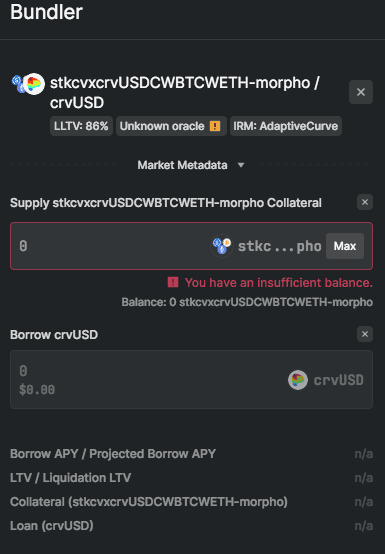

#Monitor your Position on the Dune Dashboard

We supply a dashboard with insights into the TricryptoUSDC market interactions, including LTV, oracle, and liquidation data which may not be readily available elsewhere. Data on this dashboard may be useful for visualizing the health of your position.

Source: Dune TricryptoUSDC Analytics | Date: June 25, 2024

-

#Claim rewards on Convex

A unique feature of the Morpho crvUSD markets is that your collateral is automatically deposited into Convex under the hood. This allows your collateral to earn CRV and CVX rewards in addition to usual swap fees while you leverage your LP position. Visit the Convex UI to claim rewards. Rewards do not expire and can be claimed at any time. Note that the Morpho claim menu is only available when your connected address has claimable rewards from Morpho.

Source: Convex Claims | Date: June 25, 2024

#TricryptoUSDT Market

-

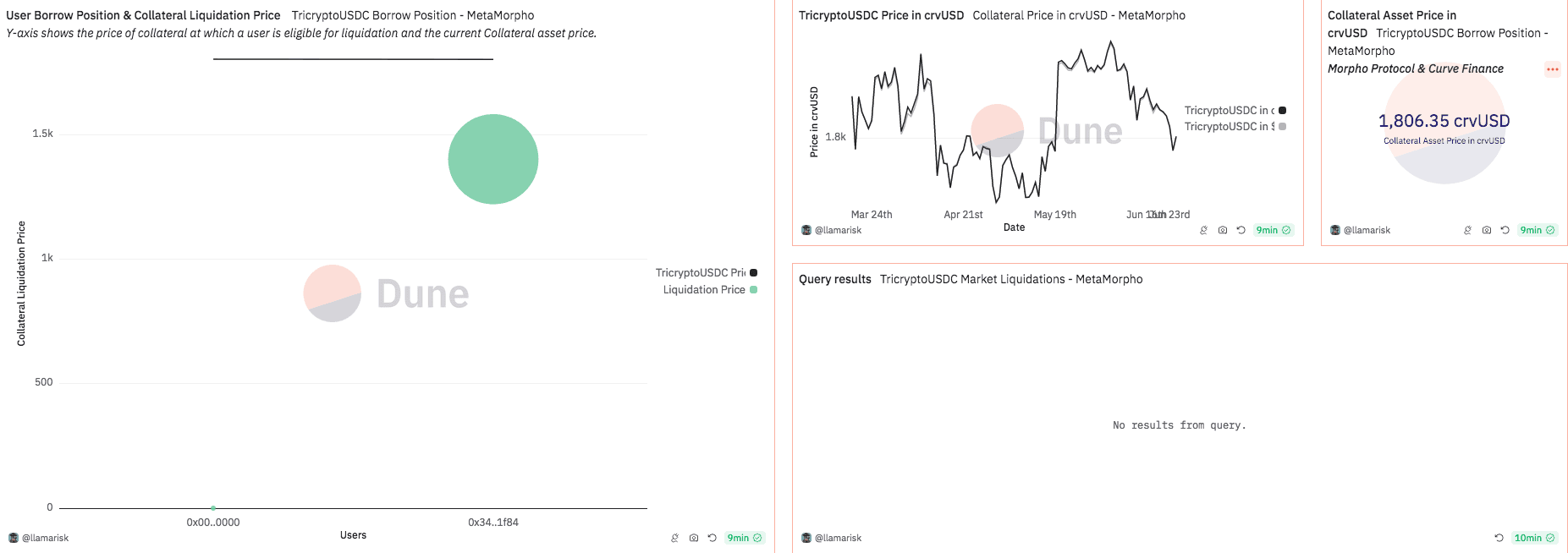

#Acquire TricryptoUSDT Curve LP

TricryptoUSDT is a Curve Tricrypto LP composed of USDT, WBTC, and WETH. Users can acquire the LP by visiting the Curve pool page below and depositing any or all of the constituent tokens. Supply tokens in balanced proportion to minimize slippage upon deposit. The LP will accrue value from swap fees as traders swap the underlying tokens in the pool. Note that this pool uses the CryptoSwap algorithm, which concentrates liquidity around an internal pool oracle price. Since the pool consists of non-correlated assets, the relative balance of underlying tokens may change over time as asset prices change.

Note that you should hold the unstaked TricryptoUSDT LP token. If you already have exposure to the LP and have staked it to the Curve gauge or deposited it to one of the reward boosting services (e.g. Convex, StakeDAO), you need to unstake the LP.

Source: TricryptoUSDT pool page | Date: 6/25/2024

-

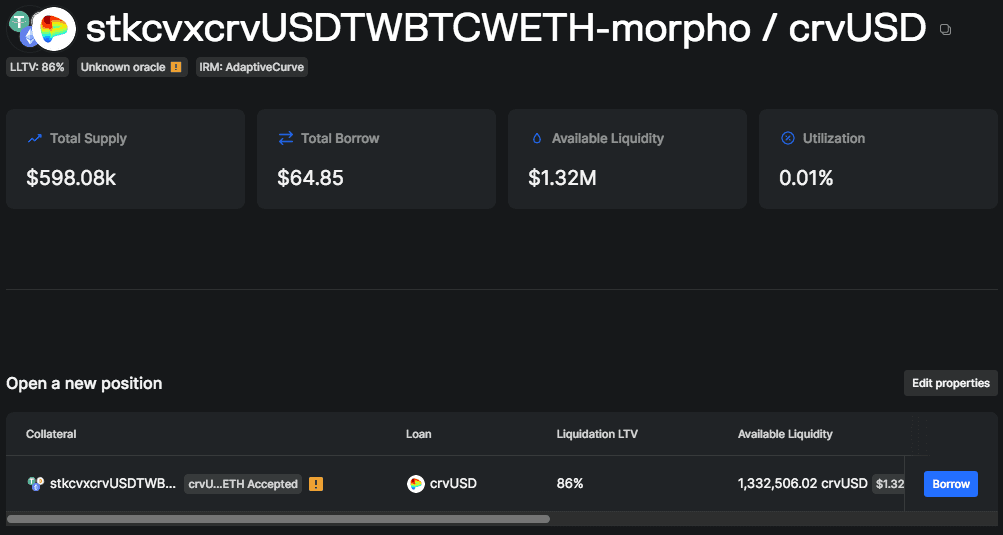

#Supply LP to Morpho TricryptoUSDT Market and Borrow crvUSD

Visit the Morpho UI at the market shown below to deposit your Curve LP and borrow crvUSD. Simply select "borrow" in the "Open a new position" menu and you will be prompted to supply some quantity of the LP and borrow some quantity of crvUSD.

Source: Morpho TricryptoUSDT market | Date: 6/25/2024

Your borrow APY, LTV/LLTV, collateral amount, and loan amount will be displayed below based on your selection.

-

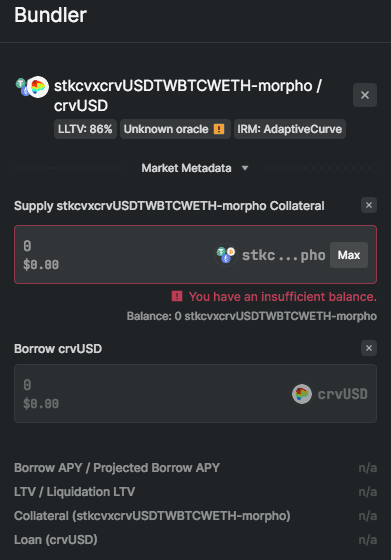

#Monitor your Position on the Dune Dashboard

We supply a dashboard with insights into the TricryptoUSDT market interactions, including LTV, oracle, and liquidation data which may not be readily available elsewhere. Data on this dashboard may be useful for visualizing the health of your position.

Source: Dune TricryptoUSDT Analytics | Date: June 25, 2024

-

#Claim rewards on Convex

A unique feature of the Morpho crvUSD markets is that your collateral is automatically deposited into Convex under the hood. This allows your collateral to earn CRV and CVX rewards in addition to usual swap fees while you leverage your LP position. Visit the Convex UI to claim rewards. Rewards do not expire and can be claimed at any time. Note that the Morpho claim menu is only available when your connected address has claimable rewards from Morpho.

Source: Convex Claims | Date: June 25, 2024

#TriCRV Market

-

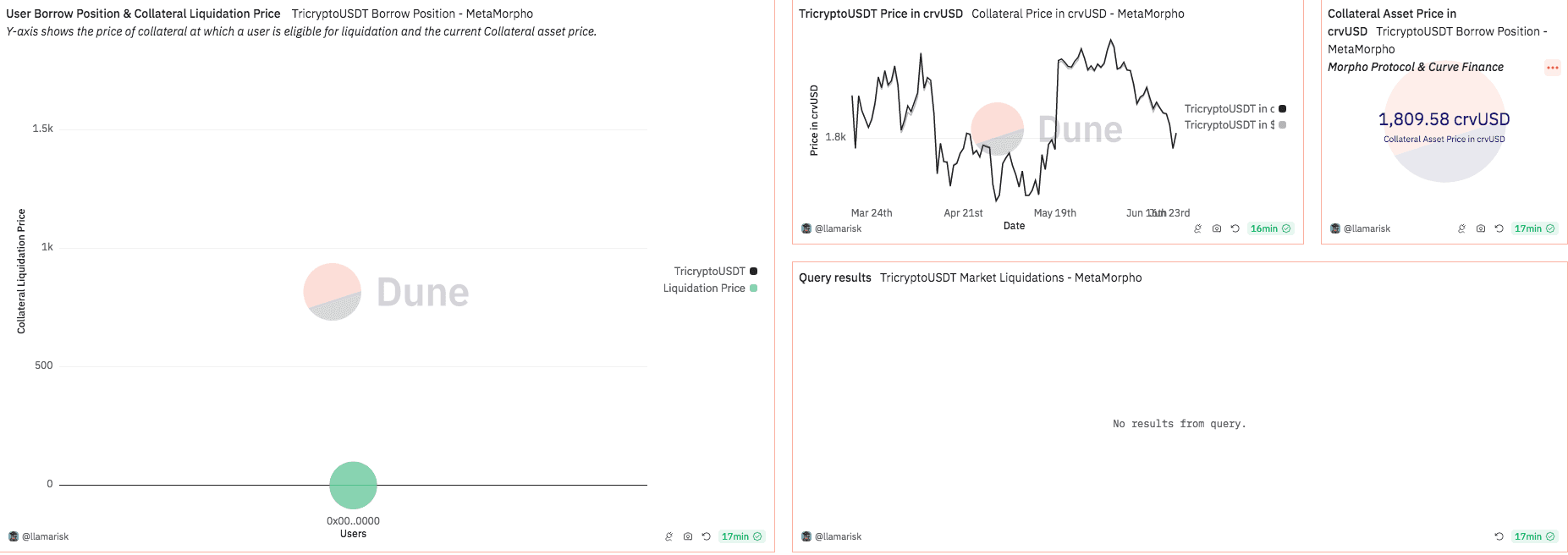

#Acquire TriCRV Curve LP

TriCRV is a Curve Tricrypto LP composed of crvUSD, WETH, and CRV. Users can acquire the LP by visiting the Curve pool page below and depositing any or all of the constituent tokens. Supply tokens in balanced proportion to minimize slippage upon deposit. The LP will accrue value from swap fees as traders swap the underlying tokens in the pool. Note that this pool uses the CryptoSwap algorithm, which concentrates liquidity around an internal pool oracle price. Since the pool consists of non-correlated assets, the relative balance of underlying tokens may change over time as asset prices change.

Note that you should hold the unstaked TriCRV LP token. If you already have exposure to the LP and have staked it to the Curve gauge or deposited it to one of the reward boosting services (e.g. Convex, StakeDAO), you need to unstake the LP.

Source: TriCRV pool page | Date: 6/25/2024

-

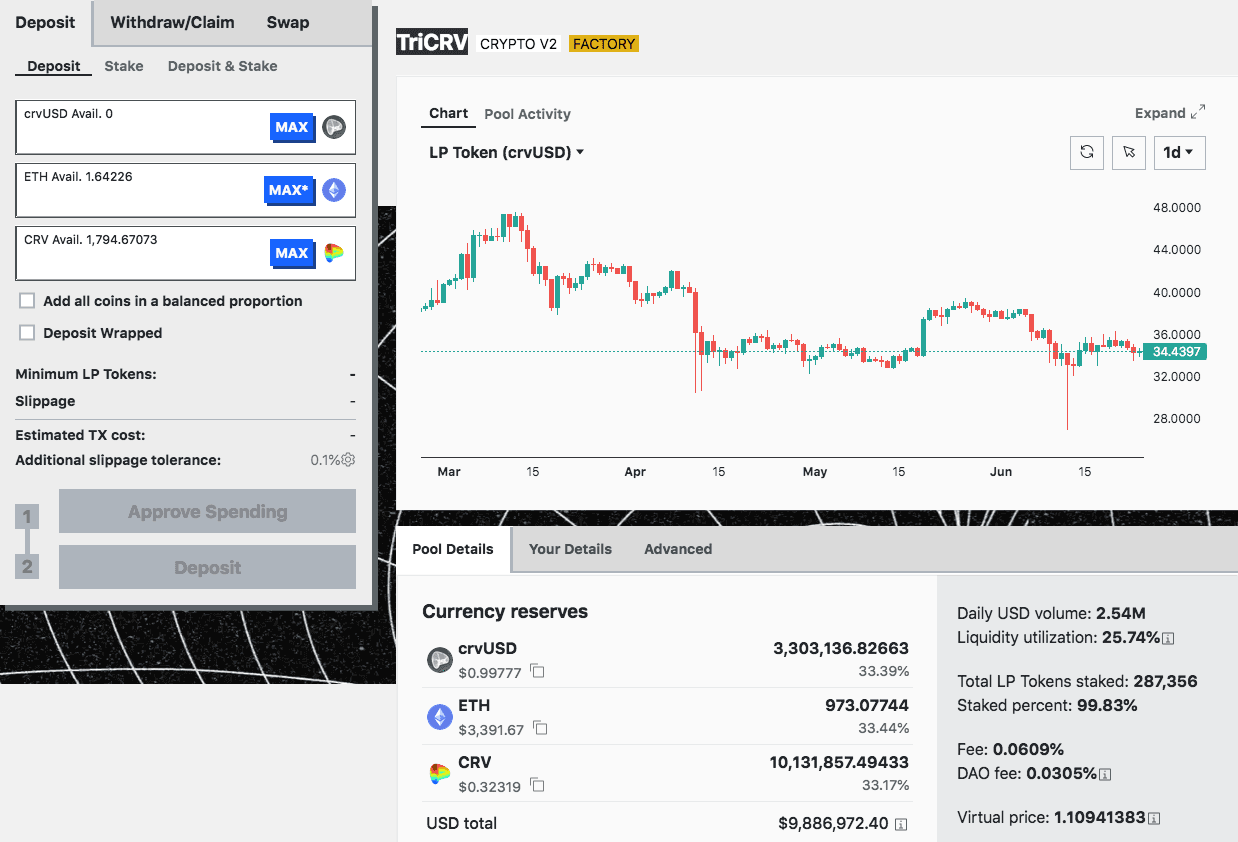

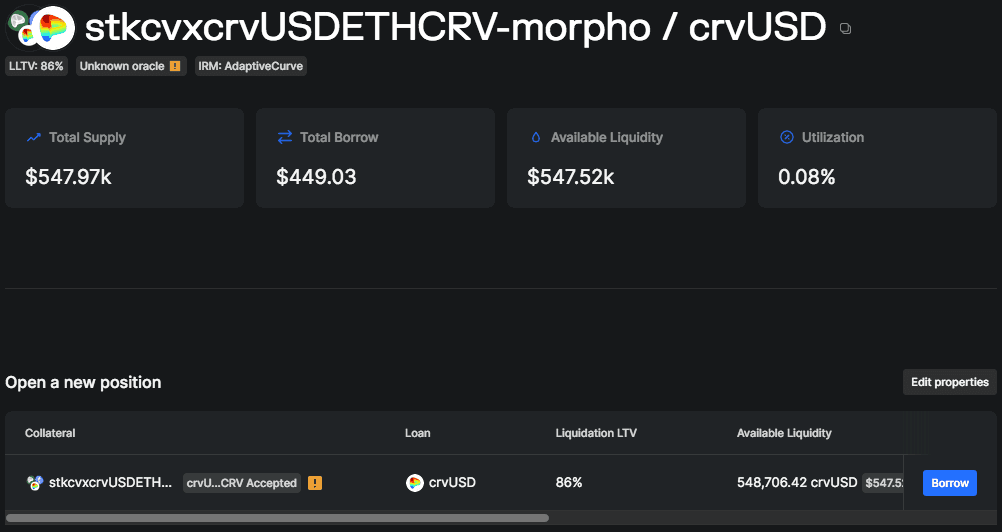

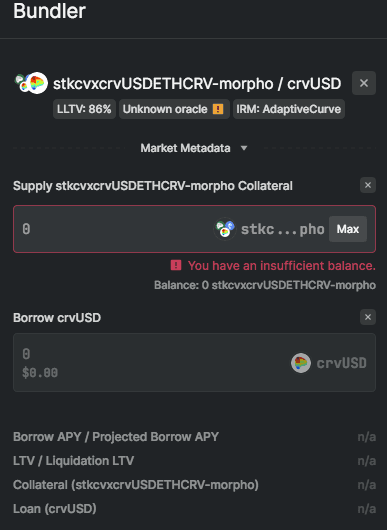

#Supply LP to Morpho TriCRV Market and Borrow crvUSD

Visit the Morpho UI at the market shown below to deposit your Curve LP and borrow crvUSD. Simply select "borrow" in the "Open a new position" menu and you will be prompted to supply some quantity of the LP and borrow some quantity of crvUSD.

Source: Morpho TriCRV market | Date: 6/25/2024

Your borrow APY, LTV/LLTV, collateral amount, and loan amount will be displayed below based on your selection.

-

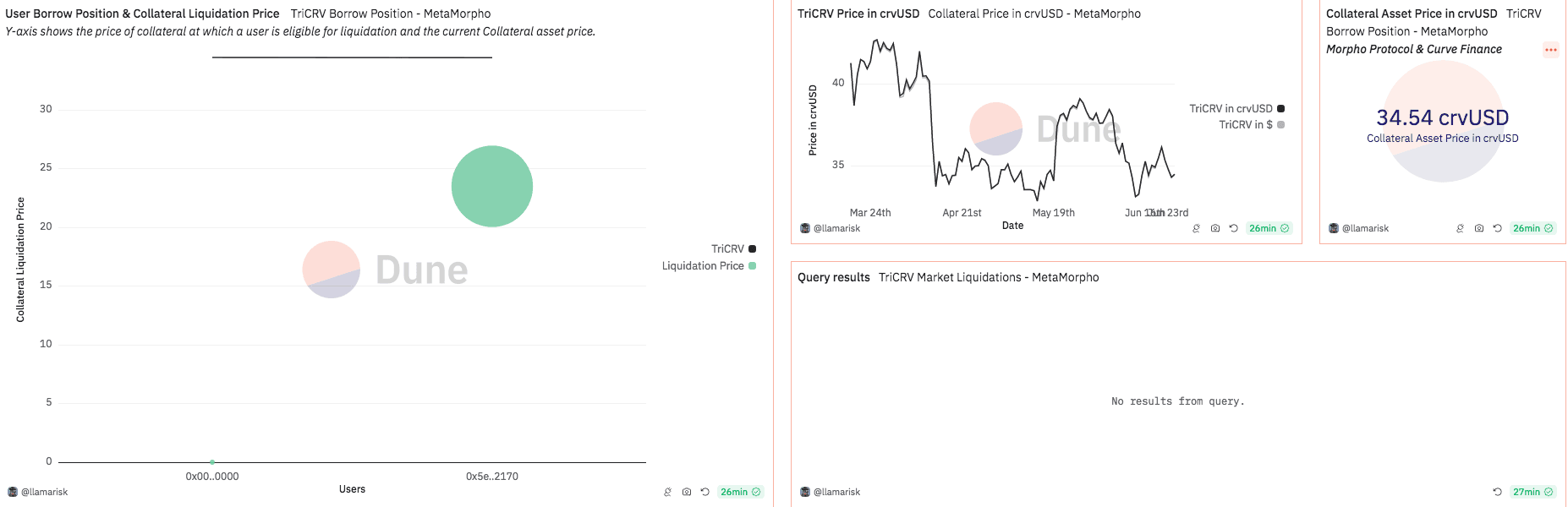

#Monitor your Position on the Dune Dashboard

We supply a dashboard with insights into the TriCRV market interactions, including LTV, oracle, and liquidation data which may not be readily available elsewhere. Data on this dashboard may be useful for visualizing the health of your position.

Source: Dune TriCRV Analytics | Date: June 25, 2024

-

#Claim rewards on Convex

A unique feature of the Morpho crvUSD markets is that your collateral is automatically deposited into Convex under the hood. This allows your collateral to earn CRV and CVX rewards in addition to usual swap fees while you leverage your LP position. Visit the Convex UI to claim rewards. Rewards do not expire and can be claimed at any time. Note that the Morpho claim menu is only available when your connected address has claimable rewards from Morpho.

Source: Convex Claims | Date: June 25, 2024

#Final Notes

Borrow positions on Morpho can be closed at any time from the Morpho Borrow page by repaying the crvUSD debt and withdrawing collateral. You should be prompted with a tx to claim your Convex rewards before withdrawing collateral. If you are not, claim from Convex before completing the withdrawal. This is important to successfully checkpoint your claimable rewards.

All crvUSD vault markets have an 86% liquidation LTV. If your collateral value falls, causing your LTV to rise above 86%, your position will be eligible for liquidation. Most Tricrypto LPs have a stablecoin component, helping to reduce volatility, however it remains important to monitor the oracle price and your position health, which can be done from the Dune dashboard we provide.

The Morpho interest rate model favors borrowers with a time-based component that gradually modifies the interest rate based on market utilization levels. For instance, at 100% utilization, the borrow rate is 4x the rate at the target (90% utilization). As the borrow rate at the target is currently very low (0.1%), borrowers have strong assurances of prolonged low rates. See our post on the MetaMorpho IRM for more details on the IRM behavior. This condition is exacerbated by the yieldbearing property of the Convex-wrapped collateral types and by opportunities to search yields on crvUSD on several platforms, including Curve Lend and Sturdy Finance.

Given that the additional complexity of leveraging LP tokens and features such as auto wrapping on Convex may not be immediately intuitive to users, we hope this explainer serves to clarify the ease with which one can interact with the crvUSD vault. For any additional questions or clarifications, join us on the Llama Risk Telegram Channel where we can be reached directly.

Disclaimer: LlamaRisk provides the review of the MetaMorpho vault for informational purposes only, and such provision does not constitute financial, investment, legal, or professional advice. In the context of MetaMorpho, LlamaRisk does not take custody, control, or influence over user funds or investment choices and expressly disclaims any liability or responsibility for losses, damages, or other issues that may arise from users' investment decisions. The content provided by LlamaRisk, including any reports or overviews, is intended as a general guide and should not be relied upon as definitive or comprehensive advice. Users are advised not to act upon this information without seeking appropriate professional counsel specific to their situation.