This report will analyze Falcon USDf. This analysis aims to comprehensively assess the risks associated with USDf. Our evaluation will employ quantitative and qualitative methods, providing insights for teams considering to onboard USDf into DeFi protocols and for capital allocators to understand the asset risk profile.

We will categorize the assessment into four main areas:

-

Performance Analytics - Analysis of stablecoin adoption, market liquidity, and volatility.

-

Reserves Analysis - Review of the composition, solvency, and structural risks of Falcon’s reserves.

-

On-chain Management - Considerations about smart contracts, dependencies, and other technology components.

-

Regulation and Compliance - Aspects concerning reserves management, protocol structure, and legal/regulatory factors.

#Section 1: Stablecoin Fundamentals

This section addresses the fundamentals of the pegged asset. It conveys (1) the value proposition/utility of the stablecoin, and (2) an overview of the on-chain technical architecture. This section contains descriptive elements that cannot be quantified and serves as a descriptive introduction to the stablecoin.

This section is divided into 2 sub-sections:

-

1.1: Description of the Stablecoin

-

1.2: System Architecture

#1.1 Description of the Stablecoin

#1.1.1 User Flow

Source: LlamaRisk, September 8th, 2025

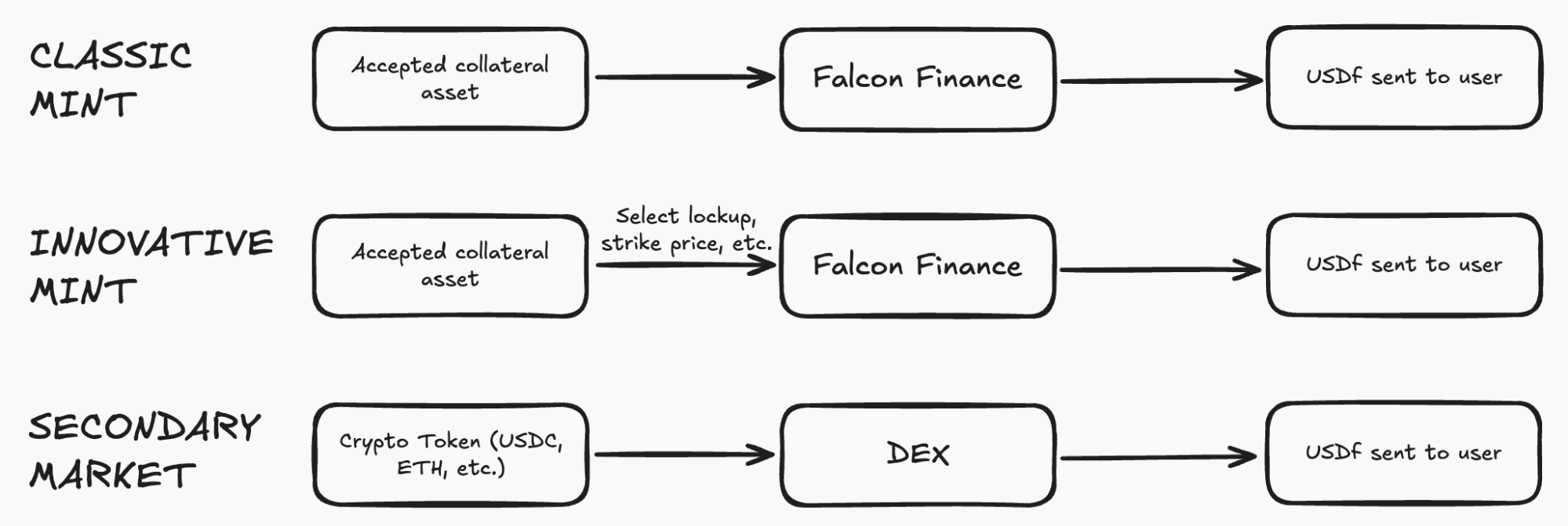

Users who have passed KYC requirements are allowed to mint USDf by depositing approved collateral assets. Users are allowed to mint USDf through two methods: classic mint or innovative mint.

If a user chooses to mint using an approved stablecoin, the classic mint method is used, where USDf is returned at a 1:1 ratio.

If a user chooses to mint using an approved non-stablecoin asset, either the classic or innovative mint method can be used. In both methods, USDf is not returned at a 1:1 ratio. For innovative mint, the user selects a lockup period, strike price, and capital efficiency level, which determines the amount of USDf eligible to be minted. For classic mint, the user simply deposits an acceptedasset and receives USDf. These methods always utilize an overcollateralization ratio, making sure that the backing collateral is always greater in value than the minted USDf.

Users can also acquire USDf from secondary marketplaces.

#1.1.2 Reserves Overview

USDf is backed by stablecoins, non-stablecoin assets, and real-world assets. The stablecoin assets currently supported are USDC, USDT, USDS, DAI, FDUSD, and USD1. Yet, as will be covered in Section 3 Reserves composition, USDT, USDC, and USD1 are the primary stablecoins used by Falcon. The real-world assets supported include Tokenized Gold, Tokenized Stocks, Tokenized US Treasuries, and Tokenized Corporate Credit.

For an asset to become supported as collateral, it must pass a risk framework set by Falcon, which can be viewed here. In short, a token must first pass the eligibility screening by being listed on Binance (either spot or futures) and have another listing on a top 10 CEX or have deep DEX liquidity. If a token is deemed eligible, then it undergoes a quantitative analysis that considers Binance liquidity, open interest, funding rate stability, and overall market liquidity. When choosing assets to accept as collateral, Falcon also considers current market conditions and partnerships with protocols.

#1.1.3 Fees and Business Model

There are no current mint/redeem fees for USDf.

#1.1.4 Organizational Structure

Falcon identifies the contracting entity as Falcon Digital Limited, with the Terms governed by the laws of the British Virgin Islands and subject to the exclusive jurisdiction of BVI courts. The Terms are the only authoritative corporate reference published by the project.

Public-facing materials position “Falcon Finance” as the operating brand. Company footer notices and the news site attribute ownership of the site and materials to Falcon Digital Limited, which reinforces that the BVI entity sits at the center of the corporate stack. Press and communications list Andrei Grachev as “Managing Partner at Falcon Finance”, with repeated references to his role at DWF Labs. Falcon launched the FF governance and utility token in late September. With the governance page set up on Snapshot, Falcon will be having governance proposals and voting.

#1.1.5 Third Party Relations

Falcon is incubated by DWF Labs and backed by several other investors, and senior Falcon figures are publicly associated with DWF Labs. Separate reporting in late July 2025 states that Falcon secured an initial $10M strategic investment from World Liberty Financial (WLFI).

Liquidity origination and incentives are managed through a blend of centralized listings and DeFi programs. Falcon’s USDf news and external notices refer to CEX listings (including MEXC and Bitfinex), while on the DeFi side Falcon runs an incentives layer through Merkl to route rewards to LPs on Uniswap, PancakeSwap, and other venues, and co-sponsors incentives tied to integrations such as Euler Frontier.

Falcon has also publicized distribution partnerships and growth programs with retail and DeFi front ends. The HOT Wallet integration is positioned to surface USDf and sUSDf features to a large retail base within that app, and the Falcon “Miles” and “Yap2Fly” campaigns coordinate on-chain activity and content incentives across multiple venues.

On protocol infrastructure and cross-chain distribution, Falcon has announced the adoption of Chainlink’s CCIP for native cross-chain transfers of USDf and has stated its intent to use Chainlink Proof of Reserve for automated reserve checks.

#1.1.6 History and Roadmap

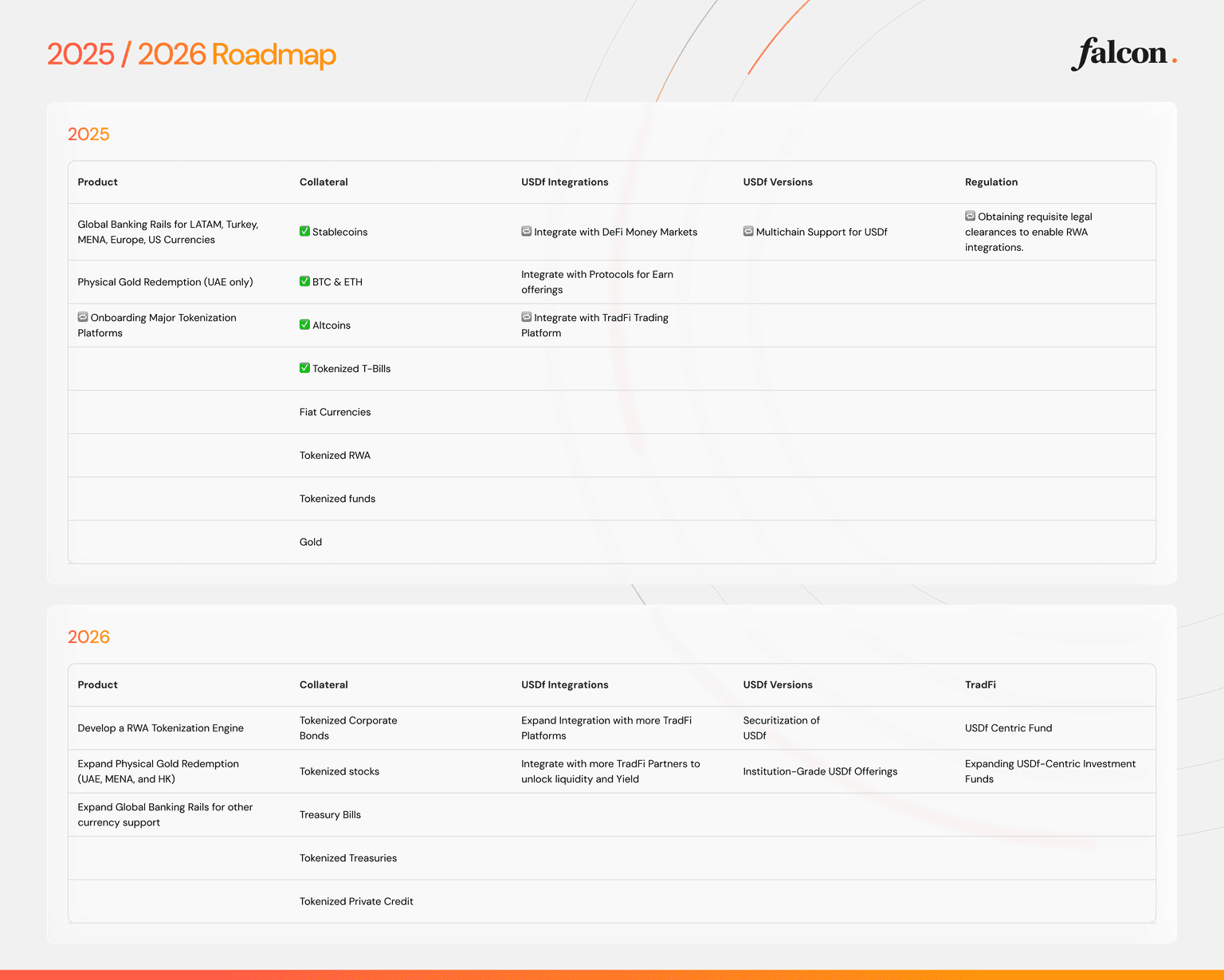

Falcon launched USDf and sUSDf to the public on 4/30/25 along with their incentive program, called Falcon Miles. USDf circulating supply surpassed $2b on 11/25/25, becoming a top 10 stablecoin on Ethereum.

Falcon's goal is to become a globally utilized stablecoin solution that allows anyone to deposit a variety of supported funds and gain leverage over USDf in the expanding DeFi ecosystem. Falcon plans to expand collateral options in the coming year. Ultimately, Falcon will serve as an infrastructure that allows people to collateralize their assets to unlock onchain liquidity and yield.

Source: Falcon Roadmap

#1.2 System Architecture

#1.2.1 Stablecoin Overview

When a user deposits supported collateral, Falcon has the option to mint USDf, or utilize an express mint option. Both options use either the classic or innovative mint methods. By choosing the express mint option, a user may either immediately stake their newly minted USDf (for sUSDf) or stake and then restake it without delay (for boosted sUSDf).

After USDf is minted, collateral is routed into third-party custodians (Ceffu/Fireblocks), which utilize multi-sig wallets and multi-party computation to secure funds. Through these custodians, off-exchange settlement is utilized to allow for CEX usage while minimizing risk. Falcon uses collateral funds to generate yield through four main strategies:

-

Positive and Negative Funding Rate Arbitrage

-

Collateral Staking

-

Cross-Exchange Arbitrage

-

Spot/Perps Arbitrage

-

Statistical Arbitrage

-

Options-Based Strategies

-

Extreme Movements Trading

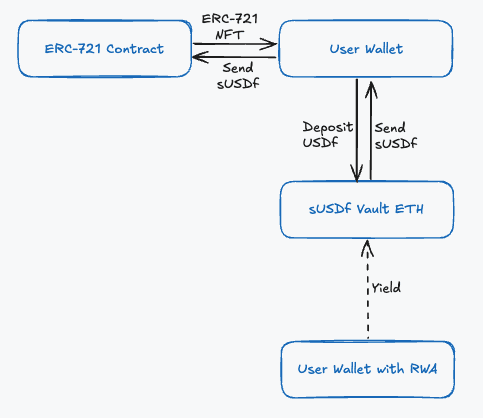

A user can stake their USDf for sUSDf (ERC-4626 vault) to receive a portion of the yield generated from collateral. sUSDf can be simply held or restaked to gain access to boosted yield. To restake sUSDf, a user must choose a fixed lock term. After selecting a lock term, sUSDf can be restaked for an ERC-721 NFT, which represents a user's restaked position. Users who decide to restake can redeem their ERC-721 NFTs for the corresponding sUSDf balance at the end of the lock term. Unstaking sUSDf for USDf is instantaneous, but there is a one-hour daily lock period (typically between 1-2 pm UTC) where staking and unstaking are paused to prevent potential exploits.

When a user wants to redeem USDf, there is a universal 7-day redemption period. However, the redemption process is dependent on the collateral used to mint USDf. Classic redemptions allow users to exchange their USDf for one of Falcon's stablecoins; this is used if a user minted using stablecoins. The alternative redemption method, called "claims" by Falcon, allows users to exchange their USDf for deposited non-stablecoin assets. More on this redemption method and both minting methods can be found in section 1.2.3.

Falcon has a publicly verifiable insurance fund in place to absorb losses. The balance can be found at the Ethereum address here.

#1.2.2 Architecture Diagram

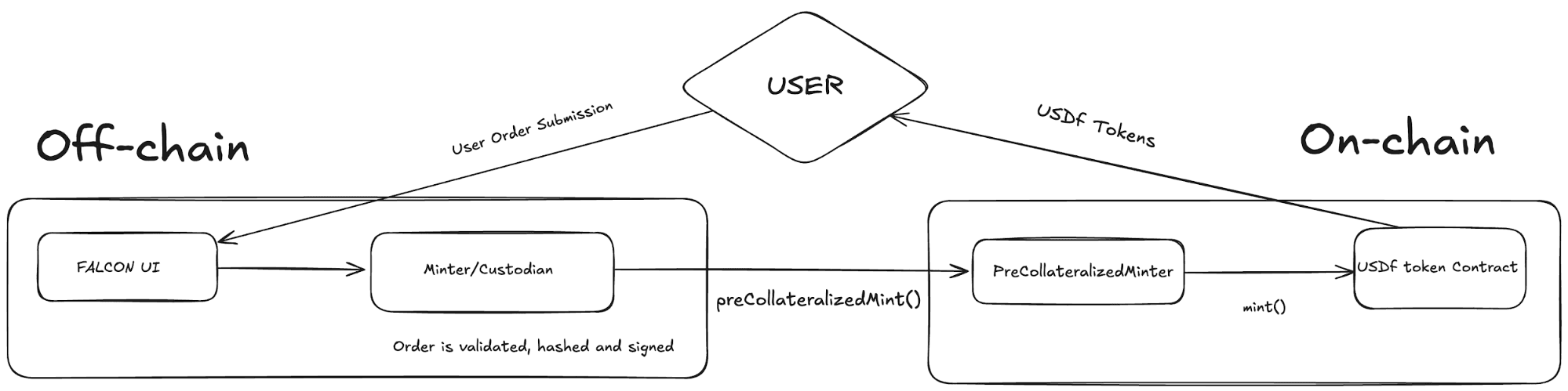

This diagram illustrates the minting flow of USDf tokens, showing interactions between off-chain and on-chain components. Off-chain, the user submits an order via the Falcon UI, which is validated, hashed, and signed by the Minter/Custodian. The signed order is sent on-chain to the PreCollateralizedMinter contract via preCollateralizedMint(), which then calls the USDf token contract’s mint() function to issue tokens to the user.

Source: LlamaRisk, August 14th, 2025

#1.2.3 Key Components

Some noteworthy points from the user perspective include:

-

The mint and redemption process for USDf can be complex, depending on one's preferred minting method.

-

A user who deposits stablecoins to mint can simply obtain USDf at a 1:1 ratio via the classic mint method.

-

A user who deposits a non-stablecoin asset to mint can use either the classic mint method or the innovative mint method.

If a user chooses the classic mint method with a non-stablecoin asset, they are subject to providing an overcollateralization buffer when minting USDf. This means that the underlying collateral value must exceed the value of USDf minted. The ratio of collateral value to USDf minted is dynamically adjusted based on several market factors of the collateral asset.

Upon redemption, a user can exercise the "claims" method and redeem the underlying value of USDf in stablecoins plus the overcollateralization buffer they initially provided. If the current mark price < initial mark price of the collateral asset, then the user will reclaim the full amount of the initial buffer collateral. If the current mark price > initial mark price, then the user will instead reclaim the USD value of the buffer collateral at the time of depositing.

If a user chooses the innovative mint method with a non-stablecoin asset, they must select a lock time, liquidation level, and strike price multiplier. These factors contribute to a position's strike price, liquidation price, and amount of USDf minted. Essentially, the innovative mint method acts as a CDP money market for USDf, except it has a fixed term and capped upside. After minting via an innovative mint, three scenarios can happen:

-

Collateral price drops below liquidation price - collateral is liquidated, but the user retains USDf

-

Collateral price remains between liquidation and strike price - the user may reclaim collateral at the end of the term by returning USDf minted

-

Collateral exceeds strike price - collateral is sold by Falcon, and the user keeps USDf plus an additional USDf payout from collateral profit

Redemption for innovative mint positions only occurs if the collateral price remains between the liquidation and strike price. In this case, a user must return the full amount of USDf minted and reclaims their deposited collateral.

It should be noted that classic mints have a minimum deposit of $10,000 of collateral, while innovative mints have a $50,000 minimum.

#Section 2: Performance Analytics

This section evaluates the USDf from a quantitative perspective. It analyzes stablecoin performance metrics in terms of market adoption, peg stability, and liquidity.

This section is divided into 3 sub-sections:

-

2.1: Market Performance

-

2.2: Peg Stability Metrics

-

2.3: Liquidity

#2.1 Market Performance

#2.1.1 Outstanding and Free-Float Supply

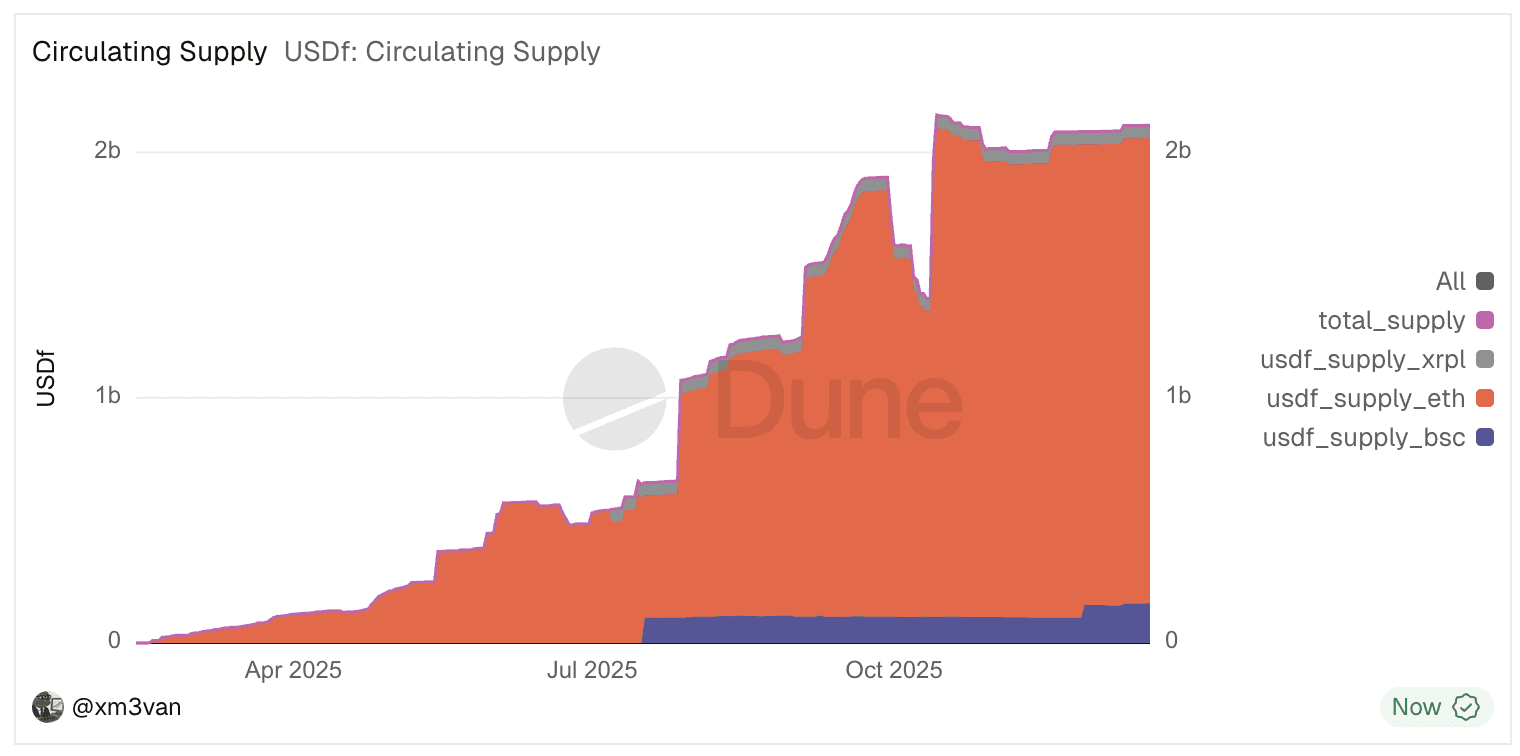

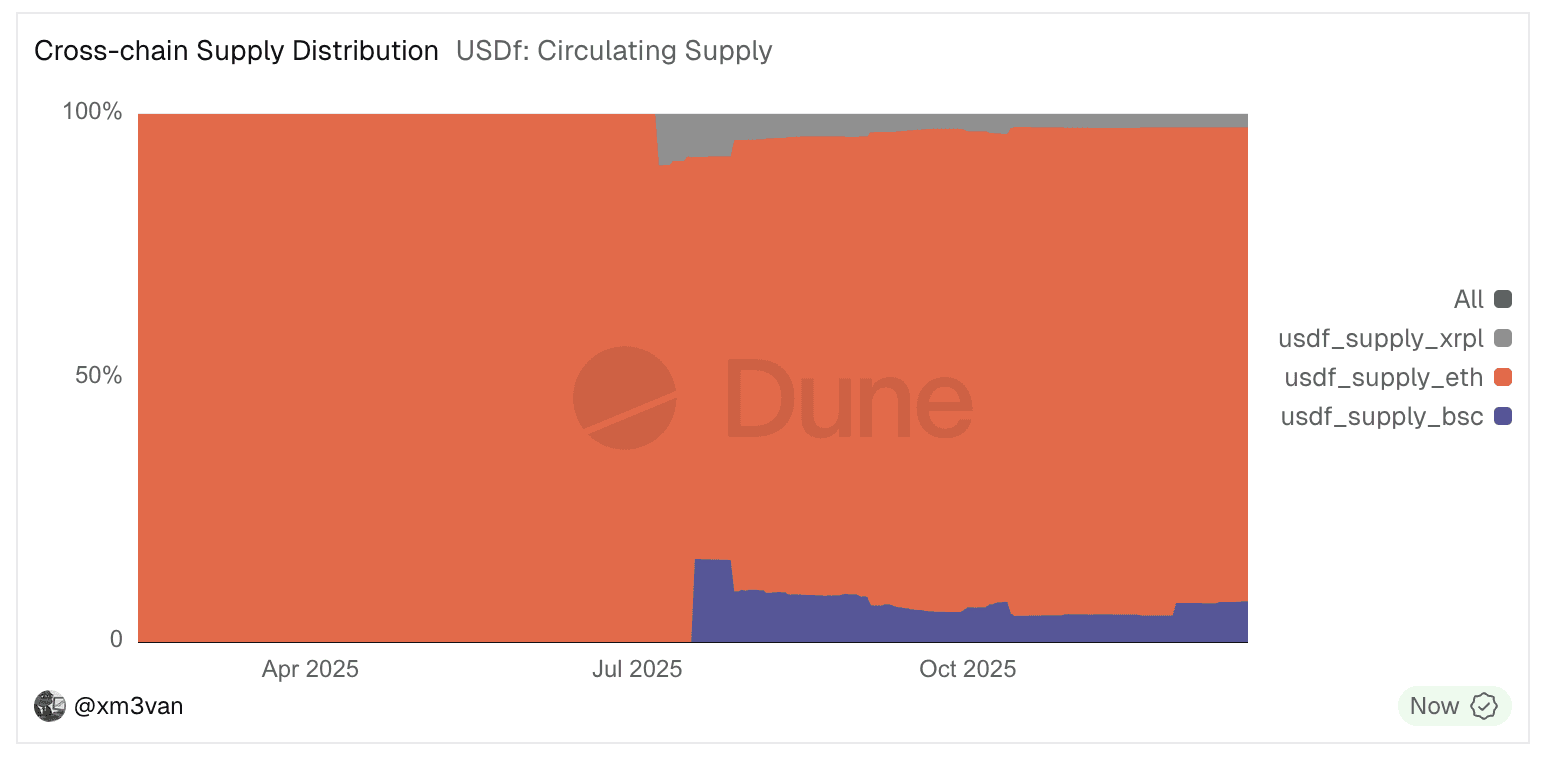

Circulating Supply

Source: Dune (Last executed:18-12-2025)

The circulating supply is defined as the total amount of stablecoins in circulation over time. Since inception, the circulating supply has been increasing steadily, with a huge jump in growth toward the end of July. The current Circulating Supply as of query execution totals 2.1 billion USD.

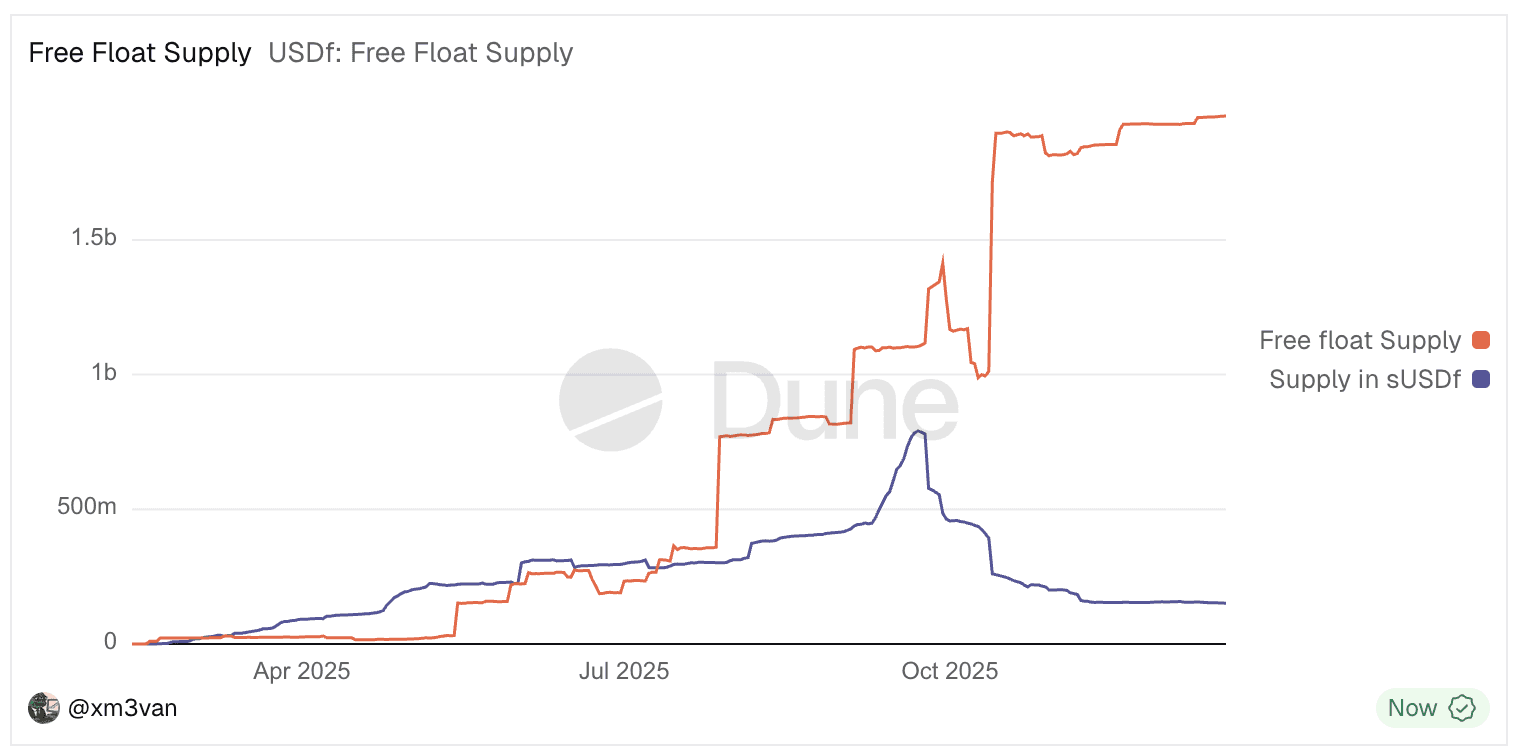

Free Float Supply

Note: Only excludes USDf in sUSDf

Source: Dune (Last executed: 18-12-2025)

The free float supply sits at query execution just shy of 2 billion. Note that, for the calculation, we do not count USDf within the sUSDf ERC-4626 Vault contract.

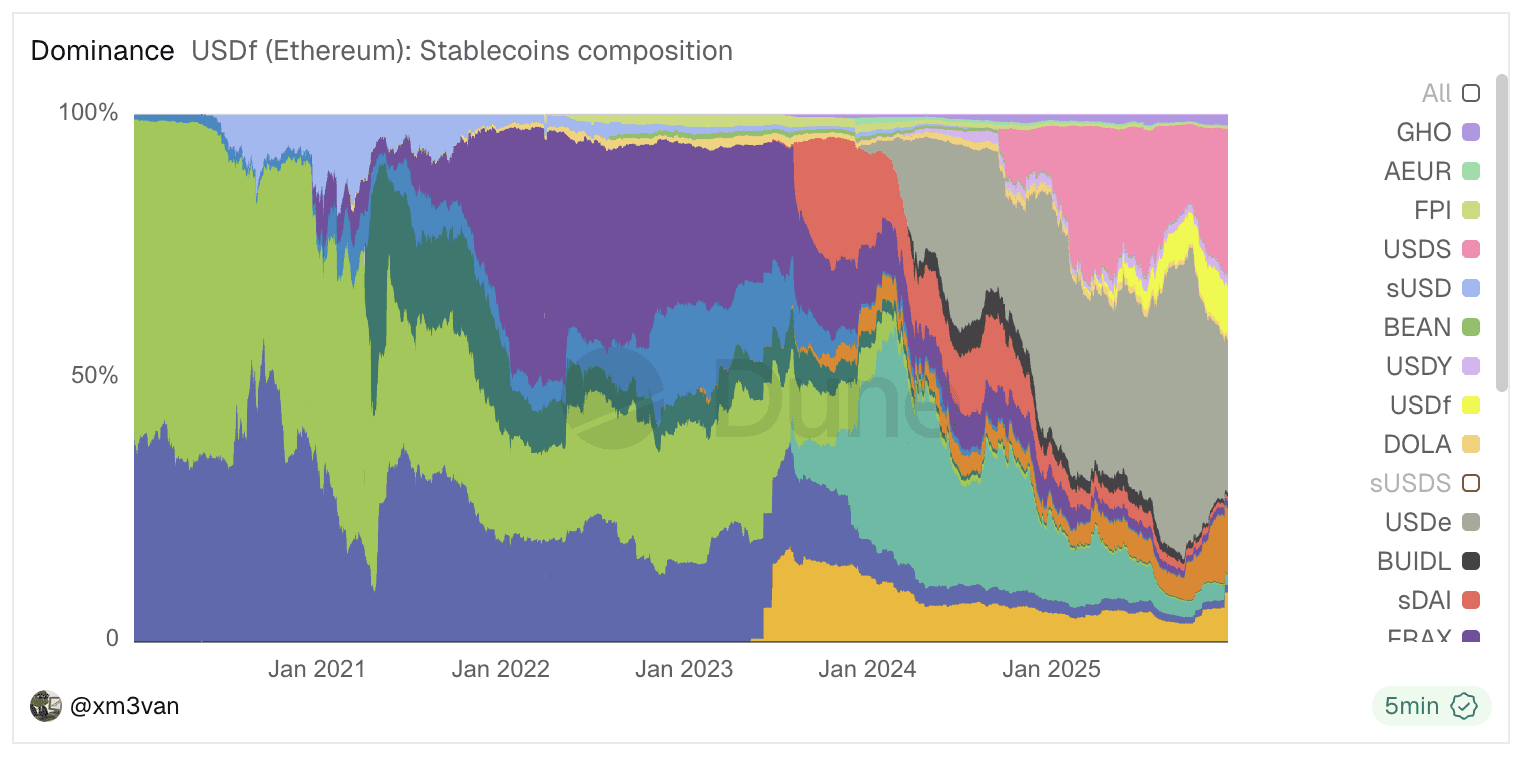

#2.1.2 Market Share in Overall Stablecoins Supply

Source: Dune (Last executed: 18-12-2025)

USDf dominates around 1.1% of Stablecoin Supply on Ethereum at the execution of the query. In the figure, the neon-yellow area appearing towards the end of the series represents USDf, showing increasing dominance. Note that for visibility of the growth, we exclude major stablecoins from the visualization (not calculation).

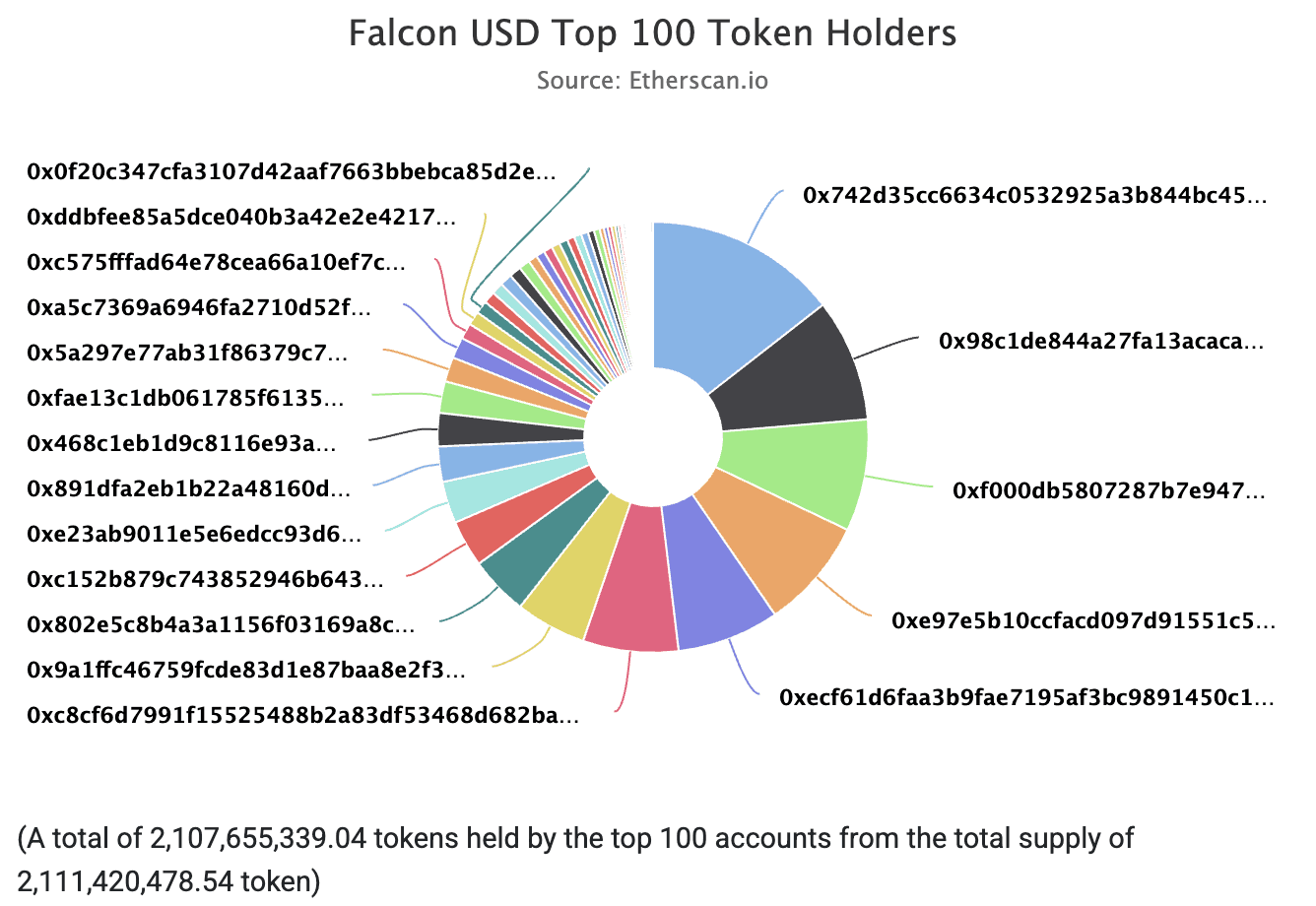

#2.1.3 Supply Distribution

Ethereum

Source: Etherscan (Accessed 18-12-2025)

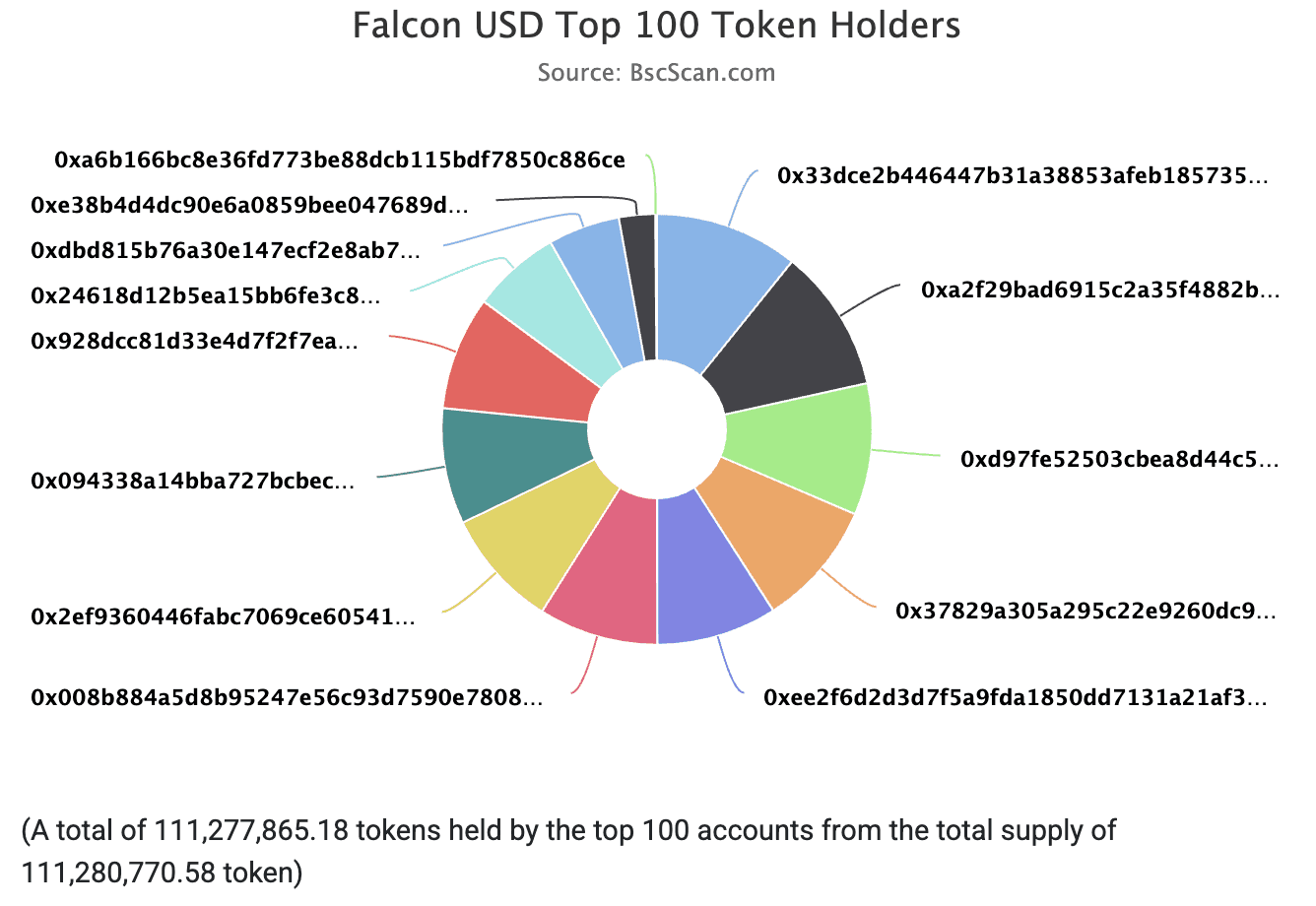

BSC

Source: BSCScan (Accessed 18-12-2025)

The distribution of Stablecoin supply of the Top 100 holders on Ethereum and BSC is highly centralized, with 99.82% and 100% held by the Top 100 holders, respectively.

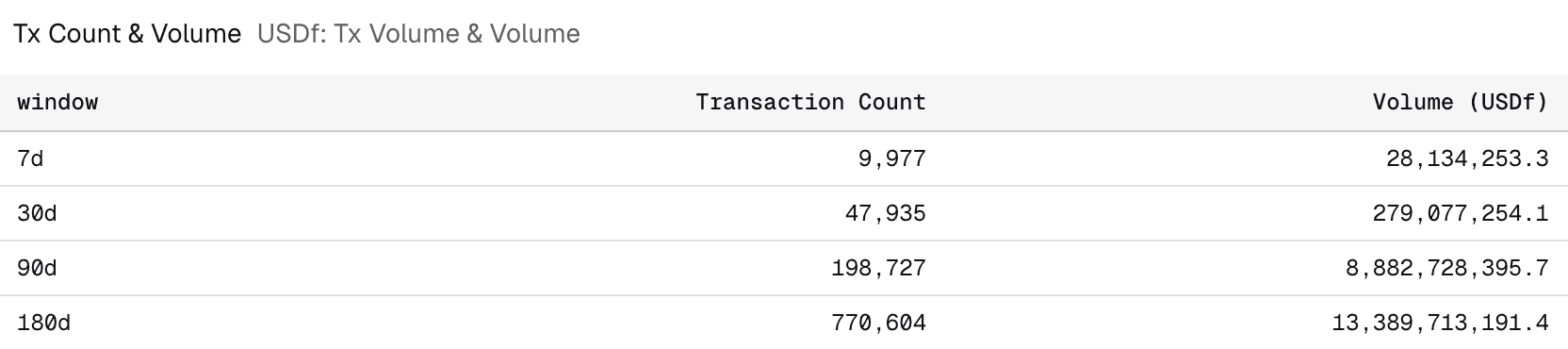

#2.1.4 Transaction Count and Volume

Source: Dune (Last executed:18-12-2025)

Above we show the daily values for the last 7d, 30d, 90d, and 180d of transaction events of mint/redeem/transfer. Volume and transactions are plentiful, but have decelerated in size.

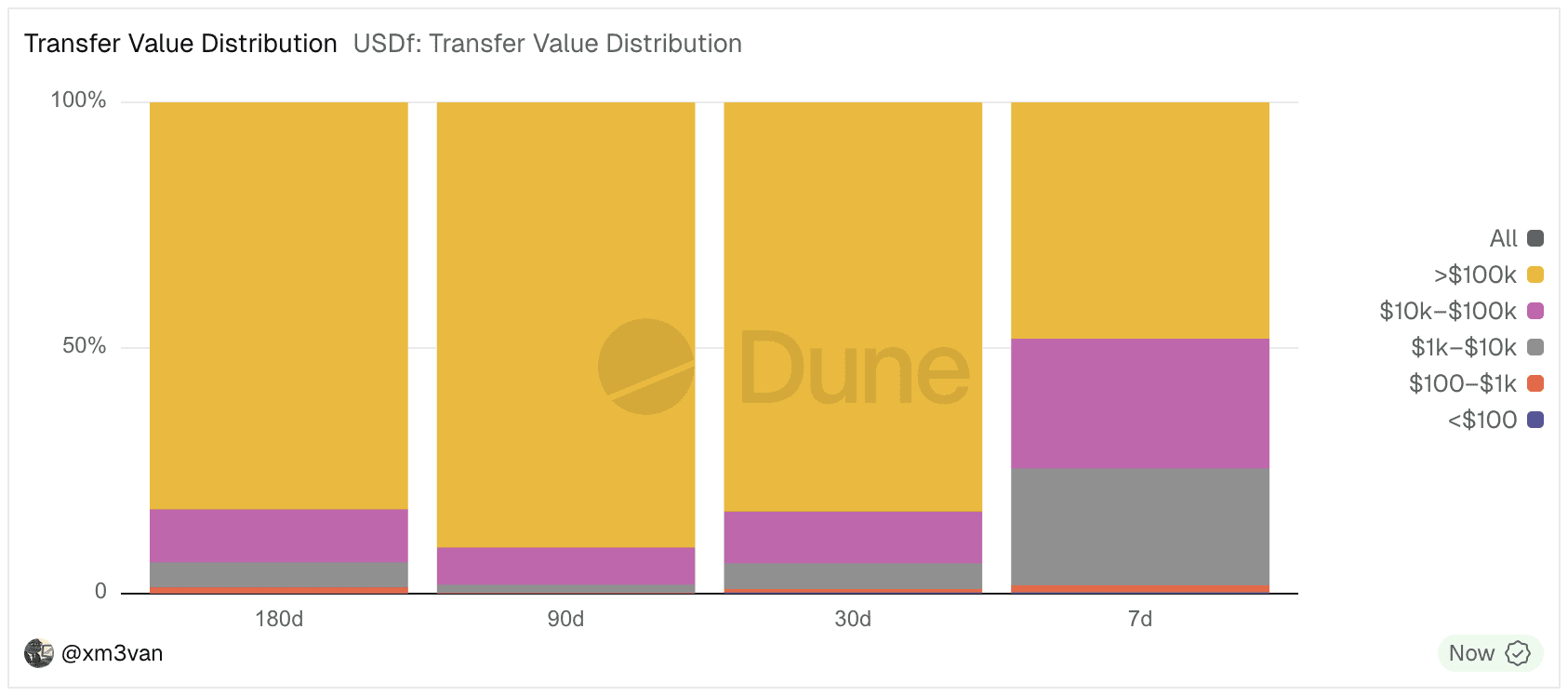

#2.1.5 Transfer Value Distribution

Source: Dune (Last executed: 18-12-2025)

The Transfer Value Distribution shows a prevalence of high value transfers. This suggests the primary use case of USDf is liquidity rails for traders, rather than payments. Though, there has been an uptick in smaller transfers recently.

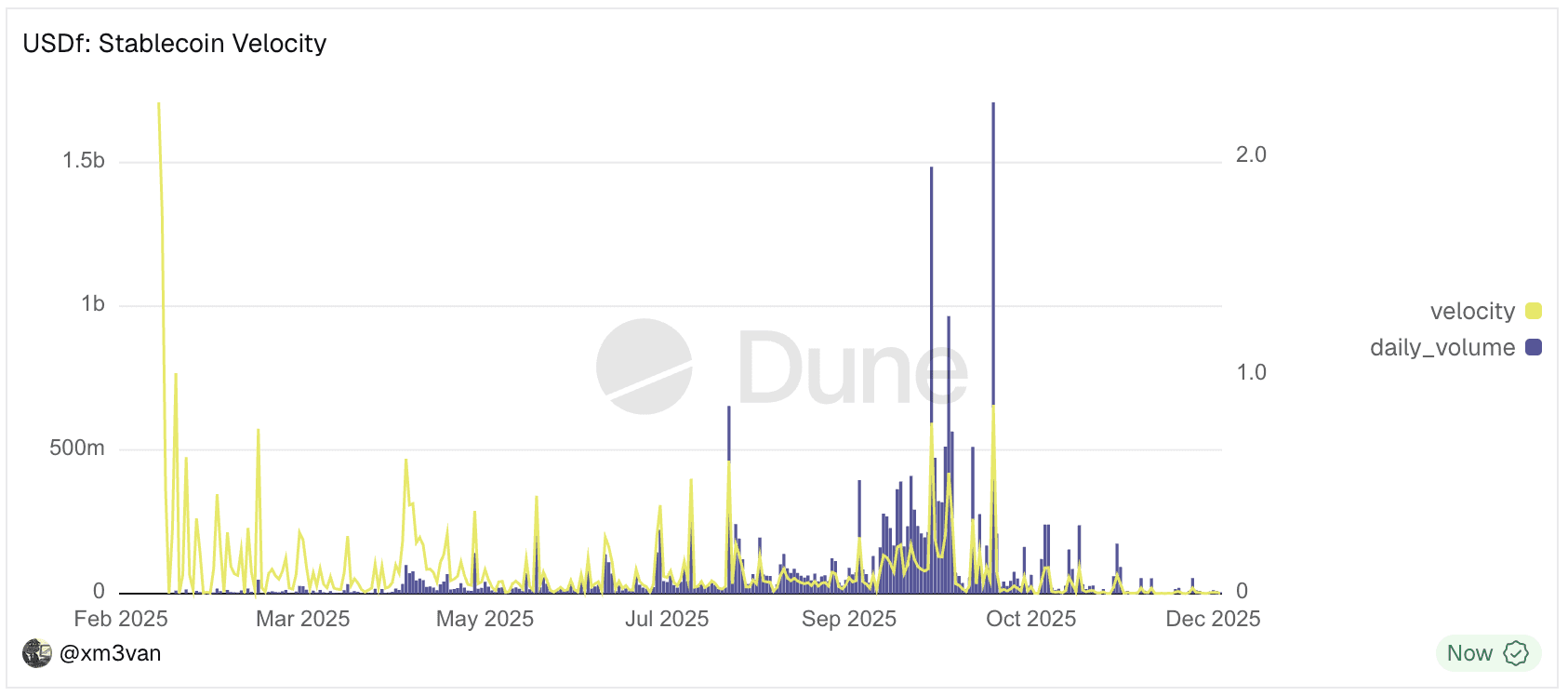

#2.1.6 Stablecoin Velocity

Source: Dune (Last executed: 18-12-2025)

The Stablecoin Velocity represents the rate at which the stablecoin changes hands in the economic system. It is given by the ratio between Transfer Volume and Circulating Supply. Since April 2025, the velocity has ranged between 0.01 and 0.8. In other words, around 1% to 80% of the USDf units are transferred between addresses. The decline in activity since October can be related to overall more pessimistic market wide sentiment.

#2.1.7 Active Users

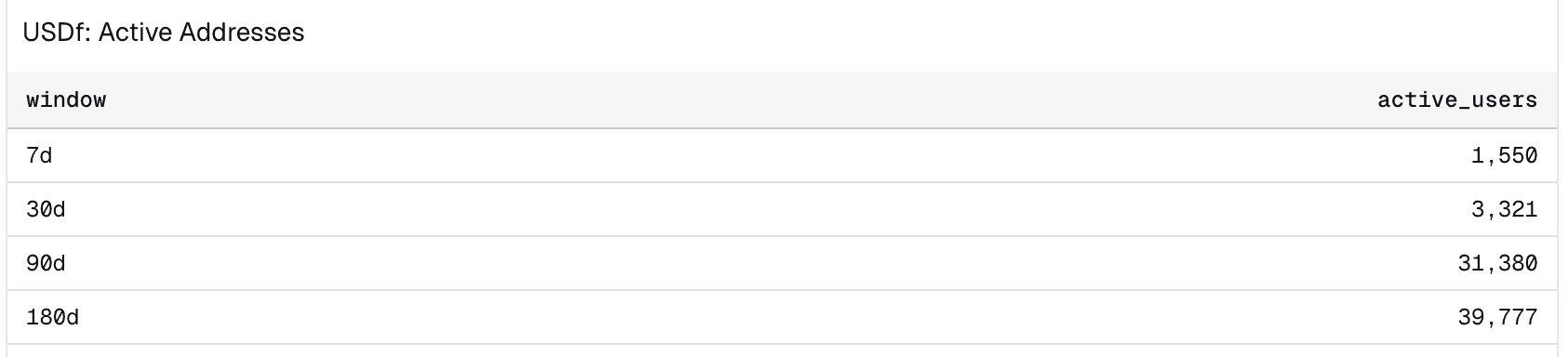

Source: Dune (Last executed: 18-12-2025)

Viewing the number of distinct addresses that have made an on-chain transaction in the last 7d, 30d, 90d, and 180d and the respective volume and tx count (refer to 2.1.4) suggests to us a volume concentration of usage in power users.

#2.1.8 User Growth

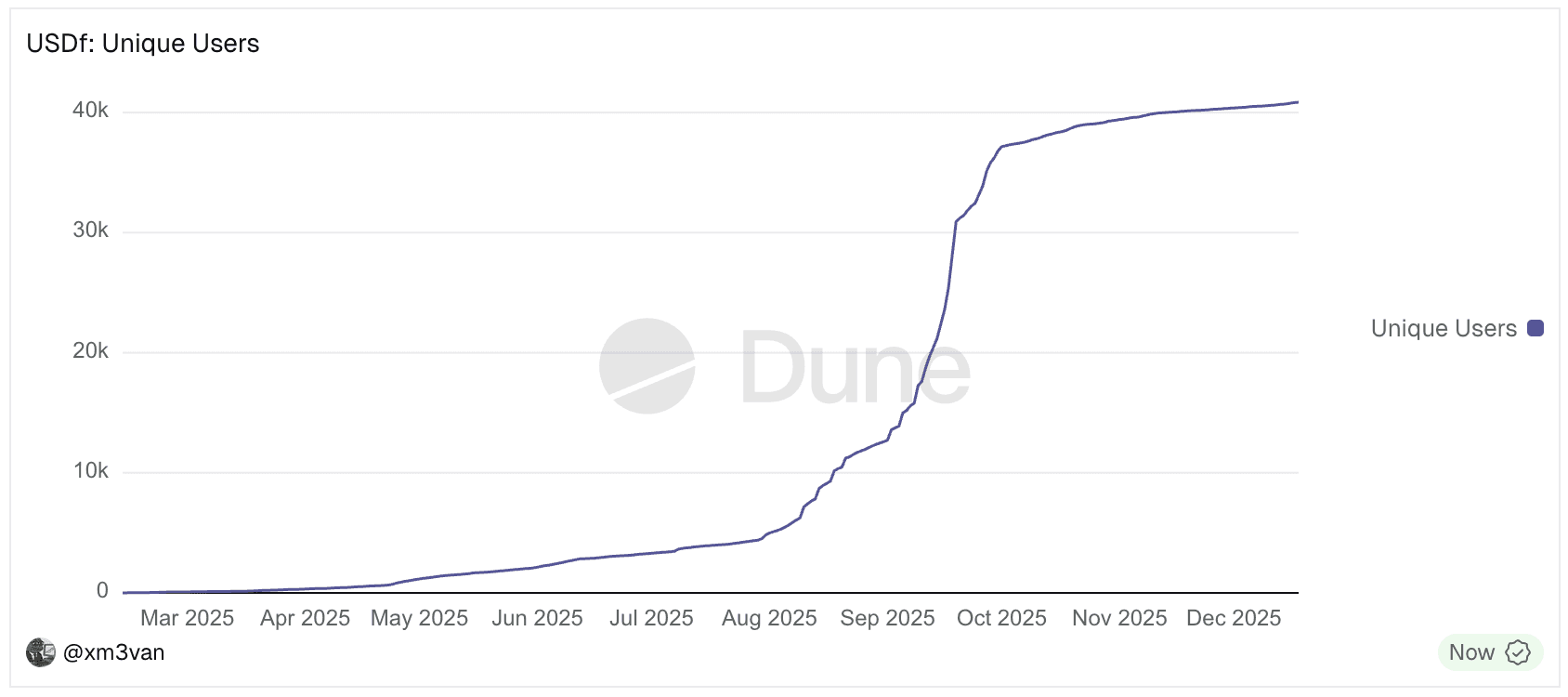

Source: Dune (Last executed: 18-12-2025)

The unique addresses interacting with USDf across BSC and Ethereum show sustained growth since inception. Since October, the market growth has decelerated with overall market sentiment.

#2.1.9 Activity Distribution

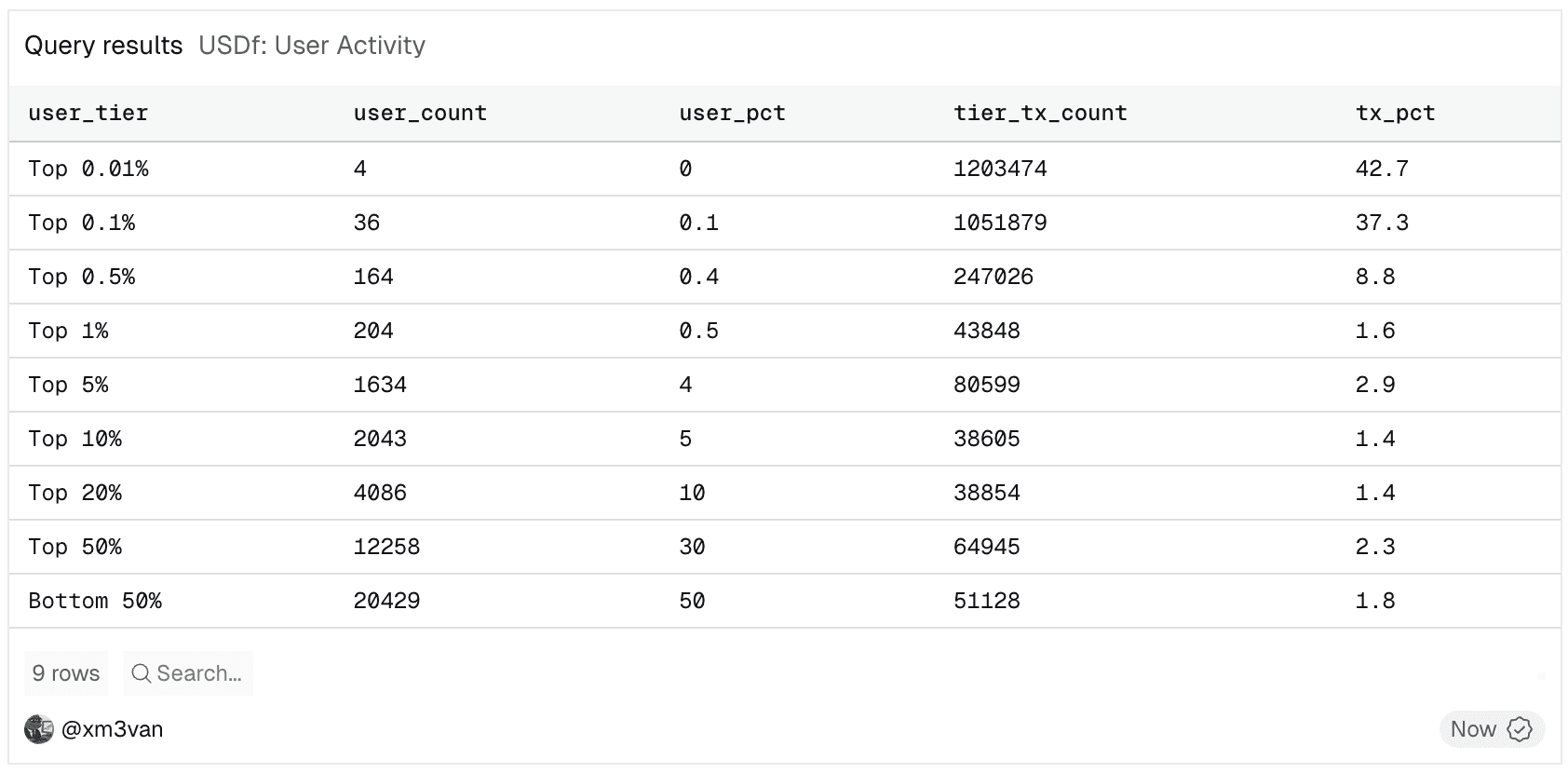

Source: Dune (Last executed: 18-12-2025)

User activity suggests a small number of accounts are responsible for most of the transactions, with the top 0.5% of addresses (or 204 addresses) having generated 88.8% of all transactions for USDf.

#2.2 Peg Stability Metrics

#2.2.1 Peg Deviation Frequency

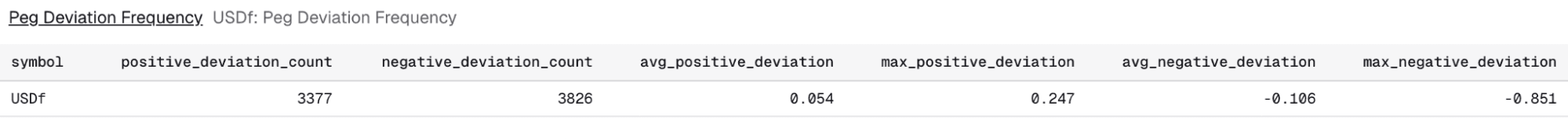

Source: Dune (Last executed:18-12-2025)

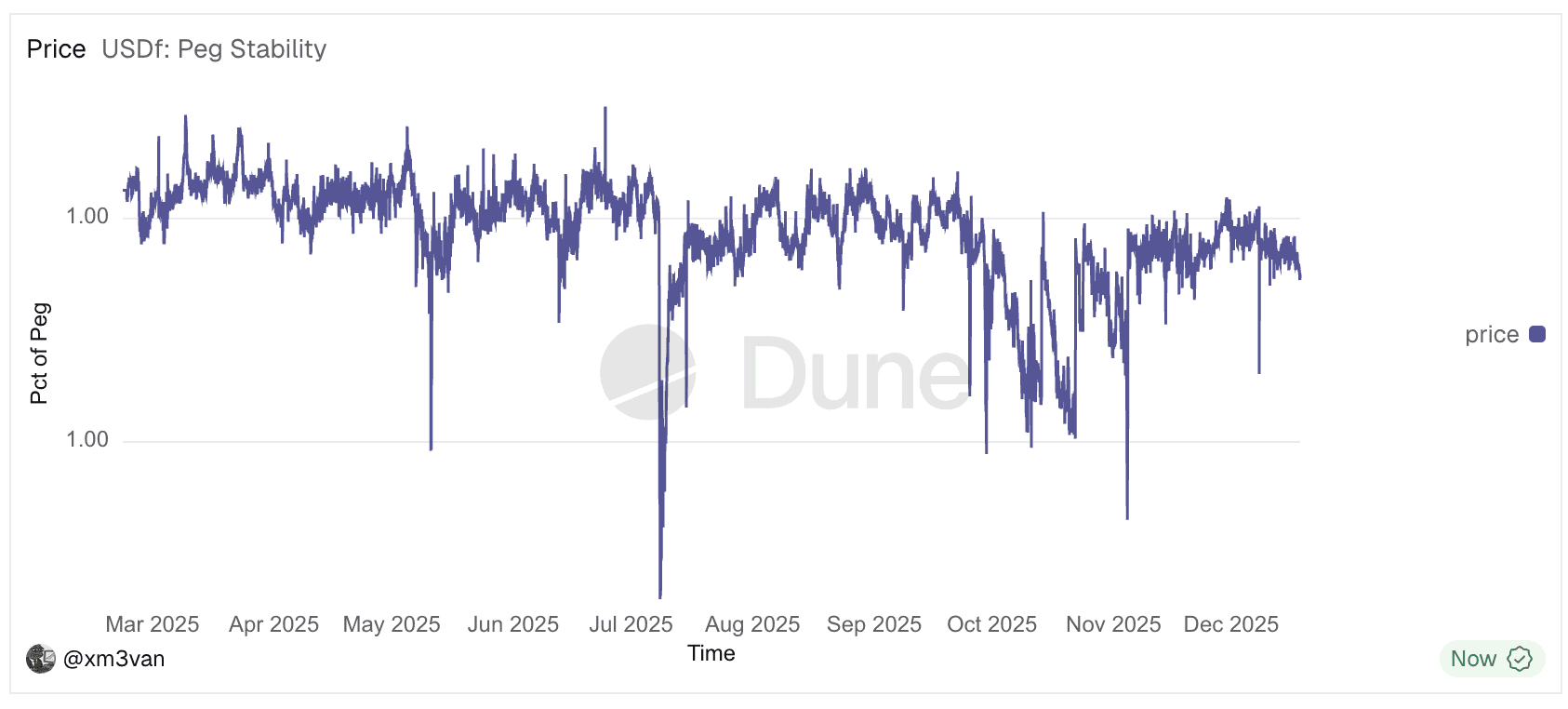

The image above shows the price of USDf over time from March 2025 to October 2025.

Source: Dune (Last executed: 18-12-2025)

We analyze USDf’s peg stability by computing hourly deviations from the $1 target. Over the observed period, USDf traded above peg in 3,377 instances and below peg in 3,826 instances. The average deviation was extremely modest in both directions: +0.054¢ above and –0.072¢ below. However, while upward deviations peaked at only +0.247¢ (≈ $1.0025), downward deviations reached as low as –0.851¢ (≈ $0.9915).

#2.2.2 Maximum Peg Deviation

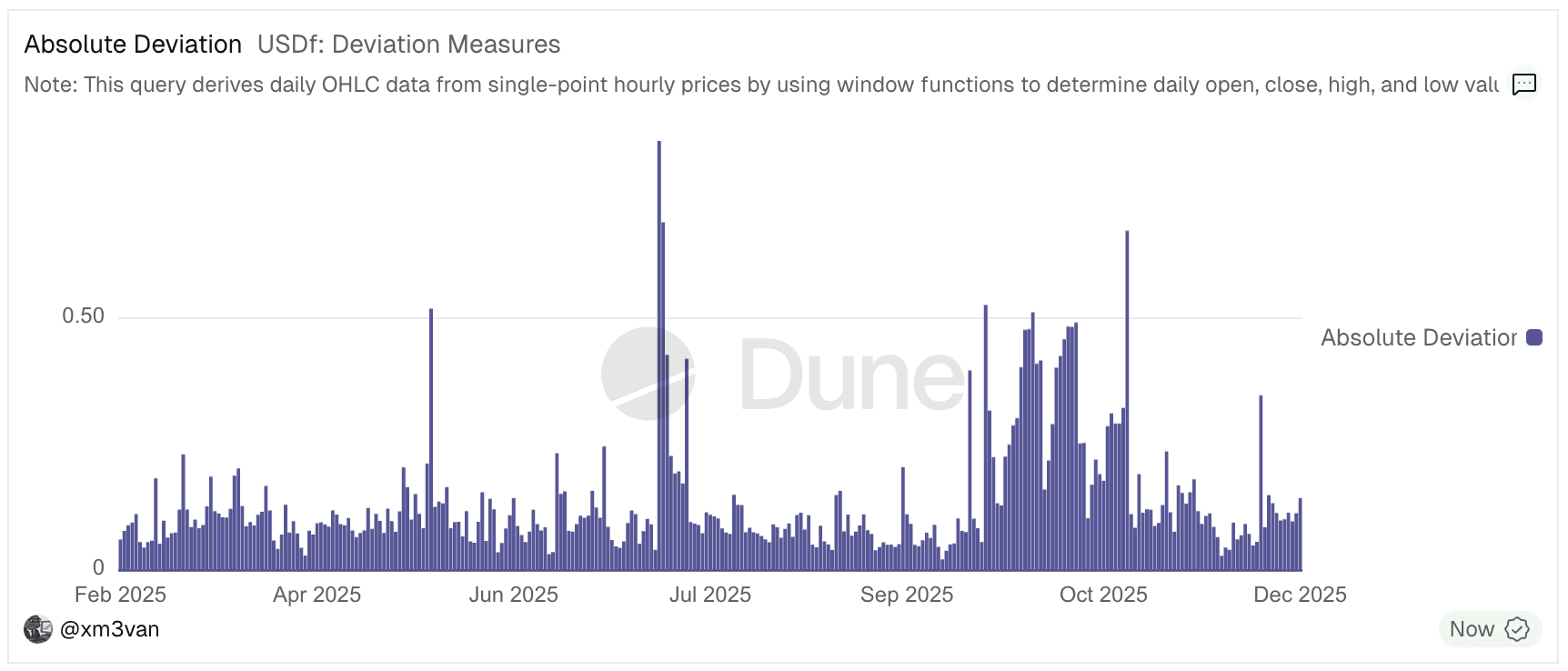

Source: Dune (Last executed: 18-12-2025)

The maximum deviation from Peg was 0.851% Percent or 0.851 cents. The chart highlights that larger deviations do occur, but most are kept below 0.25% or 0.25 cents.

#2.2.3 Standard Deviation of Pegged Value

Source: Dune (Last executed: 18-12-2025)

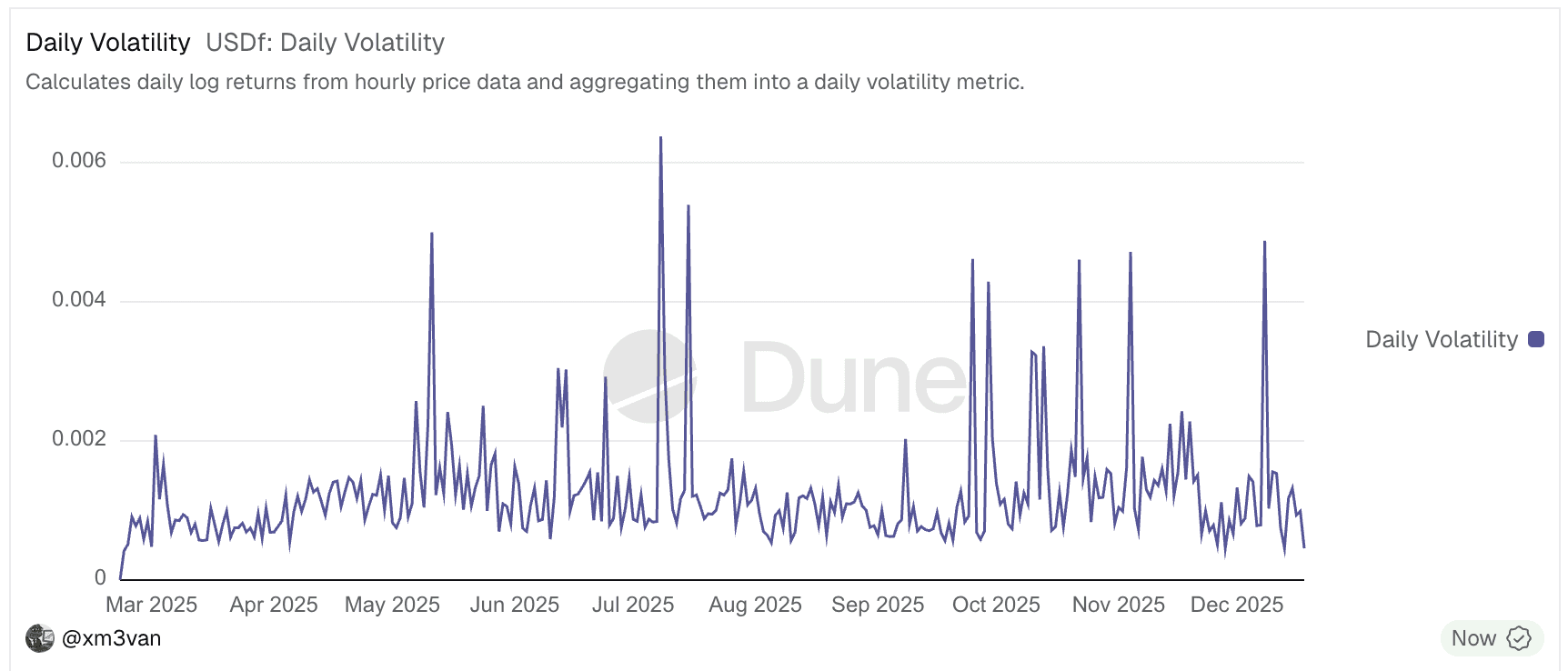

We see that the peg shows temporary fluctuations occasionally in dynamic market conditions.

#2.2.4 Market Depth at Pegged Value

Source: Dune (Accessed 18-12-2025)

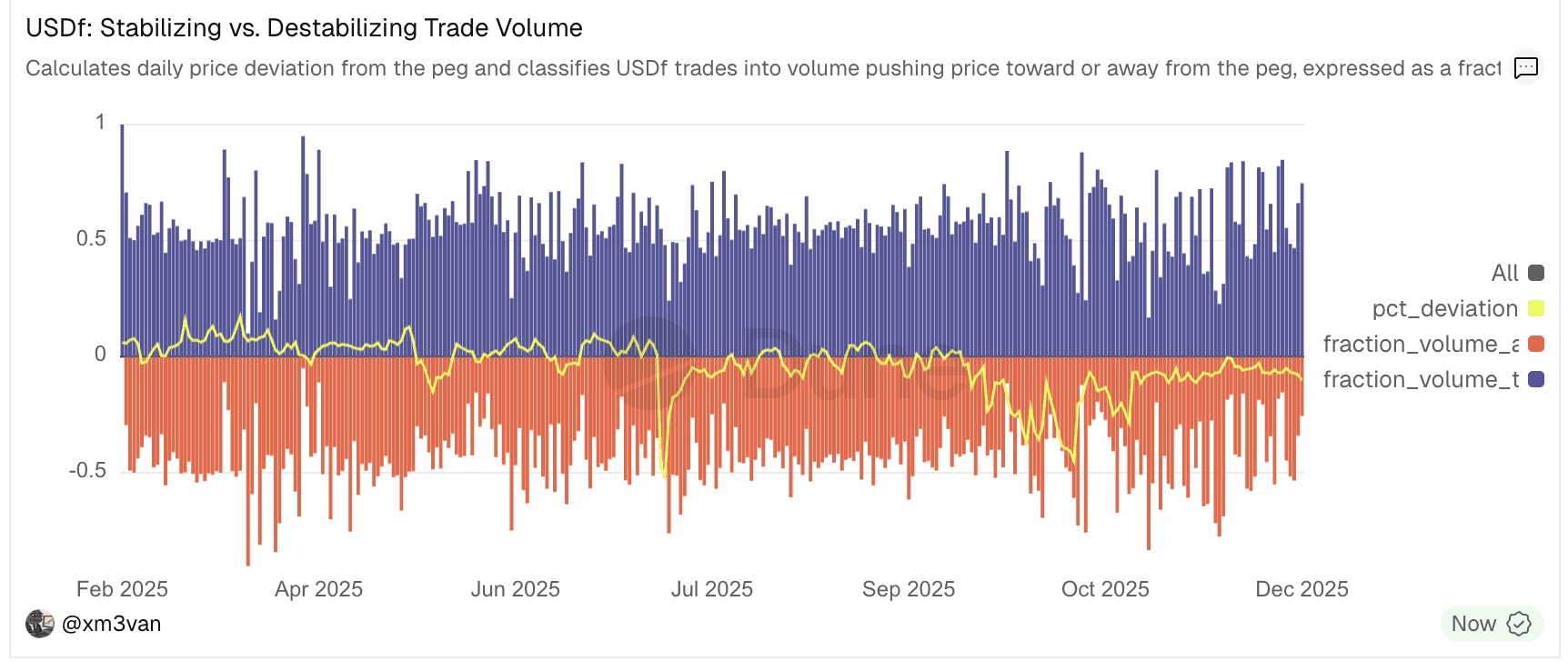

This query calculates daily price deviation from the peg and classifies USDf trades into volume pushing price toward or away from the peg, expressed as a fraction of total volume. We overlay the Percentage deviation for convenience to see how volume behaves on Peg deviation days.

It is important to note that not all pools may be indexed by Dune, hence not all volume is captured, and it should be viewed with this caveat.

From our chart, we can see a consistent presence of stabilizing trades (orange), demonstrating robust market-making activity even on days with large peg deviations. While destabilizing volume (blue) also appears, particularly around price movement, this reflects the natural diversity of trading strategies in a healthy, active market. On extreme deviation days, both stabilizing and destabilizing volumes are often high, indicating strong market engagement and liquidity depth that facilitates efficient price discovery.

#2.2.5 Peg Recovery Time

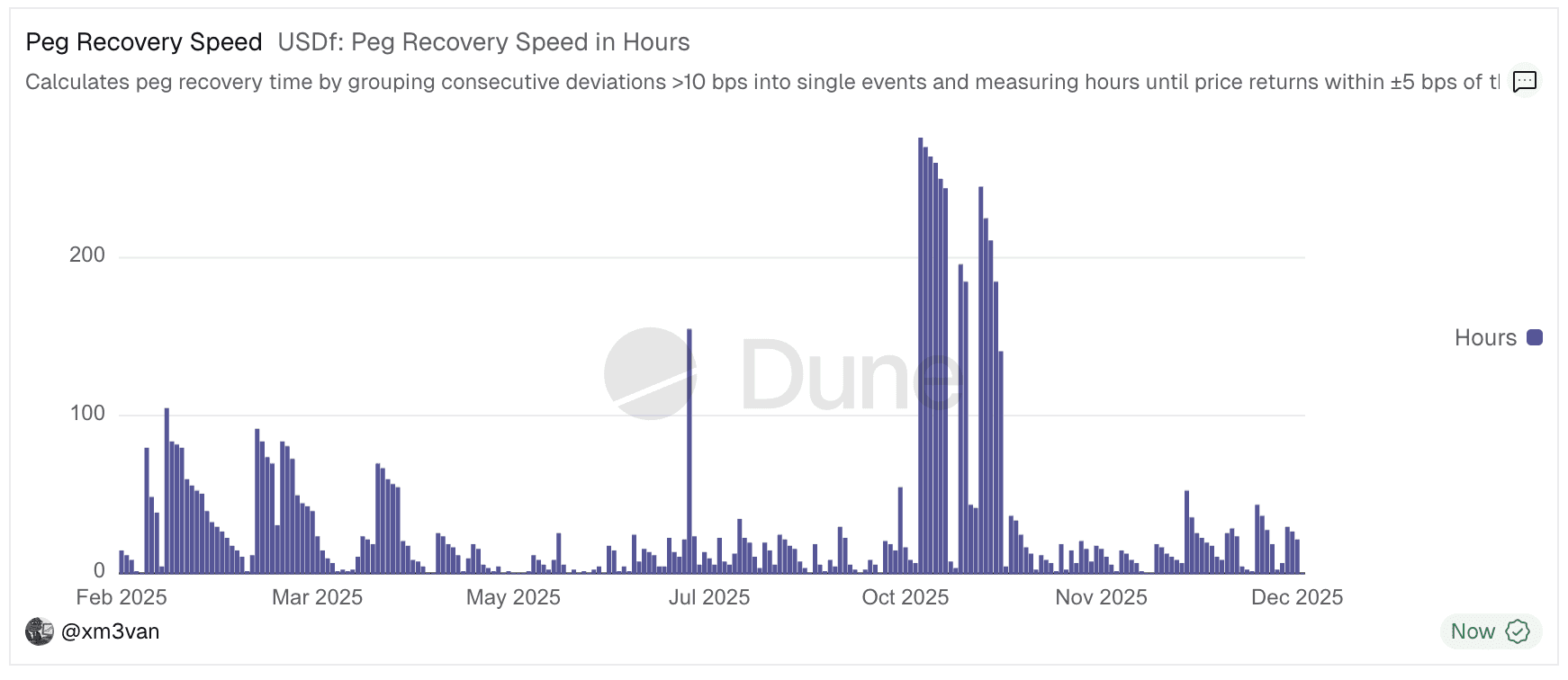

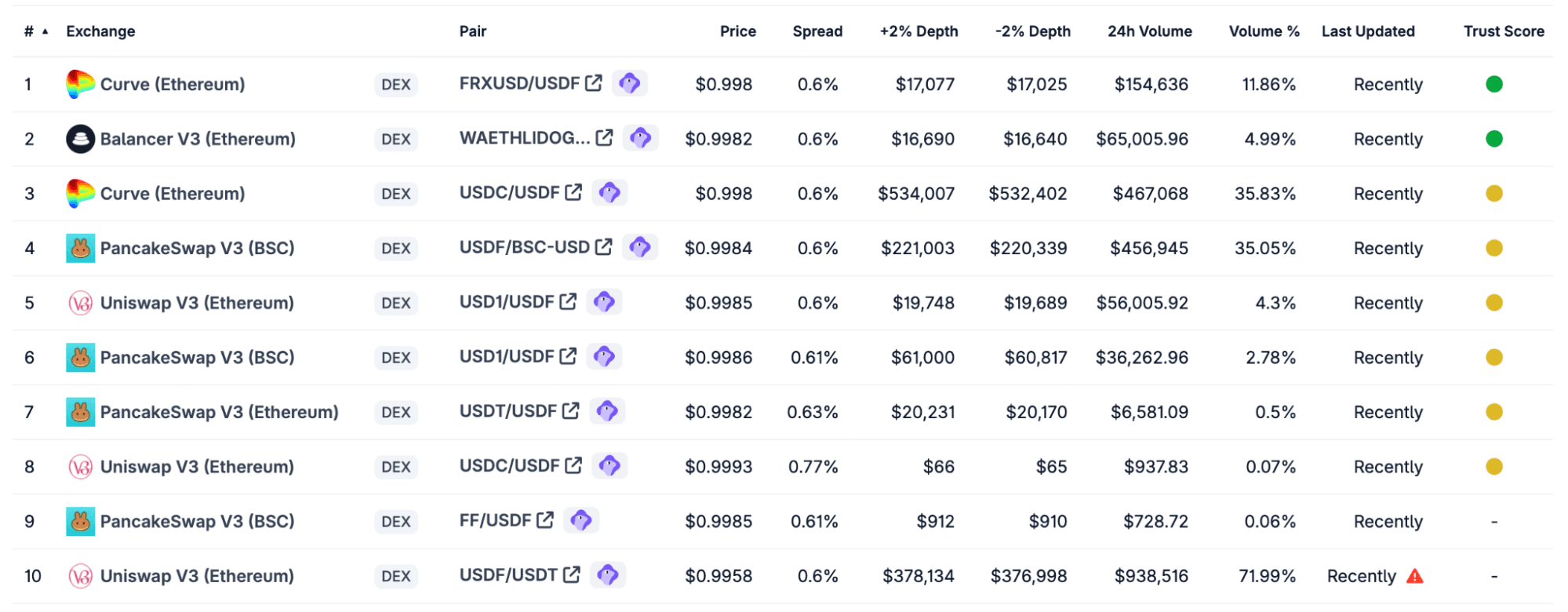

The query calculates peg recovery time by grouping consecutive deviations >10 bps into single events and measuring hours until price returns within ±5 bps of the peg.

Source: Dune (Accessed 18-12-2025)

Source: Dune (Accessed 18-12-2025)

USDf experienced 155 peg deviation events, with a median recovery time of 13 hours and an average of ~22 hours. Most deviations were resolved quickly, but recovery occasionally stretched beyond 24 hours, with a maximum duration of 155 hours. This indicates that while the peg is generally resilient, rare stress events can lead to prolonged instability.

#2.3 Liquidity

#2.3.1 Supported CEXs and DEXs

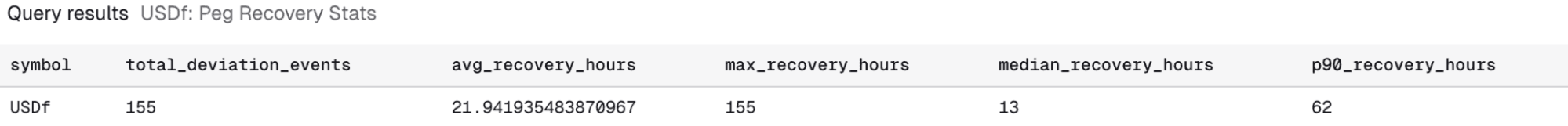

CEX

Source: Coingecko [Accessed 18-12-2025]

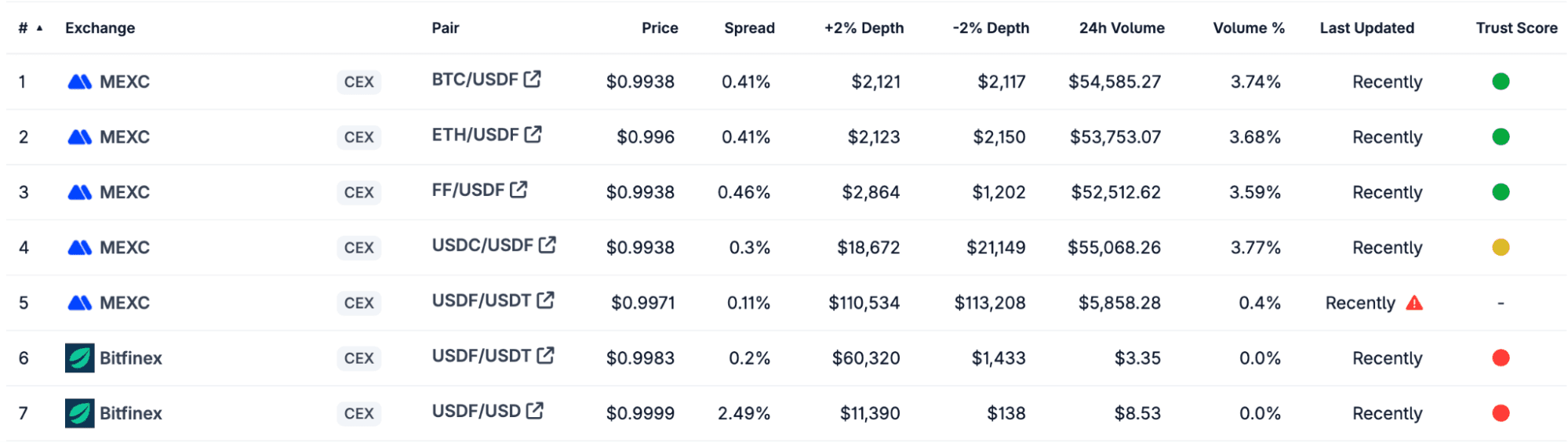

DEX

Source: Coingecko [Accessed 18-12--2025]

Liquidity venues for public trading are currently concentrated with 2 CEX and 4 DEX Venues available, and Falcon Finance has planned to expand to more venues on the roadmap.

#2.3.2 Liquidity Pool Distribution

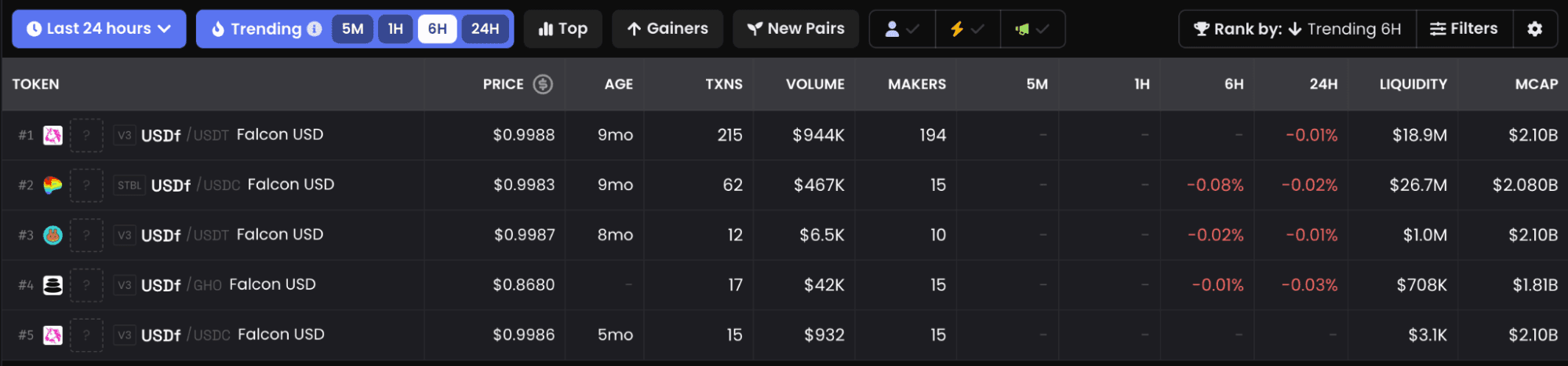

Ethereum

Source: DexScreener (Accessed 18-12-2025)

BSC

Source: DexScreener (Accessed 01-10-2025)

Across BSC and Ethereum, 7 liquidity pools are available, with 6 being actively maintained by Falcon. In total, across both chains, around 60m in liquidity is available. This is primarily concentrated on the Curve and Uniswap pools on Ethereum.

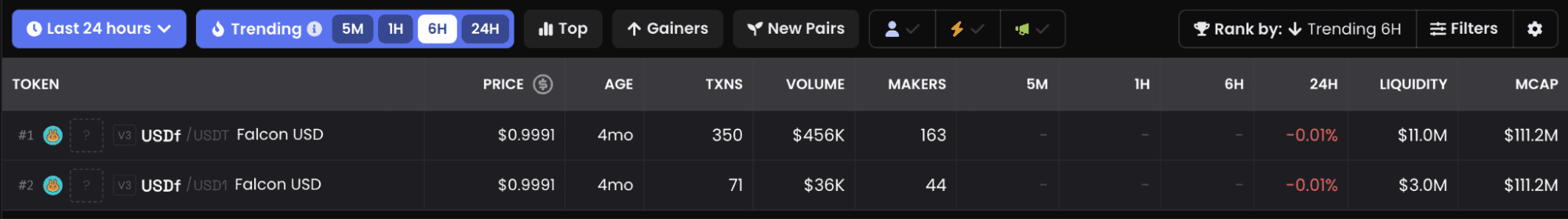

#2.3.3 Liquidity Incentives and Yield

USDf yield varies greatly based on strategy and venue - yields between 5% and 15% are not uncommon. Incentives are partially distributed by third party platforms.

Source: DefiLlama (Accessed 18-12--2025)

In addition, Falcon has its own incentive program where users can earn Falcon Miles for protocol support actions. Miles are earned by minting, holding, or staking USDf on Falcon (including Boosted Vaults). Provide USDf liquidity or trade on supported DEXs like Uniswap, Curve, and PancakeSwap. Supply USDf, sUSDf, or USDC to lending platforms (Morpho, Euler, Silo, Gearbox). Use Pendle, Spectra, or Napier for yield tokenization—Miles are based on LP and YT token balances. The latest miles earning tasks can be found on Falcon’s website (https://app.falcon.finance/miles). Miles are updated daily.

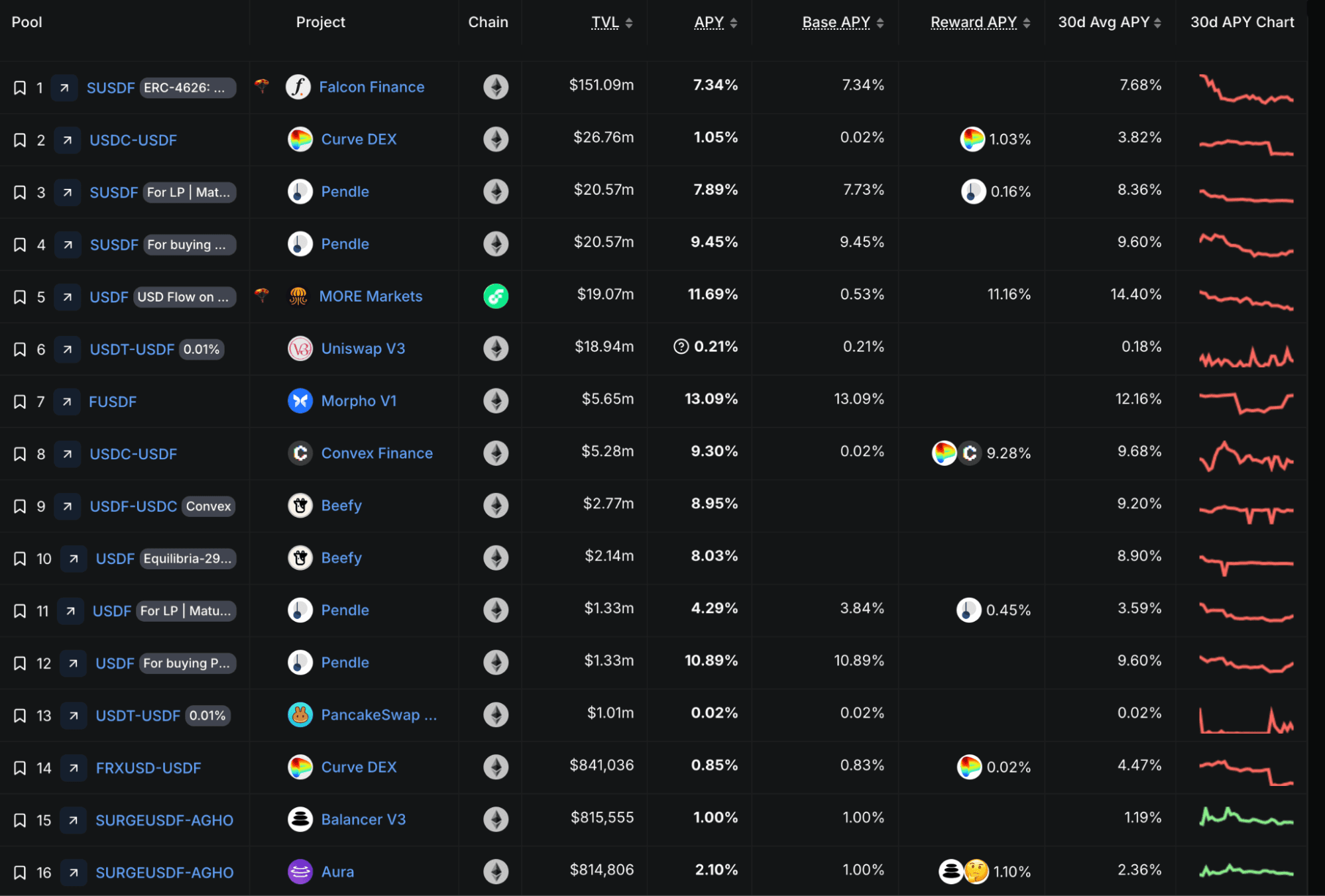

#2.3.4 DEX Trading Volume

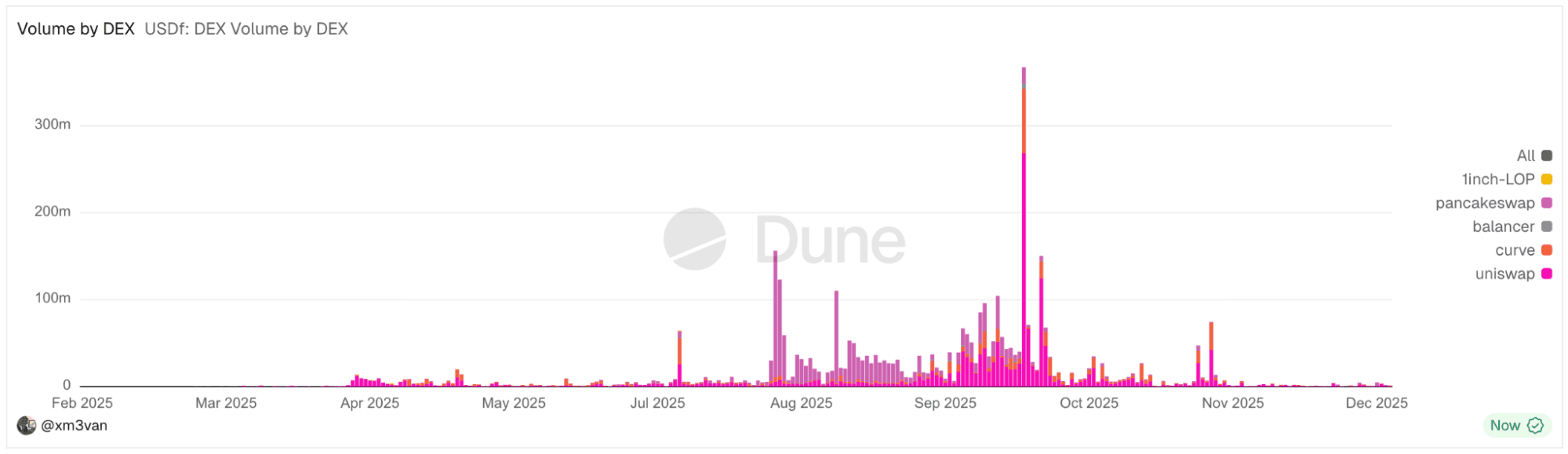

DEX Volume by Pool Address

Source: Dune (Accessed 18-12--2025)

Dex Volume by DEX

Source: Dune (Accessed 18-12--2025)

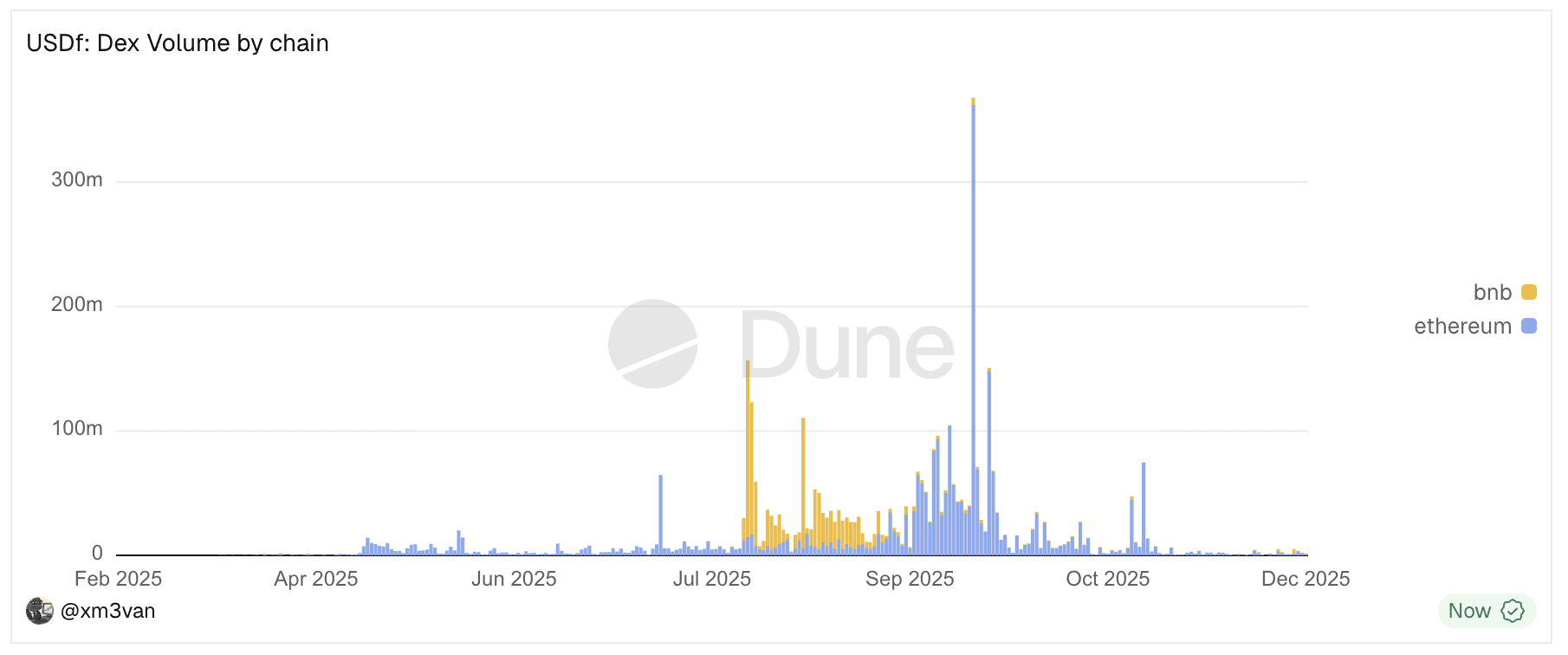

DEX Volume by Chain

Source: Dune (Accessed 18-12--2025)

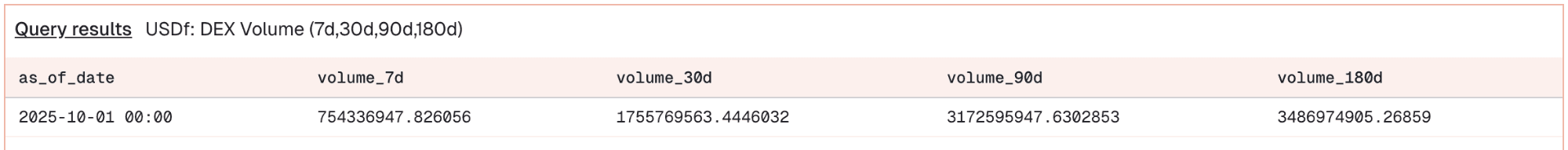

DEX Volume 7d, 30d, 90d, 180d

Source: Dune (Accessed 01-10-2025)

DEX volume is concentrated in two main venues - Curve and Uniswap, with a few pool addresses driving a majority portion of flow. The launch on BNB has also brought in significant volumes at the start in mid July until mid September.

#2.3.5 Liquidity Utilization Rate

We measure Liquidity Utilization on three venues: Curve StableSwapNG (USDT/USDf, Ethereum), Uniswap V3 (Ethereum), and PancakeSwap V3 (BNB).

For concentrated-liquidity AMMs (Uniswap/Pancake), daily utilization equals USDf volume vs. a trusted counterparty set (USDT, USDC, USD1, frxUSD, WETH/WBNB) divided by TVL, where TVL = 2 × (trusted-side cumulative net flows: mint + swap − burn − collect) valued in USD using daily median prices. For Curve NG, daily utilization equals swap notional (sold leg, decimals-normalized, valued at the matching hourly USD price) divided by TVL from the last daily token_supply × virtual_price snapshot.

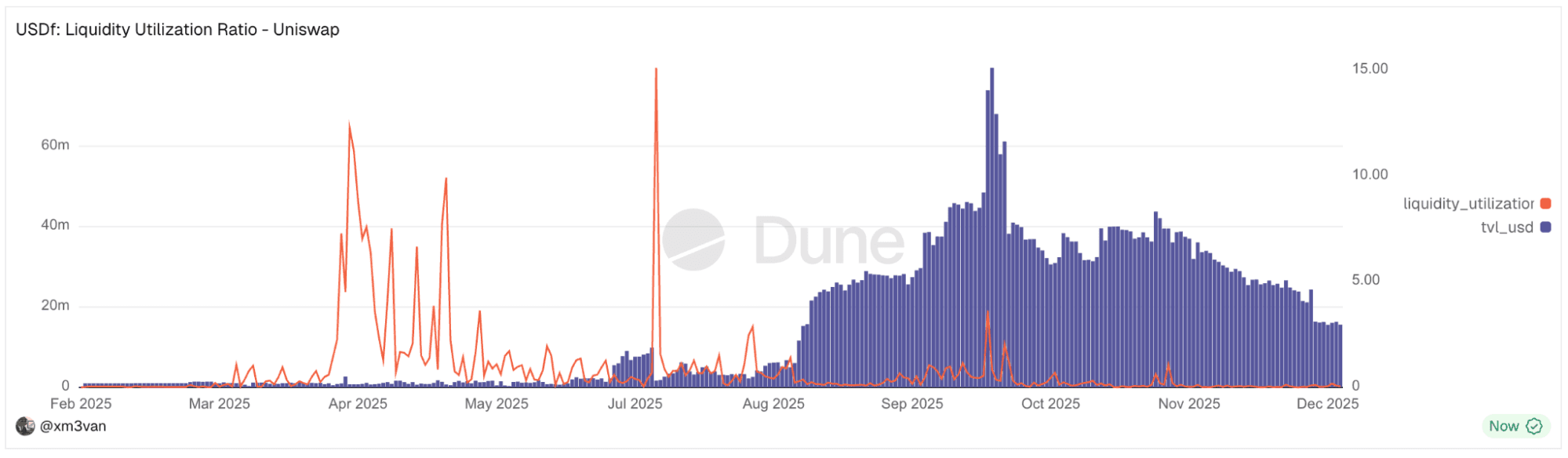

Uniswap V3 (Ethereum)

Source: Dune (Accessed18-12--2025)

Day-by-day turnover of USDf against trusted counterparties relative to available liquidity; zeros on days with no qualifying Uniswap V3 trades.

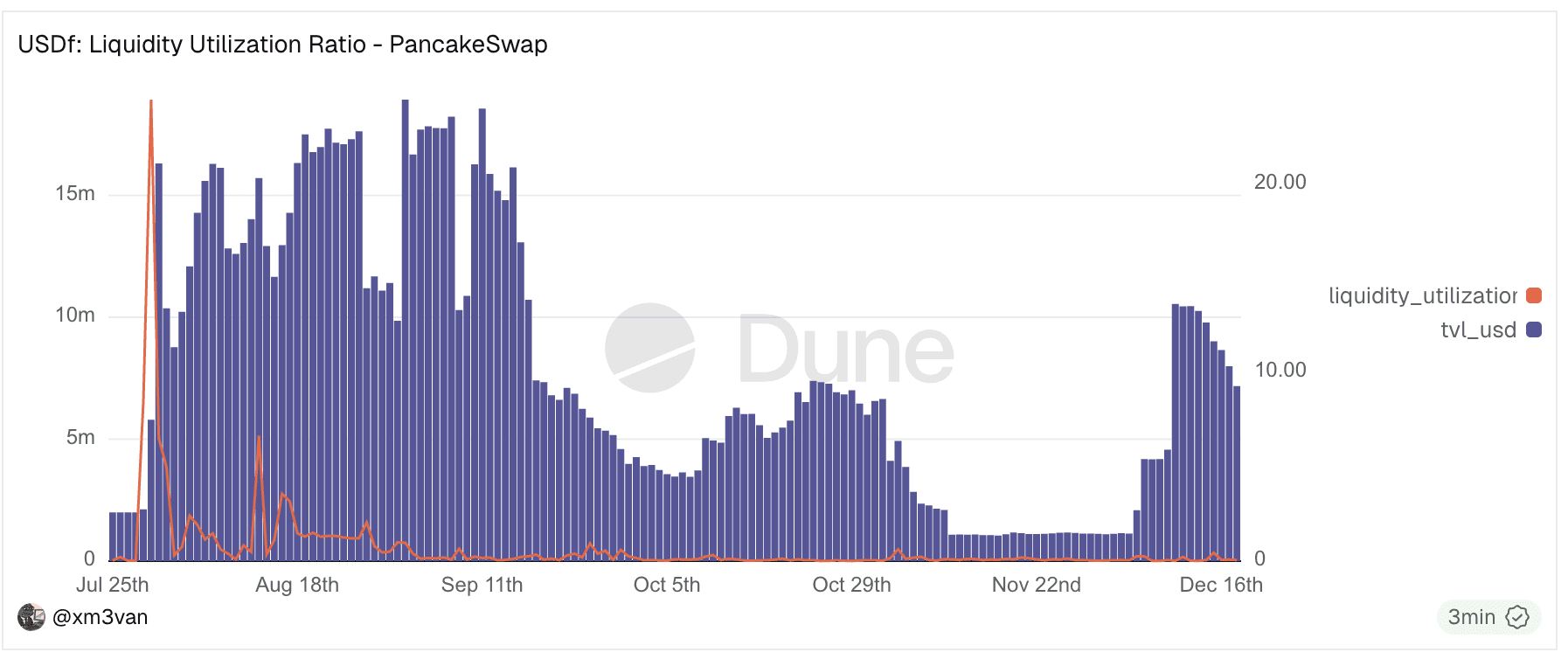

PancakeSwap V3 (BNB)

Source: Dune (Accessed 18-12-2025)

Daily ratio of trade activity to liquidity on BSC; captures bursts in BSC market activity and slowdowns when no qualifying trades occur.

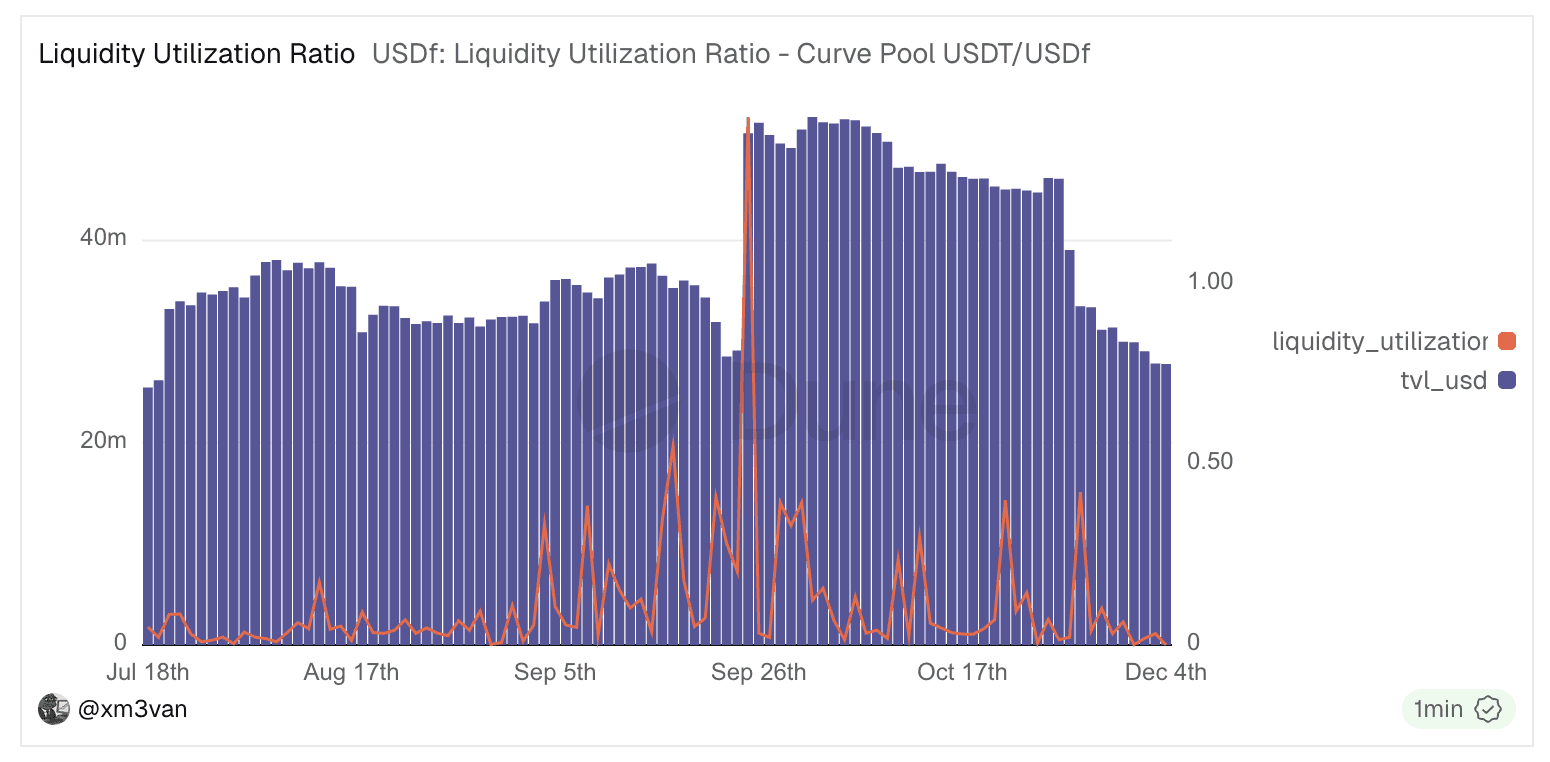

Curve StableSwapNG (Ethereum)

Source: Dune (Accessed 18-12-2025)

Pool-level turnover intensity in the USDT/USDf NG pool; spikes on high-activity days, flat when swaps are minimal.

Across venues, liquidity utilization is episodic—generally below 1 on typical days (ample liquidity vs. flow) with occasional spikes >1 when turnover exceeds TVL. Venue mechanics and token coverage matter: Uniswap/Pancake capture cross-pair activity, while Curve uses on-chain swap events with LP token–based TVL. Interpret cross-venue comparisons with these caveats in mind.

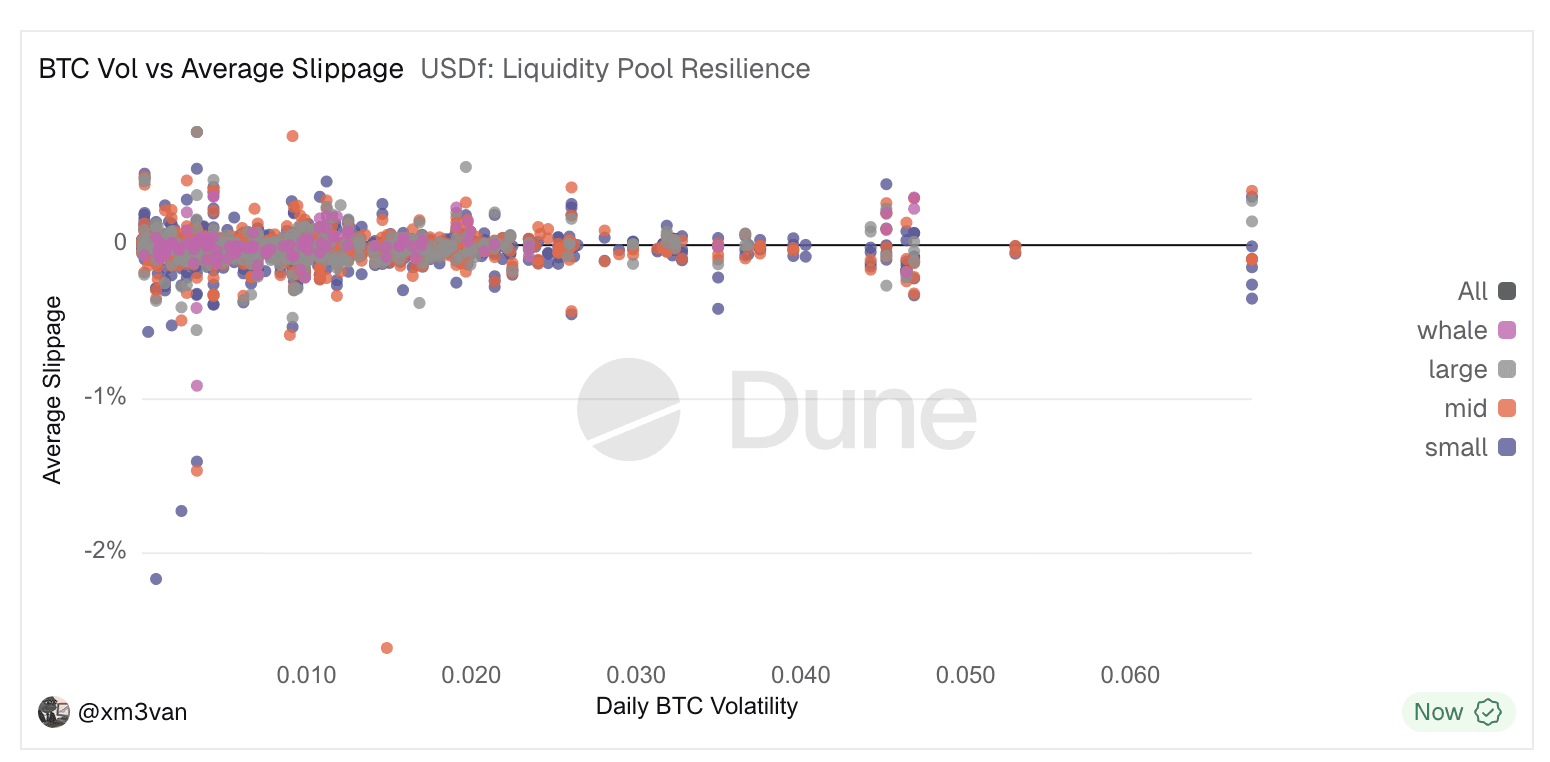

#2.3.6 Liquidity Pool Resilience

Source: Dune (Accessed 18-12-2025)

The resilience of DEX pools containing USDf is assessed by analyzing average slippage on trades exceeding $10,000, categorized by trade size (small, mid, large, whale). Slippage is defined as the percentage deviation from the assumed $1 peg and is plotted against daily BTC volatility, which serves as a proxy for market stress.

Across all trade size categories and a broad range of BTC volatility levels, most trades demonstrate an average slippage (less than 1%), suggesting that USDf pools generally maintain pricing efficiency under the conditions observed. However, it is important to acknowledge that this analysis may not fully capture behavior during extreme market events or in the case of exceptionally large trades not represented in the sample.

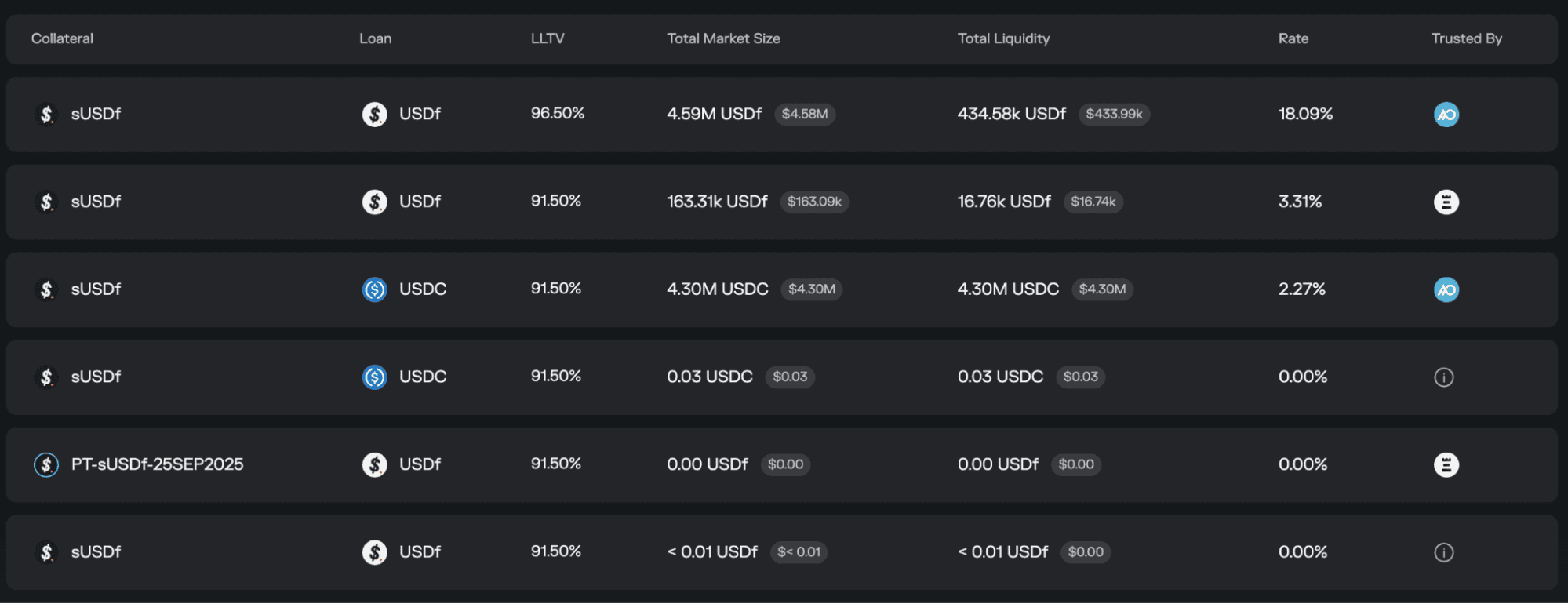

#2.3.7 Stablecoin Usage in DeFi

Integration in Lending Platforms (Money Markets)

USDf is integrated into lending protocols where users can supply or borrow it, much like other major stablecoins. Notably, USDf is supported by Morpho and Euler Finance.

Source: Morpho (Accessed 18-12-2025)

In the context of findings in section 2.2 around peg stability, we first outline a conceptual mapping on how buy and sell pressure can affect the USDf peg.

-

Scenario: USDf / sUSDf as Collateral → Borrow USDC: If collateral value drops, liquidators seize USDf or sUSDf, unwrap to USDf, and sell it for USDC - creating sell pressure on the USDf peg.

-

Scenario: USDf / sUSDf as Collateral → Borrow USDf (Looping): Users buy USDf to loop, creating initial buy pressure. But if positions unwind (e.g., liquidation), the borrowed USDf is dumped - causing sell pressure on the peg.

-

Scenario: PT-sUSDf as Collateral → Borrow USDC: When PT-sUSDf is liquidated, liquidators redeem it into sUSDf → unwrap to USDf → sell to recover USDC - generating indirect USDf sell pressure via the Pendle unwind.

Morpho offers high LTVs. At current utilisation, the amount of USDf-related collateral represents a small amount of the total supply, suggesting that market volatility would not affect it too much.

DEX Liquidity Provision

USDf is listed on decentralized exchanges including Uniswap, Curve, Pancakeswap, and Balancer on Ethereum, as well as PancakeSwap on BNB Chain. It is typically paired with other stablecoins like USDC or USDT to form stablecoin pools with low slippage. Yield farmers can provide liquidity in these pools to earn trading fees and, in some cases, liquidity mining rewards. The presence of USDf in stablecoin pools also facilitates arbitrage that helps maintain its $1.00 peg. For example, a USDf-USDC pool on Curve or a USDf-USDT pool on Uniswap allows traders to swap with minimal price impact, and LPs (liquidity providers) earn a steady fee yield.

Yield Tokenization (Pendle, Napier, Spectra)

USDf’s yield-bearing nature (via sUSDf) is further leveraged on protocols like Pendle Finance, Napier, and Spectra. These platforms enable yield tokenization and fixed-rate strategies. For instance, on Pendle, users can deposit sUSDf and split it into a Principal Token (PT) and Yield Token (YT), such as PT-sUSDf that represents the fixed principal and a separate token for the future yield. This allows users to sell or buy future yield, effectively locking in a fixed yield or speculating on interest rate changes. In USDf’s case, one could lock in a portion of the ~8-10% APY by selling the YT, or conversely buy YT to get leveraged exposure to the yield. Napier and Spectra (which evolved from APWine) offer similar functionality, letting users create fixed-yield vaults or trade the yield of USDf and other stablecoins.

#2.3.8 Net Cross-Chain Flow

USDf is currently available on Ethereum, Ripple, and BSC natively. It still has a heavy concentration on Ethereum (~90.1%).

Source: Dune (Accessed 18-12-2025)

#Section 3: Reserves Analysis

This section evaluates the composition, solvency, and structural risks of Falcon’s reserves. It aims to convey (1) how reserves are allocated across assets and custodians, and what vulnerabilities arise from these allocations, and (2) how reserves have evolved over time in terms of solvency coverage, flows, and concentration.

This section is divided into 4 sub-sections:

-

3.1: Solvency & Backing – adequacy of reserves against supply, including stress scenarios and unwind capacity.

-

3.2: Composition & Drift – breakdown of reserve allocations by asset, type, and custodian, highlighting structural changes.

-

3.3: Flows & Rotation – analysis of week-over-week reserve inflows/outflows and position changes across assets.

-

3.4: Concentration – assessment of diversification versus concentration risk across assets and custody channels.

Data Sources and Processing

We combine three feeds: CoinGecko for daily USD price & market-cap (last 180d), Dune Analytics for USDf supply (ETH; we shift Dune’s day by +1 to align with 23:59:59 UTC end-of-day), and Falcon’s weekly reserve snapshots. Assets are canonically mapped via a symbol; we join on (date,coingecko_id) and fallback to symbol if needed (USD only). Dates are normalized to UTC week boundaries; labels are harmonized (e.g., M-BTC→MBTC, Binance→Ceffu). Where amount is missing, we backfill as usd_value / mkt_price; where sheets mistakenly copied amount = usd_value, we repair using market price (but never for stables near $1). We classify stablecoins (USDT/USDC/FDUSD/DAI/USD1/USDF/USDS/GHO) and bucket non-stables by market-cap (≥$10B Large, $1–10B Mid, $100M–1B Small, $25–100M Micro, <$25M Pico). For tokens with no tradable history before launch (e.g., LINEA before 2025-09-10 UTC), pre-launch rows are zeroed to avoid phantom P&L. We merge the shifted USDf supply onto weekly dates, drop duplicates, compute diagnostics (e.g., price_diff_pct vs sheet price), and persist a clean panel used for every board. Composition views exclude USDf itself, and BTC wrappers (e.g., MBTC) inherit BTC market cap for position/mcap ratios.

#3.1 Solvency & Backing

#3.1.1 Backing Coverage

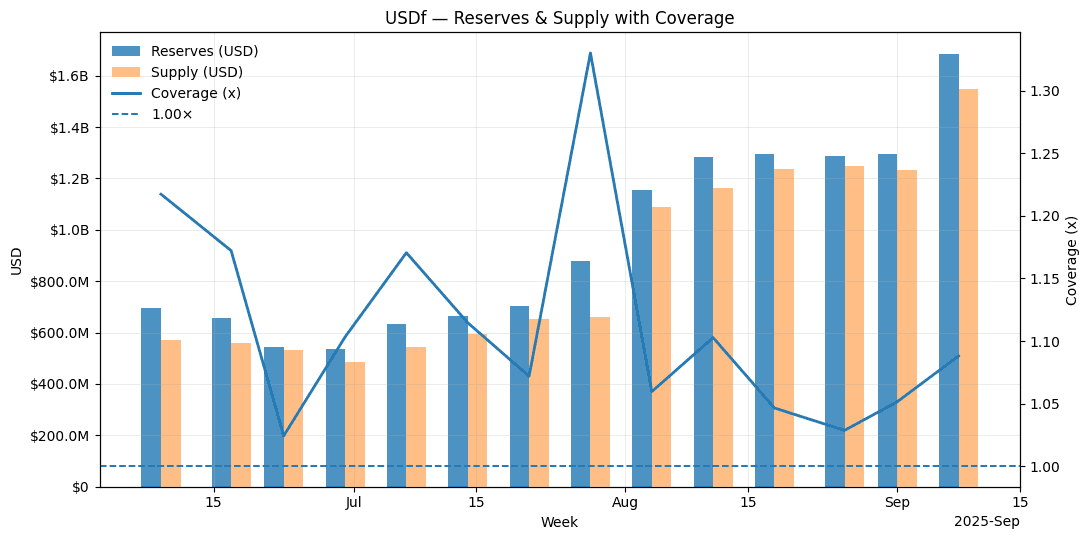

This chart overlays Falcon’s weekly reserve portfolio (USD value) and USDf circulating supply, merged from Falcon’s reserve snapshots and Dune supply data. Both series are expressed in USD (we assume USDf at value of 1$) and shown as grouped bars for each week. The coverage ratio—defined as total reserves ÷ total supply—is computed weekly and plotted as a line on the secondary axis, with a dashed reference at 1.0×, indicating full collateralization.

The chart shows that reserves generally exceeded supply, maintaining a backing ratio above 1.0× across the observation period. Short-term fluctuations in reserves, particularly visible in July and early August, led to spikes in the coverage ratio, while later weeks show smoother growth in both supply and reserves. By September, reserves reached new highs, with coverage stabilizing slightly above unity. This indicates that despite week-to-week volatility, the system consistently held more assets than liabilities, suggesting solvency.

#3.1.2 Stress Backing Coverage

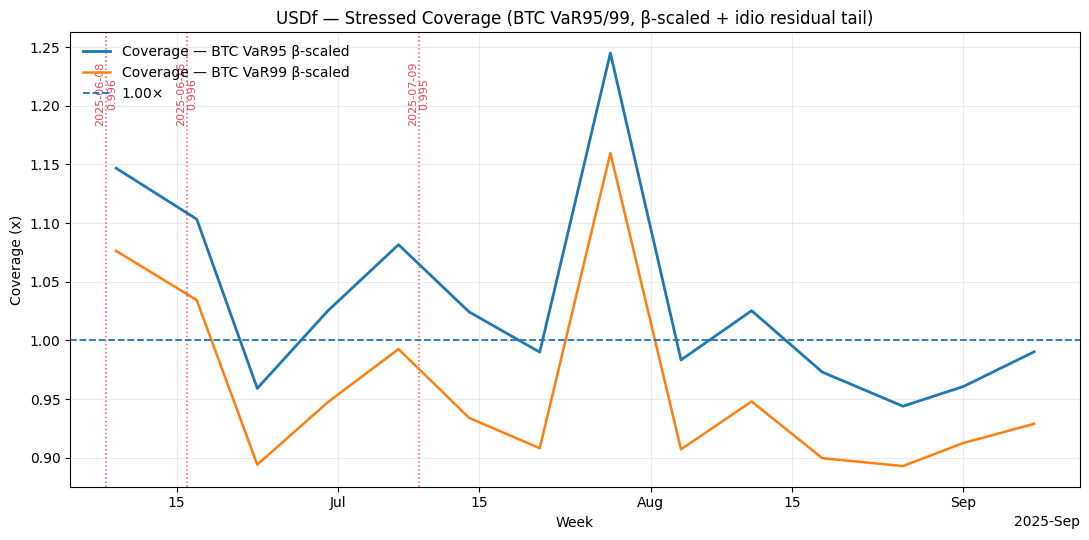

This chart evaluates USDf reserve adequacy under stressed scenarios. Weekly portfolio values are stressed using asset-specific haircuts derived from β-scaled correlations to BTC returns with a 26-week lookback. Two coverage lines are shown: VaR95 and VaR99, which incorporate BTC downside shocks plus idiosyncratic residual tails. Stablecoins are fixed at 1.0×. Event flags mark observed USDf peg dips (2025-06-08, 2025-06-16, 2025-07-09). The horizontal dashed line at 1.0× indicates the solvency threshold.

The results show that under BTC-linked stress, coverage ratios experienced pressure—particularly under the stricter VaR99 scenario, which signals a need for deeper buffers for most of the sample. While there was notable reserve strengthening in late July and early August, the general trend emphasizes the importance of managing correlated shocks. Overall, while baseline reserves cover supply, stressed scenarios identify specific areas to fortify against market downturns, especially in tail events. Importantly, these simulations apply static shocks without assuming active management responses, meaning they represent theoretical conservative baselines rather than the likely outcome of dynamic risk management.

#3.1.3 Unwinding Capacity

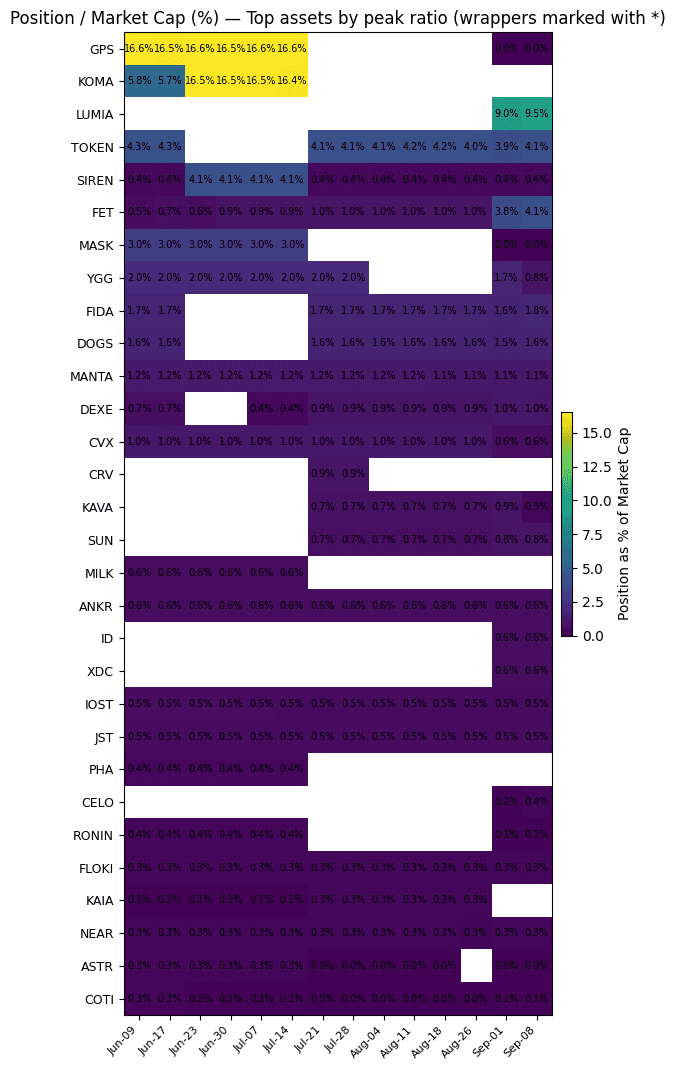

This heatmap shows the weekly ratio of Falcon’s reserve holdings in individual tokens relative to each token’s market capitalization. Ratios are computed as position USD value ÷ token market cap, with CoinGecko data providing market caps aligned to reserve dates. BTC wrappers (e.g., MBTC) inherit BTC’s market cap and are marked with an asterisk. To keep the view tractable, the chart highlights the top assets by peak ratio over the period. Cells are colored by a percentage scale and annotated with values ≥0.1%.

The heatmap represents the concentration of each token position relative to its market cap. Analysis reveals that two higher-risk tokens exceeded 10% of the position/market cap threshold, but exposure to these assets was reduced over a short period. For smaller-cap assets, it is important to note that position sizes are all relatively small (<1%) against Falcon’s total reserves. Mid to high cap ratios consistently maintained low concentration ratios, indicating less systemic exit risk. The result underscores the importance of stress-testing for liquidity-adjusted liquidation capacity, as some positions may not be unwound quickly in volatile market conditions. This measure assumes static market capitalizations and does not account for active trade execution or potential liquidity growth during unwinds. In addition, as we will see in the following section, the overall position size in the assets is rather marginal.

#3.2 Composition & Drift

#3.2.1 Composition by Top Assets

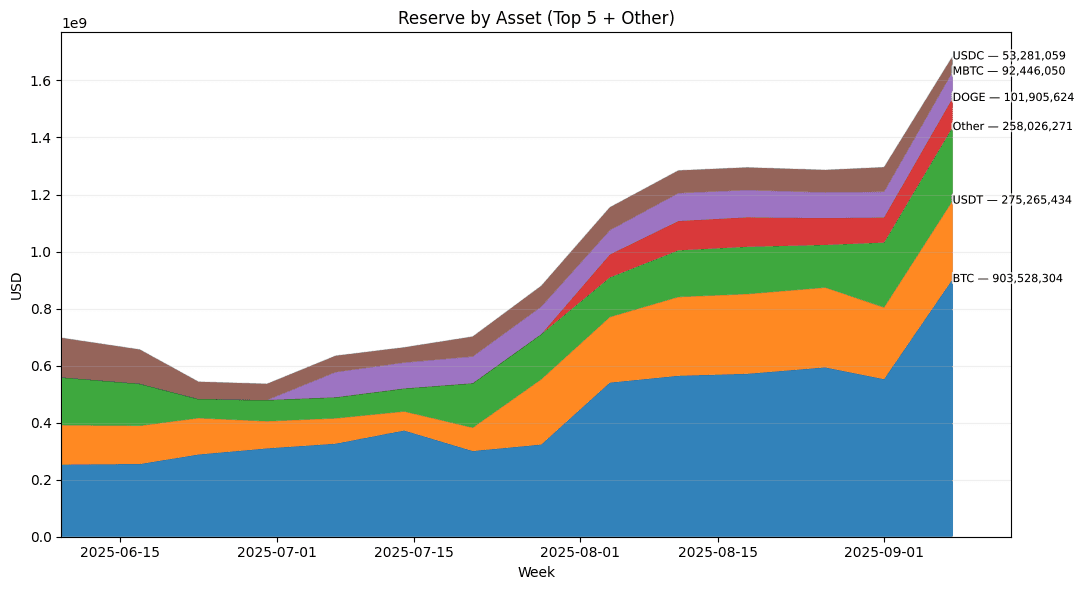

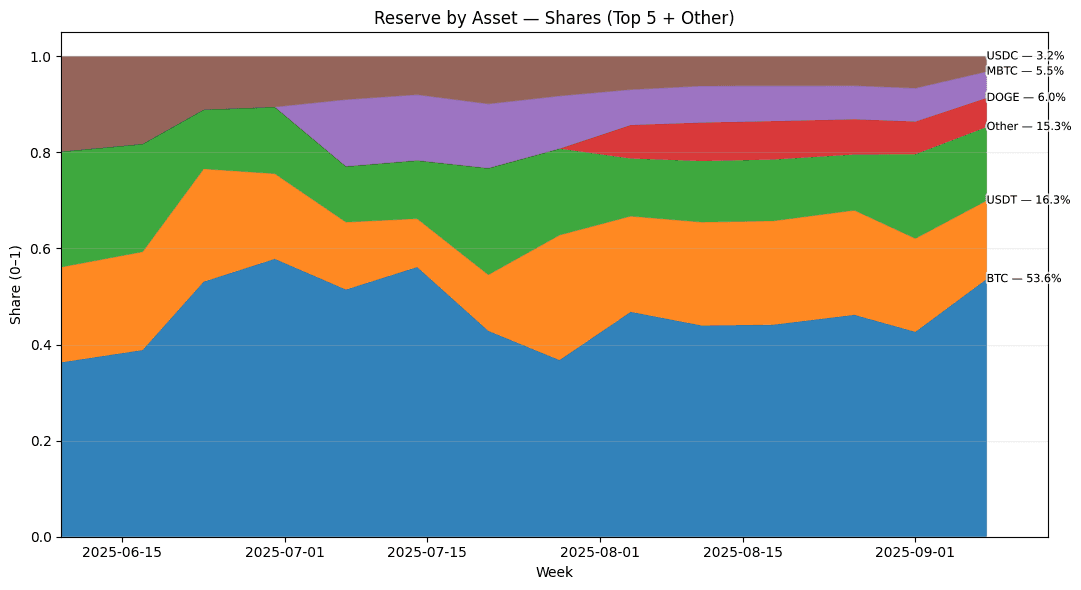

These charts display Falcon’s reserve composition over time by asset, based on weekly snapshots enriched with CoinGecko pricing. The top five assets by latest USD value are shown individually, while all others are aggregated into an “Other” category. The first chart shows absolute USD levels, while the second normalizes by total reserves to highlight relative shares. This dual view captures both the scale and proportional drift of reserve allocations.

Reserve by Asset (USD)

Reserve by Asset (Shares)

Reserves grew substantially from mid-July through early September, led primarily by BTC, which reached over $900m and accounted for more than 50% of reserves by share. USDT steadily expanded to around 16%, while smaller allocations to DOGE, MBTC, and USDC contributed marginally to total size. The “Other” category remains sizeable (~15%), indicating diversification across long-tail assets. The share-based view shows that despite overall growth, reserves have become increasingly BTC-dominant, suggesting rising dependence on a single asset for system solvency. This concentration strengthens sensitivity to BTC price movements, but with a strong stablecoin buffer that supports liquidity.

#3.2.2 Composition by Asset Type

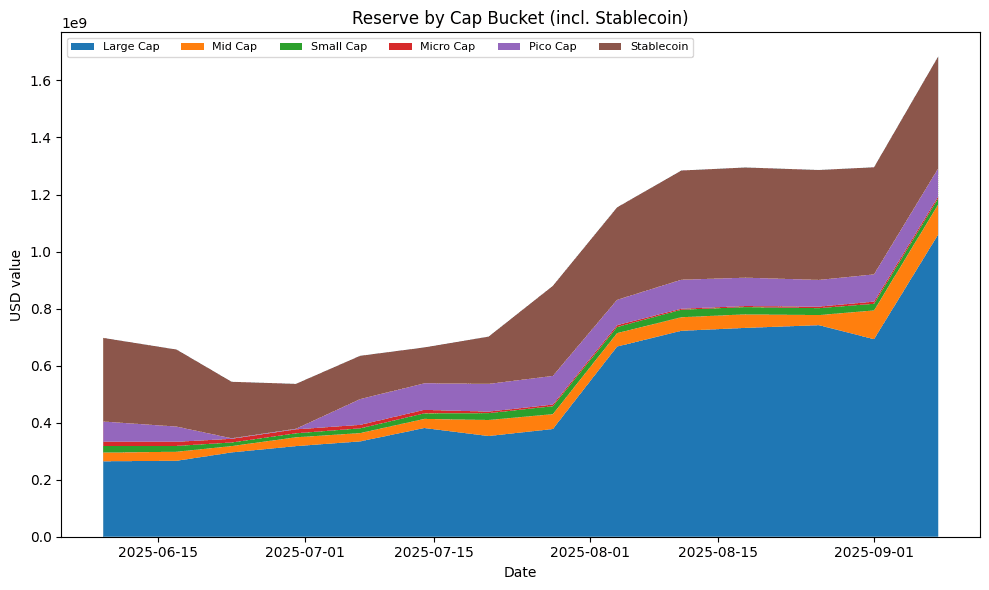

This chart groups weekly reserve holdings by market capitalization buckets using CoinGecko data. Tokens are classified into Large Cap (≥$10B), Mid Cap ($1–10B), Small Cap ($100M–1B), Micro Cap ($25–100M), and Pico Cap (<$25M), with stablecoins shown separately. Reserve USD values are aggregated within each bucket and stacked to show total composition over time.

The reserve profile is dominated by large-cap assets (primarily BTC), which expanded significantly in August and September, reinforcing their role as the core collateral base. Stablecoins consistently account for a sizable share, acting as a liquidity buffer. Additionally, exposures to smaller-cap buckets (small, micro, pico) remain modest in absolute terms, but are persistent. The August growth phase was driven almost entirely by large caps and stablecoins, underscoring a shift toward a more robust collateral base.

#3.2.3 Composition by Stablecoin Share

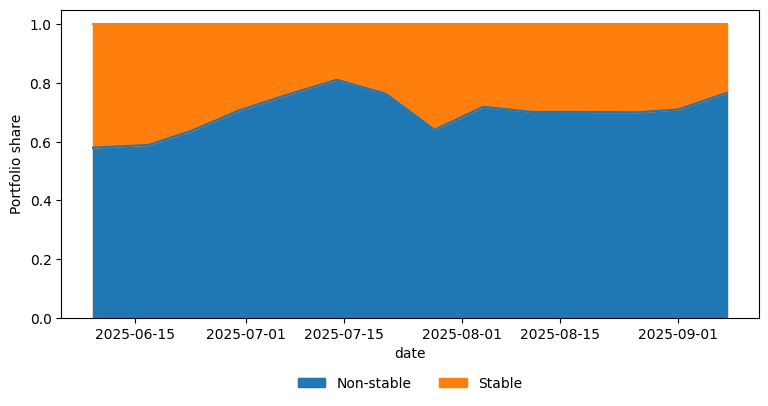

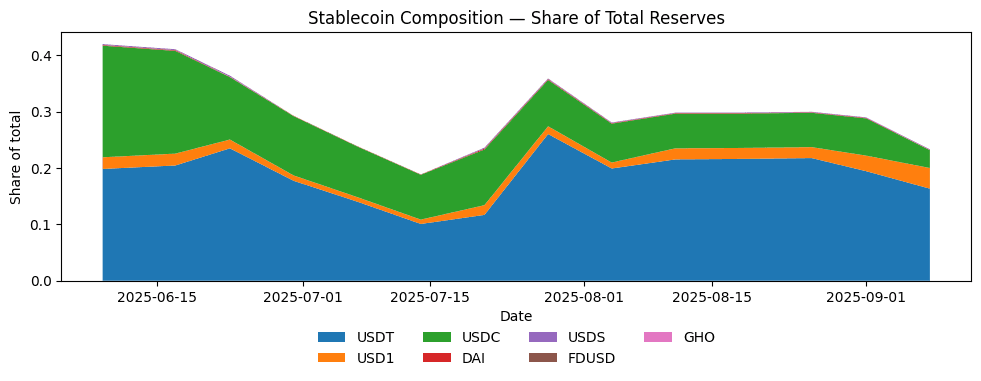

Zooming in on the stablecoin composition, we classify weekly reserves into stablecoins (USDT, USDC, FDUSD, etc.) versus non-stable assets (BTC, DOGE, altcoins). Market values are aggregated into the two categories and expressed as portfolio shares (0–1). This view abstracts away individual asset dynamics to highlight the balance between volatility-exposed assets and stable collateral.

The reserve composition is consistently tilted toward non-stable assets, averaging around 70–75% of the portfolio. Stablecoin share peaked near 40% in mid-June but trended downward as BTC and other volatile assets grew in absolute and relative weight. The increase in non-stable dominance through July and August reflects both reserve growth and rising BTC concentration. By early September, stablecoin share recovered slightly but remained below earlier highs. This composition implies a stablecoin supply readily available between 20-40%.

The dominant stablecoins held are USDT, USDC, USD1. As illustrated in the chart below:

#3.2.4 Composition by Custodian

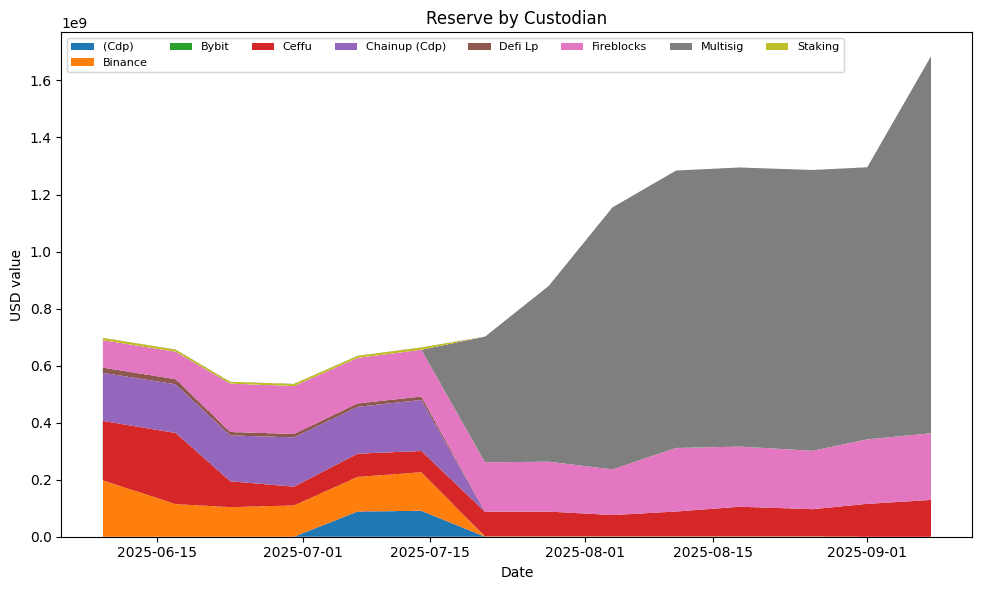

This chart allocates weekly reserve values in USD by custodian or storage arrangement. Categories include centralized venues (Binance, Bybit, Ceffu), institutional providers (Fireblocks, Chainup), on-chain custody (DeFi LP, Staking, Multisig), and internal CDPs. Weekly reserve USD values are aggregated within each custodian bucket and stacked to show total composition over time.

The custodian profile shows a structural shift in mid-July, where large portions of centralized exchange custody (Binance, Bybit, Ceffu, Chainup) were replaced by multisig holdings, which now dominate the reserve base. By early September, multisig custody alone accounted for well over half of total reserves, reaching more than $1.2B. Fireblocks maintained a steady share as the second-largest custodian, while other venues declined to marginal roles. This transition indicates a deliberate move toward decentralized, governance-aligned custody, reducing counterparty risk to centralized exchanges. However, the concentration of control within a single multisig arrangement introduces management risks and requires additional trust placed in the protocol team.

#3.3 Reserve Concentration

#3.3.1 HHI by Custody

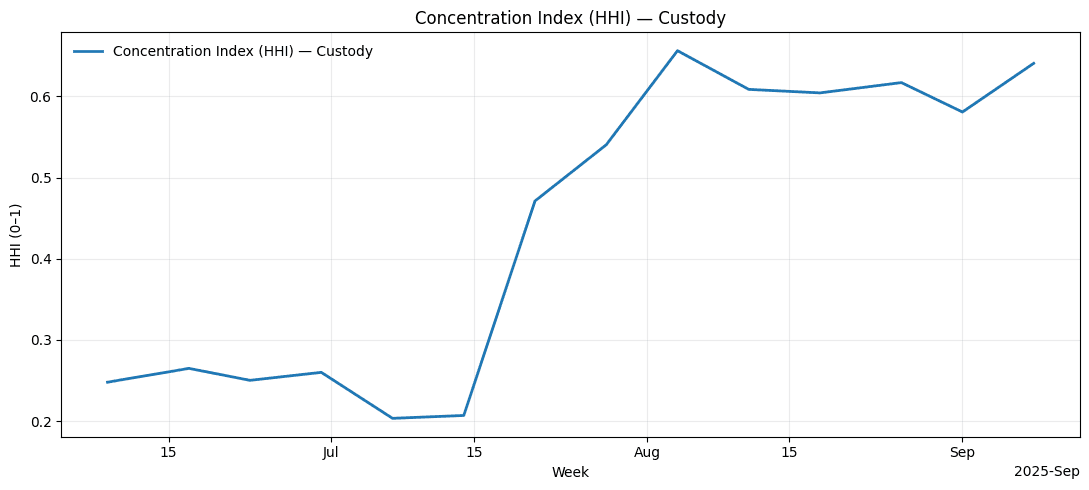

This chart computes the Herfindahl–Hirschman Index (HHI) to measure the concentration of reserves across custodians. For each weekly snapshot, the share of reserves held by each custodian is squared and summed, yielding an index between 0 (fully diversified) and 1 (fully concentrated). The HHI is plotted over time to capture shifts in custody concentration.

The custody HHI remained low and stable through June and early July (0.20–0.25), indicating diversified holdings across multiple custodians. However, from mid-July onward, the index rose sharply, reaching levels above 0.6 by August. This coincides with the shift of large reserve tranches into multisig custody, as seen in the custodian breakdown. The persistence of high HHI levels through September suggests the reserve structure is now under a multisig arrangement.

#3.3.2 HHI by Asset Type

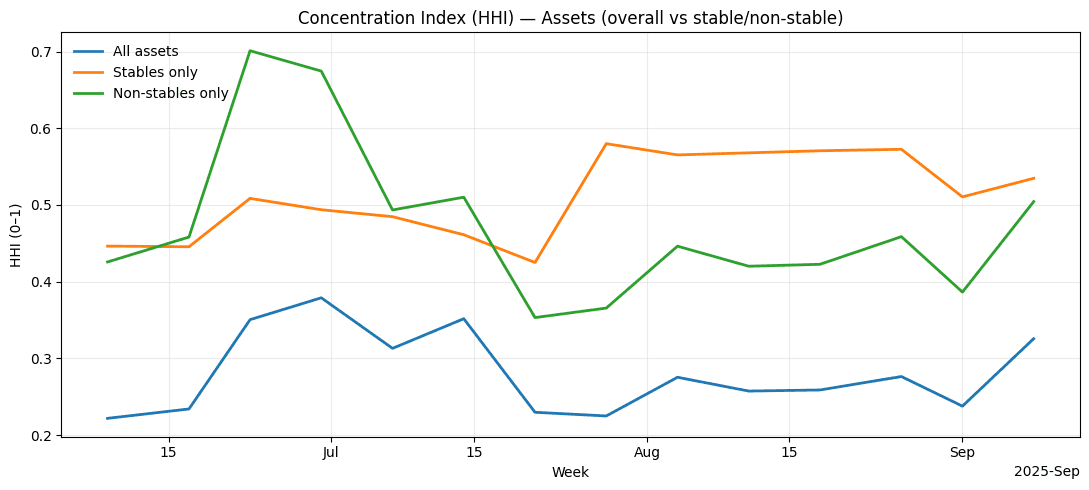

This chart applies the Herfindahl–Hirschman Index (HHI) to measure the concentration of reserves by asset category. For each week, shares of reserves are squared and summed, producing an HHI between 0 (fully diversified) and 1 (fully concentrated). To highlight structural differences, three series are shown:

-

All assets (overall portfolio concentration)

-

Stables only (subset: USDT, USDC, FDUSD, etc.)

-

Non-stables only (subset: BTC, DOGE, altcoins)

This separation shows whether concentration trends are driven by stable or volatile holdings.

The overall portfolio HHI remains moderate (0.25–0.35), reflecting broad diversification across multiple assets. However, when split by type, divergent patterns appear:

-

Stablecoins show a steady and elevated HHI (0.45–0.58), indicating dominance by one or two major stables (mostly USDT and USDC). This points to systemic reliance on a small number of stable issuers, with limited diversification benefits.

-

Non-stables show sharper swings, with spikes above 0.7 in late June due to concentrated bets (notably BTC dominance). Later declines reflect partial rebalancing, though the HHI remains higher than the overall portfolio. This indicates that non-stable allocations are prone to concentration during market rallies or asset-specific inflows.

Together, this suggests that while the total reserve appears diversified at headline level, there are underlying concentration risks within each asset class, especially in stables where its issuer risk, and in non-stables where BTC often crowds out smaller assets.

#3.4 Flows & Rotation

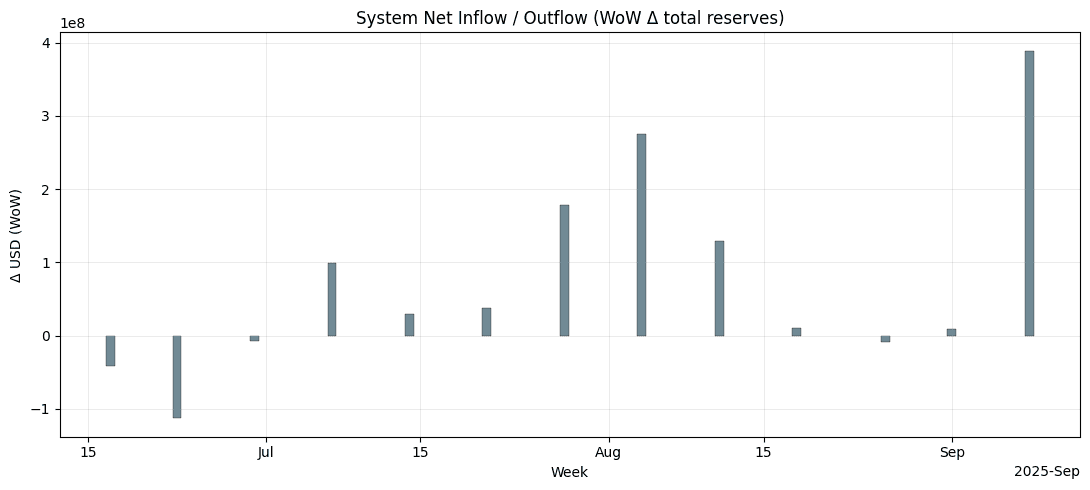

#3.4.1 Week Over Week Reserve Changes

This chart tracks week-over-week (WoW) changes in total reserves, calculated as the difference in aggregate USD value of all assets between consecutive weekly snapshots. Positive bars represent net inflows of capital into reserves, while negative bars indicate outflows or drawdowns. This measure abstracts from price-level changes by focusing purely on the directional delta in system reserves.

The chart reveals a regime shift from early July onward, with consistent positive inflows replacing the initial outflows of June. Reserve growth accelerated in late July and early August, peaking with large net additions of nearly $400m in the first week of September. Meanwhile, outflows remained shallow and sporadic after the early-June drawdown, suggesting resilience in reserve accumulation. The inflow dominance in the second half of the sample period aligns with the observed expansion in BTC and stablecoin holdings, reinforcing system solvency.

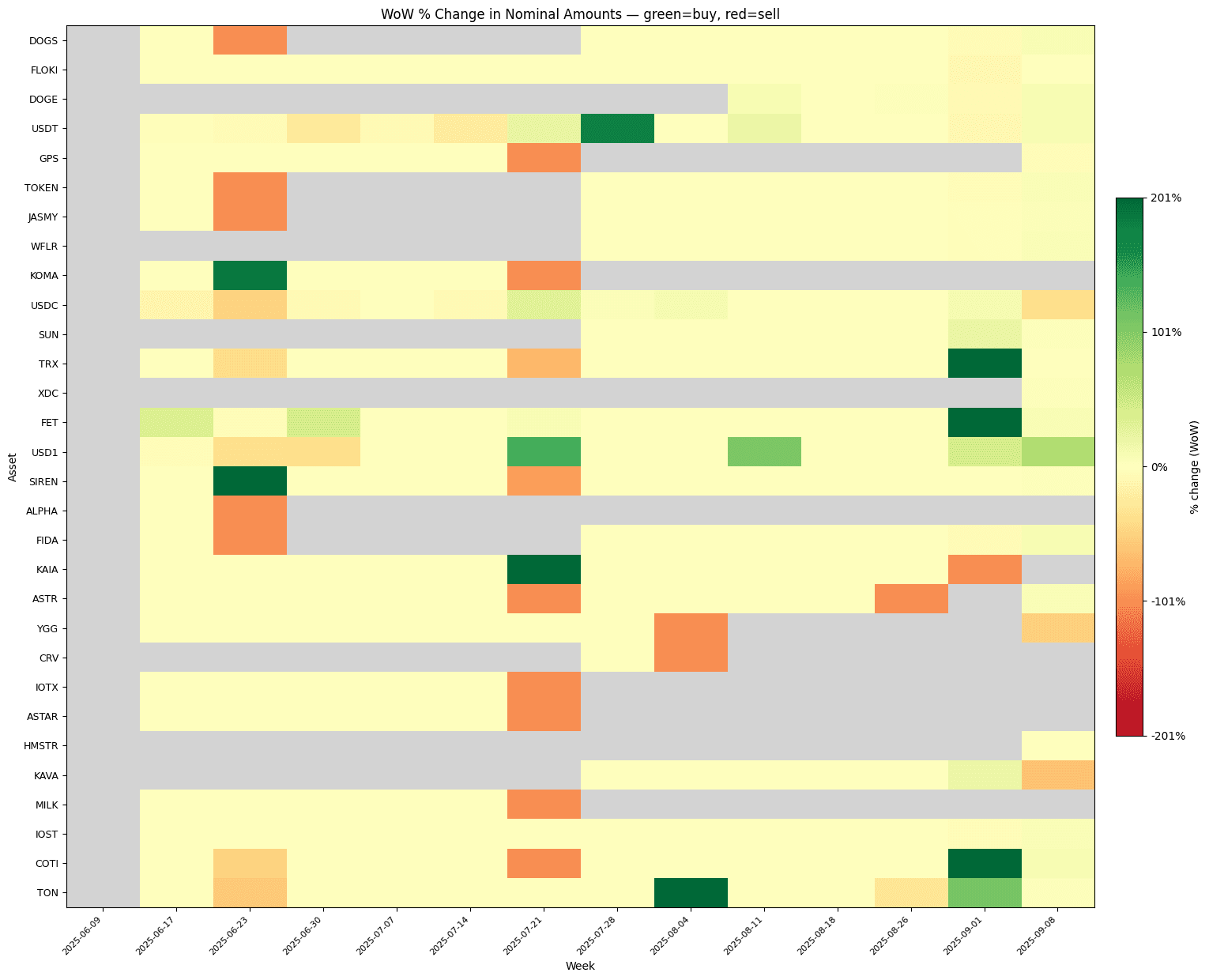

#3.4.2 WoW - Position Change (Nominal Amounts)

This heatmap tracks week-over-week percentage changes in the nominal amounts of individual reserve assets. For each asset, weekly balances are compared to the prior week, with changes expressed as relative percentages. Values are clipped at ±200% for readability, with green indicating net purchases (inflows) and red indicating net sales (outflows). Grey cells denote weeks where the asset was not held in reserves.

The heatmap reveals that Falcon’s reserve management involved frequent tactical adjustments in smaller and mid-cap assets, contrasted with steadier allocations in BTC and major stablecoins. Assets such as DOGE, USDT, and FET show recurring positive shocks, indicating incremental accumulation over the period. Conversely, tokens like CRV, KAVA, and FIDA experienced sharp drawdowns, suggesting deliberate exits or rebalancing. The presence of alternating inflows and outflows across niche assets highlights a rotation strategy, likely balancing yield, liquidity, and risk considerations.

#Reserve Analysis Conclusion

Falcon’s reserve system demonstrates headline solvency and consistent reserve growth, with total collateral exceeding circulating USDf supply across the observation period. On a nominal basis, reserves have expanded significantly since July, supported primarily by BTC accumulation and reinforced by a stablecoin buffer. Stress tests indicate that baseline coverage is adequate, and also highlight areas for further strengthening system resilience under correlated downside shocks, particularly those associated with BTC volatility.

From a composition perspective, reserves are increasingly dominated by large-cap assets—most notably BTC—which accounts for more than half of the portfolio. Stablecoins provide 20–40% liquidity coverage, with the issuer concentrating on USDT/USDC. Smaller-cap exposures remain marginal in size, limiting the potential tail risks that could hinder unwind capacity in adverse markets.

The custody transformation marks a structural break: Falcon reduced reliance on centralized custodians and migrated the majority of reserves into a multisig arrangement. While this mitigates exchange counterparty risk, it creates new governance and operational dependencies. Custody concentration metrics (HHI >0.6) underscore this systemic reliance, with resilience hinging on effective multisig management.

Flow and rotation analysis show that reserve growth has been driven by large inflows. Tactical reallocations across mid- and small-cap tokens indicate active positioning and risk management, though BTC and major stables remain structurally core.

Overall, Falcon’s reserve management has achieved growth and successfully maintained sufficient solvency, while we note concentration risks and dependency on custodians.

#Section 4: On-chain Management

This section addresses the technological properties of the stablecoin. It aims to convey, (1) how the on-chain system is architected and where technological risk can arise, and (2) historical performance metrics involving the stablecoin's development and security.

This section is divided into 2 sub-sections:

-

4.1: Operational Overview

-

4.2: Development and Security Metrics

#4.1 Operational Overview

#4.1.1 Smart Contracts

USDf is natively deployed on Ethereum which has logic implemented via a TransparentUpgradeableProxy proxy pattern. USDf is also natively deployed on Binance Smart Chain, but has no proxy implementation. Users can bridge between Ethereum and Binance Smart Chain using a third-party application or Chainlink's CCIP. Finally, USDf can also be bridged to XRPL via Axelar.

USDf can be staked into sUSDf on Ethereum, which has logic implemented via a TransparentUpgradeableProxy proxy pattern. The sUSDf staking rewards distributor can be viewed here and does not have a proxy implementation. The contract for restaked USDf positions represented as ERC-721 NFTs can be viewed here and has a proxy implementation.

Source: LlamaRisk, August 5th, 2025

#4.1.2 Potential Dependencies

Falcon uses collateral from USDf to generate yield in several ways, all of which bring some third-party risk.

On-chain liquidity strategies involve liquidity pools that rely on third-party protocols. This makes Falcon vulnerable to exploit of a partner protocol, which could result in a loss of funds. Falcon currently uses well-established on-chain liquidity pools. This includes Uniswap, Curve, and PancakeSwap on Ethereum and Binance Smart Chain. The liquidity pools are paired against core stable assets such as USDT, USDC, USD1, as well as smaller pools with frxUSD. The liquidity pools that Falcon uses introduce potential dependencies, as these liquidity pools are reliant on these on-chain protocols.

Native altcoin staking also brings in dependency risk. Falcon states that they use professional staking service providers, such as Luganodes, when staking altcoins. Altcoins are only staked if there is a negotiated zero lock-up period, allowing Falcon to swiftly exit positions in times of market volatility.

From Section 3: Reserve Analysis, it is clear that the majority of funds are deployed in Arbitrage Strategies (Positive/ Negative Funding Rate Arbitrage and Cross-Exchange Arbitrage).

Falcon relies on two custodial solutions to house funds and utilize off-exchange settlement. Although these custodians bring third-party risk, the risk is minimized through diversification and multisig/MPC measures.

Minting functions for USDf occur entirely off-chain. Falcon states that they use an internal price oracle that integrates over 40 trading venues to calculate an internal fair price. This reduces the dependency risk by utilizing a diverse selection of data sources; however, the off-chain oracle process is not publicly available.

The integration of Chainlink CCIP bridging has a strong security record, but also brings additional risks as a third-party application.

#4.1.3 Access Control

The DEFAULT_ADMIN_ROLE for the USDf proxy contract is set to a 4/6 multisig. This role has the ability to pause/unpause transfers and manage a blacklist, allowing for swift responses to security threats.

The signers are:

-

0x804016c31e52805eb00e0Ef42126Fd3e980A0b33 - identified as Falcon Contract Deployer

The contract is giving mint rights to PreCollateralizedMint, which has a MINTER role set to the following address: 0x57Dd832f0d9547fcA3aA3CCEB052C2FD8818bF4d.

#4.1.4 Operational Security Practices

Falcon Finance maintains a policy of discretion regarding specific operational security protocols to maximize protection. The protocol employs a hybrid operational model, with a dedicated core team that ensures agile and decisive management. Falcon has launched a governance framework to empower community participants to vote on protocol developments. Falcon enforces a robust management practice where at least 3 members of the trading team must work on each strategy, reducing the risk of a single member making an exploitable mistake.

There are currently no timelocks implemented in core Falcon Finance contracts, meaning that administrative actions have no enforced delay.

#4.2 Development and Security Metrics

#4.2.1 Development Activity

The GitHub repository is not currently public for Falcon Finance.

#4.2.2 Number of Active Developers

The GitHub repository is not currently public for Falcon Finance.

#4.2.3 Documentation Quality

Falcon Finance maintains documentation on its products, USDf and sUSDf. The documentation receives consistent updates with the latest information and offers a good overview of Falcon Finance's ecosystem and mechanisms. However, Falcon remains a closed-source protocol.

#4.2.4 Upgrade Frequency

On 7/23/25, Falcon Finance announced the integration of Chainlink to enable Chainlink CCIP for cross-chain bridging. Other than this upgrade, Falcon has not implemented any core changes to USDf. The Falcon incentive program was recently expanded with Falcon Badges on 7/31/25.

#4.2.5 Smart Contract Audits

Falcon Finance has been audited by Zellic and Pashov. These audits took place in February and March, before the public launch of USDf. The audits cover Falcon's EVM contracts necessary for protocol function. Specifically, Zellic looked to secure mint/redeem functions for USDf and sUSDf. These audits reported no high or critical severity issues, with several medium/low severity issues being remedied or acknowledged.

#4.2.6 Known Vulnerabilities Count

The Zellic audit revealed 1 medium impact and 1 low impact vulnerability. The medium impact finding was fixed in a GitHub commit, and the low impact finding was acknowledged by Falcon and should not pose additional smart contract risk.

The Pashov audit revealed 2 medium impact and 10 low impact vulnerabilities. All of these vulnerabilities were either acknowledged or fixed in a GitHub commit.

It should be noted that the Pashov audit took place before the Zellic audit, so the Zellic audit represents the most recent code repository.

#4.2.7 Bug Bounty Program Size

Falcon Finance plans to launch a bug bounty program within 2026 Q1.

#4.2.8 Historical Downtime

There has been no incident or downtime of Falcon Finance since the public launch.

#Section 5: Regulation and Compliance

This section addresses the extent of consumer protections from a regulatory perspective. The reader should get a clear idea of (1) the solvency and transparency assurances provided by reserves management requirements, and (2) the current state and historical track record of the issuer's regulatory compliance.

This section is divided into 2 subsections:

-

5.1: Reserves Management

-

5.2: Regulations

#5.1 Reserves Management

#5.1.1 Reserve Assets

Falcon positions USDf as an overcollateralized “synthetic dollar,” minted against stablecoins and non-stablecoin assets via “Classic” and “Innovative” mint paths. The protocol states it manages deposited collateral with delta-/market-neutral strategies, enforces overcollateralization, and relies on cross-market arbitrage by KYC’d users to support the peg. Redemptions are at 1:1 to eligible assets, subject to a minimum redemption size and a cooldown. The docs disclose a 7-day cooldown and a USD 10,000 minimum redemption threshold. These features are consistent with a stability model that leans on institutional-style flows rather than retail free-mint/redeem. Alternatively, users can opt to sell directly on-chain.

Operational transparency has been augmented by a “Transparency” page and daily reserve checks performed by Harris & Trotter’s digital asset unit (HT Digital). A July 7, 2025 HT Digital letter shows a point-in-time collateral snapshot while explicitly stating it is not an ownership/control assurance; it also previews quarterly ISAE 3000 assurance engagements going forward. Notably, the letter’s table shows material exposure to centralized custodians/exchanges (Fireblocks, Binance, Ceffu) and BTC holdingsty risk; the firm represents that assets are “segregated” for USDf collateral purposes.

#5.1.2 Overcollateralization Buffer

Falcon’s design imposes an explicit buffer on every USDf that is minted against non-stablecoin collateral. The buffer is defined in the documentation as the surplus collateral retained beyond the notional value of USDf issued, calculated by

OCR Buffer = (OCR – 1) × Collateral Amount. Over-collateralisation ratios (OCRs) are set per asset and adjusted “dynamically” for volatility, liquidity, and slippage risk; stablecoins mint 1:1 with no buffer. The same page explains that the buffer is only released when the user claims back collateral and then only if price conditions are met; otherwise, the claim is satisfied in USD-equivalent value at the original mark price.

No statute or license obliges Falcon to maintain either the buffer or any minimum ratio: the British Virgin Islands VASP Act contains no hard-numeric collateral rules, and Falcon itself states it is “not currently licensed by any regulatory authority.” The buffer is therefore a voluntary risk-management parameter that Falcon can alter by governance decision.

Falcon also operates an on-chain Insurance Fund held in a multisig wallet. A portion of protocol profits is earmarked for that fund, which is intended to protect the protocol and users during periods of stress. Details surrounding the target size, the capital adequacy metric, or the conditions under which it will draw on the fund are undisclosed

Falcon maintains a reserve-allocation framework built around defined eligibility schedules, concentration caps, and liquidity tiers. Each collateral asset is subject to pre-set maximum position limits derived from quantitative models that incorporate venue coverage, historical and current open interest, funding-rate stability, price volatility, and traded volumes. Limits are reviewed on a periodic cycle and may be adjusted intra-period when the risk engine flags material changes in market conditions.

In the absence of a regulator-mandated reserve coverage rule, reserve parameters are anchored to risk appetite statements and venue diversification thresholds designed to mitigate single-point-of-failure and liquidity risk. In this regard, Falcon employs institutional-grade custody and settlement solutions (including Ceffu and Fireblocks alongside cold-storage tiers).

Falcon Finance Wallets Security Policy describes approval and execution flows, segregation of duties, and out-of-band verification. All fund and budget requests require Managing Partner approval before processing; operators confirm the purpose, asset, and amount through a second-factor, out-of-band channel prior to release.

#5.1.3 Custody of Reserves

Falcon routes all user-deposited collateral first to third-party custodians working on an off-exchange-settlement (“OES”) model. The two named providers are Fireblocks CVA and Ceffu MirrorX; each creates an MPC-based vault that remains legally segregated while “mirroring” balances onto the trading sub-accounts Falcon maintains at Binance and Bybit for strategy execution.

Falcon’s Transparency-page announcement makes the quantitative claim that “the majority of reserves” stay in these vaults, with only a limited slice left at Binance/Bybit for execution. Daily reserve letters from HT Digital list venue balances (Fireblocks, Ceffu, Near, on-chain pools, BTC, etc.).The public Fireblocks documentation explains that a Collateral Vault Account (CVA) is an MPC wallet jointly controlled by customer and custodial key shards; balances are mirrored to the exchange and settled on chain, T+0–T+1. Ceffu’s MirrorX literature likewise says client assets remain “fully segregated in Ceffu wallets” while a 1:1 credit is delegated to the Binance sub-account, settled off chain at T+1.

Custody and settlement controls are assessed on a recurring basis.

#5.1.4 Payment Rails

USDf redemptions are initiated inside the Falcon web-app. A holder must (i) deposit USDf into a KYC-verified Falcon Account; (ii) select a redemption asset (USDT, USDC, FDUSD, or, for “claim” redemptions, the original non-stablecoin collateral); and (iii) accept a seven-day cooldown before the chosen asset is credited to the Falcon Account. The minimum ticket size is US $10 000. After cooldown expiry, the user triggers a Withdraw transaction that at present is supported only on the Ethereum network; withdrawals on other networks require a manual support ticket.

Redemption processing is request-based with deferred settlement. For issuer redemptions into stablecoins, USDf is submitted in-app, and a seven-day processing period applies; once the cooldown lapses, the redeemed stablecoin becomes available for withdrawal to the user’s external wallet. Claims against non-stablecoin collateral follow the mint track. Under Classic Mint, a holder exchanges USDf for the previously locked collateral position and may recover the over-collateralisation buffer applied at issuance; at claim, the holder can elect to receive the payoff in the original asset, in USDT, or as a split between the two. Under Innovative Mint, a claim is only available after the selected tenure matures; to reclaim the original collateral, the holder must repay the amount of USDf originally minted, and full recovery is possible only if the position was not liquidated or exited due to the asset hitting the preset strike during the term. Following maturity, there is a seventy-two-hour window to complete full collateral recovery.

Withdrawal rails are crypto-native. Issuer-side withdrawal currently settles on chain after redemption processing, while holders may also exit positions by selling USDf on public DEXs or by using the in-app 1:1 redemption into supported stablecoins. These market exits provide continuity when redemptions are queued but are inherently dependent on venue liquidity and prevailing prices; they supplement rather than replace the issuer’s redemption pipeline and do not create an immediate, enforceable payout right.

Falcon has announced (a) BitGo integration that “will introduce fiat settlement … through BitGo’s Go Network,” and (b) Chainlink CCIP support to move USDf between Ethereum and BNB Chain. Both are framed as roadmap items rather than live facilities.

#5.1.5 Attestations

Independent-auditor process

Falcon publishes a one-page “Collateral Letter” on its app sub-domain on most trading days. The letter is prepared by HT Digital Ltd (a subsidiary of Harris & Trotter LLP) and states:

-

the USDf supply outstanding at a UTC timestamp;

-

the USD-valuation of collateral by venue (Fireblocks, Ceffu, Binance, Near, etc.);

-

that the valuation is “quantity × previous-day CoinGecko close”;

-

management’s assertion that the assets are in segregated accounts not verified by the auditor;

-

an explicit disclaimer: “we have not performed any procedures over the control and ownership of the above assets, nor any procedures over whether any security has been placed on these assets.”

The letter adds that Harris & Trotter LLP intends to perform an “ISAE 3000 assurance engagement” in the future to test ownership, control, and security interests. The engagement is completed as of Q3 2025.

Self-reporting metrics

Falcon hosts a real-time Transparency Dashboard, self-served by Falcon’s backend, that shows:

-

circulating USDf and sUSDf supply;

-

over-collateralisation ratio;

-

charts of reserve composition by asset class and custody venue;

#5.1.6 Legal Qualification of Collateral

The dashboard shows that the reserve is now overwhelmingly concentrated in BTC, with only a small stablecoin sleeve and a comparatively minor ETH balance. Under U.S. law, those assets are broadly treated as commodities under the Commodity Exchange Act with the CFTC asserting jurisdiction; the SEC has not secured a contrary ruling for BTC or ETH. Wrappers such as WBTC nonetheless add a second layer of analysis: legal title and segregation sit with the wrapper’s trustee/custodian, and enforceability turns on the mint–burn terms and the custodial trust deed. Under BVI law, BTC and ETH are “virtual assets” and intangible property. Mere holding or use as a medium of exchange does not trigger financial-services licensing; however, activities carried on “in or from within” the Virgin Islands that amount to safekeeping/administration, exchange, or providing financial services related to an issuance can fall inside the VASP Act perimeter, and structures that add profit or investment-like rights can engage SIBA. For Falcon’s purposes, these positions are legally straightforward provided Falcon can evidence clean title to the underlying BTC (and enforceable wrapper redemption rights where applicable) and can demonstrate that any BVI-nexus activity is either registered or demonstrably out of scope.

The stablecoin sleeve remains heterogeneous in legal character. U.S. treatment is fragmented: certain fiat-backed stablecoins are treated as commodities for CFTC purposes, whereas NYDFS-supervised issuers operate under prescriptive redeemability, reserve, and attestation guidance; others rely primarily on contract law and attestations of varying depth. From a holder-rights perspective, the claim stack differs materially by issuer. In the BVI, stablecoins are recognized as virtual assets; pure payments/utility use is generally not a SIBA “investment,” but intermediation, safekeeping, or exchange services can require VASP registration, and pooled-investment features would trigger SIBA. Falcon’s control environment should therefore differentiate among stablecoins at the policy level (eligibility schedules, counterparty caps, sanctions posture, and redemption risk) rather than treating them as a single class.

While the “Top-100/altcoin” buckets now include material named exposures—most notably DOGE, FET, TRX, TON, NEAR, XDC, and smaller positions across a long tail, Falcon Finance reserves the right to remove specific altcoins when needed. These engage the unsettled U.S. securities analysis that turns on Howey/Reves and fact-specific disclosures and marketing. Several of the named tokens have featured in SEC pleadings or adjacent enforcement histories (for example, SOL and TRX in exchange cases; TON in SEC v. Telegram), with outcomes mixed and in some instances pending. The immediate implication is regulatory uncertainty for U.S. distribution and custody—even if Falcon excludes U.S. Persons—together with heightened delisting or liquidity risk at U.S.-touching venues. In the BVI, the FSC applies an economic-substance test: where a token confers rights that go beyond simple exchange or utility (profit share, dividends, governance with economic consequences), it can constitute a “security” under SIBA and related activities may be regulated; otherwise, it is treated as a virtual asset under the VASP Act framework. Given this perimeter risk, Falcon should maintain concentration limits, volatility-adjusted haircuts, and rapid eligibility-review triggers for any token that becomes the subject of securities-law action.

The tokenized U.S. Treasury sleeve (e.g., USTB) is unequivocally within securities law. In the United States, it is offered under private-fund exemptions (e.g., Reg D with 3(7)), limited to Qualified Purchasers and subject to transfer restrictions recorded off-chain by the transfer agent; any conversion to a registered 2a-7 fund would materially change the compliance profile but not retroactively cure past transfers. Under BVI law, tokenized T-bill interests are “investments” within SIBA; issuance, custody, and intermediation are regulated activities, and any transaction must follow the fund’s offering documents and investor-eligibility rules. If Falcon accepts such instruments as collateral, it must ensure its wallets are pre-approved/allow-listed with the issuer/transfer agent, that pledges and foreclosures are procedurally compliant, and that any liquidation path respects the fund’s transfer restrictions.

Two cross-cutting points remain. First, legal sufficiency depends not just on the classification of each asset, but on Falcon’s ability to prove unencumbered ownership or enforceable redemption rights across custodians and wrappers; until third-party assurance goes beyond point-in-time “sight of assets”, that is an open item. Second, perimeter outcomes turn on where activities are carried on: if mint, redeem, custody, or transfer services are conducted “in or from within” the BVI, VASP registration and its ongoing obligations apply.

The BVI framework applicable to Falcon does not prescribe reserve-composition rules in the way some prudential regimes do. The VASP Act and related FSC materials impose no mandated mix, liquidity tiering, or concentration limits for reserves backing virtual-asset products. Scrutiny is substance-over-form: where a reserve asset—or the arrangement around it—delivers rights akin to securities, derivatives, or interests in a managed pool, SIBA can be engaged and more specific disclosure, custody, and conduct obligations follow; where a token functions purely as a medium of exchange or utility, it typically falls outside SIBA, with the VASP perimeter determined by whether safekeeping, exchange, or issuance-related services are carried on “in or from within” the Virgin Islands. In all cases, AML/CFT, sanctions, and record-keeping duties under the BVI’s “relevant business” regime continue to apply, including risk assessment of the assets held and ongoing monitoring, but those obligations stop short of dictating the legal qualification or composition of reserves. Practically, this leaves Falcon with wide discretion coupled with responsibility: maintain a thorough investment policy (eligibility schedules, counterparty and venue caps, liquidity tiers), refresh legal classifications as facts or law evolve, and engage the FSC proactively where token characterization is uncertain or structures change.

#5.2 Regulations

#5.2.1 Licenses

Falcon identifies the contracting entity as Falcon Digital Limited and selects BVI law and BVI courts. Its Terms carry an express risk disclosure that “Falcon Digital Limited … is not currently licensed by any regulatory authority.” That is the only status statement the issuer makes about authorizations.

Under BVI law, the Virtual Assets Service Providers Act, 2022 (the VASP Act) prohibits any person from carrying on “in or from within the Virgin Islands” the business of providing a virtual asset service without registration with the BVI Financial Services Commission. The Act’s scope is deliberately broad. “Virtual assets service” includes safekeeping/administration of virtual assets or keys, providing financial services related to an issuer’s offer or sale of a virtual asset, and exchange/transfer services for or on behalf of others. The Act also creates specific custody and exchange categories, imposes AML/CFT, Travel Rule and systems-and-controls expectations, and empowers the FSC to enforce. Falcon does not claim registration under the VASP Act.

From a permitted-activities perspective, Falcon’s public materials describe minting, redemption, staking, and custody arrangements, but they do not point to any license or authorization that confers regulated permissions in any jurisdiction. In BVI terms, if Falcon is providing custody, transfer, or financial services related to its own issuance “in or from within” the BVI, registration as a VASP would be the appropriate permission.

Based on an external BVI-law memorandum obtained by Falcon, and subject to its stated assumptions and limitations, USDf—as described—would not constitute an “investment” for purposes of the Securities and Investment Business Act, 2010 (SIBA). The memorandum further concludes that Falcon Digital Limited, acting solely in the capacity of issuer of crypto tokens, would not fall within the definition of a “virtual assets service provider” under the VASP Act, and therefore would not be required to register with the BVI Financial Services Commission.

#5.2.2 Enforcement Actions/Lawsuits

A reasonable search did not identify any enforcement action, lawsuit, or formal regulatory inquiry naming Falcon Digital Limited or USDf as of 4 August 2025. Press coverage shows unrelated “Falcon” enforcement stories (e.g., CFTC action against “Falcon Labs, Ltd.”; Indian “Falcon scam” arrests) that are not the same entity and should not be conflated.

Scope note: Because Falcon Digital Limited is BVI-domiciled, definitive regulatory and litigation checks require paid searches with the BVI Financial Services Commission and the BVI Commercial Registry. These searches were not performed for this desk review.

#5.2.3 Legal Opinion

Further to the BVI-law memorandum noted in 5.2.1, the team reports that it has not obtained an EU MiCA opinion. The stated approach is to avoid active marketing in jurisdictions that require licensing.

#5.2.4 Sanctions Compliance

Falcon’s Terms define “Restricted Jurisdictions” by reference to U.S./UN-sanctioned territories and list Crimea, Donetsk/Luhansk, Cuba, DPRK, DRC, Iran, Libya, Belarus, Russia, Somalia, South Sudan, Sudan, Syria, the United States, Yemen, and any jurisdiction subject to applicable sanctions/embargoes. The Terms also prohibit transactions involving ML/TF, weapons, darknet markets, and other high-risk activities and reserve rights to monitor, suspend, and block transactions and accounts to comply with applicable laws.

On-chain, the USDf implementation contract exposes an isRestricted mapping and an admin-only setRestriction function; transfers revert if the sender or recipient is flagged. That on-chain denylist functionality provides a concrete mechanism to enforce sanctions and other restrictions at the token level.

#5.2.5 User Restrictions

Falcon Finance imposes user restrictions designed to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. All users are required to undergo identity verification as a condition of account registration and continued access to the platform’s services. This process includes providing accurate, complete, and up-to-date personal or corporate information, as well as any additional documentation requested by Falcon Finance for customer due diligence or to comply with applicable laws. The platform reserves the right to make inquiries directly or through third parties to verify user identity, and may share user information with credit bureaus, fraud prevention agencies, law enforcement, or other competent authorities as necessary. Users are also obligated to promptly update Falcon Finance of any changes to their information, and failure to comply with these requirements can result in account suspension, restriction, or termination.

In addition to AML/KYC checks, Falcon Finance enforces strict jurisdictional and eligibility restrictions. The platform is not available to users who are located in, or are citizens or residents of, “Restricted Jurisdictions,” which include the United States and other countries subject to international sanctions or embargoes. U.S. Persons, as defined extensively in the Terms, are explicitly prohibited from using the services or transacting in Falcon Stablecoins.

The Terms do not require users to be qualified or accredited investors. The eligibility criteria focus on legal capacity—requiring individuals to be at least 18 years old and entities to be duly incorporated and validly existing under their jurisdiction’s laws. There are no financial thresholds, investment experience requirements, or other criteria typically associated with qualified or accredited investor status. The main restrictions are based on age, legal capacity, and jurisdictional compliance.

Falcon Finance also enforces a single account policy, requiring each user to maintain only one account that has successfully completed KYC verification. Multiple accounts are subject to consolidation. The platform conducts ongoing monitoring of user activity and transactions to ensure compliance with its terms and applicable laws, including AML/CFT obligations. Users are prohibited from engaging in a wide range of activities, such as fraud, dissemination of false information, unauthorized access, and transactions involving illegal goods or services. The Terms grant Falcon Finance broad discretion to suspend, restrict, or terminate accounts for non-compliance, suspicion of prohibited activities, or at its sole discretion.

AML/KYC and sanctions controls are implemented through third-party tooling. Sumsub is engaged to perform KYC for individuals and KYB for legal entities. Chainalysis is used for transaction screening and ongoing wallet/activity monitoring.

#5.2.6 Restrictions for Illegal Use

Users are expressly prohibited from engaging in any activity that violates applicable laws, including but not limited to money laundering, terrorist financing, fraud, and the use of proceeds from illegal activities. The Terms specifically ban transactions involving prohibited goods and services such as weapons, controlled substances, gambling, adult content, Ponzi or pyramid schemes, unlicensed money transmission, counterfeit goods, and any activity related to darknet markets. Users are also forbidden from providing false or misleading information, attempting unauthorized access to accounts or systems, and using the platform on behalf of third parties or as an intermediary.

Falcon Finance reserves the right to monitor user activity and transactions to ensure compliance with these restrictions. If the platform learns or reasonably suspects that a user is engaging in prohibited or illegal transactions, it may suspend or terminate the user’s account, potentially leading to the forfeiture of digital assets. The company may also be required to report such activities to relevant authorities and comply with court orders regarding information and assets held in the account.

Additionally, the Terms make clear that Falcon Stablecoins are not to be offered, sold, or transferred in the United States or to U.S. Persons, and that the platform is not available in any jurisdiction where its use would be illegal or violate local laws.

#5.2.7 Customer Protection

The Terms contain extensive disclaimers and risk warnings. Falcon Finance explicitly states that it is not licensed by any regulatory authority and that its stablecoins are not legal tender, nor are they backed by any government or central bank. The platform disclaims any responsibility for the stability or value of its stablecoins, and users are warned of risks such as market volatility, depegging, cybersecurity threats, operational failures, and regulatory changes. The Risk Disclosure Statement further emphasizes that users bear all risks associated with using the platform, including the potential for total loss of assets due to technical errors, unauthorized access, or changes in law.

Falcon Finance’s liability to users is strictly limited. The Terms provide that, to the fullest extent permitted by law, the platform and its affiliates are not liable for any direct, indirect, special, incidental, punitive, or consequential damages, including loss of profits, business, or data, arising from the use of the platform or its services. Any liability that does arise is capped at the amount of interest or yield paid or payable to the user, and damages are considered an adequate remedy, with users waiving rights to other legal or equitable remedies such as injunctions or specific performance. Users also agree to fully indemnify Falcon Finance and its affiliates against any claims, losses, or liabilities arising from their use of the platform or breach of the Terms.

Issuance and redemption are contractual privileges subject to filters and timing, not absolute rights. Redemption requires wallet whitelisting and completion of processing, screening, and verification checks, and is expressly “subject to any applicable cooling period.” Falcon also claims discretion to apply haircuts on collateral at mint and to refuse or reverse instructions to correct “errors” even after confirmation. Public-facing materials add two practical constraints: a seven-day cooldown before payout and a minimum redemption size, which together mean users can submit requests at any time but cannot expect immediate settlement. In short, the ToS and the product guides align on a request-based redemption model with deferred delivery and operational discretion.

#Disclaimer

This report was subsidized by Falcon Digital Limited, which paid a fee for its preparation and publication. The statements and conclusions herein are not intended to—and must not be construed or relied upon as—any approval, endorsement, recommendation, rejection, promotion, facilitation, or commitment regarding the onboarding, acceptance, listing, or integration of USDf by any protocol or client serviced by LlamaRisk.

_This document is for information only and is not legal, financial, investment, or tax advice, nor an offer or solicitation to buy or sell any asset or service. _

Information herein is provided “as is,” without warranties as to accuracy, completeness, or timeliness, and may change without notice. LlamaRisk has no obligation to update this report and, to the maximum extent permitted by law, disclaims liability for any losses arising from its use.