A comprehensive risk analysis of Reserve's ETH+

Useful Links

-

Website: reserve.app

-

Documentation: Protocol Docs | Github | Audits

-

Social: Reserve Twitter | ETH+ Twitter |Blog | Discord

-

Contracts: Contract Deployments, Contracts architecture

-

Governance: Tally | Governance App | Governor Alexios (owner) | 3-of-4 Guardian multisig

-

Markets: Curve ETH+/ETH | Curve TriRSR | UniV3 ETH+/WETH

-

Dashboard: Reserve ETH+ Overview | Dune | DeFiLlama

-

Relevant Work: RToken General Assessment | eUSD Risk Assessment | wstETH Collateral Risk Assessment | rETH Collateral Risk Assessment

#Introduction

This report is conducted by the Reserve independent risk and research team operated by Llama Risk as part of a series on RToken risk assessments. In this report, we do a comprehensive review of ETH Plus (ETH+).

This series will comprehensively cover all relevant risk factors of ETH+. Our approach involves quantitative and qualitative analysis to help users gain insight into risks associated with the RToken.

As Reserve introduces a standard for issuing RTokens, our review involves analysis of properties specific to that framework, where applicable. Risks are categorized into:

-

Market Risk - risks related to market liquidity and volatility of the RToken

-

Counterparty Risk - risks related to the governance framework employed by the RToken and regulatory considerations

-

Technology Risk - risks related to the parameter configuration of the RToken, upgradability, and risks related to the underlying collateral basket making up the RToken

These risk categories will be summarized in the final section of the report and are meant to elucidate properties of ETH+ such that users can form opinions about exposure to the asset that suits their risk appetite, and to assist decentralized lending and stablecoin platforms in making onboarding decisions.

#Section 1: RToken Collateral Basket

This section addresses the fundamentals of ETH+, including relevant details about its underlying collateral. It is essential to convey the significance of its underlying collateral basket, including associated risks and trust assumptions. This section contains descriptive elements that cannot be quantified and serves as a descriptive introduction to the asset.

#1.1 Basket Funadamentals

The ETH+ RToken is described on the Reserve ETH+ overview page as a reward-generating Ethereum Liquid Staking Token basket with over-collateralized protection.

Each RToken involves a mandate that describes what goals its governors should try to achieve. It is a brief description (stored in the RToken contract) of the RToken’s purpose and what the RToken is intended to do, providing common ground for the governors to decide upon priorities and how to weigh tradeoffs. ETH+ has a mandate to:

-

Maintain an Ethereum-aligned Liquid Staking Token basket.

-

Positively impact the Ethereum staking distribution.

-

Provide value to ETH+ holders through diversification.

Simply put, ETH+ is intended to be an interest-bearing ETH token backed by several liquid staked ETH assets. How the mandate is interpreted is at the discretion of RSR stakers on ETH+ who can authorize upgrades, changes to collateral makeup and changes to parameters within ETH+ through on-chain governance.

#1.1.1 Underlying Collateral

The current target collateral basket ("prime basket") for ETH+ can be referenced in the BasketHandler contract by calling getPrimeBasket(). This balance may deviate from the target as the underlying collateral appreciate at different rates, and the protocol is designed to rebalance the basket toward the target.

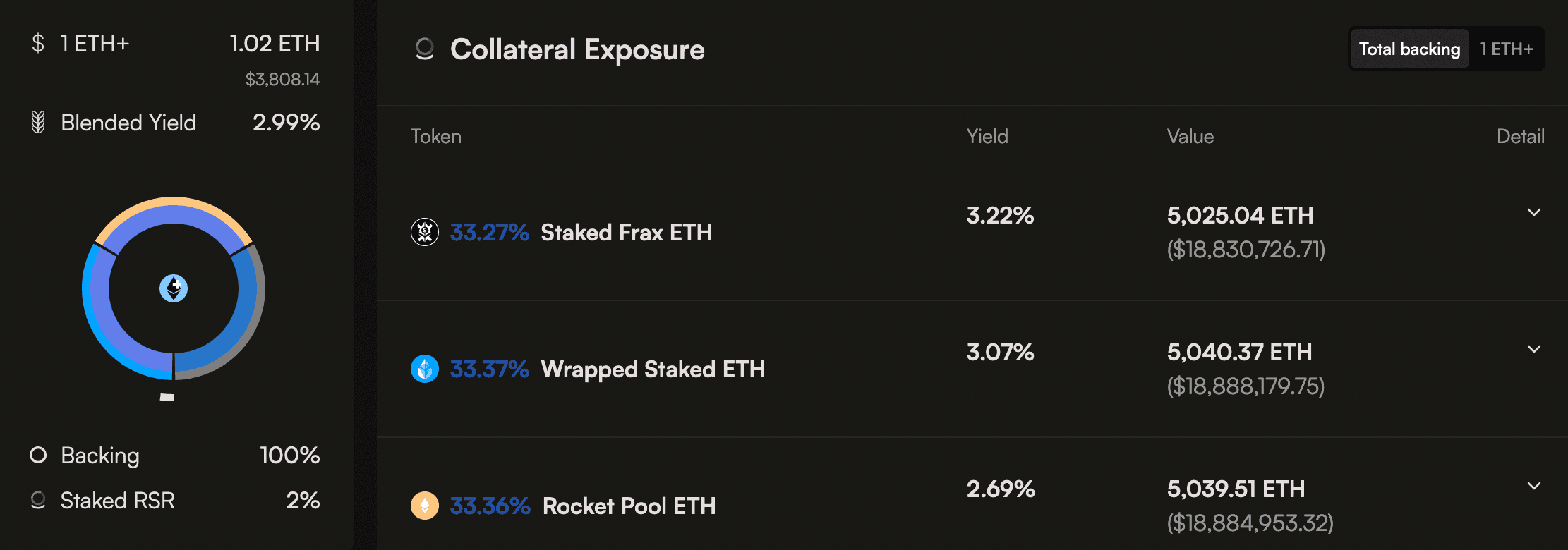

The current prime basket consists of three collateral types with weighting targets as follows:

-

33.33% Rocketpool rETH

-

33.33% Lido wstETH

-

33.33% Frax sfrxETH

These three collateral types are a selection of the most prominent liquid staking ETH protocols in DeFi. The protocols have a common purpose to allow users to stake their ETH and earn native staking rewards while having a liquid receipt token. Although each protocol performs essentially the same purpose, their designs may differ in important ways, as described in the following sections.

Source: Reserve ETH+ Overview | Date: 5/30/24

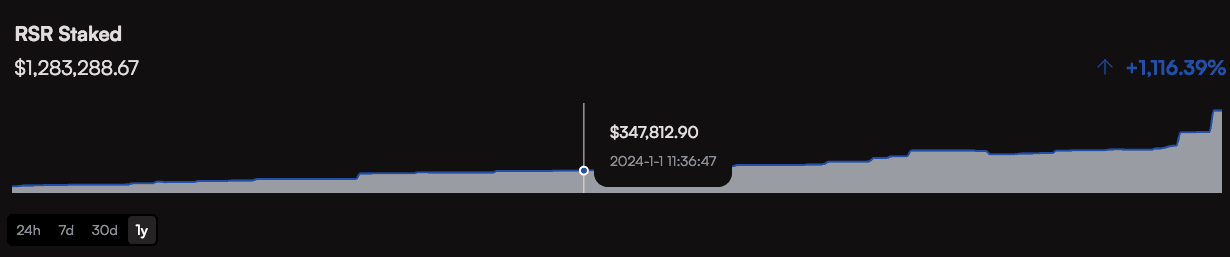

Notice in the image above that ETH+ is also overcollateralized by RSR, which is staked to ETH+ for governance rights, to earn a portion of fee revenue, and as a backstop in case of collateral default. This mechanism is reserved as the final protection and the amount of RSR overcollateralization may contribute to confidence in the overall basket. See above the figure above shows 2% overcollateralization on May 30, and below the amount of RSR staked on ETH+ over time.

Source: Reserve ETH+ Overview | Date: 6/17/2024

In case either collateral type experiences a default, as determined by an Oracle price feed, the protocol will replace the defaulted collateral type with the designated emergency collateral. This is currently set to WETH.

The collateral tokens and basket distribution are configurable by RSR stakers through on-chain governance. As an example of the governance process to modify the ETH+ collateral basket, see the RFC proposal on the Reserve forum to introduce Pendle swETH LP as a collateral type. This proposal did not proceed beyond the discussion phase.

ETH+ collateral has been modified from its initial composition established upon RToken creation. This amendment to the collateral basket, proposed on April 29, can be verified on the Governance page where sfrxETH was introduced to the basket. This is the only change to the basket composition in ETH+ to date.

#1.1.2 DeFi Composability

Based on the current underlying collateral basket, ETH+ directly relies on the integrity and security of the following protocols:

-

Lido: Lido is the predominant liquid staking protocol on Ethereum that has been designed with a series of smart contracts to trustlessly manage user ETH deposits with a set of professional, whitelisted node operators. The protocol has been designed to balance security and scalability, and has achieved the greatest adoption both in terms of liquid staking TVL and integrations into other DeFi applications.

-

Rocket Pool: Rocket Pool is another frontrunner in the liquid staking market. It has also been designed with a series of smart contracts to manage user ETH deposits. In contrast with Lido, Rocket Pool emphasizes node operator onboarding, and allows permissionless node operation with bonding requirements to align incentives with users. Rocket Pool has experienced scalability challenges, although it has emerged as one of the most reliable liquid staking platforms with DeFi integrations second only to Lido.

-

Frax: Frax is a DeFi platform that showcases a diverse array of products, including a stablecoin, ETH LSD, lending platform, and AMM. Its primary innovation is the "Algorithmic Market Operations" (AMO) contracts, pre-programmed monetary policy contracts that are authorized to manage protocol-owned liquidity such as frxETH. Although it is a DeFi platform, users should be aware that there are significant trust assumptions in the protocol team and its frxETH LSD is markedly more centralized than either Lido or Rocket Pool.

In connection with the underlying protocols, the ETH+ collateral basket is made up entirely of ETH staking derivatives (wstETH, rETH, and sfrxETH). The underlying token in all cases is ETH, the native asset of Ethereum. That is to say, there is no additional risk of backing assets beyond dependency of the aforementioned liquid staking protocols and all associated risk therein.

See the ETH+ Backing and Risk section in the Reserve app for additional information, including the RToken exposure to various DeFi protocols in real-time.

#1.1.3 Yield Accrual Mechanism

Liquid Staking Yield

ETH+ generates its yield through the interest-earning property of its underlying LSD collateral types: wrapped staked ETH (wstETH), Rocket Pool staked ETH (rETH), and Frax staked ETH (sfrxETH).

Below is a breakdown of the revenue source of each collateral asset:

-

Wrapped Staked ETH (wstETH): ETH+ earns yield from wstETH, which represents staked ETH in Lido's liquid staking platform. The yield comes from Ethereum staking rewards, reflecting the staking activities on the Ethereum network. Wrapped stETH receives yield distribution through an internal wstETH:stETH exchange rate. This reflects the rewards earned by the protocol minus slashing and penalties, with the expectation that wstETH appreciates against ETH over time.

-

Rocket Pool Staked ETH (rETH): rETH represents staked Ethereum within the Rocket Pool network. Like wstETH, rETH earns staking rewards from ETH staked in the platform and allocated to node operators. rETH does not have a rebasing token, rather it accrues value through updates to its internal exchange rate, and can be redeemed for a proportional amount of ETH held in the system.

-

Frax Staked ETH (sfrxETH): sfrxETH is the yield-bearing version of ETH deposited in frxETH. Frax divides its LSD into frxETH and sfrxETH- the former to maintain peg with ETH for use in DEX and its Automated Market Operations (AMO); the latter to be a value accruing collateral token. sfrxETH has historically enjoyed yields in excess of typical Ethereum staking yields thanks to the substantial protocol-owned frxETH liquidity that forgoes its share of the yield to sfrxETH tokenholders.

ETH+ Yield Accrual

Yield from the ETH+ collateral basket is captured through a series of contracts that handle revenue distribution. Any equal amount of appreciation between wstETH, rETH, and sfrxETH results in the minting of new ETH+, and unequal appreciation involves sending the unequal balance to the RTokenTrader to auction for RTokens. Newly acquired ETH+ from these activities is sent to the Furnace and gradually distributed as an appreciation in the exchange rate of ETH+ to the underlying collateral basket.

Additionally, a portion of the yield can be distributed to RSR stakers who provide an overcollateralization buffer to ETH+. A complete overview of yield accrual and distribution within the RToken system can be found in the section on System Architecture in this report.

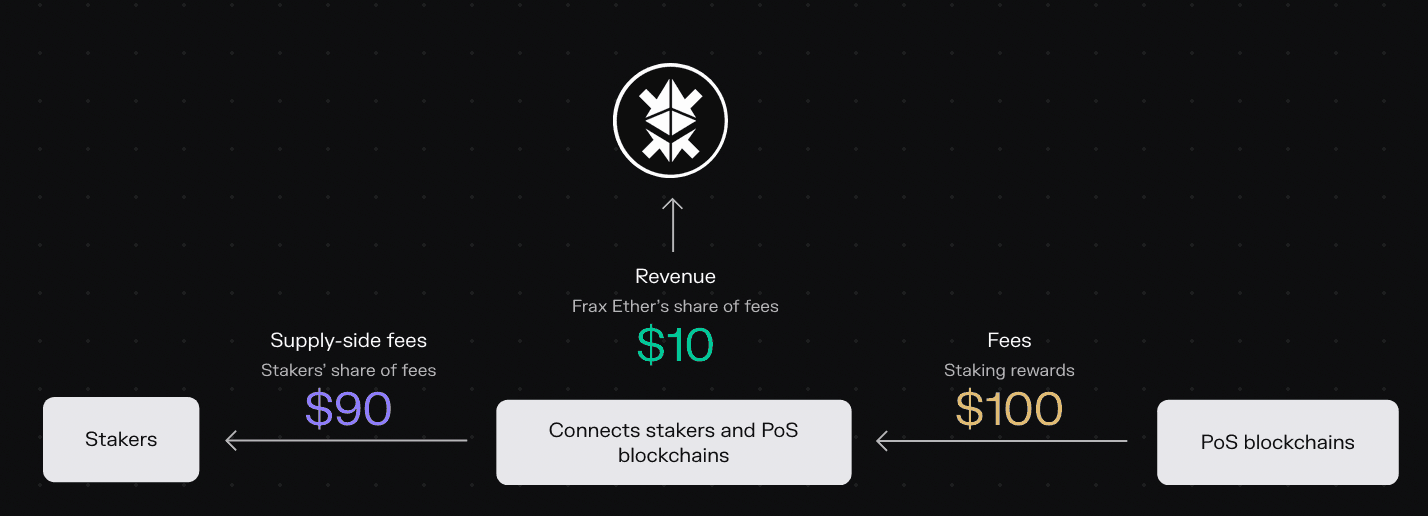

#1.1.4 Provider Fee

Each liquid staking platform includes a provider fee to compensate node operators or accrue value to the protocol as a form of revenue.

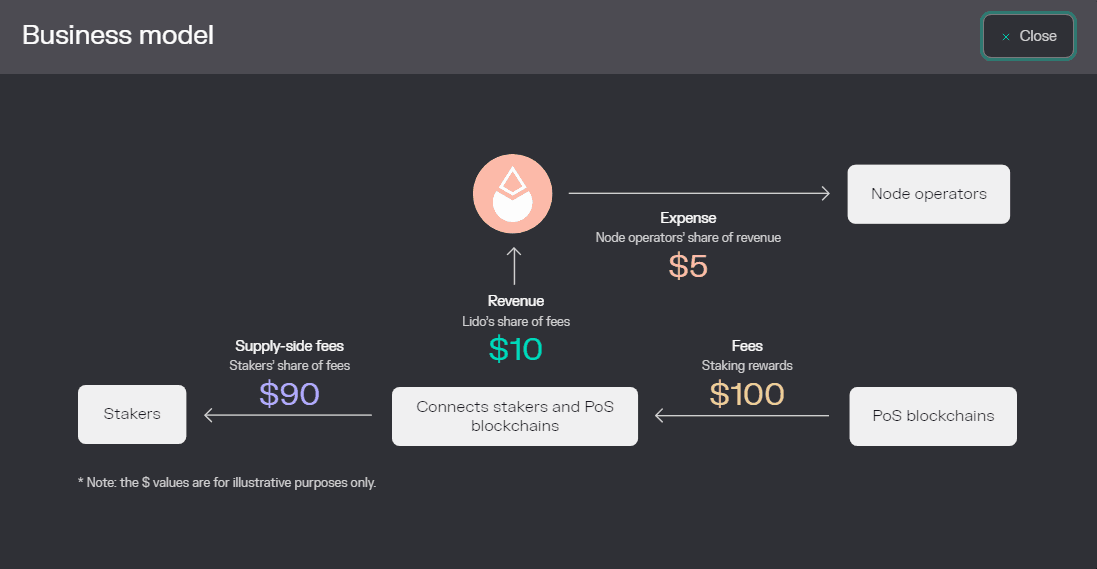

- Wrapped Staked ETH (wstETH): Lido passes on 90% of its staking rewards to stETH holders, deducting 5% for node operators and 5% as a protocol fee.

Source: TokenTerminal

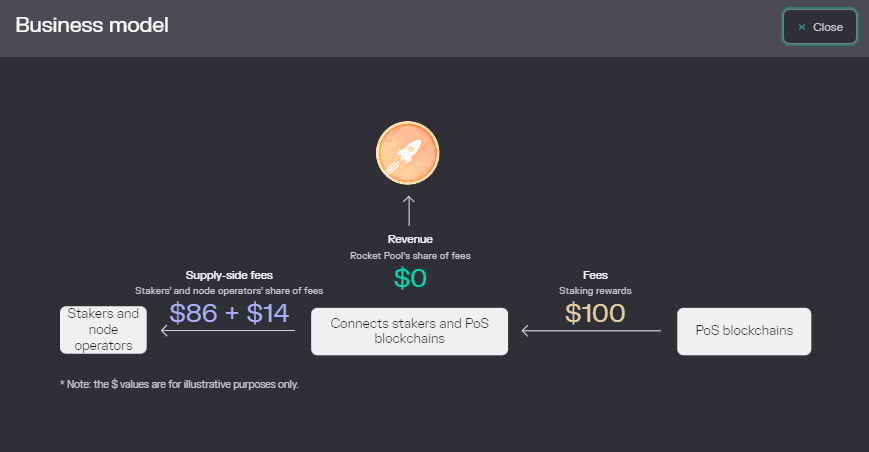

- Rocket Pool Staked ETH (rETH): Rocket Pool uses a decentralized network of node operators that have instantiated with different fees depending on when they were deployed, so the exact fee taken by node ops is not clearly defined (currently the fee on new minipools is set to 14%, passing on 86% of rewards to rETH holders). Rocket Pool does not take a protocol fee.

Source: TokenTerminal

- Frax Staked ETH (sfrxETH): Frax passes 90% of its staking rewards to sfrxETH and retains 10% as a protocol fee.

Source: TokenTerminal

#1.1.5 Node Operator Set (LSD Collaterals)

The collateral types underpinning ETH+, Rocket Pool rETH, Lido wstETH, and Frax sfrxETH offer different approaches to node operation management that diversify their risk profiles. Understanding these approaches is important for assessing the security and efficiency of the staking processes critical to ETH+'s performance.

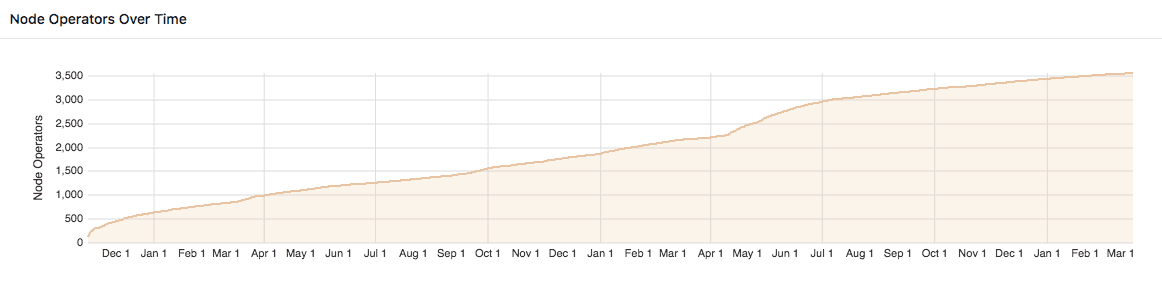

Rocket Pool's Node Operator Framework

Rocket Pool enables individuals to permissionlessly become node operators by instituting a mandatory bond of ETH and its native token RPL. This approach diversifies node operator participation but has also revealed inefficiencies that have limited its ability to scale. A mismatch of demand for rETH and a limited supply of node operators willing to bond has led to a prolonged glut in the deposit pool and caused rETH to historically trade at a premium to its net asset value. Despite inefficiencies, Rocket Pool boasts perhaps the most diverse node operator set in the LSD industry with over 3,500 unique node operator addresses.

Source: Rocketscan Nodes

Being a node operator for Rocket Pool involves some key responsibilities and benefits:

-

System Setup and Maintenance: Operators must configure and secure their computing systems, including the installation of Rocket Pool software and the management of minipools.

-

Collateral and Risk: A minimum stake of 10% in RPL tokens, alongside 8 or 16 ETH per minipool, is required. This stake acts as insurance against penalties or slashing, aligning operator incentives with network security.

-

Incentives: Operators receive ETH rewards, interest on staked RPL, and DAO voting rights, promoting good performance and adherence to protocol standards.

Lido's Node Operator Ecosystem

By contrast, Lido relies on a curated set of professional staking service providers for node operation, ensuring expertise and reliability in managing validator nodes. As of a recent quarterly VaNOM report published Feb. 15, 2024, Lido has 35 whitelisted, professional node operators. Lido is also working toward enabling solo stakers to participate as node operators in the network, although this continues to be a point of active development.

Lido's platform involves some key responsibilities and features:

-

Professional Operators: A select group of professional entities is tasked with node operation, enhancing the reliability and security of the staking process.

-

Transparency and Accountability: The NodeOperatorsRegistry records operators and their keys, fostering oversight within the Lido ecosystem.

-

Centralized Risk Management: While this model centralizes operation, it also focuses risk, making the selection and oversight of operators crucial to maintaining protocol integrity.

Frax's Node Operator Ecosystem

Frax operates in some ways as a decentralized application governed by smart contracts and a DAO of tokenholders, although it has a notably centralized approach to node operation in frxETH. The Frax core team operates all nodes.

In retort to the centralization vector, Frax's founder has claimed the following:

The validators are ran by the Frax Core Team in geodiversified commodity data centers across North America and Europe through AWS and OVH with firewall+DDOS protection. The frxETH v1 validator set is consistenly rated #1 out of all entities running validators including higher rated than Lido, Binance, Kraken, Coinbase etc. -Sam Kazemian, Frax Founder

The claim of superior historical performance can be verified on rated.network and Frax does make each validator's public address and real-time stats available for monitoring at Frax Facts.

Implications for ETH+

Navigating the operational landscapes of Rocket Pool, Lido, and Frax involves balancing the trade-offs between decentralization and scalability. This balance is vital for optimizing yield generation while minimizing the risks associated with node operation and the broader staking ecosystem.

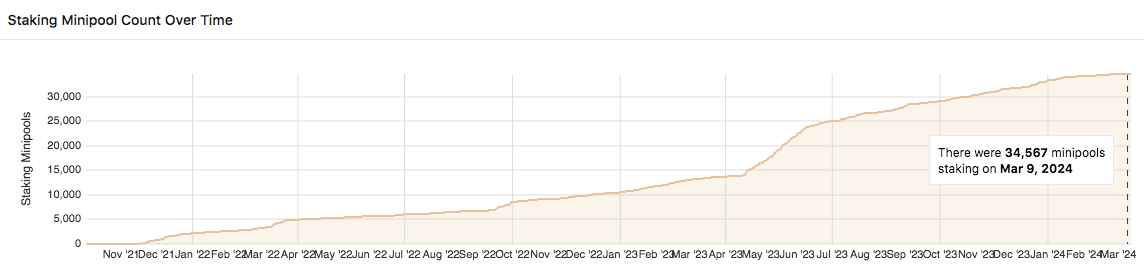

#1.1.6 Validator Selection (LSD Collaterals)

Understanding the operational intricacies of Rocket Pool, Lido, and Frax provides valuable insights into the mechanisms that support ETH+'s stability and yield generation. Validator selection is the process by which the protocol onboards additional validators.

Rocket Pool's Minipool Creation Process Rocket Pool's innovative approach allows for flexible participation in Ethereum's staking ecosystem through its minipool feature. The Atlas update introduced an important adjustment, offering node operators the choice between 8 ETH or 16 ETH bonds (previously 16 ETH bonds were required), facilitating a more accessible entry point for diverse participants.

Minipool Initiation Steps:

-

Deployment and Queue: A minipool is initialized with the chosen ETH amount and enters a queue, awaiting a total stake of 32 ETH.

-

Prelaunch Phase: Upon receiving the full stake, the minipool enters a prelaunch state with a 14-day launch timeout. During this phase, the operator's collateral is locked in and verified by a trusted set of oracle DAO operators.

-

Operational Status: The final step sees the minipool receiving ETH from the staking pool, enabling the validator to commence operations, marking the transition to active staking status.

Source: Rocketscan Minipools

Lido's Node Operator Onboarding

Lido's approach to expanding its node operator (NO) base is methodical, emphasizing security and reliability through a permissioned onboarding process. This process ensures that only the most capable and trustworthy operators manage the protocol's staking operations.

Onboarding Process:

-

Structured Expansion: Lido introduces NOs in waves, carefully selecting candidates based on demonstrated reliability and operational history.

-

Verification and Approval: Candidates submit public validator keys and signatures, which are then verified by DAO members and subject to DAO approval.

-

ETH Distribution: Approved NOs receive ETH deposits in 32 ETH increments, allocated across their provided validator keys, ensuring a balanced and secure distribution of staking responsibilities.

For validator selection, each whitelisted node operator submits public validator keys along with associated signatures for future validators that they will manage. The keys are verified by DAO members and approved by DAO vote. The protocol then distributes ETH deposits in 32 ETH chunks across all NOs, starting with the first unused signing key from an NO's useable set.

frxETH Current and Future Processes

As node operation in frxETH is completely centralized by the Frax team, validator selection does not present a relevant issue. A promotion of a frxETH v2 was tweeted last year on June 2 that would introduce decentralized node operation through an innovative node op marketplace. The status of this development remains unknown and given the time that has passed since this upgrade was promoted, it is possibly an abandoned plan.

#1.1.7 Validator Collateralization (LSD Collaterals)

The unique operational frameworks of Rocket Pool, Lido, and Frax involve specific requirements designed to optimize performance and minimize risks. Understanding these frameworks is essential for assessing the robustness of ETH+'s collateral strategy.

Rocket Pool's Collateral and Reward Mechanism

Rocket Pool is relatively unique within the liquid staking market in that it addresses unique challenges to enable permissionless node operation. To ensure alignment between node operators and stakers who effectively lend their ETH to the platform, Rocket Pool requires node operators to provide ETH collateral and additional collateral in RPL tokens. Therefore, operators that perform their duties poorly may have their own collateral slashed as a consequence.

RPL Collateralization requirments and mechanics include:

-

Proportional Stake: The RPL stake must be proportional to the borrowed ETH from the staking pool, ranging from a minimum of 10% to a maximum of 150% of the bonded ETH amount.

-

Example Scenario: For an 8 ETH bond, the operator's RPL stake can vary from 2.4 ETH worth of RPL (10% of the borrowed 24 ETH) to 12 ETH worth of RPL (150% of the 8 ETH bond).

-

Inflation and Rewards: RPL's 5% annual inflation rate incentivizes operators to maintain their required stake, with rewards distributed based on 28-day snapshot intervals. Operators may need to adjust their RPL stake in response to price fluctuations to continue receiving rewards.

Lido's Operational Protocols and Penalties

Lido's node operators (NOs) are professionals subjected to a strict operational protocol agreed to within the terms of their whitelisting. As the incentive structure involves operators avoiding reputational harm, Lido therefore wholly lacks the requirement for node operators to post collateral. However, penalties are in place to ensure adherence to high standards of operation.

Penalty Mechanisms for Lido operators include:

-

Validator Management: NOs can face penalties for mismanagement, such as failing to process exit requests promptly, which leads to exclusion from new stake deposits and a reduction in rewards.

-

Slashing Events: A slashing event or a validator's balance falling below the EJECTION_BALANCE of 16 ETH triggers a forced exit, emphasizing the critical nature of maintaining operational integrity.

-

DAO Oversight: In cases of severe delinquency, the DAO has the authority to eliminate fees for the offending NO, effectively removing them from the protocol. This includes scenarios where ETH becomes irretrievable, such as loss of private keys.

Frax Centrally Controlled Validators

Due to the central authority Frax has over the operation of frxETH validators, it avoids the need to address any cryptoeconomic incentive structure to ensure operator performance. This is, of course, an advantage that comes at the cost of requiring complete trust in the Frax team to responsibly act in the interests of its users.

Implications for ETH+

The operational management strategies of Rocket Pool, Lido, and Frax involve different approaches that may or may not necessitate cryptoeconomic assurances such as collateral requirements. Users may consider the value of such assurances and identify trust assumptions that may compromise the integrity of the LSD.

#Section 2: Performance Analysis

This section evaluates ETH+ from a quantitative perspective. It analyzes onchain token usage and competitive metrics that give insight into the adoption trend and user behaviors.

This section is divided into two sub-sections:

-

2.1: Usage Metrics

-

2.2: Competitive Analysis Metrics

#2.1 Usage Metrics

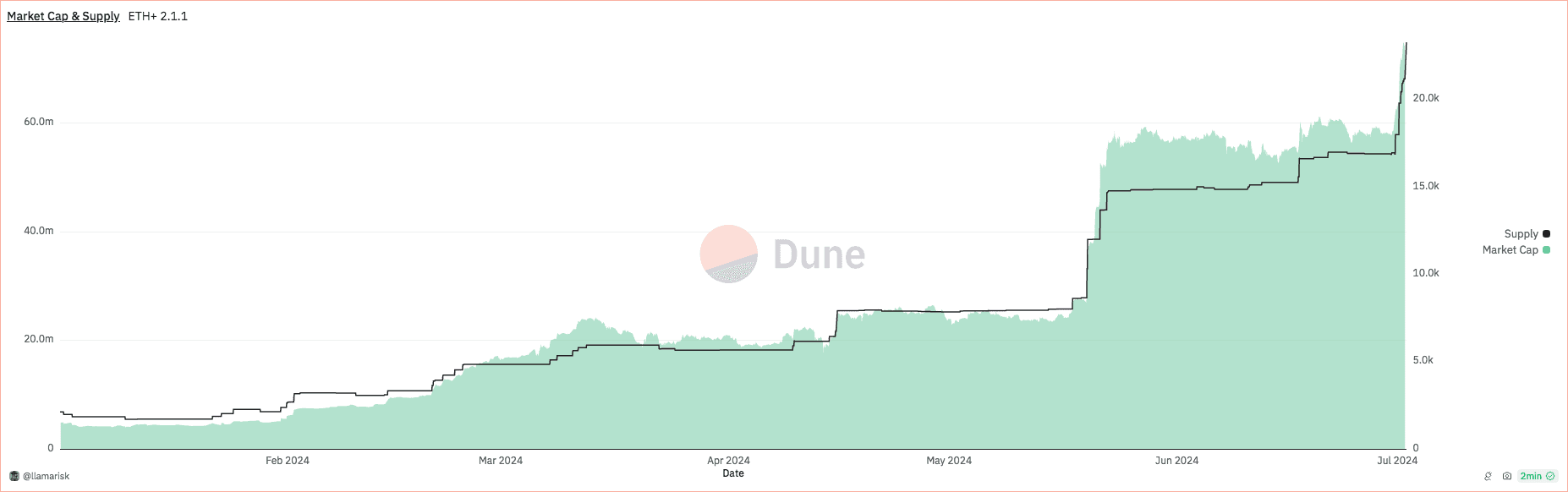

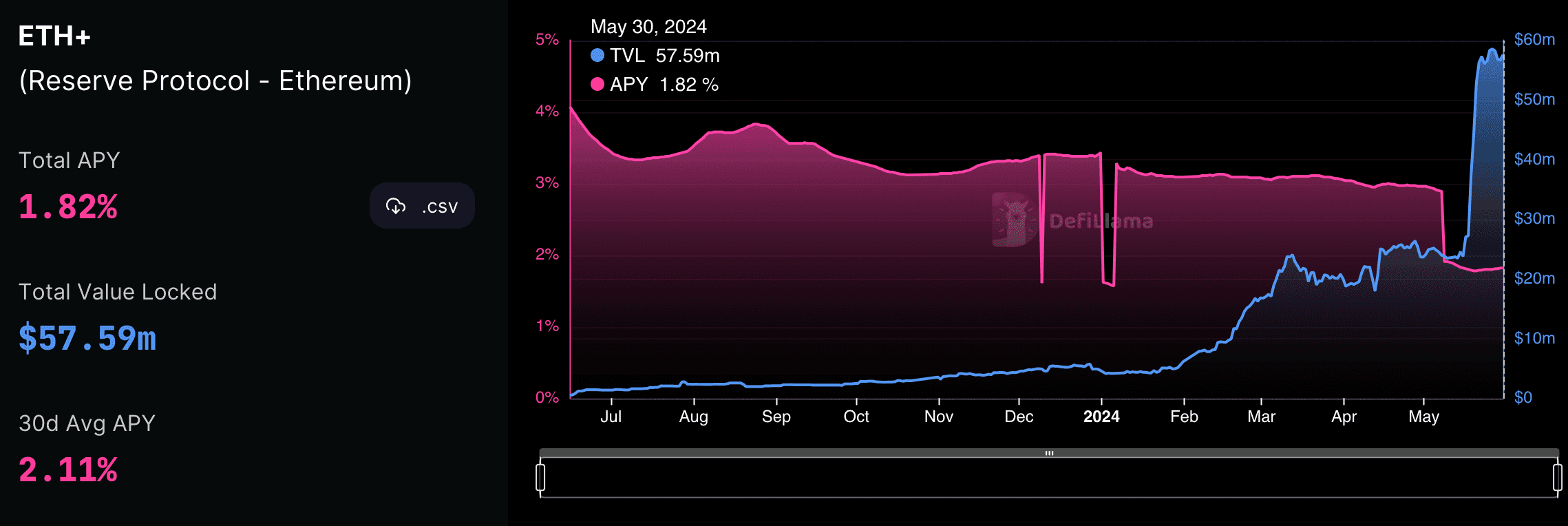

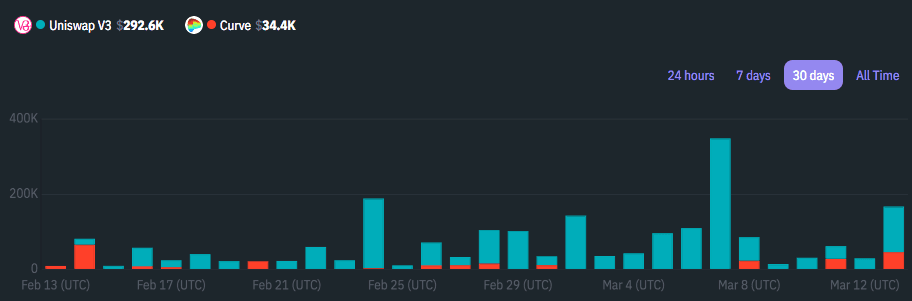

#2.1.1 Total Value Locked (TVL)

ETH+ has experienced a sharp increase in TVL since February 2024, partially as a result of an increase in value of the underlying ETH collateral. The TVL nearly doubled in late May when a sharp influx increased supply from ~8k to ~14.8k ETH+.

Source: Dune Analytics

The below chart shows the annualized supply growth of ETH+ along with RSR staked. The supply of ETH+ has been in a growth trend since January 2024 along with an increase in RSR staked on ETH+.

Source: Reserve ETH+ App | Date: 5/31/24

#2.1.2 Transaction Volume

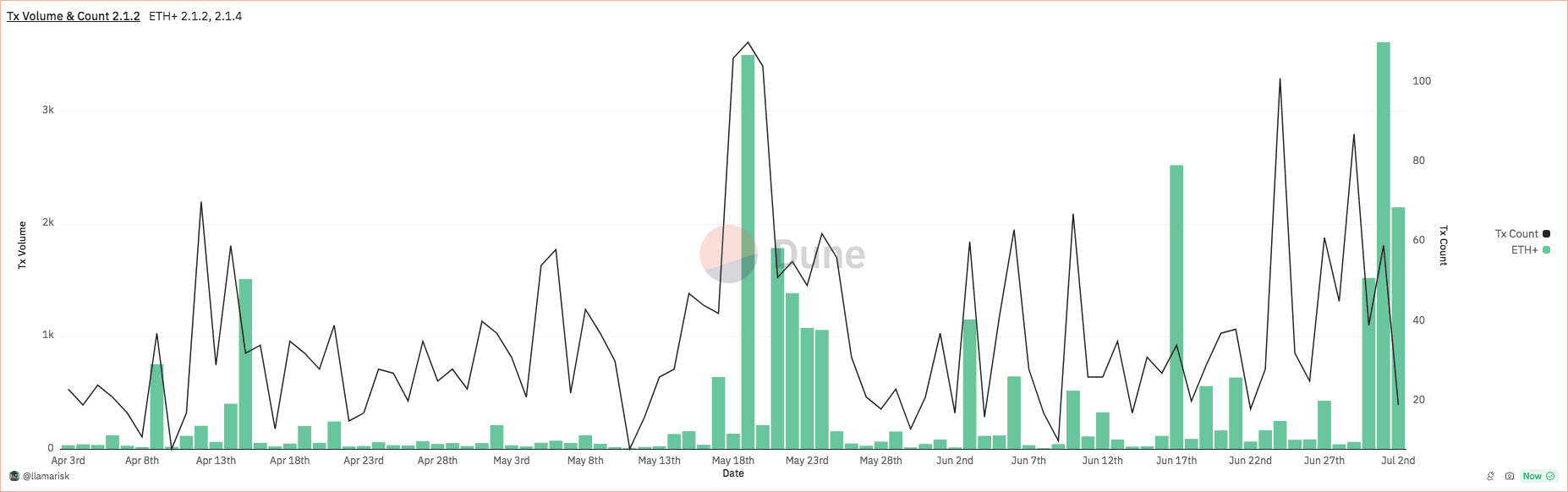

Total on-chain transfers for ETH+ have increased in a cyclical trend since February with a max daily transfer amount of 3,504 ETH+ on May 19, 2024. Transaction counts show a more clearly defined growth trend between February and May 2024.

Source: Dune Analytics

#2.1.3 Average Transaction Size

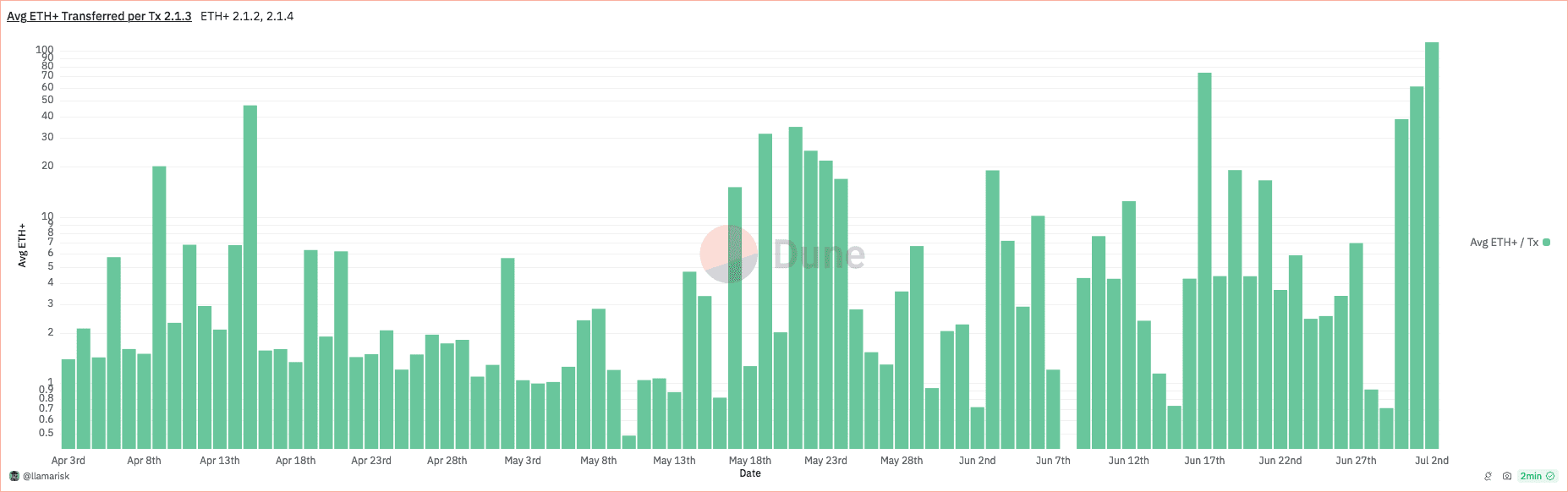

The following log chart provides a breakdown of the average daily transaction size per transaction. There is a clear cyclic trend with tx size spikes in mid-March, April, and May. The overall trend from March to June shows a general declining trend in average tx size.

Source: Dune Analytics

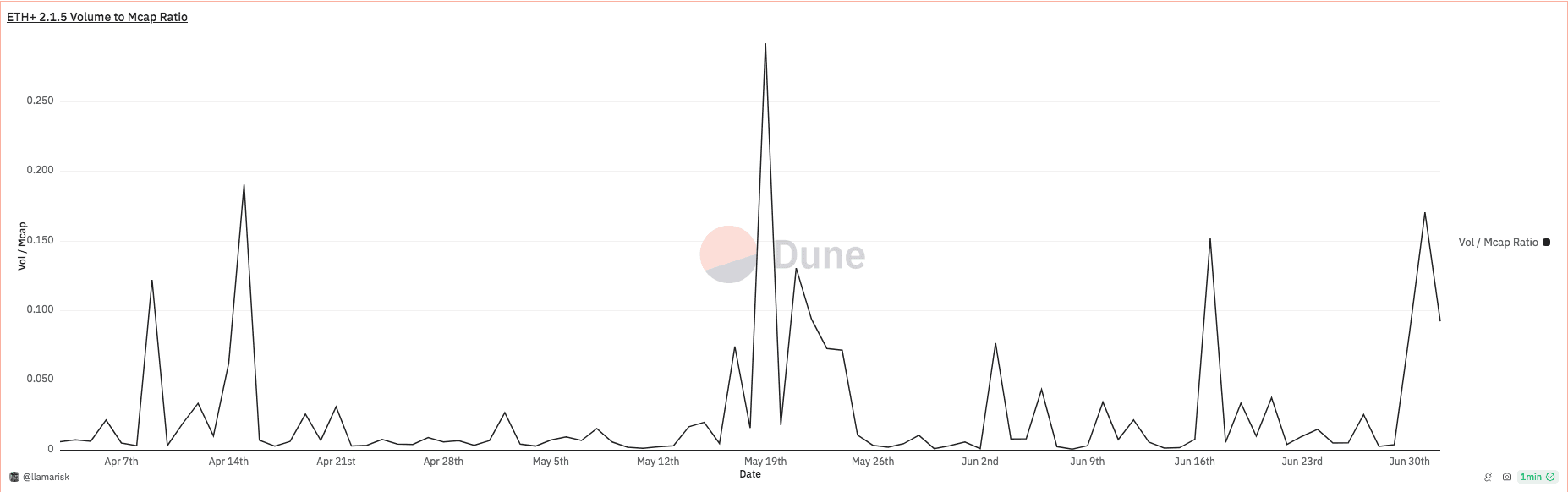

#2.1.4 Trading Volume to Market Capitalization Ratio

Trading volume to market cap ratio takes the overall daily onchain transaction volume divided by the market cap at the daily close. This value is generally very low with periodic spikes.

Source: Dune Analytics

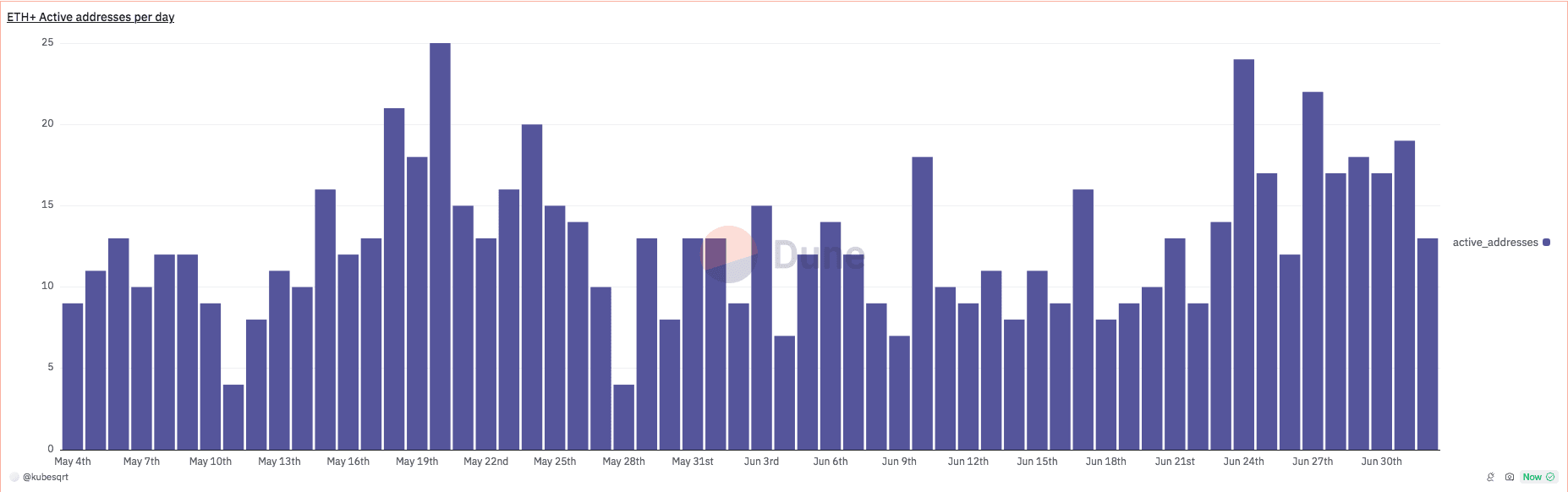

#2.1.5 Active Addresses/Users

Active addresses are unique addresses that make an on-chain transaction involving ETH+ on a given day. This value has show a modest growth trend from April through May 2024.

Source: Dune Analytics

#2.1.6 User Growth

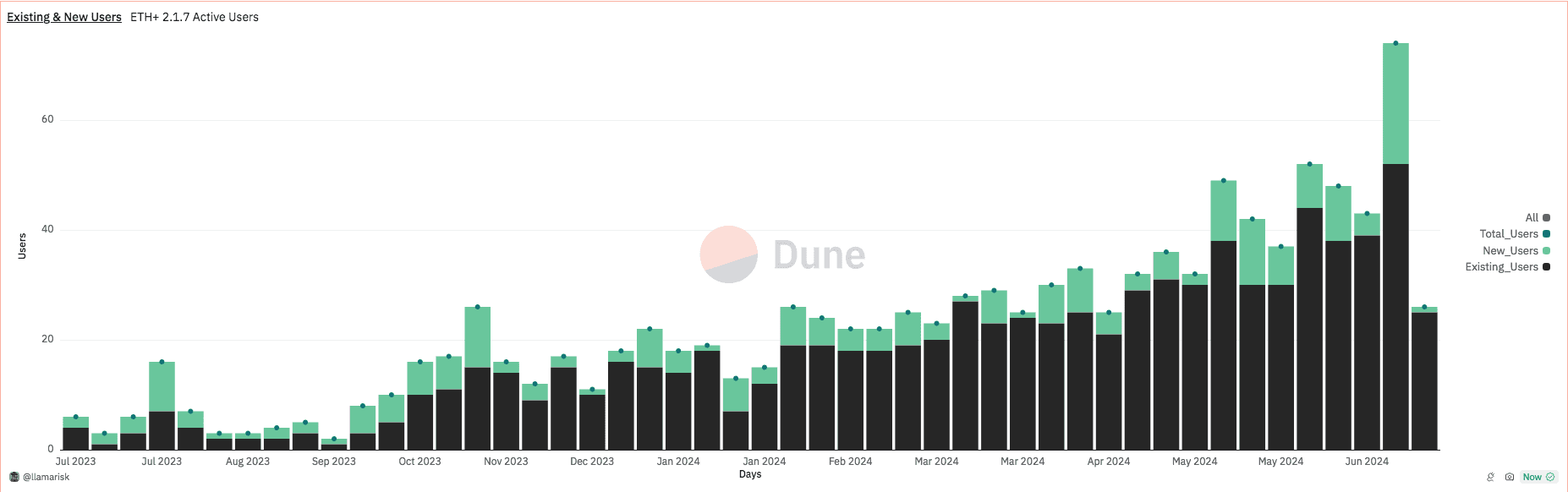

The following query identifies weekly active addresses that have transferred ETH+ and divides them between previously active users and new users. The nominal value of user interaction remains low but does show a clear growth trend from June 2023 until present.

Source: Dune Analytics

#2.2 Competitive Analysis Metrics

#2.2.1 Market Share

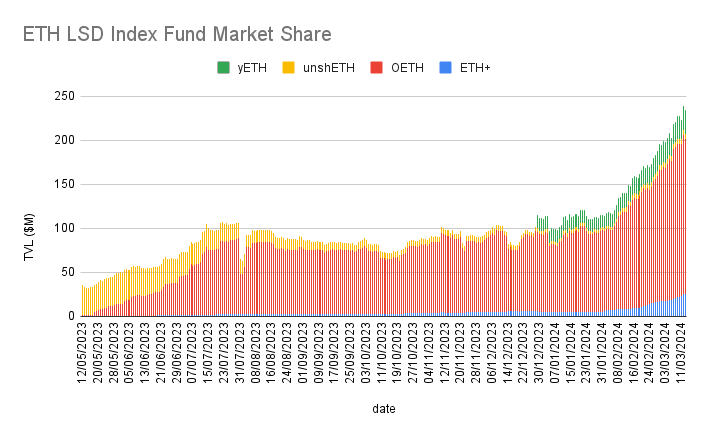

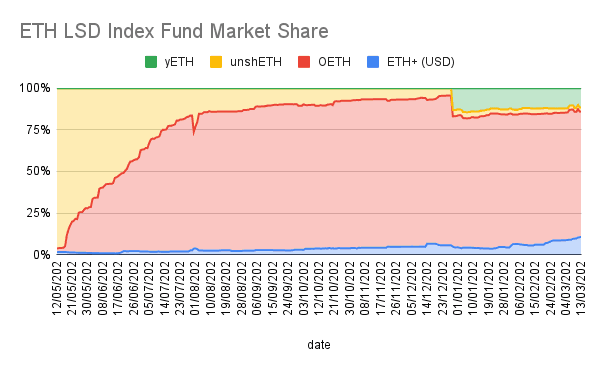

ETH+ can be considered an index of ETH LSDs, which bears similarity to several competing products from Origin (OETH), unshETH, and Yearn (yETH). The market for these products is a small subset of the overall LSD market, but has seen substantial growth since January 2024.

Source: DefiLlama Data

OETH has the majority marketshare of the projects compared, having rapidly outpaced unshETH throughout 2023. ETH+ has seen a sizable increase in marketshare by TVL more recently, since January 2024. Its share has increased from 4.4% of marketshare on January 1, 2024 to 10.7% of marketshare on March 13.

Source: DefiLlama Data

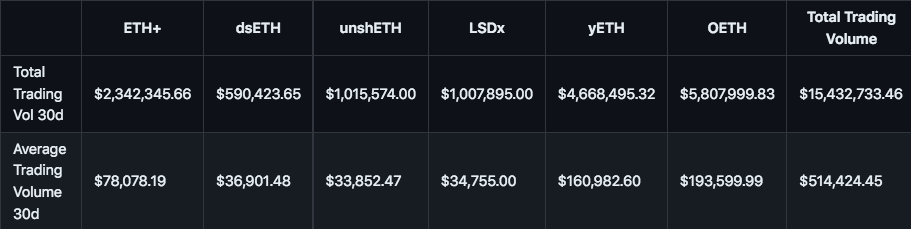

#2.2.2 Trading Volume Share in LSD Index Trading Volume

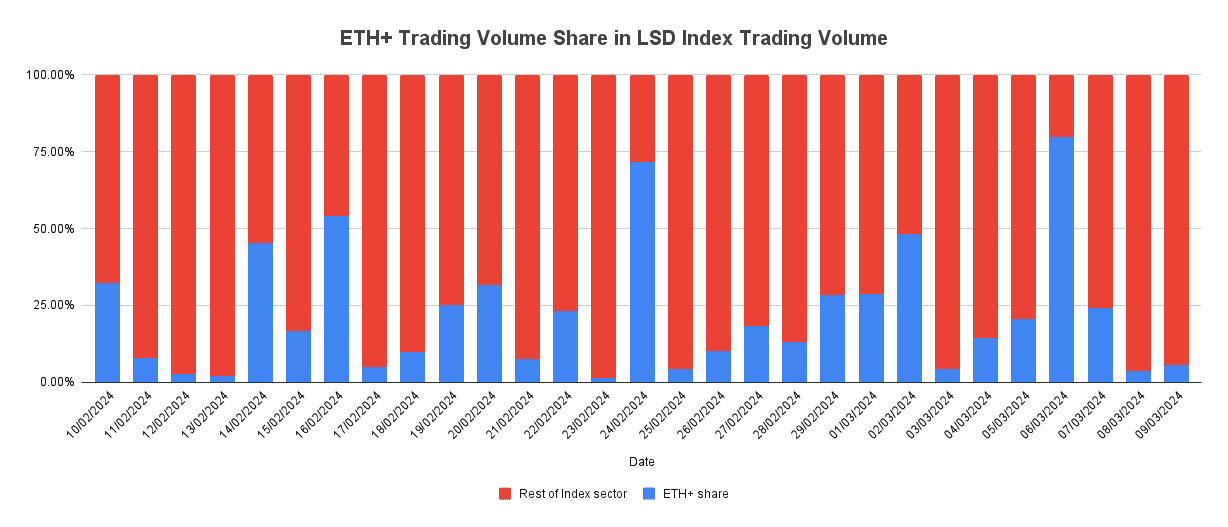

Several competing products are referenced in the chart below as "Rest of Index Sector". This includes dsETH, unshETH, LSDx, yETH, an OETH, found in the table below. The chart below shows the ETH+ volume over the previous 1 month period as a percent over overall sector volume.

Source: CoinGecko and CoinMarketCap

#2.2.3 Protocol Yield

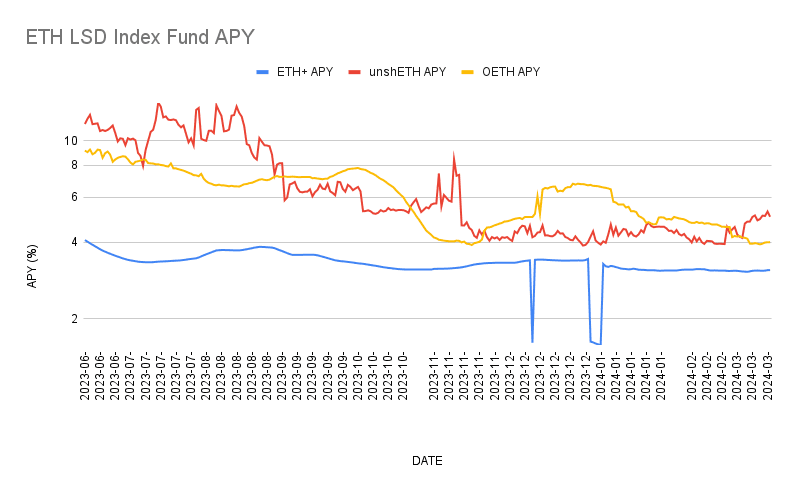

The ETH+ yield is the average of the underlying LSD collaterals minus a 5% fee to stRSR. According to DefiLlama, the average ETH+ 30-day APY is 2.11% as of May 31, 2024. The chart below shows the ETH+ APY:

Source: DefiLlama

According to APY data from DeFiLlama, unshETH and OETH have historically outperformed ETH+ on yield, although both competitors have experienced much higher yield volatility and overall declines since Q3 2023.

Source: DefiLlama

#Section 3: Market Risk

This section addresses considerations regarding the use of the RToken as collateral and ease of liquidation based on historical market conditions. It seeks to clarify (1) the Liquid Staking Basis & Volatility of ETH+, and (2) the liquidity profile of the asset. Market risk refers to the potential for financial losses resulting from adverse changes in market conditions.

This section is divided into 3 sub-sections:

-

3.1: Volatility Analysis

-

3.2: Liquidity Analysis

-

3.3: Subsidization of Economic Activity

#3.1 Volatility Analysis

#3.1.1 Yieldbearing Stable Basis (YSB)

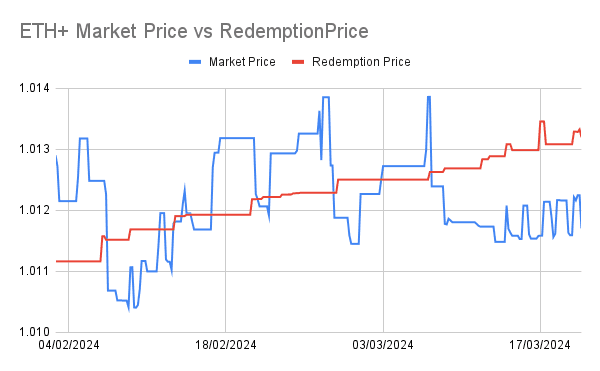

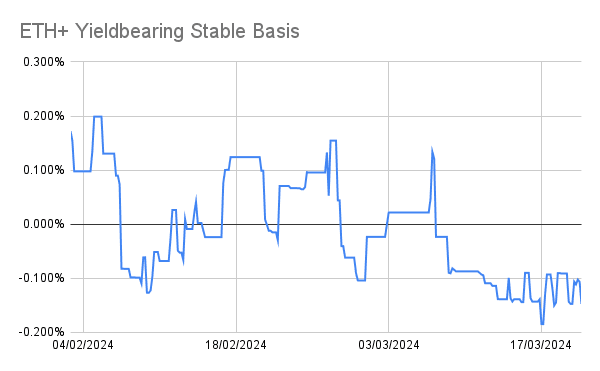

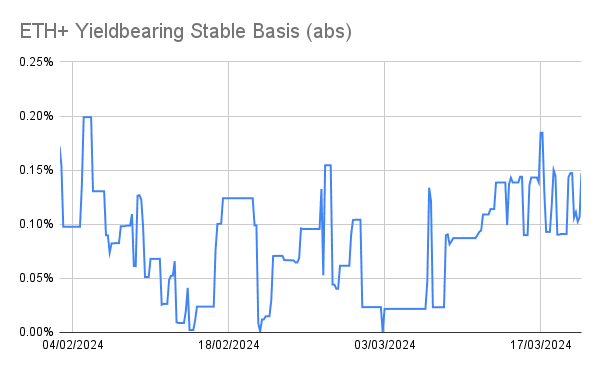

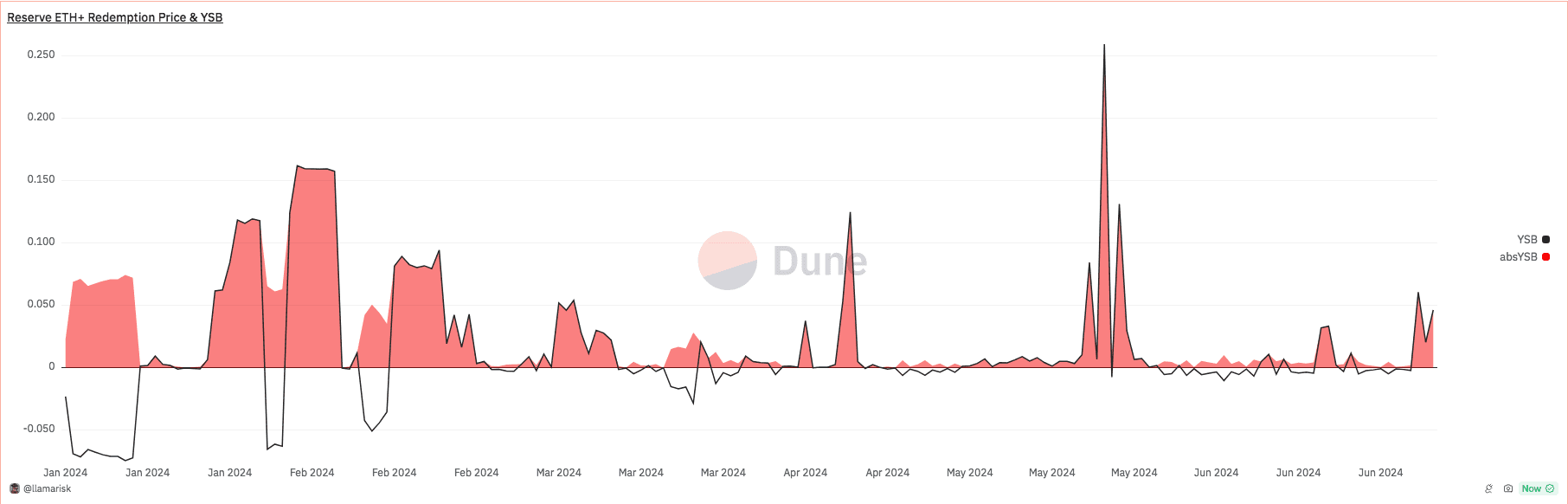

The yieldbearing stable basis (YBS) measures the deviation between the RToken's redemption price quoted by Reserve compared to the observed market price. This offers insight into the efficiency of the redemption process that reinforces the peg to the underlying basket.

The redemption price increases over time as revenue is distributed to ETH+ holders and can be determined by calculating the basketsNeeded/totalSupply in the RToken contract. Whereas the change in basketsNeeded have been fairly infrequent events, having occurred under 150 times in its lifespan, as of March 14, 2024, the value is actually updated continuously.

The charts below take the market price from the Curve ETH+/ETH pool oracle. The chart below shows the market price of ETH+ along with the redemption price on the primary market. Note that, in actuality, the redemption price is updated continuously, not in discreet steps.

The YSB value shows the percentage deviation of ETH+ from the redemption price over time.

The absolute YSB shows the percentage deviation of the ETH+ market price from the redemption price in absolute terms. It considers the magnitude of the deviation without respect to positive or negative fluctuations.

Source: Curve ETH+/ETH pool and ETH+ contract

Using an average daily price for ETH+, the following query overlays the YSB and the absoluteYSB. ETH+ has generally traded closer to its underlying since March and notably trades at a premium to its underlying in most cases where deviation occurs.

Source: Dune Analytics

#3.1.2 Volatility

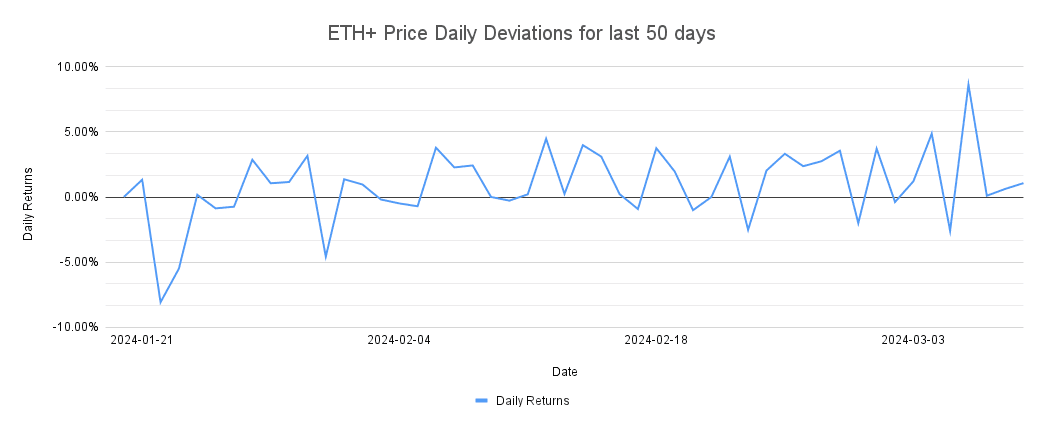

The chart below shows the daily returns of ETH+ over a 50 day period. Also provided are the standard deviation and annualize volatility rate of the asset.

Source: Syve

-

Standard Deviation: 2.77%

-

Annualized Volatility Rate: 53.01%

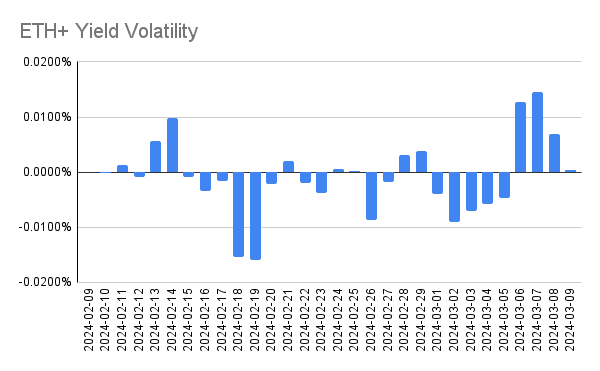

#3.1.3 Yield Volatility

ETH+ yield APY has proven to be very stable over a long period of time (since ETH+ launch), which is expected due to the fact that ETH+ relies on Ethereum staking yield from its underlying basket of LSDs. The chart below shows the daily yield volatility over a 30 day period.

Source: Syve

#3.2 Liquidity Analysis

#3.2.1 Supported DEXs and CEXs

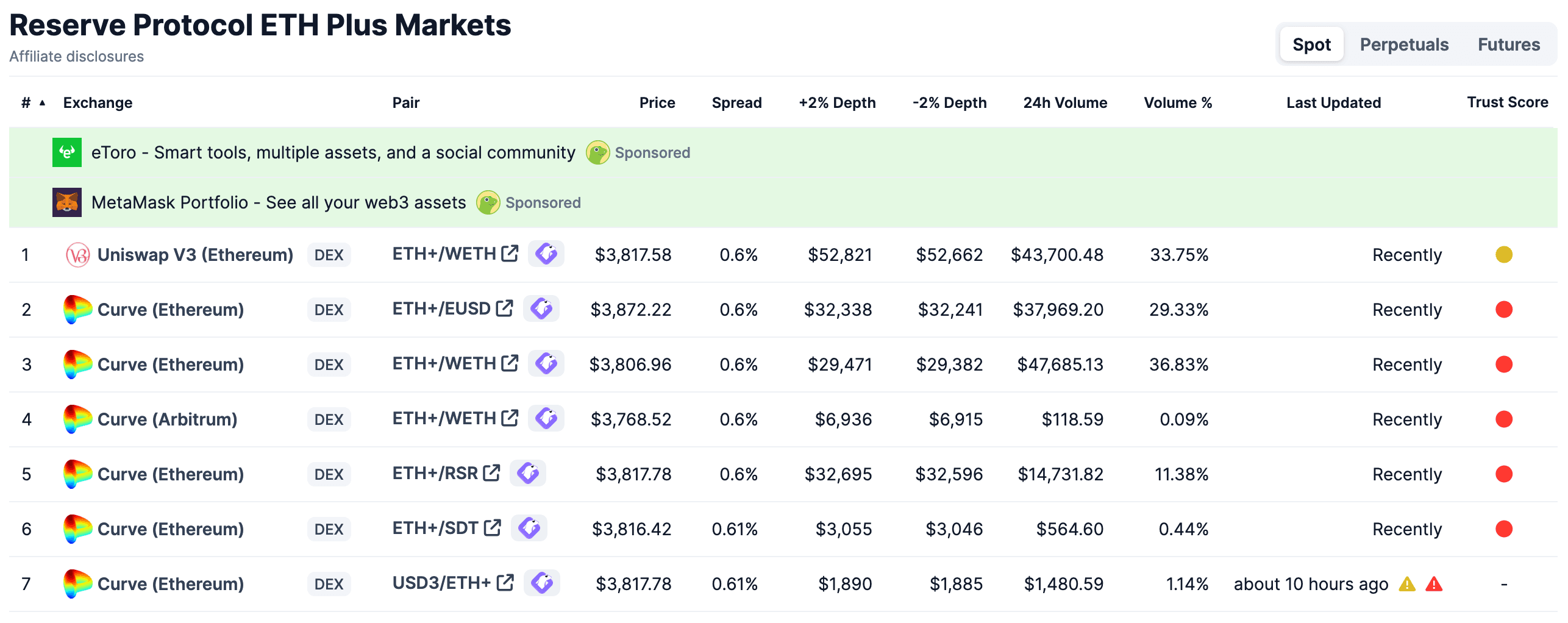

Currently, ETH+ has not been integrated into any centralized exchanges (CEXs), though its core governance token is listed on major platforms, including Binance and OKX.

ETH+ is supported by several DEXs, with most notable presence on Curve and Uniswap.

Source: CoinGecko | Date: 5/31/2024

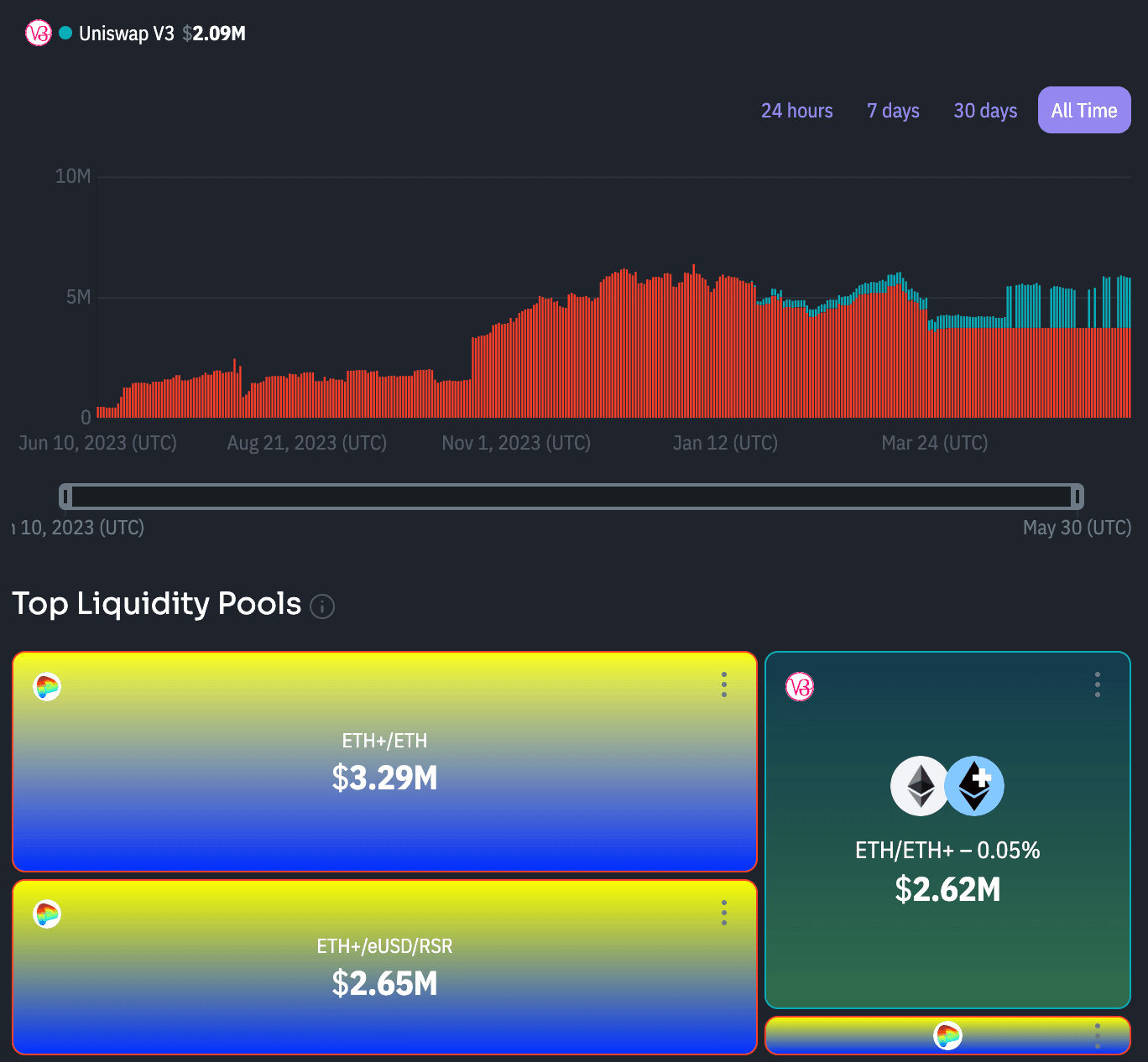

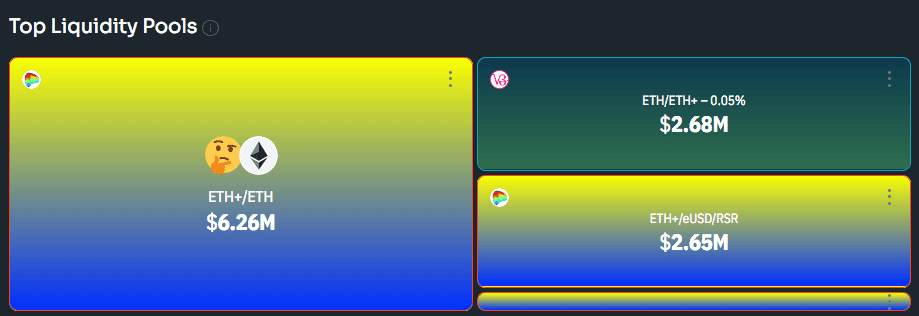

#3.2.2 LSD (LSD Index) Token Total On-chain Liquidity

The ETH+ on-chain liquidity is $5.84m as of May 31, 2024, according to DexGuru. This calculation does not total TVL of all liquidity pools; rather it calculates the value of counterparty tokens that ETH+ can be swapped into. The majority of liquidity has been in Curve pools with more recent growth of the Uniswap ETH/ETH+ pool. Although the ETH+ market cap has substantially increased over 2024, the onchain liquidity has remained stagnant.

Source: DexGuru

The majority of liquidity has historically been concentrated on Curve where Reserve focuses attention with its liquidity incentive strategy and protocol owned liquidity. Since March, there has been a liquidity reduction in the Curve ETH+/ETH pool.

Source: DexGuru | Date: 3/14/24

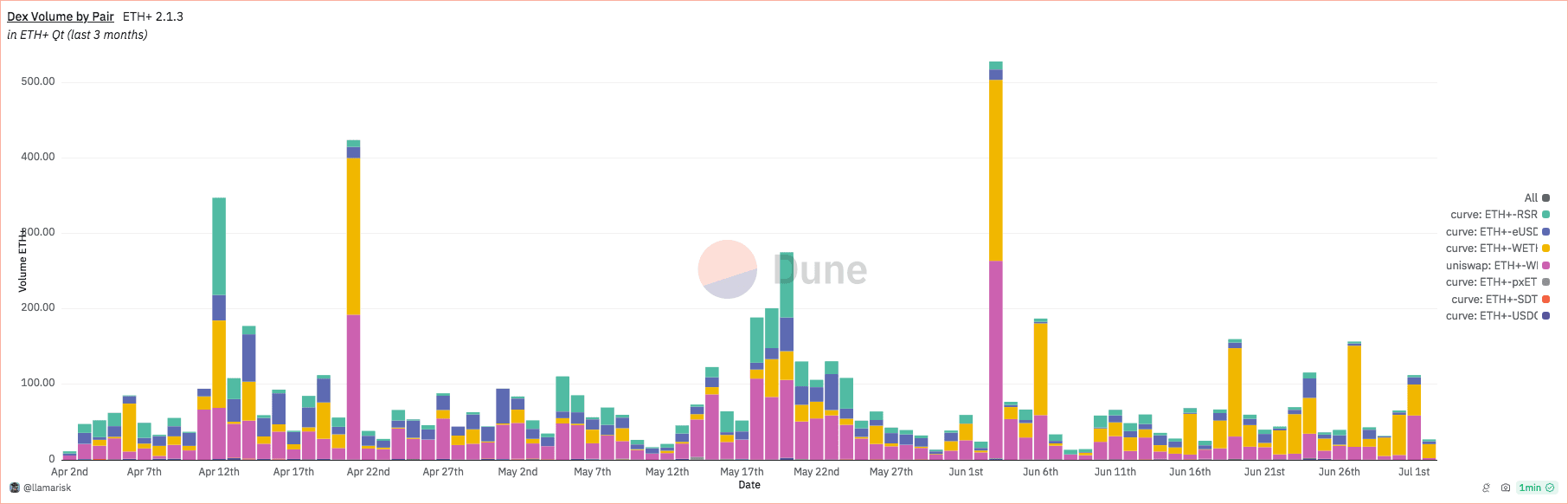

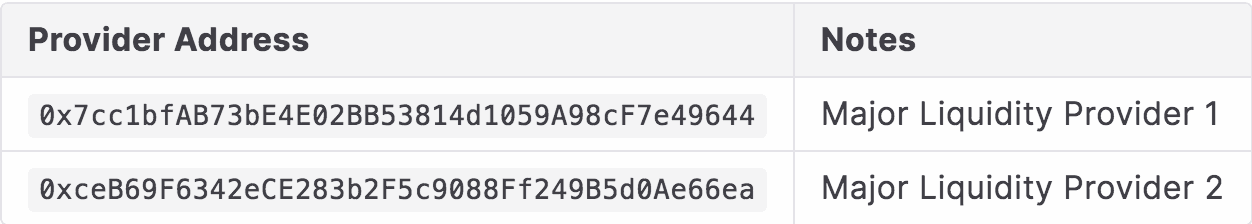

#3.2.3 DEX Volume

DEX trade volume for ETH+ is broken down in the query below by pair volumes. Uniswap makes up a large portion of overall volume compared to the concentration of liquidity on that venue. Other high volume venues include the Curve ETH+/eUSD/RSR tripool and the Curve ETH+/ETH stableswap pool.

Source: Dune Analytics

Major Uniswap Liquidity Providers

Participation in the Uniswap pool is concentrated, with two major liquidity providers making up the majority of pool liquidity.

Below is a table of the major liquidity providers for the ETH+ pool on Uniswap V3:

Despite its lower liquidity compared to Curve, the Uniswap pool has made up the majority of overall DEX volume over the past month.

Source: DexGuru

#3.2.4 DeFi Integrations

The integration scope for ETH+ is currently narrow. As outlined in previous sections, ETH+ pools are present on Curve and Uniswap; however, activity on these platforms is minimal. ETH+ has recently been integrated into Morpho's lending platform, but the majority of DeFi integration currently consolidates token supply in DEXs.

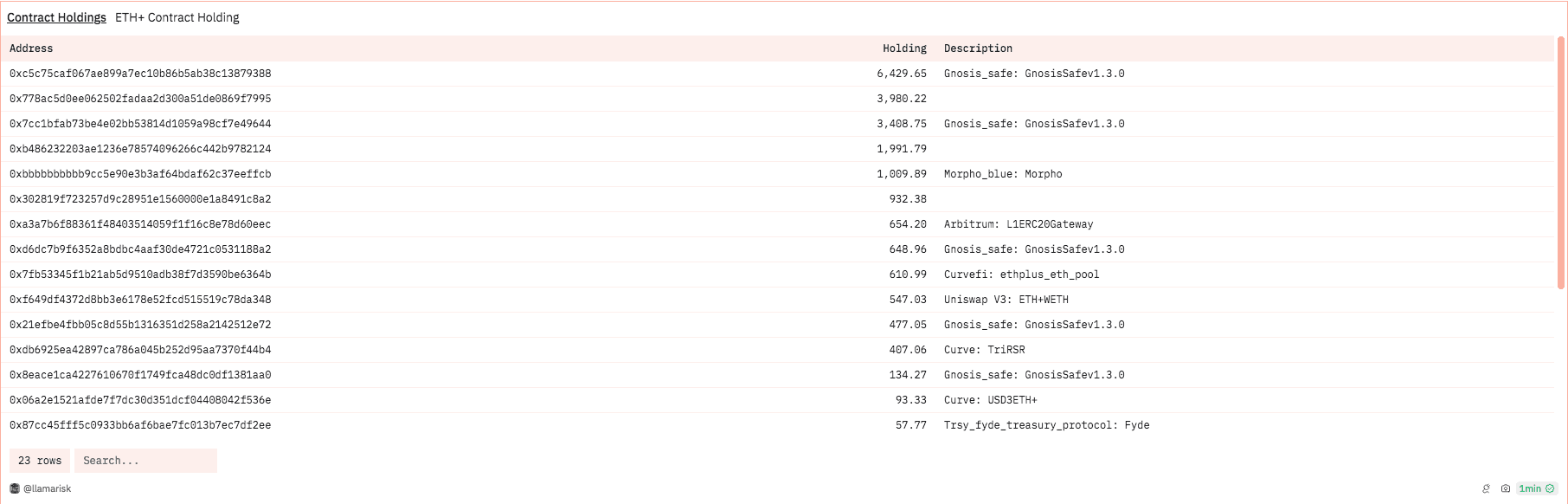

Below is a query showing the contracts that hold ETH+. As of May 31, 2024, the majority of supply in contracts are in Gnosis Safes. The top contract 0xb48 appears to be a market maker performing arbitrage operation for ETH+ by direct interacting with the protocol Backing Manager.

Source: Dune Analytics

A list of contracts containing ETH+ can be viewed below:

Source: Dune Analytics

#3.2.5 Leverage Ratio

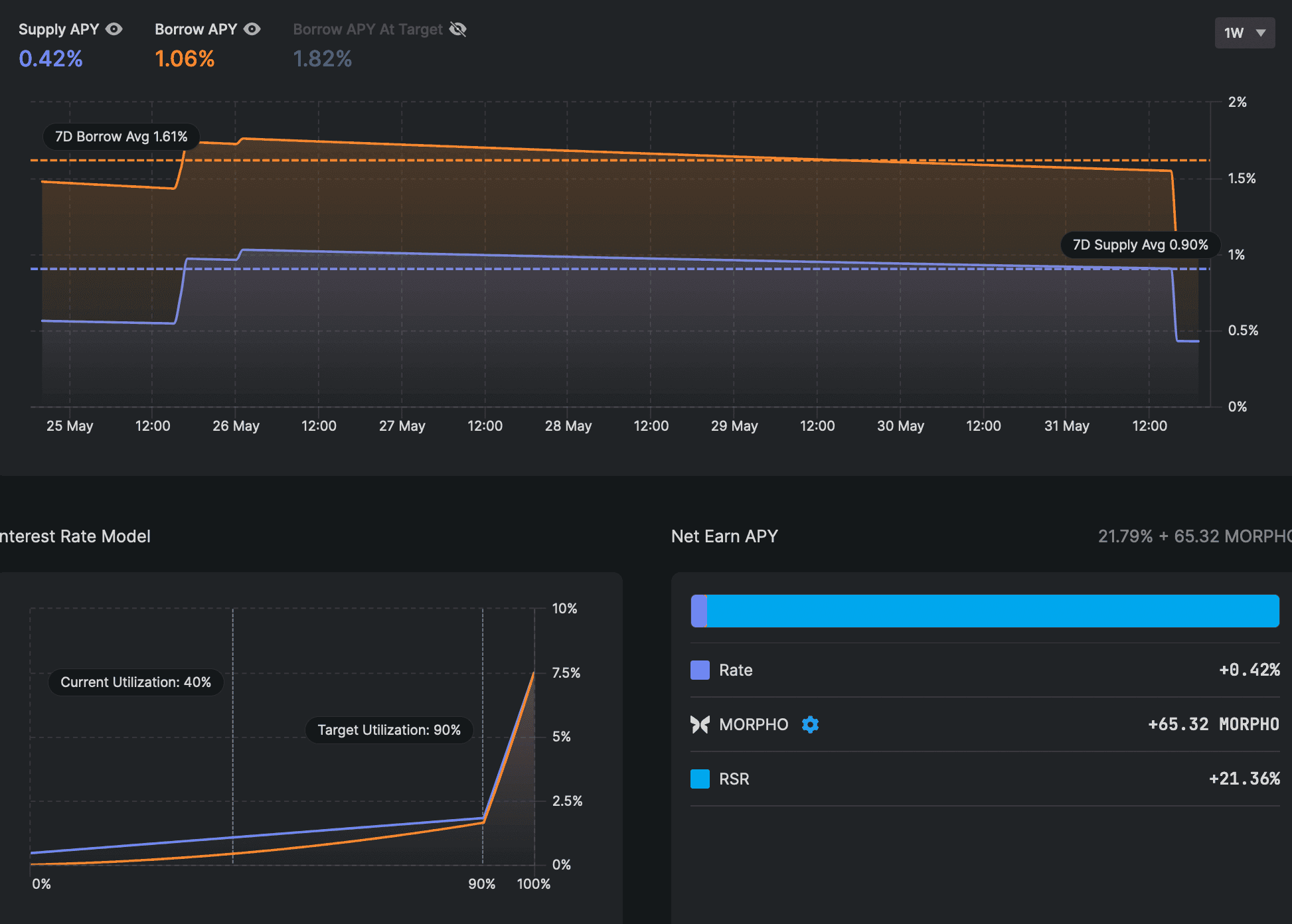

The Morpho integration is a siloed market within the Re7 WETH lending vault managed by Re7 labs. In the ETH+/WETH market, users can borrow WETH against ETH+ supplied as collateral. The market has a liquidation LTV of 86% and uses a Redstone Oracle price feed.

As of May 31, there is a borrow APY of 1.06%, down from a 7 day average of 1.61%. Re7 Labs manages liquidity in the vault and rebalances WETH supplied to the market along with the other vault markets. The vault includes many markets consisting of LSD, LRT, and ETH index yieldbearing assets to gain leveraged exposure. There are additional incentives for suppling to the ETH+/WETH market in the form of RSR tokens.

Source: Morpho UI | Date: 5/31/2024

#3.2.6 Slippage

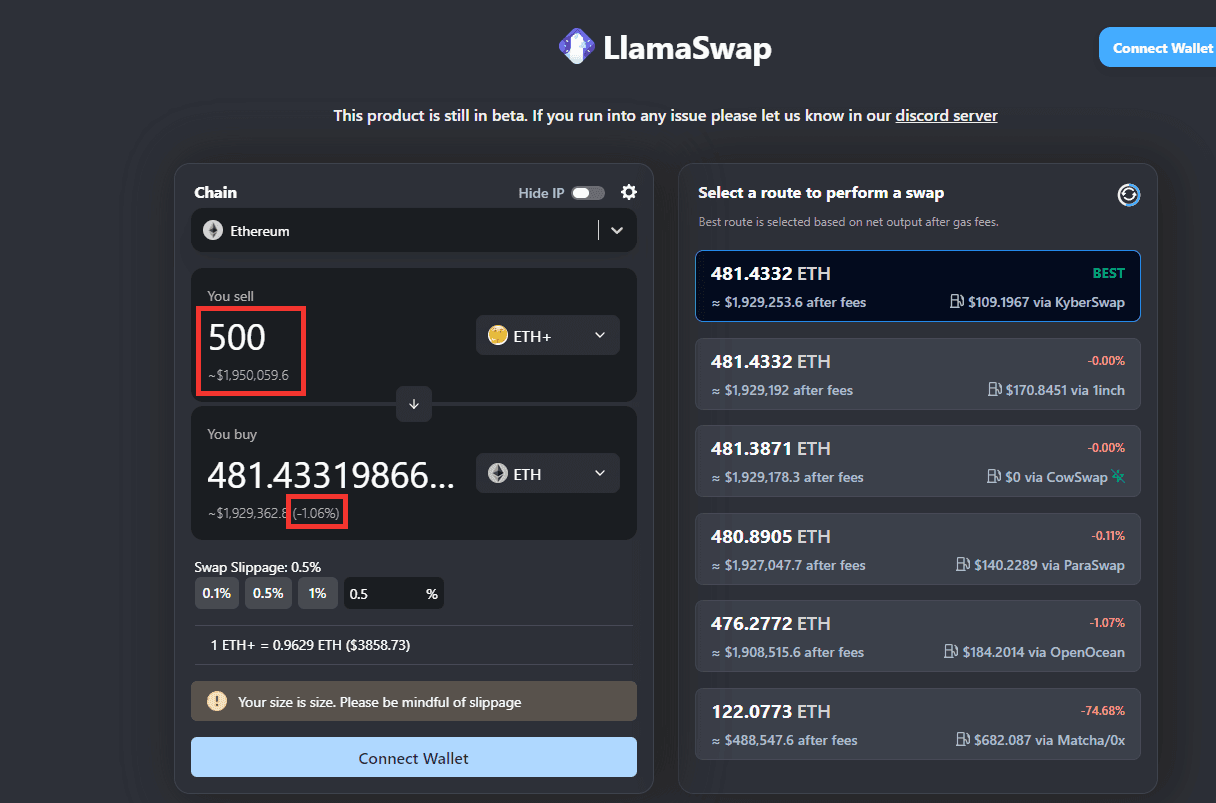

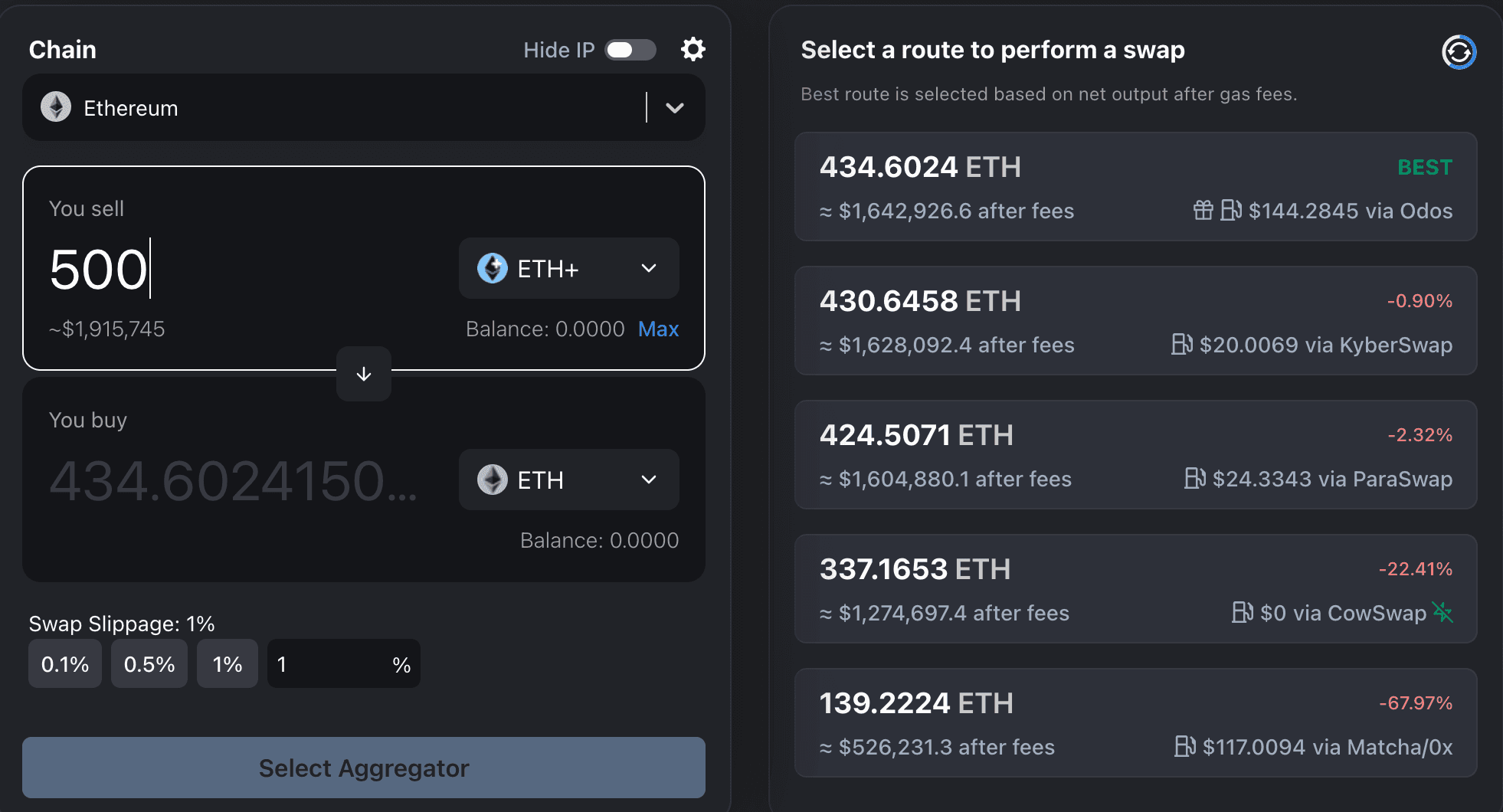

On the screenshot below, it can be seen that a swap size of 500 ETH+ (~$1,950,000) to ETH causes slippage over 1% (1.08%) on the DefiLlama Meta DEX aggregator on the snapshot date.

Source: Defi Llama Swap | Date: 3/11/24

A more recent snapshot shows that the same swap size currently produces more substantial slippage, indicating that liquidity depth may be deteriorating somewhat in recent months.

Source: Defi Llama Swap | Date: 5/31/24

#3.3 Liquidity Incentive Strategies

In June 2023, Reserve announced a $20m investment into the Curve ecosystem as part of its liquidity incentivization strategy. This involved purchasing and locking StakeDAO and Convex tokens (sdCRV, SDT, and vlCVX). These governance tokens can be used to directly incentivize specific Curve pools with rewards emissions by participating in weekly gauge votes.

The multisig used by Reserve to manage its treasury contains (as of a check in March 2024):

-

12,804,258 sdCRV ($10.5m)

-

277,327 SDT ($370k)

-

1,039,011 CVX ($5m)

A second multisig managed by Reserve contains additional SDT:

- 1,500,001 SDT ($890k)

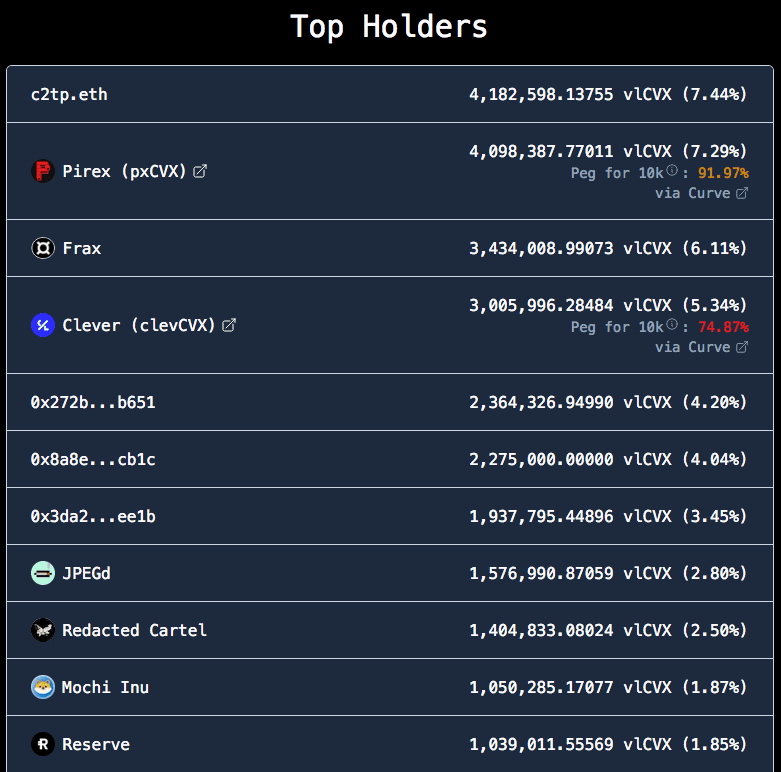

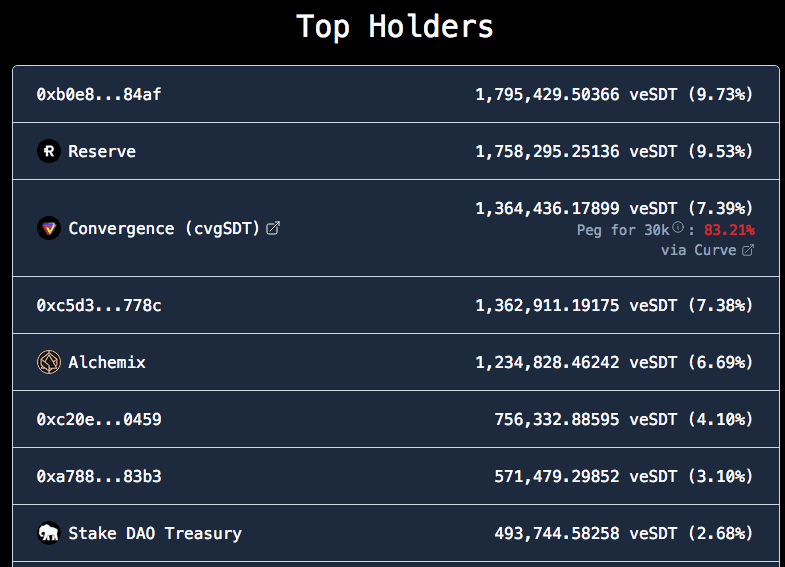

According to DeFiWars, Reserve's CVX stake places it as the 11th largest holder of vlCVX with 1.85% of the supply. It is also the second largest stakeholder of StakeDAO with 9.53% of the veSDT supply.

Source: DeFiWars vlCVX Top Holders | Date: 3/13/2024

Source: DeFiWars veSDT Top Holders | Date: 3/13/2024

These governance tokens perform different functions regarding Curve gauge voting. Both Convex and StakeDAO hold a treasury of veCRV that has its vote power passed on to protocol stake holders. However, vlCVX acts as a proxy for veCRV, giving it proportional share of its underlying vote power. veSDT, by contrast, provides a boosted vote power toward sdCRV, its liquid derivative of veCRV that is granted vote power of StakeDAO's treasury. Both strategies ultimately allow Reserve to direct Curve gauge emissions toward its own pools, which includes pools containing ETH+.

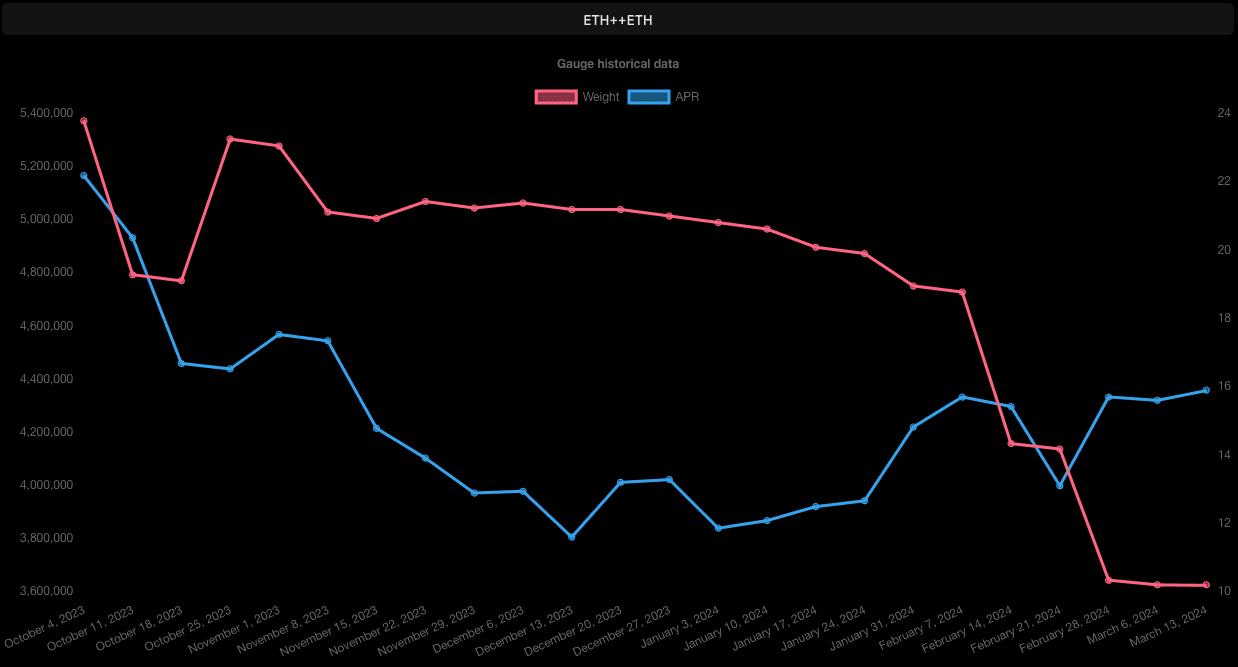

ETH+ Curve Pool Gauge Weighting According to StakeDAO gauge analytics, the Curve ETH+/ETH pool has received substantial initial weighting and has since declined, with a noticeable weighting reduction in mid-February. This trend suggests that Reserve placed extra weighting to bootstrap the pool and has since diverted gauge weight toward other pools.

Source: StakeDAO Analytics

Reserve treasury management also includes protocol owned liquidity in Curve. The 0xc6625129c9df3314a4dd604845488f4ba62f9db8 multisig referenced previously has a $5.5m stake in the Curve TriRSR pool (ETH+/RSR/eUSD). It comprises the entirety of the pool liquidity and does not have a Curve gauge or offer additional incentives.

#Section 4: Technological Risk

This section addresses technical configurations of the RToken and their influence on the overall risk profile. It aims to convey, (1) any unusual or noteworthy parameter configurations, and (2) do any composability/dependency requirements present potential issues (e.g. is a reliable price feed oracle available?).

This section is divided into 3 sub-sections:

-

4.1: Smart Contract Risk

-

4.2: RToken Dependencies

-

4.3: Oracle Pricefeed Availability

#4.1 Smart Contract Risk

#4.1.1 System Architecture Overview

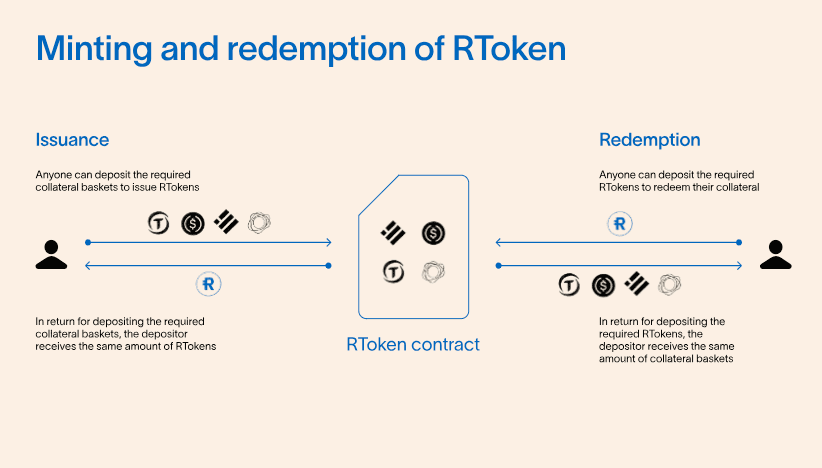

Users can issue newly minted ETH+ by depositing an equal value of wstETH, rETH, and sfrxETH, which for convenience can be done with a single asset deposit zapped into the required collateral types. The ETH+ contract mints ETH+ to the user at the current exchange rate calculated by the protocol. There is an issuance throttle that limits the total amount and percentage of the total ETH+ supply that can be minted per hour. This is a mitigation strategy that limits protocol losses in case of an exploit.

Redemptions are handled in a similar way, with the protocol burning ETH+ in exchange for a pro rata share of the underlying collateral. There is similarly a redemption throttle that imposes a limit on overall ETH+ and percent of total supply that can be redeemed in an hour.

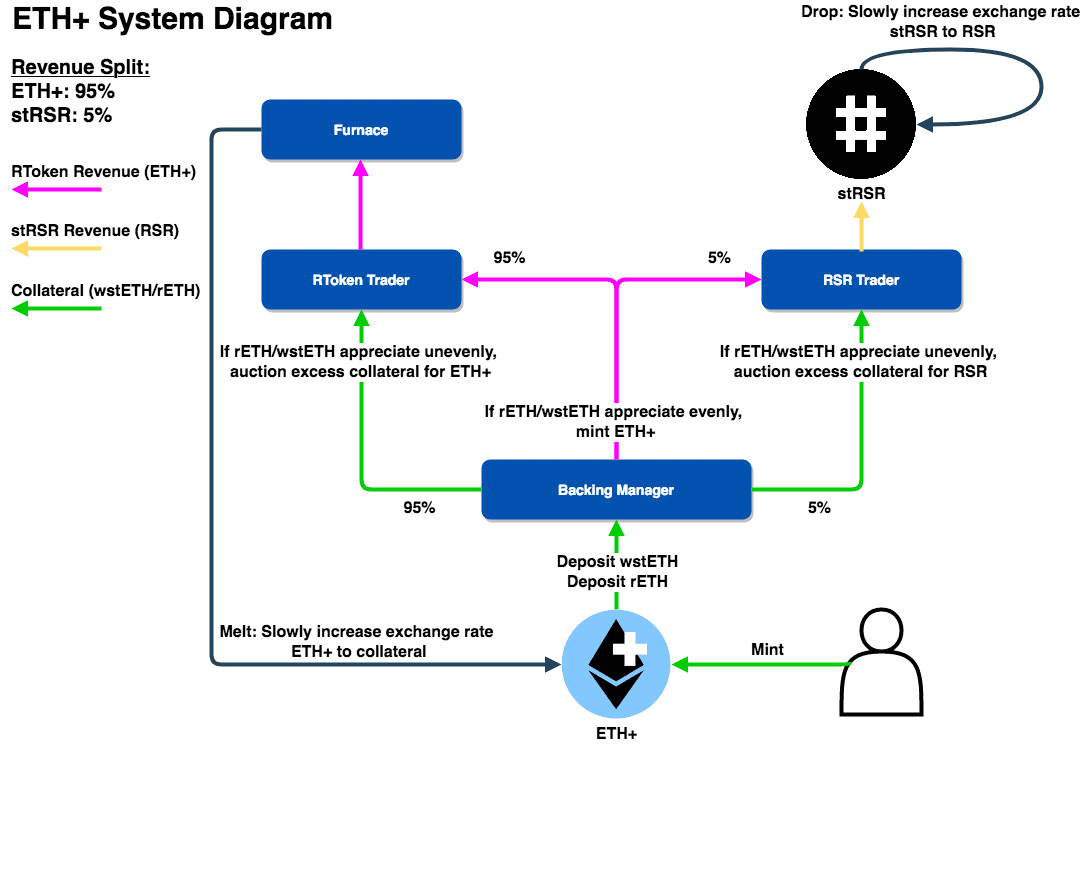

As wstETH, rETH, and sfrxETH are yieldbearing ETH tokens that appreciate through an internal rate oracle, they are expected to be closely correlated in value accrual, although at slightly different rates. Collateral is held in the BackingManager contract and can periodically mint ETH+ for the amount that basket assets evenly appreciate. The minted ETH+ is transferred to the RTokenTrader and RSRTrader to distribute revenue to ETH+ holders and RSR staked on ETH+, respectively.

Any discrepancy in collateral appreciation (beyond a predefined threshold) requires triggering an auction that sells the collateral for ETH+ (in the RTokenTrader) and RSR (in the RSRTrader). This rebalances the underlying basket back toward the target ratio. ETH+ revenue is sent to the Furnace and gradually burned to increase the internal exchange rate of ETH+ to the underlying collateral, thereby distributing revenue to ETH+ holders. RSR revenue is sent to stRSR where it gradually increases the stRSR to RSR exchange rate, thereby distributing revenue to staked RSR.

There are two types of auctions: Dutch Auctions and Batch Auctions that are used to execute all swaps. Dutch trades are the preferred method of trading. They provide protection against price manipulation, due to their bonding curve and can be quicker than batch auctions in that they don't need to wait for the full auction time limit to settle, as a bidder should place their bid the moment the auction is profitable, providing better pricing for the protocol. Batch auctions are available as a fallback option.

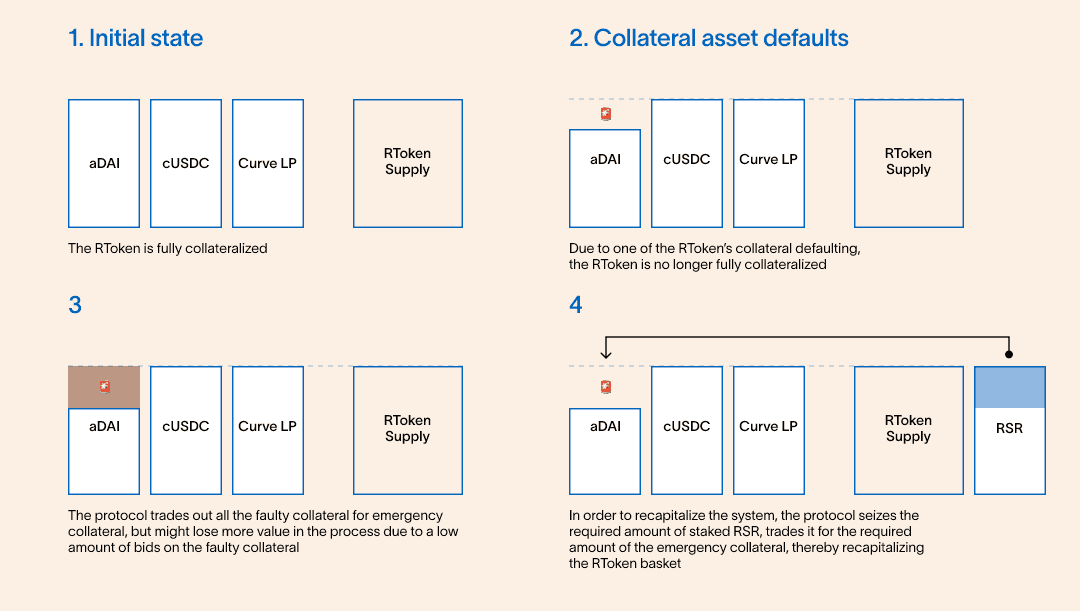

An important component of the design involves recapitalization. The system strives for full redeemability, which requires an equal value of wstETH, rETH, and sfrxETH, i.e. the underlying collateral basket. In case of a significant depeg affecting any collateral asset (as reported by price feed oracles), a default is triggered. This initiates an auction to sell the defaulted collateral for the emergency ETH+ collateral (set to WETH). Any shortfall that results will be recapitalized by auctioning off RSR in stRSR for the required amount of WETH.

#4.1.2 Architecture Diagram

The diagram below provides an overview of the system architecture highlighting the flow of user funds within the ETH+ RToken system, including the process of distributing yield to both ETH+ holders and RSR staked on ETH+.

Source: ReserveRisk Diagram | Date: 3/13/24

Note that the diagram above shows the collateral basket current as of March 13. Governance has since added sfrxETH to the collateral basket, although the general architecture principle remains the same.

#4.1.3 Stakeholder Fee

The distribution of the yield earned by the RToken holder and stakeholders is set by the RToken creator and configurable by governance.

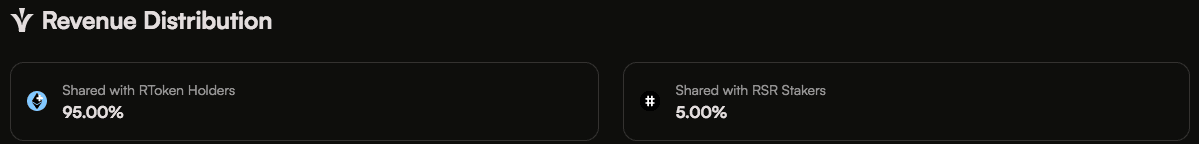

Notice in the diagram above that 95% of revenue earned through the yieldbearning properties of the underlying collateral basket is distributed to ETH+ holders, while 5% is distributed to RSR staked on ETH+. This distribution can be verified in the Distributor contract RSR and RToken shareTotals. This value can be changed by governance, so ETH+ holders are advised to monitor governance action to modify this parameter.

Source: Reserve ETH+ Overview | Date: 5/31/24

The rewards distribution (and all configurable governance related to ETH+) is configurable by the stRSR tokenholders staked on ETH+. The amount of RSR staked on ETH+ can be verified in the stRSR contract. In addition to governance rights, stRSR bear the first capital-at-risk in case of collateral default. This is a notably low fee to stRSR compared to other RTokens and may suggest a preference amongst stakeholders to prioritize growth of the ETH+ supply, or possibly confidence in the collateral types is considered sufficient to not require substantial overcollateralization from RSR.

#4.1.4 RToken Parameters

The following parameters are used in ETH+ as of March 2024, although governance can modify these values. Reserve provides default values for advanced parameters, and these default values are provided as a reference against the ETH+ parameters. Where there is a deviation from the default suggested value, or there has been a historical governance modification to any parameter, we provide additional context and risk considerations. See section 2.2 RTokens Technology in the General RTokens report introducing this series on RToken risk for further description of the risk considerations relevant to parameter selection.

Current parameter information is available from the Reserve ETH+ app.

Basket warmup period

The delay time between when a collateral becomes SOUND before issuance or trading can resume. This is a defense against possible oracle manipulation or momentary volatility that may otherwise contribute to protocol losses.

- 15 minutes (default: 15 minutes)

Withdrawal leak

The percent of cumulative RSR that is allowed to withdraw before triggering a refresh on asset prices. A value too high may allow a large outflow of RSR during a legitimate default event (when RSR should be locked for recapitalizing ETH+). This parameter is set for gas efficiency reasons.

- 5% (default: 5%)

Trading delay

The time that must pass before an auction can open. This allows traders to prepare for an upcoming auction with the intention of limiting possible losses to the protocol and may be reduced as a robust market of MEV searchers is developed.

- 2 hours (default: 0 seconds)

Reserve had previously recommended 6 hours as a trading delay, due to a lack of MEV searchers and the risk of incurring high slippage in the absence of ample warning before initiating auctions. It has recently revised its recommendation, and now considers the market to be mature enough that this value can safely be set to 0.

ETH+ continues to have a 2 hour delay, which can carry certain risks. In case a collateral legitimately defaults and the RToken must auction it for WETH, the trading delay requires a 2 hour delay, which may increase the protocol loss, depending on the nature of the depeg. There is an upgrade planned to 3.4.0 in the coming weeks that will set the trading delay to 0.

Batch auction length

The time a Batch auction is open. A longer time allows CEX/DEX arbitrage to complete, while a shorter time reduces protocol exposure to the auctioned token, necessitating a careful balance.

- 10 minutes (default: 15 minutes)

ETH+ has reduced the batch auction length 33% from the recommended time of 15 minutes. Batch auctions are a fallback auction type in general. Looking at the ETH+ auctions page shows 30 records of Dutch auctions and only 1 of batch auctions, as of May 31. Reserve recommends not to set the value too low that it prevents CEX/DEX arbitrage loops from completing. However, the assets included in the ETH+ basket can be described as DeFi-native with predominant liquidity available on-chain, making this consideration markedly less important.

Dutch auction length

The time a Dutch auction is open. A longer time allows greater pricing granularity that reduces slippage.

- 30 minutes (default: 30 minutes)

Backing buffer (%)

This is the deviation tolerance between collateral values in the basket before allowing them to send to the RTokenTrader and RSRTrader for auction.

- 0.25% (default: 0.1%)

This value is set to prevent excessive auctions, as there must be a sufficient deviation before an auction is allowed to occur. This can also be thought of as a small overcollateralization of basket assets held in the RToken.

ETH+ has set this value 150% higher than the recommended value of 0.1%. A value too high may prevent the basket from rebalancing when necessary and the threshold must fill before RSR can earn a share of the revenue.

Max trade slippage

The max deviation that any protocol trade can clear at in relation to an oracle price. Oracle prices also have a range, so this is additional slippage along with the worst-case oracle price.

- 0.5% (default: 0.5%)

Issuance throttle rate

The limit on issuance of new ETH+ as a percent of supply over 1 hour that recharges linearly over the period to ensure organic behavior.

- 10% (default: 10%)

ETH+ governance increased this value from 5% to 10% in a recent vote. Increasing this value may expose the RToken to additional risk in case a system vulnerability is exploited, although there are additional security measures to pause the protocol and as the system matures, it may be advisable to lift these restrictions, allowing larger organic volumes to occur. ETH+ has experienced heightened organic growth in recent months commensurate with the increase.

Issuance throttle amount

The limit on issuance of new ETH+ over 1 hour that recharges linearly over the period to ensure organic behavior.

- 1700.00 ETH+ (default: $2m RToken)

ETH+ governance increased this value from 250 to 1,700 ETH+ in a recent vote. Considerations for setting this value are similar as with the issuance throttle rate.

Redemption throttle rate

The limit on redemption of ETH+ as a percent of supply over 1 hour that recharges linearly over the period to ensure organic behavior.

- 12.5% (default: 12.5%)

ETH+ governance increased this value from 7.5% to 12.5% in a recent vote. Setting this value higher may allow more efficient ETH+ arbitrage, although it does increase the risk of losses in case of a technical exploit.

Redemption throttle amount

The limit on redemption of ETH+ over 1 hour that recharges linearly over the period to ensure organic behavior.

- 2000.00 ETH+ (default: $2.5m RToken)

ETH+ governance increased this value from 500 to 2,000 ETH+ in a recent vote. The considerations for this change are similar as with the redemption throttle rate.

Minimum trade volume

The minimum volume for allowable protocol trades. A value too high can prevent necessary auctions from taking place, while a value too low can allow griefers to delay important auctions or for gas fees to substantially reduce revenues.

- $1,000.00 (default: $1k)

RToken Maximum trade volume

The max size of any ETH+ auction in the protocol. This is in addition to max volumes imposed by each collateral plugin.

- $1,000,000.00 (default: $1m)

Unstaking Delay

The delay on withdraws from the stRSR contract that prevents stakers from withdrawing during a recapitalization event.

- 2 weeks (default: 2 weeks)

#4.1.5 RToken Maturity

The ETH+ contract was deployed on April 20, 2023.

A governance proposal went to vote on October 16, 2023 to upgrade ETH+ to version 3.0.0. This upgrade set implementation addresses for core system addresses, adding new features such as Dutch auctions. A version 3.0.0 blog post explains many of the changes made and a full list of changes can be found in the changelog. The upgrade instructions for ETH+ can be found here.

#4.1.6 Previous Incidents

There were no previous incidents noted related to ETH+.

#4.2 RToken Dependencies

#4.2.1 Redemption process

ETH+ sets a specific threshold for redemptions. This threshold is two-fold:

-

a predetermined fraction of the ETH+ supply that can be redeemed on a rolling basis over an hour (The redemption throttle rate).

-

a predefined amount of ETH+ that can be redeemed on a rolling basis over an hour (The redemption throttle amount).

If the cumulative total of withdrawals exceed both throttles over a rolling hour, whether they occur through a single large transaction or multiple smaller ones, the redemption request will revert. The throttles in ETH+ are described in the preceding section on RToken parameters, and generally are imposed as a sanity check to mitigate malicious value extraction in case of a technical exploit.

Redemptions of ETH+ are otherwise permissionless and immediate. Note that the collateral basket is protocol owned, making a share of the underlying wstETH/rETH/sfrxETH redeemable by anyone in possession of ETH+.

Source: Reserve Protocol

The protocol redeems ETH+ for an equal value of the constituent collateral types, weighted by the target weighting of the basket. Although ETH+ is readily redeemable, it may not be fully redeemable at all times. This is the case immediately after a basket change or a collateral default. In the extreme case of a collateral default, there may be a shortfall in the basket's overall value that permanently affects the redemption value of ETH+. However, the system will attempt to recapitalize by auctioning off RSR staked on ETH+, utilized as an overcollateralization buffer, for the required collateral.

Another important consideration regarding ETH+ redeemability is dependency on the exchange rates in the underlying protocols (e.g. the rate between a Compound cToken and its underlying) within each collateral plugin. The value accrual informs the protocol of the relative value of each basket asset so it accurately transfers an equal value of each basket asset.

#4.2.2 Collateral Pricing

ETH+ requires the use of external price feed oracles that trigger significant events within the protocol, namely to identify when a collateral in its basket has defaulted and must be auctioned for the designated emergency collateral (although external oracles are also used during normal auctions as a reference for establishing initial auction exchange rates).

This protective mechanism is meant to limit losses in case of a severe depeg event. This external dependency therefore is entrusted to ensure system stability, as inaccurate pricing may result in a collateral incorrectly triggering a default auction (in case the reported price is below market price) or fail to trigger a legitimate auction in a timely manner (in case the oracle does not report a depeg despite one having occurred).

Source: Reserve Docs - Recapitalization

Each collateral has an associated plugin address that contains a price feed from an external oracle source and is referenced during the above mentioned protocol action to ensure accurate pricing of the collateral assets.

The plugin addresses can be replaced by governance and are currently set to the optimal available oracles for all collateral assets. This generally involves a Chainlink feed where possible, although not all oracles have access to a Chainlink feed. Below are the oracle sources for each collateral asset in ETH+:

-

wstETH oracle: stETH/USD Chainlink feed * internal wstETH contract rate

-

rETH oracle: rETH/ETH Chainlink feed & ETH/USD Chainlink feed

-

sfrxETH oracle: Curve frxETH/WETH pool EMA Chainlink ETH/USD internal sfrxETH contract rate

The wstETH collateral contract used by Reserve takes the Chainlink feed multiplied by the internal oracle rate because stETH is rebasing while wstETH is the oraclized variant more suitable for DeFi integrations.

The rETH collateral contract, by contract, uses two Chainlink feeds (rETH/ETH * ETH/USD) to derive the rETH price in USD.

The sfrxETH collateral contract does not use a Chainlink oracle to price frxETH because there is not one available. Instead, it calls the price_oracle method in the Curve frxETH/WETH pool, using the manipulation-resistant EMA oracle in that pool. It uses Chainlink for the ETH/USD leg and finds the sfrxETH through the internal contract rate (similar to stETH).

Note, in general, the potential complexities involved with price feeds for assets in the collateral basket, and their dependency on external service providers. Oracle providers such as Chainlink are well regarded in the industry, securing billions in TVL, although there is trust in its system and pricing methodology to deliver accurate pricing. Price sources such as the Curve pool may be at risk of liquidity/volume migrating to other pools, causing its pool source to become less reliable and more manipulable. There are also technical dependencies on the pool to operate without incident. Internal rate updates for LSD contracts may involve centralization vectors in the operator entrusted to accurately update the contract rate.

#4.3 Oracles Pricefeed Availability

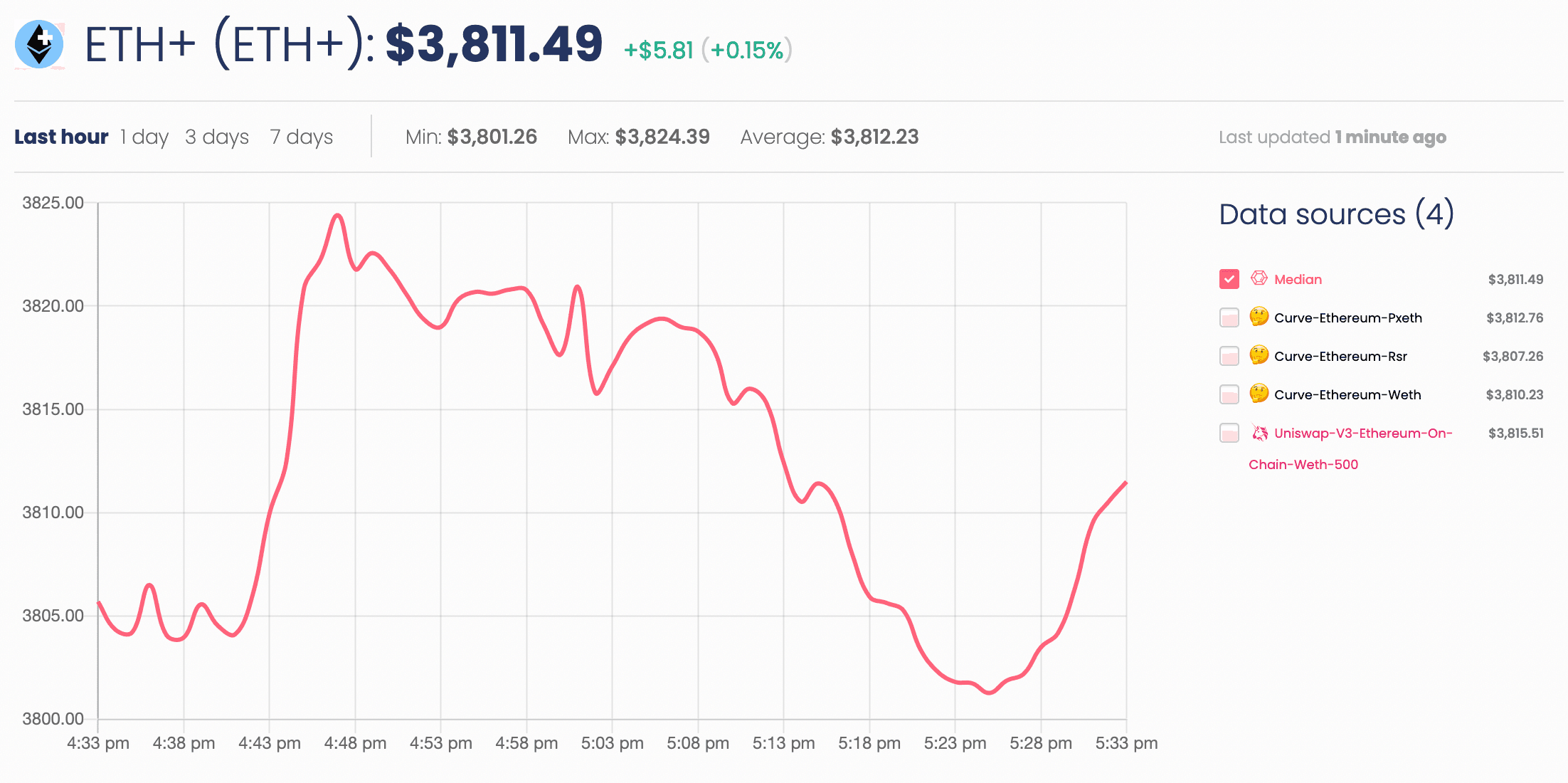

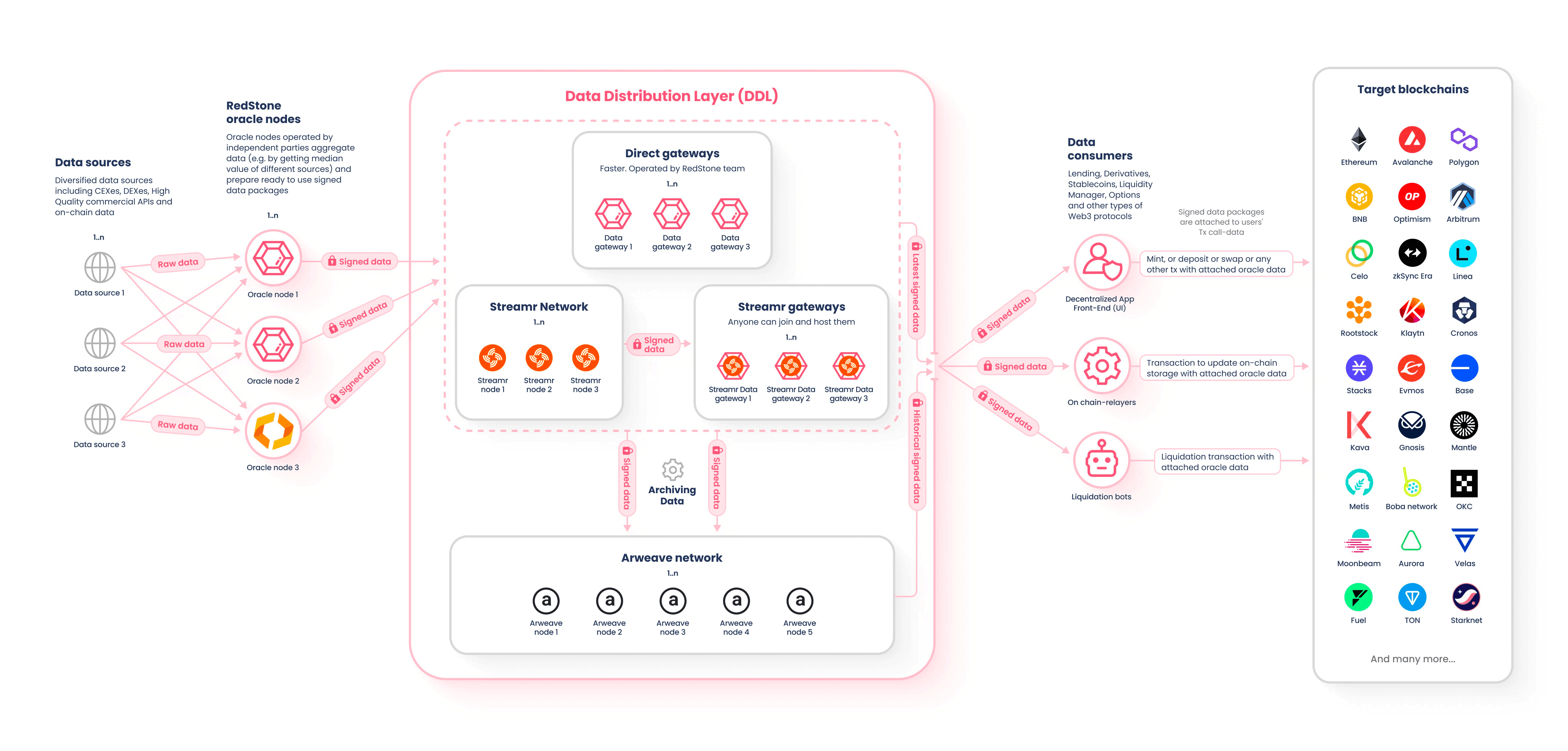

ETH+ currently has a price feed available by Redstone Finance, which in turn sources its information from the Curve and Uniswap liquidity pools. The oracle references pricing on four pools and delivers a median price from those sources.

Source: Redstone - ETH+ | Date: 5/31/2024

We have previously reviewed Redstone's architecture and associated risks in an Oracle Risk Assessment. Its primary innovation is the Distributed Data Layer that provides data availability service and scales Redstone's ability to serve a diverse range of data across many chains.

Source: Redstone Docs

Note that while Redstone has intentions to decentralize the various components of its stack, it currently operates all oracle nodes and performs internal monitoring necessary to manage manipulation risk of the long tail assets it supports. Redstone does involve considerable trust in the core team at this time, and it remains a relatively minor player in the price oracle sector by total value secured.

Oracle Risk Considerations

As ETH+ is a relatively new token with modest market adoption, manipulation of the oracle remains a concern. Increasing the TVL in these pools is a critical factor. A higher TVL contributes to deeper liquidity, which, in turn, makes the price data sourced from these pools more reliable and reflective of the market. It reduces the impact of large trades on the price of assets within the pool, ensuring that the oracle data remains stable even in volatile market conditions.

The primary reliance of ETH+ on Curve for its liquidity introduces a notable concentration risk. Should Curve experience any form of technical issues or security breaches, it could directly compromise the oracle relied upon by ETH+. This dependency on Curve amplifies the potential for operational disruptions, posing a significant threat to the stability and reliability of protocols integrating ETH+ as a collateral asset.

Moreover, concerns regarding liquidity and slippage within the Curve pool used by ETH+ cannot be overlooked. The current liquidity levels suggest that even trades of moderate size could lead to substantial impacts on the pool's balance, increasing the risk of high slippage. This vulnerability to market fluctuations not only creates an environment prone to less favorable trading conditions but also opens the door for potential market manipulation. Such conditions could be exploited by actors looking to benefit from the induced volatility, further endangering the integrity and appeal of ETH+ as a viable collateral option.

#Section 5: Counterparty Risk

This section addresses the persistence of ETH+ properties from an ownership rights perspective (i.e. possession, use, transfer, exclusion, profiteering, control, legal claim). The reader should get a clear idea of (1) who can legitimately change properties of the collateral (e.g. minting additional units) and what their reputation is, (2) the extent to which changes can be implemented and the effect on the collateral.

This section is divided into 3 subsections:

-

5.1: Governance

-

5.2: Economic Performance

-

5.3: Legal

#5.1 Governance

#5.1.1 Governance Model

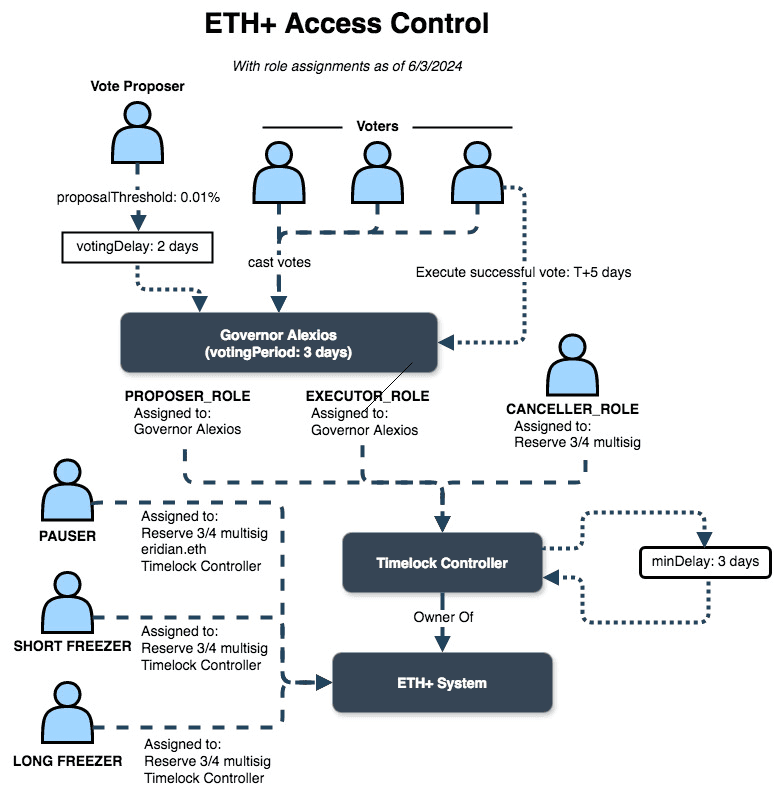

ETH+ uses the default suggested governance framework offered by Reserve, Governor Alexios, which is a modified version of OpenZeppelin Governor and allows fully on-chain governance (Note that there is an imminent planned upgrade to "Governor Anastasius", the successor to Alexios. It has the same attributes as Alexios for the purpose of discussion here). ETH+ governance can be found on the Reserve ETH+ governance page. ETH+ governance is isolated from the governance of all other RTokens.

Similar to many other Reserve Protocol RTokens, ETH+ is governed by RSR stakers that choose to stake on ETH+. Stakers are granted a voting weight proportional to their share of the overall RSR stake at the time of a vote snapshot. Their combined vote weight must meet a 10% quorum to successfully pass a vote.

ETH+ also uses the default suggested timelock on vote execution. A full vote from proposal to execution takes 8 days, with the following delay settings:

-

Voting snapshot delay (voters have this period to stake before vote weight snapshots are taken): 2 days

-

Voting period (the active voting period): 3 days

-

Execution delay (timelock delay following the vote period before execution): 3 days

There are a series of checks and balances in the governance model. The Reserve 3/4 multisig is assigned the CANCELLER_ROLE (termed colloquially as the "Guardian"), allowing it to veto potentially malicious or erroneous votes before execution. In case a bug is introduced to the system, a set of addresses are assigned privileged roles to freeze certain actions within the system.

See below an overview of the ETH+ governance system, as of June 3, 2024.

#5.1.2 Governance Scope

The Governor Mandate encapsulates three core directives. These suggest an intention that may inform governance decisions, although the Mandate is ultimately up to interpretation by stakeholders:

-

Ensure the ETH+ portfolio consistently includes a variety of Ethereum-based liquid staking tokens;

-

Contribute to the overall distribution of staked assets within the Ethereum network;

-

Deliver value to ETH+ holders by diversifying the investment and risk profile of the token.

The ETH+ governance system carries out its mandate thorugh the governance structure designed to strike a balance between security and adaptability. Stakeholders can make alterations to the properties of ETH+, including:

-

Changes to the collateral basket composition and weighting

-

Upgrades to the ETH+ system contracts

-

Setting privileged roles assignments

-

Modifying parameters that influence revenue distribution, governance processes, and system protections.

The governance mechanism relies on the participation of RSR stakers who are essential in decision-making processes and in providing over-collateralized protection to the ecosystem. RSR stakers are granted the capacity to propose, vote on, and execute governance proposals.

#5.1.3 Access Control

The Owner role granted to the Governor Alexios timelock carries supreme authority within ETH+, encompassing rights to:

-

Grant and revoke access roles across any Ethereum account.

-

Define and modify governance parameters.

-

Implement upgrades to system contracts.

The Guardian role, assigned to a 3/4 multisig managed by ABC Labs serves as a critical safety mechanism. It possesses the unique capability to override and reject proposals, even those that have successfully passed through standard governance processes.

The PAUSER_ROLE is assigned to the Guardian multisig, the token deployer eridian.eth and Timelock Controller. These entities are empowered to toggle the ETH+ system between two states—active or paused—without a predefined time limit. PAUSED state includes two operations:

-

Pause trading: pause operations involving auctions, revenue distribution, and RSR unstaking.

-

Pause issuance: pause RToken issuance.

ETH+ redemption is notably unaffected, and therefore this role is considered tolerant of false positives.

The SHORT_FREEZE and LONG_FREEZE roles are assigned to the Guardian multisig and Timelock Controller. This role has more expansive control to also freeze redemptions, and therefore plays a significant role in system protection. There are limits placed on how many times a privileged address can freeze, which mitigates the potential for abuse (if, say, the address were compromised), but ultimately this role is responsible for acting quickly in emergency without accurately assessing the need for action.

The short/long freeze durations are parameters configured by governance. in ETH+ these are set to:

-

short freeze: 3 days

-

long freeze: 1 week

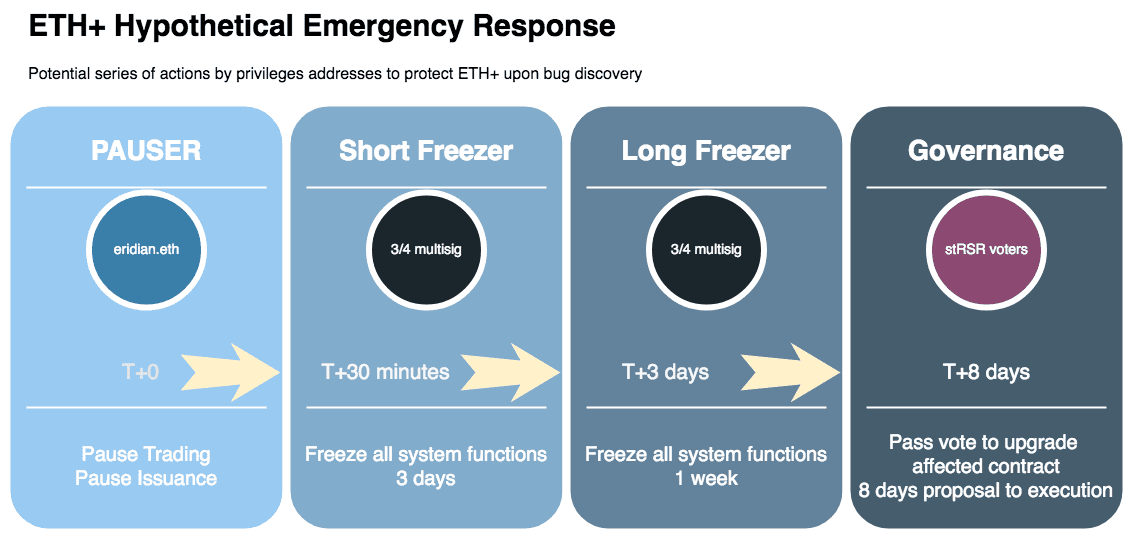

In case a bug were discovered, the emergency response flow would potentially involve a series of actions by privileged addresses that afford governance time to upgrade the affected contract. EOAs may deliver the initial response, followed by the multisig, and finally Governor Alexios.

#5.1.4 Distribution of Governance

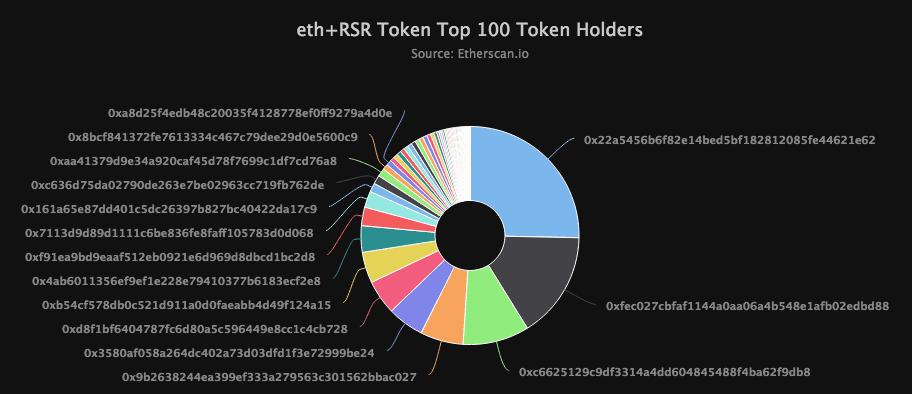

The mechanism for participating in governance is intrinsically linked to the staking of RSR on ETH+. An examination of staked RSR on ETH+ can provide insight into who has influence over ETH+ and how widely distributed is the governance power.

Source: etherscan.io - eth+RSR

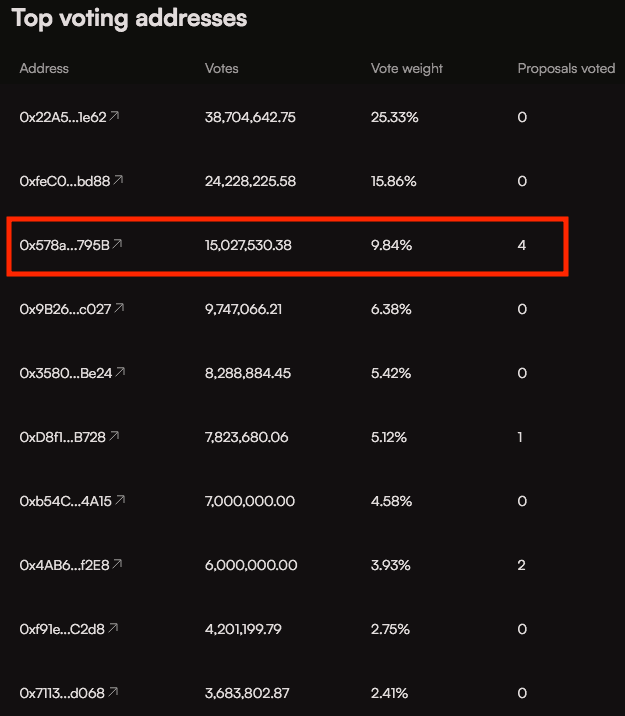

The top 3 addresses make up over 50% of the vote power, as of June 3. Here are some brief insights:

-

0x22a5: This address is an EOA that just recently staked (<1 week) with RSR valued at $323k. It has not participated in any votes.

-

0xfec0: This address is a multisig that recently staked (<2 weeks). It has not participated in any votes.

-

0xc662: This address is a multisig that has been a long term stakeholder in ETH+ for over 1 year. It has not participated in any votes.

The unique identity of each address cannot be confirmed and it may be possible for stakeholders to frequently enter and exit. There is a two week unstaking delay that may mitigate staker velocity and can also serve as a protection against participants who might stake attempting to pass a malicious vote.

The value of RSR staked on ETH+ has increased substantially since the beginning of this year, but it continues to make up a small portion of the overall ETH+ market cap.

Source: Reserve App | Date: 6/3/2024

Since there is a relatively small value of RSR staked on ETH+ compared to its TVL (stRSR makes up 2.13% of ETH+ TVL as of June 3, 2024), there may be an increased risk of governance takeover. To mitigate the risk of malicious governance actions, the Guardian role assigned to a 3-of-4 multisig managed by ABC Labs (Reserve core protocol team) is authorized to reject proposals, even if they pass. See the docs on system states and roles for more information on the extent of influence privileged EOA and multisig addresses can have within the governance and operational framework of RTokens.

#5.1.5 Proposals Frequency

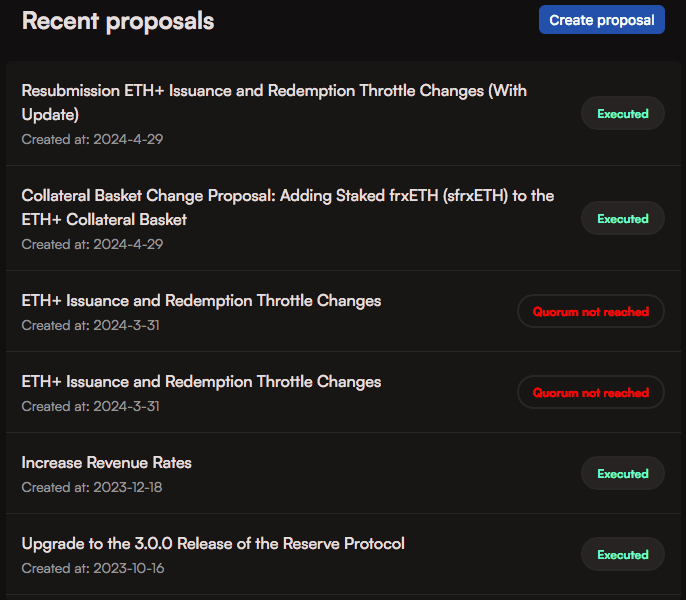

ETH+ governance forum reveals seven RFC discussions, while a total of seven proposals proceeded to on-chain voting. Generally, proposals receive unanimous support from the voting participants, leading to their successful execution. The exception was a vote to increase issuance and redemption throttles that would allow larger scale activity on the RToken. The initial vote did not receive quorum, but was resubmitted, citing widespread community support for the proposal.

Source: ETH+ Governance

#5.1.6 Participation

A total of 152,794,535.66 tokens has been allocated to participate in ETH+ voting (as of June 2024), as represented by 64 distinct voting addresses. Among these, it is evident that only a single address has exhibited regular active voting engagement. Despite active involvement, this address does not possess a majority of the voting rights. It does, however, maintain sufficient quorum to pass a vote without action by other governance participants (quorum is set to 10% on ETH+).

Source: ETH+ Governance | Date: 6/3/2024

Historically, votes have been cast by 1 to 6 distinct addresses. This may be explained by gas costs involved with casting votes, relatively concentrated vote power, and the expectation among stakeholders that the team will manage governance requirements. No historical vote has been adversarial, so it is difficult to predict whether dormant stakeholders would become readily active to vote against malicious governance action. Note again, however, that the Guardian role serves as an additional check (and trust assumption) against governance takeover.

#5.2 Economic Performance

#5.2.1 Revenue Source

The initial revenue distribution strategy for ETH+ is designed to ensure a balanced and attractive return for both RToken holders and RSR stakers, reflecting the dual priorities of rewarding investment and ensuring robust governance and security mechanisms. Here's a closer look at how the distribution is structured and the rationale behind it:

Revenue Distribution Structure

-

95% of generated revenue is allocated to RToken holders. This allocation directly benefits those with exposure to ETH+, ensuring they receive a substantial portion of the earnings generated from the underlying basket.

-

5% of the revenue is allocated for RSR stakers. This portion compensates RSR stakers for their critical role in governance and providing a safety net through over-collateralization, which helps protect against potential de-pegging scenarios.

Rationale for the Distribution Ratio

This distribution ratio was carefully chosen based on several key considerations:

-

Competitiveness in the LSD Market: To ensure ETH+ remains an attractive option for investors, the rewards for holding ETH+ need to be competitive with the returns from the underlying assets themselves. A less favorable reward structure could deter potential investors from choosing ETH+ over direct investments.

-

Incentivizing RSR Stakers: It's crucial that the rewards for RSR stakers are compelling enough to motivate them to stake their tokens and participate actively in governance processes. This incentivization helps secure the platform and contributes to its effective management.

-

Market Parity: The chosen fee structure aims to be on par with what is offered by existing competitors within the Ethereum LSD space, ensuring that ETH+ can successfully compete and retain its market share.

#5.2.2 Revenue

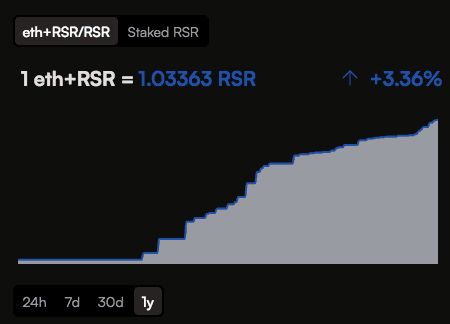

Revenue distribution to RSR staked on ETH+ can be gleaned from the increase in the ETH+RSR/RSR exchange rate over time. This represents the portion of the revenue that is auctioned for RSR and distributed to stakers.

November 10, 2023 marks the day RSR began accruing revenue. As of June 4, it has appreciated 3.36%, or an annualized rate of 5.92%.

Source: Reserve App | Date: 6/4/2024

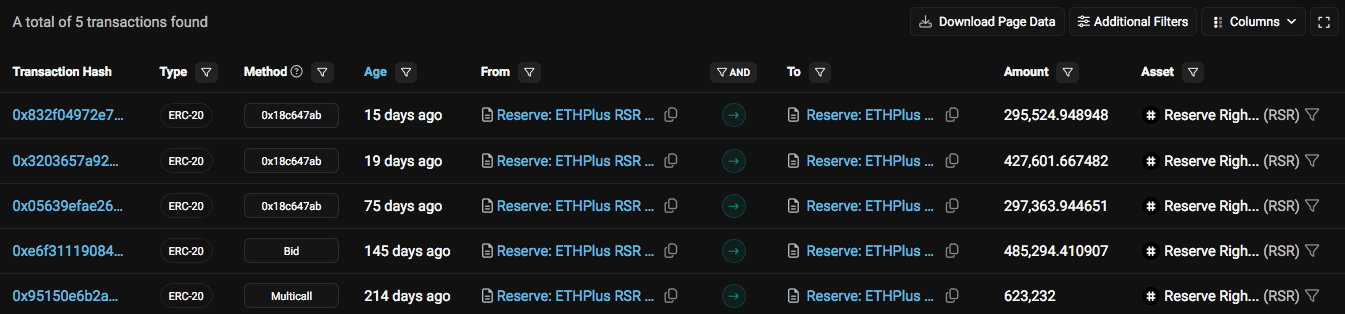

There have been five historical events when RSR was distributed to the stRSR contract from the RSR Trader. A total of 2,129,016.97 RSR (worth ~$17,360 at current prices) has been distributed to stakers over the RToken's history.

Source: Etherscan | Date: 6/4/2024

#5.3 Legal

Legal risk considerations for ETH+

ETH+ minting follows a decentralized paradigm, allowing anyone to mint or redeem the token permissionlessly.

The ETH+ RToken Deployer is attributed to an individual whose identity and contributions to the blockchain space are publicly disclosed, providing a layer of transparency and accountability. Information regarding Eridian Alpha's activities and affiliations can be accessed through public channels, offering stakeholders a degree of reassurance about the legitimacy of the deployer.

A feature that warrants emphasis regarding RTokens is the deployers' lack of control or influence over the deployed token, unless they consciously elect to stake RSR and participate in the governance processes. In the case of ETH+, there is no track record demonstrating Eridian Alpha's active governance participation.

The system architecture does not imply the possibility for ETH+ issuance in exchange for fiat currency, as well as any custodial arrangements. Additionally, token deployer does not assume the role of a trusted intermediary that controls or manages user interactions with the application. These key aspects of the Reserve protocol's design support the argument that the mere development of a decentralized application does not constitute an act of money transmission, i.e. regulated activity under the US Bank Secrecy Act.

ETH+ is conceptualized as a basket of Ethereum Liquid Staking Tokens, designed to generate rewards for holders while ensuring over-collateralized protection. While this approach introduces a layer of financial stability and risk mitigation, users should be cautious of the legal status of basket assets. At the time of writing, the assets comprising the ETH+ basket have not been classified as securities or subjected to complex licensing regimes.

The offering of ETH+ through app.reserve.org is aligned with the principles of information disclosure, emphasizing the importance of clarity regarding the services provided and the comprehensive disclosure of all pertinent information to users. This approach is bolstered by the commitment to utilizing accurate terminology and abstaining from providing investment advice, thereby ensuring that participants are well-informed and shielded from misleading representations.

#Section 6: Risk Management

This section will summarize the findings of the report by highlighting the most significant risk factors in each of the three risk categories: Market Risk, Technology Risk, and Counterparty Risk.

#6.1.1 Market Risk

LIQUIDITY: Does the token have a liquid market that can facilitate liquidations in all foreseeable market events?

ETH+ has experienced a healthy growth trend over recent months in terms of ETH inflows to the system. The majority of liquidity is concentrated on Curve, an exchange known for prioritizing deep liquidity, although the limited market diversity may increase the risk that its dependence on Curve may make it vulnerable to issues specific to that venue.

In terms of liquidity stability, ETH+ shows promise as a reliable collateral asset. Reserve has opted for a long term liquidity management strategy that has involved building a strong governance stake in Curve that ensures continuous emissions for RToken pools. The liquidity metrics over the observed time period show a commitment to stability that may make ETH+ an appropriate addition to lending markets with low debt caps appropriate for the adoption level of the product.

VOLATILITY: Is the asset at risk of significant depeg events?

ETH+ is always redeemable for a proportional share of its underlying collateral, meaning that during normal operation, there is always expected to be an arb opportunity to bring ETH+ back to peg. In practice, there is friction involved with minting and redeeming ETH+, as an equal share of its underlying basket assets are required, increasing complexity and gas cost associated with such operations.

ETH+ shows an observable trend of value accrual over time as revenue is distributed from its underlying LSD basket assets. Significant to its continued stability is the reliability of the constituent LSD collateral types, which may be exposed to a number of risks that can result in temporary or permanent losses for ETH+ and RSR staked on ETH+. Understanding the risks of the current collateral basket and any future additions to the collateral basket are paramount to maintaining ETH+ stability.

#6.1.2 Technology Risk

SMART CONTRACTS: Does the analysis of the on-chain technology components, including RToken parameters, suggest good practice in security risk mitigation?

The factory for deploying RTokens is well audited and described in the docs, including the somewhat extensive list of customizable parameters. ETH+ generally conforms to the default parameters and adopts the conservative on-chain governance system promoted by the Reserve team. Reserve advertises a generous bounty program operated by ImmuneFi and ETH+ has not experienced any technical bug that has disrupted operation or led to user losses. There have been two contract upgrades in October 2023 and June 2024. Reserve has historically been conservative with upgrades and conduct audits of all code introduced, although it may be possible to inadvertently introduce bugs in upgrades.

DEPENDENCIES: Are dependencies related to the collateral basket and external oracles reasonably designed to mitigate risks?

There is an inherent risk introduced by all RTokens in a dependency on third-party protocols to operate effectively and to maintain the solvency of the yield-bearing assets. The collateral basket in ETH+ is reasonably conservative within the category of yield-bearing ETH products.

Both Lido and Rocket Pool are frontrunners in the liquid staking sector with a long history and substantial development effort to mitigate security and centralization risks. The introduction of sfrxETH introduces a more aggressive yield strategy that exposes ETH+ to an asset that operates in a much more centralized fashion than the original basket. However, it has operated without incident since its inception in late-2022. As the asset does not have a Chainlink pricefeed, its oracle relies on a Curve pool EMA, which requires active monitoring in case of liquidity/volume shifts or technical bugs in the specific pool.

Do historical trends in RSR staked on the RToken indicate a reasonable protection against potential collateral defaults?

Overcollateralization in the ETH+ design is a value add to its stability assurance that may not be present in other products. The ability to recapitalize does depend on certain external factors such as the market liquidity and price action of RSR to facilitate auctions reliably.

While the nominal value of RSR staked on ETH+ has historically increased over time, it has generally not exceeded to rate of ETH+ issuance. At time of writing, it provides an overcollateralization of 2%. This is attributable to the relatively low fee shared with RSR stakers. As an ETH index composed of LSD assets, ETH+ may justify a lower buffer. Unlike USD-backed RTokens, the underlying asset is native to Ethereum, and basket risk exposure is limited to liquid staking protocols, none of which have experienced significant losses from exploits or slashing. ETH+ also notably has a higher than average backing buffer (0.25% vs 0.1%) which provides a modest overcollateralization buffer within ETH+ itself. However, in case of a critical failure in any underlying collateral, the current RSR overcollateralization is unlikely to fully recapitalize ETH+.

#6.1.3 Counterparty Risk

DECENTRALIZATION: Are there any significant centralization vectors that could rug users?

There are several privileged roles in ETH+, with the most critical role entrusted to an on-chain Governor Alexios contract with a timelock on execution. Control of the contract is granted to a DAO of RSR staked on ETH+. Theoretically, governance could be compromised by a governance takeover, especially since there is a relatively small amount of RSR staked on ETH+. There is a Guardian role that can veto governance decisions to prevent such manipulation; a multisig managed by the Reserve team. Roles are designed such that privileged EOAs and multisigs do not have an ability to rug users and can only prevent or mitigate loses resulting from technical bugs or governance takeover.

Overall, the system is designed with sufficient checks and balances to respond quickly to emergencies while distributing governance directly to a subset of ETH+ stakeholders.

LEGAL: Does the legal analysis of the protocol suggest any cause for concern?

ETH+ adheres to decentralized permissionless mint/redeem principles. The architecture eschews fiat transactions and custodial roles, arguing against classification as money transmitter or similar. LSD backing assets are currently non-regulated, thus minimizing the regulatory burden on the protocol. App.reserve.org offers comprehensive disclosures to ensure participant protection.

#6.1.4 Risk Rating

The following chart summarizes a risk rating for ETH+ as collateral based on the risks identified for each category. The rating for each category is ranked from excellent, good, ok, and poor.

-

We rank ETH+ as ok on liquidity because although it remains a DeFi- native token with no CEX listing, liquidity is diversifying across multiple DEXs and pools. Although demand for the token has grown in recent months, its liquidity depth seems to be reducing somewhat.

-

We rank ETH+ as good on volatility because it has not experienced any significant depeg event and is readily redeemable through the protocol. However, redemptions are gas intensive on mainnet and may incur slippage on the operation, which may affect peg strength.

-

We rank ETH+ as good on smart contracts because ETH+ generally adheres to default parameters and suggested governance configuration designed to enhance RToken security, and is relatively conservative with contract upgrades, although such upgrades may inadvertently introduce bugs.

-

We rank ETH+ as good on dependencies because the basket is composed of three well regarded LSD tokens that have substantial adoption as collateral assets. The introduction of frxETH, which has notable centralization vectors and limitations (e.g. has no Chainlink price feed), increases the overall risk profile of the basket and requires more active monitoring. There is an additional modest overcollateralization buffer available thanks to RSR staked on ETH+.

-

We rank ETH+ as good on decentralization as access control resides with an on-chain DAO of token holders, which may be at risk of governance takeover. Limited access control by centralized entities, including ABC Labs, mitigate this risk but introduce an additional trust assumption.

-

We rank ETH+ as excellent on legal because it eschews centralized or permissioned management of the system, and further reduces regulatory burden by virtue of the non-regulated status of its underlying LSD basket.

ETH+ has shown a track record of dependability over the past year in production. There have been a modest number of changes made to the RToken, including the recent alteration to its collateral basket composition and contracts upgrades in October 2023 and June 2024. However, it remains one of the most conservative RTokens in terms of basket composition, RToken parameter config, and governance model. From the perspective of ETH index tokens generally, ETH+ strives for a balance between reliability and adaptability that includes adequate checks and timelocks to ensure its properties cannot radically change without notice.

We highlight two categories in which ETH+ could improve: market maturity and distribution of RSR governance.

-