The current state of restaking and YieldNest's strategy to navigate developments

#Introduction

This report outlines YieldNest’s origins as a liquid restaking protocol and its strategic adaptations to evolving market conditions. Restaking, while still in its early stages, has shown substantial potential through shared security models pioneered by protocols like EigenLayer. However, these models primarily address network security, which represents only a fraction of what restaking could theoretically achieve. YieldNest views restaking as an evolving primitive within a broader mission to unlock capital efficiency and redefine what's possible in DeFi.

For instance, advanced slashing mechanisms and on-/off-chain proof submissions can unlock new ways for restaked capital to flow dynamically, fostering diverse economic games and accelerating innovation for restaked applications (RAs). As the EigenLayer whitepaper states:

“Cryptoeconomic security quantifies the cost that an adversary must bear in order to cause a protocol to lose a desired security property. This is referred to as the Cost-of-Corruption (CoC) [9]... A core idea of EigenLayer is to provision cryptoeconomic security through various slashing mechanisms which levy a high cost of corruption.”

Despite these theoretical possibilities, restaking platforms such as EigenLayer require enhanced SDKs and tooling to support customizable slashing (“various slashing mechanisms”) and streamlined proof generation. Without these improvements, meaningful growth in shared security remains challenging. YieldNest’s original vision, illustrated in the design of ynETH, aimed to structure and dynamically allocate between various restaking mechanisms. While many restaking platforms still lack user-friendly slashing systems or proof submission processes, YieldNest continues to expand its core mission of packaging and stacking yield-bearing protocols to enrich returns and advance the overall DeFi ecosystem by bringing real, structured DeFi products to market.

Building on restaking’s foundations, YieldNest envisions a broader mechanism that unlocks capital efficiency well beyond conventional shared security. This outlook drives the development of MAX LRTs—composable tokens that aggregate multiple DeFi strategies, enhanced by AI Agents to auto-compound yields and optimize risk management across chains and protocols.

In response to the limitations of existing restaking platforms, YieldNest aims to fulfill three core objectives:

1. Risk-Adjusted Returns – Strategies target not only higher yields but also sustainability and resilience amid varying market conditions. 2. Security and Flexibility – With 24/7 monitoring powered by HyperNative and intelligent AI Agents, assets are continuously safeguarded and dynamically managed against emerging risks. 3. Innovation in Capital Efficiency – YieldNest seeks to maximize the productivity of every asset without exposing users to unnecessary risks, leveraging AI-driven parameter tuning and strategic reallocation.

By treating restaking as one component of a larger DeFi strategy rather than a standalone solution, YieldNest adapts swiftly to market realities and user demands. The current state of restaking, along with its limitations, sets the stage for YieldNest’s strategic direction.

#Section 1: Intro to Restaking

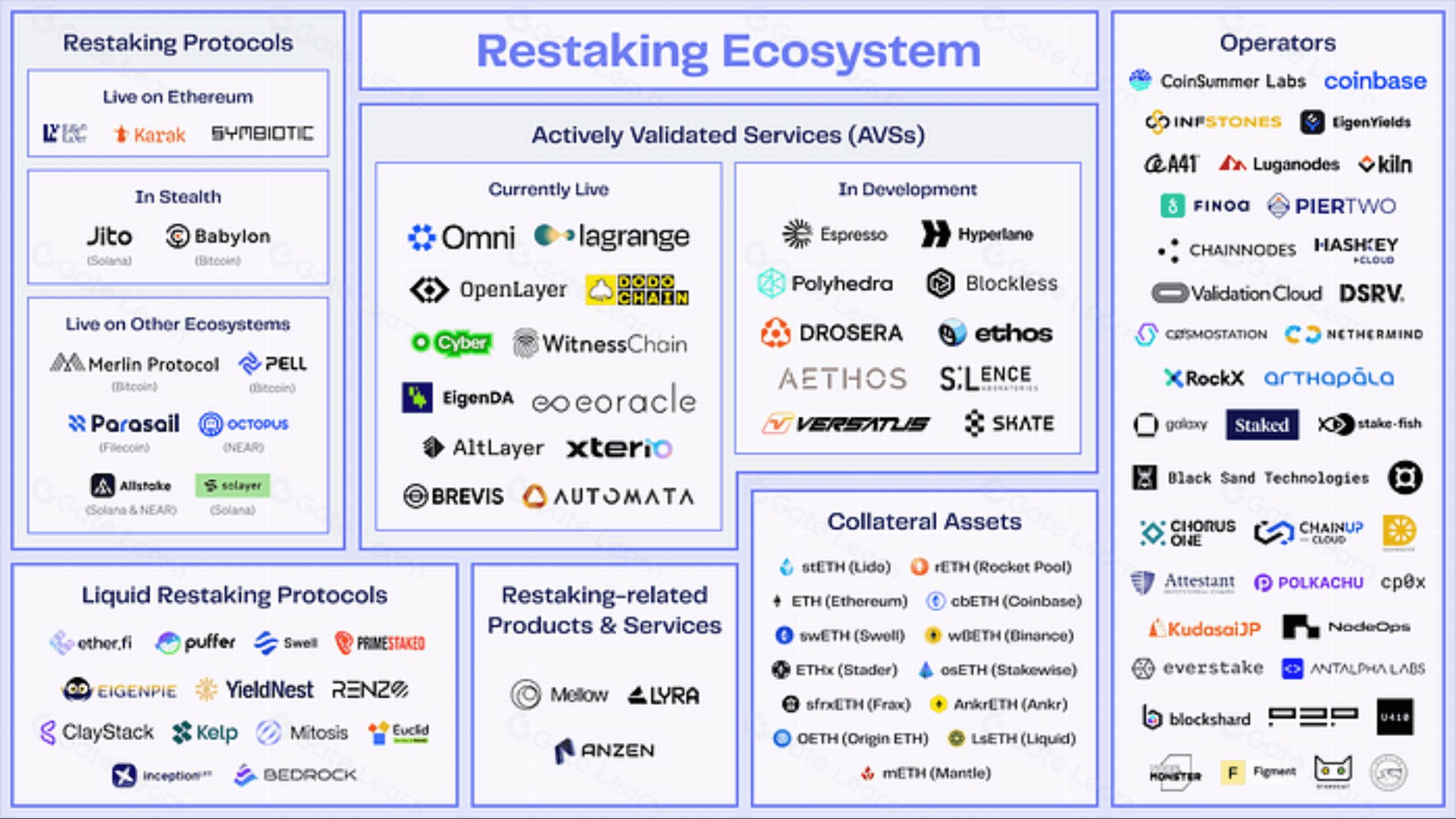

This section will briefly introduce the concept of restaking, its use cases, and the participants involved in the restaking ecosystem.

#1.1 Brief Overview of Restaking’s Evolution

Restaking emerged as a logical extension of Proof of Stake principles, particularly following Ethereum’s transition to PoS. From its theoretical roots in 2022 to practical deployments in 2024, restaking has progressed from an abstract concept to a growing reality, supported by multiple platforms.

Despite these strides, restaking still lacks certain features needed for broad market fit. Restaking platforms such as EigenLayer require SDKs and tooling to support customizable slashing (“various slashing mechanisms”) and streamlined proof generation. Without these improvements, meaningful growth in shared security remains challenging. This report evaluates the current state of restaking, identifies its limitations, and addresses the path forward.

#1.2 Participant Relations in the Restaking Ecosystem

Restaking hinges on three primary participants—restaking application (RA) providers, node operators, and restakers (notably represented by LRT providers)—each fulfilling distinct but evolving roles:

-

RA Providers – Sometimes referred to as Active Validated Services (AVSs), Networks, or DVNs, these entities develop and maintain applications that rely on restaked assets for security and functionality. They need stable business models, revenue generation, robust consensus mechanisms, and effective coordination with other participants to succeed.

-

Node Operators – Supply the hardware and software infrastructure for validating transactions. By running validator nodes, they ensure network continuity, security, and reliability for RAs.

-

LRT Providers & Restakers – Act as the capital layer by staking assets, enabling the entire ecosystem to function. They earn rewards from multiple services and incentives, retaining liquidity through tokenized staked positions.

(source: Gate_io article)

A self-sustaining restaking ecosystem emerges when fees, validation rewards, and incentive distributions flow among these groups, each contributing to and benefiting from the protocol’s security and economic activity.

YN Adaptive Vision

While restaking has bolstered network security, its current scope remains largely confined to shared security mechanisms. YieldNest sees restaking as a flexible tool rather than a self-contained solution—one that, if expanded, could significantly enhance capital efficiency in DeFi. Trust-as-a-service has merits, but often yields modest returns for restakers compared to more robust economic models. For restaking to reach its full potential, it must evolve beyond validator-based network security to include diverse, capital-intensive use cases.

#1.3 Restaking Current and Potential Use Cases

Restaking extends the functionality of staked assets, allowing them to secure multiple RAs while preserving decentralized trust guarantees. Though still in early development, it has seen traction in Rollup Services, where modular components (e.g., transaction aggregation, state management) utilize restaked assets for enhanced trust. From a high-level perspective, RAs often fall into categories such as rollup services, coprocessors, interoperability, Web3 infrastructure, or tooling.

However, many existing restaking protocols (e.g., EigenLayer, Kernel) mainly address network security, underutilizing the potential for economic security. YieldNest envisions restaking as more than just an extension of shared security networks. Future DeFi protocols may leverage restaking across multiple layers—like lending platforms that restake collateral in multiple protocols (e.g., Resupply) or AMMs that enable cross-chain liquidity provisioning. This broader perspective underpins YieldNest’s MAX LRTs, which unify diverse restaking strategies—enhanced by AI-driven automation—to maximize yield and ensure sustainable, risk-adjusted returns.

#Section 2: Current State of Restaking

This section will further elaborate on the current restaking ecosystem across different blockchain environments and marketplace strategies.

#2.1 Market Size and Adoption

#2.1.1 Total Restaked Value

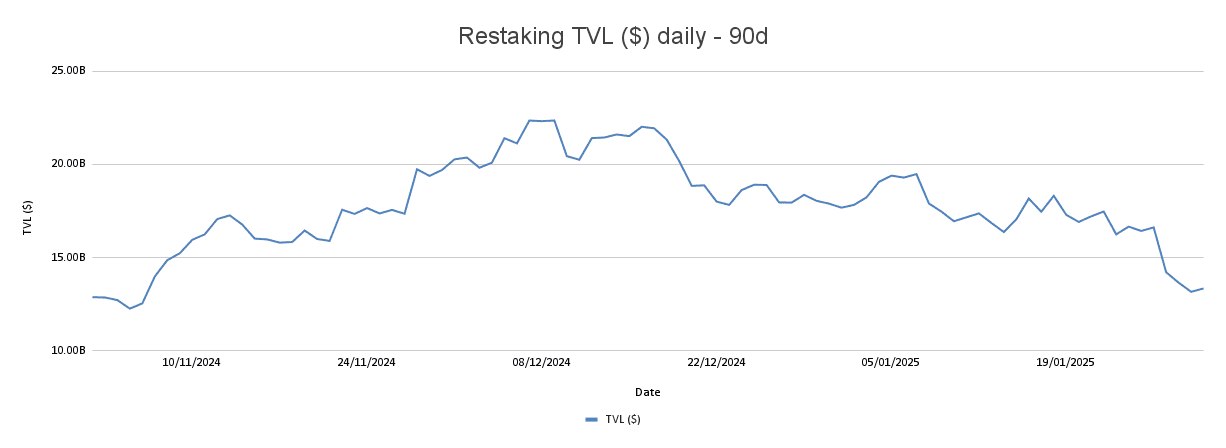

Total Restaked Value (Restaking TVL) measures capital restaked in these protocols, reflecting user confidence. Over the past 60 days, a -34.19% decline in Restaking TVL indicates capital outflows, partly due to broader crypto market volatility. Over a 90-day window, there is a +3.65% increase, showing how the system’s growth still heavily depends on price movements and portfolio rebalances.

(source: IntoTheBlock)

#2.1.2 Restaking Protocol TVL Market Share

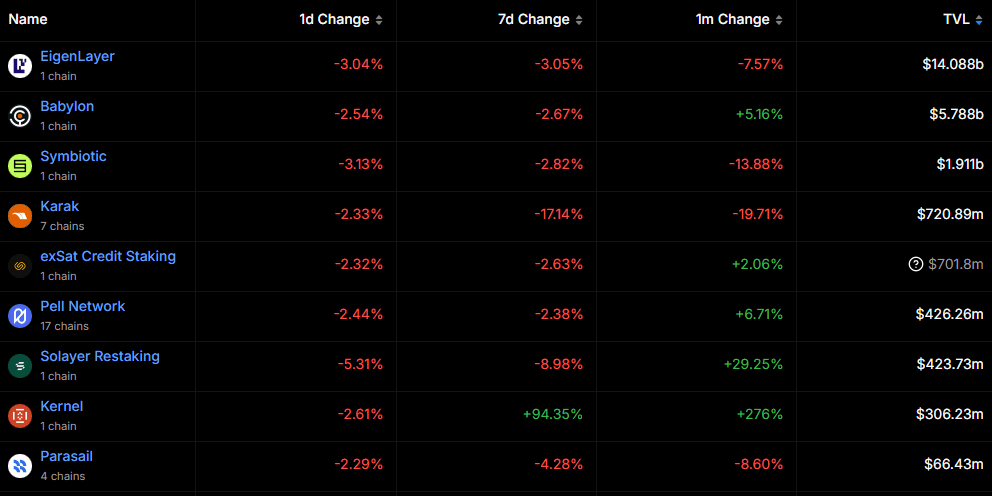

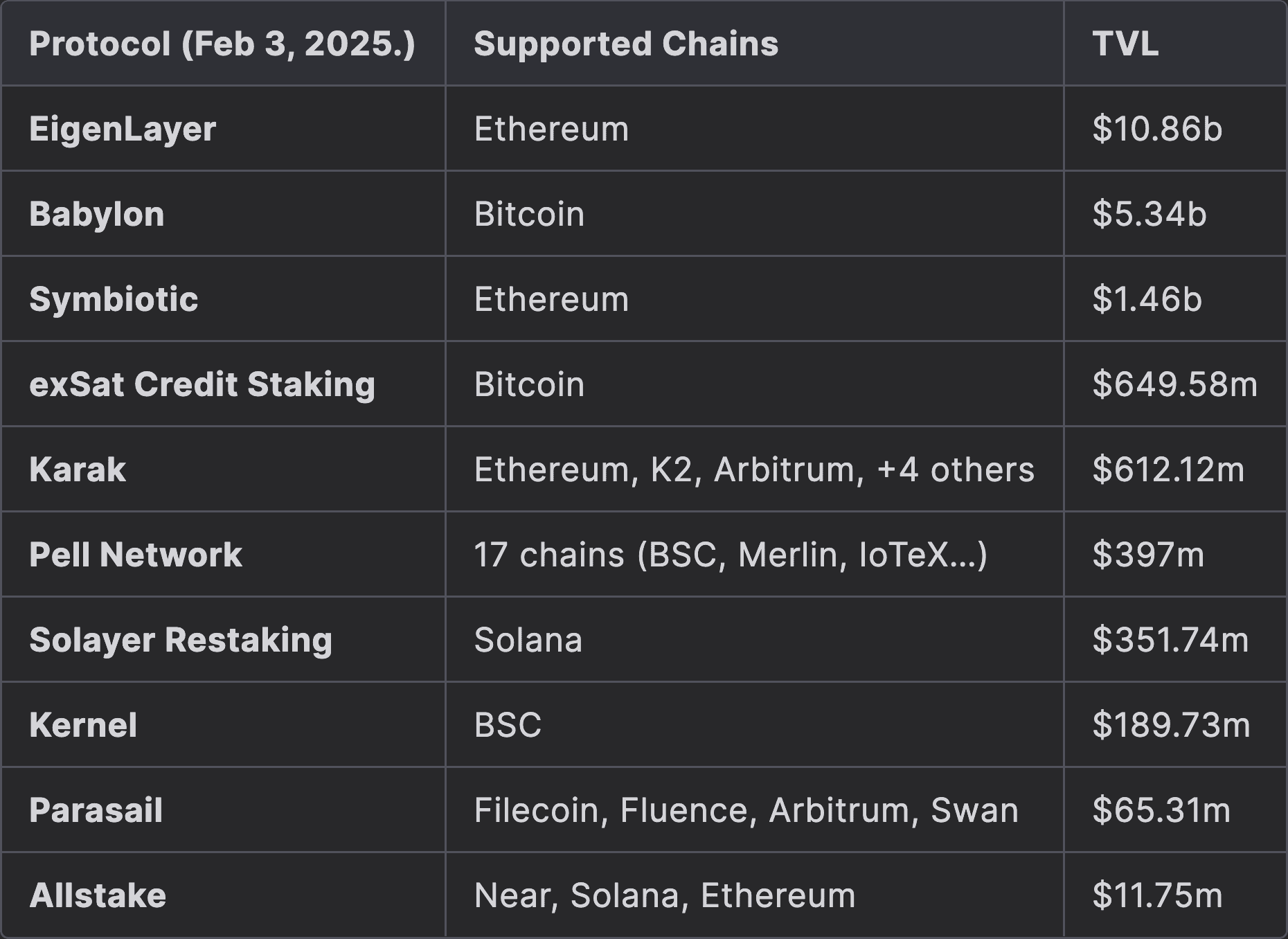

As of January 30, 2025, EigenLayer remains a key restaking protocol on Ethereum, capturing roughly $14.08 billion in TVL (~57.65% share). Babylon (BTC-based) and Symbiotic (flexible Ethereum-based) are notable competitors.

(source: DefiLlama)

Similar services exist on other chains, such as Solayer Restaking on Solana and Kernel on BSC, each focusing primarily on network security but leaving room for expanded economic security functionalities.

#2.2 Restaking Protocols

“Shared security” concepts exist across multiple ecosystems—e.g., Cosmos’ Interchain Security, Polkadot’s Parachains—yet EigenLayer popularized the idea of using already-staked ETH to secure RAs. While these protocols have lowered entry barriers for new services, most still concentrate on network security over broader economic security.

-

EigenLayer – Focuses on RAs, sometimes labeled AVSs, and staking ETH/LSTs to secure specialized middleware.

-

Symbiotic – Offers flexible restaking across a range of ERC20 tokens.

-

Kernel – A restaking protocol on BSC, securing DVNs and shared security layers.

Other ecosystems, such as Babylon (BTC-based) or Solayer Restaking (Solana-based), underscore restaking’s cross-chain evolution while retaining an emphasis on network-oriented security solutions.

(source: DefiLlama)

#2.3 Restaking Use Cases – Examples

#2.3.1 Aethir Integrates EigenLayer for Decentralized Cloud Infrastructure

Aethir leverages EigenLayer’s restaking model to offer decentralized GPU cloud services without requiring direct crypto stake from enterprises. Retail stakers delegate ATH tokens, earning dual rewards while powering a $91 million annualized on-chain revenue stream—a notable illustration of restaking bridging Web3 with mainstream enterprise needs.

#2.3.2 RedStone RA: Oracle Security via EigenLayer Restaking

RedStone’s RA integrates EigenLayer to deliver cost-effective, decentralized price feeds. By shifting validation off-chain, RedStone lowers gas costs and maintains a trust-minimized environment. This approach exemplifies how restaking can enhance network security for oracles, though deeper economic security use cases remain largely unexplored.

#Section 3: Problems/Limitations in Current Restaking Protocols

This section will explain the limitations in current restaking protocol designs that restrict their full potential. The restaking sector is under active development and the problems/limitations described here may find resolution as the ecosystem matures.

#3.1 Market Dynamics Imbalance

#3.1.1 Supply-Demand Mismatch

Protocols like EigenLayer aggressively accumulate restaked capital to bolster TVLs, yet genuine demand for economic security lags. This fosters speculative inflows reliant on token emissions rather than authentic user adoption of the underlying RA services.

#3.1.2 Low RA Adoption

Many RAs operate like early-stage ventures, lacking proven business models and stable revenue streams. Their token launches often precede substantial utility, relying on points-based or airdrop-centric incentives. Consequently, capital providers may hesitate to stake assets without evidence of sustained demand for these applications. Given the limited number of real yield-generating protocols in the current crypto industry, the total addressable market (TAM) remains small, reinforcing the need for a broader outlook—one that embraces more customizable slashing (“various slashing mechanisms”) and improved proof generation and submission processes.

#3.2 Economic Model Flaws

#3.2.1 Yield and Revenue Distribution

A shortage of “real yield” from RA usage undermines restaking’s sustainability. Excessive intermediary fees reduce net returns for restakers bearing the underlying risk. Without tangible revenue flows, the system struggles to maintain long-term viability.

#3.2.2 Incentive Misalignment

Tokenomics often emphasize short-term TVL growth, diluting the link between RA performance and token rewards. Restakers receive tokens regardless of RA utility, creating a disconnect between capital inflows and real economic value.

#3.2.3 Token Value Sustainability

RA token models frequently rely on speculative valuations that lack robust revenue streams or utility, making them vulnerable to market sentiment and hype cycles.

#3.3 Structural Limitations

#3.3.1 Operational and Technical Challenges

Node operators face non-standardized requirements from multiple RAs, hindering scalability. Developers lack unified tooling—such as modular SDKs or slashing frameworks to implement advanced features seamlessly across different restaking protocols.

#3.3.2 Centralization Risks

Early-stage token distributions can grant disproportionate influence to insiders or institutional investors. Economies of scale benefit larger node operators, consolidating power and posing governance risks for smaller participants.

#3.3.3 Smart Contract Integration Challenges

At the Smart contract API layer, EigenLayer’s current architecture remains largely optimized for Web3 frontends, leaving smart contract integrations cumbersome and costly. A streamlined smart contract interface, designed with trustless, gas-efficient access to EigenLayer’s state, would significantly reduce integration friction and unlock seamless composability within DeFi. By providing well-crafted interfaces for both reading and writing state, EigenLayer could enhance its role as a foundational security layer, allowing protocols to interact programmatically without relying on centralized middleware. Just as YieldNest structured ynETH to efficiently allocate capital across restaking mechanisms, the evolution of EigenLayer’s smart contract tooling would foster deeper integrations, expanding its utility across DeFi and accelerating the adoption of restaking as a core primitive.

#3.3.4 Innovation Constraints

Rigid protocol architectures and vested stakeholder interests impede upgrades or novel implementations. Fragmented standards, backward compatibility demands, and limited documentation collectively stifle creativity, slowing the pace of innovation within shared security protocols.

#Section 4: YieldNest Strategy

This section will explain YieldNest's product strategy informed by the current state of restaking.

#4.1 YieldNest: Redefining Liquid Restaking

YieldNest acknowledges restaking’s challenges and adopts a pragmatic approach. Recognizing that most existing protocols primarily address network security, YieldNest seeks to expand restaking’s scope to encompass broader economic security. Rather than relying solely on shared security use cases, YieldNest integrates with diverse DeFi products to deliver high, risk-adjusted yields via MAX LRTs—tokens managed by AI Agents that dynamically allocate capital among staking, restaking, and DeFi protocols. HyperNative’s AI-driven monitoring adds an extra layer of security, enabling swift responses to suspicious activity or market shifts.

#4.2 Unified Yield Approach

MAX LRTs unify multiple restaking and DeFi strategies into a single, composable asset that settles on Layer 1. This design abstracts away the complexity of managing separate positions while providing liquidity and diversification. Each MAX LRT dynamically rebalances based on real-time risk metrics, allowing users to capture opportunities across the broader DeFi landscape without manual oversight.

Critically, the AI Agents that govern MAX LRTs in a hybrid manner do more than automate yield—they also collect and analyze data across multiple chains and protocols to gauge evolving risks and returns. By incorporating restaking into this broader system, users gain exposure to a range of strategies that expand the capital efficiency of the MAX LRT assets.

#4.3 AI-Driven Optimization and Security

YieldNest employs NestAI—an advanced system of AI Agents—alongside HyperNative’s real-time threat detection to optimize returns while protecting user assets:

-

Autonomous Strategy Execution – AI Agents continuously evaluate on-chain data, adjusting allocations to capture emerging yield opportunities across both restaking and DeFi.

-

Proactive Risk Mitigation – HyperNative monitors mempools, contract deployments, and liquidity patterns to preemptively address potential exploits. AI Agents can swiftly pause or redistribute assets if suspicious activity is detected.

-

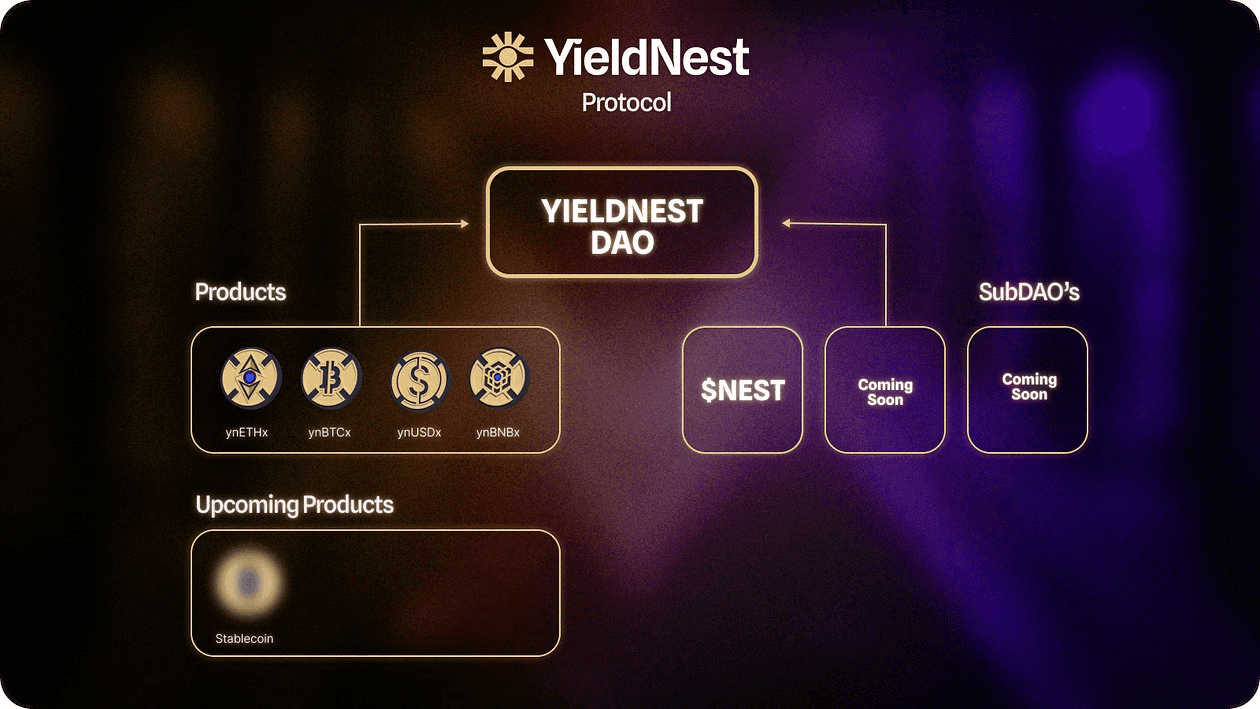

Adaptive Governance – Over time, subDAO-based governance can delegate certain decision-making processes to AI Agents, ensuring that protocol parameters, fee structures, and strategy compositions evolve in real time.

This proactive security framework supports efficient capital allocation, offering users a robust shield against the volatility and risks intrinsic to DeFi.

(source: YieldNest Medium)

#4.4 User-Centric Design

YieldNest is built for both retail and institutional participants. Automated vaults manage restaking, reward collection, and compounding, enabling a “restake and forget” experience. AI Agents streamline rebalancing and yield optimization, sparing users the need for technical intervention. Real-time notifications and fail-safes—such as emergency withdrawals—enhance transparency and control. By reducing complexity, YieldNest democratizes access to advanced yield opportunities without compromising security or capital efficiency.

#Conclusion

While restaking may yet fulfill its promise as a vibrant ecosystem for delivering services underpinned by shared security, it is prudent for profit-oriented capital allocators to recognize the current deficiencies that pose opportunity costs. YieldNest addresses these challenges by developing products that can benefit from restaking’s future potential while preserving the flexibility to avoid stagnation within the sector. YieldNest views restaking as an evolving primitive within a broader mission to unlock capital efficiency and redefine what's possible in DeFi.

By leveraging strategies across a broad spectrum of DeFi offerings, YieldNest ensures that restaking remains a vital component of its toolkit. The modular design of MAX LRTs allows these products to adapt swiftly to emerging market opportunities by leveraging AI-powered decision-making and automated risk management. In an industry where innovation moves at breakneck speed and yield opportunities can shift suddenly—this strategic flexibility helps YieldNest maintain its competitive edge, regardless of how the restaking landscape evolves.