A comprehensive risk analysis of PayPal USD (PYUSD) as a potential PegKeeper asset for crvUSD

#Introduction

In this report, we will analyze staked PayPal USD (PYUSD) as a potential pegkeeper asset for crvUSD. The objective of this analysis is to comprehensively assess the risks associated with PYUSD to determine its suitability for pegkeeper onboarding. Our evaluation will employ both quantitative and qualitative methods, providing insights into the safety of integrating PYUSD and recommending any necessary exposure restrictions.

We will categorize the assessment into three main areas:

-

Performance Analytics - Concerns related stablecoin adoption, market liquidity, and volatility.

-

On-chain Management - Considerations pertaining to smart contracts, dependencies, and other technology components.

-

Regulation and Compliance - Aspects concerning reserves management, centralization potential, and legal/regulatory factors.

This review will involve a comparative analysis against existing crvUSD pegkeepers in the final section of this report, providing tokenholders with valuable information to make informed decisions regarding the integration of PYUSD and the establishment of appropriate parameters.

#Section 1: Stablecoin Fundamentals

This section addresses the fundamentals of the proposed pegkeeper asset. It is essential to convey (1) the value proposition/utility of the stablecoin, and (2) an overview of the on-chain technical architecture. This section contains descriptive elements that cannot be quantified and serves as a descriptive introduction to the stablecoin.

This section is divided into 2 sub-sections:

-

1.1: Description of the Stablecoin

-

1.2: System Overview

#1.1 Description of the Stablecoin

#1.1.1 User Flow

Obtaining PayPal's stablecoin involves a straightforward process designed for PayPal users, focusing on simplicity and accessibility within PayPal's ecosystem.

A user first needs to have a PayPal account. If they don't have one, they can sign up on the website or through their app. PayPal requires users to complete Know Your Customer (KYC) requirements, incl. identity verification, which is a standard practice for financial services to ensure security and compliance. Once the account is set up and verified, it should be funded accordingly.

Purchase or sale of PayPal USD can be made on PayPal, using one's US PayPal balance, PayPal-linked debit card or bank account.

PYUSD was subsequently launched for Venmo customers in September 2023. The accessibility through Venmo means that the stablecoin(s) can be purchased or sold on Venmo and can be sent to compatible external wallets and friends and family on Venmo and PayPal, and vice versa. Account requirements mirror these of PayPal.

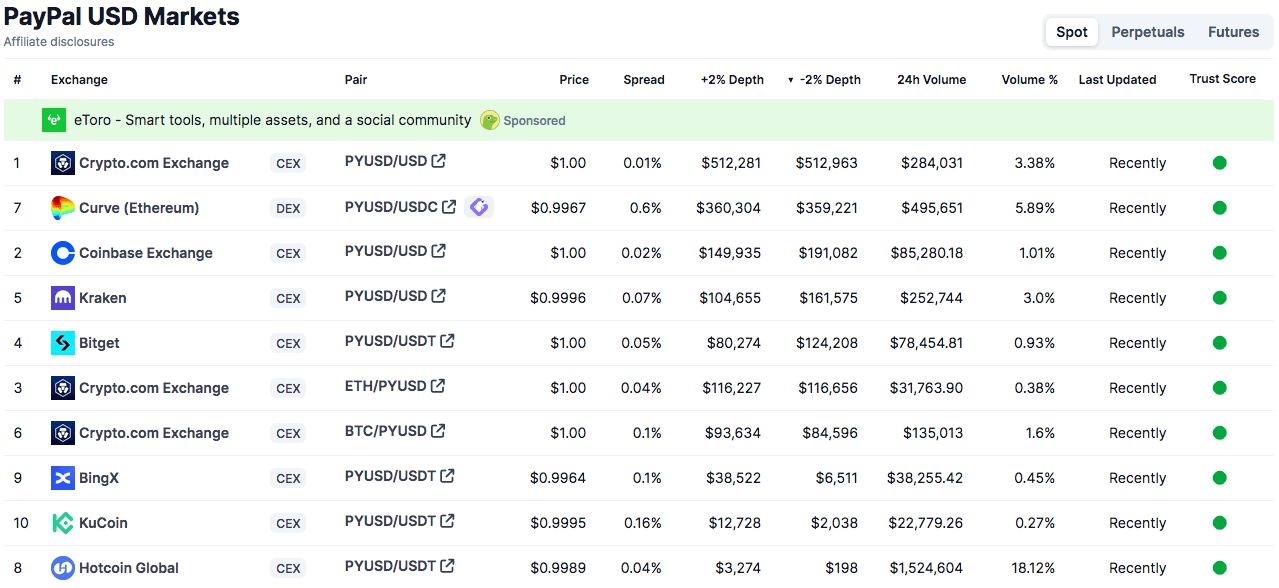

Availability on both centralized exchanges (CEXs) and decentralized exchanges (DEXs), according to Coingecko data, provides users with multiple secondary venues to engage with the stablecoin. It is most prominently paired with USD and USD stablecoins, with some pairings against ETH and BTC.

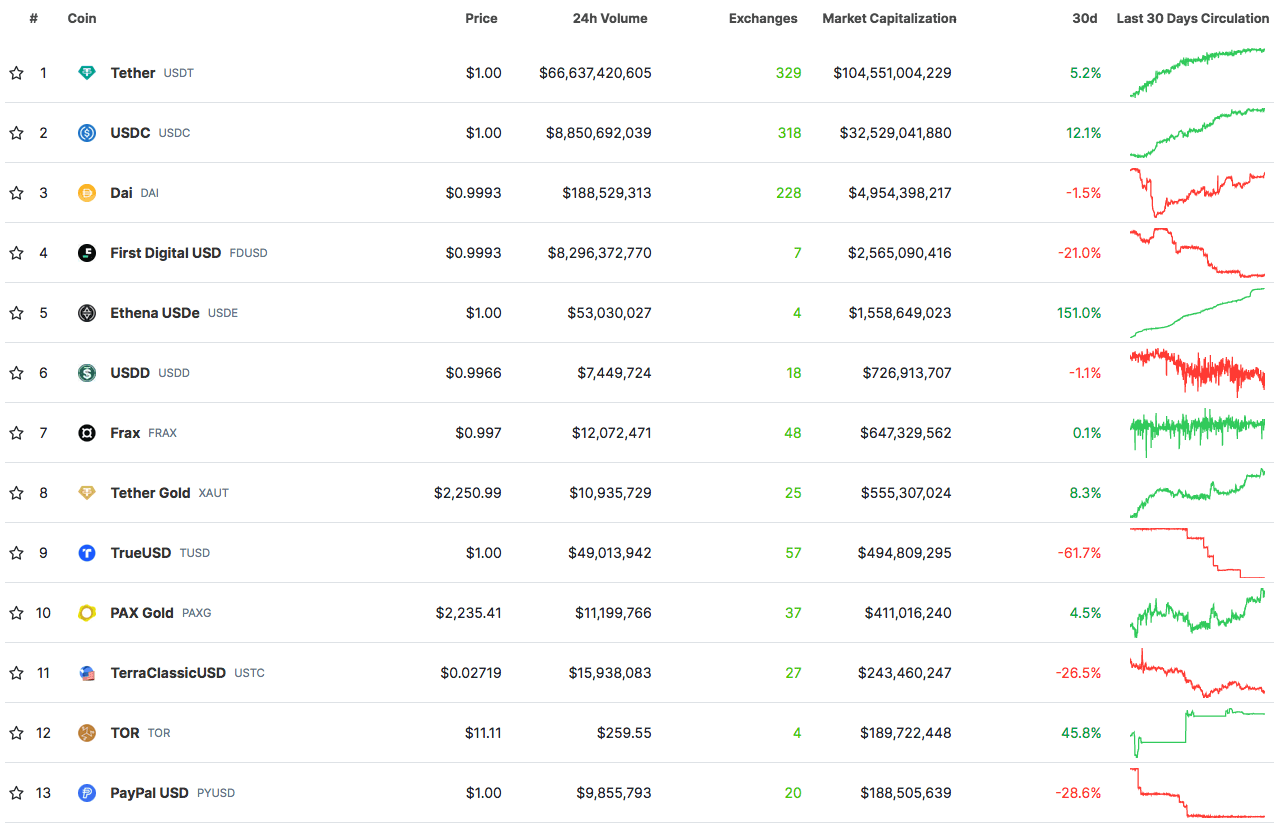

Source: Coingecko - PYUSD | Date: 1/1/2024

#1.1.2 Reserves Overview

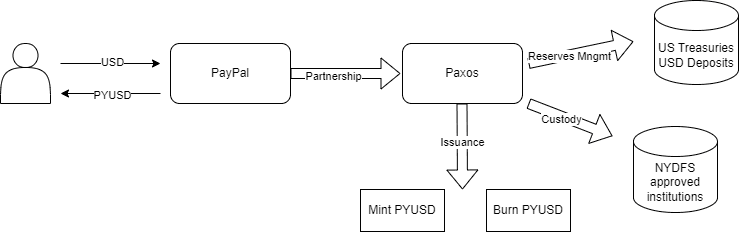

PayPal USD is issued by Paxos Trust Company, LLC, not PayPal or Venmo. Paxos operates under the stringent regulations of the New York State Department of Financial Services (NYDFS), mandating a robust reserve structure to underpin the stability of PayPal USD stablecoin. The reserve assets of PYUSD consist of overnight reverse repurchase agreements (repos) backed by US Treasuries, alongside cash held in segregated accounts -a composition which ensures that Paxos maintains adequate liquidity and security.

To align with regulatory standards, PYUSD’s reserves are exclusively held within regulated, insured banks and financial institutions in the USA. The NYDFS has thoroughly vetted each custodian to guarantee compliance and safeguard the reserves. Among the banks Paxos may utilize for holding PYUSD reserves are BMO Harris Bank N.A., Customers Bank, and State Street Bank and Trust Company. Additionally, Paxos has the option to place reserves within deposit placement networks, including IntraFi Network LLC and Reich & Tang Deposit Solutions LLC, enhancing the diversification and safety of reserve holdings.

Paxos has contracted WithumSmith+Brown, a reputable CPA firm, to conduct monthly audits and provide assurance opinions regarding the adequacy and integrity of the stablecoin reserves.

#1.1.3 Fees and Business Model

There are no fees to buy, sell, hold, or send PayPal USD. There is a fee to convert between PYUSD and other cryptocurrencies. Network fees may apply when sending PYUSD to Ethereum wallet addresses.

#1.1.4 Organizational Structure

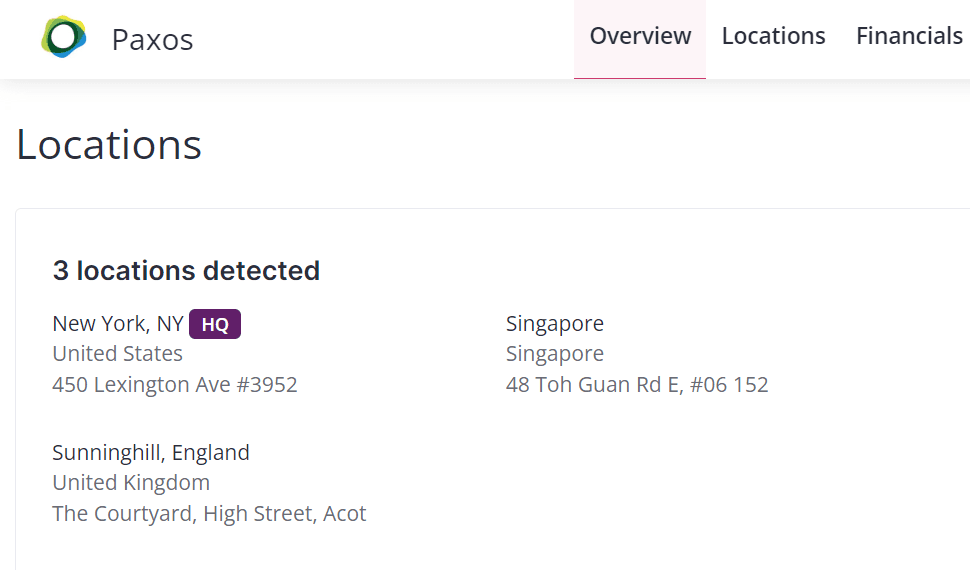

While carrying the PayPal brand, PayPal USD is identified within the PayPal Cryptocurrency Terms and Conditions as one among several supported crypto assets. PYUSD's issuer is Paxos Trust Company, LLC. Paxos was founded in 2012 and is headquartered in New York, USA with additional locations in Singapore and UK.

Source: Craft

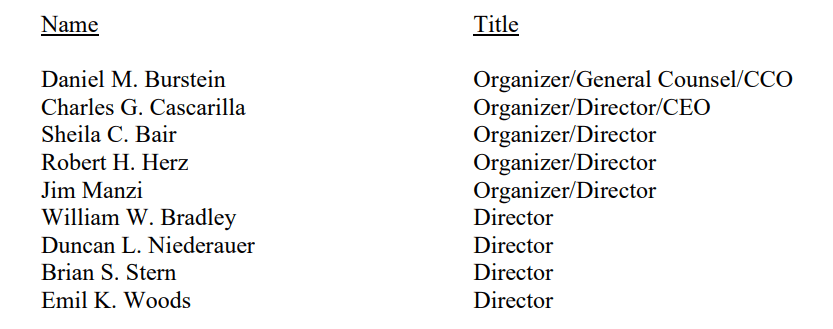

On April 23, 2021 Paxos Trust Company, LLC received preliminary conditional approval from the Office of the Controller of the Curreny (OCC) to charter a Bank. Even though this approval expired last year, the public document shed light on the ownership structure and representatives of Paxos Trust at that time. Paxos Trust Company, LLC, is a New York-chartered limited liability trust company. The Bank subject to approval and Paxos Trust Company were projected as affiliates and direct wholly owned subsidiaries of Kabompo Holdings Ltd., Grand Cayman, Cayman Islands.

The OCC did not object to the persons serving as executive officers, directors, and/or organizers as proposed in the application. Background checks and other reviews for the executive officers and directors were still in process at that time.

Source: Preliminary conditional approval

The aforementioned individuals have been screened against publicly accessible databases to assess any potential links to illicit activities. Our query has not produced any evidence suggesting their involvement or association with unlawful conduct.

According to Golden-DP489V#Table:-Funding-Rounds) and Forbes, PayPal on its own through PayPal Ventures participated in Paxos' Series D funding round in 2021. The company successfully raised $300 million, considered one of the largest ever in the cryptocurency business environment.

#1.1.5 Third Party Relations

A Chainlink Price Feed on mainnet is integrated to provide accurate and secure market data. A cited goal is to drive the adoption of tokenized real-world assets across a variety of use cases, including on-chain payments carried out with PYUSD.

Onboarding into the Aave V3 Ethereum pool was DAO-voted and approved, allowing PayPal USD to deepen its liquidity base and extend its reach into the DeFi space.

Crypto.com has announced a partnership with PayPal and Paxos to enable PYUSD for both retail and institutional users.

The integration onto the Universal Digital Payments Network (UDPN) aims to bridge legacy payment systems and digital currencies. PYUSD is expected to take a pivotal role in UDPN's proof-of-concept cases, enhancing foreign exchange, digital swaps, and e-commerce payments.

#1.1.6 History

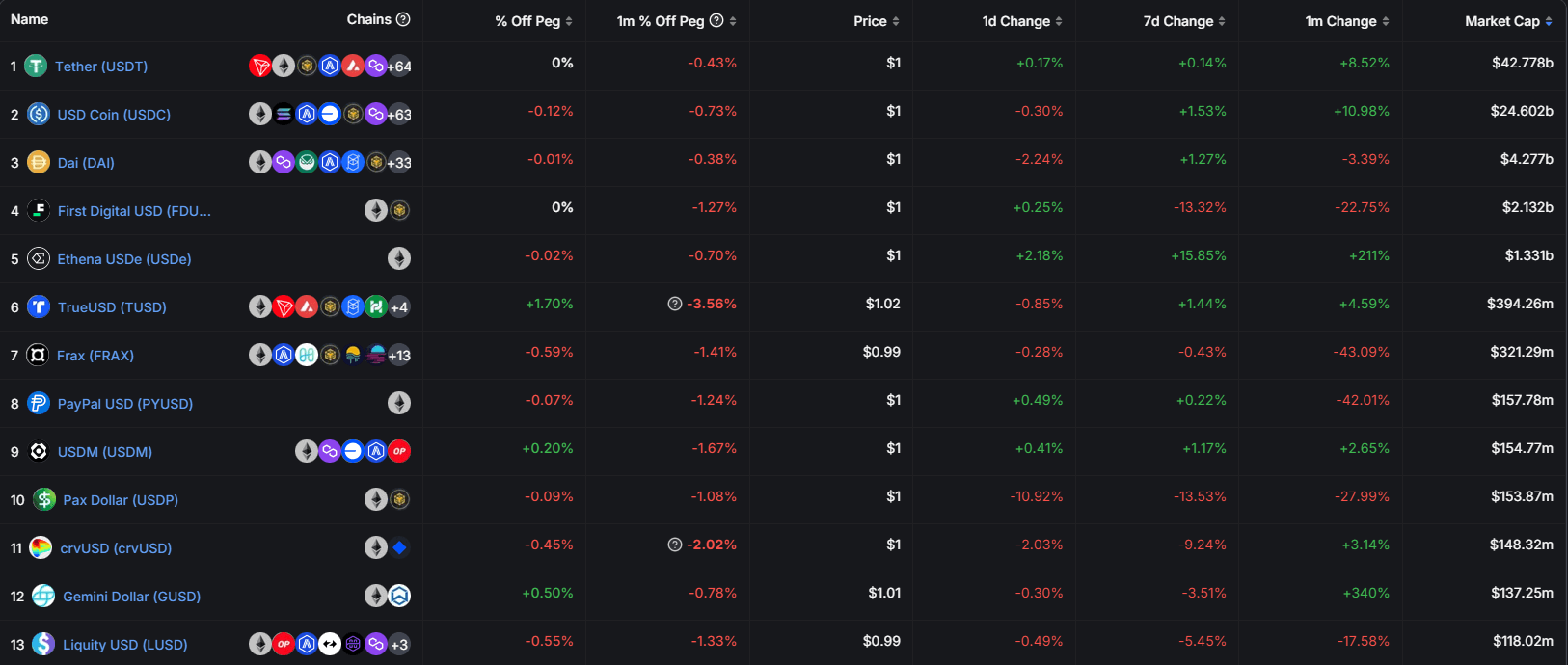

After its launch in August 2023, PayPal's stablecoin achieved a $300 million market cap, securing a top ten position in global stablecoin charts for a time. It has since declined from a top 10 position as of April 2024. In the crowded market PYUSD faces competition from established players like USDC, USDT and DAI.

Source: Coingecko - Stablecoins | Date: 1/1/2024

The launch of PYUSD also led to the emergence of nearly 30 fake PYUSD tokens across various blockchain networks, including Ethereum, BNB Smart Chain and Base. Created by opportunists to capitalize on the hype surrounding PayPal's announcement, some of the impostor tokens recorded significant trading volume before experiencing a dramatic price drop.

In November 2023, PayPal received a subpoena from the SEC, requesting production of documents related to the USD stablecoin. PayPal announced that they were cooperating with the SEC without further updates.

PayPal Ventures has initiated the use of PYUSD stablecoin for their strategic investment activities, marking a significant adoption of the stablecoin within the investment framework. Notably, $5 million of the investment in Mesh, a platform designed to facilitate the movement of cryptocurrency across various financial accounts and wallets, was paid out in PYUSD.

#1.2 System Architecture

#1.2.1 Stablecoin Overview

PYUSD is built on the Ethereum blockchain, following the ERC-20 token standard.

The core on-chain system component is the smart contract that handles Minting (creating new PYUSD tokens when users deposit fiat currency), Burning (destroying PYUSD tokens when users redeem them for fiat currency) and Transfer (facilitating PYUSD transfers between Ethereum addresses) functions.

In the off-chain dimension, Paxos performs activities of the highest degree of importance concerning issuance, custody, transfers, reserves management, etc. PayPal integrates PYUSD into its platform, providing users the ability to buy, hold and transact with stablecoins.

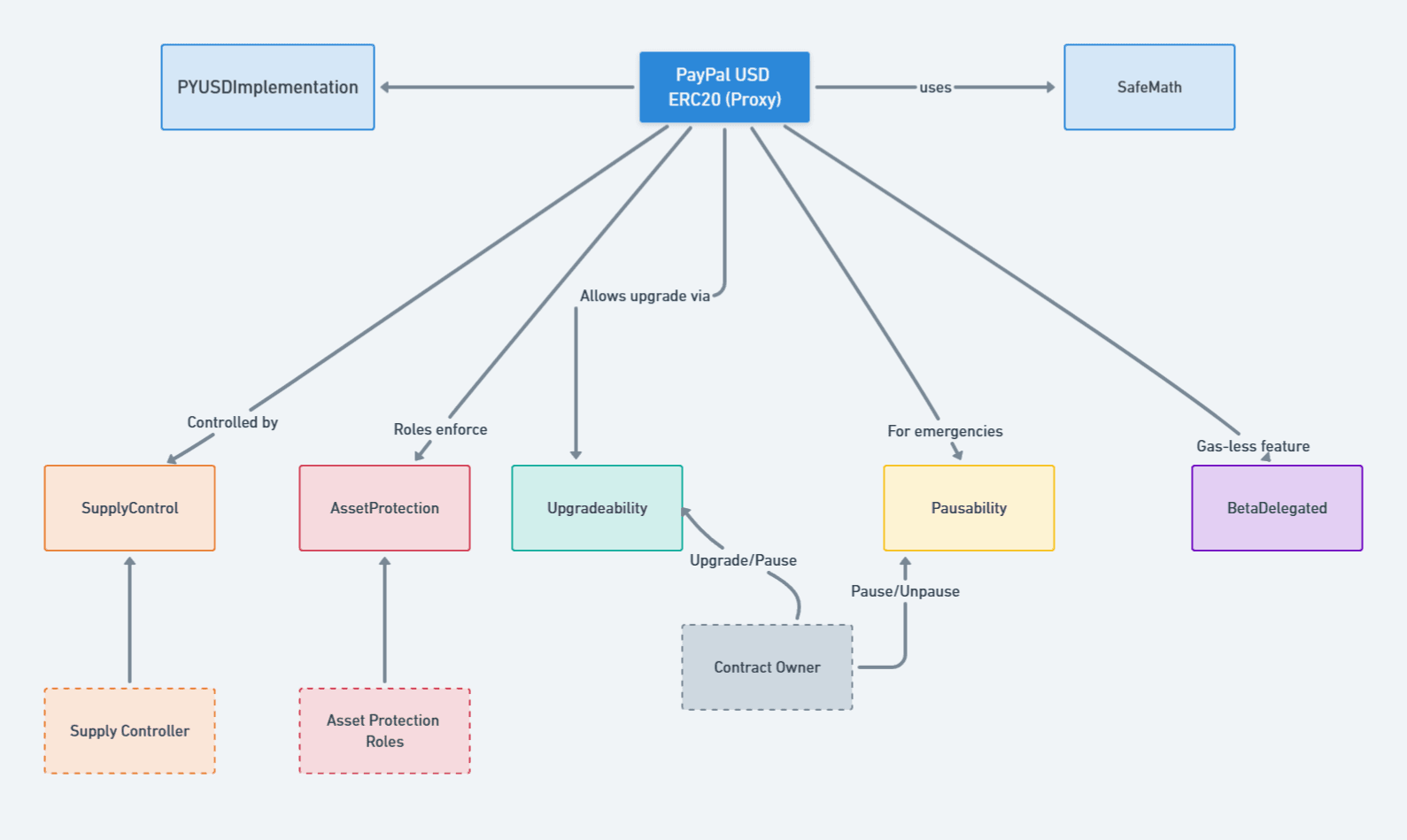

#1.2.2 Architecture Diagram

The visual diagram highlights the main components of the system, both on-chain contracts and off-chain entities, showing the flow of funds, and partner institutions.

#1.2.3 Key Components

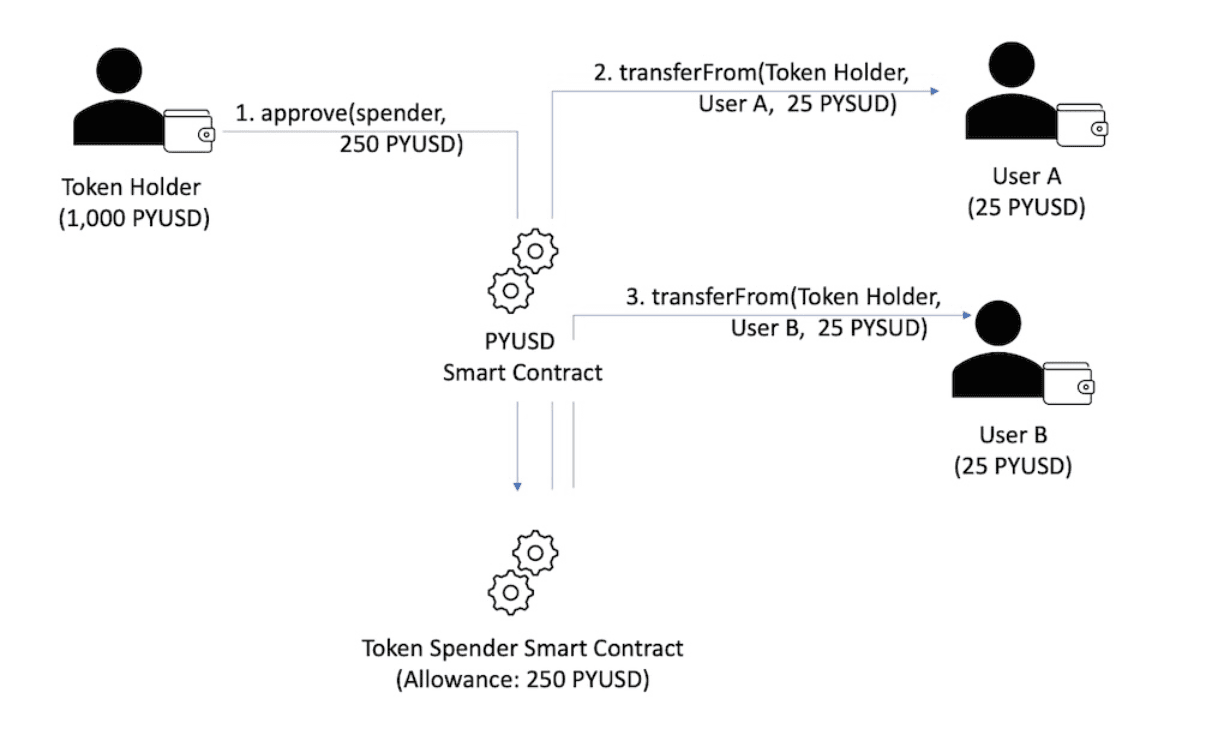

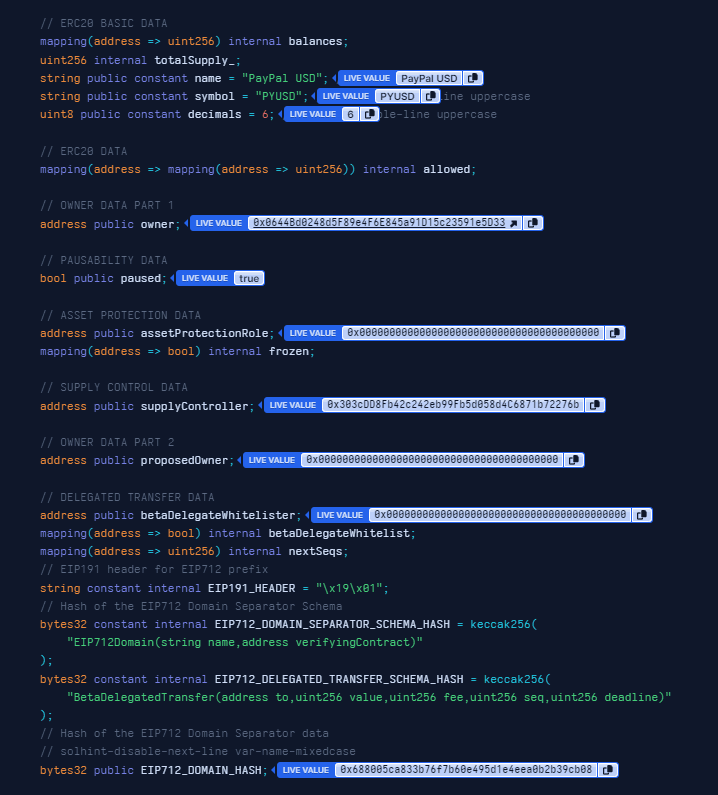

The fundamental functionalities of PYUSD smart contract revolve around a set of primary functions that manage token transactions and balances.

**Transfer**: Enables token holders to send tokens directly to another address.

**Approve**: Allows a token holder to grant another address (spender) permission to transfer a specified amount of tokens on their behalf.

**TransferFrom**: Used by the approved spender to move an allocated amount of tokens from the token holder’s account to another account.

Source: PayPal Developer Docs

Issuance and redemption are overseen by a designated supply control address, empowered by Paxos Trust Company to mint or burn tokens in alignment with the real-time fluctuations of the reserves.

To tackle potential security concerns, the contract incorporates a pause mechanism, a feature that temporarily halts all transfers and approvals. It is built on the OpenZeppelin Pausable framework and managed by an owner role.

assetProtectionRole allows to freeze/unfreeze the balance of any address - a measure designed to comply with regulatory standards and safeguard against illicit use. This is achieved respectively through freeze, which sets the frozen status of an address to true and unfreeze, which reverses the effect of the freeze function, allowing the previously frozen address to resume normal activities

Through wipeFrozenAddress the balance of a frozen account can be effectively confiscated. When this function is called, the tokens from the frozen account are subtracted from the total supply of PYUSD tokens, and the balance of the frozen account is set to zero. This represents a secondary mechanism for reducing the supply of PYUSD.

reclaimPYUSD prevents unwanted locking of funds in the contract. The function allows the contract owner to reclaim any PYUSD tokens that have been accidentally or intentionally sent to the contract address itself.

Any whitelisted address can call betaDelegatedTransfer in instances when delegated transfer mechanism should be enabled, allowing token holders to delegate the transfer of their tokens to another party by signing a permission slip. This function enables scenarios where a token holder wants to authorize a transaction without directly executing it himself, e.g pay transaction fees in PYUSD.

The contract is designed for upgradeability using the AdminUpgradeabilityProxy from ZeppelinOS.

#Section 2: Performance Analytics

This section evaluates the pegkeeper candidate from a quantitative perspective. It analyzes stablecoin performance metrics in terms of market adoption, peg stability, and liquidity.

This section is divided into 3 sub-sections:

-

2.1: Market Performance

-

2.2: Peg Stability Metrics

-

2.3: Liquidity

#2.1 Market Performance

#2.1.1 Outstanding and Free-Float Supply

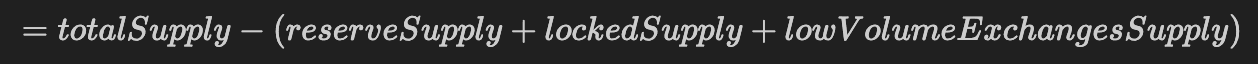

The outstanding supply is simply the total amount of stablecoins in circulation over time. Free-float supply uses a methodology developed by CoinMetrics that applies a standardized criteria for which units of supply to exclude from free float. Free-float Supply is calculated as:

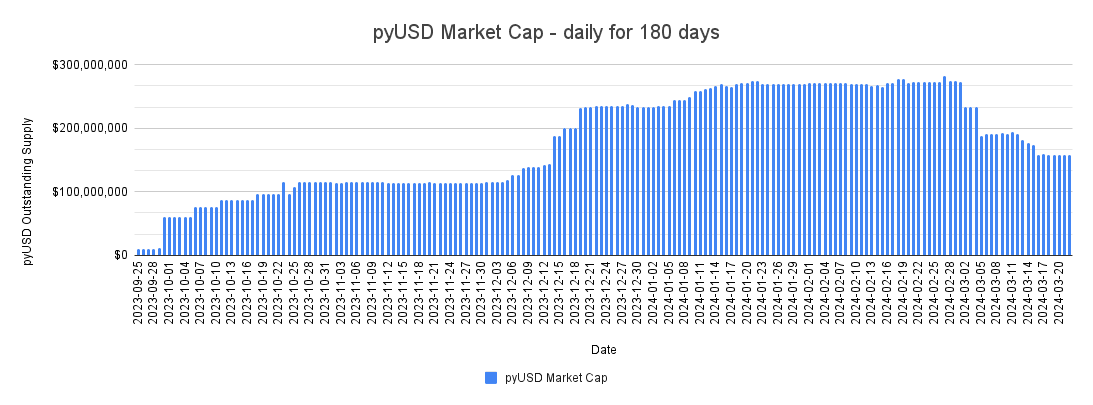

Below is the pyUSD outstanding supply over a 180 day period since late-September until 3/22/2024.

Source: Defi Llama

The 1547.48% increase in the market capitalization of PYUSD over the past 180 days can be attributed to the launch of PayPal USD approximately 230 days ago, on August 7, 2023. However, it is noteworthy that within the last 90, 30, and 7 days, the market capitalization of PYUSD has experienced a decline. The peak market capitalization for PYUSD was observed on February 27, 2024, reaching $281,987,555.

The Free-Float Supply of PYUSD is calculated by DeFiLlama, which is accessible through their website by navigating to the sidebar, selecting 'Stables,' and then 'Overview.' As of 22 March 2024, the market capitalization of PYUSD is reported to be $157,265,428. DeFi Llama offers an option for users to include the minted but unreleased portion of the PYUSD supply, which amounts to $30.95 million, in their calculations.

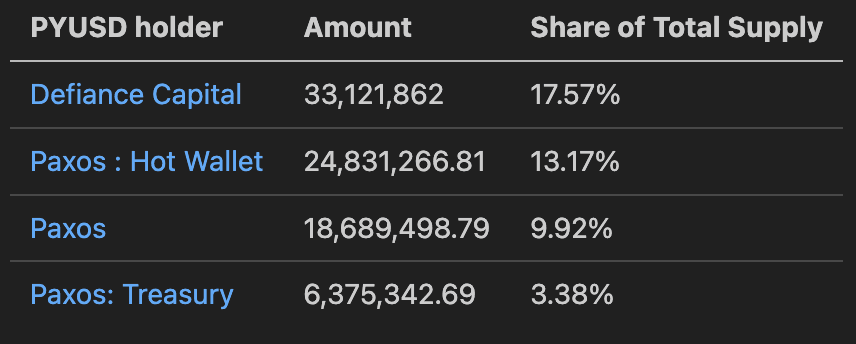

After analysis of PYUSD largest holders (TOP 20), addresses listed below can be excluded from Free-Float Supply:

PYUSD holderAmountShare of Total SupplyDefiance Capital33,121,86217.57%Paxos : Hot Wallet24,831,266.8113.17%Paxos18,689,498.799.92%Paxos: Treasury6,375,342.693.38%

By comparison, DefiLlama's calculation only takes into account the "Paxos: Hot Wallet" and "Paxos: Treasury, as seen in the block of code below:

const chainContracts: ChainContracts = { ethereum: { issued: "0x6c3ea9036406852006290770BEdFcAbA0e23A0e8", unreleased: [ "0x264bd8291fAE1D75DB2c5F573b07faA6715997B5", // "0xE25a329d385f77df5D4eD56265babe2b99A5436e", // paxosTreasury ], }, };

#2.1.2 Market Share in Overall Stablecoins Supply

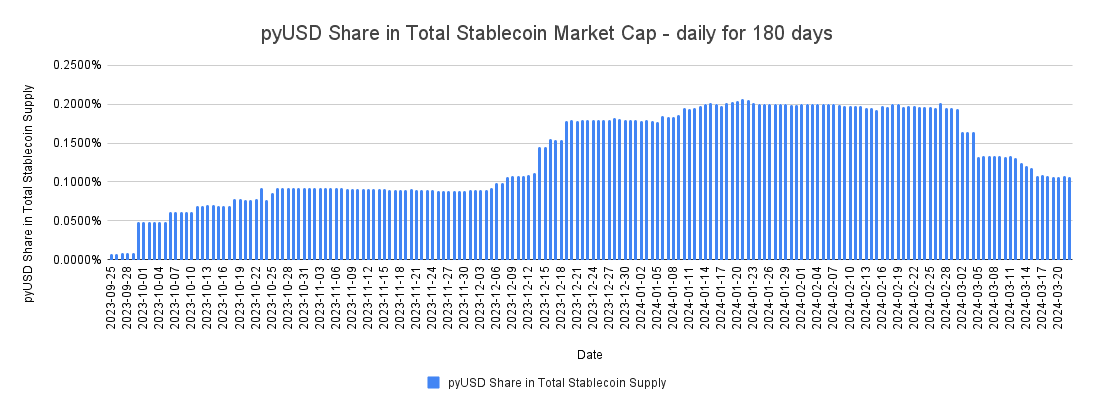

Shown below is the proportion of the stablecoin's market cap relative to the total market cap of all stablecoins over a 180 day period.

Source: DefiLlama

The market share of PYUSD in the total stablecoin market capitalization is approximately 0.106%, and PYUSD is ranked as the 8th largest stablecoin on the Ethereum blockchain in terms of market capitalization, as of March 22.

Source: DefiLlama | Date: 3/22/2024

#2.1.3 Supply Distribution

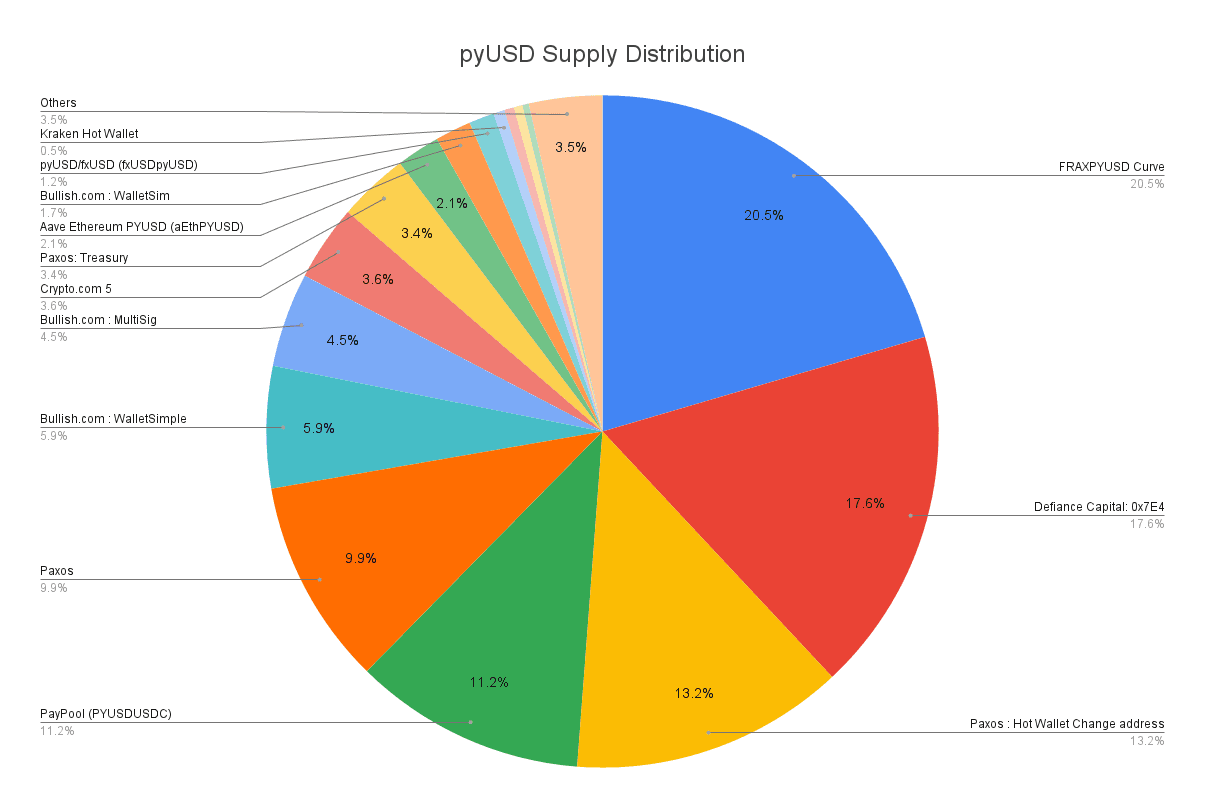

The supply distribution of a stablecoin can help us understand how it is used. If it is only used on few exchanges without much other activity, most of the supply will be concentrated in few addresses. On the contrary, if it’s used by many exchanges and users, it will be more broadly distributed.

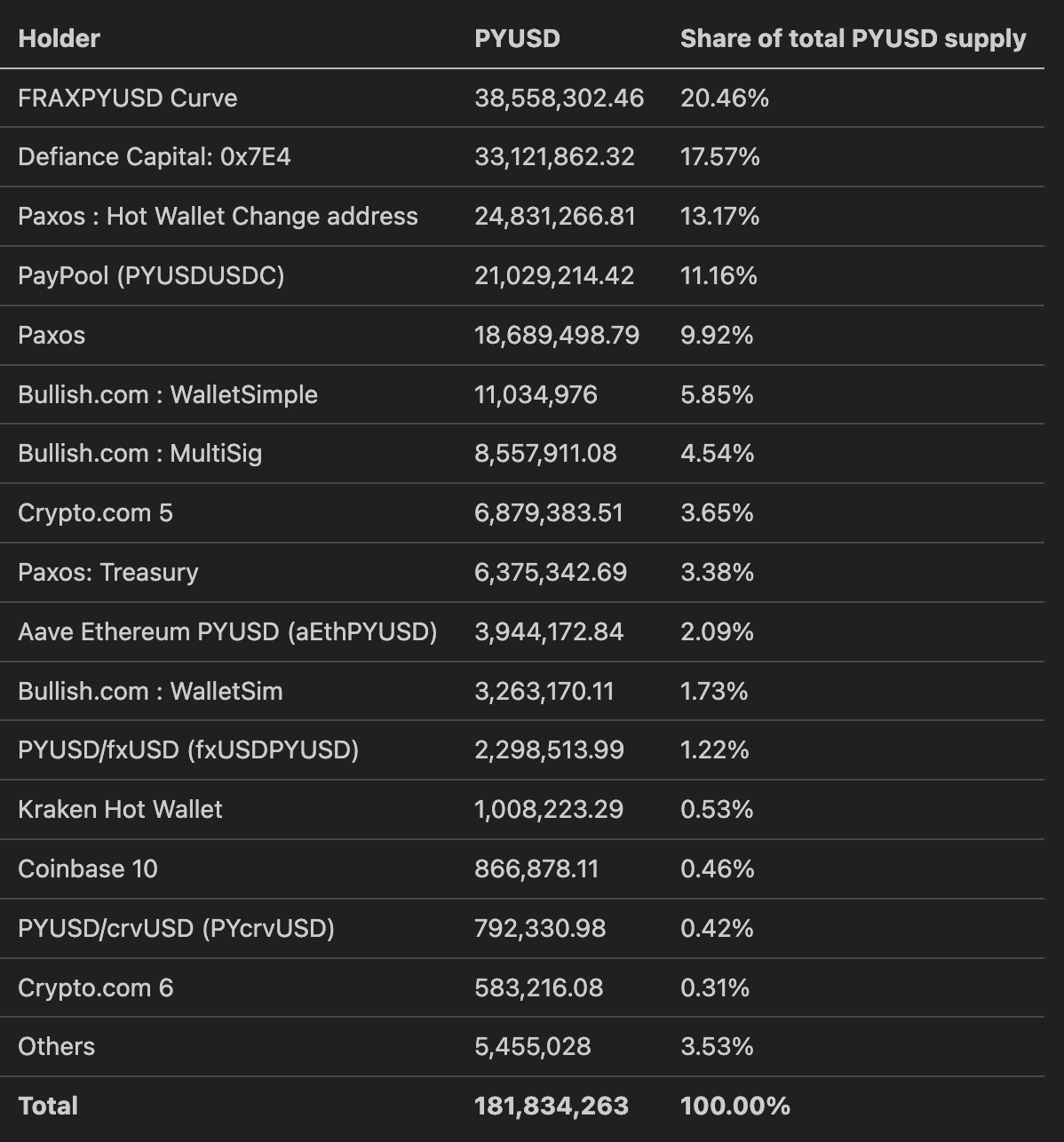

The table below shows the top 16 PYUSD holders, who together hold 96.47% of the total PYUSD supply (as of 3/22/24):

Source: Etherscan | Date: 3/22/2024

Source: Etherscan, Arkham Intelligence and Nansen | Date: 3/22/2024

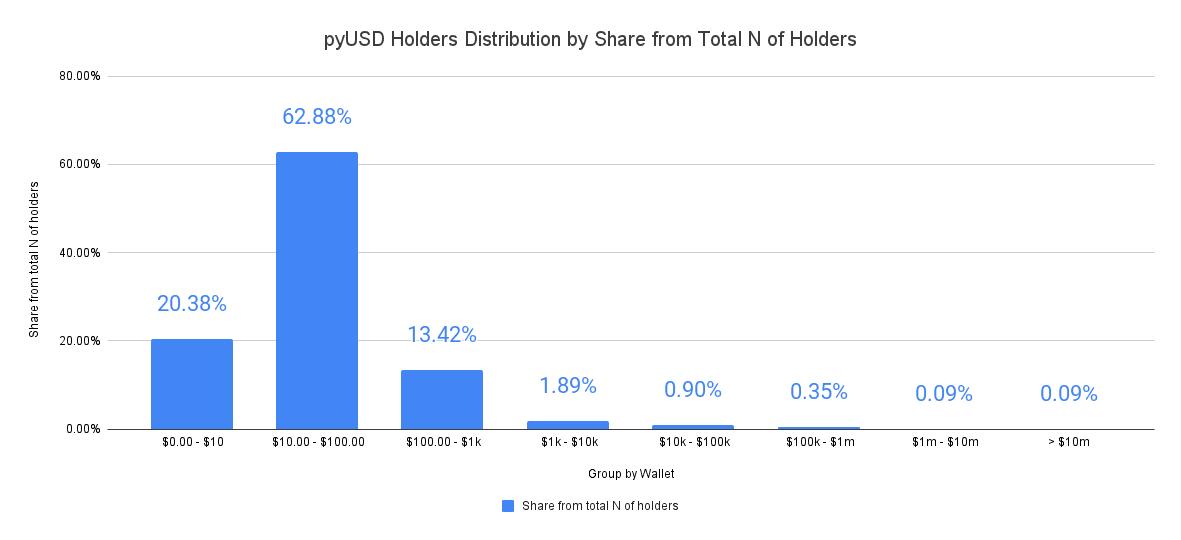

The supply distribution of PYUSD, viewed from a 'wallet-size' perspective, categorizes holders into 7 groups based on the amount of PYUSD each address holds.

Source: IntoTheBlock | Date: 3/23/2024

The chart above shows that 62.88% of the total number of PYUSD holders are addresses containing between $10 and $100 in PYUSD tokens. Additionally, 96.68% of PYUSD holders possess less than $1,000 worth of PYUSD in their wallets.

#2.1.4 Transaction Count and Volume

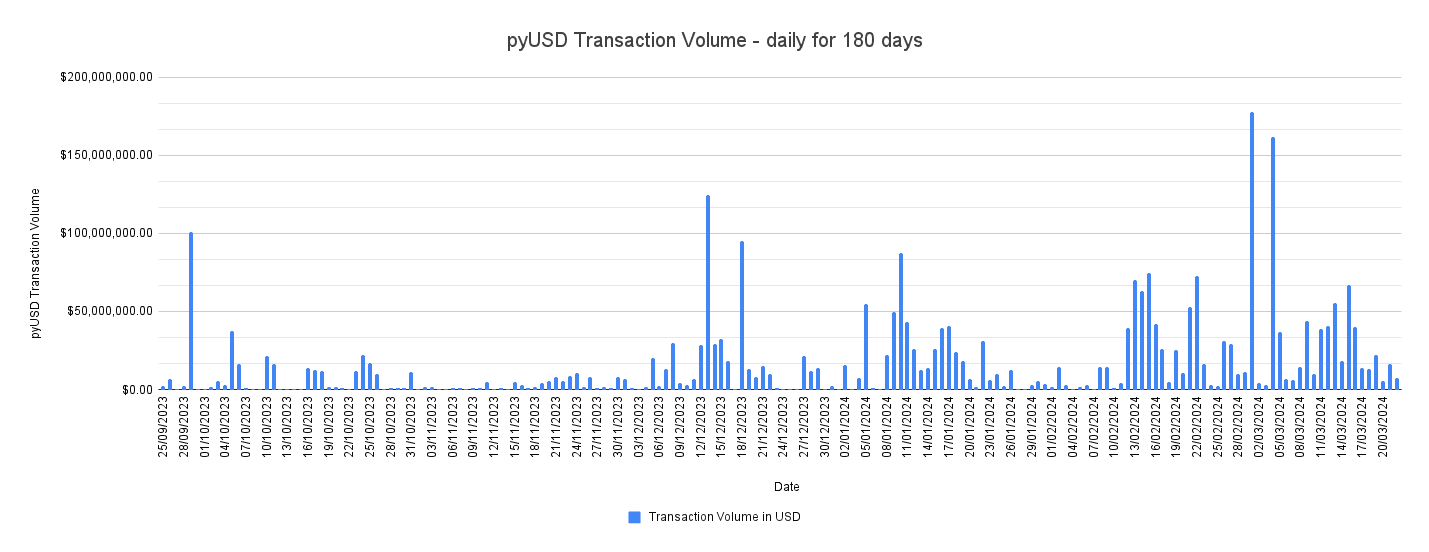

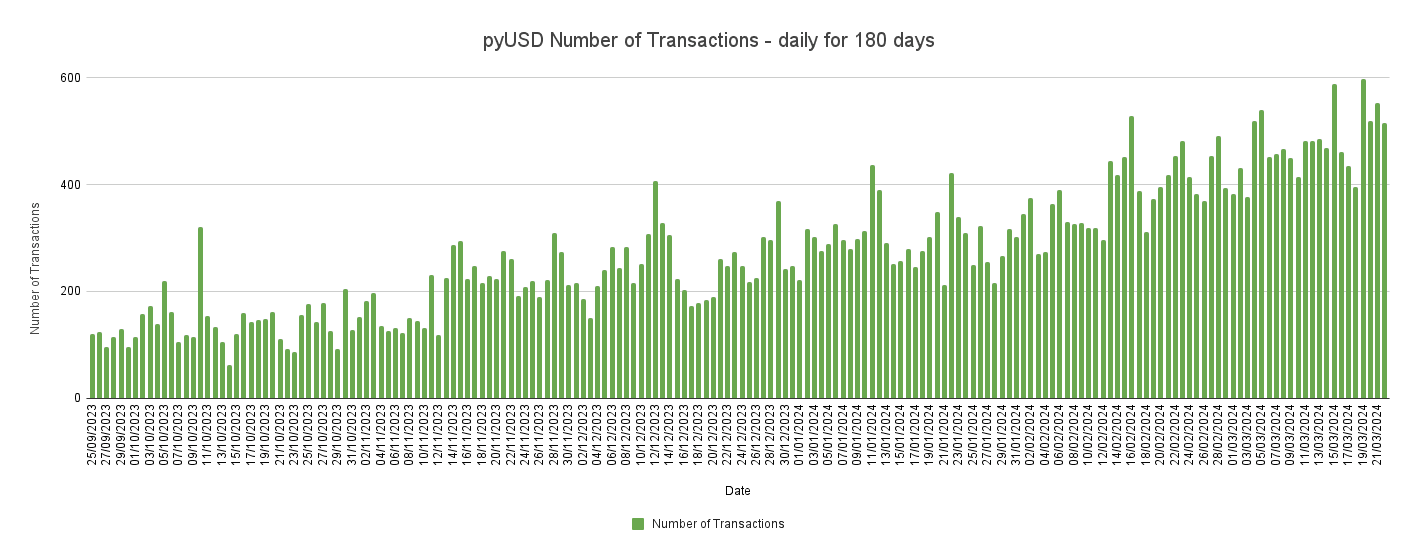

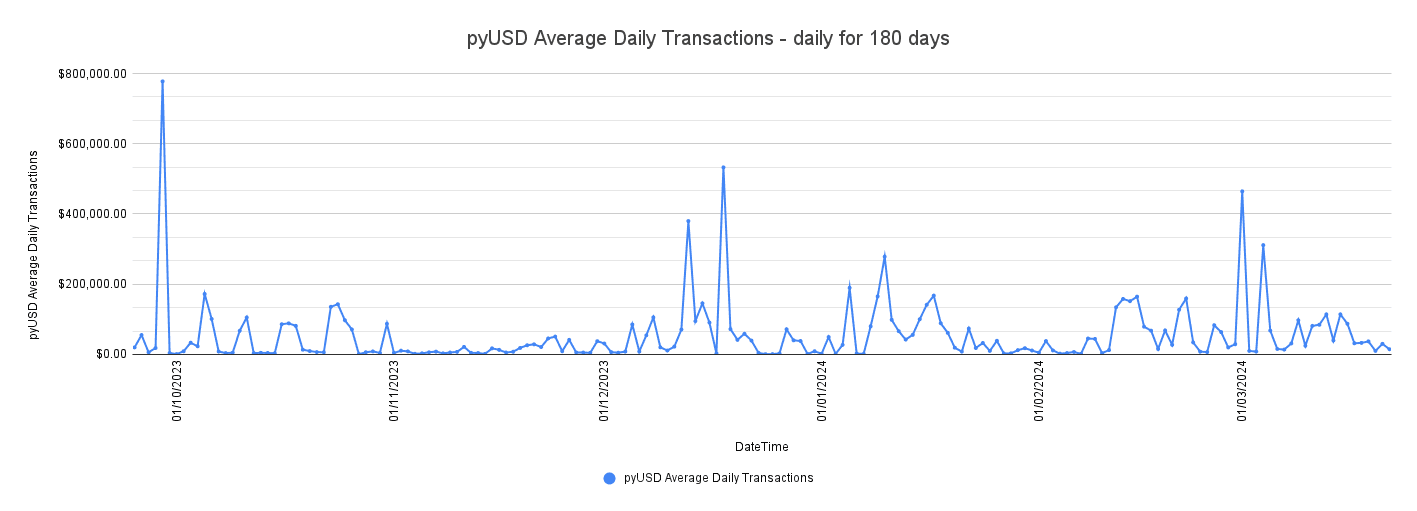

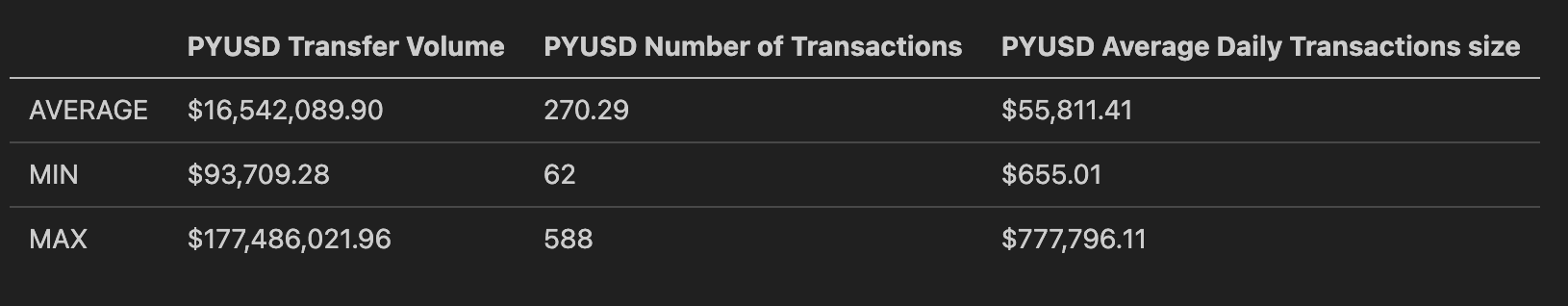

The transaction volume of PYUSD over the past 180 days has exhibited significant variability, with the daily volume ranging from a low of $93,709 to a high of $177,486,021.

Source: IntoTheBlock

Conversely, the chart tracking the number of transactions per day during the same period shows much less short-term volatility, with daily transactions numbering between 86 and 588 with an upward trajectory over a 180 day period.

Source: IntoTheBlock

When these data sets are viewed together, they reveal a pattern: despite the consistent number of daily transactions, the vast differences in transaction volumes suggest a relatively small user base. This pattern indicates the presence of significant transactions by large stakeholders, or 'whales,' on specific days, driving the observed variability in transaction volume.

Source: IntoTheBlock

#2.1.5 Transfer Value Distribution

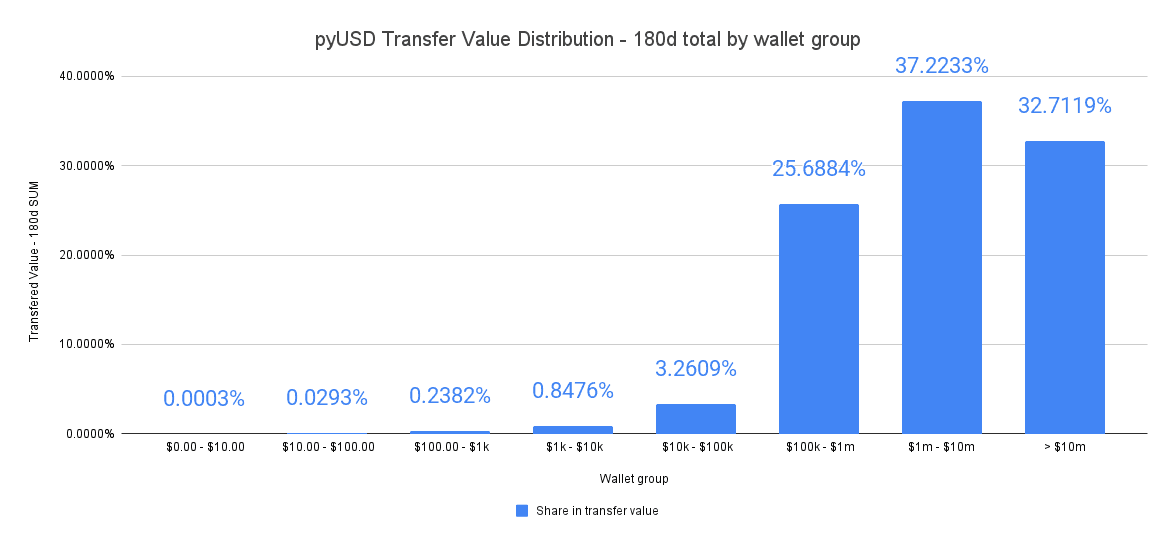

If stablecoins are used as a means of payment for retail users, we should see that the majority of transfers’ value falls below $100 (PayPal’s average transaction value in Q1 2020 was around $58). On the other hand, if we see stablecoins as liquidity rails for traders, the majority of payments should be of high value.

In our analysis of the PYUSD market over the last 180 days, a significant concentration of transfer volume has been observed among a small fraction of holders. Specifically, 94.36% of the total transfer volume was accounted for by merely 0.53% of PYUSD holders, who possess balances exceeding $100,000. This concentration of transactional activity among a narrow segment of the market underscores the utilization of PYUSD primarily as a liquidity mechanism for large-scale traders rather than for retail payment purposes.

Source: IntoTheBlock| Dates: 9/2023 - 3/2024

This distribution differs from what we'd expect with a retail payment system commonly used by the public, where most transactions are for smaller amounts, similar to the average seen on PayPal. The fact that most of the high-value transactions are happening in the PYUSD ecosystem shows it's being used mainly for big financial transfers.

#2.1.6 Stablecoin Velocity

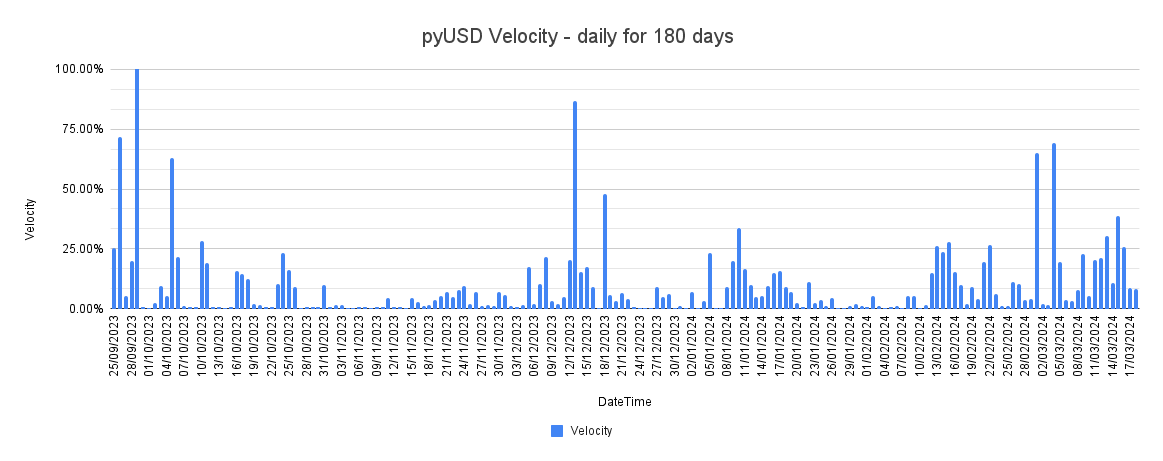

Velocity is the rate at which the stablecoin changes hands in the economic system.

Source: IntoTheBlock and Defi Llama

The PYUSD velocity data over the last 180 days, when considered alongside a stable daily market cap, indicates that while the overall market size of PYUSD remains consistent, the frequency and size of transactions vary considerably.

#2.1.7 Active Users

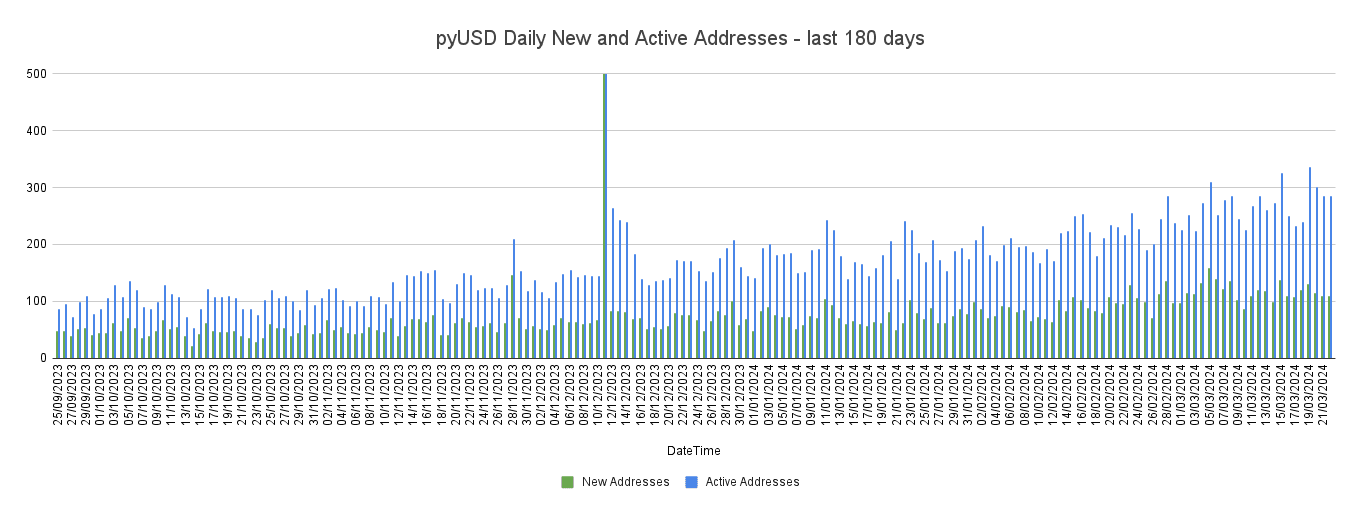

Active users takes daily values over a 180 day period, showing the number of distinct addresses that have made an on-chain transaction.

Source: IntoTheBlock

#2.1.8 User Growth

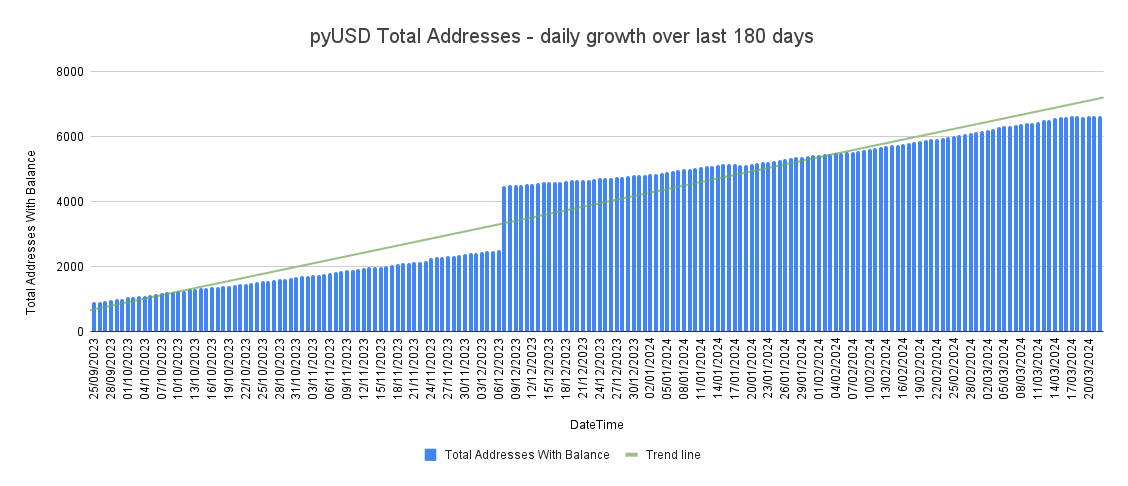

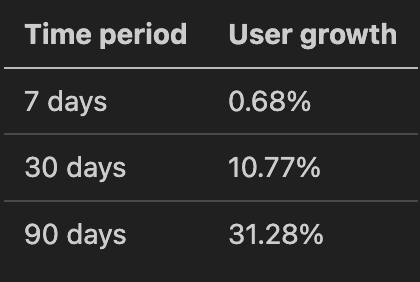

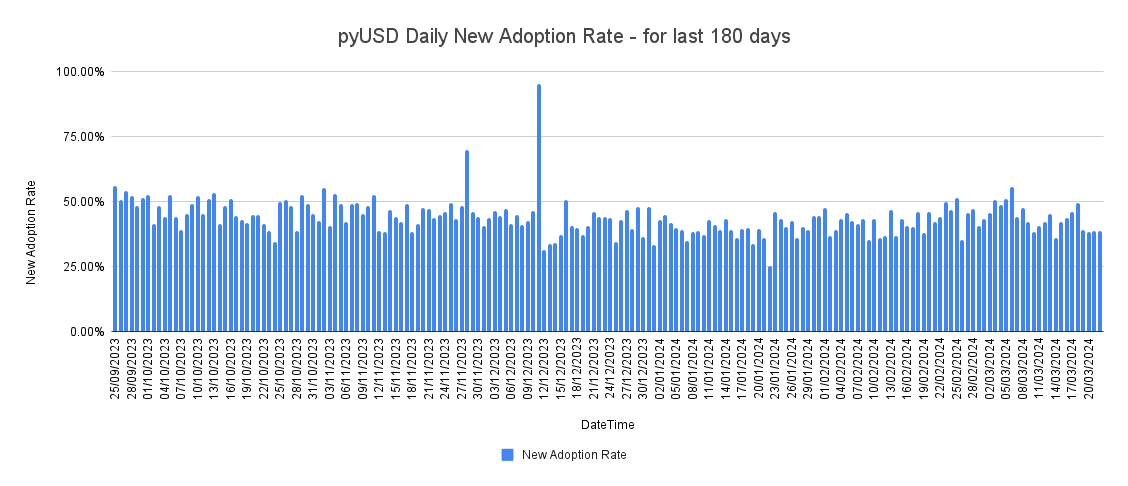

User Growth is a cumulative metric over a 180 day period showing the new user growth rate.

Source: IntoTheBlock

The New Adoption Rate indicator defined by ITB: "The percentage of new addresses making their first transaction out of all active addresses on a given day. This provides insight into the share that newcomers make out of total activity."

Source: IntoTheBlock

#2.1.9 Activity Distribution

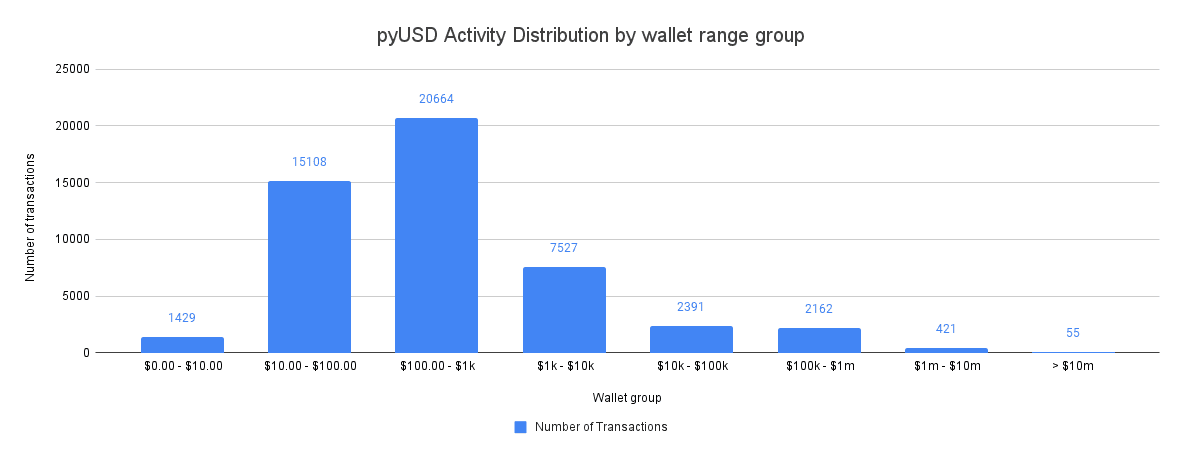

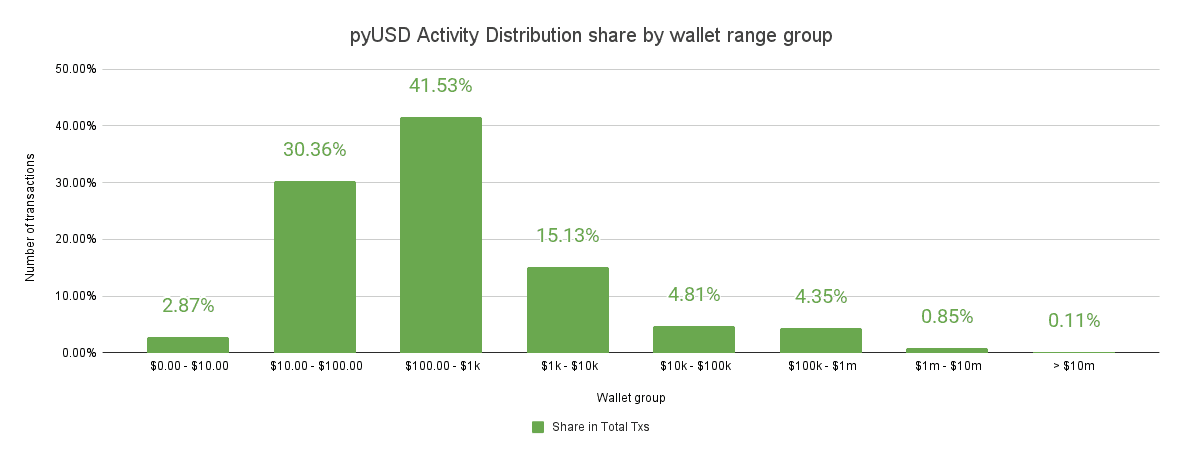

Activity distribution looks at how many accounts are responsible for the majority of the on-chain activity. If a small number of accounts are responsible for most of the transactions, it shows a lack of use outside of a handful of exchanges.

The chart below displays the activity distribution of PYUSD transactions across seven wallet range groups in a 180-day time period. The most significant level of activity occurs in the $100.00–$1k range, with a total of 20,664 transactions, indicating that the majority of PYUSD holders engage in small to moderate value transactions. The data shows a decline in activity as the transaction value increases, with the $1m-$10m and >$10m ranges accounting for only 421 and 55 transactions, respectively, which suggests a smaller number of high-value holders or transactions.

Source: IntoTheBlock | Dates: September 2023 - March 2024

Source: IntoTheBlock | Dates: September 2023 - March 2024

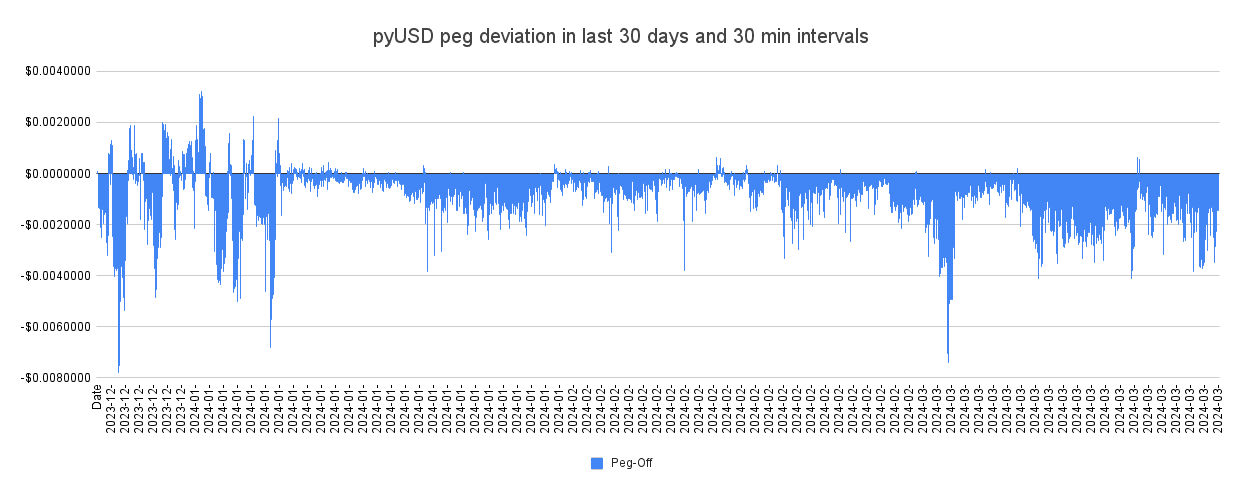

#2.2 Peg Stability Metrics

#2.2.1 Peg Deviation Frequency

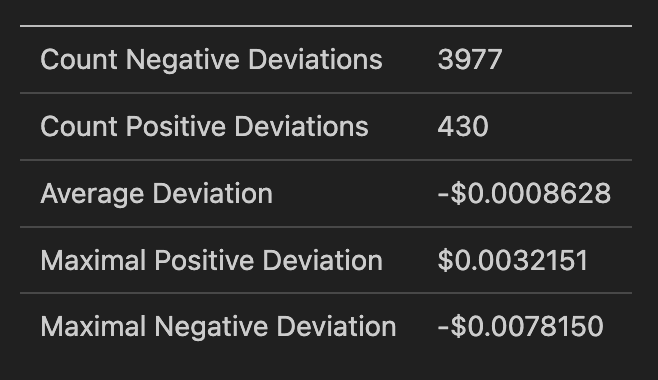

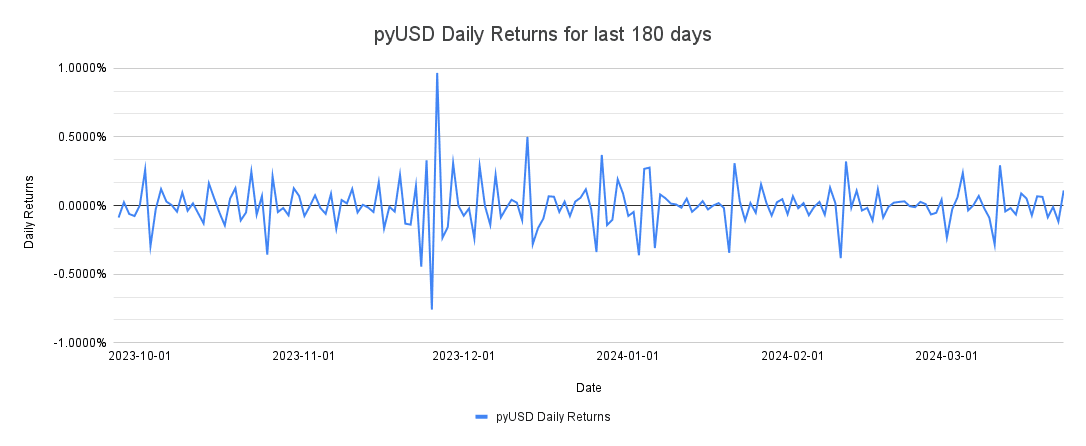

Peg deviation frequency shows the frequency of deviations from the pegged value on an half-hourly basis. Positive and negative deviations are shown, along with calculations of the average and maximal positive and negative deviations.

Source: Santiment

#2.2.2 Maximum Peg Deviation

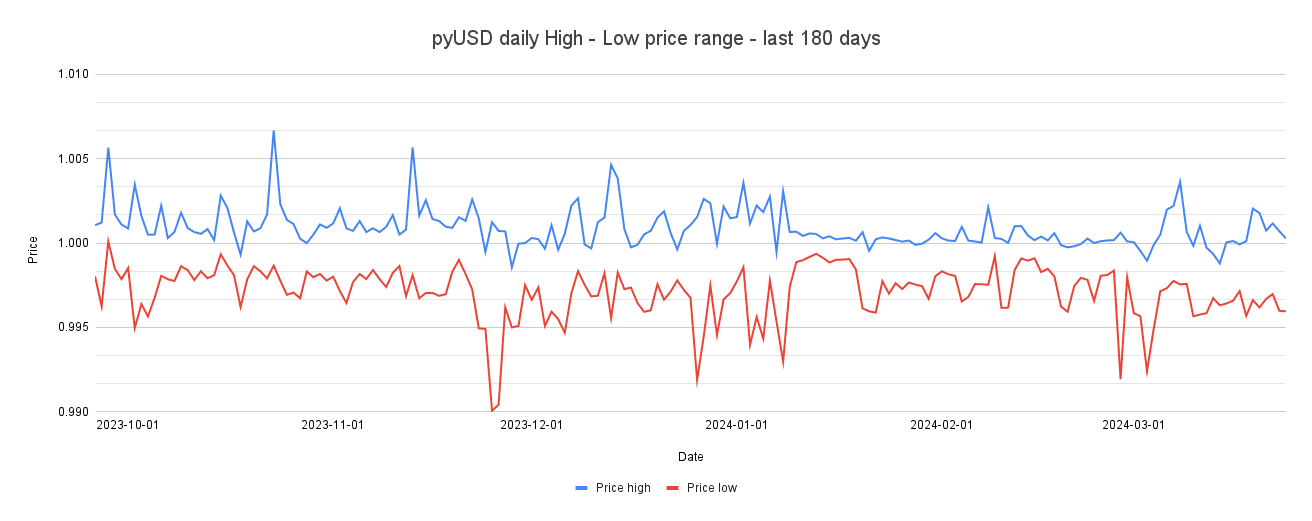

Maximum Peg Deviation is the largest recorded deviation from the pegged value for a specific time-period. For that we look at the High - Low from OHLCV data on a daily basis.

Source: CoinMarketCap

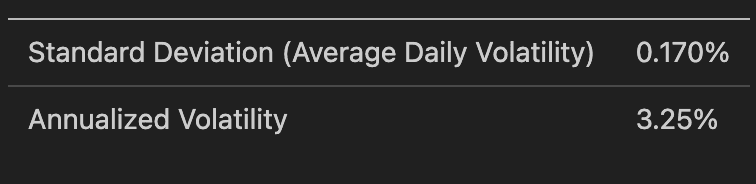

#2.2.3 Standard Deviation of Pegged Value

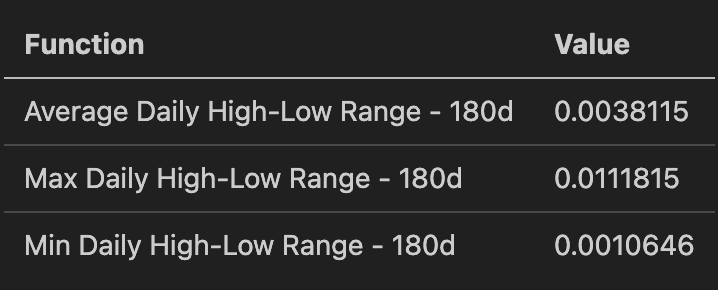

Peg SD is a statistical measure of the variation in the pegged value. (We already use this method by calculating daily returns. It's less precise than deviation frequency but shows long-period performance). The chart below shows the daily returns over a 180 day period.

Source: Santiment

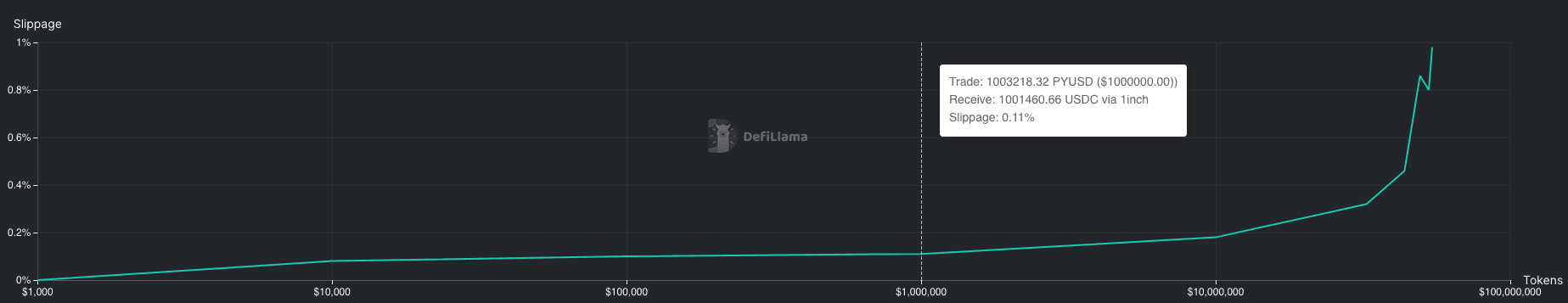

#2.2.4 Market Depth at Pegged Value

Liquidity available at the pegged price point can be estimated by the available on-chain liquidity. As of a snapshot on April 1, a PYUSD to USDC swap of $1m introduces minimal slippage of 0.11%, and a $10m swap introduces 0.18% slippage.

Source: DeFiLlama Liquidity Tool | Date: 4/1/2024

#2.3 Liquidity

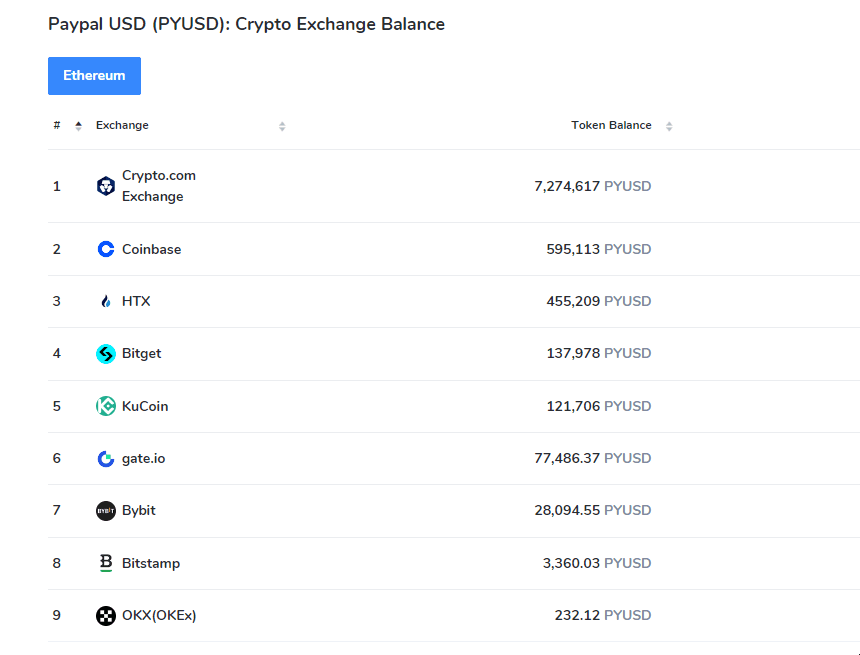

#2.3.1 Supported CEXs and DEXs

PYUSD supported CEXs with balances, as of March 25:

Source: CoinCarp | Date: 3/25/2024

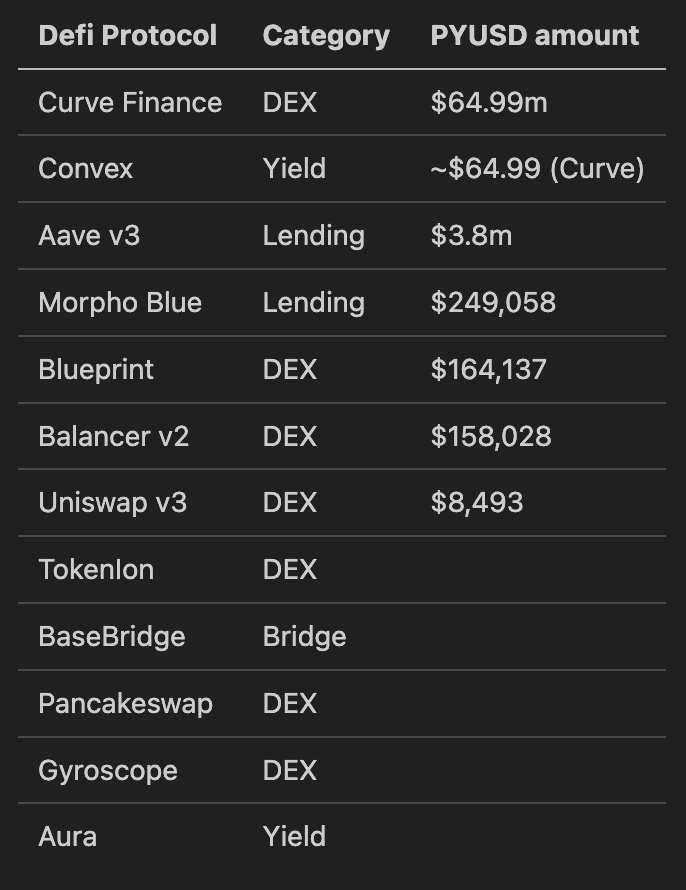

For DEXs, PYUSD is supported by Curve Finance, Uniswap, Balancer and Pancakeswap.

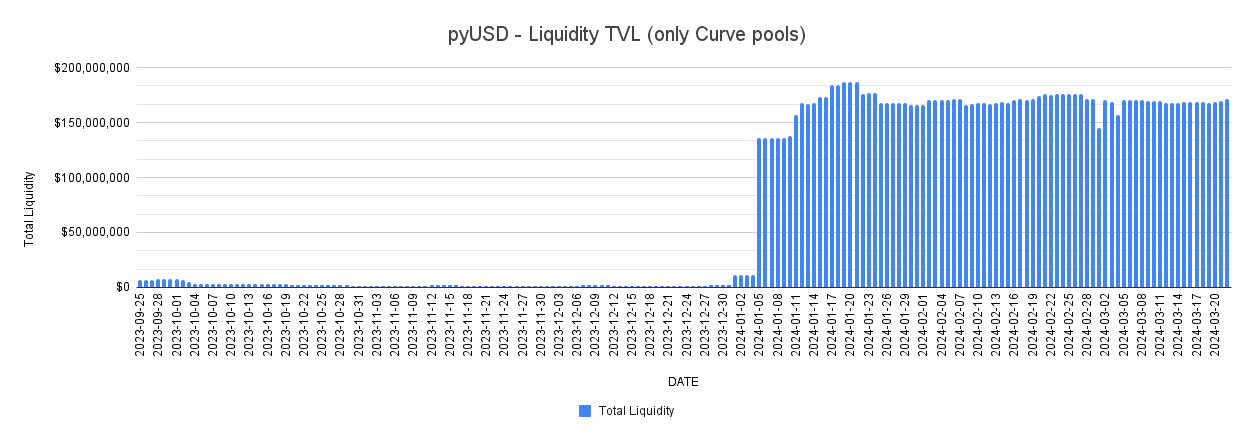

#2.3.2 On-chain Liquidity TVL

Liquidity TVL measures the total amount of assets deposited in a stablecoin's liquidity pools. Liquidity Depth assesses the price impact and slippage for large transactions.

At this point, almost all PYUSD on-chain liquidity is on Curve. Therefore the chart below shows on-chain TVL in Curve pools:

Source: Defi Llama | Date: 3/25/2024

#2.3.3 Liquidity Pool Distribution

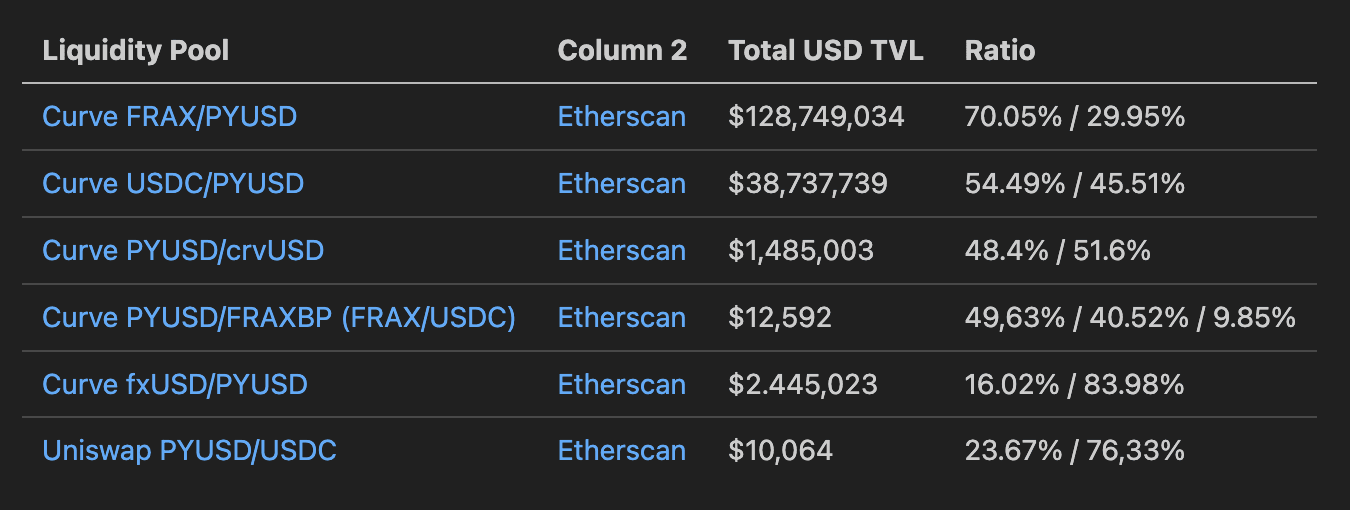

As of late March, the vast majority of PYUSD on-chain liquidity is concentrated in a handful of Curve pools.

Source: Curve.fi and Etherscan | Date: 3/22/2024

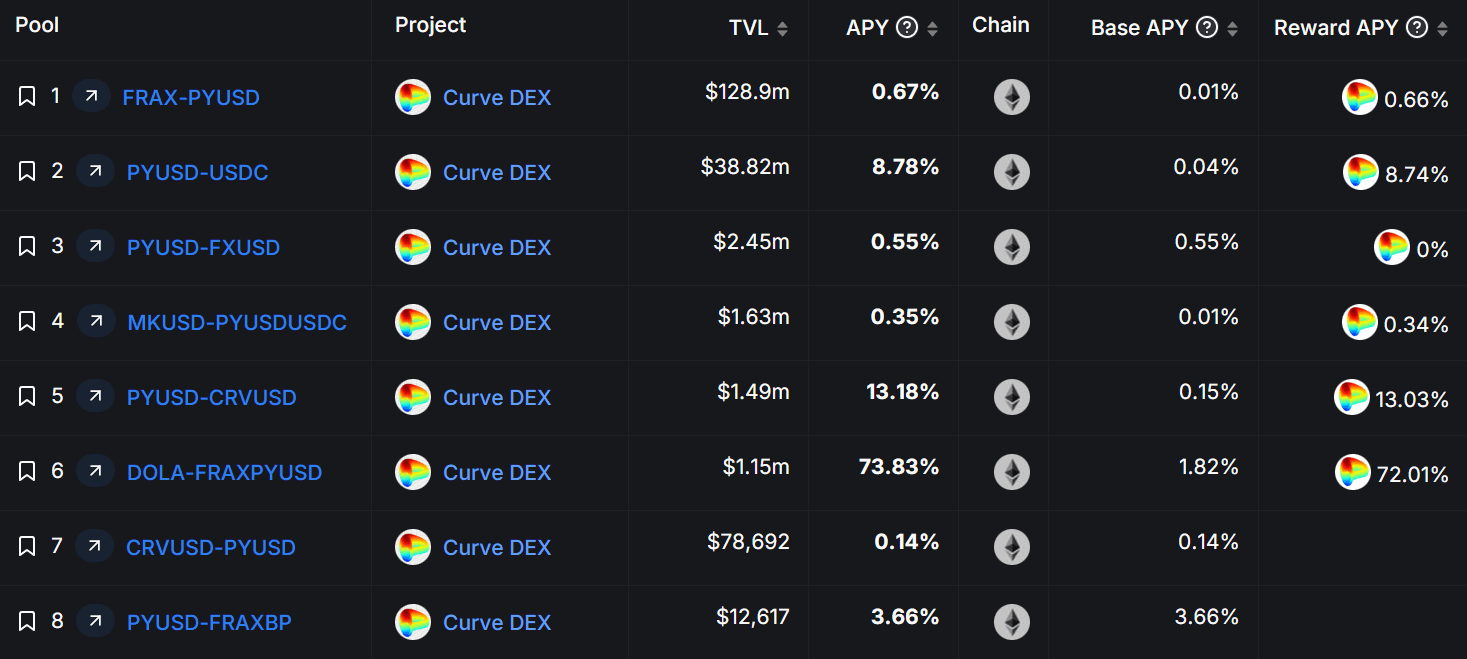

#2.3.4 Liquidity Incentives and Yield

PYUSD liquidity is incentivized only on Curve Finance. The most incentivized PYUSD pools are "Paypool" and FRAXPYUSD liquidity pools because those pools are used as a base for mkUSD-Paypool (8.74% + 0.34% APY in CRV) and DOLA-FRAXPYUSD (0.66% + 72.01% APY in CRV) metapools.

Source: Defi Llama | Date: 3/22/2024

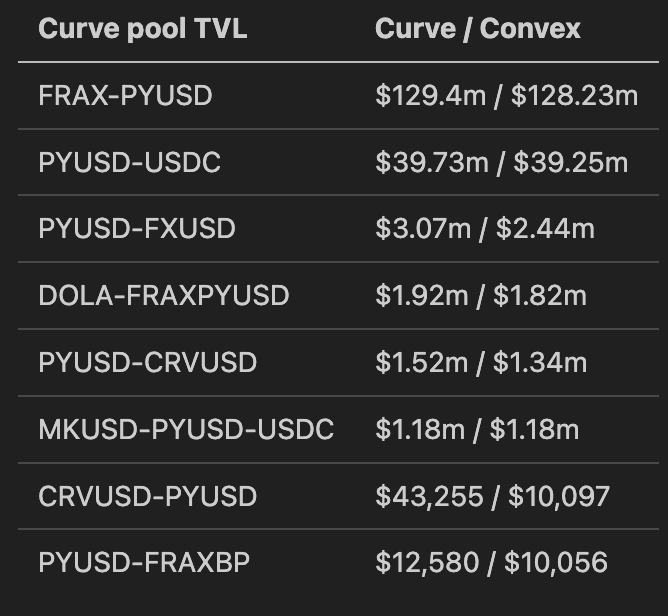

Each of 6 liquidity pools and 2 metapools on image above also can be locked in yield optimizers such as Convex or StakeDAO (reward APY). In the table below, it is possible check the amount of Curve liquidity deposited in Convex for generating extra yield.

Source: Defi Llama | Date: 3/22/2024

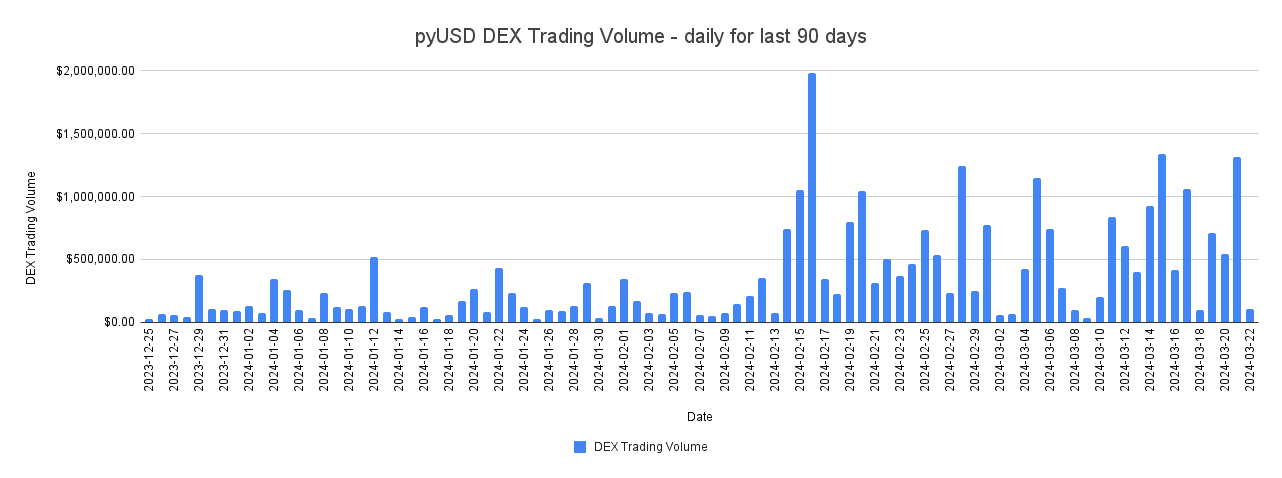

#2.3.5 DEX Trading Volume

PYUSD daily on-chain trading volume for a 90 days period:

Source: Bitquery | Date: 3/25/2024

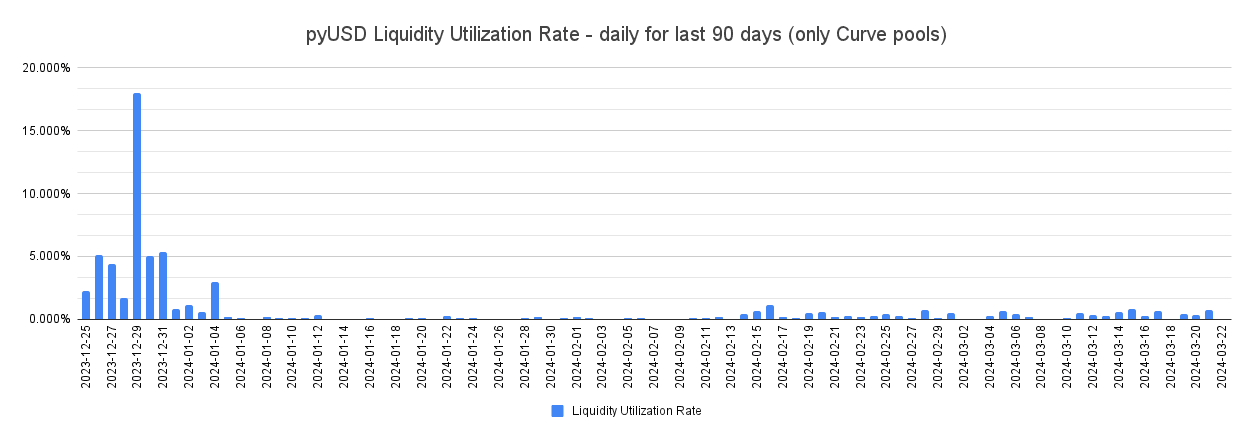

#2.3.6 Liquidity Utilization Rate

This measures the ratio of on-chain volume to liquidity TVL over a 90 day period. Because the vast majority of on-chain liquidity is concentrated on Curve, the chart below accounts for liquidity utilization of Curve pools.

Source: Defi Llama and Bitquery | Date: 3/25/2024

#2.3.7 Stablecoin Usage in DeFi

This shows stablecoin usage in lending platforms and yield farming strategies. This includes "Money Market" CDP protocols, yield farming strategies, and DEXs.

Source: DefiLlama | Date: 3/22/2024

#2.3.8 Net Cross-Chain Flow

Stablecoin bridged- quantity over time categorized by network.

According to data from DefiLlama, the total PYUSD supply exists only on Ethereum.

#Section 3: On-chain Management

This section addresses the technological properties of the stablecoin. It aims to convey, (1) how is the on-chain system architected and where can technological risk arise, and (2) historical performance metrics involving the stablecoin's development and security.

This section is divided into 2 sub-sections:

-

3.1: Operational Overview

-

3.2: Development and Security Metrics

#3.1 Operational Overview

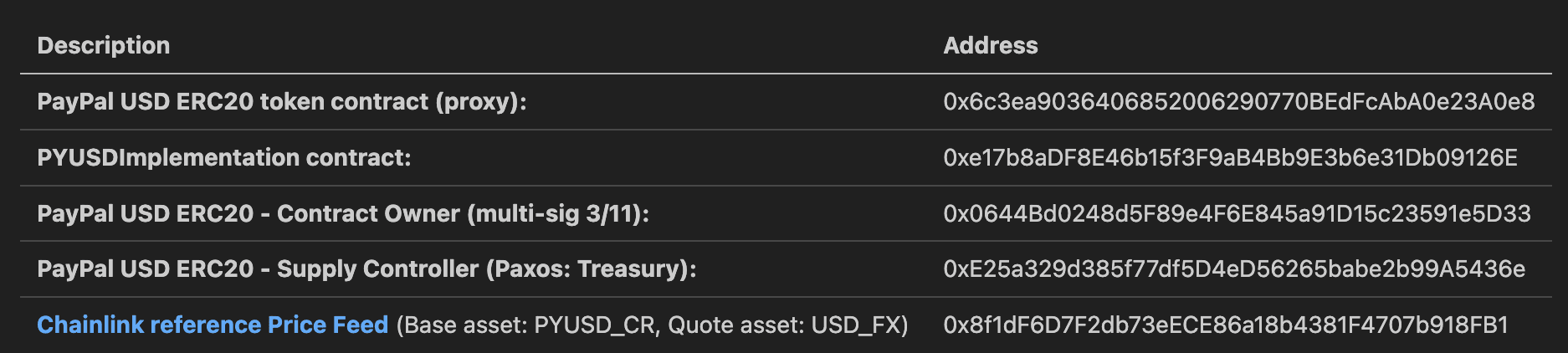

#3.1.1 Smart Contracts

Provided is a description of the technical on-chain architecture of the stablecoin, including supported chains and any associated contracts.

PayPal USD smart contracts and addresses:

Chainlink reference Price Feed

The PYUSD stablecoin smart contract shares its codebase with other Paxos-issued stablecoins such as USDP and BUSD. The primary distinction lies in the precision of the token; PYUSD is configured with 6 decimal points, aligning with banking standards, whereas the common template for others like USDP specifies 18 decimal points in accordance with Ethereum's conventions.

Source: ContractReader PYUSDImplementation

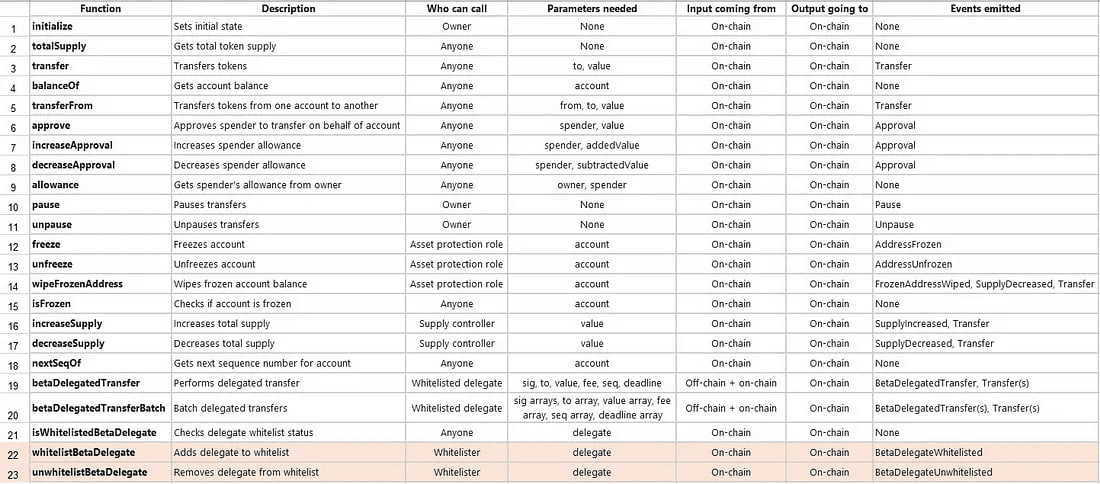

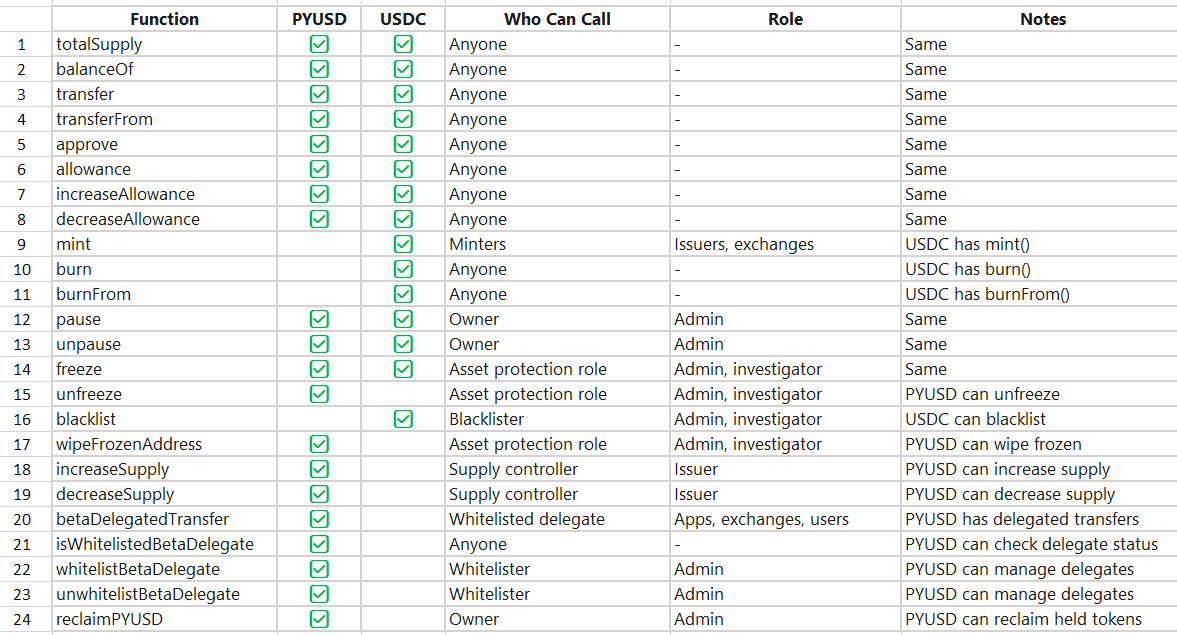

The table below lists all PYUSD contract functions, their description, callers, parameters, flow input-output and emitted events:

Source: Medium article

PYUSD and USDC comparison:

Source: Medium article

#3.1.2 Dependencies

Dependencies include any external components of the stablecoin design that introduce additional risk or trust assumptions e.g. a proof of reserves oracle.

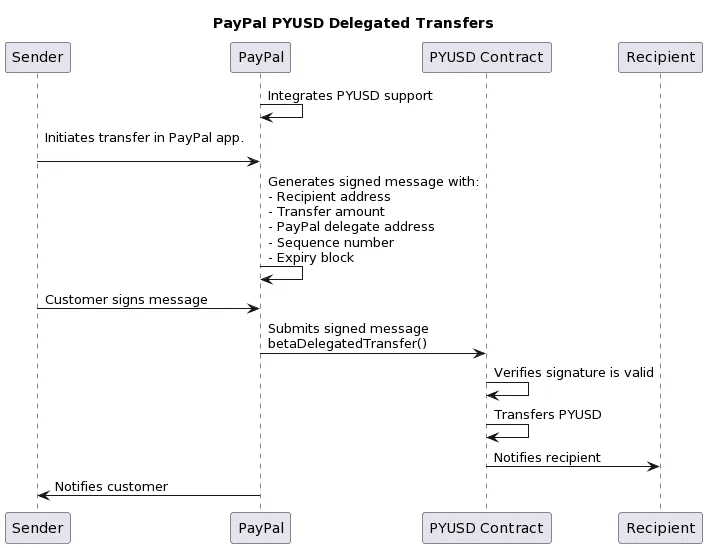

Beta Delegate Transfer and Whitelist function in PayPal USD contract allows a token owner to generate an off-chain signed "voucher" and represent that as a "transaction proof" to another account owner (probably receiver). The idea behind that function isn't new because it was implemented in USDP and BUSD contracts by Paxos (same template).

The scheme below is a representation of how off-chain authorization for on-chain transactions could work with the PayPal application as a trusted party:

Source: Medium article

In this case, the PayPal app will represent additional risk, but only if the Beta Delegate function is activated (at the moment, the function isn't activated).

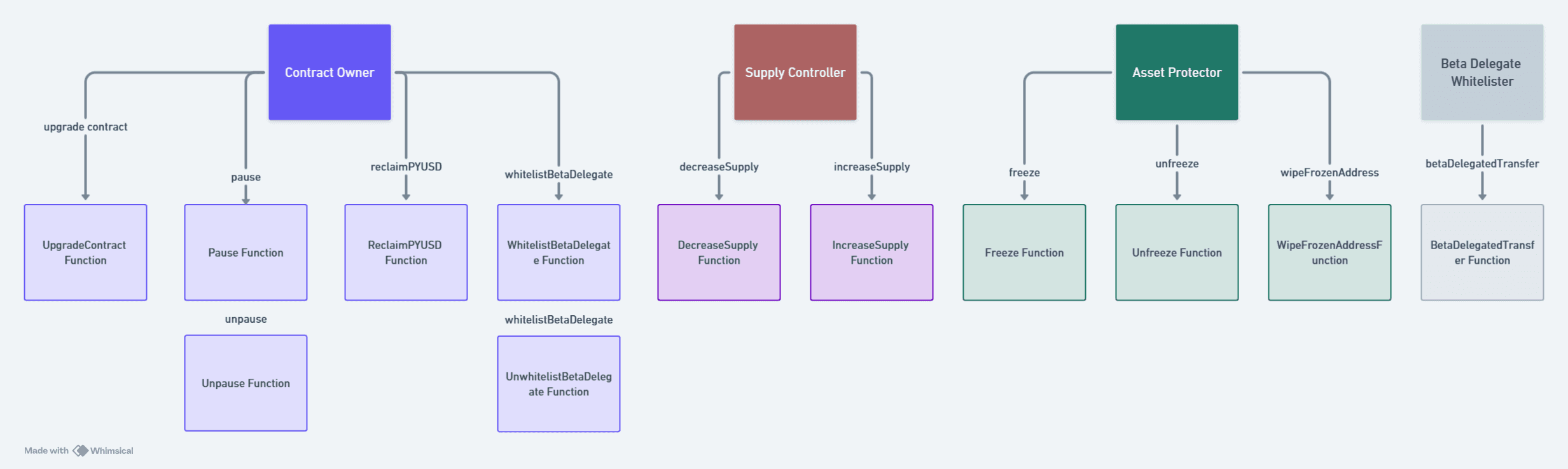

#3.1.3 Access Control

PayPal USD ERC20 smart contract has implemented the following roles:

-

Contract Owner (0x0644Bd0248d5F89e4F6E845a91D15c23591e5D33 multisig)

-

Upgradability - owner can upgrade the contract.

-

Pausability - contract owner has ability to pause and unpause transactions .

-

Asset Protection - contract owner can freeze the assets of any account and destroy account.

-

-

Supply Control (0xE25a329d385f77df5D4eD56265babe2b99A5436e) - manage total supply of PYUSD tokens. That address has authority to mint and burn tokens according to reserve funds movement (Held by Paxos Trust Company)

-

Beta Delegate Transfer and Whitelist - this role decides who will get delegate transfer functionality and serves only for gasless transaction purposes.

Source: Etherscan

#3.1.4 Contracts Architecture Diagram

Below is a visual diagram of the technical on-chain architecture of the stablecoin, including any associated contracts, privileged roles managing the stablecoin, and typical operations.

Source: GitHub

#3.2 Development and Security Metrics

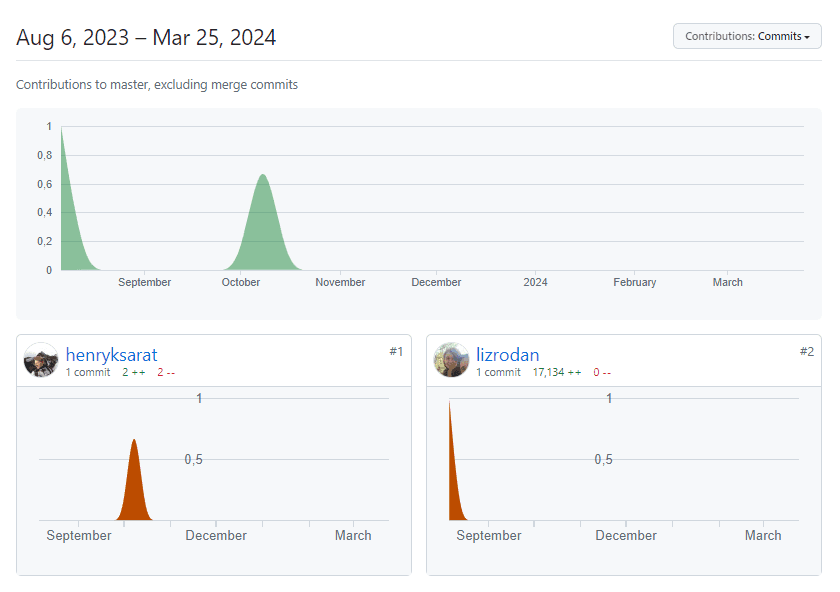

#3.2.1 Development Activity

Development activity Includes frequency and volume of code commits, merges, and updates in the stablecoin's repository.

After PYUSD contract deployment in August, the only activity in the PYUSD repository was to update the Trail of Bits audit in October:

Source: Github

#3.2.2 Number of Active Developers

The PYUSD Github repository has 2 contributors (visible in 3.2.1 sub-section above).

#3.2.3 Documentation Quality

Observations about the quality and comprehensiveness of technical documentation.

Given that it is a fairly simple codebase with a standard ERC20 smart contract that was already implemented with other Paxos stablecoins, technical documentation is comprehensive. Below are links with detailed technical documentation for PayPal USD:

#3.2.4 Upgrade Frequency

PYUSD was initially implemented as XYZImplementation on August 3, 2023, and 4 days later (August 7, 2023) was upgraded to PYUSDImplementation.

#3.2.5 Smart Contract Audits

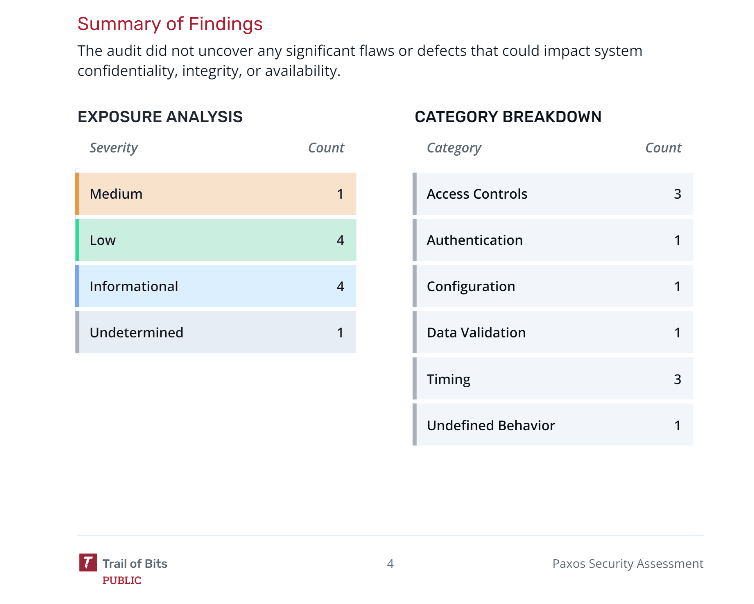

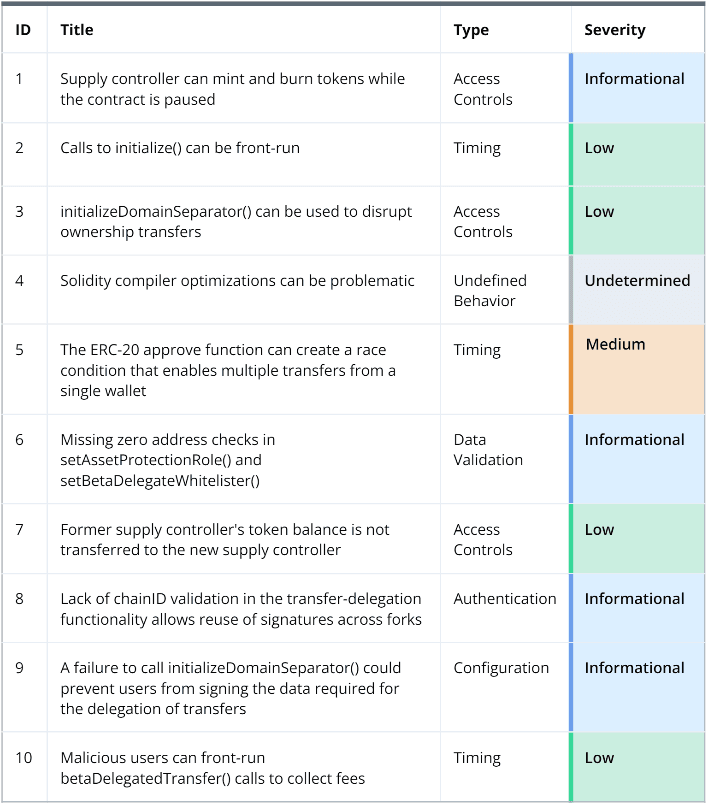

Between the 12th and 16th of December 2022, Trail-of-Bits provided security audit and review of PayPal USD (PYUSD) token contract. The audit didn't uncover any significant flaws. In the image below can be seen an audit summary and table:

Source: Trail of Bits Audit Report

#3.2.6 Known Vulnerabilities Count

Paxos documentation recommends using increaseApproval and decreaseApproval functions for transferFrom rather than a standard approve function. In that way, it's possible to avoid attack vectors in the standard approve function.

That potential vulnerability was also pointed out in the Trail-of-Bits audit: check section 3.2.5, number 5 in the table, categorized as "Medium".

#3.2.7 Bug Bounty Program Size

There is no bug bounty program for PYUSD contract(s).

#3.2.8 Historical Downtime

Paxos hasn't experienced any network downtime or similar problems that can potentially negatively affect mint or redeem.

#Section 4: Regulation and Compliance

This section addresses the extent of consumer protections from a regulatory perspective. The reader should get a clear idea of (1) the solvency and transparency assurances provided by reserves management requirements, and (2) the current state and historical track record of the issuer's regulatory compliance.

This section is divided into 2 sub-sections:

-

4.1: Reserves Management

-

4.2: Regulations

Under the NYDFS supervision, Paxos is obligated to comply with fundamental regulations specifically designed for issuing US dollar-backed stablecoins. The NYDFS pays particular attention to three critical areas: the ability to redeem stablecoins, the reserves underpinning these stablecoins, and the verification of these reserves' sufficiency to back the issued stablecoins.

The sections below examine each area under regulatory scrutiny against the current implementation of these guidelines.

#4.1 Reserves Management

#4.1.1 Reserve Assets

- The stablecoin must be fully backed by a Reserve of assets, meaning that the market value of the Reserve is at least equal to the nominal value of all outstanding units of the stablecoin as of the end of each business day

NYDFS Guidance on the Issuance of U.S. Dollar-Backed Stablecoins

Paxos US Dollar-Backed Stablecoin Terms and Conditions ("Stablecoin Terms") explicitly detail Paxos’s commitment to maintaining full collateralization of PYUSD with assets including U.S. dollar bank deposits, U.S. Treasuries backed by the unequivocal guarantee of the United States Government, and U.S. Treasury reverse repurchase agreements, all safeguarded by Paxos for the direct advantage of PYUSD holders. The funds are held in separate custodial accounts within U.S. banks, or they are backed by debt instruments.

The U.S. dollars utilized for purchasing USD Stablecoins are either placed in FDIC-insured depository banks within the U.S. or are invested in the debt instruments. This strategy ensures a strict one-to-one correspondence between each USD Stablecoin and an equivalent amount of U.S. dollar deposits or the nominal value of the debt instruments. For instance, if a user buys five PYUSD with five U.S. dollars, Paxos Trust, acting as a custodian, will secure those five U.S. dollars in a bank account or in the form of debt instruments' face value, thereby backing the issuance of the five PYUSD in circulation.

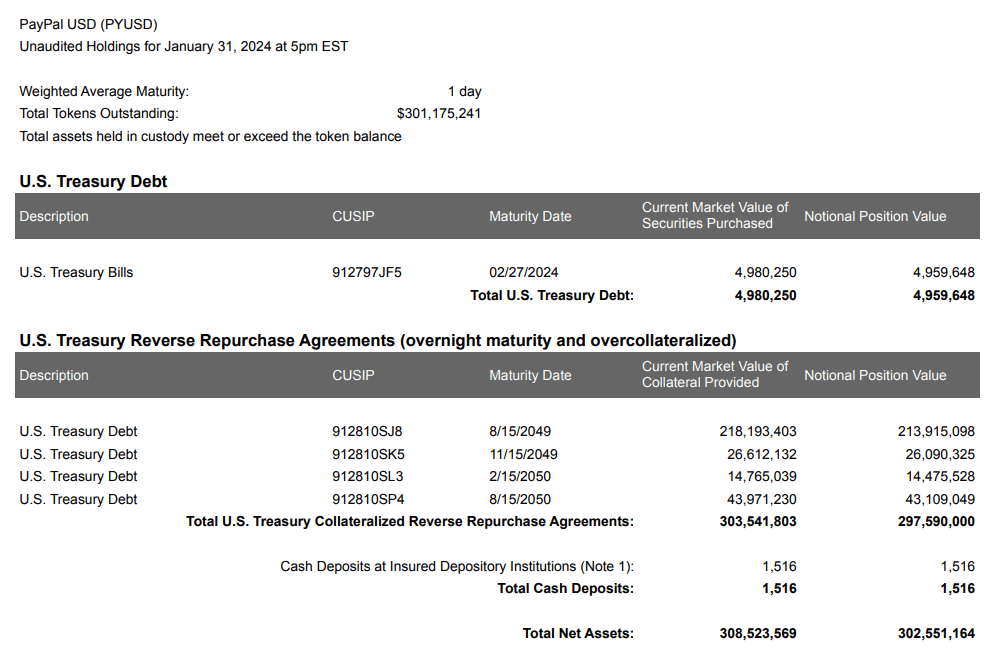

Paxos self-reports its portfolio composition 5 business days after the month’s end; these reports have not been subjected to independent review. The most recent reports published (Oct 2023-Jan 2024) indicate overcollaterization of PYUSD - total assets held in custody exceed the token balance

#4.1.2 Overcollateralization Buffer

Is there an overcollateralization buffer. If so how much? Is it mandated by the regulatory regime? Any other "insurance pool"?

N/A

#4.1.3 Custody of Reserves

- The assets in the Reserve must be segregated from the proprietary assets of the issuing entity, and must be held in custody with (i) U.S. state or federally chartered depository institutions with deposits insured by the Federal Deposit Insurance Corporation (“FDIC”) and/or (ii) asset custodians, approved in advance in writing by DFS. The Reserve assets shall be held at these depository institutions and custodians for the benefit of the holders of the stablecoin, with appropriate titling of accounts.

NYDFS Guidance on the Issuance of U.S. Dollar-Backed Stablecoins

Paxos discloses the financial institutions in which it holds accounts covered by the FDIC:

-

BMO Harris Bank N.A., under FDIC Certificate #16571;

-

Customers Bank, with FDIC Certificate #34444;

-

State Street Bank and Trust Company, designated by FDIC Certificate #14.

These institutions provide Paxos with FDIC-insured omnibus and stablecoin-specific deposit accounts. The principal account, designated for holding fiat currency, benefits from FDIC insurance protection, ensuring coverage up to $250,000 per account ownership category.

- The Reserve shall consist only of the following assets: (a) U.S. Treasury bills acquired by the Issuer three months or less from their respective maturities; (b) Reverse repurchase agreements fully collateralized by U.S. Treasury bills, U.S. Treasury notes, and/or U.S. Treasury bonds on an overnight basis, subject to DFS-approved requirements concerning overcollateralization; (c) Government money-market funds; (d)Deposit accounts at U.S. state or federally chartered depository institutions

NYDFS Guidance on the Issuance of U.S. Dollar-Backed Stablecoins

The January report indicates that the asset portfolio remains primarily comprised of US Treasury Repo Agreements, with a considerably smaller allocation in US Treasury bills and minimal cash holdings. This asset mix aligns with the regulatory standards established by the NYDFS.

Source: PYUSD Monthly Stablecoin Reporting (January 2024)

The specific custodians managing the U.S. Treasury Debt and U.S. Treasury Reverse Repurchase Agreements have not been disclosed in the routine self-reporting documentation. The absence of such disclosure is not deemed to elevate risk, provided that the issuer adheres to the regulatory expectations set forth by their prudential regulator. Nonetheless, transparency regarding the custodianship entities could enhance user trust, particularly if the custodian's institutional rating were made known.

#4.1.4 Payment Rails

- The issuer of the stablecoin must adopt clear, conspicuous redemption policies, approved in advance by DFS in writing, that confer on any lawful holder of the stablecoin a right to redeem units of the stablecoin from the Issuer in a timely fashion at par — i.e., at a 1:1 exchange rate for the U.S. dollar, net of ordinary, well-disclosed fees — subject to reasonable, non-burdensome conditions including otherwise applicable legal or regulatory requirements, such as the ability of the stablecoin holder to onboard successfully with the Issuer before redeeming.

NYDFS Guidance on the Issuance of U.S. Dollar-Backed Stablecoins

The utilization and provision of the PayPal stablecoin are governed by the US Dollar-Backed Stablecoin Terms and Conditions ("Stablecoin Terms"), which serve as an integral supplement to the General Terms and Conditions set forth by Paxos.

Paxos manages the issuance and redemption of PYUSD via its proprietary online platform, accessible solely to verified members. These members are categorized into two distinct groups: Member Token Holders, encompassing registered users engaged in activities such as purchasing, selling, converting, redeeming, holding, or transferring PYUSD, and Non-Member Token Holders, encompassing third parties, non-members engaged in the purchase, sale, or holding of PYUSD, irrespective of whether these transactions occur through the platform.

At present, institutional account holders exclusively enjoy bidirectional access to the stablecoin without incurring any fees, benefiting from unrestricted liquidity and guaranteed 1:1 redemption capabilities.

Paxos commits to expediently redeeming PYUSD, employing commercially reasonable efforts to credit the redemption amount to the member's account within one business day, contingent upon the successful completion of Compliance checks and adherence to the specified redemption timetable.

As of this report's publication, no fees are imposed for the redemption of stablecoins in accordance with the Stablecoin Terms. Nevertheless, Paxos retains the prerogative to set a minimum redemption threshold, subject to modifications over time, corresponding to the minimum wire transfer fee levied by banks.

The redemption protocol adheres to NYDFS stipulated guidelines, recognizing a redemption in USD as executed upon the issuer's initiation of the outbound transfer of funds to the holder’s designated financial institution or the crediting of said funds to the holder's cash account with the issuer, upon the holder's request. Furthermore, "timely" redemption is defined as a process completed within two full business days ("T+2") subsequent to the business day on which a "compliant redemption order" is received, denoting the day on which (A) Paxos receives a redemption request, and (B) the holder has successfully completed the onboarding process with Paxos, satisfying all prerequisites for a compliant redemption.

#4.1.5 Attestations

Every month, an independent Certified Public Accountant (CPA) who is licensed in the US must check and confirm the details about the Reserve. The review includes verifying the total value and types of assets in the Reserve, the number of stablecoins in circulation, and ensuring that the Reserve has enough assets to back all issued stablecoins. The CPA also checks whether all rules set by NYDFS for the Reserve are followed.

Besides the monthly checks, there is a requirement for an annual review by an independent CPA. This yearly check is more about making sure the issuer's internal controls and procedures are up to scratch, ensuring compliance with NYDFS requirements.

The issuer must share the CPA's monthly reports with the public and send them to DFS within 30 days after each month ends. The annual report needs to be sent to NYDFS within 120 days after the year ends.

Attestation reports for Paxos are issued by WithumSmith+Brown PC, an independent third-party accounting firm. According to their official statement, Withum conducts its examinations based on the attestation principles set forth by the American Institute of Certified Public Accountants (AICPA). Their appointment as Paxos’ examination provider has been approved by Paxos’ prudential regulator NYDFS.

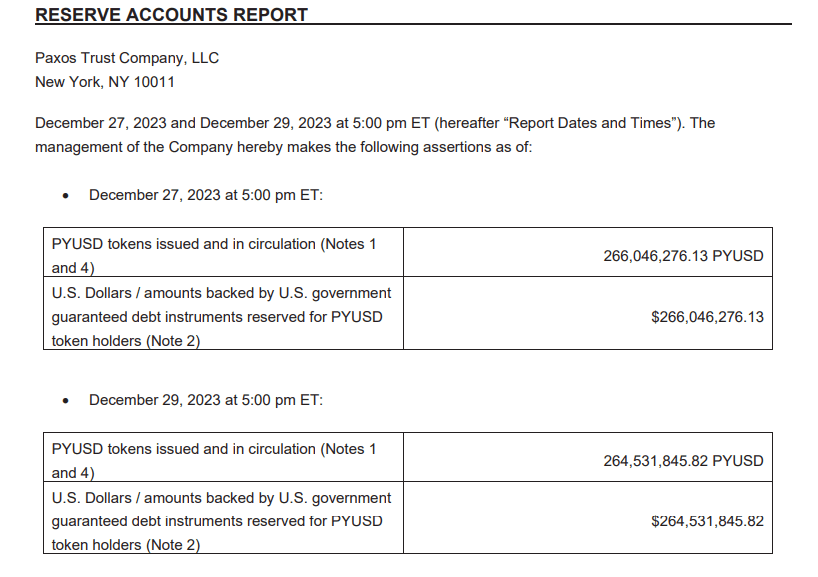

Five different attestations have been published for the period August 2023 - December 2023. In line with the guidelines, each report specifically lists the conditions checked during the review. The expressed examination opinion on the assertions is limited solely to the Reserve Accounts Report at the respective Report Date and Time.

Source: Attestation December 2023

#4.1.6 Collateral in the context of Basel III

The Basel III framework, a set of comprehensive reform measures established by the Basel Committee on Banking Supervision (BCBS)—with the United States as a contributing member—aims to enhance the banking sector's regulation, supervision, and risk management. Since its inception in 1988 through various accords and publications, the BCBS has been pivotal in setting international regulatory capital standards. Basel III, in particular, focuses on critical liquidity and capital reforms to fortify the banking industry's resilience.

Under the Basel III framework, assets qualify as High-Quality Liquid Assets (HQLA) if they can be swiftly and reliably converted into cash with minimal or no loss in value. The liquidity level of an asset is influenced by the specific stress scenario applied, the volume of assets being liquidated, and the considered timeframe. Key attributes that define HQLA include:

a) Low risk: The liquidity of an asset is bolstered by the issuer's high creditworthiness and minimal subordination. Attributes such as short duration, reduced legal and inflation risks, and denomination in a convertible currency with minimal foreign exchange risk also contribute to an asset's liquidity profile.

b) Ease and certainty of valuation: An asset's liquidity is enhanced when there is a consensus among market participants regarding its valuation.

c) Low correlation with risky assets: High-quality liquid assets should not exhibit a significant correlation with riskier assets, avoiding what is known as wrong-way risk.

d) Listing on a developed and recognized exchange: A listing on such an exchange increases the transparency and perceived liquidity of an asset.

The Basel Committee categorizes Level 1 assets as the highest tier of liquidity, representing the most secure category of assets within a bank's liquidity pool. These assets are not subject to haircuts within the Liquidity Coverage Ratio calculations.

Level 1 assets include coins and banknotes, central bank reserves (when central bank policies permit their use in stress conditions), and marketable securities backed or guaranteed by sovereigns, central banks, public sector entities (PSEs), the Bank for International Settlements, the International Monetary Fund, among others, provided these securities meet specific criteria.

In this context, the collateral backing PYUSD is exclusively comprised of assets that meet the Basel III criteria for high-quality liquid assets, ensuring robustness and stability in line with international banking standards.

#4.2 Regulations

#4.2.1 License

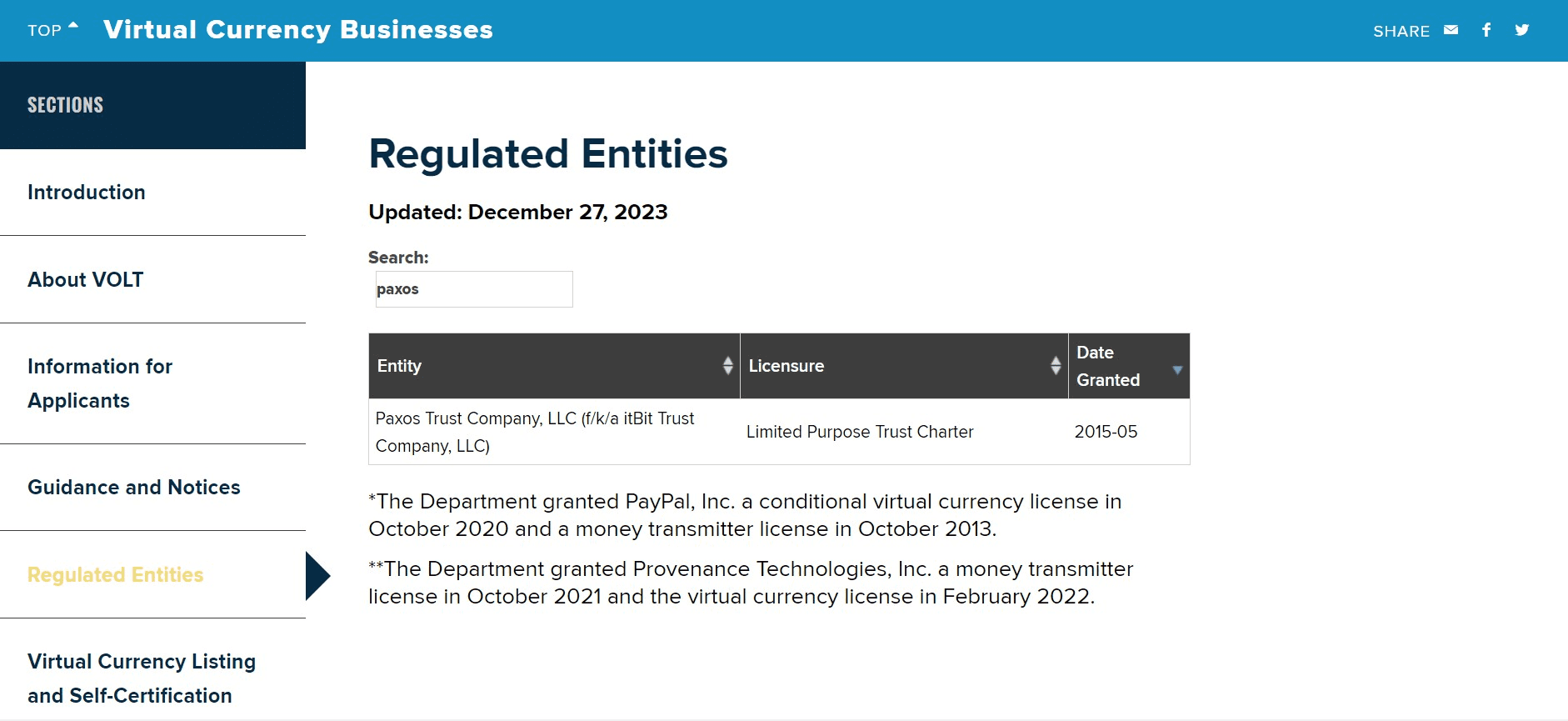

Paxos Trust Company LLC operates under the strict oversight of the New York State Department of Financial Services (NYDFS), serving as its principal regulatory body. The level of supervision ensures that every facet of Paxos Trust’s activities meets regulatory standards.

Unlike typical corporations or limited liability companies, a trust company is established by statute and endowed with unique powers not available to other business forms. Such entities are empowered to manage assets for their clients in a fiduciary capacity, a role that requires them to prioritize their clients' interests above their own, a responsibility not commonly held by other business structures, except banks. This fiduciary authority grants trust companies a significant advantage in conducting business.

A key requirement for trust companies is the separation of client assets from the company's own assets, offering a layer of protection against claims by the trust company’s creditors. The designation of a “limited purpose trust company” indicates a special charter under New York Banking Law, allowing these entities to operate under specific conditions without engaging in traditional banking activities like accepting deposits or issuing loans.

Paxos Trust stands out due to its regulatory framework and adherence to New York Banking Law, distinguishing it from standard LLCs. Should Paxos Trust face insolvency, it wouldn’t undergo typical bankruptcy processes. Instead, under the direction of the NYDFS Superintendent, assets under Paxos Trust’s custody which should be separated from any corporate funds by design, would be directly returned to their rightful owners based on the company’s records.

During the insolvency proceedings under New York Banking Law, the Superintendent plays a crucial role in managing the liquidation and conservation of assets for banking organizations, including trust companies. The Superintendent is authorized to take control of the organization, liquidate its affairs, and take necessary actions to conserve its assets and business. This includes the ability to sell, assign, compromise, or dispose of bad or doubtful debts, as well as real and personal property, in effort to maximize the value returned to creditors and depositors while preserving the trust company's assets.

#Recognition from Other Regulators

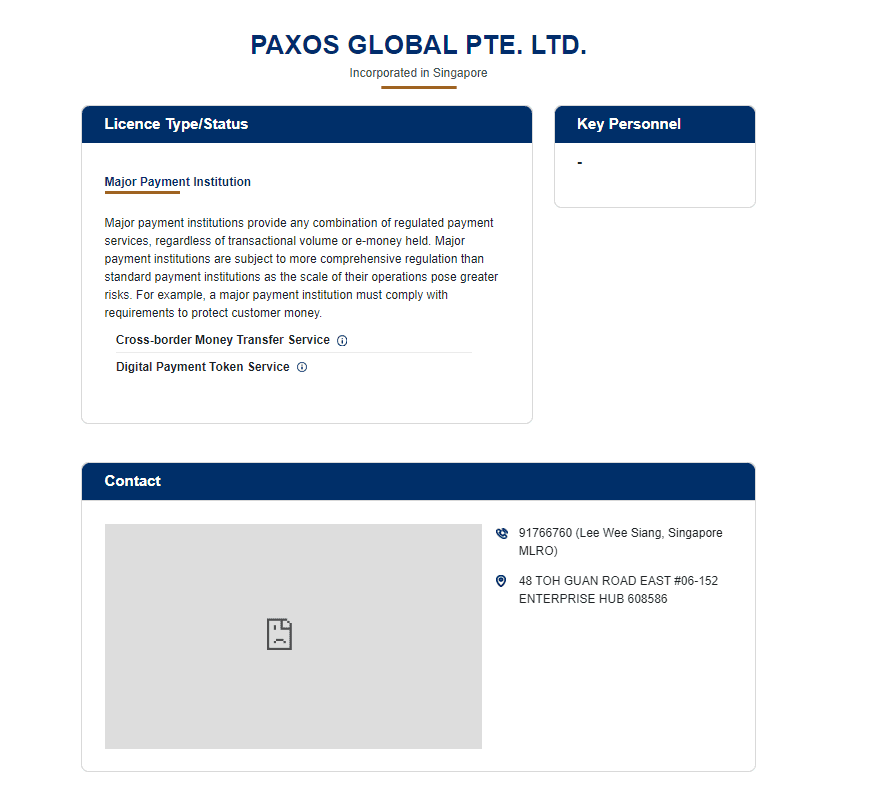

Paxos Global Pte. Ltd., incorporated in Singapore, has been granted a Major Payment Institution License by the Monetary Authority of Singapore (MAS), allowing it to offer Cross-border Money Transfer Services, including both inbound and outbound remittance services, and Digital Payment Token Services, which encompass buying or selling digital payment tokens, or providing a platform for the exchange of digital payment tokens.

Source: Monetary Authority of Singapore

Further advancing its regulatory standing, on November 15, 2023, Paxos's new entity, Paxos Digital Singapore Pte. Ltd., received in-principle approval from MAS to offer digital payment token services. This approval positions Paxos Digital Singapore to launch a new US dollar stablecoin, recognized by MAS as being in substantial compliance with its forthcoming stablecoin regulatory framework, ahead of the formal introduction of this legislative framework. With the eventual full approval, Paxos will have the capability to collaborate with enterprise clients in Singapore to issue USD-backed stablecoin, marking a significant step in its regulatory engagementnexpansion.

#4.2.2 Enforcement Actions/Lawsuits

In addition to SEC subpoena (discussed in History section above), PayPal reported receiving a civil investigative demand from the Consumer Financial Protection Bureau (CFPB) in October, focusing on company's obligations under Regulation E regarding investigation and error-resolution and the presentation of transactions to linked bank accounts. In mandatory SEC disclosures, PayPal affirmed cooperation with the CFPB in connection with this inquiry.

#4.2.3 Legal Opinion

Has the issuer obtained legal counsel or legal memoranda on the regulatory standing of the stablecoin or an explanation of the same from the perspective of any jurisdiction?

N/A

#4.2.4 Sanctions Compliance

Specific details of PayPal's sanctions screening scope, restricted jurisdictions, and active blacklist functionality are not publicly available. In 2022 the U.S. Treasury Department fined PayPal £5M for inadequate sanctions screening, which allowed payments violating sanctions against Iran, Cuba, and Sudan. In response, PayPal reportedly has taken steps to improve the real-time screening of payments.

Similar to PayPal, Paxos does not publicly disclose the specifics of implemented compliance measures. Bank Secrecy Act/anti-money-laundering (“BSA/AML”) and sanctions compliance program of Paxos are thorougly vetted by the supervising authority. NYDFS may further impose requirements on the issuer to address deficiencies, consistent with the ongoing monitoring carried out by the agency.

#4.2.5 User Restrictions

Currently, there are no specific restrictions on qualified or accredited investors for using PYUSD. The stablecoin is available to all eligible PayPal users who have undergone the standard AML/KYC checks.

#4.2.6 Restrictions for Illegal Use

If investigations reveal a user's PYUSD are linked to illegal or sanctioned activities, Paxos may deny redemption and potentially forfeit those stablecoins and their backing US dollars.

Paxos can freeze access to stablecoins and their US dollar backing, temporarily or permanently, without prior notice.

PayPal USD and their backing funds may be seized or forfeited by law enforcement, with Paxos complying with such legal orders. Affected stablecoins or funds could become permanently lost or destroyed.

These terms apply to all PYUSD holders, regardless of Paxos membership status, i.e being verified or not.

#4.2.7 Customer Protection

For the avoidance of doubt, the Issuer highlights in the Stablecoin Terms that PYUSD along with other USD Stablecoins are not FDIC insured. Paxos maintains separate fiat cash depository accounts in its name for the exclusive benefit of both Member and Non-Member Token Holders, distinct from its operational accounts. The primary account is FDIC insured up to $250,000 per ownership category. Additionally, Paxos has secured private uninsured deposit insurance, but not all deposits are covered, posing a risk of loss in case of bank failure.

Paxos offers an option for users to opt into FDIC "pass-through" deposit insurance, which can cover the fiat cash portion of the reserve account backing their stablecoins, up to the FDIC's insurance limits. This insurance safeguards against losses due to the failure of insured banks but does not cover Paxos's insolvency. Assets held by Paxos Trust are protected under New York banking law, ensuring they remain separate in the event of Paxos Trust's insolvency. However, reserves held in U.S. Treasury bills or related money-market funds are not eligible for this insurance.

To benefit from the coverage, users must opt-in and satisfy all related conditions, but the single consent does not guarantee FDIC coverage, as it also depends on the user's total insured deposits held at the bank. Not all reserves backing PYUSD qualify for FDIC insurance. The availability of FDIC insurance may be affected if users cannot verify their ownership of stablecoins, hold stablecoins in an omnibus account, or transfer coins after opting in.

Non-member token holders who do not opt in will not have direct access to "pass-through" deposit insurance through Paxos for deposits backing their PYUSD.

#Section 5: Pegkeeper Suitability

This section concludes the review of the pegkeeper asset by conducting comparative analysis with the existing pegkeeper assets. The aim it to diversify the pegkeeper basket without introducing undue risk. Finally, we provide a pegkeeper score and onboarding recommendation.

This section is divided into 2 sub-sections:

-

5.1 Comparative Analysis of Pegkeeper Assets

-

5.2 Recommendation

#5.1 Comparative Analysis of Pegkeeper Assets

#5.1.1 Geographical Correlation

We conduct below a comparative analysis of the regulatory oversight applied to various stablecoins recognized as peg keeper assets, including USDT, USDC, TUSD, and USDP. The aim is to evaluate the geographical risk associated with reliance on a singular regulatory jurisdiction that could potentially become hostile or restrictive for business operations.

-

USDP, issued by Paxos Trust Co., headquartered in New York, USA, falls under the same regulatory framework as PayPal USD, with supervision from the New York State Department of Financial Services (NYDFS).

-

USDC, issued by Circle Internet Financial, LLC, headquartered in Boston, Massachusetts, USA, operates as a registered money services business under the Financial Crimes Enforcement Network (FinCEN) of the U.S. Treasury. USDC adheres to regulations pertinent to stored value or prepaid access within the ambit of U.S. state and territory money transmission laws. Furthermore, Circle is recognized as an Electronic Money Institution by the U.K.'s Financial Conduct Authority, a Major Payment Institution by the Monetary Authority of Singapore, and holds a Bermuda Digital Asset Business (DAB) License issued by the Bermuda Monetary Authority.

-

USDT, issued by Tether Ltd., a company incorporated in Hong Kong and fully owned by Tether Holdings Ltd., registered in the British Virgin Islands, does not come under the purview of any specific regulatory authority. Its FinCEN registration mandates adherence solely to anti-money laundering and know-your-customer protocols.

-

TUSD, currently unregulated, lacks transparency regarding the segregation of its assets from Techteryx, an Asia-based consortium that took over full management of TUSD in July 2023, following its acquisition from TrueCoin LLC (a subsidiary of Archblock, Inc.) in October 2020. Techteryx Ltd. is listed with the BVI Financial Services Commission, but detailed information about the consortium, its subsidiaries, and the ultimate beneficial ownership of TUSD remains scarce, fueling speculation.

The issuers of two out of the four pegkeeper assets, USDP and USDC, exhibit clear dependencies on the United States, attributable to their subjection to US regulatory frameworks. While incorporated outside the US, Tether also conscientiously aligns with AML/KYC requirements as mandated by US laws.

Despite branching out into international markets and securing licenses that harmonize with local laws and regulations, the issuers of USDP and USDC retain profound connections to the US. This affinity is logical, considering their stablecoin offerings are pegged to the US dollar. Yet, the potential for a seismic shift in the regulatory landscape that could render the US jurisdiction untenable for stablecoin operations remains unexplored. Likewise, the feasibility of these entities adapting to such changes by transitioning and restructuring their issuance processes under alternative legal regimes remains an untested hypothesis.

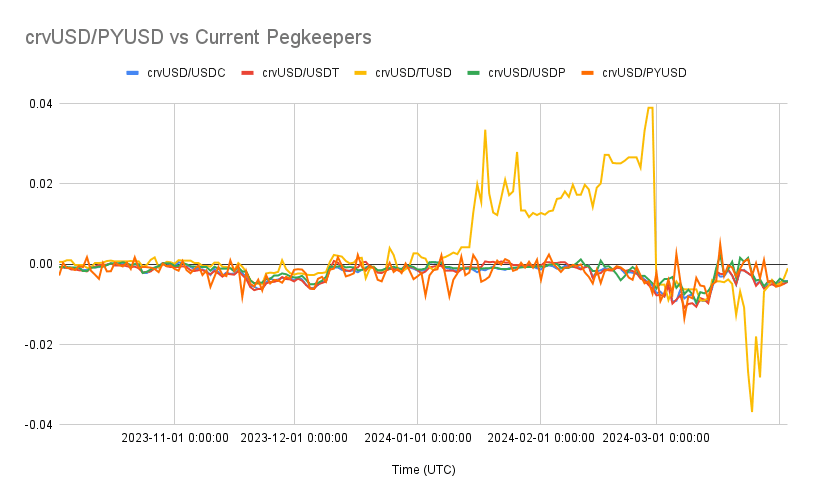

#5.1.2 Peg Stability

Below is a comparison of of the pegkeeper candidate's historical peg strength compared to the existing pegkeeper assets. Each stablecoin is priced against crvUSD. Minor periods of non-correlation may increase profit opportunity for the pegkeeper, but prolonged depeg events may result in excessive amounts of crvUSD entering circulation, having an adverse effect on the peg.

TUSD is a notable outlier for the other pegkeepers, including the PYUSD candidate, over the observed time period from 10/5/2023 - 4/2/2024.

Source: Intotheblock crvUSD dash and Coingecko

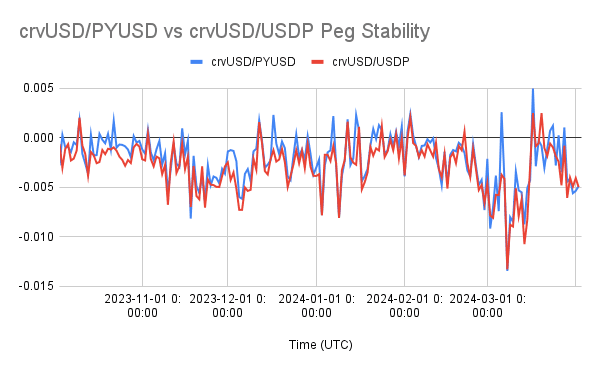

Since PYUSD and USDP are both issued by Paxos, the chart below compares the historical peg performance of those two stablecoins. Since these stablecoins have similar properties and exhibit highly correlated peg performance, it may be advisable to consider splitting the debt ceiling between these stables (i.e. reduce USDP debt ceiling and proportionally increase PYUSD debt ceiling).

Source: Intotheblock crvUSD dash and Coingecko

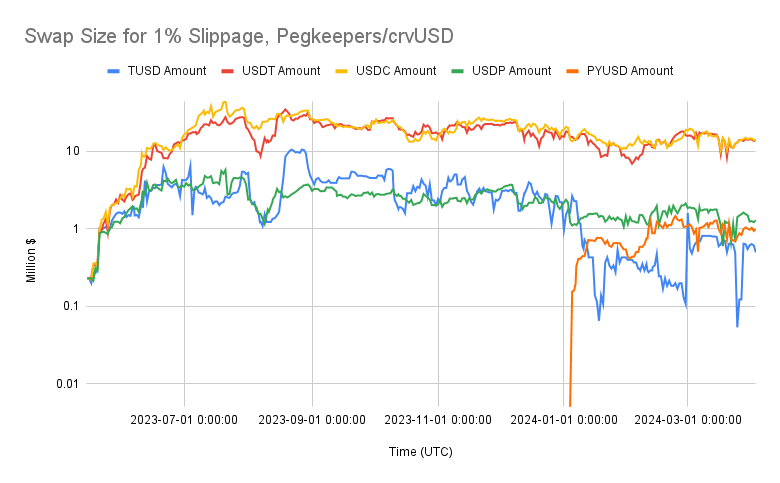

#5.1.3 Pegkeeper Pool Liquidity Depth

The existing pegkeeper pools (crvUSD/USDT, crvUSD/USDC, crvUSD/USDP, and crvUSD TUSD) and the candidate pegkeeper pool are compared by the swap size needed to produce 1% of slippage over time. The chart is in log scale due to the scale of the USDT/USDC crvUSD pools compared to the rest.

PYUSD has a much shorter history than the other pegkeepers, although it has quickly reached close to parity in liquidity depth compared to USDP and TUSD. The trend shows a relatively strong growth trend of PYUSD against USDP, further suggesting a reasonable case for transitioning some pegkeeper reliance from USDP to PYUSD.

Source: Intotheblock crvUSD dash

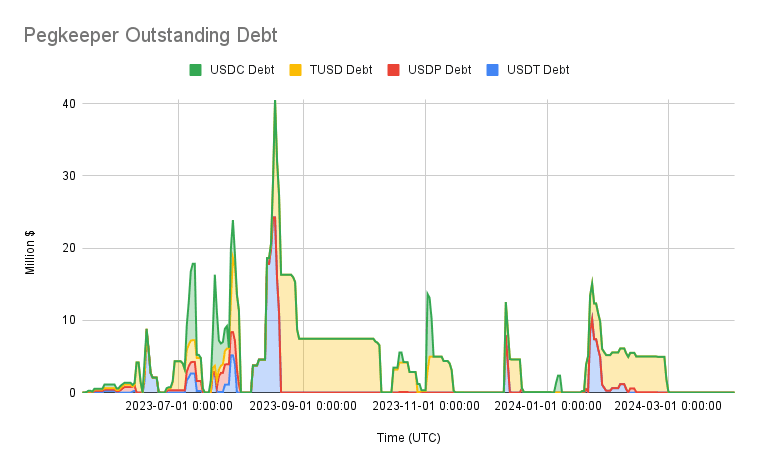

#5.1.4 Pegkeepers Utilization

Considering the correlations between PYUSD and USDP, it may be reasonable to assume similar pegkeeper behavior. The chart below shows outstanding pegkeeper debt by pegkeeper asset. USDC and USDT tend to have sharp infusions during periods of excess demand for crvUSD, whereas TUSD has historically extended periods of maintaining debt. This is attributable to its historical non-correlation with other pegkeeper assets.

USDP has, overall, had low debt utilization. At its peak debt, it utilized 12.8% of its total debt (3.22m of 25m on July 27, 2023). There may be periods of heightened demand for crvUSD that necessitate deployment of USDP pegkeeper debt, but its marginal size has limited its usefulness for pegkeeping, which has historically demanded short, intense spurts of liquidity infusions.

Source: Intotheblock crvUSD dash

It can be assumed that PYUSD, at its current level of adoption and pool robustness, may behave similarly as a pegkeeper. This may make it more suitable to be considered a secondary pegkeeper, at least until the stablecoin has had time to mature.

#5.2 Recommendation

PYUSD excels in its fundamental properties, including regulatory compliance. Paxos Trust Company LLC operates under the strict oversight of the New York State Department of Financial Services (NYDFS), one of the most stringent stablecoin regulatory regimes. The issuer has a mandate to meet proper transparency guidelines with regular reserves audits and allocations toward conservative and liquid assets, including short-term U.S. Treasuries and overnight repos. This offers a high reliability of timely redemptions processing in nearly all market conditions.

The tech stack employed by Paxos is modeled from other well-known products, BUSD and USDP. The codebase is battle-tested, and Paxos has a long history of reliable on-chain management, without significant incidents. While Paxos had previously been forced to terminate issuance of BUSD in the wake of an SEC lawsuit against Binance, the wind-down process was expertly handled gradually and without disrupting the stablecoin peg. This event demonstrates a commitment to stability in all circumstances that further bolsters confidence in PYUSD's pegkeeping ability.

Where PYUSD lacks (from the perspective of Curve pegkeeper onboarding) stems from its relatively short history, low level of organic adoption, relatively low liquidity in the pegkeeper pool, and high correlation with an existing pegkeeper asset. With these considerations, it makes sense to take a gradual approach to onboarding PYUSD as a pegkeeper asset, bearing in mind that its initial growth spurt may have been temporary and artificially bolstered by short-term incentives. The introduction of PYUSD as a pegkeeper asset should coincide with a reduction of exposure to USDP, given that these tokens are both issued by Paxos. Both of these assets are marginal compared to USDT and USDC, justifying a lower combined debt cap.

We recommend the following debt caps for the crvUSD pegkeepers in light of this research:

-

USDT: 25m crvUSD

-

USDC: 25m crvUSD

-

USDP: 10m crvUSD

-

PYUSD: 10m crvUSD