A comprehensive risk review of First Digital FDUSD for crvUSD PegKeeper onboarding consideration

This report will analyze FDUSD as a potential pegkeeper asset for crvUSD. This analysis aims to comprehensively assess the risks associated with FDUSD to determine its suitability for pegkeeper onboarding. Our evaluation will employ quantitative and qualitative methods, providing insights into the safety of integrating FDUSD and recommending any necessary exposure restrictions.

We will categorize the assessment into three main areas:

-

Performance Analytics - Concerns about stablecoin adoption, market liquidity, and volatility.

-

On-chain Management - Considerations about smart contracts, dependencies, and other technology components.

-

Regulation and Compliance - Aspects concerning reserves management, centralization potential, and legal/regulatory factors.

This review will involve a comparative analysis against existing crvUSD pegkeepers in the final section of this report, providing tokenholders with valuable information to make informed decisions regarding the integration of FDUSD and the establishment of appropriate parameters.

#Section 1: Stablecoin Fundamentals

This section addresses the fundamentals of the proposed pegkeeper asset. It is essential to convey (1) the value proposition/utility of the stablecoin, and (2) an overview of the on-chain technical architecture. This section contains descriptive elements that cannot be quantified and serves as a descriptive introduction to the stablecoin.

This section includes one sub-section:

- 1.1: Description of the Stablecoin

#1.1 Description of the Stablecoin

FDUSD is a custodial stablecoin issued by FD121 Limited, a limited liability company incorporated in Hong Kong, and branded as First Digital Labs. It is backed by a combination of U.S. Treasury Bills, cash, fixed deposits, and overnight reverse repurchase agreements.

It launched in June 2023, shortly after Binance BUSD was ordered to halt minting by the NYDFS, and became a strategic partner for Binance during the transition. Therefore FDUSD has experienced significant growth on Binance where it continues to have the vast majority of trading volumes across a multitude of trade pairs. Nonetheless, it is listed on several other centralized exchanges (Bitget, Gate.io, Bybit and VALR) and decentralized exchanges (PancakeSwap, Uniswap, Curve, Cetus, KiloEx and Thena).

First Digital has expressed a roadmap that includes launching FDUSD on many popular L1 and L2s by Q3 2025 and promoting DeFi integrations with a strategic fund for growing lending/DEX liquidity, primarily on Ethereum. Additionally, they are working with several payment service providers to improve the accessibility and utility of the stablecoin.

#1.1.1 User Flow

Persons interested in purchasing FDUSD can do so through three avenues, either on-chain or off-chain:

-

Purchasing through decentralized exchanges (on-chain)

-

Purchasing through centralized exchanges (off-chain)

-

Purchasing directly from the issuer, FD121, which mints tokens to the purchaser (off-chain)

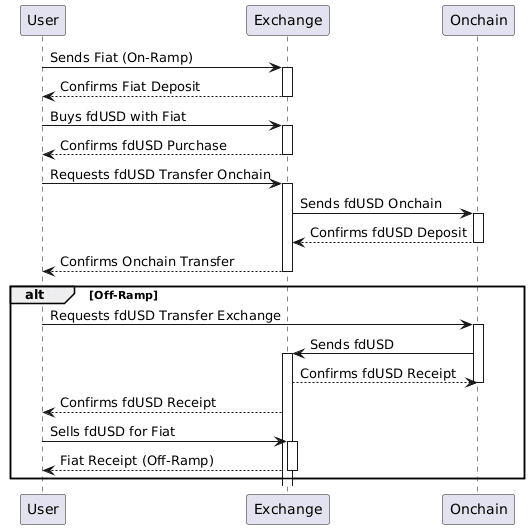

We have illustrated the process users would typically follow if they would like to purchase FDUSD on a centralized exchange and subsequently onboard on-chain to engage in DeFi applications.

Minting and redeeming processes for FDUSD are not disclosed publicly.

#1.1.2 Reserves Overview

The Reserve Accounts Report specifies the types of assets that can be held as reserves:

-

U.S. Treasury Bills;

-

Cash Balances (US dollars);

-

Fixed Deposits;

-

Overnight Reverse Repurchase Agreements.

First Digital Trust Limited is the appointed custodian, maintaining accounts with financial institutions in numerous countries, held under the custodian’s name for the benefit of the issuer. Attestations are provided by a licensed CPA firm - Prescient Assurance LLC.

#1.1.3 Fees and Business Model

The FDUSD whitepaper lacks transparency regarding the projected revenue model. Additionally, the FD121 Account User Agreement does not provide sufficient clarity. It states that the issuer may impose fees related to the services offered, with such fees detailed in a fee schedule that is periodically made available to the public. However, this document is not currently publicized.

While specific details about minting and redemption fees are not publicly disclosed, the primary revenue streams for First Digital likely include:

-

Charging fees for minting and redeeming FDUSD.

-

Providing additional services such as custody solutions or integration support to institutional clients, generating supplementary revenue.

-

Earning interest from reserves held in interest-bearing accounts or low-risk investments like U.S. Treasury bills.

#1.1.4 Organizational Structure

The ownership structure of First Digital Group is not extensively detailed in public sources, but it is known that the company is based out of Gibraltar and operates as a private entity focused on digital asset innovation.

One of the primary subsidiaries of First Digital Group is First Digital Labs (FD121), which is actively engaged with FDUSD issuance. Another entity under First Digital Group umbrella is First Digital Trust, which serves as a digital asset custodian. Both companies are incorporated in Hong Kong.

#1.1.5 Third Party Relations

Recently, FDUSD was launched as the first native stablecoin on Sui Network, aiming to provide users with a 1:1 USD-backed stablecoin experience. FDUSD has further expanded its reach by integrating with Solana in a move to leverage Solana's high-performance capabilities, enabling faster and more efficient transactions. First Digital has expressed plans to deploy FDUSD on additional networks by Q3 2025, including TON, Polygon, KAIA, Celo, Arbitrum, Optimism and Scroll. These are planned to include targeted marketing campaigns, user incentive programs, and strategic partnerships with blockchain foundations and wallet providers.

FDUSD is enhancing its practical utility through strategic integrations with Payment Service Providers - notably Banxa for fiat on-ramping, Travala for travel bookings, and Alchemy Pay for merchant payment solutions. This comprehensive deployment strategy demonstrates an intent to promote trading accessibility and real-world utility, with a particular focus on building a global stablecoin payments infrastructure.

The roadmap also involves expansion of on-chain activities by launching new DEX / lending pools with >US$1m TVL, ensuring deep liquidity through strategic partnerships with market makers and efforts to expand cross-chain interoperability. The feasibility of a dedicated DeFi Strategic Fund is being explored that would promote TVL growth for DeFi integrations.

#1.1.6 History

FDUSD was launched in June 2023 with initial deployment on Ethereum and BNB Chain. FDUSD was deployed amidst rapid shrinking of stablecoin supply in Q1 2023, particularly for BUSD, which Binance sunsetted after the SEC issued a Wells notice for BUSD's issuer, Paxos.

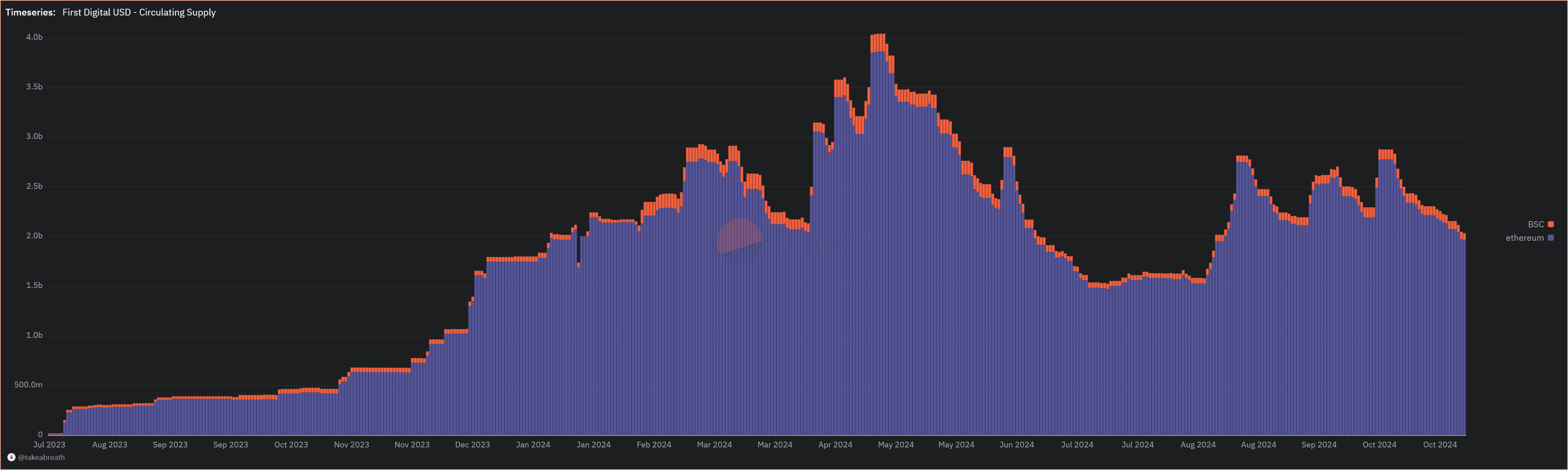

By January 2024, FDUSD’s market capitalization surged to $2.6 billion, positioning it as the fourth-largest stablecoin at that time. The circulating supply peaked at $4.42 billion but later declined to $1.9 billion, indicating fluctuations in its adoption and market dynamics.

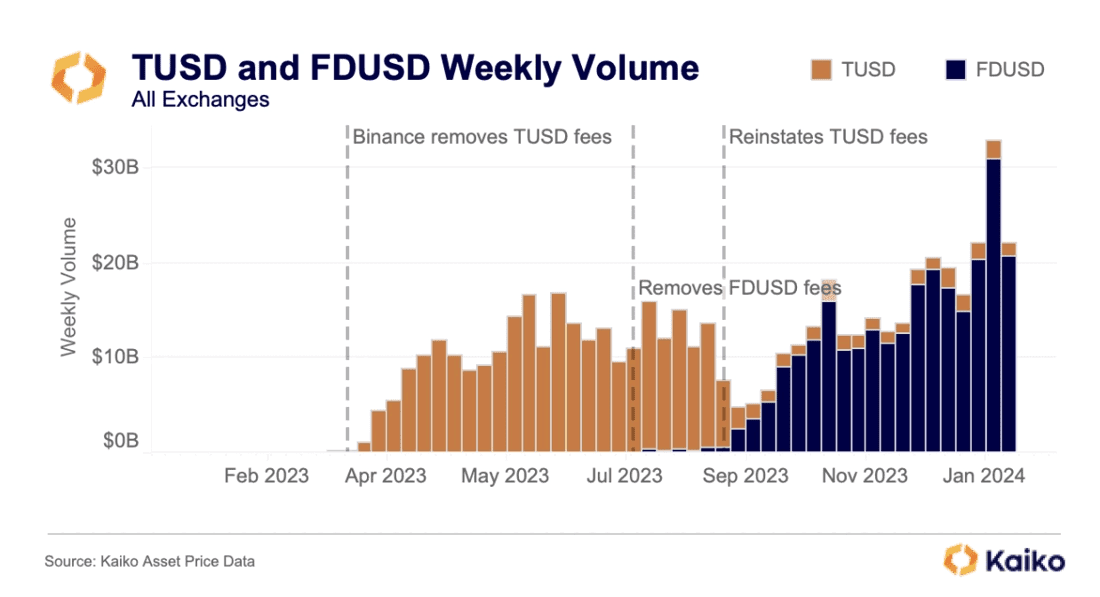

FDUSD's volume also outperformed another Binance-backed stablecoin, TUSD, within months of its deployment.

Source: Kaiko Research

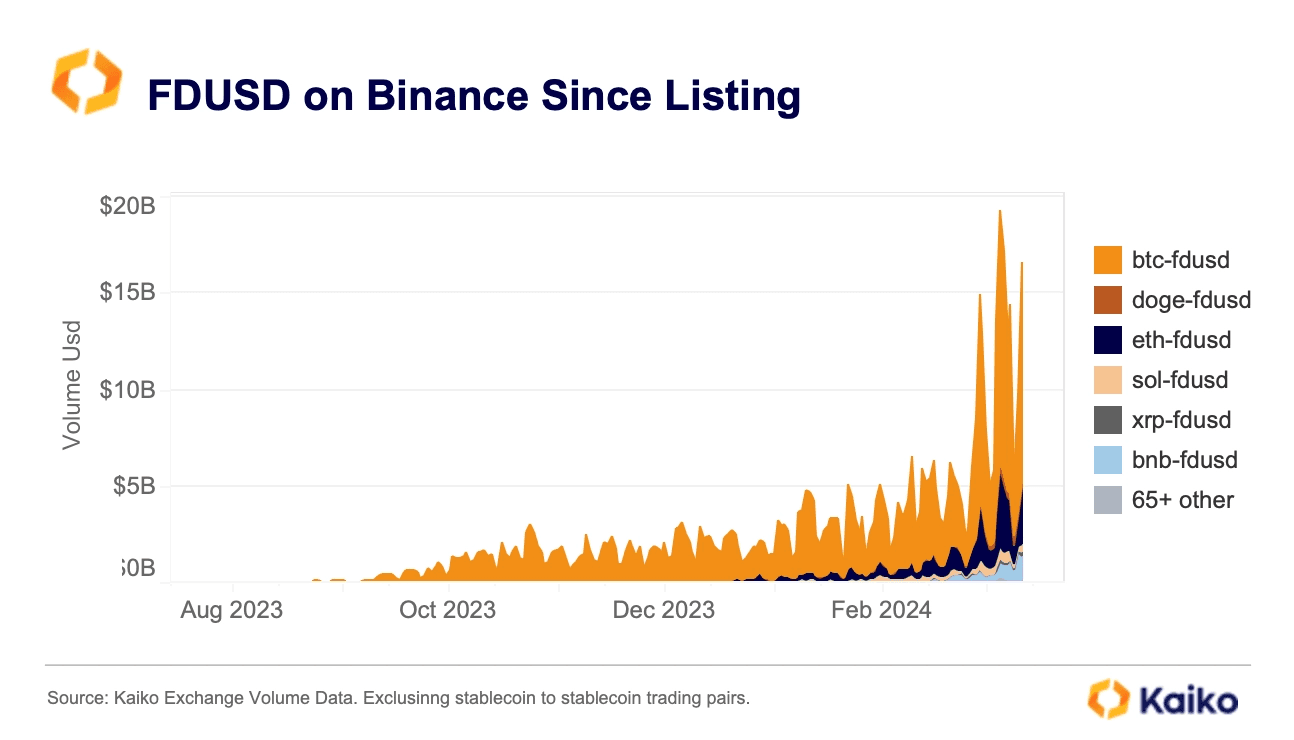

The stablecoin is predominantly traded on Binance, where there are numerous "zero-fee" promotions where FDUSD is paired with other assets, such as ETH and BTC.

Source: Kaiko Research

#Section 2: Performance Analytics

This section evaluates the pegkeeper candidate from a quantitative perspective. It analyzes stablecoin performance metrics in terms of market adoption, peg stability, and liquidity.

This section is divided into 3 sub-sections:

-

2.1: Market Performance

-

2.2: Peg Stability Metrics

-

2.3: Liquidity

#2.1 Market Performance

#2.1.1 Outstanding and Free-Float Supply

The total amount of stablecoins in circulation over time is shown below. We should note that this chart illustrates the outstanding supply since FDUSD's deployment, aggregated by EVM chains deployed.

Source: Dune, via DefiLlama

We observe that 96.7% of FDUSD's supply is concentrated on Ethereum Mainnet. Most of this FDUSD supply is not being actively used in DeFi mechanisms such as DEXs and Lending. We will comment on this further in Section 3.

#2.1.2 Market Share in Overall Stablecoins Supply

Here we compare the stablecoin's market cap relative to the total market cap of all stablecoins.

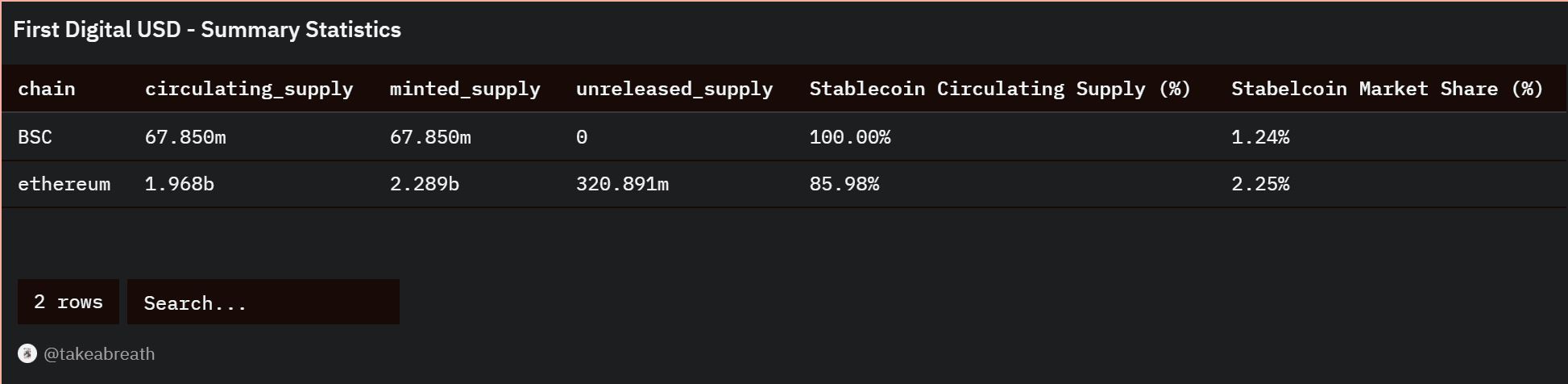

Source: Dune, via DefiLlama. Note: “Stablecoin Circulating Supply %“ is the proportion of FDUSD which is circulating vs minted

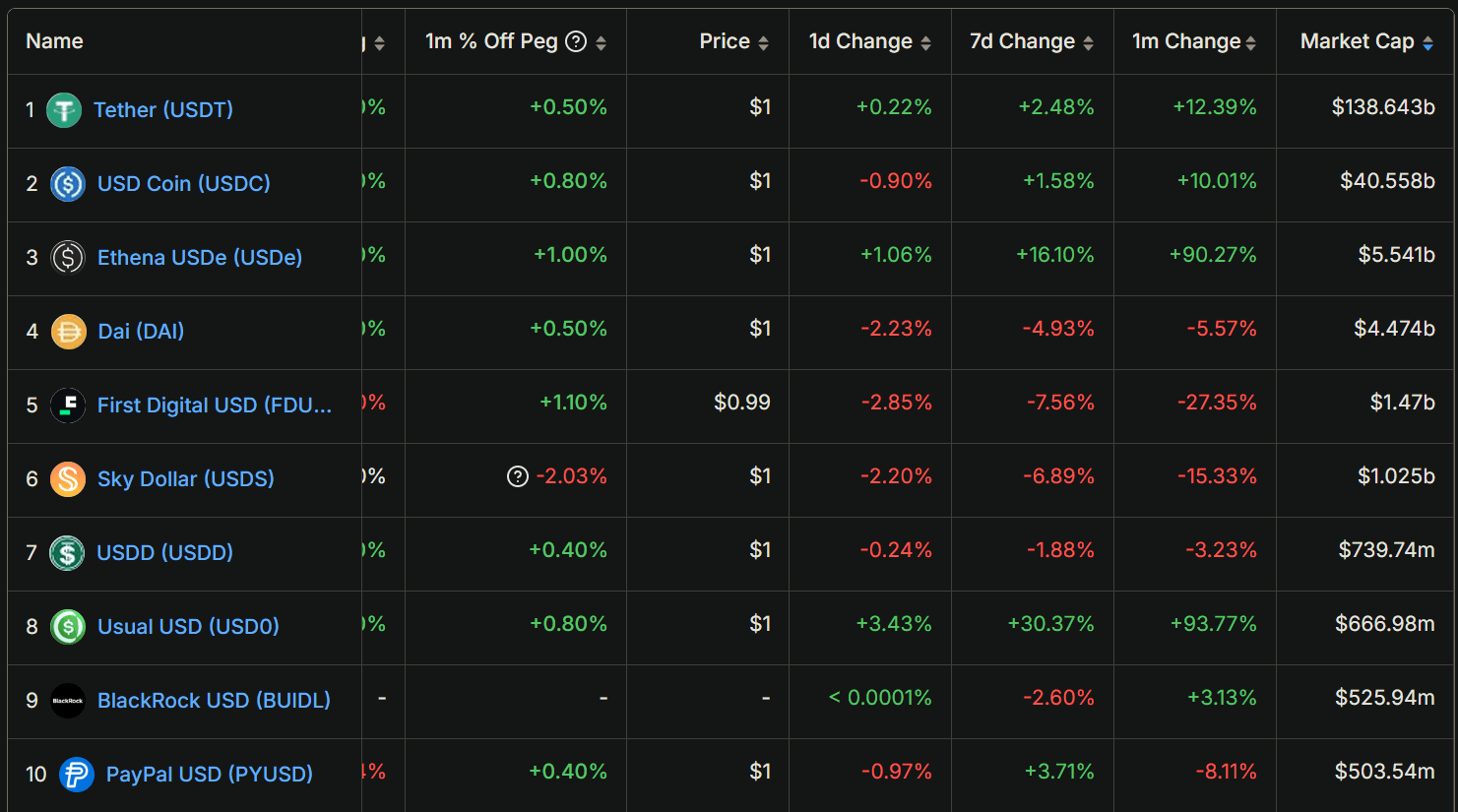

We have found that FDUSD accounts for 2.25% of stablecoin marketshare on Ethereum Mainnet, and 1.24% of marketshare on BNB Chain.

Whilst FDUSD seems to have a very small market share in terms of circulating supply, this is mostly due to the dominance of USDT and USDC, which together dominated ~90% of the market. Outside of the top two stablecoins, FDUSD is relatively competitive.

Source: DefiLlama

#2.1.3 Supply Distribution

The supply distribution of a stablecoin can help us understand how it is used, and what class entity holds the majority.

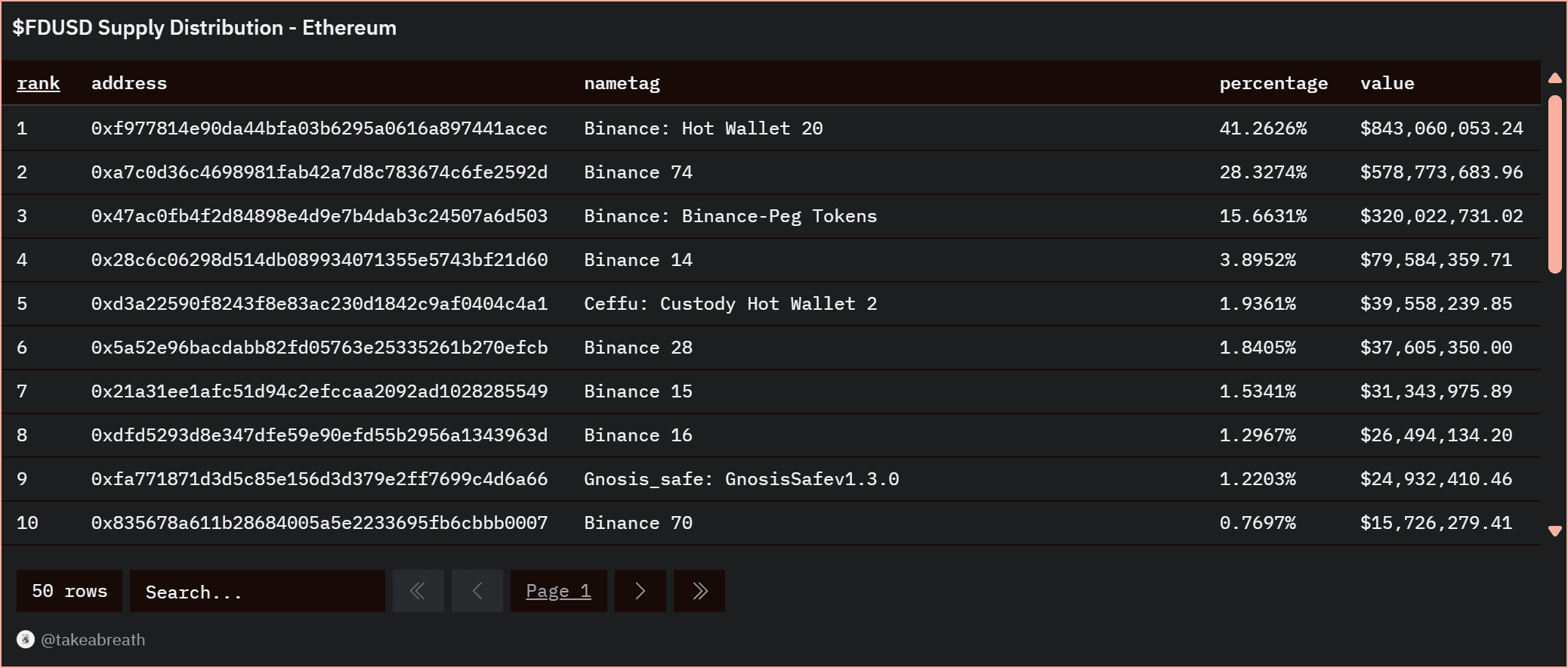

On Ethereum Mainnet, we observe Binance's dominance in holding the stablecoin vs other exchanges, and smart contracts (e.g. DeFi smart contracts such as Uniswap pools, Aave lending, etc.).

For address 5 shown above, we see that Etherscan has labeled this address as a Ceffu "Hot Wallet". However, we believe that this is actually a cold wallet as part of Ceffu's "MirrorX" solution. This would make sense considering Ceffu and First Digital's close ties with Binance. Arkham Intelligence also agrees that this is a cold wallet.

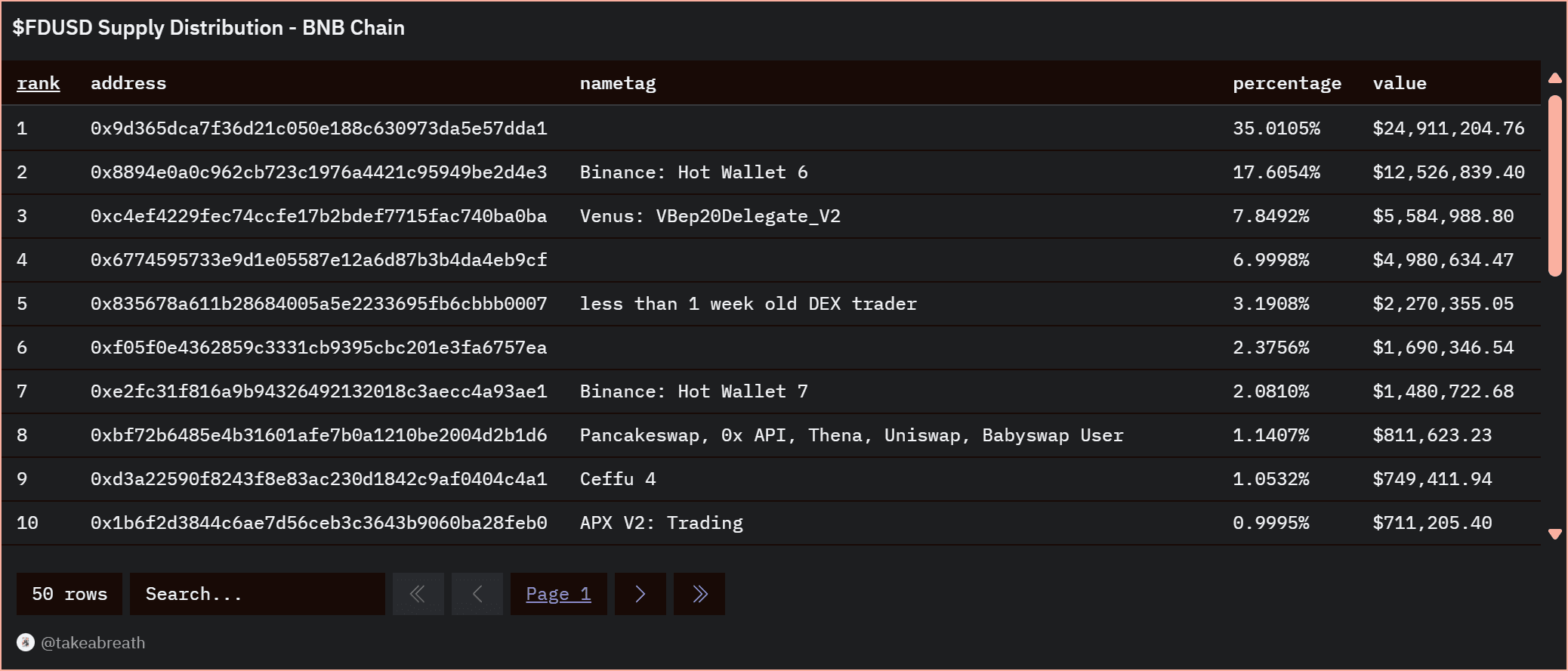

On BNB Chain, we see more presence in DeFi and held by EOA addresses. The top wallet address is an EOA which was funded from Binance, followed by Venus lending, then a mix of EOAs which are fresh or notorious DEX traders.

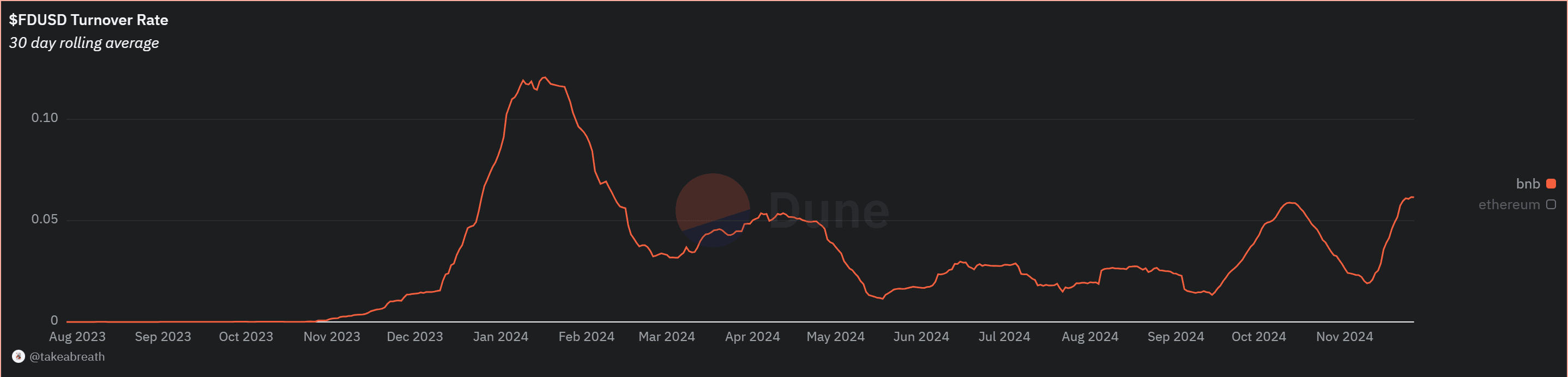

#2.1.4 Stablecoin Velocity

Also known as the Turnover Rate, this is the rate at which the stablecoin changes hands in its economic system. Stablecoin velocity = Average Total Transaction Volume / Outstanding Supply over the last 30 days.

Velocity on Ethereum is essentially zero and has been close to zero since deployment. On BNB Chain, it is slightly higher, with this rate averaging at ~0.62 on the date of publishing this article.

Source: Dune

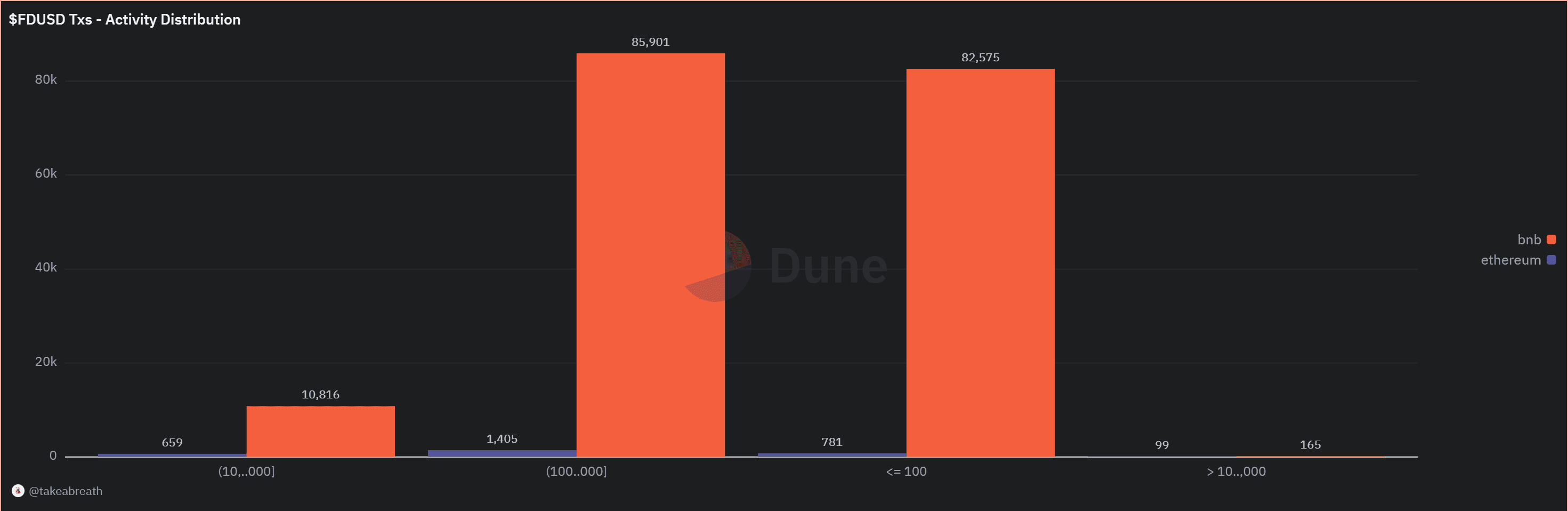

#2.1.5 Activity Distribution

In this section, we look at how many accounts are responsible for the majority of the on-chain activity.

We looked at all FDUSD transfers since deployment and found the number of wallets that sent FDUSD to other wallets (both EOA and smart contract). We measured their frequency of sending FDUSD cumulatively and excluded minting (i.e., we did not include the zero address in our analysis).

Source: Dune

We can observe a few things here:

-

BNB Chain has the most active accounts/wallets with most accounts sending between 0 and 10,000 FDUSD

-

Most Ethereum accounts sent between 100 and 10,000 FDUSD

From this, we can surmise that FDUSD was typically used by retail users. However, as explained earlier in Section 2.1.3: Supply Distribution, most FDUSD is held in Binance-related wallets on Ethereum, whilst a significant proportion of FDUSD is held by EOAs on BNB Chain. Readers should consider this as well in our analysis.

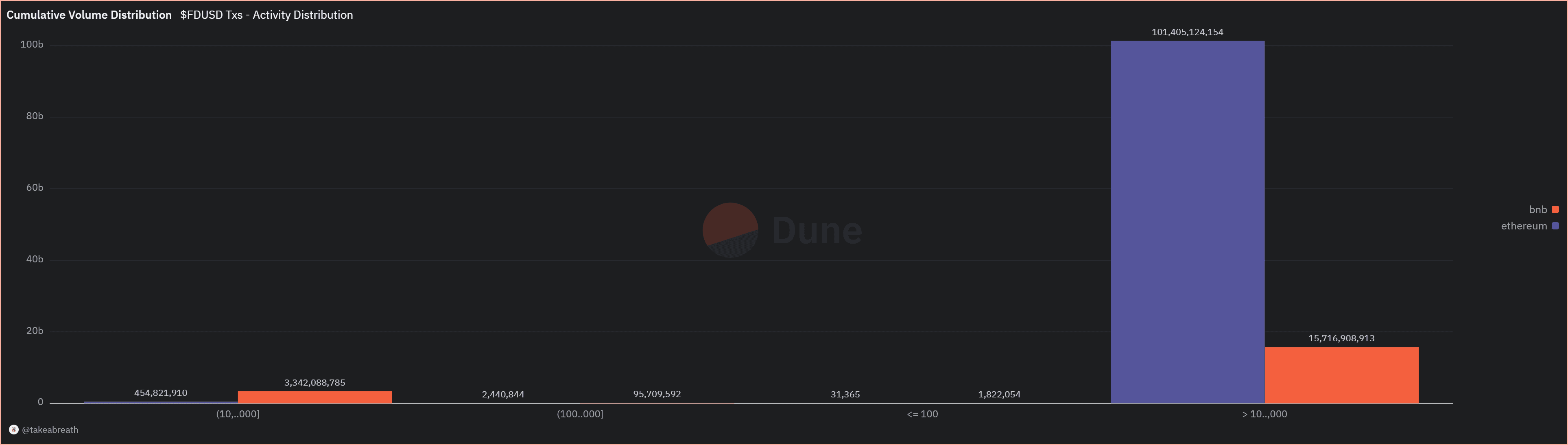

We have also observed that while very few wallets sent more than 10M FDUSD, their cumulative volume dominated the rest of the wallet classes observed.

Source: Dune

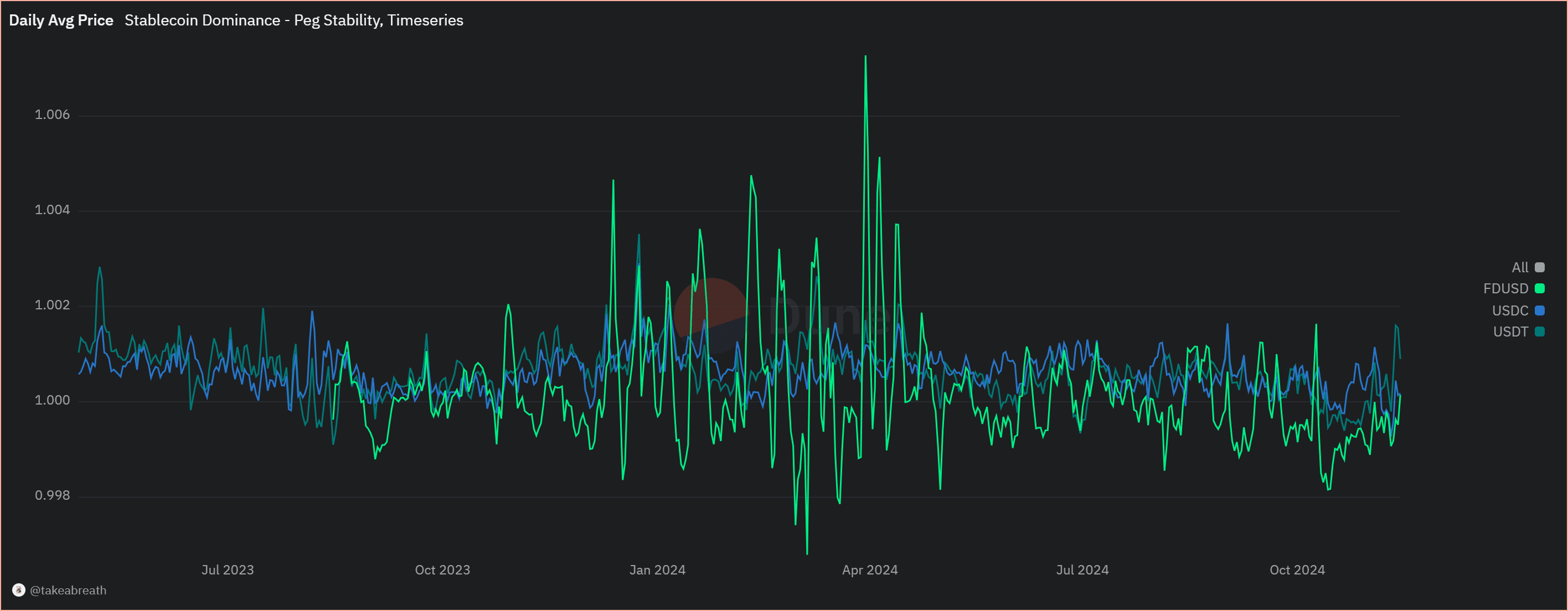

#2.2 Peg Stability Metrics

#2.2.1 Peg Deviation Frequency

Shown below is the frequency of deviations from the pegged value on an hourly basis. Here, we use the spot price of FDUSD and its competitors to evaluate how well each does at maintaining peg value.

Spot price timeseries of FDUSD vs USDC vs USDT. Source: Dune, via CoinPaprika

#2.2.2 Max Peg Deviation

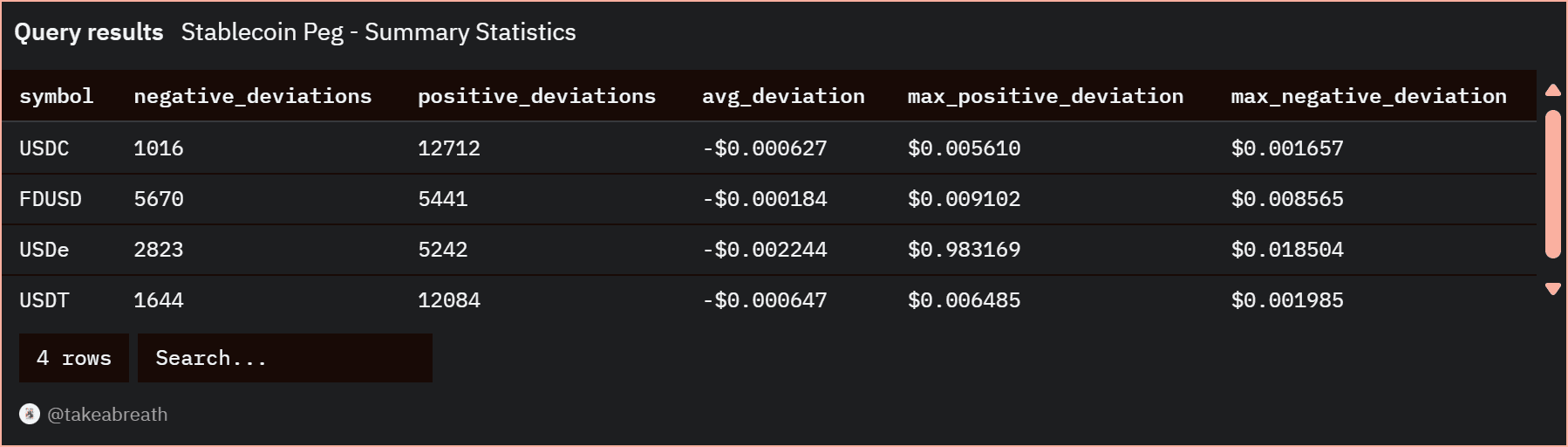

The table below quantifies the average and max positive/negative deviations in the observed time period.

Source: Dune, via CoinPaprika

Positive and negative deviations given above are the number of times the stablecoin spot price was above or below $1.00, respectively.

#2.2.3 Standard Deviation of Pegged Value

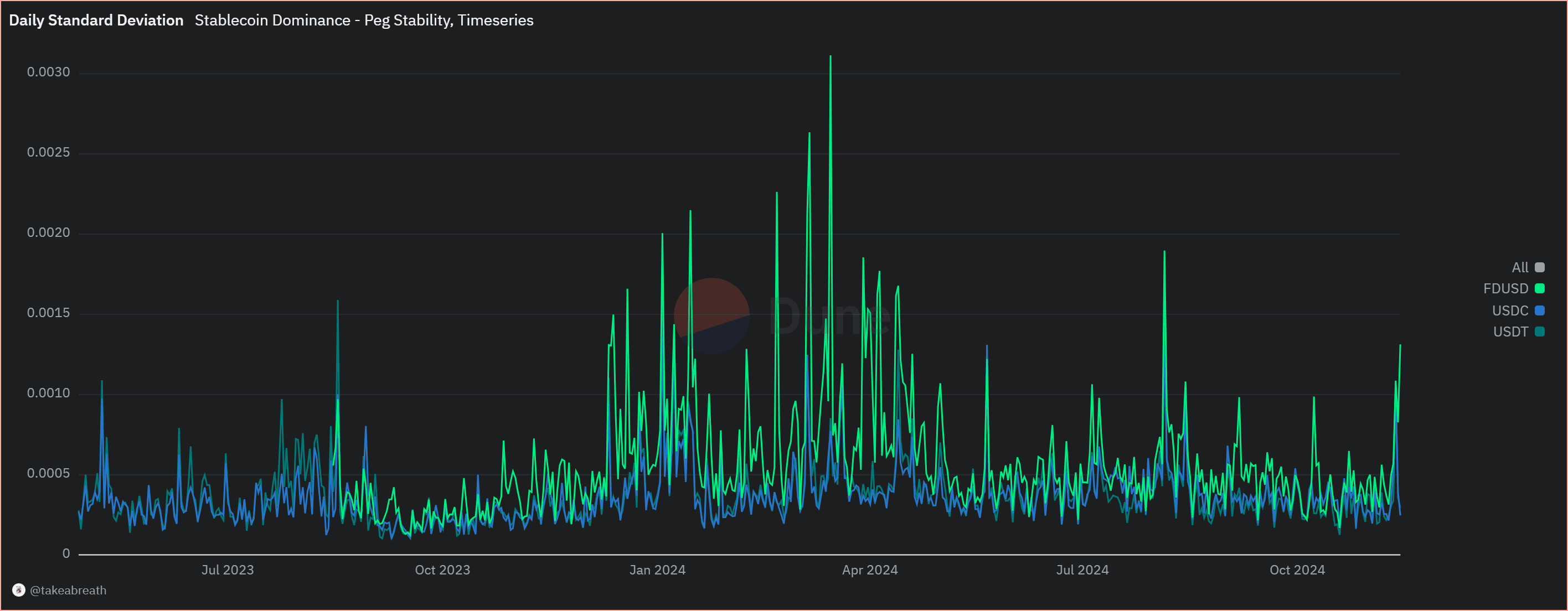

Given below is the daily standard deviation timeseries comparison of FDUSD vs major stablecoins.

Source: Dune, via CoinPaprika

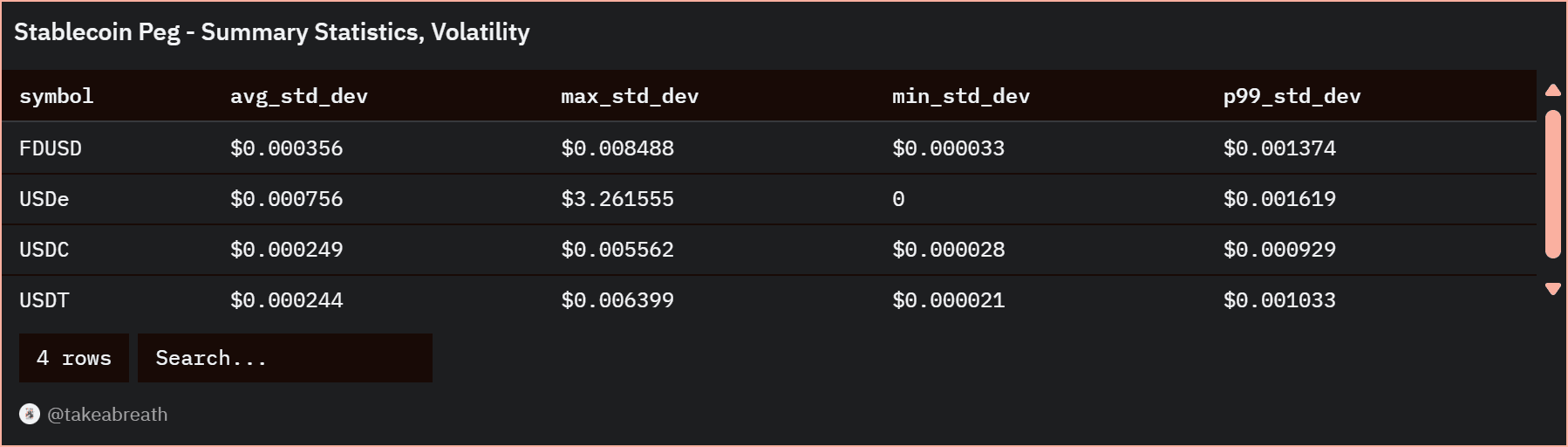

In the table below, we took a closer look at the standard deviation of prices and found that in the typical worst-case scenario (p99 standard deviation, or standard deviation in the 99th percentile) standard deviation was $0.001374.

Source: Dune, via CoinPaprika

#2.2.4 Market Depth at Pegged Value

Shown below is the liquidity available at the pegged price point, a metric we will use to test how stablecoins perform under pressure when conducting redemptions.

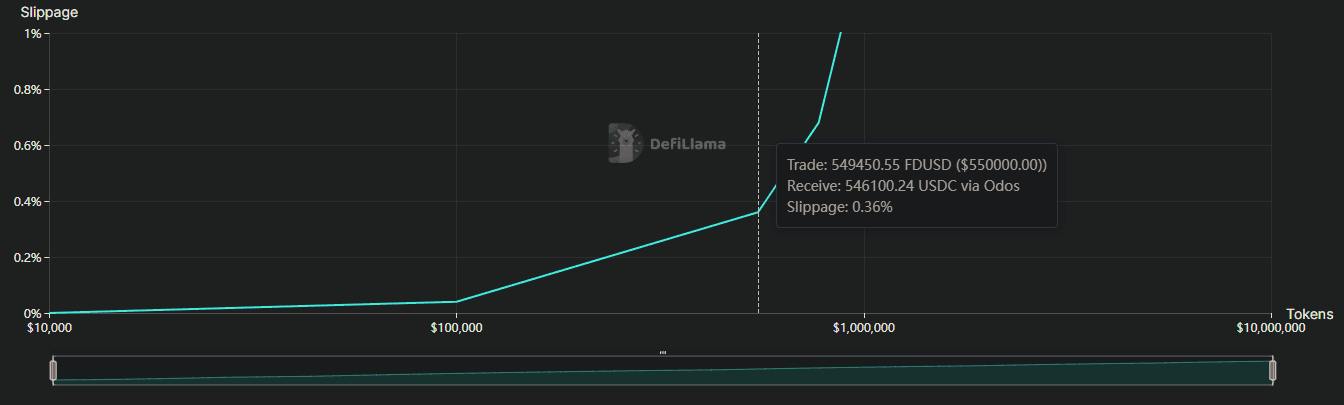

On Ethereum, we observe some significant slippage for large orders of FDUSD selling for USDC. For a sell order of ~550k FDUSD, DeFiLlama's token liquidity tool found ~0.36% slippage.

Source: DefiLlama

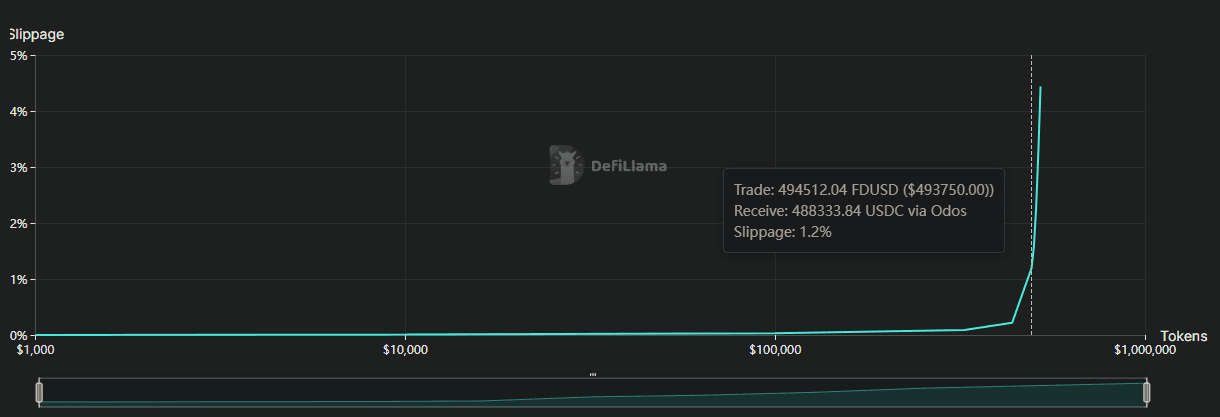

On BNB Chain, we see worse results. For a trade of ~500k FDUSD for USDC, 1.2% slippage was observed.

Source: DefiLlama

It should also be noted that these quotes are taken through Swap Routers, such as 1inch, CowSwap, Ondo, etc. So despite there being more liquidity deployed in BNB Chain pools, the paired asset's sell-side liquidity is also important to consider.

#2.2.5 Peg Recovery Time

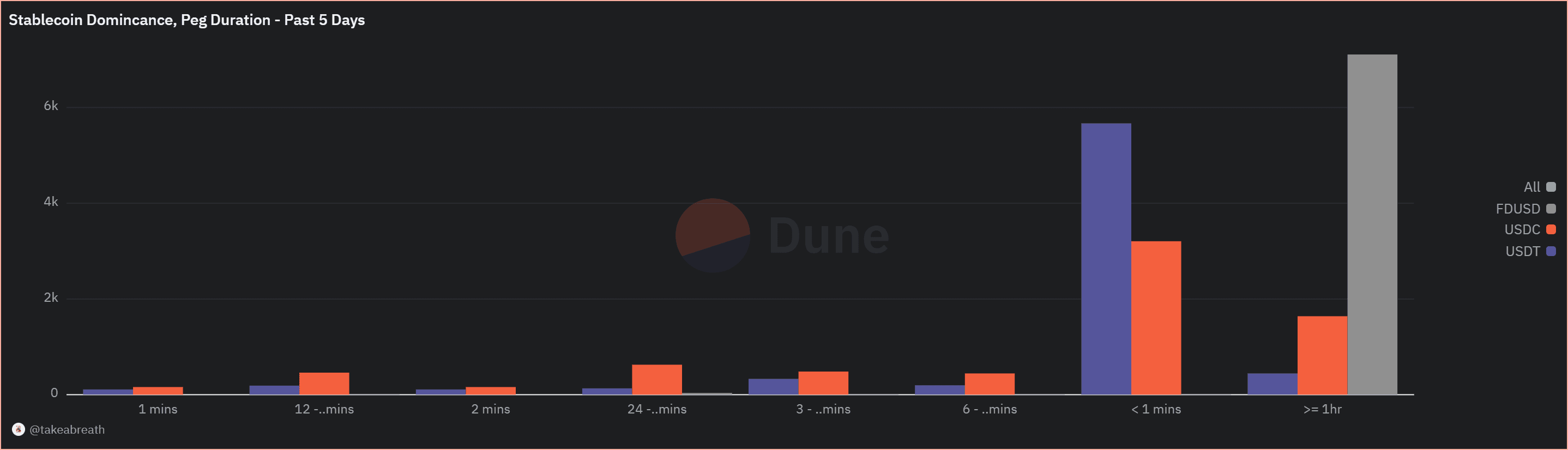

Here we find the time taken to return to the pegged value after a deviation from either direction, i.e. above or below $1.00 USD.

To avoid being too pedantic, we are rounding off the price by 3 decimal places and then checking if it is more or less than one dollar. Granularity of price data is 1 minute.

Source: Dune, price data from CoinPaprika

Note: Order of bins from left to right: 1 minute, 12 - 24 mins, 2 mins, 24 - 60 mins, 3 - 6 mins, 6 - 12 mins, <1 min, >= 1 hr

Here we can see that FDUSD has the most issues in reaching peg value for long periods vs. its competitors, which usually only lose peg for less than a minute.

#2.3 Liquidity

#2.3.1 Supported CEXs and DEXs

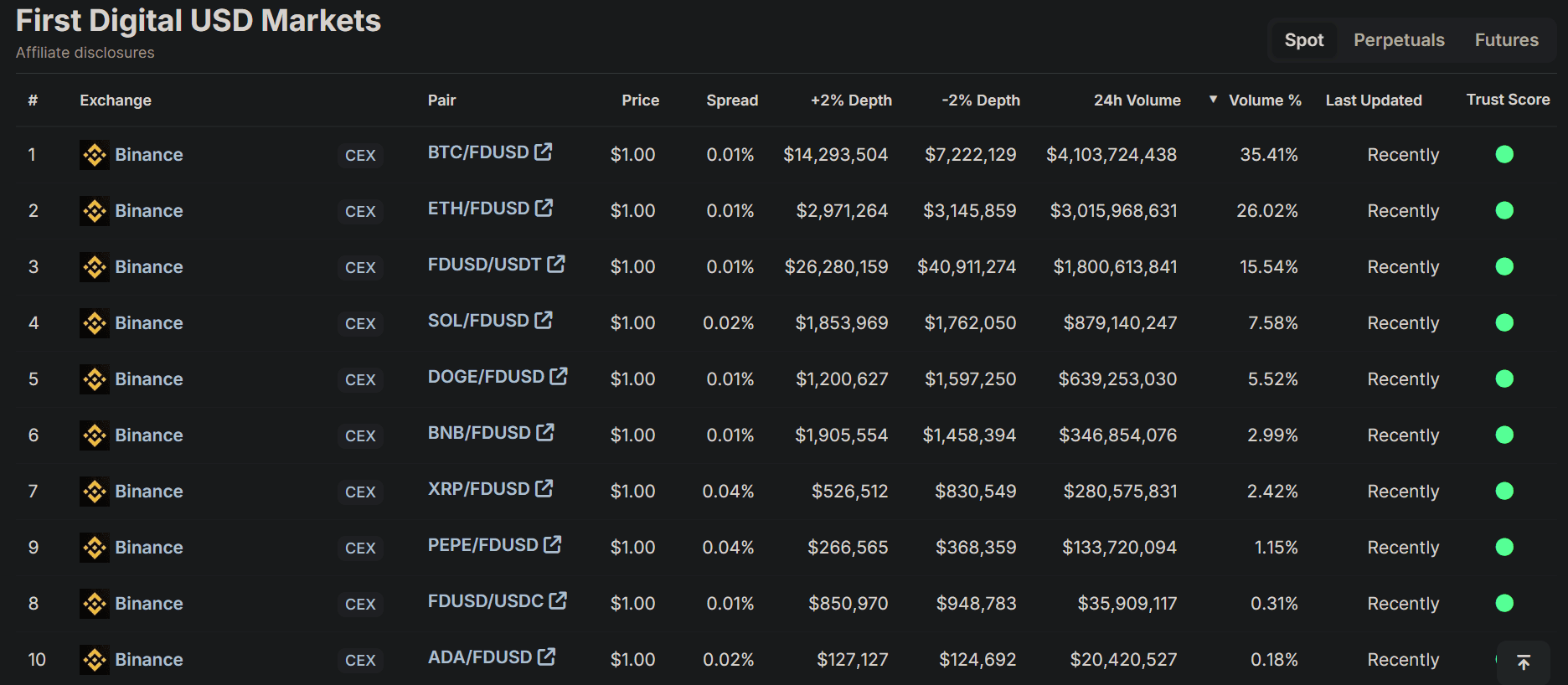

The following is a selected list of Centralised Exchanges where FDUSD is supported. The FD121 team has stated that a full list of exchanges can be found on CoinMarketCap:

-

Binance

-

Bitget

-

MEXC

-

Coins.Ph

-

VALR

We emphasize the importance Binance has in the success of this stablecoin. The exchange dominates in terms of daily volume of FDUSD and diversity of trading pairs.

Source: CoinGecko

The following is a list of Decentralised Exchanges FDUSD with liquidity exceeding $50k in total value locked (TVL).

Ethereum

-

Curve

-

Uniswap

BNB Chain

- Pancakeswap

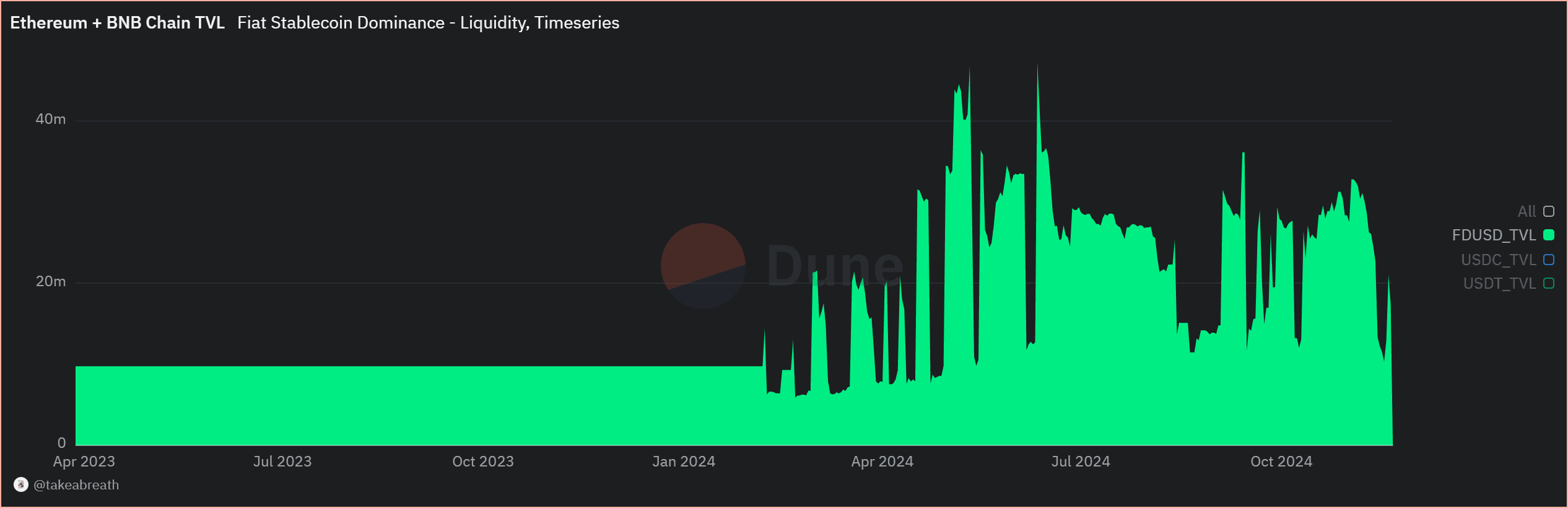

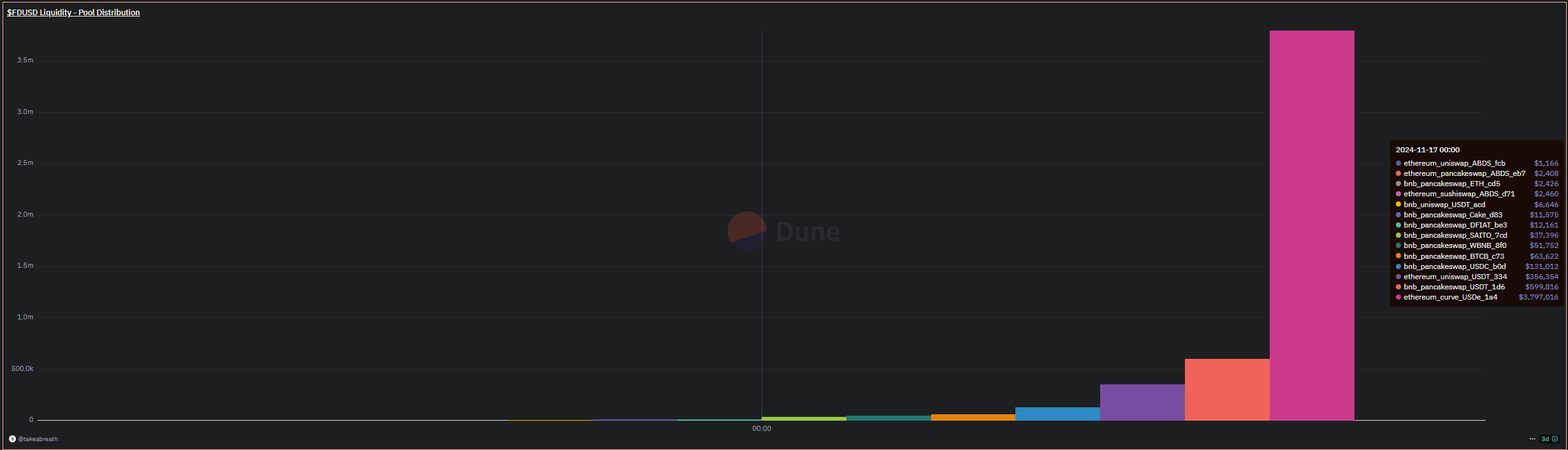

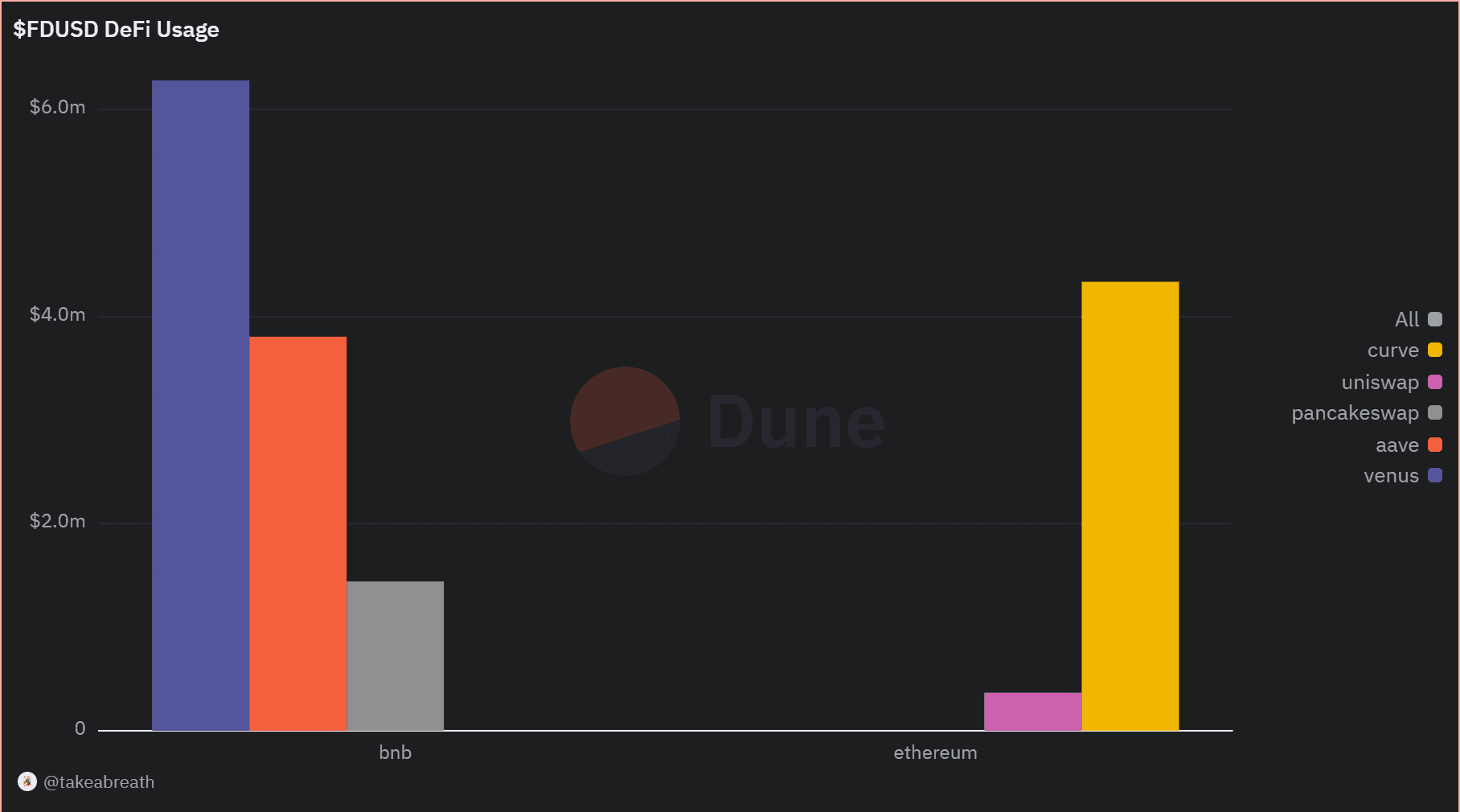

#2.3.2 On-chain Liquidity TVL and Depth

Liquidity TVL measures the total amount of assets deposited in a stablecoin's liquidity pools.

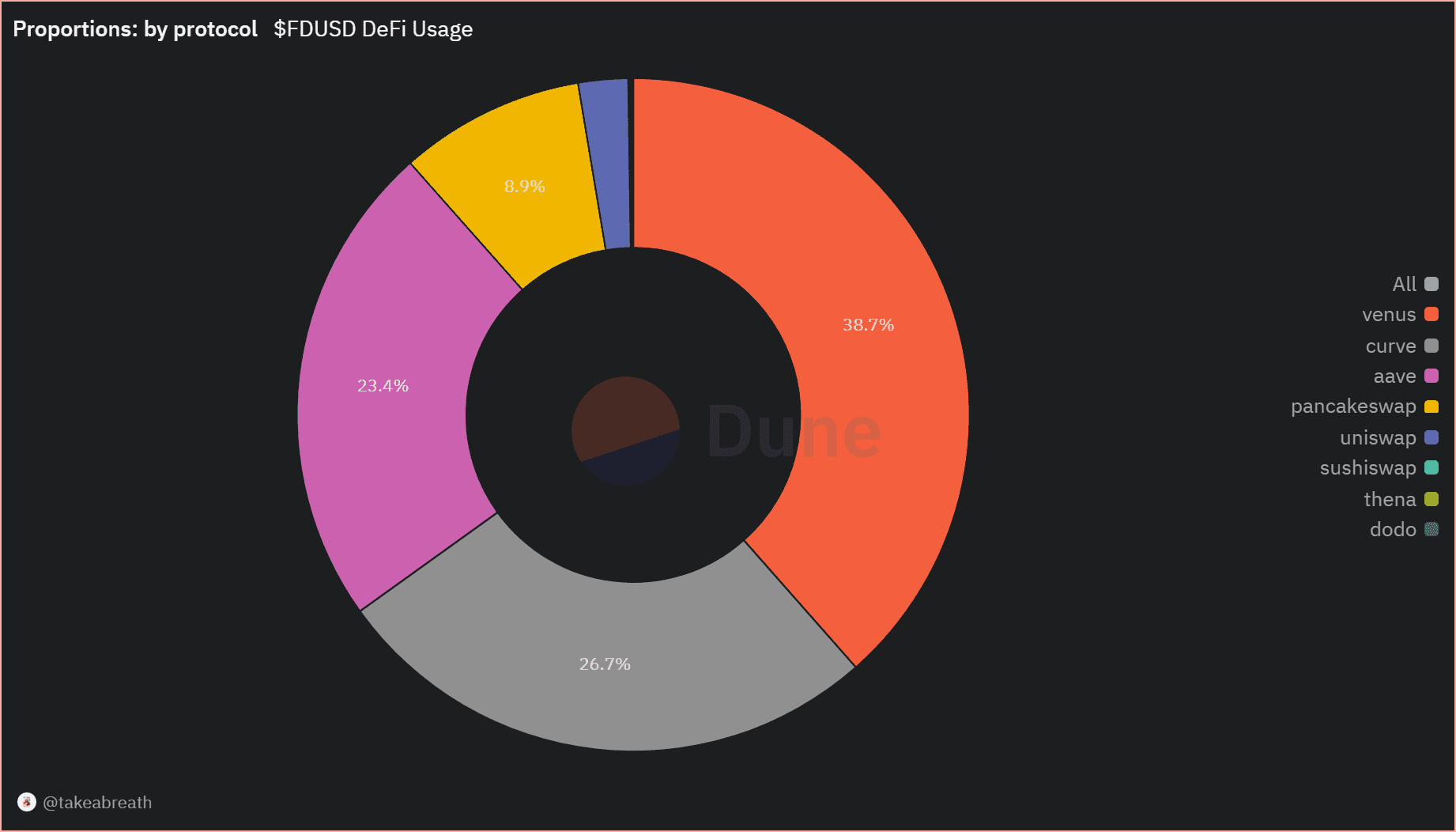

Source: Dune

Most DEX liquidity here is deposited on Curve, followed by Pancakeswap. There is also significant liquidity on lending platforms Aave and Venus on BNB Chain. In fact, most liquidity for FDUSD on-chain is deposited on these lending platforms.

Source: Dune

#2.3.3 Liquidity Pool Distribution

Here we analyze the distribution of liquidity across different pools. As explained previously, most of FDUSD’s DEX pool liquidity (measured in TVL of FDUSD) is deployed on Ethereum in a Curve pool (74.8% of all DEX liquidity).

Source: Dune

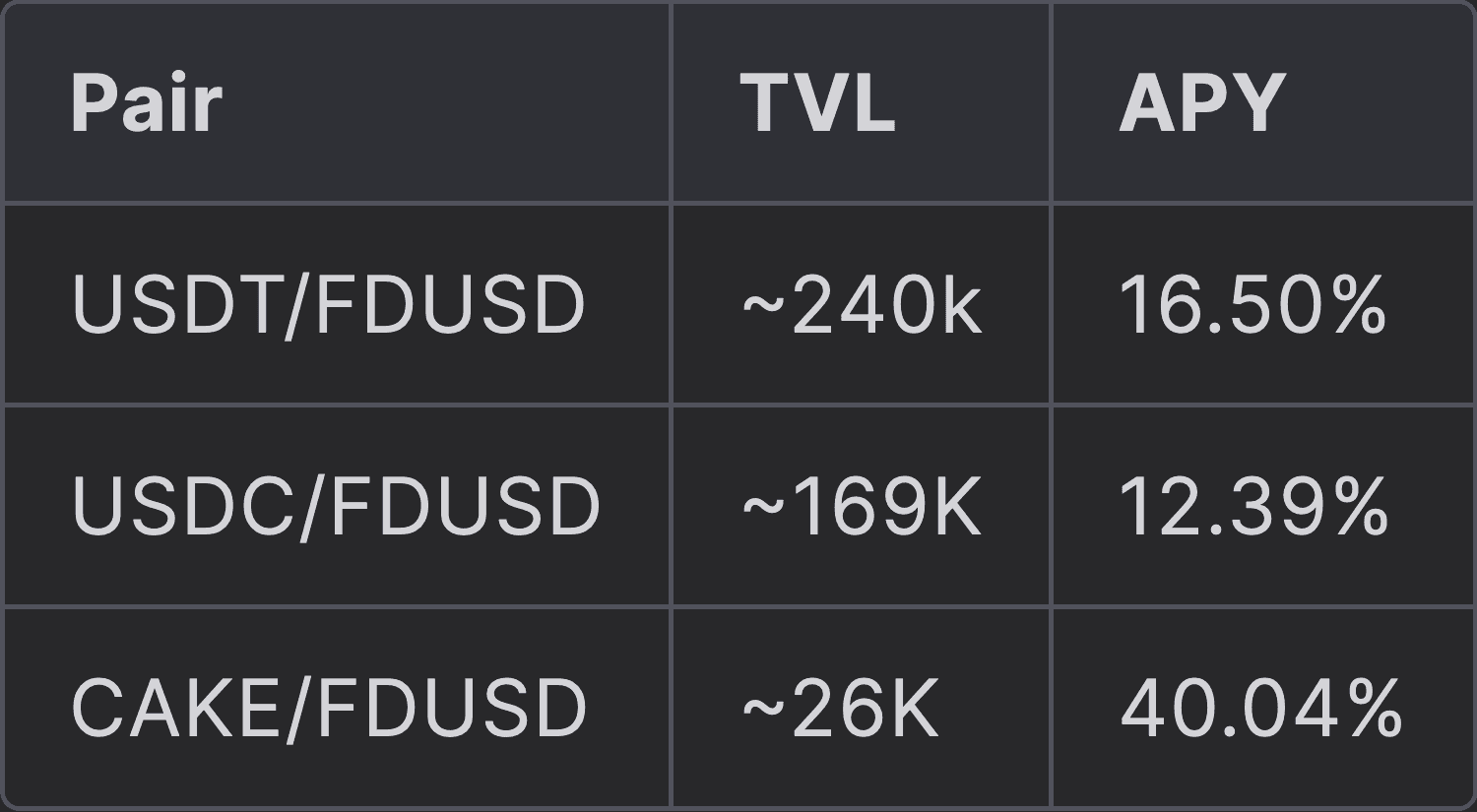

These are yield opportunities available on Pancakeswap for pools with greater than $25k in liquidity

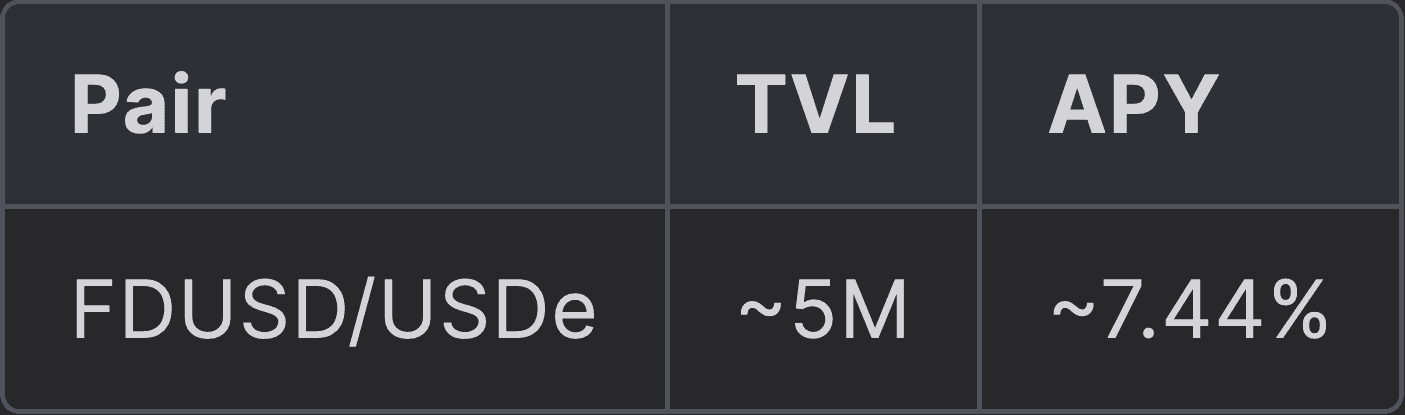

Here are the stats for the USDe/FDUSD Curve pool. Note that the Curve UI shows "daily" APY which we convert to an annual rate for comparison.

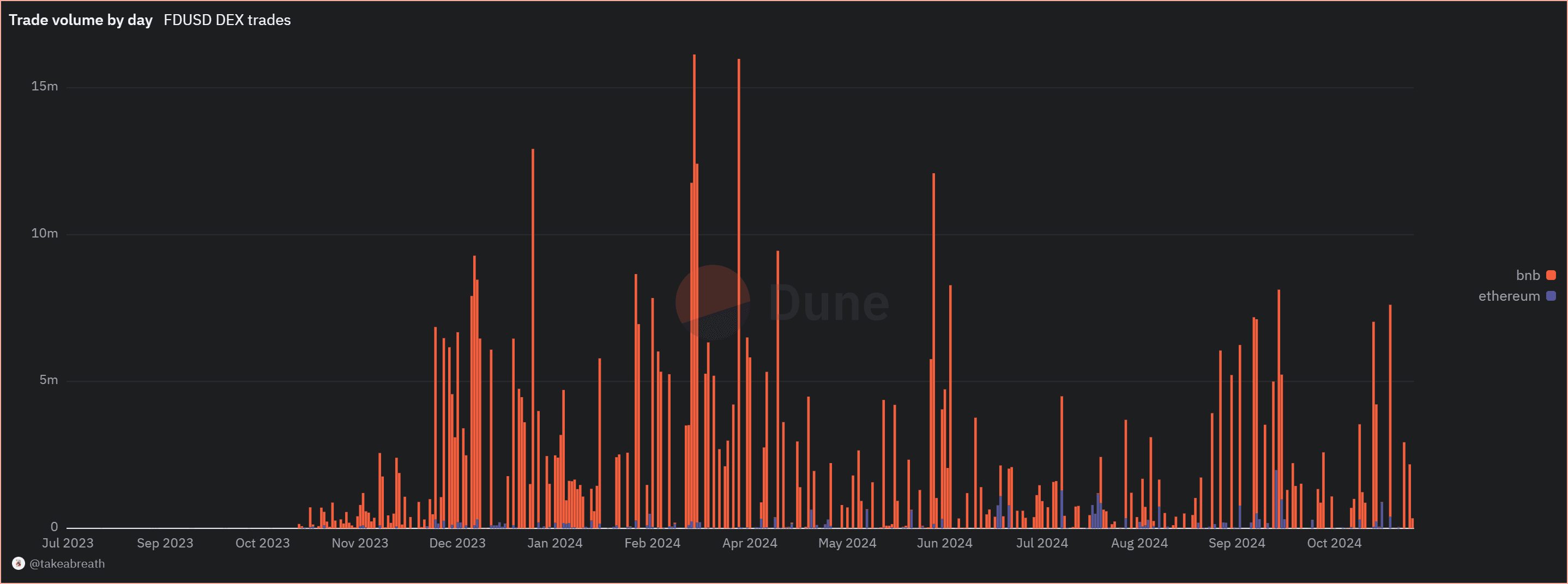

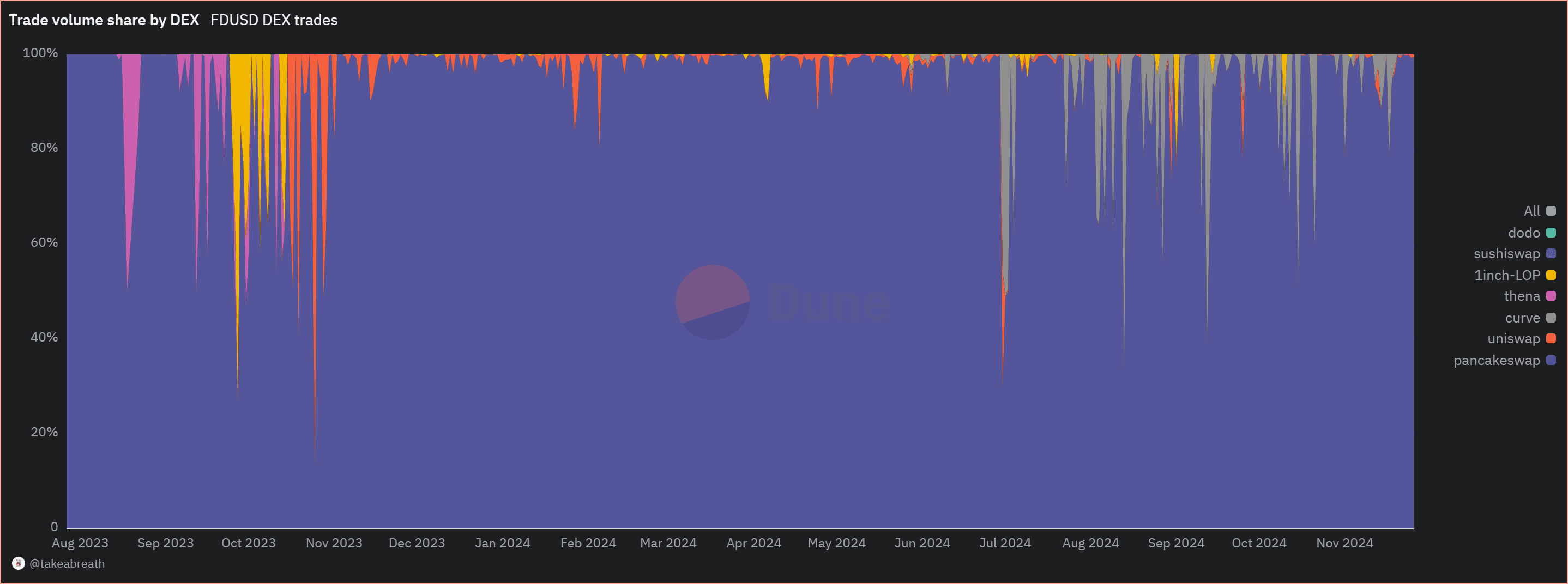

#2.3.5 DEX Trading Volume

Shown below is the total on-chain trading volume since FDUSD's deployment. Note the spikes in volume only exceed $10M in periodic bursts. This is important to consider when observing the Liquidity Utilization Rate.

Source: Dune

Also, note the dominance of BNB Chain here. Pancakeswap on BNB Chain essentially dominates the market for FDUSD volume. Since Q2 2024, Curve has usurped Uniswap for second place.

Source: Dune

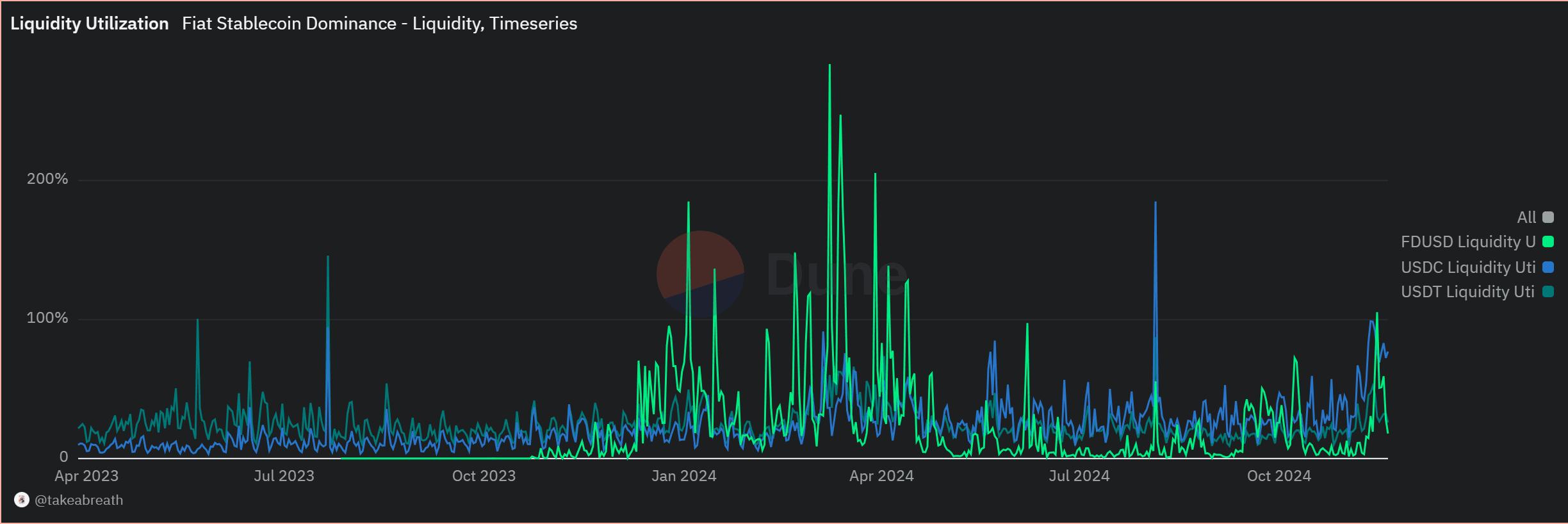

#2.3.4 Liquidity Utilization Rate

This measures the ratio of on-chain volume to TVL since FDUSD's deployment.

Source: Dune

Considering FDUSD's relatively low liquidity compared to its competitors, we interpret moments of high Liquidity Utilization rate for FDUSD as a lack of liquidity to meet the demand it receives.

This high volume relative to TVL could be due to FDUSD holders from centralized exchanges engaging in DEX trading. It is important to note that the utilization rate has reduced since the end of April when TVL has consistently been above $10M.

#2.3.5 Stablecoin Usage in DeFi

Shown below is the stablecoin usage in lending platforms, DEXs, and yield farming strategies. Note that this chart only shows DEX liquidity greater than $50k.

Source: Dune

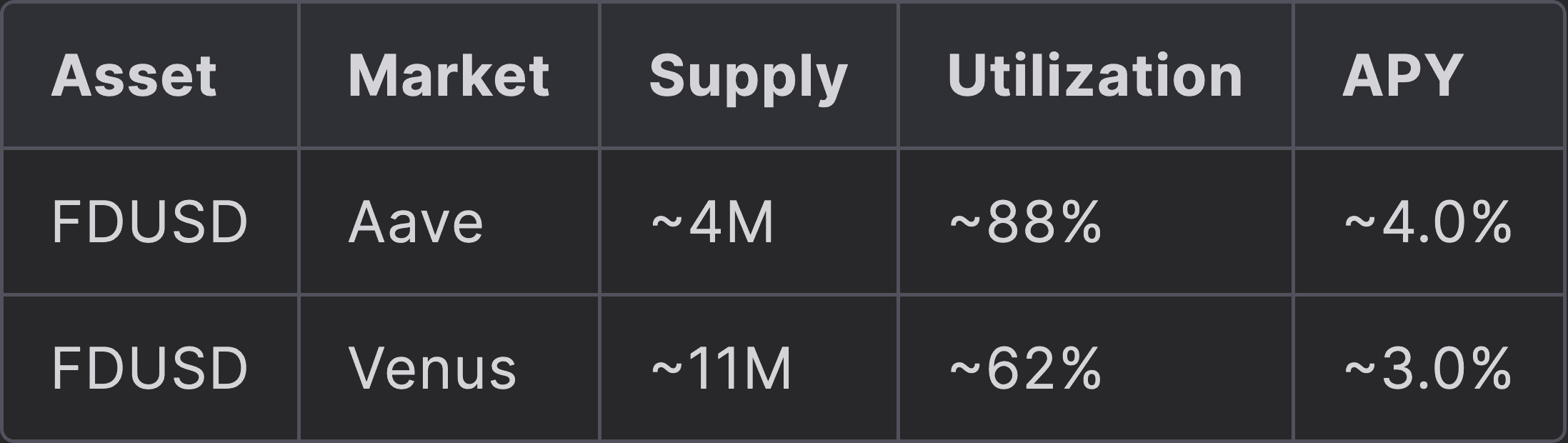

Here, we observe the dominance of Venus and Aave for lending, and Curve for DEX FDUSD liquidity. We also observe the dominance lending has over DEX liquidity, with Venus and Aave having a FDUSD TVL of over ~$10m vs the ~$6m liquidity found in DEX pools.

At the time of writing, we observed comparatively high utilization of FDUSD on Aave compared to Venus, although Venus possessed a higher TVL.

#Section 3: On-chain Management

This section addresses the technological properties of the stablecoin. It aims to convey, (1) how is the on-chain system architected and where can technological risk arise, and (2) historical performance metrics involving the stablecoin's development and security.

This section is divided into 2 sub-sections:

-

3.1: Operational Overview

-

3.2: Development and Security Metrics

#3.1 Operational Overview

#3.1.1 Architecture Diagram

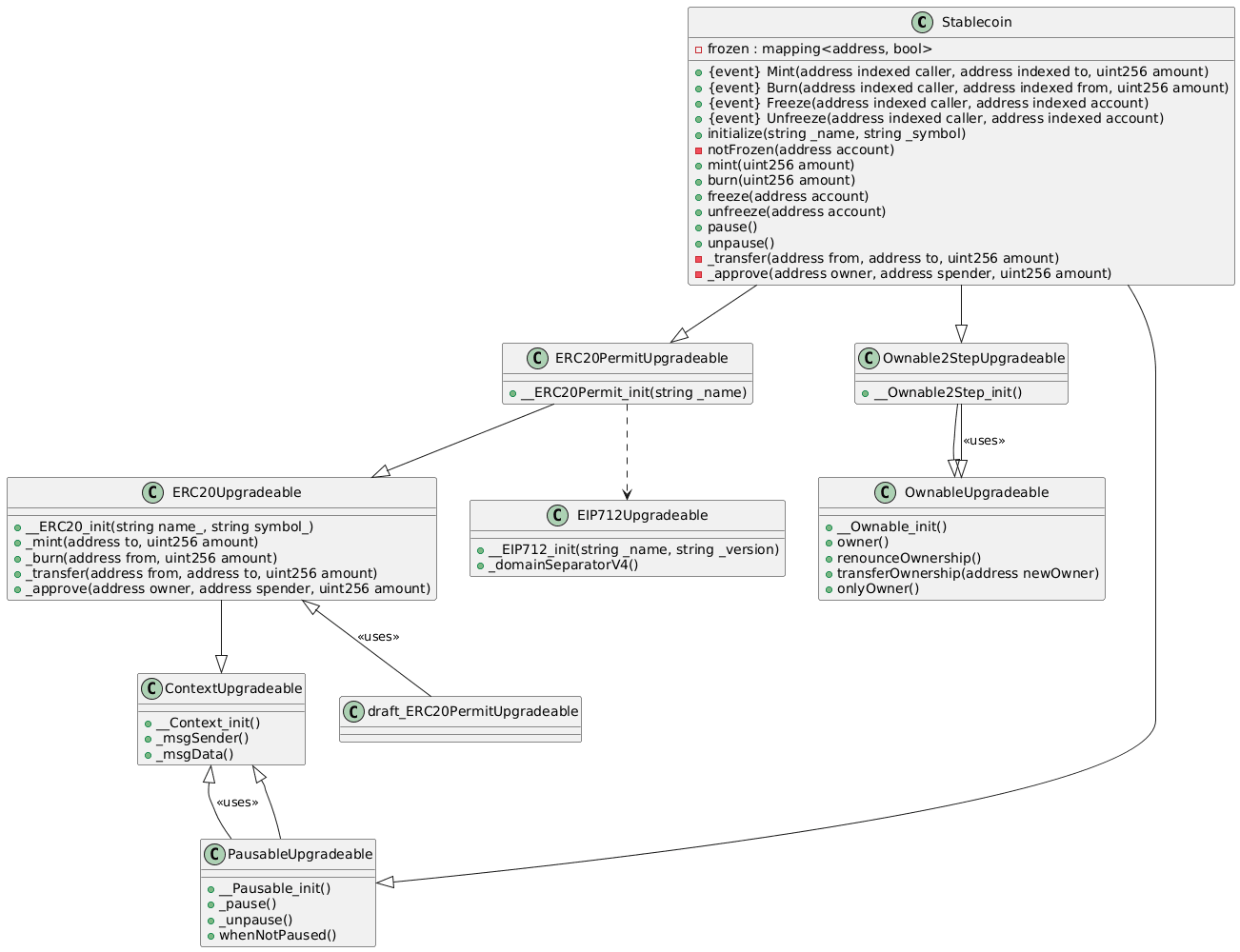

The following is a UML of the on-chain architecture of the FDUSD Stablecoin smart contract as deployed on Ethereum Mainnet and BNB Chain.

It can be observed from this chart that FDUSD does not have any external dependencies. The Stablecoin smart contract is simply a child class of the ERC20PermitUpgradeable and Ownable2StapUpgradeable OpenZeppelin smart contracts (for a background on smart contract inheritance and polymorphism check out the official Solidity docs).

#3.1.2 Key Components

The stablecoin operates using a singleton smart contract on all its deployed instances (both EVM chains and on Sui). This means that it has no external dependencies to function as a stablecoin such as an oracle, or governance contracts.

Bridging is supported via the Celer cBridge where, as of writing, has ~500k of $FDUSD liquidity for Ethereum Mainnet <> BNB Chain bridging operations.

#3.1.3 Smart Contracts

As mentioned previously, FDUSD is currently deployed on EVM chains (Ethereum Mainnet and BNB Chain) and Sui, a MoveVM chain.

FDUSD's EVM smart contracts are written in Solidity, and rely heavily on OpenZeppelin's smart contract implementations of the ERC20 and ERC2612 token standards.

The ERC20 token standard essentially provides a specification for interaction with tokens deployed on EVM chains. FDUSD uses 18 decimal precision for accounting and the "FDUSD" symbol for their EVM chain deployment.

The ERC2612 standard essentially provides a specification that allows for costless/gasless transfers. This is done by a token owner, who permits another account to make transfers on their behalf without making an onchain approval (which would cost gas).

The deployed contracts also utilise a design pattern for Solidity smart contracts upgradability, known as the Transparent Proxy Pattern.

The following lists all the addresses the FDUSD stablecoin utilizes on EVM chains:

Chain: Ethereum Mainnet

Deployer Account: 0x240…be44

Admin Account: 0xbB8…5957

Proxy: 0xc5f…6409

Implementation: 0xda1…0c8d

Chain: BNB Chain

Deployer Account: 0x240…be44

Admin Account: 0xbB8…5957

Proxy: 0xc5f…6409

Implementation: 0xda1…0c8d

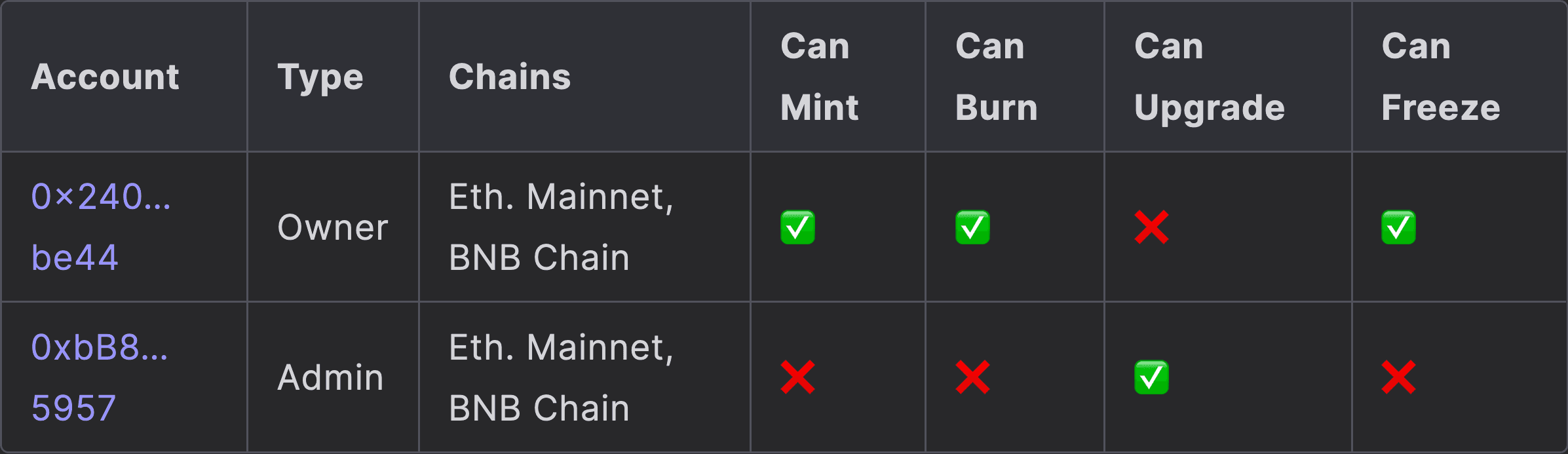

Only a designated admin account can upgrade the implementation for the FDUSD stablecoin, and only the designated "owner" account can mint, burn, pause, and freeze transfers.

On Sui, a simple Coin contract with Transfer capabilities is deployed for FDUSD.

Chain: Sui Mainnet

Deployer Account: 0x49d…c00a

Admin Account: N/A

Contract: 0x573…a961

The deployed contract has an initial supply of 23,074,890,406 FDUSD, has 6 decimal precision, and uses the FDUSD symbol. The First Digital team has assured us that the supply is variable.

#3.1.4 Dependencies

In this sub-section, we will disclose any external components of the stablecoin design that introduces additional risk or trust assumptions.

We found that FDUSD does not rely on any type of external dependency for their smart contracts to be operational.

#3.1.5 Access Control

In this section, we will describe the privileged roles and role assignments within the on-chain system for FDUSD. These roles are in charge of minting and burning the on-chain supply for FDUSD, as well as enabling system-wide transfer pauses, contract upgrades, and freezing of accounts.

Operational controls and upgradability are segregated between the owner account (0x240...be44) and the admin account (0xbB8...5957).

This is part of the OpenZeppelin Transparent Proxy Pattern to avoid collisions in contract calls for upgrades vs. other on-chain calls (such as restricted actions like minting, burning, and freezing, as well as permisionless actions like transfers).

Note that the owner account on both EVM chains is a simple EOA account. The admin account on both chains are deployed "ProxyAdmin" smart contracts whose sole purpose is to facilitate upgrades (this is also common for the Transparent Proxy Pattern). These ProxyAdmins are ownable, and their current "owner"s are GnosisSafe 4/6 multisigs without timelock.

#3.1.6 Operational Security Practices

Here we describe any emergency procedures the protocol team attests to have in place as well as protocol upgrade procedures.

We reached out to the FD121 team for comment on existing procedures for enabling "freezes" on wallet addresses that engage with FDUSD. As mentioned previously, freezes prevent wallet addresses (both EOA and smart contract addresses) from receiving or sending FDUSD. This is the response from FD121:

FD121 has established procedures to freeze specific wallet addresses in compliance with applicable laws and regulations. Wallet freezing is conducted only under the following circumstances: (1) when FD121 is required to act in response to a formal directive issued by a recognized authority, such as a judicial body, law enforcement agency, or other governmental entity with jurisdiction over FDUSD, or (2) in limited cases where FD121 determines, based on its policies, that such action is necessary to ensure compliance or address potential risks.

To support its wallet monitoring and freezing processes, FD121 employs third-party tools such as Elliptic and Hypernative. Elliptic is used for wallet screening to ensure adherence to regulatory and compliance standards. Hypernative specializes in analyzing on-chain activity to detect and flag potentially malicious smart contracts, which may pose risks to users. While Hypernative’s focus is on identifying risky contracts rather than specific accounts, its insights help enhance overall account security by proactively alerting users to potential vulnerabilities and scams.

#3.2 Development and Security Metrics

In this section, we analyze the FD121 Stablecoin smart contract, which is hosted here on GitHub. The Sui smart contracts are not available for public viewing.

#3.2.1 Development Activity

Here we gauge the frequency and volume of code commits, merges, and updates in the stablecoin's repository in this section.

The above repo has a single commit from May 2023. It may be that this repo was recently publicized or migrated to the above repo, and thus no earlier commits were observed; prior commits could've been squashed.

#3.2.2 Number of Active Developers

Here we observe the number of active developers contributing to the protocol codebase.

We could only find one developer who committed to the stablecoin's smart contract: h0tmilktea.

#3.2.3 Documentation Quality

Here we observe the quality and comprehensiveness of the technical documentation of the FDUSD stablecoin.

Besides the regular attestation of reserves made by FDUSD, FD121 has also published their whitepaper and has verified their contracts on Etherscan and BSCScan, making it possible for independent auditing of their smart contracts.

#3.2.4 Upgrade Frequency

While the development of the contracts cannot be determined from the GitHub repository linked above, FD121 has disclosed their audit reports privately, and it has shown the FD121 team making minor updates to the stablecoin on both EVM chains as well as Sui prior to deployment.

No further upgrades are noted on either EVM chain. This was verified by checking the event logs from both EVM chains for the "Upgraded event". This event is emitted once on first deployment and every time the logic contract is upgraded. It has only been emitted once on each chain (on deployment).

#3.2.5 Smart Contract Audits

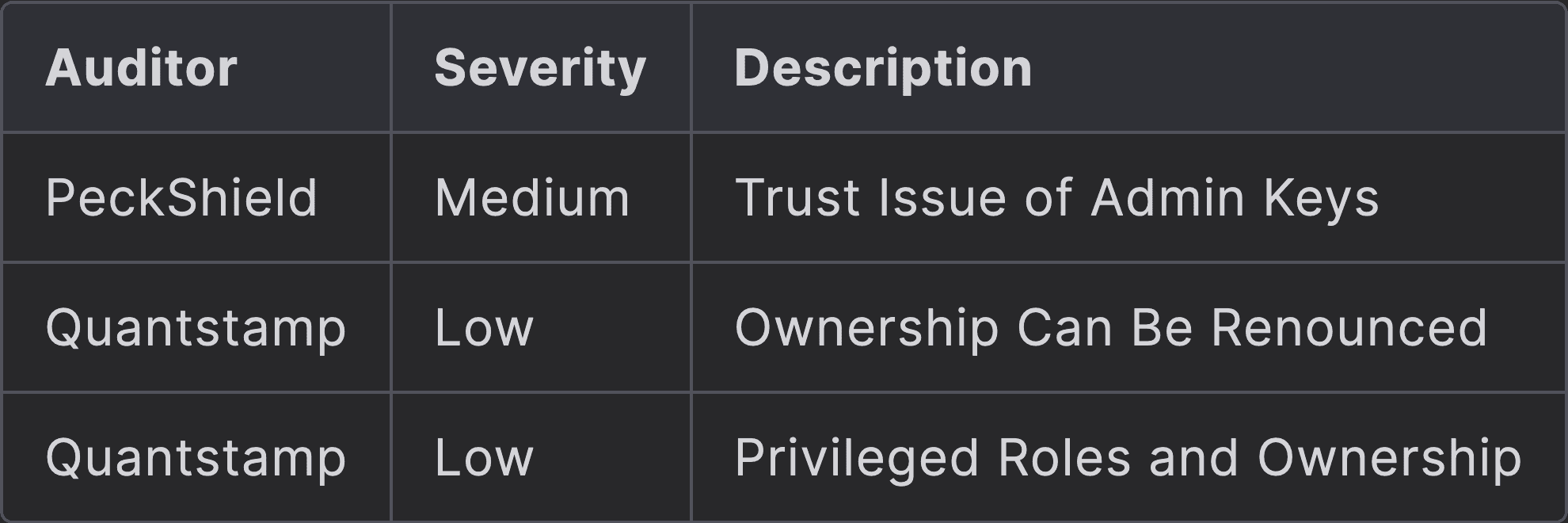

FDUSD has undergone five audits, conducted by three auditors, since deployment. In this section, we will only acknowledge the EVM smart contract audits.

Two audits were done for their smart contracts deployed on EVM chains, one conducted by PeckShield and the other conducted by Quantstamp. We summarise the findings in the table below:

PeckShield describes the "Trust Issue of Admin Keys" as being an issue stemming from the owner account having privileges that could be abused unless delegated to a governance contract. FD121 has acknowledged this and made a compromise by using a multisig instead of a simple EOA account for the owner role.

Quantstamp found that if the owner account renounces ownership via the renounceOwnership() function then this essentially breaks the workflow of the stablecoin contract ("Ownership Can Be Renounced").

In this event, minting, burning, freezing, and pausing becomes impossible. FD121 acknowledges this and states that in the event this happens, the separate admin account can upgrade this contract to reenable these functionalities and install a new owner in this crucial role.

Quantstamp also found an issue in the trust assumptions of a single owner account having sole power to mint and burn FDUSD as well as freeze and pause transfers ("Privileged Roles and Ownership"). Quantstamp's only recommendation for this was to disclose this to users, which FD121 acknowledges.

#3.2.6 Known Vulnerabilities Count

There were no major vulnerabilities observed in the audits conducted on the FDUSD Stablecoin smart contract.

#3.2.7 Bug Bounty Program Size

We did not acknowledge any Bug Bounty program organized by FD121, the stablecoin issuer and developer.

#3.2.8 Historical Downtime

In April 2024, Binance’s OMNI Launchpool reported FDUSD stablecoin deposits totaling $6.37 billion, significantly exceeding the stablecoin’s market capitalization of just under $4 billion. Binance promptly addressed the issue, clarifying that the inflated figures were due to a display error. Despite this correction, the incident led to a temporary depegging of FDUSD.

The incident in question was not directly attributed to the asset issuer, however, it is important to acknowledge that it may impact the redemption timeline. A potential increase in redemption requests could result in temporary delays. It is worth noting that as of today, there have been no publicly disclosed instances of FDUSD redemption delays or failures.

#Section 4: Regulation and Compliance

This section addresses the extent of consumer protections from a regulatory perspective. The reader should get a clear idea of (1) the solvency and transparency assurances provided by reserves management requirements, and (2) the current state and historical track record of the issuer's regulatory compliance.

This section is divided into 2 sub-sections:

-

4.1: Reserves Management

-

4.2: Regulations

#4.1 Reserves Management

#4.1.1 Reserve Assets

The conditions applicable to FDUSD reserves are defined in FDD Terms.

FDD Reserves are the assets held by FD121 Limited (FD121) to back each FDD stablecoin issued and in circulation. For every FDD stablecoin (such as FDUSD) that FD121 issues, it holds an equivalent amount of assets denominated in USD or the specific fiat currency of the FDD.

The reserves include cash holdings and permissible securities (U.S. Treasury-backed Bills, fixed deposits, and Overnight Reverse Repurchase Agreements) as determined by FD121, following applicable laws and regulations.

FD121 may invest the reserves in interest-bearing accounts or yield-generating instruments. While FD121 may earn interest or returns on the reserves, these earnings are retained by FD121. Holders of FDD stablecoins are not entitled to any interest, dividends, or returns generated from the reserves.

From the user perspective, the reserves serve the sole purpose to ensure FDUSD in circulation is fully backed by equivalent fiat assets and allow holders to redeem their FDUSD for fiat 1:1.

#4.1.2 Overcollateralization Buffer

N/A

#4.1.3 Custody of Reserves

First Digital Trust Limited, a licensed Hong Kong Trust or Company Service Provider, serves as the custodian for the reserves. As disclosed in monthly attestations, the USD balance is held in a dedicated Custody Account, maintained for the benefit of the FDUSD issuer.

In addition to the primary Custody Account, the Custodian has established a network of distinct accounts with various financial institutions in Hong Kong, Singapore, Australia, Canada, Luxembourg, and USA. These accounts, while held under the Custodian's name, are designated for the benefit of the issuer and are segregated from the main Custody Account.

Within this custody structure, the reserves are allocated across different financial instruments, incl. cash holdings, fixed-term deposits, and debt instruments. Of particular significance are the debt instruments guaranteed by the full faith and credit of the U.S. Government, which offer a high degree of security and stability to the reserve portfolio.

The information above is sourced from the monthly attestation reports. While the reports stipulate that each financial institution maintaining Reserve Accounts must hold a minimum Standard and Poor's short-term local issuer credit rating of "A-2," the absence of specific institutional identification presents a material obstacle to independent verification. First Digital's decision to withhold the identities of these financial institutions, coupled with the lack of supplementary information about their operations, creates a significant impediment to open-source validation of their creditworthiness and operational stability. Sensitive relationships with Hong Kong banks (in the absence of a definitive stablecoin licensing regime) has been cited by First Digital as a key impediment to disclosing the financial institutions where its reserve funds are held.

#4.1.4 Payment Rails

Direct redemptions through the issuer are exclusively available to institutional clients. Retail users must utilize secondary market channels for liquidating their FDUSD holdings into fiat currency - CEXs and OTC providers that support for FDD stablecoins.

Specific timeline is not delineated for the redemption process. The issuer retains substantial authority over the execution of transactions, i.e. the ability to delay, suspend, or terminate both issuances and redemptions under certain circumstances, such as suspicious activity, potential fraudulent behavior, or misconduct.

#4.1.5 Attestations

Attestation reports for August, September, and October are available at https://firstdigitallabs.com/. Legacy reports cannot be easily accessed.

The attestation consists of The Independent Accountant’s Report (conducted by Prescient Assurance LLC) and Reserve Accounts Report (made by FD121 Limited). The Independent Account, i.e. Prescient, examines FD121's assertions in accordance with attestation standards established by the American Institute of Certified Public Accountants.

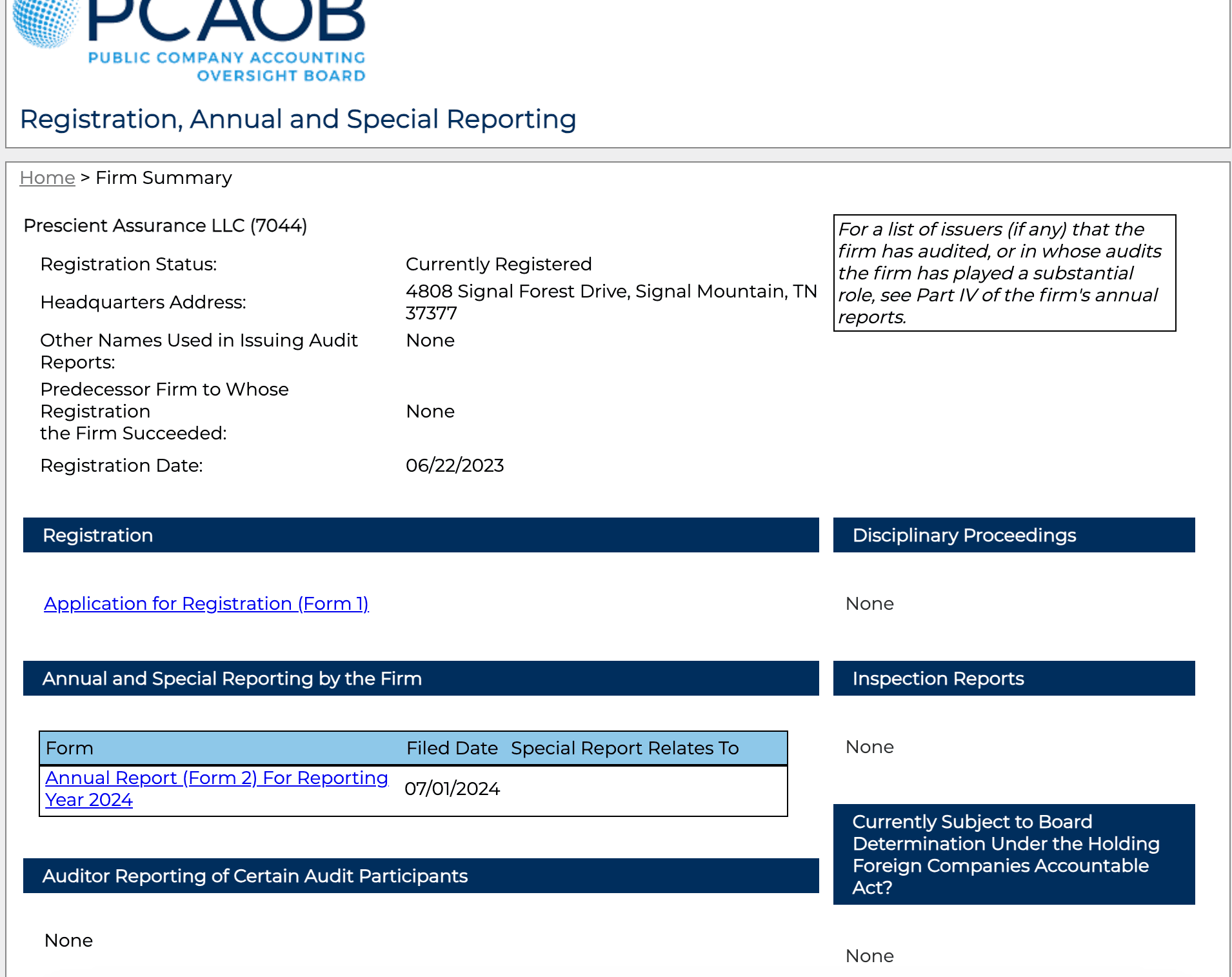

Prescient Assurance LLC is a licensed CPA firm. Its registration status with PCAOB is confirmed below.

Source: PCAOB | Date: 25.11.2024

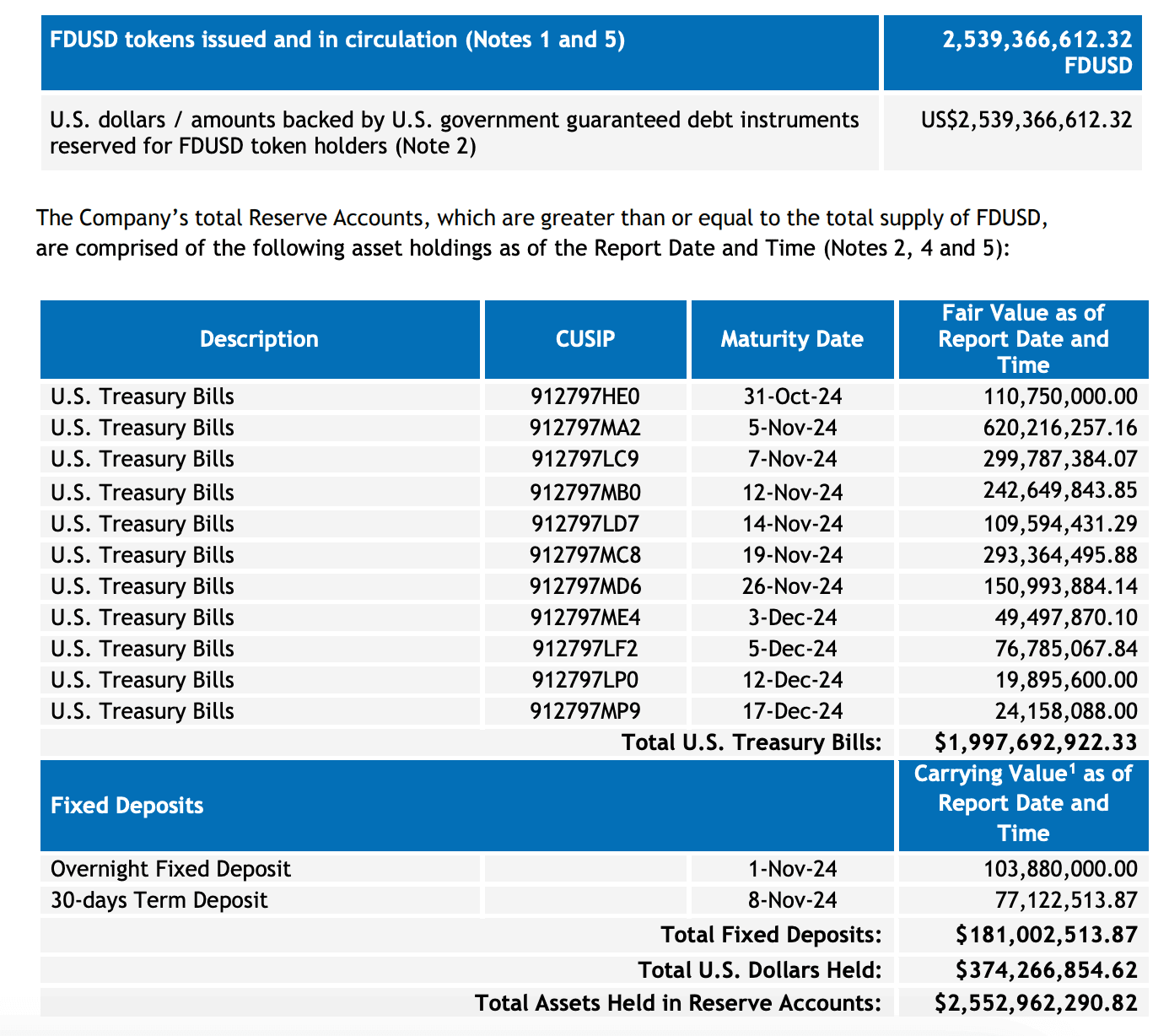

The latest reports affirm that as of October 31, 2024 the total USD balance in the Reserve Accounts exceeds the total circulating supply of FDUSD on Ethereum, BSC, and SUI.

Source: October 2024 Report | Date: 27.11.2024

#4.2 Regulations

#4.2.1 License

First Digital discloses the licenses and registrations obtained by First Digital entities.

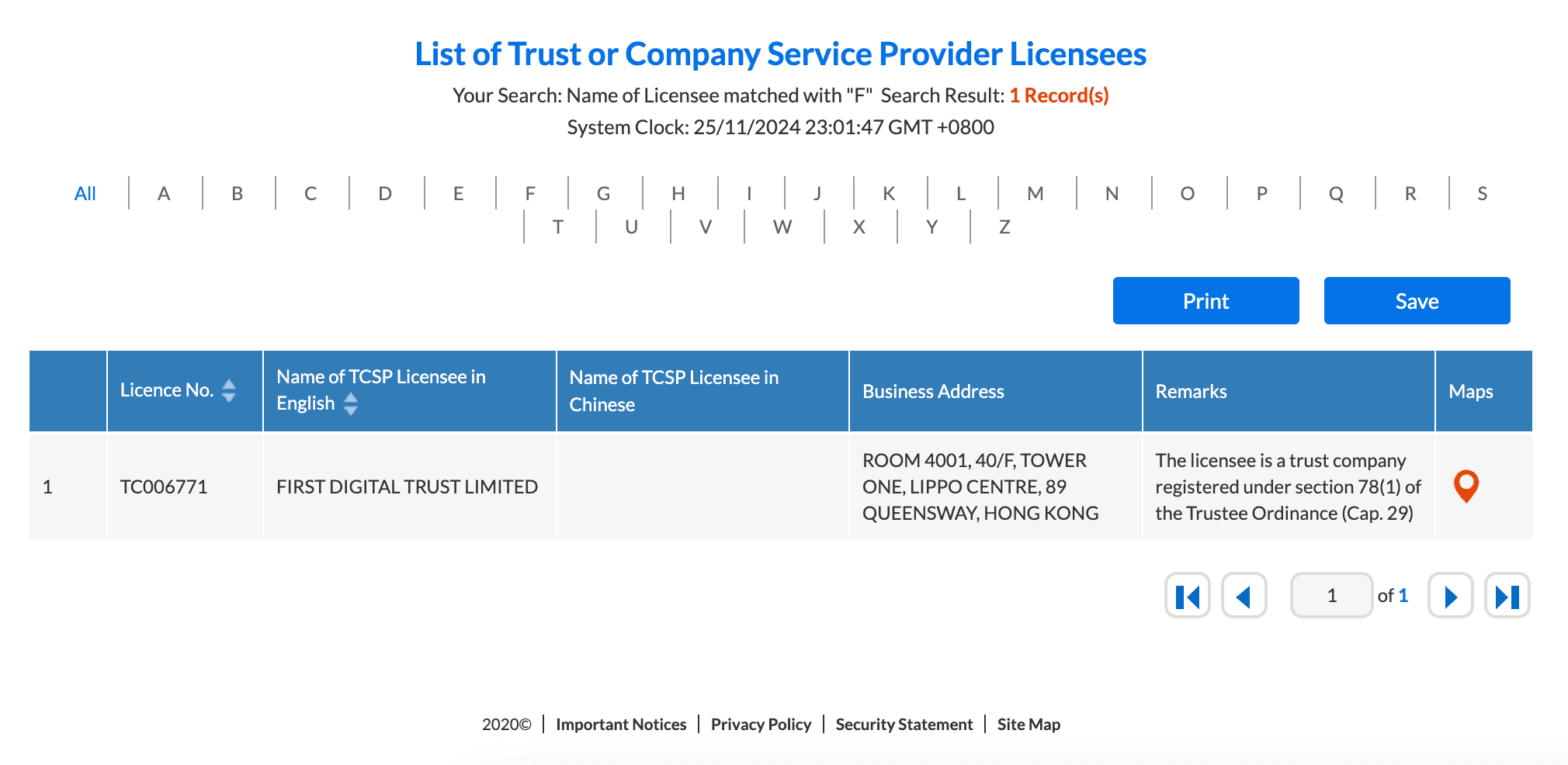

In Hong Kong, First Digital Trust Limited maintains a Trust or Company Service Provider (TCSP) license, which has emerged as a regulatory and industry standard for crypto custody operations. This licensing arrangement gains particular significance in light of the Securities and Futures Commission's (SFC) Virtual Asset Trading Platform Guidelines, which explicitly mandate that client assets be held in trust through TCSP-licensed entities.

Source: TCSP Registry | Date: 25.11.2024

The entity's United Kingdom presence is established through First Digital Trust (UK) Limited, which has secured registration as a Trust or Company Service Provider with Her Majesty's Revenue and Customs (HMRC). This registration fulfills mandatory regulatory obligations under UK money laundering regulations, encompassing professional trustee services.

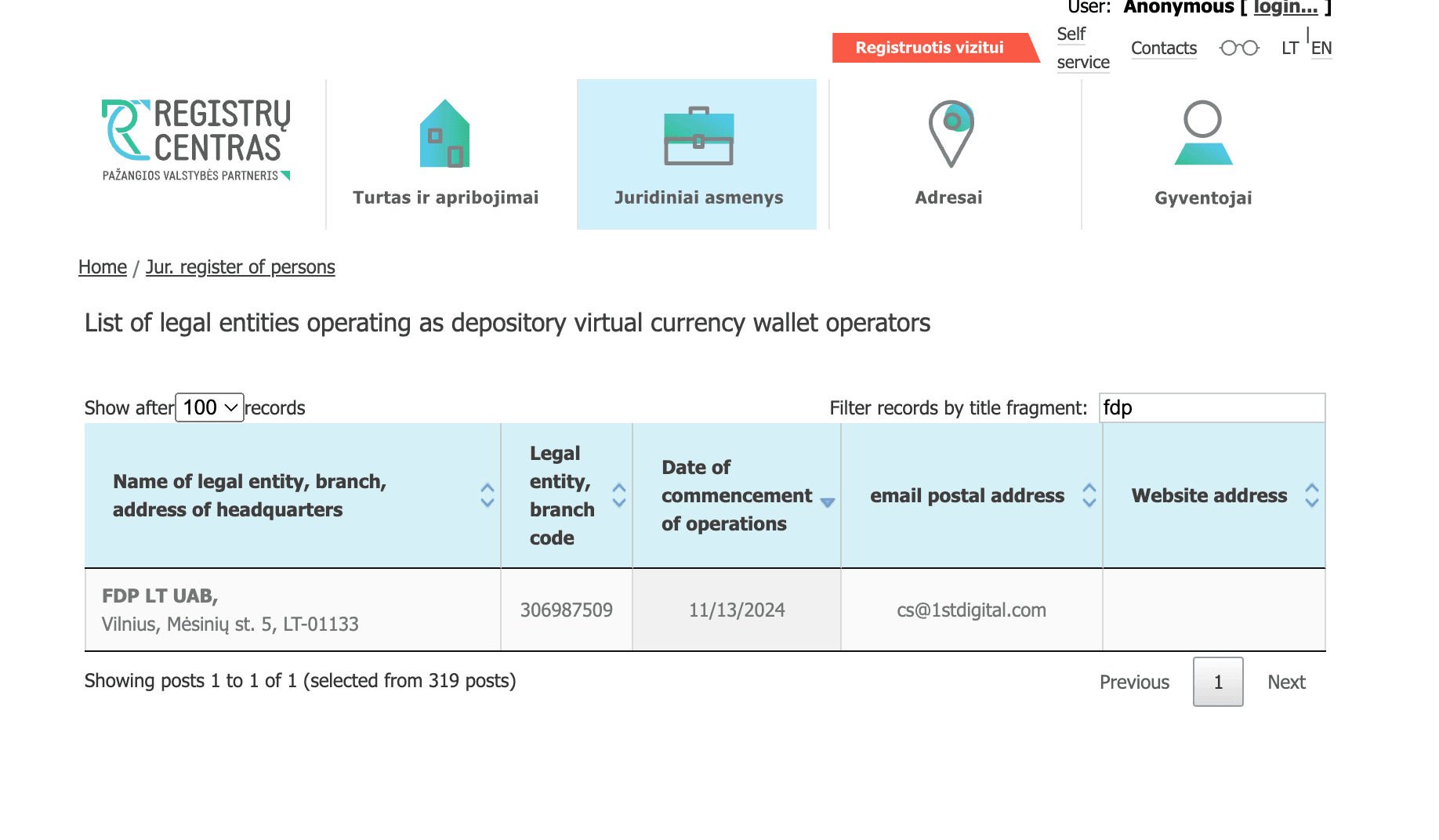

In the European Union context, FDP LT UAB has completed Virtual Asset Service Provider (VASP) registration with Lithuania's Financial Crime Investigation Service (FCIS). The registration enables the provision of virtual currency exchange services, including purchase and sale transactions for remuneration. Additionally, FDP LT UAB may act as Depository virtual currency wallet operator, managing custodian virtual currency wallets on behalf of clients.

Source: FCIS | Date: 25.11.2024

FD121, the designated issuer, currently operates without explicit regulatory authorization or registration. While First Digital maintains a portfolio of regulated entities capable of providing secure custody solutions, none of these existing licenses explicitly encompass the authorization to issue fiat-referenced stablecoins.

The Hong Kong regulatory environment for stablecoin issuers remains in a state of development. The Financial Services and the Treasury Bureau (FSTB) and the Hong Kong Monetary Authority (HKMA) have initiated steps toward establishing a comprehensive regulatory framework through their December 2023 consultation paper addressing fiat-referenced stablecoin issuers. However, despite expectations for legislative advancement in 2024, the implementation of this regulatory regime remains pending, with no substantial progress reported in the legislative process.

In March 2024 HKMA introduced a regulatory sandbox framework. This initiative represents a progressive step toward regulated stablecoin issuance, providing institutions with a controlled environment to test their operational protocols. FD121 is not among the three participants.

Looking ahead to 2025, First Digital has outlined its regulatory ambitions, with licensing applications at various stages of progress, incl. SG MPI license with the Monetary Authority of Singapore (currently under application), a UAE VARA license (application in progress), an EU EMI license in Latvia (preparing for submission), and an EMI license for the rest of Europe in Gibraltar (preparing for submission). First Digital has also expressed its intention to engage with HKMA Sandbox.

#4.2.2 Enforcement Actions/Lawsuits

No public records of legal actions or enforcement proceedings against the entities associated with FDUSD.

Open search also has not yielded concerning results about the core team members: • Vincent Chok (Chief Executive Officer) • Gunnar Jaerv (Chief Operating Officer) • Aleck Lee (Chief Financial Officer)

#4.2.3 Legal Opinion

We seek to determine if the issuer obtained legal counsel or legal memoranda on the regulatory standing of the stablecoin or an explanation of the same from the perspective of any jurisdiction.

It is unclear whether First Digital has consulted with HK lawyers regarding the regulatory standing of FDUSD. No documentation has been provided in this regard.

#4.2.4 Sanctions Compliance

The legal framework governing FDUSD is established through the FDD Terms and FD121 Account User Agreement, with FD121 Limited, a Hong Kong-incorporated private company, serving as the token issuer.

FD121 prohibits access to its services from Restricted Territories, which are jurisdictions under comprehensive sanctions. While specific countries are not listed in the terms, they generally include nations sanctioned by international bodies or national governments where FD121 conducts business.

#4.2.5 User Restrictions

The Terms establish strict compliance requirements regarding AML/CTF and Sanctions regulations for FDUSD and FD121 Services usage. Users must warrant that their activities comply with sanctions requirements, with the explicit prohibition of services to "Restricted Persons" - defined as individuals or entities subject to comprehensive sanctions in jurisdictions where FD121 operates.

However, there is a significant inconsistency in the documentation regarding eligible users:

-

Terms indicate support for both individual and institutional clients.

-

User Agreement restricts services exclusively to institutional clients in "supported jurisdictions" without detailing them.

#4.2.6 Restrictions for Illegal Use

The Terms outline a set of restrictions and prohibitions governing FDD usage. The Restricted Activities section prohibits actions such as unauthorized jurisdictional transfers, fraudulent behavior, provision of false information, system interference, and unauthorized access attempts. Prohibited Transactions encompass a broader scope of forbidden activities including transactions involving weapons, controlled substances, unlicensed gambling, money laundering, and terrorist financing.

FD121 maintains significant enforcement authority, including the right to monitor, block, or prevent suspicious transactions, suspend or terminate user accounts, report illegal activities to authorities, and freeze assets associated with prohibited activities. FD121 has discretionary power to delay or cancel transactions that raise compliance concerns.

#4.2.7 Customer Protection

To access FD121’s services, users must meet certain eligibility criteria, including age restrictions and residency requirements. Users must comply with all applicable laws and regulations including, without limitation, all applicable tax, AML/CTF provisions and sanctions.

The terms disclaim any provision of investment, tax, or legal advice, while FD121 is offering their services strictly on an "as is" and "as available" basis. The terms exclude all warranties, whether express, implied, or statutory, and provide no performance guarantees.

There is an explicit exclusion of deposit protection schemes, including government-backed insurance programs, as well as interest payment on platform-held funds. All transactions are final once initiated and cannot be reversed or refunded.

A critical weakness in the current structure lies in the absence of clearly defined customer rights during potential issuer insolvency scenarios. The Terms specify that FDD Reserves are beneficially owned by FD121, suggesting these reserves are maintained primarily for the issuer's benefit rather than protecting end-users. This arrangement raises concerns about the segregation of reserves from the issuer's general estate and their treatment in bankruptcy proceedings.

#Section 5: Pegkeeper Suitability

#5.1 Comparative Analysis of Pegkeeper Assets

#5.1.1 Geographical Correlation

USDT and USDC regulatory stances remain unchanged since the last comparison carried out for PYUSD onboarding.

PYUSD is issued by Paxos Trust Company, a fully licensed limited-purpose trust company regulated by the New York State Department of Financial Services (NYDFS). Reserves for PYUSD are fully backed by U.S. dollar deposits, short-term U.S. Treasuries, and similar cash equivalents.

USDM issuer, Mountain Protocol is regulated by the Bermuda Monetary Authority (BMA) as a Class F licensee under the Digital Asset Business Act 2018. This classification mandates that the collateral backing USDM is segregated from Mountain Protocol’s corporate accounts and held in bankruptcy-remote accounts on behalf of USDM holders. To comply with U.S. regulations, Mountain Protocol prohibits U.S. persons from purchasing USDM and refrains from marketing to U.S. residents.

In contrast, FDUSD's regulatory positioning raises material concerns. Despite First Digital's custodial arm maintaining verifiable licenses and registrations, the issuing entity (FD121) has not provided substantial evidence of regulatory authorization in Hong Kong or documented legal assurance regarding their chosen issuance model. The absence of either licensing documentation or qualified legal opinions supporting potential exemptions or compliance structures creates significant uncertainty regarding regulatory risk mitigation.

The lack of clarity for FDUSD's issuance structure stands in marked contrast to the clear regulatory approach adopted by other major stablecoin issuers, who have deliberately chosen to operate within specific national legal frameworks and implement strategic market restrictions where regulatory uncertainty exists.

#5.1.2 Peg Stability

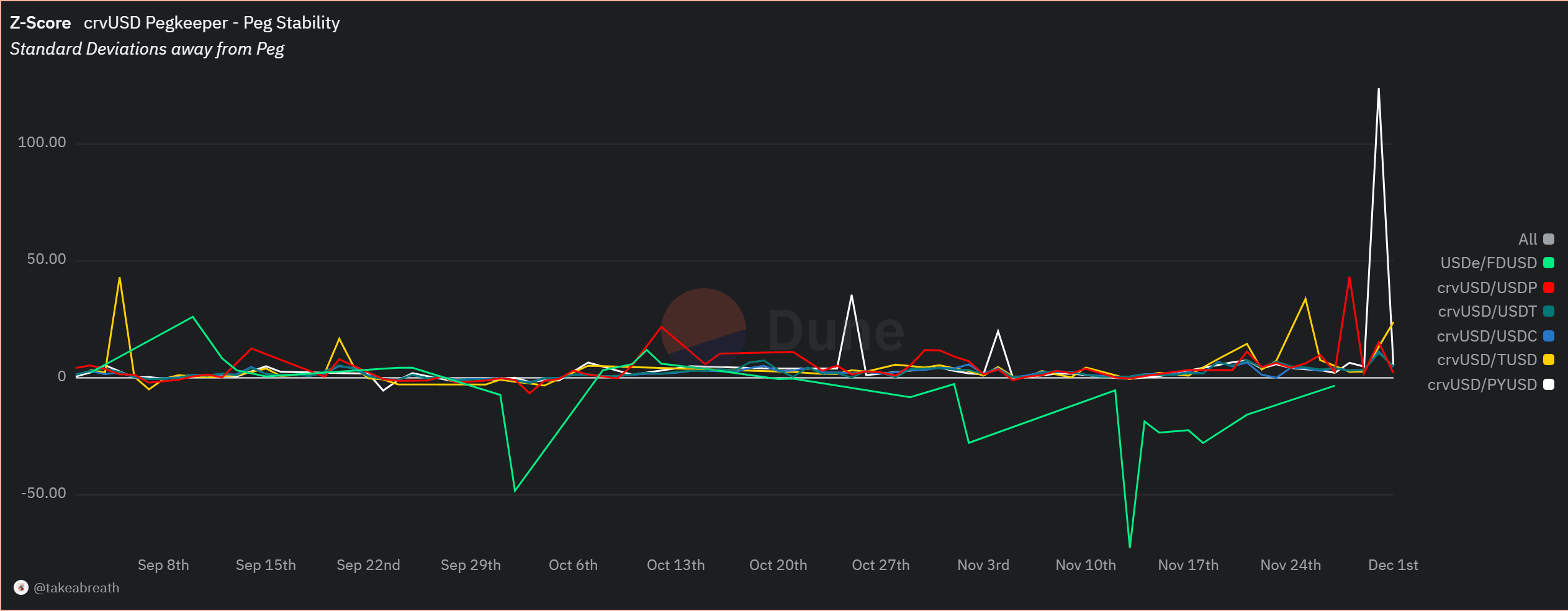

In this section, we compare the peg stability of numerous assets used for crvUSD PegKeepers and compare them to the peg stability of an asset paired with FDUSD.

As of writing this article, there is no FDUSD liquidity paired with crvUSD, so to make this comparison as fair as possible we will use the FDUSD/USDe Curve pool to determine how well it does to maintain peg for USDe.

The following compares the number of standard deviations away from the peg value of $1.00 for each pool examined. Positive values illustrate days the crvUSD or USDe value is < $1.00.

Note: price data is absent on days where there is no volume for these pairs

While the sign of the Z-Score tells us the direction of the peg instability, the magnitude is key for our analysis. Here, we observe that PYUSD and then FDUSD performed the worst for keeping peg for crvUSD and USDe, respectively. The best performers are observed to be USDT and USDC.

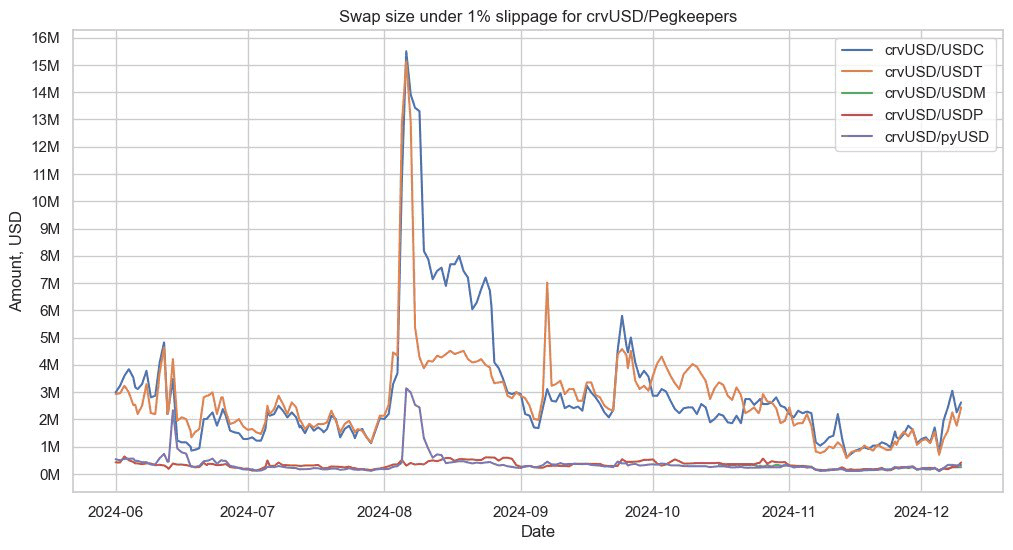

#5.1.3 Pegkeeper Pool Liquidity

As mentioned previously, FDUSD does not have a crvUSD paired pool established. However, in this section we compare liquidity depth for all current PegKeepers to establish an expected liquidity depth.

The recently onboarded USDM pegKeeper pool has consistently maintained a liquidity depth comparable to the minor PegKeepers (i.e. PYUSD). PYUSD and USDP pools have shown consistently less liquidity depth, especially since the beginning of November.

Source: IntoTheBlock

#5.2 Recommendation

Throughout our analysis, we observed strong metrics which show FDUSD's growing dominance on Centralised Exchanges, with signs of deep liquidity. There are encouraging roadmap plans to promote DeFi integrations on multiple chains with special attention on Ethereum, although these plans have not yet materialized.

We observe currently poor liquidity metrics on-chain, which will potentially pose issues in maintaining peg. We found numerous indicators of low liquidity relative to its competitors and challenges in maintaining its peg over a suitable timeframe. Most notably, we observed a lack of market depth for the stablecoin, which tends to incur high slippage costs. Additionally, we are concerned about the stablecoin's dependence on Binance, particularly since it replaces two previously dominant stablecoins that primarily served the exchange's business needs.

We failed to observe any clear disclosure of key aspects of First Digital Group's business model. The availability of attestation reports represents a positive step toward greater transparency. However, access to these reports is limited, as users are unable to easily retrieve historical data, which undermines full transparency. First Digital’s expanding regulatory footprint is promising, as evidenced by its maintenance of a TCSP license and VASP authorization, both of which are prerequisites for its ongoing licensing endeavors across multiple jurisdictions.

Despite these advances, significant concerns persist regarding the custody of reserves. First Digital has yet to disclose the specific financial institutions holding these reserves, which are reportedly maintained in accounts under the name of the custodian for the benefit of First Digital Trust Limited. This arrangement leaves the protection of end users somewhat ambiguous, as the lack of clarity around reserve custody and associated safeguards raises questions about the robustness of user asset protections.

We prefer to reserve judgment on FDUSD's suitability for crvUSD PegKeepers pending improvements to its market maturity and disclosures regarding its reserves management. We would like to see the following:

-

Deeper liquidity on-chain for FDUSD, particularly on DEXs deployed on Ethereum Mainnet. We would also like to see greater proliferation across more CEXs, reducing the reliance on Binance.

-

Clarity on the financial institutions which hold reserve custody and additional disclosure of key aspects of the business model.