Considerations relevant to crvUSD Pegkeeper assets in reflection of a recent report published by the Financial Stability Institute of the Bank for International Settlements (BIS)

#Introduction

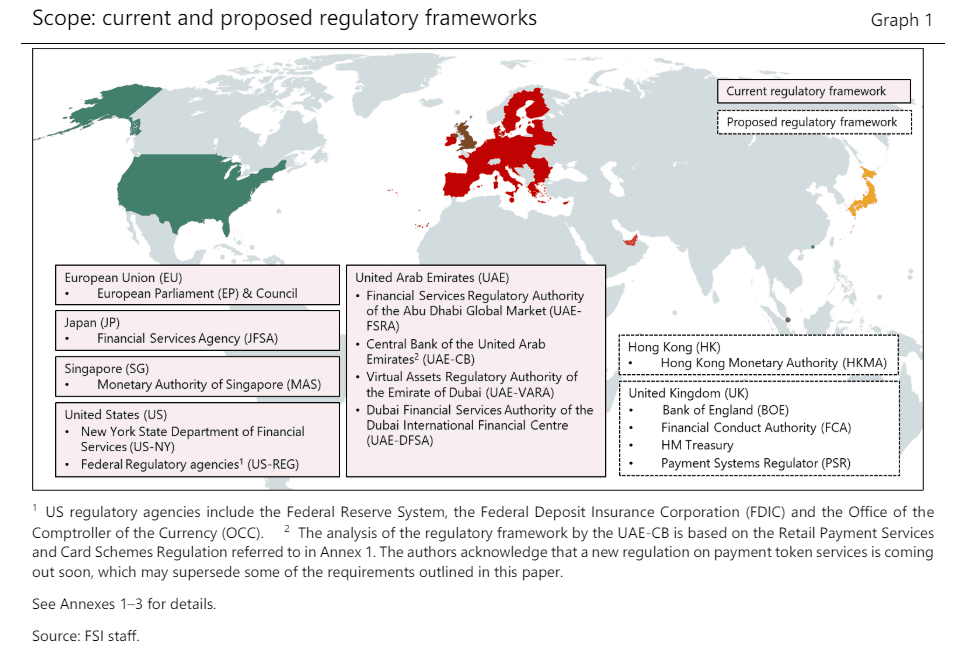

In April 2024 the Financial Stability Institute of the Bank for International Settlements (BIS) published an overview of policy implementations targetting stablecoins entitled “Stablecoins: regulatory responses to their promise of stability”. The paper recognizes the proposition of stability that stablecoins introduce by stabilizing their value to referenced assets and being redeemable upon request. A real gemstone in the research paper is the analysis of different authorisation regimes for stablecoin issuers across the world. The paper focuses on assessing regulatory responses to issuers of single fiat-pegged stablecoins while comparing regulatory approaches across 11 distinct jurisdictions.

Utilizing the insights from the BIS report, we will develop a comparative checklist tailored for stablecoins selected for PK v2—USDT and TUSD. Our approach focuses solely on existing regulatory frameworks, intentionally excluding any legislative proposals still under consultation or awaiting formal enactment. This methodology allows us to assess the tangible implications of existing regulations on these stablecoins, rather than theoretical models yet to be implemented.

Source: BIS

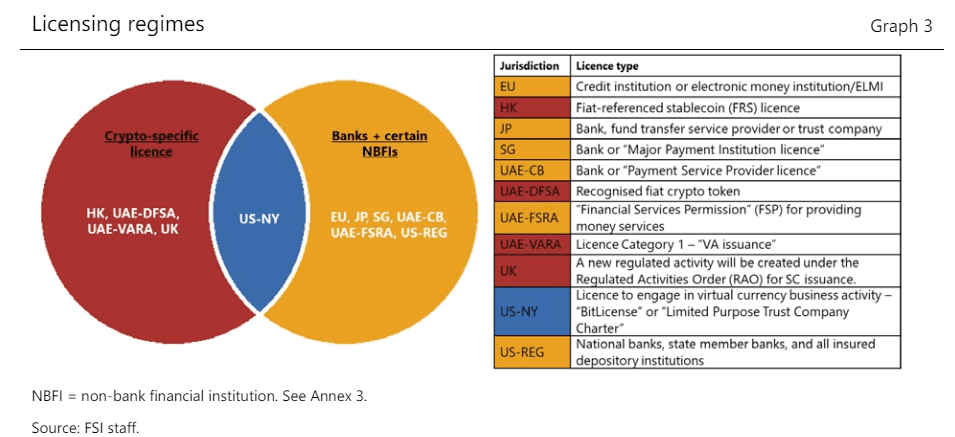

The BIS report delineates two principal types of licensing regimes: the first permits traditional financial institutions, including banks and non-bank financial entities, to issue stablecoins; the second introduces a new category of regulated entities that may issue stablecoins upon acquiring a crypto-specific license. Our evaluation will compare each stablecoin against the BIS’s synthesized criteria for issuers, thereby determining the most suitable regulatory environment for each. By aligning the stipulated requirements with those of the jurisdiction enforcing them, PK assets will undergo a thorough examination to verify their compliance with standards concerning reserve assets, redemption rights, prudential responsibilities, governance, risk management, technology, cybersecurity, anti-money laundering/counter-financing of terrorism measures, and disclosure and marketing practices.

This evaluation seeks to ascertain the appropriate licensing regime—or regimes—for the issuance of the stablecoins of interest, particularly since neither USDT nor TUSD issuers currently hold a license that explicitly facilitates the issuance of crypto assets. Notably, pyUSD and USDC are excluded from this analysis as their issuers already possess multiple licenses covering stablecoin issuance and related financial activities.

According to the BIS findings, the New York Department of Financial Services (NYDFS) has implemented a licensing framework for pyUSD that effectively integrates crypto-specific licensing with traditional financial authorization models. BIS assessment underscores the robust regulatory environment surrounding the issuance of pyUSD.

Source: BIS

#USDT/TUSD Comparative Analysis

Our comparative analysis follows the outlined model, incorporating concise notes and references for each category evaluated. We rely exclusively on publicly available data concerning stablecoins and their issuing entities. In cases where information is unavailable, we will note this as N/A.

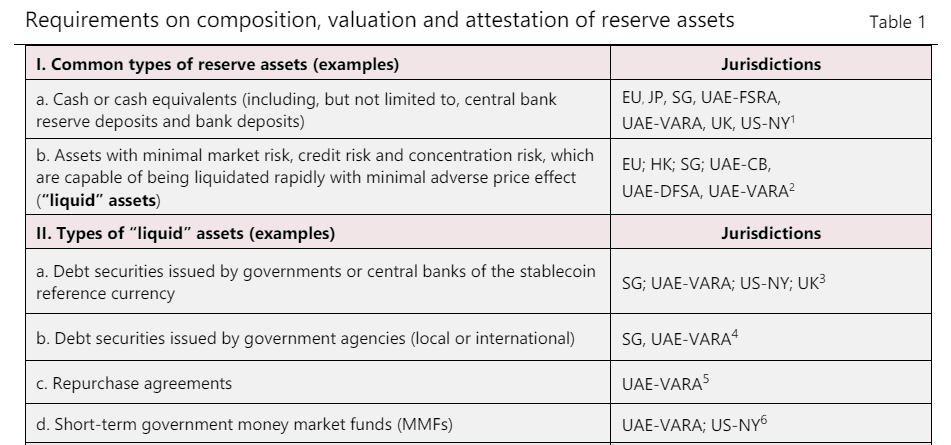

#Requirements on composition, valuation and attestation of reserve assets

1) Cash or cash equivalents (including, but not limited to, central bank reserve deposits and bank deposits)

-

USDT: Constitute 84.05% of the total Reserves https://tether.to/en/transparency/?tab=reports

-

TUSD: Cash represents a smaller part of the collateral composition. The major part of USD denominated collateral is held by First Digital Trust Limited

2) Assets with minimal market risk, credit risk and concentration risk, which are capable of being liquidated rapidly with minimal adverse price effect (“liquid”) assets

-

USDT: U.S. Treasury Bills, Overnight Reverse Repurchase Agreements, Term Reverse Repurchase Agreements, Money Market Funds, Non-U.S. Treasury Bills

-

TUSD: Short-term US Treasury Securities are not included in the asset composition as per the latest report

3) Valuation and attestation of reserve assets

-

USDT: The value of the assets composing the Reserves exceeds the value of the liabilities of the Companies issuing fiat-denominated Tether tokens as of the date of the latest auditor’s report

-

TUSD: The value of Escrowed Collateral exceeds the value of the circulating token supply

#Requirements on segregation and custody of reserve assets

1) Segregated from the proprietary assets of the issuing entity

-

USDT: No publicly available information on the segregation of USDT's assets

-

TUSD: No publicly available information on the segregation of TUSD's assets

2) Segregated in separate accounts

-

USDT: No publicly available information on the segregation of USDT's assets

-

TUSD: No publicly available information on the segregation of TUSD's assets

3) Held in custody by authorised banks and NBFIs authorised to hold client assets/provide custodial services

-

USDT: Reports do not disclose the entities that act as custodians, counterparties, or bank account providers of the assets in the reserve

-

TUSD: Held at depository institutions in HK, Switzerland and the Bahamas

4) May be held by overseas-based custodians, subject to certain restrictions

-

USDT: Reports do not disclose the entities that act as custodians, counterparties, or bank account providers of the assets in the reserve

-

TUSD: Yes

5) Not pledged, encumbered or rehypothecated

-

USDT: N/A

-

TUSD: N/A

6) Kept segregated reserve of assets per each stablecoin issued

-

USDT: N/A

-

TUSD: N/A

#Requirements on redemption rights

1) Issuers should ensure holders the right to redeem their stablecoins

-

USDT: Redeemability is restricted to users with verified account and a minimal redemption amount of 100,000 USD equivalent

-

TUSD: Available to verified users only. Minimum redemption amount is 1,000 USD

2) Timely redemption

-

USDT: Yes, Subject to limitations of banking system working hours

-

TUSD: Yes, Subject to limitations of banking system working hours

3) Redemption must be ensured at par value

-

USDT: Yes

-

TUSD: Yes

4) Redemption shall not be subject to a fee

-

USDT: Fee per redemption the greater of $1,000 or 0.1%

-

TUSD: Yes

5) Clear and detailed redemption policies and procedures shall be implemented and disclosed

-

USDT: Yes

-

TUSD: FAQ explainers

6) Prudential requirements

-

USDT: N/A

-

TUSD: N/A

7) Governance and risk management

-

USDT: N/A

-

TUSD: N/A

8) Technological and cyber security requirements

-

TUSD: N/A

9) AML/CFT requirements

-

TUSD: N/A

10) Disclosure and marketing Publication of white paper or similar document

-

TUSD: N/A

11) Publication of risks statements arising from the use of stablecoins

-

USDT: https://tether.to/en/legal/?tab=risk-disclosure-statement

-

TUSD: N/A

12) Publication of audit statement on reserve assets

13) Ongoing disclosures to users

-

USDT: Publication of quarterly reports

-

TUSD: Real-time attestations

In terms of collateral composition, both USDT and TUSD incorporate debt securities issued by governments or central banks. Additionally, USDT's backing includes repurchase agreements and money market funds (MMFs), making the regulatory regimes of Singapore and the UAE particularly well-suited due to their flexibility in accepting various liquid assets. Other jurisdictions do not offer similar breadth in permissible backing assets.

Source: BIS

Regarding asset segregation, the lack of specific information for USDT and TUSD leads us to rely only on the finding that TUSD's assets are held by overseas-based custodians, a practice permitted under the licensing frameworks of Singapore and the UAE.

All national regimes generally require guaranteed redemption of stablecoins. Only Singapore appears to offer a backdoor for USDT’s fees imposed for redemption - there are no restrictions in force for charging fees when redeeming stablecoins.

The requirement for issuers to publish attestations and maintain regular disclosures is uniformly enforced across all jurisdictions, ensuring that any omissions or inaccuracies by the issuers do not receive exemptions under any legislation.

Based on the matches observed, we can conclude that the regulatory environments in Singapore (overseen by the Monetary Authority of Singapore) and the UAE (administered by various authorities including VARA, DFSA, and FSRA are most conducive to the structural and collateral frameworks of USDT and TUSD. Although both issuing entities must undertake significant adjustments to comply with these regulatory standards, our findings indicate that these jurisdictions offer an effective and secure regulatory response that enables issuers to operate within a sound legal framework.

Undoubtedly, a cohesive and adaptable regulatory framework is paramount for the broader integration of stablecoins into the international financial landscape. From a strategic viewpoint, such a framework not only enhances stability and trust in virtual currencies but also facilitates their acceptance across various markets. Practically, securing a license in jurisdictions that offer relatively favorable conditions empowers issuers to more effectively mitigate the risks associated with regulatory actions related to the distribution of non-authorized stablecoins. A preemptive compliance step of this kind helps shielding the issuers from potential legal challenges and financial penalties, thereby promoting a smoother operational landscape.