Analysis of YieldNest ETH parameter optimization for a LlamaLend market

#Context

YieldNest intends to deploy a LlamaLend market for its token ynETH, a native liquid restaking token (nLRT) that provides exposure to a dynamically curated basket of Actively Validated Services (AVSs) across multiple industry verticals. The YieldNest DAO carefully selects and vets all operators and AVSs within ynETH’s basket to deliver a token with the highest possible risk-adjusted yield.

Importantly, ynETH is non-rebasing, meaning the token balance remains fixed over time, and its underlying value increases through compounding rewards. This characteristic makes it comparable to other non-rebasing LSTs (e.g. cbETH, WBETH, and wstETH) and LRTs (e.g. ezETH and pufETH). ynETH has not activated withdrawal functionality, but this is an imminent upgrade, according to the YieldNest team. Therefore, we assume it will exhibit market dynamics similar to those of the tokens mentioned above. The primary liquidity venue is the Curve ynETH/wstETH CryptoSwap-NG pool, deployed on July 3.

#Methodology

To determine the optimal market parameters—specifically A (amplification factor), fee, liquidation_discount, and loan_discount— we employed the Llamma Simulator. This tool allows us to model the market dynamics of the target collateral and to optimize the parameters based on historical price data and the expected performance of ynETH in comparison to non-rebasing liquid staking tokens (LSTs) and Liquid Restaking Tokens (LRTs).

Note: While ynETH has some market history, having been tading for nearly two months, the short trading history is insufficient to model the token directly. Therefore we use analogous assets as proxies to predict the future expected market behaviors exhibited by ynETH.

#Simulation Setup

The simulation was run under the assumption that ynETH would exhibit similar behaviors to comparable assets in terms of volatility and market dynamics. We first ran the simulation to determine the optimal fee for A= 50 and bands= 4. After we identified the optimal fee range, we proceeded to set up an experiment for varying ranges of A for the identified fee tier. This allows us to determine the optimal A where we can set liquidation_discount most aggressively with the minimum expected borrower losses.

We ran the simulation with two LSTs (wstETH, WBETH) and two LRTs (pufETH, ezETH) to identify the level of uniformity across the sample set and better inform the selection of parameters suitable for ynETH.

#Results

Results are divided into four sections:

-

Feeoptimization for each proxy asset -

Feerecommendation for ynETH -

A,liquidation_discount, andloan_discountoptimization for each proxy asset -

A,liquidation_discount, andloan_discountrecommendation for ynETH

#Fee Optimization

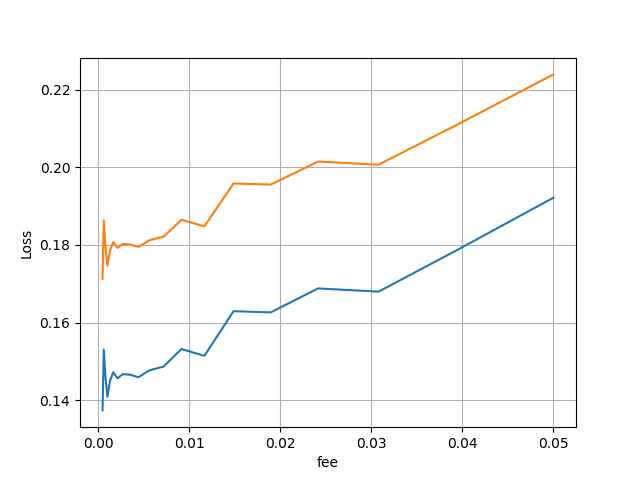

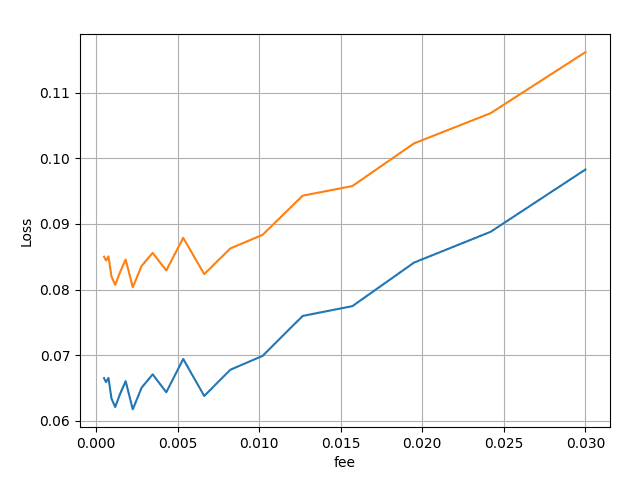

#$wstETH

The loss was minimized at a fee of 0.0010 for wstETH. For wstETH this seems to be the most ideal parameter.

#$WBETH

For WBETH the optimal fee seems to be 0.0028, followed by 0.0015.

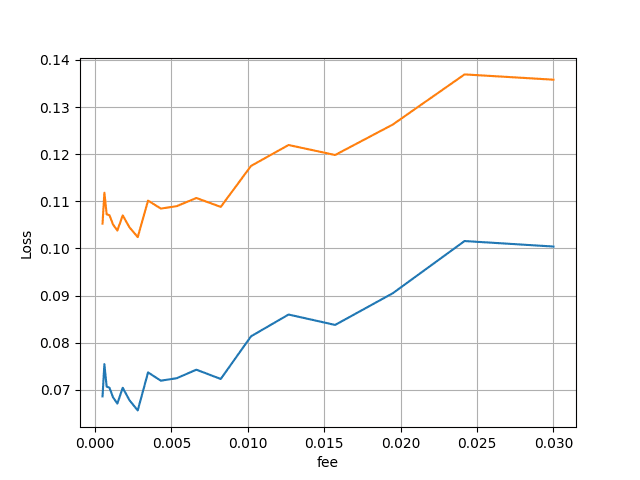

#$pufETH

$pufETH optimal fee on the existing price paths seems to be 0.0054, which is rather high compared to the previous LST assets. However, values such as 0.0008 or 0.0012 mark values close to the minimum in the loss metric in the chart.

#$ezETH

For $ezETH, fee values of 0.0008, and 0.0015 mark values close to loss minimization. Values as high as 0.0043 and 0.0066 also perform well.

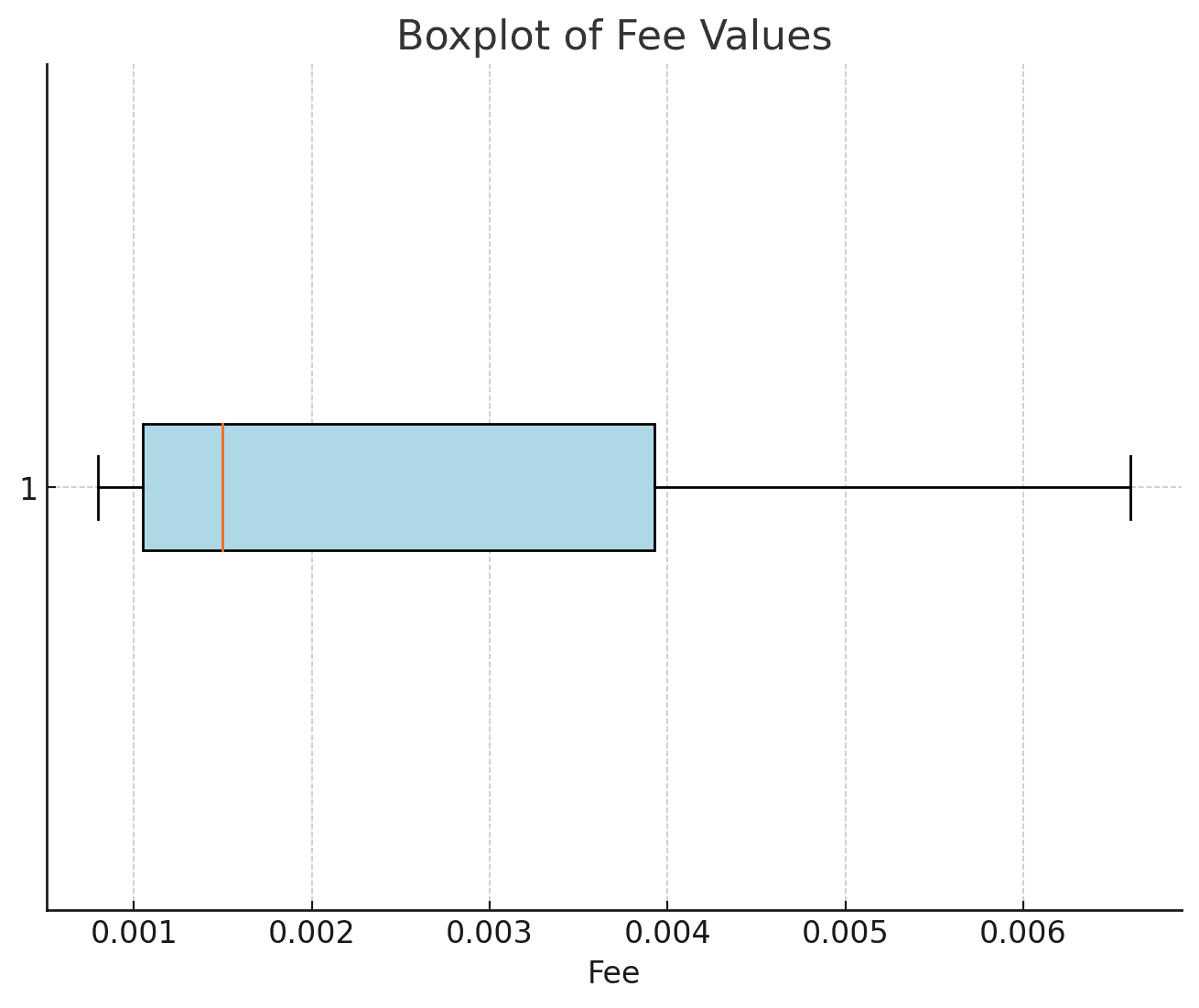

#Recommendation for Fee

The analysis of fee values (containing local minima and absolute minima) across different LRTs and LSTs revealed a range of values between 0.0008 and 0.0180, with a median of 0.0015 and an average of 0.0026.

The boxplot visualization shows that most fee values are concentrated in the lower range, with a few higher outliers. The central tendency, represented by the median, indicates that typical fee values are closer to the lower end of the spectrum. Based on the distribution of fee values, a recommended fee of 0.0015 (median) to 0.0025 (mean) for a ynETH target the most common values. We select a more aggressive fee tier as these assets tend to be more volatile and we want to prioritize effective soft liquidation arbitrage within the LLAMMA.

#A, liquidation_discount and loan_discount Optimization

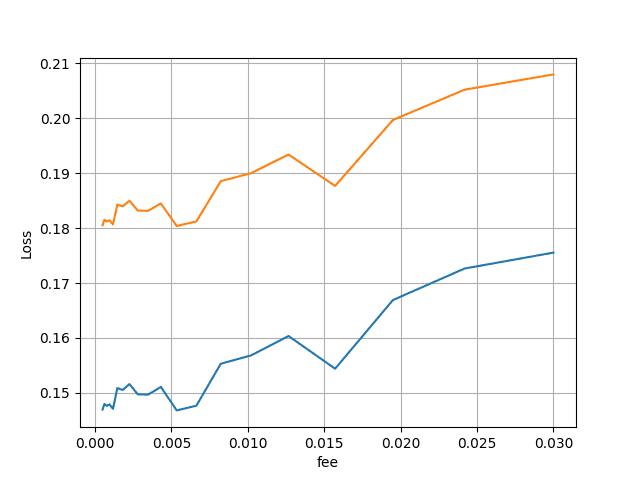

We set the fee across assets to 0.25% and study the performance across varying A's for this fee tier. The following section shows the observed results. We identify the optimal A by minimizing the Discount and selecting the corresponding Loss as recommended liquidation_discount.

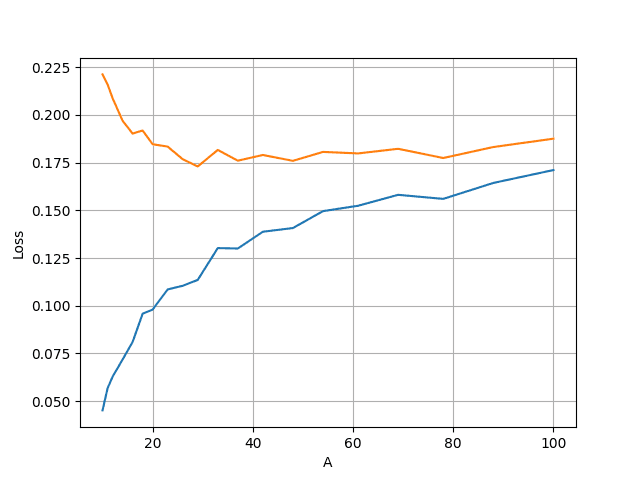

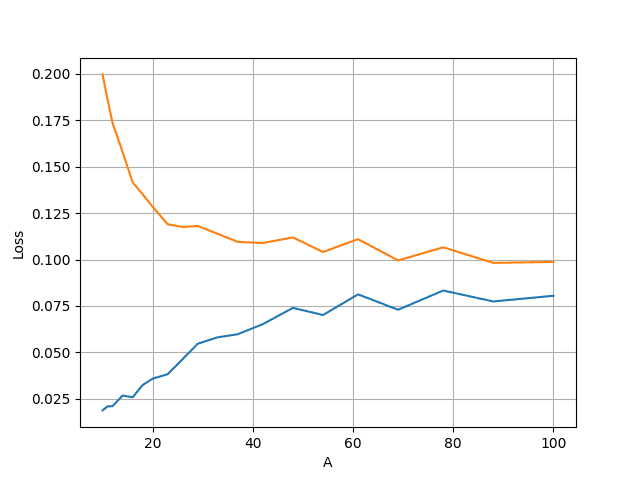

The orange line in the results is the Discount i.e. the value of liquidity if prices slowly decline. The blue line in the results is the Loss i.e. the sum of borrower losses that that may be experienced in the worst case of excessive volatility.

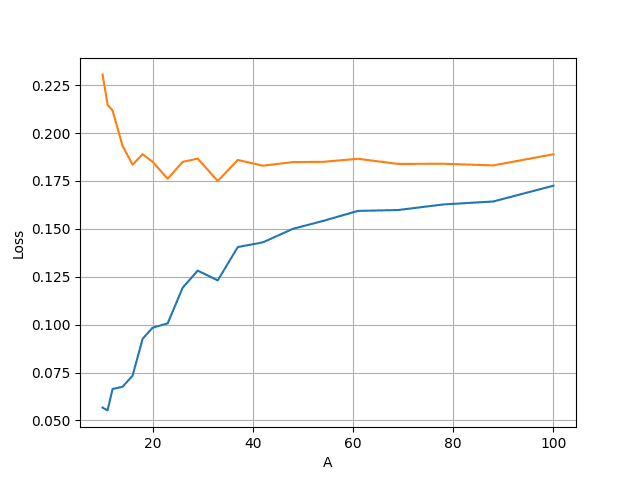

#$wstETH

The results for $wstETH suggest that the discount is minimized at 0.1730 with anA=29 and a recommended liquidation_discount= 0.1135.

#$WBETH

The results for $WBETH suggest that the discount is minimized at 0.0982 with anA=88 and liquidation_discount = 0.0774. Yet, the results should be viewed somewhat with caution as the values end close to the search range and are quite high compared to the underlying (i.e. ETH, A=72 and liquidation_discount = 0.004). This difference might be due to shorter available trading history.

#$pufETH

The results suggest that $pufETH discount is minimized at 0.1749 with anA= 33, meaning a recommended liquidation_discount= 0.1231. The discount of 0.1761 also marks a local minimum with A= 23 and results in a recommended liquidation_discount of 0.1006.

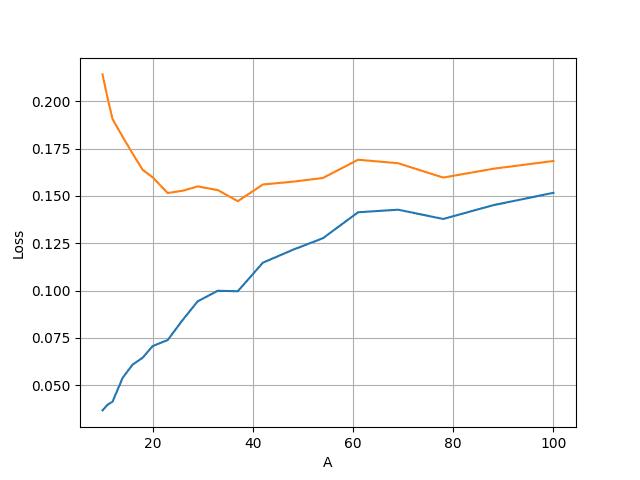

#$ezETH

The results for $ezETH suggest discount is minimized at 0.1473 with anA= 37 and hence a recommended liquidation_discount is set to 0.1006.

#Recommendation for A and liquidation_discount

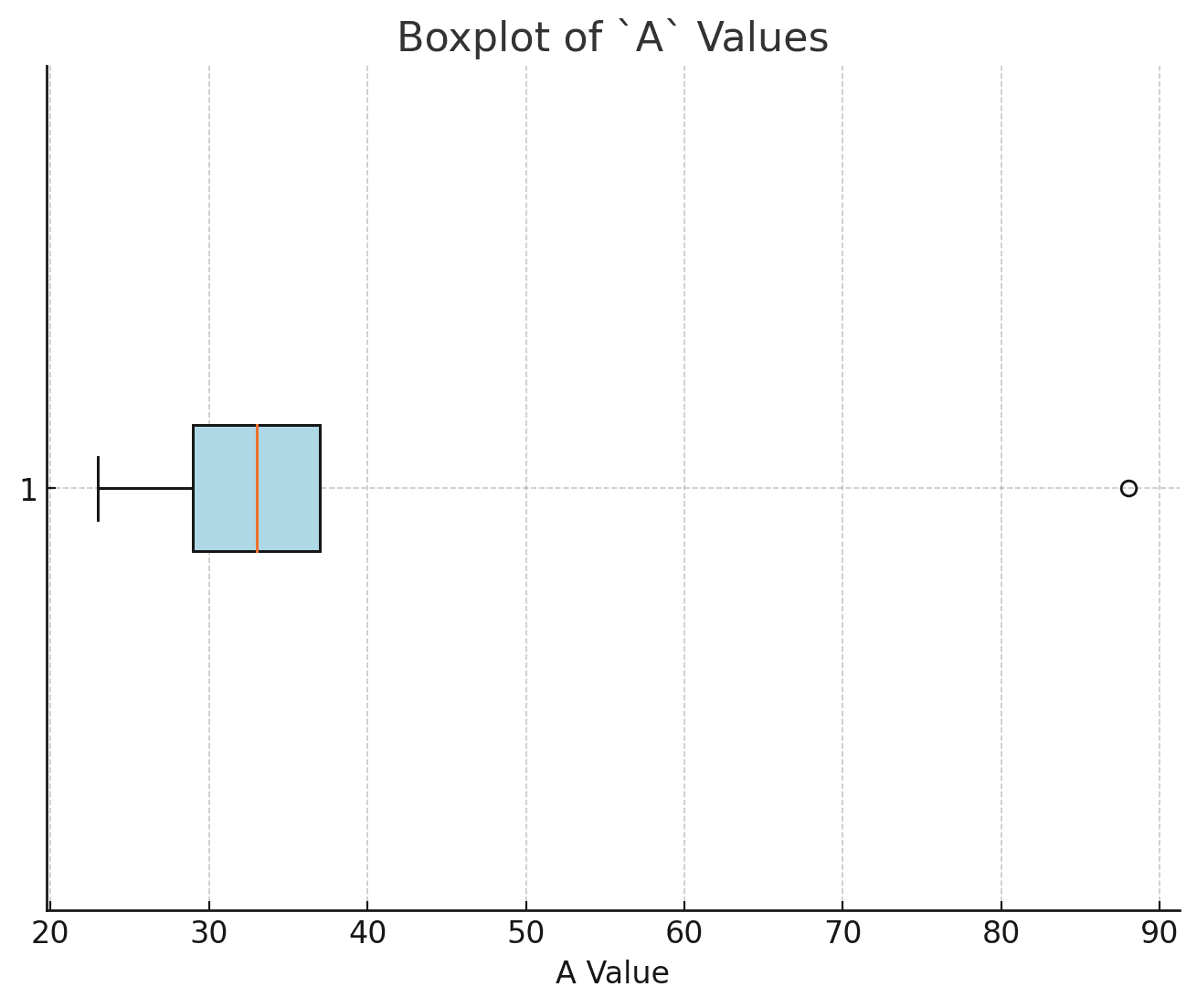

#A

Noting that we have reviewed a small sample set, the median of the A values is 33.0, and the mean (average) of the A values is 42.0. These statistics, nevertheless, provide a reasonable overview of the central tendency of the A values across the assets. Given that the median and mean are relatively close, a recommended A value in the range of 33 to 42 would be reasonable. A = 37 might be a reasonable choice as it is close to the median, which represents the middle point of the dataset, while also being slightly conservative compared to the mean. In addition, when comparing it to LRT tokens (i.e. pufETH and ezETH) which are likely most similar, an A of 37 is reasonably aligned.

#liquidation_discount

Based on the recommendation for A = 37, and that we expect ynETH to behave similarly to other LRT tokens in terms of asset volatility, we extract loss values in the simulation output of ezETH and pufETH at A=37. For ezETH this amounts to liquidation_discount= 0.1006 and for pufETH this is liquidation_discount=0.1405. pufETH has notably not enabled withdrawals, which is reflected in the more conservative optimal parameters. Since we expect ynETH to imminently enable withdrawals, we recommend assigning the more aggressive liquidation_discount= 0.1006.

#Final Recommendation

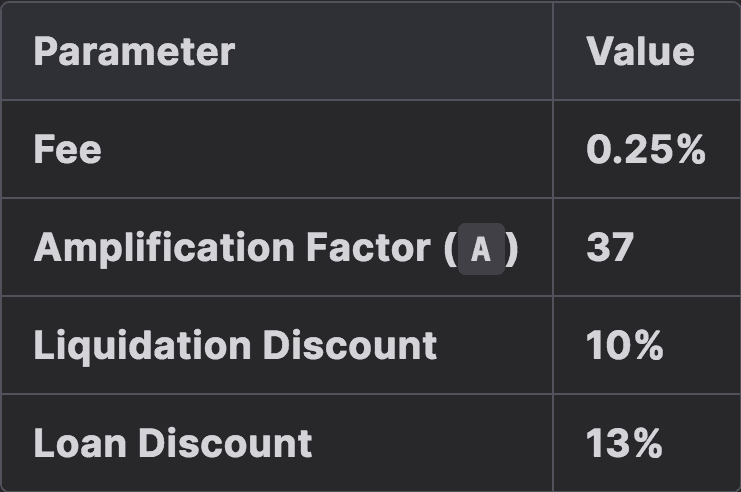

Based on these simulations and comparisons, we recommend the following market parameters for the ynETH-long LlamaLend market:

This produces a max LTV of 82.63%, allowing a max possible leverage of 5.75x.

#Rationale

-

Fee (0.15% to 0.25%): We prioritize arbitrage and hence recommend a higher fee of 0.25%.

-

Amplification Factor (33 to 42): We select a value of

A=37, as we expect a reasonable value to lie between the median and mean of observed values. -

Liquidation Discount (10% - 14%): We recommend a more aggressive of the values with

liquidation_discountof 10%. The rationale here is the conservative value may be more suitable for LRTs without withdrawals enabled (weaker peg assurances). -

Loan Discount (10% + 3%): This buffer ensures protection against sudden market movements, reducing the likelihood of immediate liquidations for borrowers. We add a fixed 3% as suggested in the llamma-simulator.

#Conclusion

In conclusion, the market parameterization for the ynETH-long market has been carefully determined through simulations and comparisons with similar assets. The selected parameters—fee of 0.25%, amplification factor (A) of 37, liquidation discount of 10%, and loan discount of 13%—are designed to balance market competitiveness and risk management. The fee prioritizes arbitrage during Soft Liquidations, while the chosen amplification factor and liquidation discount reflect the most aggressive borrowing terms allowable while minimizing expected borrower losses for LRT assets with withdrawals enabled. These settings aim to optimize market performance while ensuring the stability and resilience of the ynETH market on LlamaLend.