An examination of Tether's regulatory positioning in El Salvador, exploring the legal requirements and compliance measures established through its dual-entity registration as Digital Assets Service Providers.

#Background and DASP Registration

Tether made headlines with an announcement to relocate its operations to El Salvador. Our legal brief is designed to share details on the legal foundation and assurances Tether plans to rely upon in establishing its local presence.

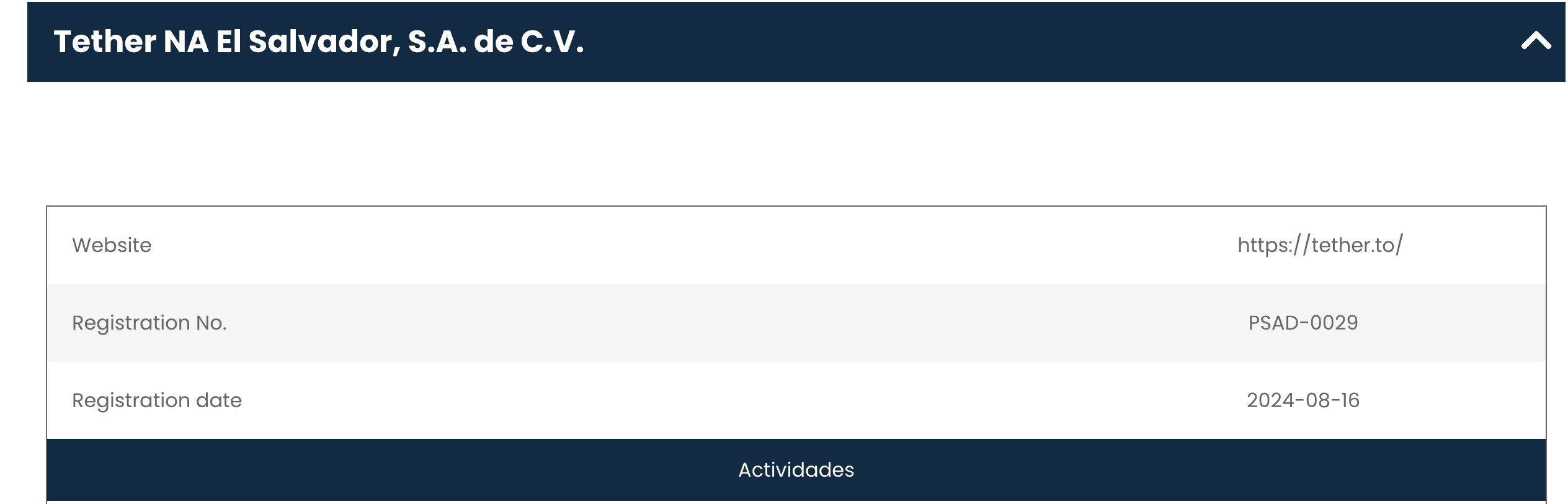

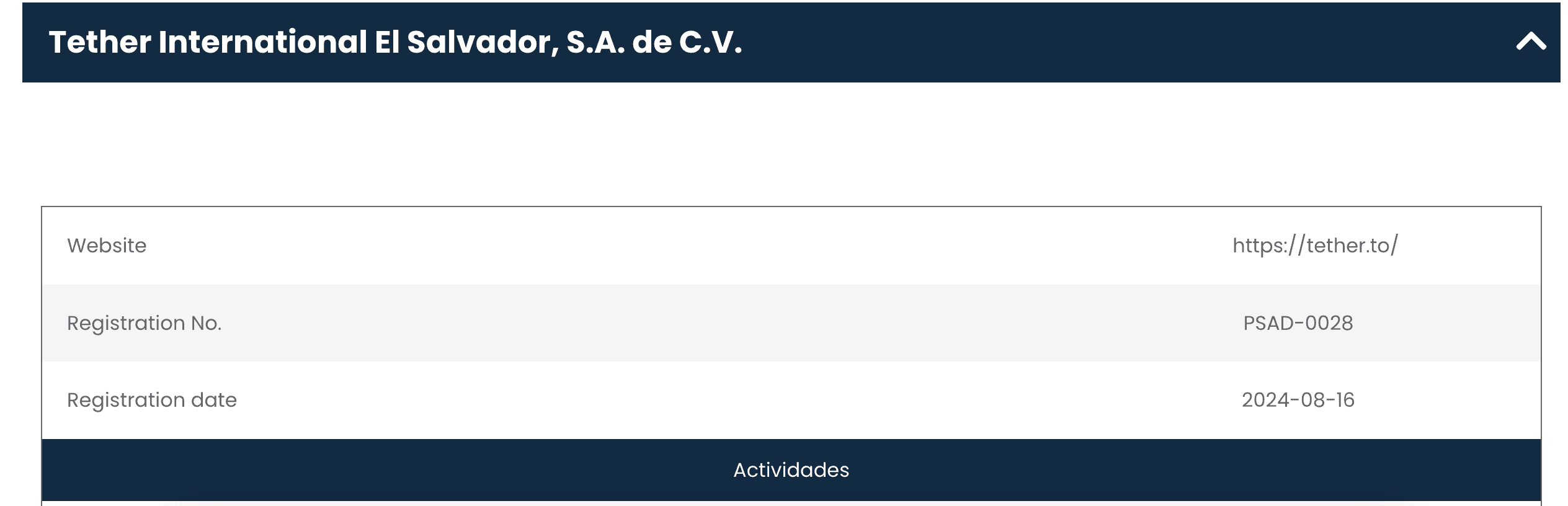

The National Commission of Digital Assets (CNAD) of El Salvador maintains a public registry of Digital Assets Service Providers (DASPs). Tether appears in the registry under two entries: Tether NA El Salvador S.A. de C.V. and Tether International El Salvador S.A. de C.V.

#Authorized Activities

Both companies are listed with identical authorized activities and operations carried out on behalf of, and for the benefit of, third parties:

Exchange of digital assets for fiat money or equivalent or for other digital assets, whether using own capital or that of a third party;

Operate a platform for exchanging or trading digital assets or derivative digital assets;

Evaluation of the risk and price, as well as the subscription of digital asset issues;

Place digital assets on digital platforms or wallets;

Promote, structure and manage all types of investment products in digital assets, as well as loans, mutual funds or any form of financing of digital assets;

Transfer digital assets or the means of accessing or controlling them, between natural or legal persons or between different acquirers, electronic wallets or digital asset accounts;

Safeguard, custody or manage digital assets or the means to access or control them;

Receive and transmit orders to buy or sell digital assets or trade derivative digital assets;

Execute buy or sell orders for derivative digital assets;

Source: CNAD Registry, January 15th, 2025

Source: CNAD Registry, January 15th, 2025

#Registration Process

The DASP licensing procedure consists of two stages: “pre-registration” and “final registration”. During the pre-registration phase, applicants submit initial information for CNAD’s review, which is followed by a second evaluation based on further data gathered. Once the final registration is approved, the DASP registration is considered complete, and a mandatory notice is then filed with the Financial Investigation Unit. Both stages fall under CNAD’s authority in accordance with the Digital Asset Law and the Digital Asset Service Provider Regulation.

#Compliance Requirements

Acquiring DASP registration confirms that Tether’s entities have demonstrated to the regulator the existence of key operational and compliance structures. These include a three-year business plan highlighting domestic objectives, a customer service program ensuring that all relevant information on traded or managed digital assets is accessible at the provider’s URL address at all times, and a robust Anti-Money Laundering, Counter-Terrorist Financing, and Proliferation of Weapons of Mass Destruction Prevention Program. Tether has also submitted comprehensive risk documentation, including a risk management framework, monitoring processes, measures to prevent regulatory breaches, and a methodology for risk-based decision-making and mitigation. The group’s compliance extends to digital and fiat asset custody policies, established information security and cybersecurity practices, business continuity plans, internal and external audit processes, and geofencing measures.

#Stablecoin Framework

CNAD supports the registration of stablecoin offerings, requiring issuers to register with the commission for placement and marketing activities while meeting specified regulatory standards. Of particular note are audited disclosures, as the issuer must submit financial statements audited by an external auditor covering the previous three fiscal years.

Additionally, the regulation mandates publication of a Relevant Information Document (DIR), which must include detailed information on the stablecoin offering. This document should provide a thorough description of the financial institutions and digital platforms employed for the transfer, custody, and settlement of any funds raised through the public offering.

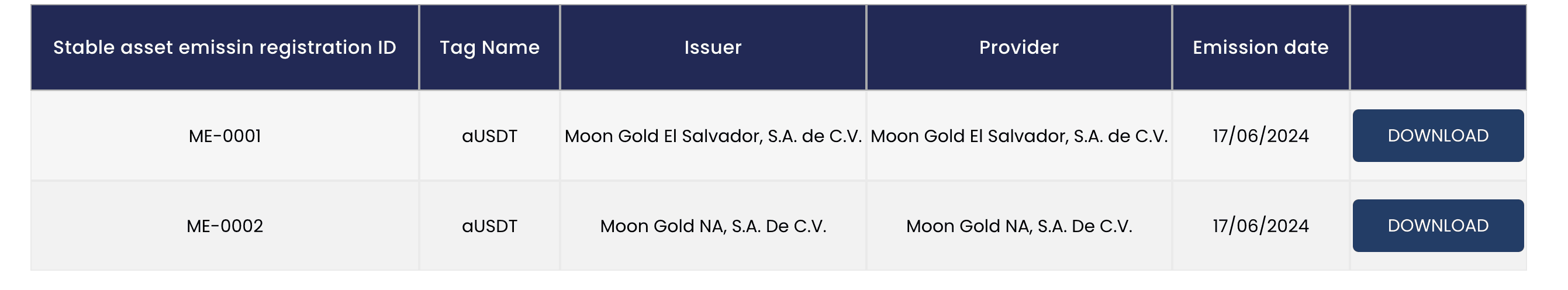

As of our most recent review, Tether has not registered any stablecoin issuances with CNAD, and Tether companies do not appear on the roster of authorized issuers with regard to USDT. We discovered two entities linked to Tether—Moon Gold El Salvador, S.A. de C.V. and Moon Gold NA, S.A. De C.V.—that are both registered with CNAD as Issuers of Public Offerings. According to official records, these companies have formally notified the regulator of their plan to issue aUSDT–Alloy by Tether token.

Source: CNAD Registry, January 15th, 2025

#Reserve Requirements

The Regulation on Issuance of Public Offering of Stable Currencies requires stablecoin issuers to maintain a one-to-one ratio of International Reserve Assets backing their stablecoins. At least seventy percent of these reserves must be held in assets that can be liquidated within thirty days, while the remaining thirty percent may be invested in assets requiring more than thirty days for liquidation.

The definition of International Reserve Assets is broad, covering any currency, asset, or basket of assets with widespread use in both domestic and international markets, including legal tender recognized by El Salvador (such as Bitcoin), cash or equivalents, low-risk debt securities, gold, other commodities, stablecoins approved by CNAD, and loans secured by liquid assets. The precise timing requirements for redeeming these reserves await further clarification from CNAD.

#Regulatory Implications

These excerpts illustrate how El Salvador’s legal framework can foster stablecoin issuance in a manner comparable to other emerging regimes. Whether Tether finds these regulations sufficiently advantageous to pursue a formal issuance registration remains uncertain and would entail aligning its reserve composition with the applicable provisions. Another open question concerns how regulators in other jurisdictions where USDT is accessible will react—some may require Tether to register its stablecoin offering in line with local standards, while others could recognize Tether’s existing authorization and adopt a more flexible approach. As legal frameworks evolve, Tether’s legal strategy may also shift, and we will continue to inform the community of any significant developments.