The V2 methodology used to recommend a safe value for the Ethena Reserve Fund

Useful Links

#Summary

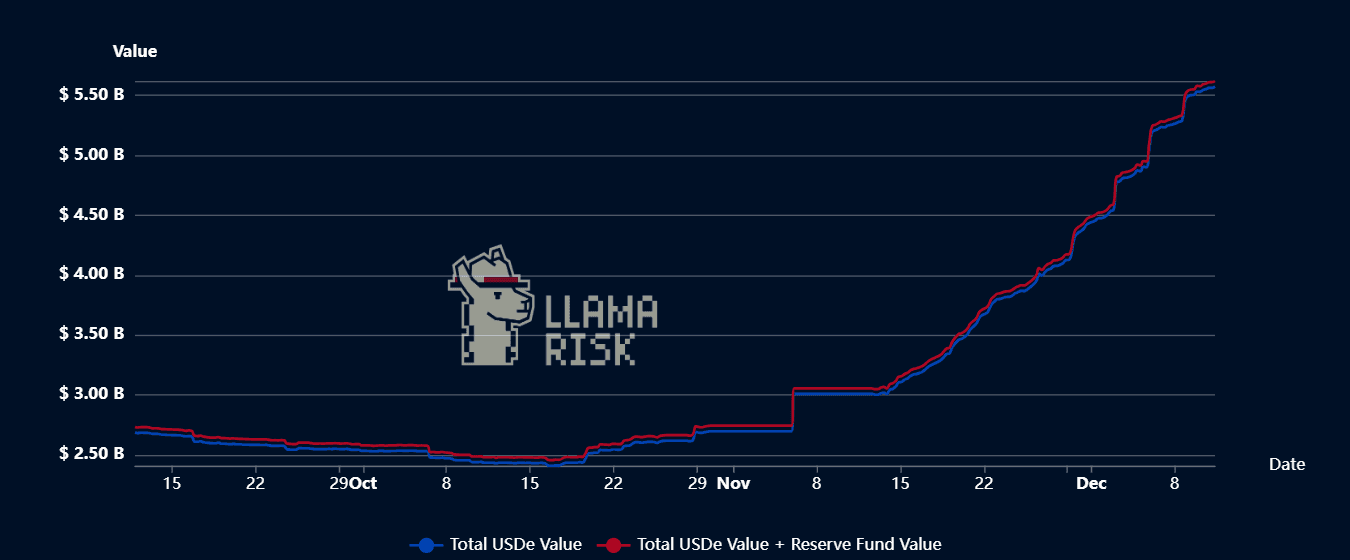

Ethena has experienced rapid growth, with the supply of USDe doubling over the past month to reach 5.5B USDe outstanding. The recent growth has been driven by the introduction of sUSDe liquid e-Mode on Aave, which accumulated new supply of over 1B sUSDe. In order to better reflect the current situation, LlamaRisk has revisited and refined the reserve fund methodology for Ethena's protocol.

The Drawdown Methodology (V1) has provided insights into long-term risk that Ethena would be exposed to if it would not unwind the perpetual positions when facing negative funding rates for an extended period. This methodology was therefore focused on long-term scenarios. However, the recent historical data has shown that Ethena has no interest in keeping perpetuals exposure in case funding rates turn negative and prefers to move the USDe collateral backing primarily to stablecoins. This preference has also been reiterated by the recent USDtb backing inclusion proposal for USDe that would help Ethena reach better capital efficiency for the stablecoin backing portion. This meant that the reserve fund methodology could be refined to focus on short-term perpetual exposure risk scenarios.

The Drawdown Methodology (V2) therefore shifts to short-term risks that would be apparent if Ethena unexpectedly faces negative funding rates and is obliged to serve large volumes of USDe redemptions. This methodology considers:

-

The risk of incurring negative funding rate payments until perpetual positions are fully closed. It has been estimated that 0.5% funding rate attributed losses could be incurred supposing that all perpetual positions take up to 24 hours to be exited.

-

The risk of incurring slippage when unwinding these positions. Under a tail-risk scenario, Ethena could face up to 75 bps (0.75%) slippage.

-

The depth of USDe liquidity and potential extent of large USDe redemptions. The possible redemption amount is capped by the circulating USDe supply that is not locked in sUSDe.

The resulting recommendations are based on historical observations and consider potential scenarios based on the assumed severeness of the above mentioned risk factors. The recommended reserve fund size interval is then defined by these scenarios. We believe that this refined methodology will help to more precisely estimate protocol's insurance needs and ensure full solvency of USDe at all times.

#Introduction

In light of the positive market sentiment that has emerged since early November, Ethena has experienced rapid growth, with the supply of USDe doubling over the past month to reach 5.5B USDe outstanding. This growth has been fueled by consistently high funding rates in perpetual futures trading venues, often exceeding an annualized yield of 30%. The attractive rates have drawn significant new capital into the delta-neutral strategy facilitated by Ethena, which leverages centralized exchanges and redistributes the resulting revenues to holders of the sUSDe token.

Source: LlamaRisk's Ethena Risk Dashboard

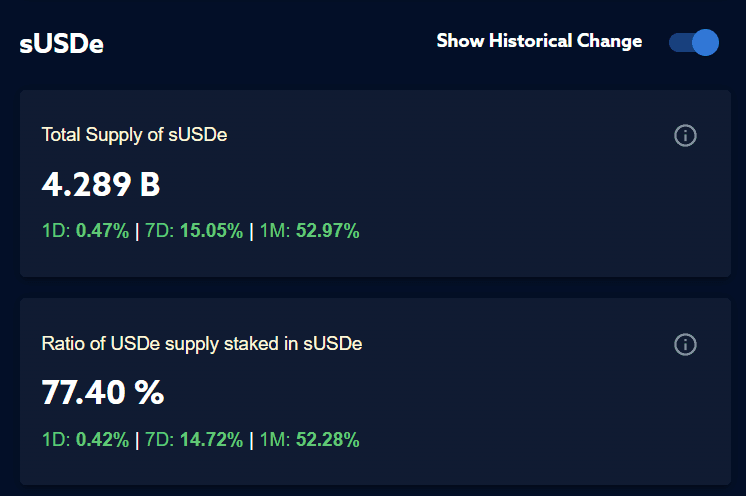

This growth has also been reflected in the supply of sUSDe, with the proportion of USDe staked into sUSDe increasing from 50% to 77% over the past month. The recent introduction of a new sUSDe liquid e-Mode on Aave's Core and Prime market instances, offering up to 90% Loan-to-Value for sUSDe as collateral to borrow USDC, USDS, and USDT stablecoins, has further driven sUSDe inflows. This enhancement, which also enables leveraging the yield on sUSDe with up to 10x leverage for as low as a 2% buffer for price fluctuations, has so far attracted 1B sUSDe to be deposited in Aave's Core market. The sUSDe supply caps were filled almost instantly upon each increment of 250M sUSDe applied by Aave's ChaosLabs Risk Stewards.

Source: LlamaRisk's Ethena Risk Dashboard

The rapid growth of USDe and Aave's increasing exposure to Ethena have sparked public discussions about the associated risks for both Aave's protocol and the overall sustainability and safety of Ethena's protocol. As a risk provider for both protocols, in this article LlamaRisk aims to:

-

Present an overview of the current risk methodology used to support the safety of Ethena's protocol.

-

Refine the methodology to better reflect recent developments.

-

Offer risk-related recommendations for both protocols.

We believe that this refined approach will help safeguard the continued stability of Ethena and Aave while also providing the public with greater transparency into the underlying risk assumptions of Ethena's protocol.

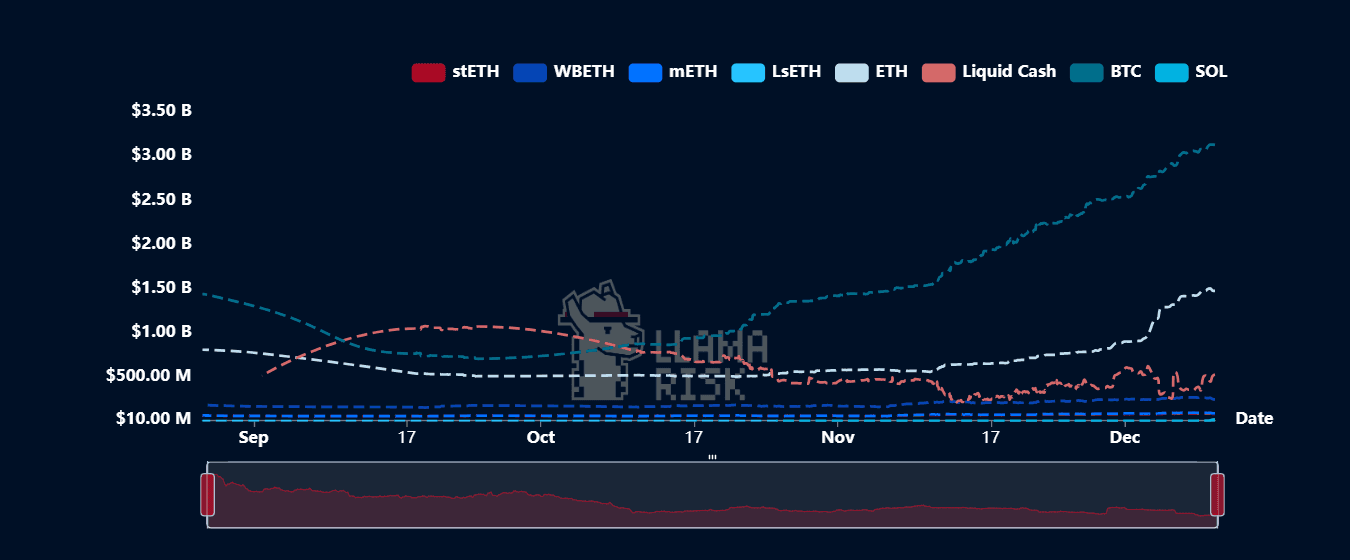

#Ethena Risk Considerations

Ethena manages the underlying USDe collateral by allocating parts of it to mainly BTC and ETH (or ETH LSTs), opening short perpetual positions over 5 different CEXs: Binance, Bybit, OKX, Deribit, and Bitget. Back in November, SOL was onboarded as a suitable backing asset for USDe, however only negligible allocations have been made to this asset, mainly due to lower funding rates and 4x smaller total Open Interest. In addition to the volatile assets and corresponding perpetual positions, another part of the collateral is held in stablecoins (USDC and USDT). This enables Ethena to have a higher flexibility in managing the collateral distribution and maintain operational efficiency in case of USDe collateral redemptions. The collateral management is completely off-chain, using transparent custodians to delegate parts of collateral to exchanges.

#Main Risk Components

Active management of collateral and perpetual positions constitutes the primary operational risk of the protocol. Fluctuating perpetual funding rates necessitate the protocol to actively redistribute the collateral assets, perpetual positions, and continuously adapt the stablecoin allocations.

#Funding Rates

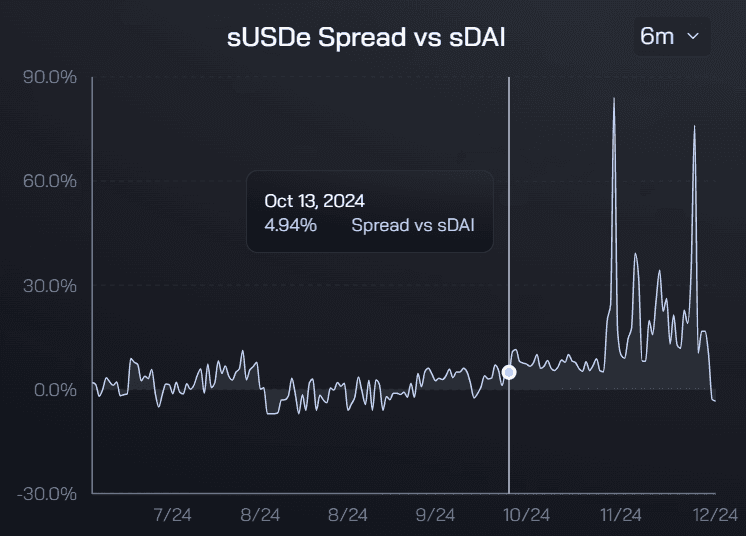

The main revenue source of the protocol is the funding yield. High funding rates that cause sUSDe's yield to surpass broader market rates generally result in an influx of revenue for the protocol and augment the total supply of USDe. For example, back in October 2024, when sUSDe yield surpassed the yield of sDAI (or sUSDS) with a 5% spread, the USDe supply has started to mount again after a period of growth consolidation.

Source: Ethena Protocol Dashboard

Inversely, sustained low funding rates result in more apparent USDe redemptions (and sUSDe unstaking) as the yield of sUSDe decreases. Nonetheless, a period of lower funding rates during the 2nd-3rd quarters of 2024 has resulted in moderate supply levels for Ethena where the supply of USDe consolidated at the 2.5B level.

However, in the instance where funding rates turn negative, even larger outflows would be expected, also requiring the protocol to unwind perpetual positions and allocate the majority of collateral into stablecoins. Since the emergence of Ethena in early 2024, only short 8-16 hour periods of slightly negative funding rates (-10% APY) have been observed over different CEXs, quickly shifting back to positive, therefore only causing a negligible negative effect on the revenue of the protocol. Looking back into as early as 2020, longer and more aggressive negative perpetual funding rate periods are observed, indicating that the probability of prolonged negative market periods is non-zero.

#Management of Perpetual Positions

Even under normal market conditions, Ethena needs to actively manage the collateral distribution and allocations between different centralized exchanges. The leverage of linear/inverse short perpetual positions should always be kept at minimal levels (~2x) to lower the potential liquidations risk in case of unexpected volatility. Other factors, such as auto-deleveraging (ADL) also pose risk and require scrutiny.

ADL is a mechanism used in cryptocurrency futures and perpetual futures markets to mitigate the risk of insolvency in highly leveraged positions. It occurs when the exchange's insurance fund is insufficient to cover the losses incurred by bankrupt traders. In such cases, the positions of profitable traders are automatically reduced to cover the losses, nullifying their profit. This process ensures the stability of the exchange and prevents a situation where it cannot pay out winning trades due to insufficient funds.

The ADL process can lead to losses for traders who are otherwise profitable. This happens because their positions are partially liquidated or closed to cover the losses of liquidated positions. The likelihood of being selected for ADL depends on several factors, including the size, effective leverage, and profitability of a trader's position. While this system helps maintain market integrity, it can be a significant risk factor for traders, particularly during periods of high volatility when the insurance fund may be overwhelmed by the number of liquidations. While being very rare, auto-deleveraging events have reportedly happened on Binance, and more recently on dYdX decentralized exchange.

Regarding Ethena protocol, ADL is a relevant risk factor, as any losses incurred by the ADL mechanism in case of high profitability of the short perpetual positions would eliminate the delta-neutral balance. In order to mitigate the risk (and stay lower in the liquidation priority ranking), Ethena should keep the effective leverage of the perpetual positions low and rebalance profitable positions frequently.

Moreover, as swaps between volatile assets (ETH, BTC, ETH LSTs, SOL) and stablecoins happen, they need to be executed with minimal slippage. The price impact of these swaps is usually minimal (<50 bps), however in volatile market conditions slippage may ramp up and therefore could hinder the efficiency of capital re-allocations. Additionally, the order book is heavily dependent on market makers, whose actions and strategies play a large role in providing liquidity. As a result, liquidity can fluctuate dynamically based on their moves, possibly affecting the execution of swaps in volatile periods.

#Centralization

The centralization factor is also relevant to Ethena. Perpetual positions are spread over different CEXs, therefore introducing operational dependence. Custodians are used to safeguard the allocations of collateral but may also introduce an inherent dependency vector. As mentioned above, the capital management process itself is off-chain, therefore a centralized point of failure is also introduced. However, these risks are expected to remain low due to several mitigating factors. As the protocol expands and matures, it is likely to diversify its venues, reducing reliance on any single entity. Moreover, improved operational expertise and robust safeguards are expected to enhance resilience, minimizing the potential of these risks.

#Main Safety Components

To mitigate the operational and market risks, Ethena employs different mechanisms that help to ensure the stability of the protocol and safeguard from potential under-collateralization of USDe.

#Stablecoin Collateral Allocations

Allocating part of the USDe collateral to stablecoins is an actively used risk management mechanism. It can be observed that back in September 2024 during a period of muted funding rates, Ethena started to allocate larger portions of the collateral, reaching up to $1.1B or almost 45% of the total TVL in stablecoin collateral. Nonetheless, while this approach effectively reduces exposure to negative funding rate risks, the stablecoin portion of the collateral does not yield interest, representing a drag on the overall profit generated by the protocol.

Source: LlamaRisk's Ethena Risk Dashboard

As soon as the funding rate yield and open interest improved, Ethena reduced the stablecoin allocation ratio in order to capitalize on the returned yield opportunities of higher funding rates. Nonetheless, the stablecoin buffer has been continuously maintained since then with $200M to $500M of collateral held in stablecoins.

Such strategy not only helps Ethena to mitigate exposure in case of negative or very low funding rates but also provides a buffer to serve USDe collateral redemption events effectively, therefore supporting the secondary market peg of USDe.

#Exposure Relative to Open Interest

Ethena has implemented a self-imposed limit on Open Interest (OI) exposure, aiming that its perpetual positions in ETH and BTC do not exceed 10% of the total OI for each asset. This limit was established after assessing the potential impact of Ethena's short perpetual positions on funding rates. Keeping positions below 10% of OI ensures that any dilutive effect on funding rates is offset by the depth of long positions. However, this constraint also limits the growth of USDe supply, as long-side OI cannot scale proportionally with additional short-side OI. While the breach of this limit would not result in negative funding rates, the rates would become more diluted, resulting in diminishing returns for the protocol.

#Reserve Fund

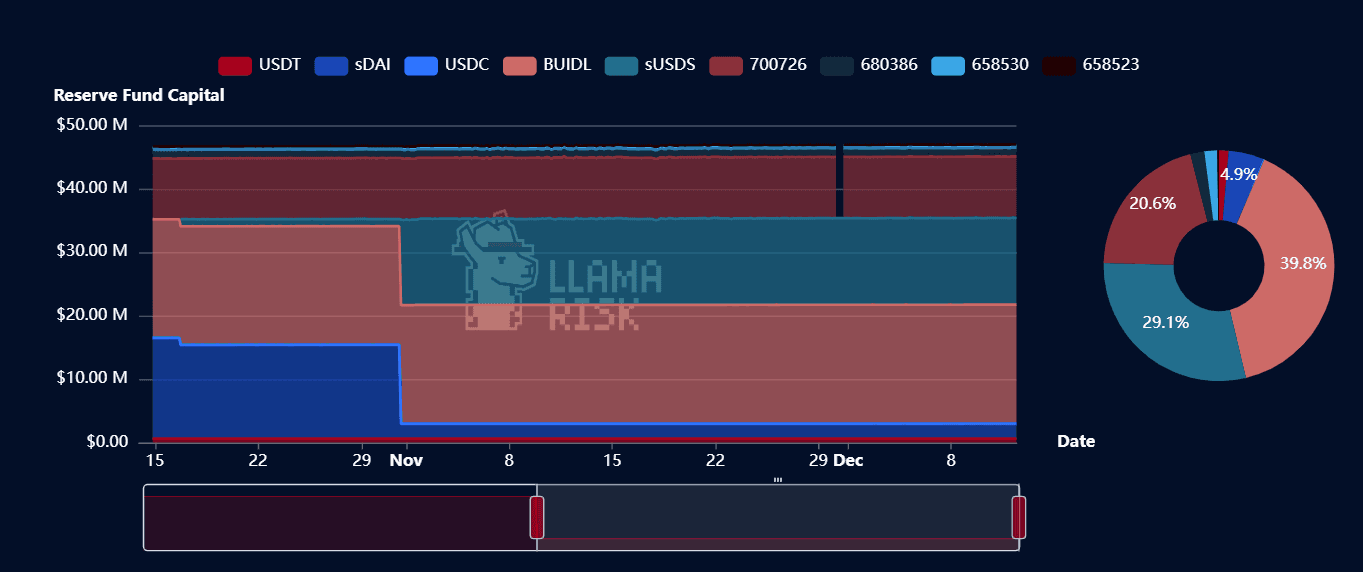

The main safeguard mechanism is the reserve fund. It serves as a safeguard against USDe under-collaterization and could be invoked in case of losses caused by negative funding rates or operational failures. The reserve fund would also serve as an additional mean to support secondary market stability of USDe in case of sustained peg pressure by either: 1) providing liquidity to USDe liquidity pools or 2) acquiring the overflow of USDe directly to reduce pool imbalances. It is therefore important to adequately capitalize the reserve fund, especially when the protocol experiences aggressive growth. The assets held in the reserve fund should be liquid to ensure quick operations in case of reserve fund's activation. Currently, the reserve fund consists of mostly yield-bearing stablecoins with a significant allocation to RWA tokens for improved capital efficiency while keeping the pricing risk of these assets low. An important criteria for these allocations was a quick settlement assurance that would ensure similar quick capital deployment ability offered by USDT and USDC.

Source: LlamaRisk's Ethena Risk Dashboard

#Drawdown Methodology (V1)

Read the full Ethena Reserve Fund Drawdown Methodology (V1) here.

#Capitalization of the Reserve Fund

The primary goal of LlamaRisk's risk methodologies is to ensure sufficient capitalization of the protocol's reserve fund. Over the last months, we have performed multiple research iterations to be able to recommend an optimal level of the reserve fund capital that would be able to cover for potential drawdowns that Ethena could face. The resulting V1 methodology has been published in LlamaRisk's research page and in a dedicated section of our curated Ethena Risk Dashboard where up-to-date recommended values of the reserve fund can be found.

Ethena is exposed to perpetual funding rate fluctuations, which historically have been varying in direction and size based on underlying market conditions. If Ethena would be holding the perpetual positions over periods of negative funding rates, the losses would need to be covered by the capital available in the reserve fund, causing reserve fund drawdowns. To estimate the duration after which the reserve fund would be completely depleted, we need to:

-

Estimate the mean negative funding rates that both ETH and BTC perpetuals would be subject to, discounting the stablecoin allocation portion that would not be affected by negative funding rates;

-

Consider the redemptions of USDe that would diminish the total supply and alleviate the pressure on the reserve fund;

-

Include slippage losses that would be incurred when exiting perpetual positions to cover USDe redemptions.

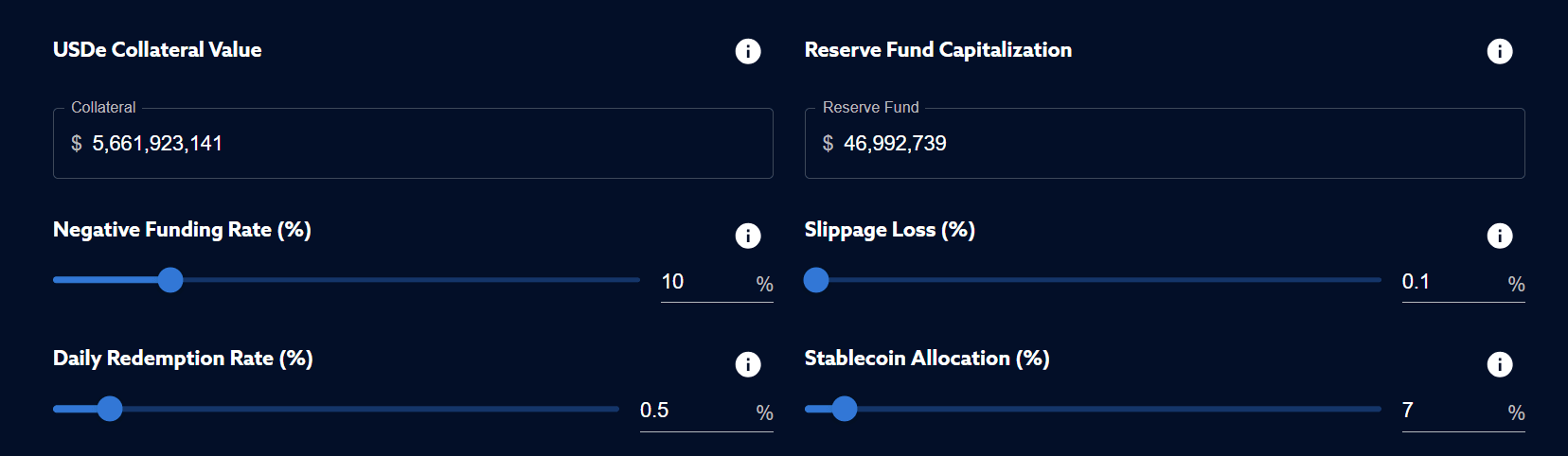

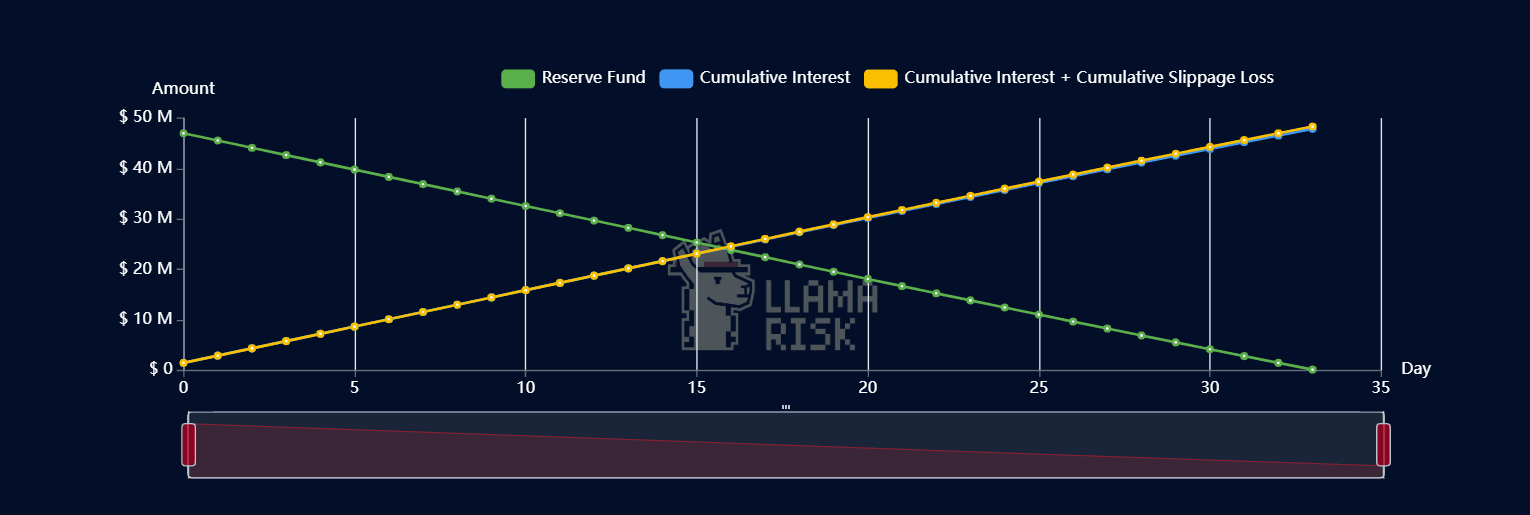

We have prepared an interactive tool which simulates the reserve fund drawdown, adjusting for all these parameters that can be modified based on personal risk assumptions.

Source: LlamaRisk's Ethena Risk Dashboard

Assuming that at the current collateral allocation, Ethena faces a negative funding rate of -10% and incurs minimal 10 bps slippage losses as well as minor 0.5% daily redemptions, the reserve fund would be completely depleted in 33 days.

Source: LlamaRisk's Ethena Risk Dashboard

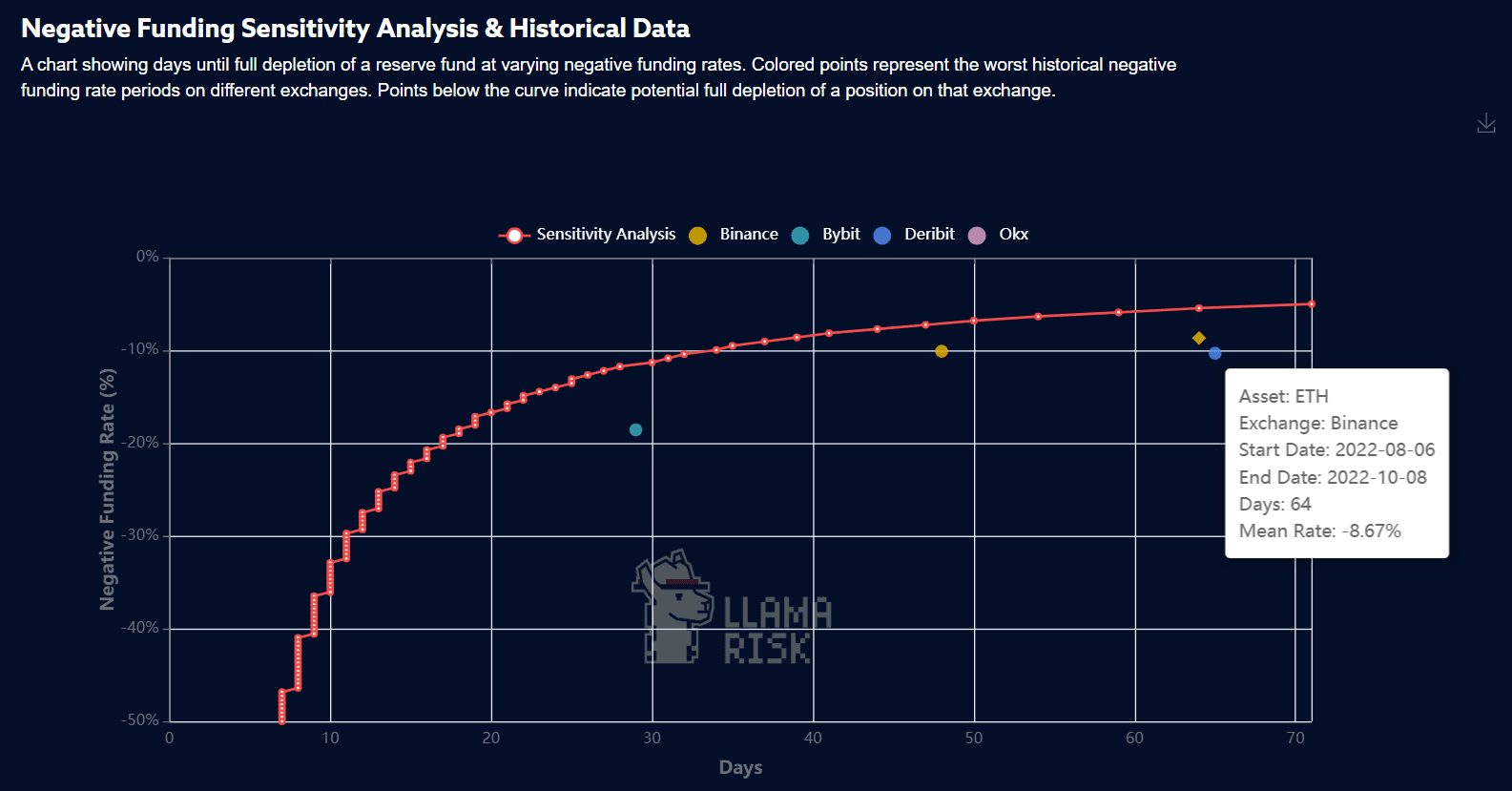

From a historical perspective, numerous prolonged periods of similar negative funding rates (~10%) have been observed over different CEXs used by Ethena both for BTC and ETH perpetual pairs. The duration and extent of some of these negative funding rate periods would have resulted in a depletion of the reserve fund.

#Recommended Reserve Fund Value

The resulting methodology for analyzing long-term funding effects provides a structured approach to determining the minimum reserve fund capital required to mitigate potential losses from significant historical drawdowns in asset funding rates. This approach leverages historical funding rate data sourced from exchanges such as Binance, Bybit, Deribit, and OKX, combined with current collateral data to provide real-time USD valuations of Ethena's collateral assets. Using our in-house model, historical drawdowns are identified as a starting point.

From there, we calculate the insurance fund requirements, incorporating metrics such as total insurance needed for the worst historical drawdown phase, net insurance requirements, and LST returns based on average duration and rate. This comprehensive methodology ensures the reserve fund is equipped to withstand adverse market conditions by integrating historical trends and counting in the current status of the protocol.

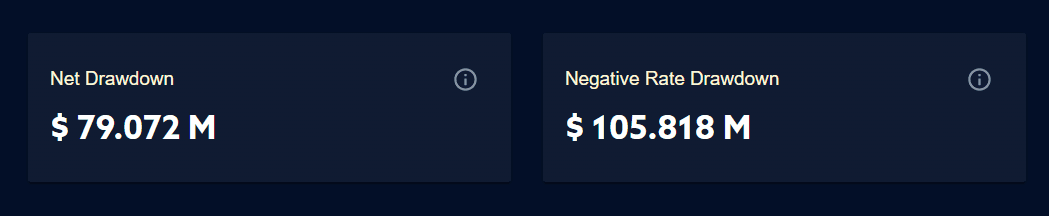

The currently recommended values can be found in a dedicated section our Ethena Risk Dashboard where:

-

The first one is a recommended value supposing a Net Drawdown after adjusting for both negative and positive funding rate periods.

-

The second, more conservative value includes only negative Rate Drawdown instances for the maximal drawdown phase.

Our recommended reserve fund value should therefore be in the range of the two recommended values. At the time of writing, this model recommends a reserve fund size of at least $78.5M. Overall, this methodology proposes a reserve fund size equal to 1-1.5% of total USDe supply, assuming no aggressive changes to the collateral composition of the delta-neutral stablecoin.

Source: LlamaRisk's Ethena Risk Dashboard

True size of the reserve fund had generally trended above the minimal recommended value until the resumed aggressive growth of the USDe supply in the last weeks. Only a single distribution to the reserve fund has been made during this growth period and therefore the current value of the reserve fund (~$50M) is now below the minimal recommended amount of $79M.

#Drawdown Methodology (V2)

The previously outlined risk methodology emphasizes the long-term effects of potential negative funding rates, assuming a static USDe collateral distribution and no unwinding of perpetual positions during extended periods of negative funding.

However, back in September, Ethena demonstrated its ability to adapt effectively by managing stablecoin balances and swiftly adjusting exposure levels in response to reduced (but still positive) funding rates and lower Open Interest. This indicates that Ethena is unlikely to maintain sustained exposure to negative funding rates, instead minimizing such exposure as soon as trends turn unfavorable. Consequently, our methodology should be refined to place greater emphasis on shorter-term risk dynamics that Ethena may encounter.

#Collateral Management

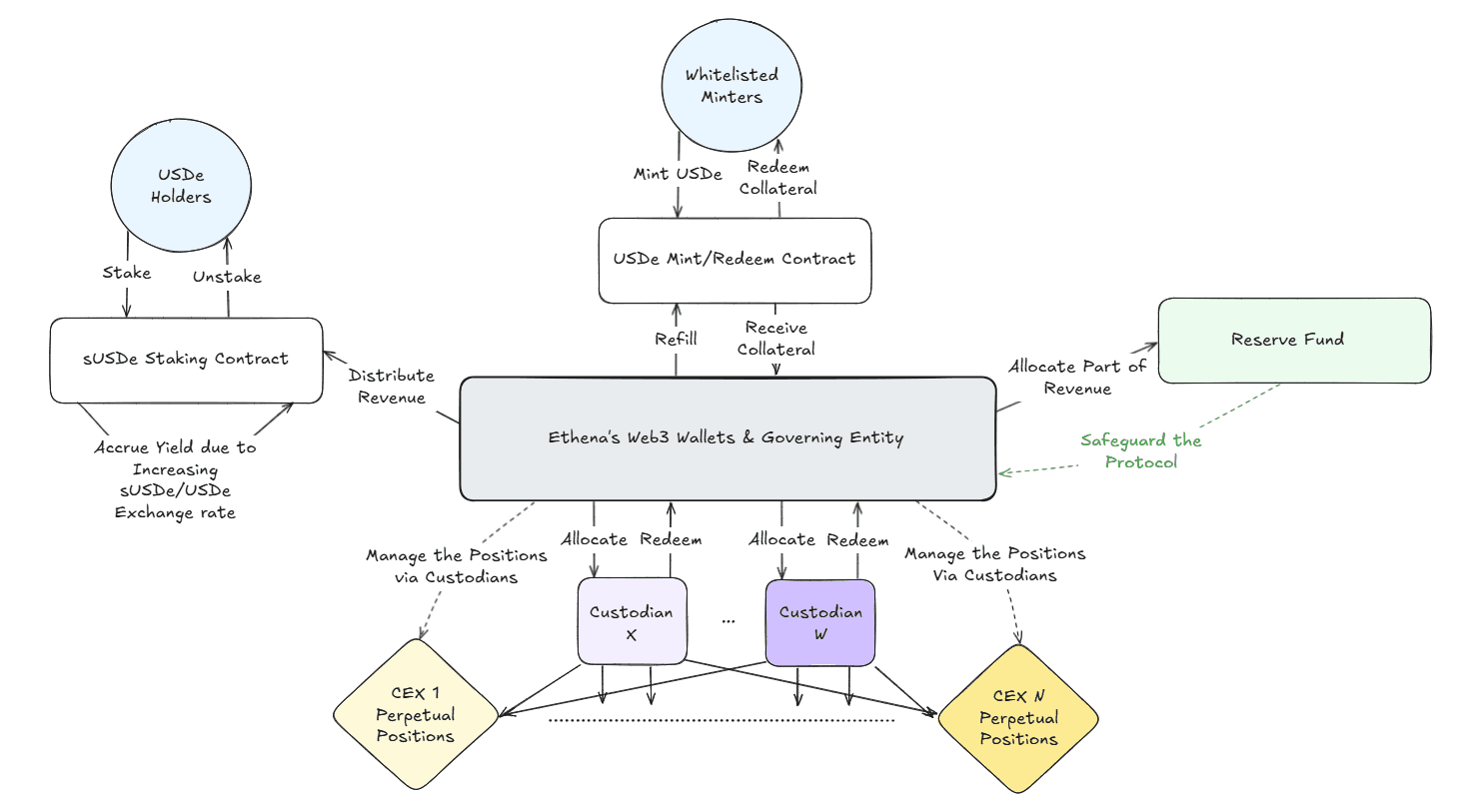

Firstly, we need to consider the main parts of the collateral management system maintained by Ethena's Governing Entity.

Source: LlamaRisk

-

Only whitelisted minters can interact with USDe Mint/Redeem Contract to Mint USDe using USDT as collateral. USDe can also be redeemed only by whitelisted entities and only for USDT subject to its availability in the contract.

-

Ethena receives the collateral and can either keep it in form of stablecoins or delegate it to selected centralized exchanges via custodians.

-

Ethena manages the allocations of collateral between different centralized exchanges and can order swaps to/from BTC, ETH, ETH LSTs, and SOL or initiate opening/closing perpetual positions.

-

When the revenue from funding rates is accrued, it can be redeemed from CEXs in form of stablecoins and then distributed to the sUSDe Staking Contract in form of newly minted USDe.

-

Users holding sUSDe can initiate unstaking, which after 7 days of cooldown lets them redeem sUSDe for the underlying USDe at a defined internal exchange rate.

-

Part of the weekly revenues can be allocated to the reserve fund in the form of (yield-bearing) stablecoins. The reserve fund could be invoked to cover USDe collateral losses or support the secondary market peg of USDe.

USDe is freely transferable in open markets and can be acquired via secondary market liquidity that is partially supported by whitelisted minters. Staked USDe can also be acquired or sold in the secondary markets.

#Potential Short-Term Risks

Having covered the collateral management process, it is important to consider all short-term risks apparent to the protocol when actively managing collateral. These risks would consequently trigger the invocation of the reserve fund. We have identified the following factors:

-

Negative funding rate risk is still apparent even in the short term, although to a much lower extent, diminishing as soon as perpetual positions are exited into stablecoins.

-

Slippage can be incurred when exiting perpetual futures positions. While minimal under normal market conditions, it can still be impactful in volatile instances when Ethena would be forced to close the perpetual positions and shift to stablecoins (either to avoid negative funding rates or serve pending USDe redemptions).

-

Secondary market price support for USDe might be needed in case whitelisted minters cannot effectively arbitrage the USDe price by absorbing the USDe imbalance in the secondary market liquidity. This imbalance might be triggered by a steep reduction of USDe utility which would result in USDe holders selling USDe for other assets in the secondary market.

These factors are highly correlated with each other and can be a result of one another, e.g. unexpected USDe secondary market selling can trigger large redemption volumes which would require Ethena to close perpetual positions and migrate to stablecoins in order to refill the redemption buffer in the USDe redemption contract. In the following subsections, we will analyze these factors in isolation and then present a combined estimation of risk and potential short-term reserve fund drawdowns.

#Negative Funding Rates

Based on recent observations, it can be deemed that Ethena would be able to intervene quickly to mitigate the impact of negative funding rates instead of trying endure negative yield. In the most CEXs the funding payments are made in 8-hour intervals. Ethena's management operates 24/7 and therefore even under conservative estimates, the perpetual positions could be completely closed over a 24-hour timeline after the first negative funding rate drawdown, incurring at most 4 funding payments to the long side.

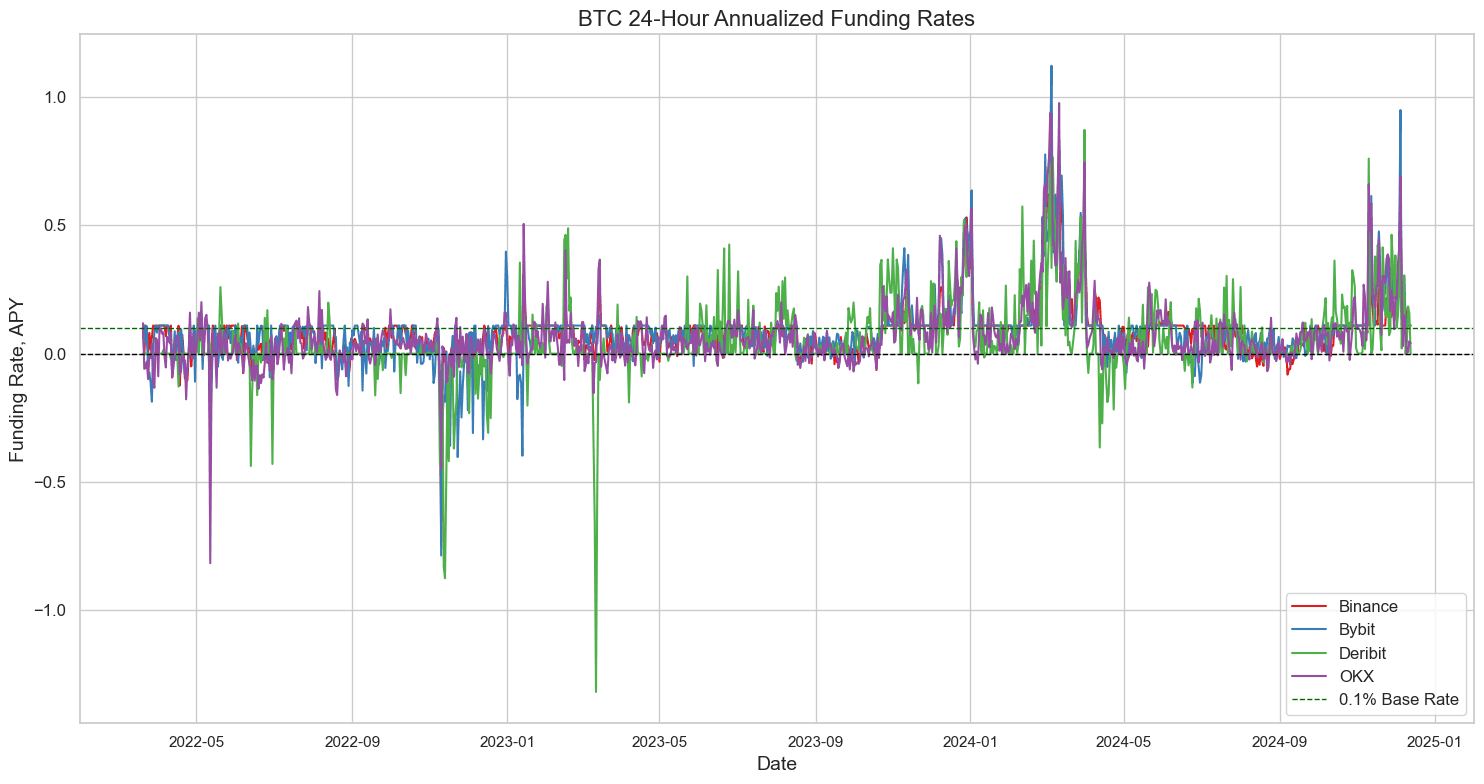

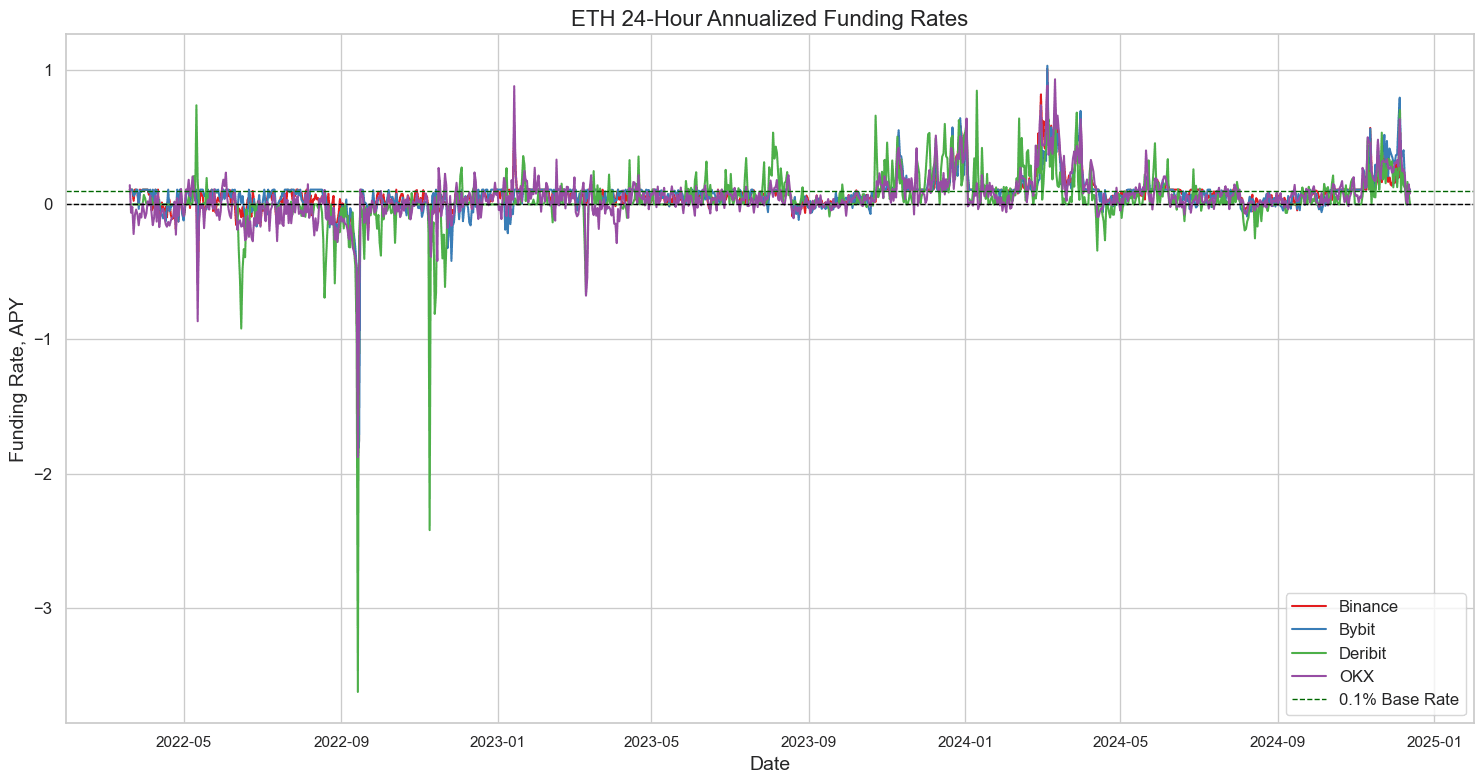

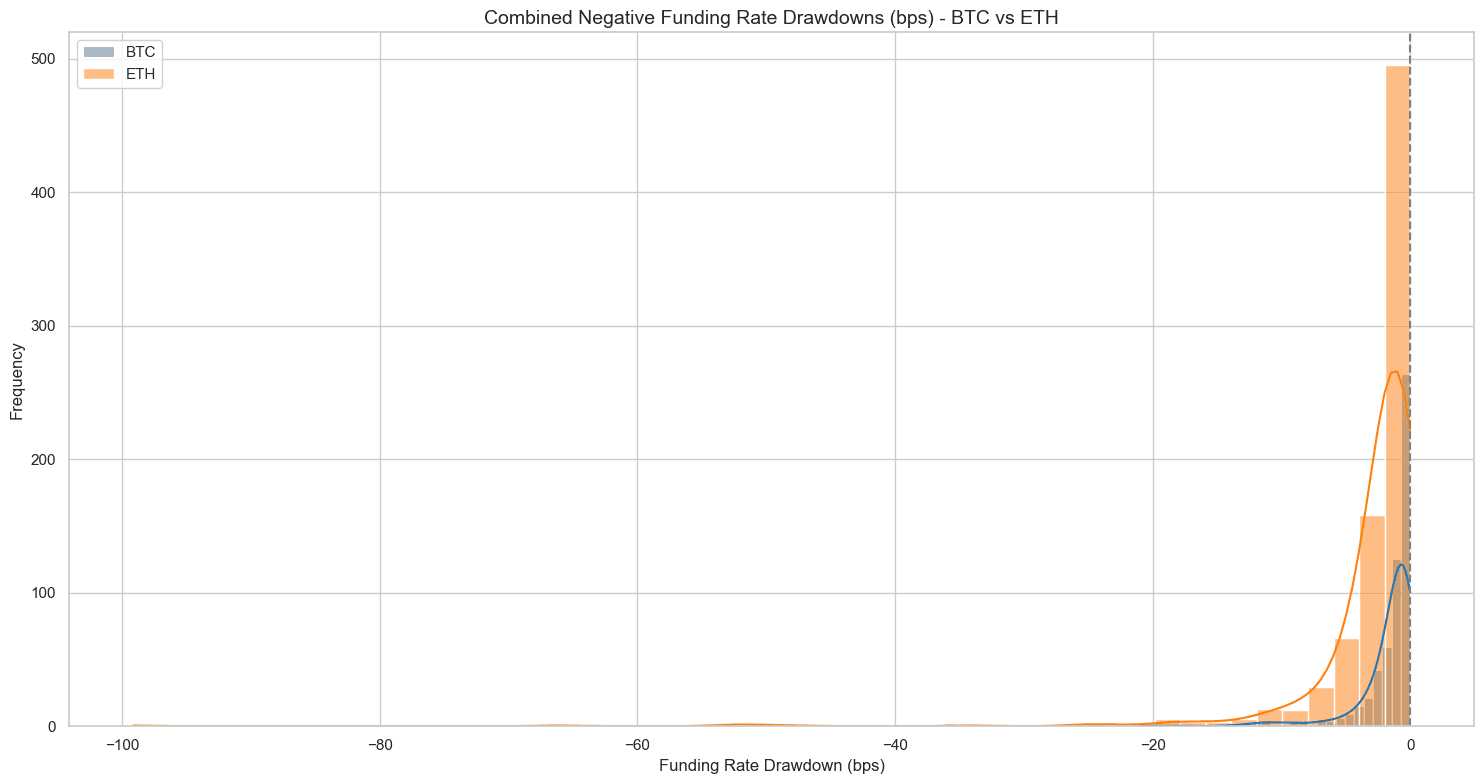

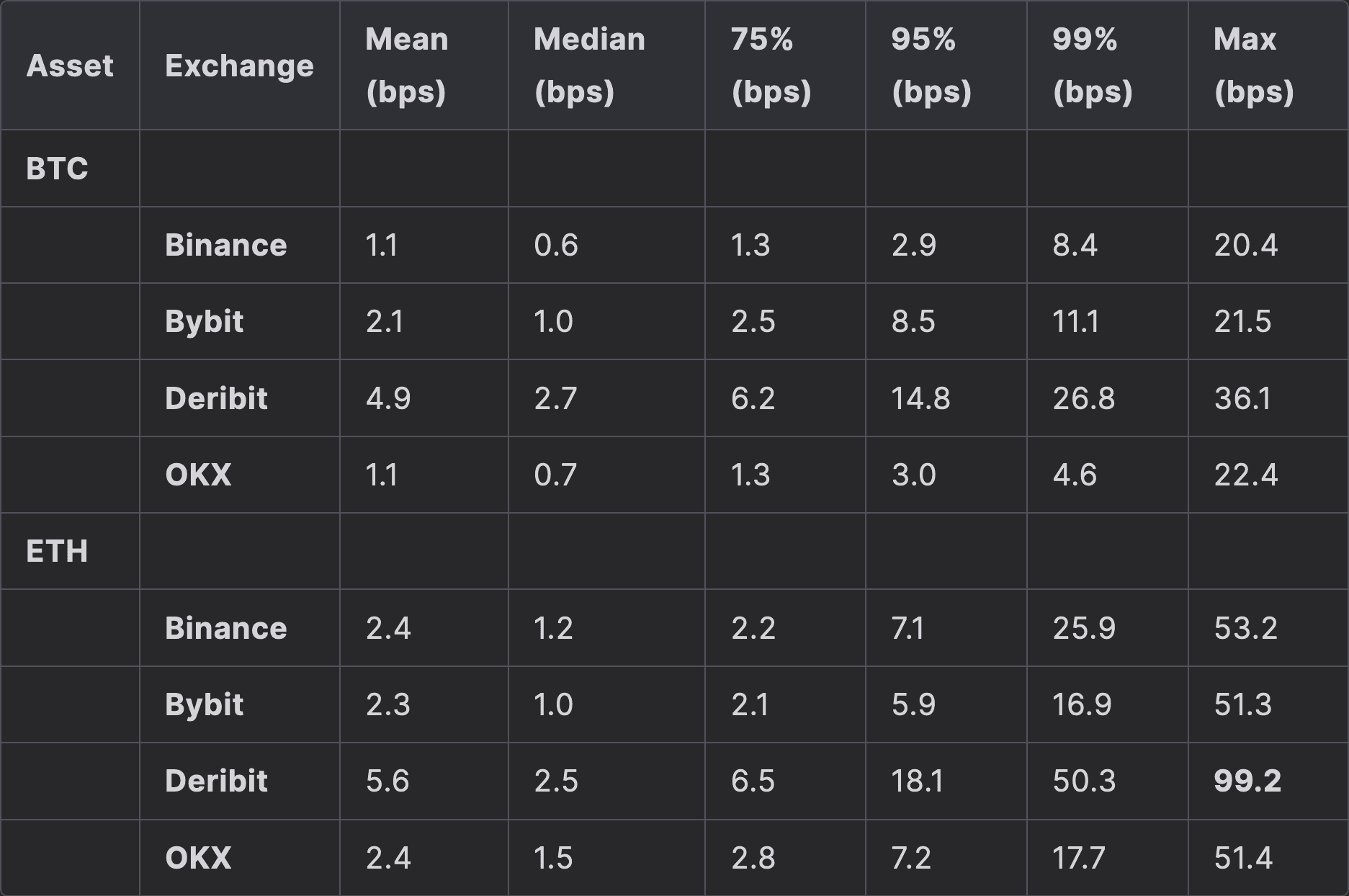

The historical funding rates were sampled for the period of March 2022 to December, 2024, aggregated into 24-hour granularity and annualized. The presented data covers funding rates of BTC and ETH linear perpetuals over main CEXs utilized by Ethena.

Ethena also uses inverse perpetuals, however, the exact perpetual types distribution is unknown. Even though inverse perpetual pairs are generally less liquid, previous analysis revealed that the funding rates of inverse perpetuals remain closely tied. For the sake of simplicity, we will further analyze linear perpetuals only.

Source: Coinalyze API

It can be observed that during the Q2-Q4 of 2022, both BTC and ETH experienced negative funding rates over all exchanges. Deribit exchange reacted the most harshly, experiencing a period of -370% annualized funding rates for ETH perpetuals during the pre-Ethereum merge market stress in September 2022.

We are interested in the largest 24-hour negative funding rate drawdowns that happened historically. The statistics are presented below, showing the absolute value of 24-hour drawdowns in bps.

Source: Coinalyze API

Therefore, under conservative estimates, in a face of a tail risk event such as the Ethereum merge, the reserve fund should be able to withstand a 0.5% nominal negative funding rate drawdown that would affect all perpetual positions for 24 hours.

#Slippage

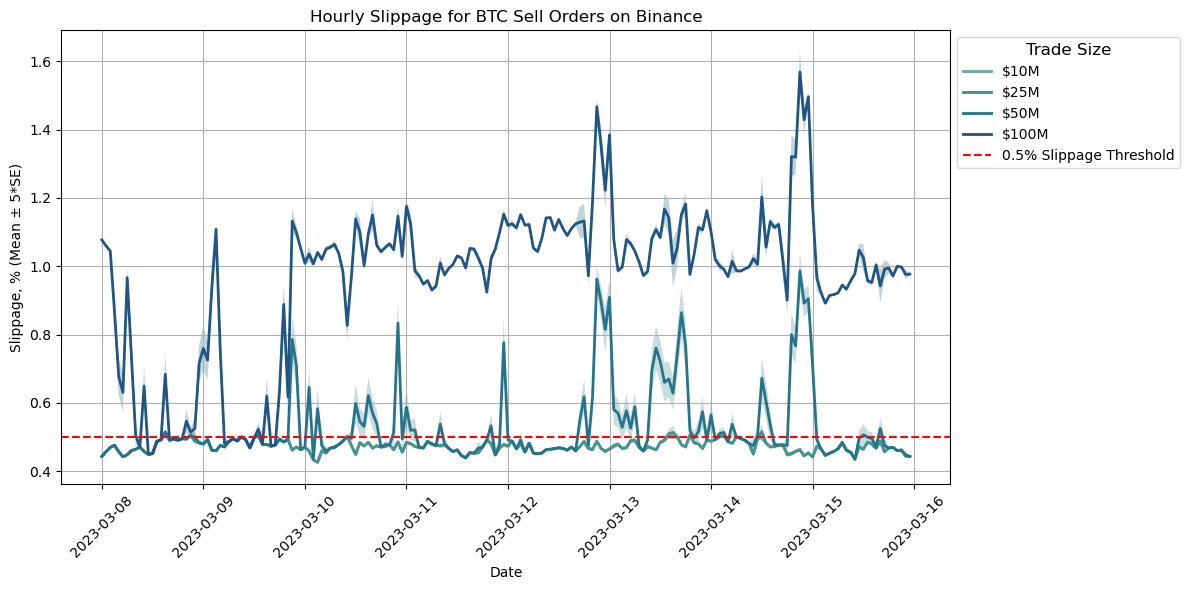

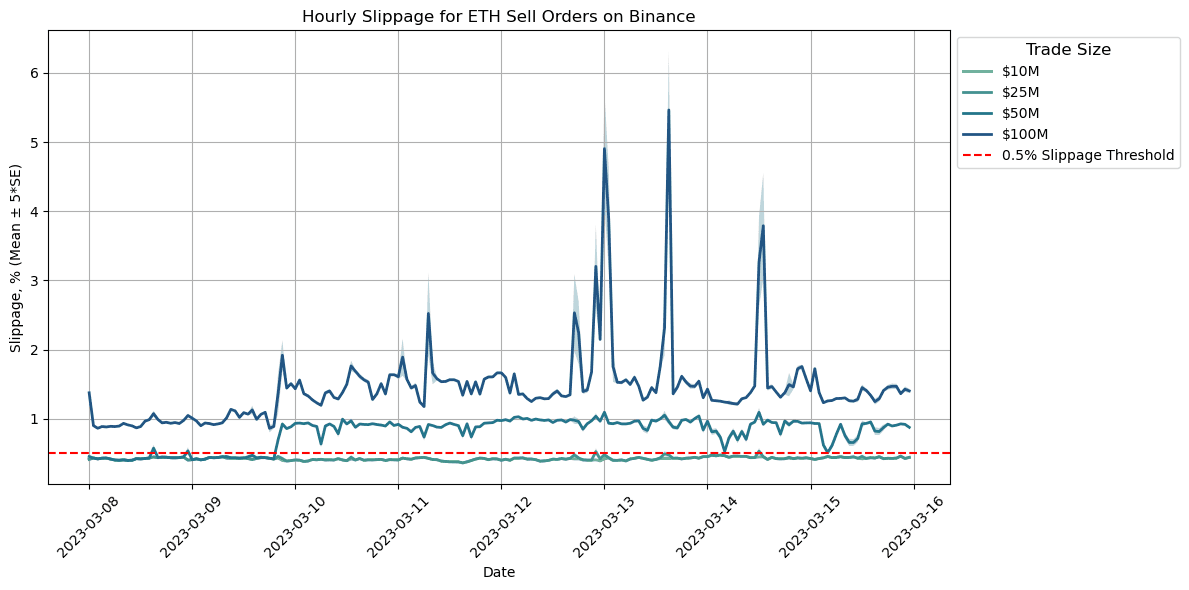

We should also estimate possible levels of slippage, both under normal and volatile conditions. The majority of backing perpetual positions reside on Binance which is also the largest Centralized Exchange by derivatives volume, therefore the slippage data was sampled from this exchange. The historical data granularity and availability is also the largest for Binance exchange. The perpetual pairs orderbook metrics were sampled from the period starting January 2023 to December 2024 where the slippage is calculated as follows:

For a sell trade:

The Mid-price is the weighted average mean of the difference between the highest bid price and lowest ask price. Furthermore, the effective price is defined as:

Below, we present the statistics of historical sell-side slippage impacts for different BTC and ETH trade sizes, denominated in dollar values to adjust for differing asset prices over time. Each entry represents the fraction of times where a given trade size would clear within the given slippage level.

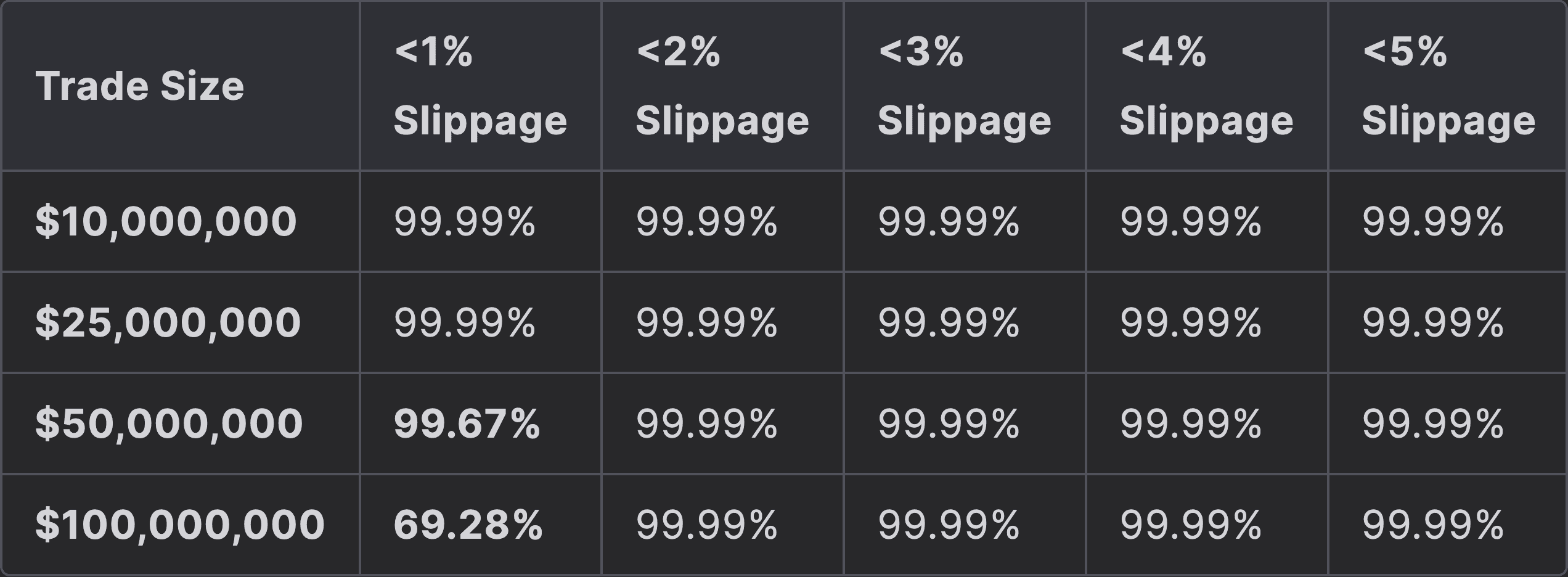

#BTC Sell Slippage Impact:

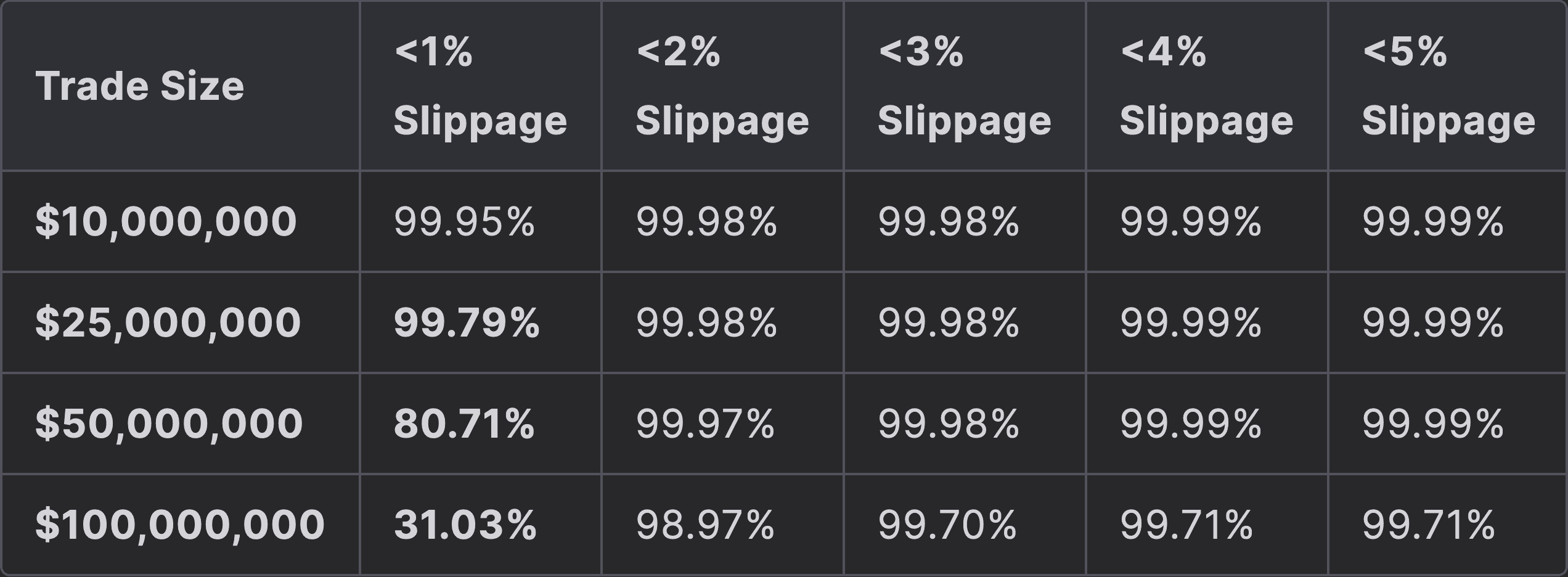

#ETH Sell Slippage Impact:

We can observe that:

-

ETH perpetuals are less liquid, showing larger slippage estimates starting at $25,000,000 trade size levels.

-

BTC trades of $25,000,000 are expected to clear within 1% slippage even under most stressful tail conditions. Correspondingly, we observe the same conservative estimate for ETH at $25,000,000.

-

It is undesirable to execute trades larger than $25,000,000. The orders would need to be time-averaged for the market orderbook to re-adjust in face of substantial selling pressure.

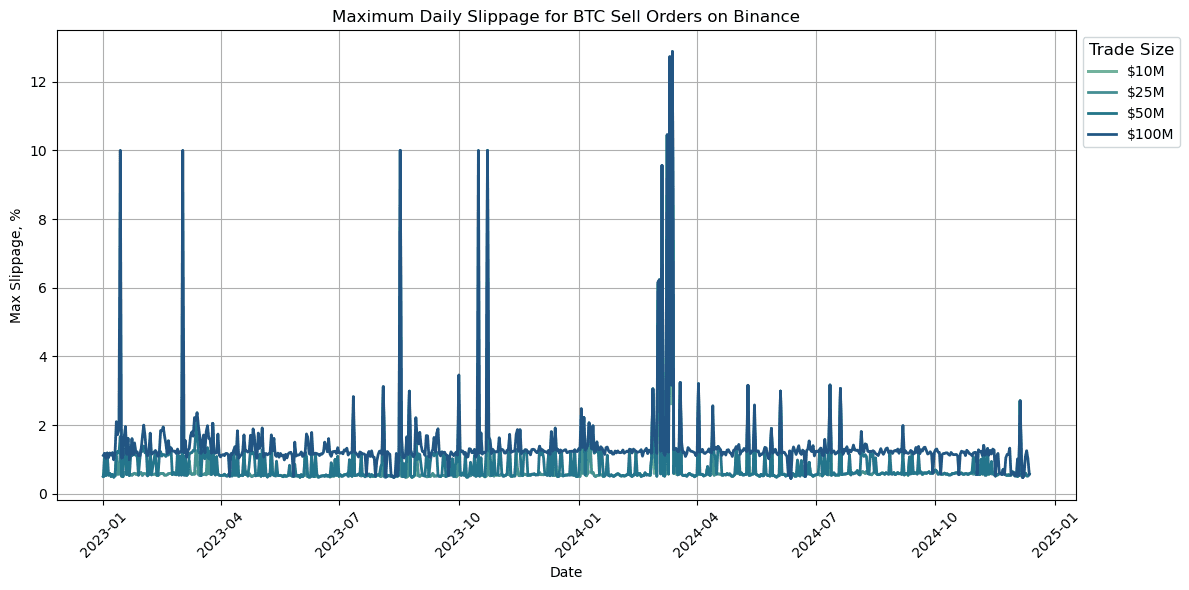

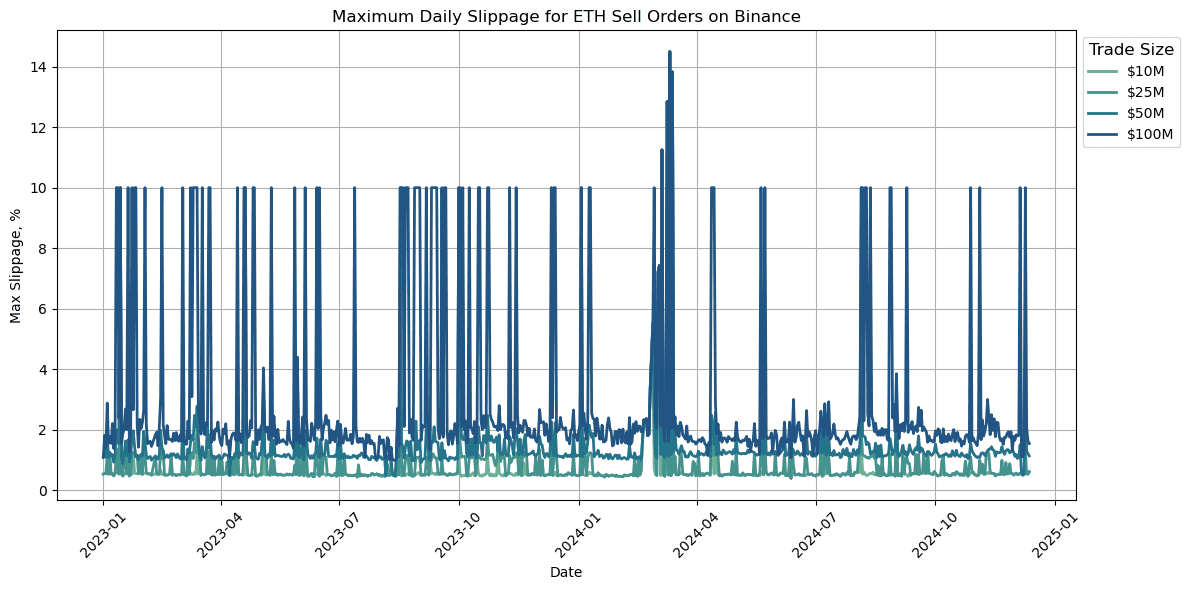

Historically, the maximal daily slippage levels for both perpetual asset sell orders under $25,000,000 remain low with the exception of more stressful periods.

Source: Binance Public Data

We can zoom into one observed elevated slippage period during the market selloff in March 2024. It is also notable that the funding rates in this period were more pronounced.

Source: Binance Public Data

During this sample period, the 0.5% slippage threshold is passed on the hourly basis (under 5-gamma confidence) for trade sizes of $25M or above, both for BTC and ETH sell orders. Once again, the ETH liquidity depth is observed to be smaller.

#Secondary Market Peg Strength

A final consideration is the USDe secondary market strength. Unexpected secondary market selling of USDe could overwhelm arbitrageurs and prompt Ethena to deploy the reserve fund to stabilize the short-term USDe price fluctuations.

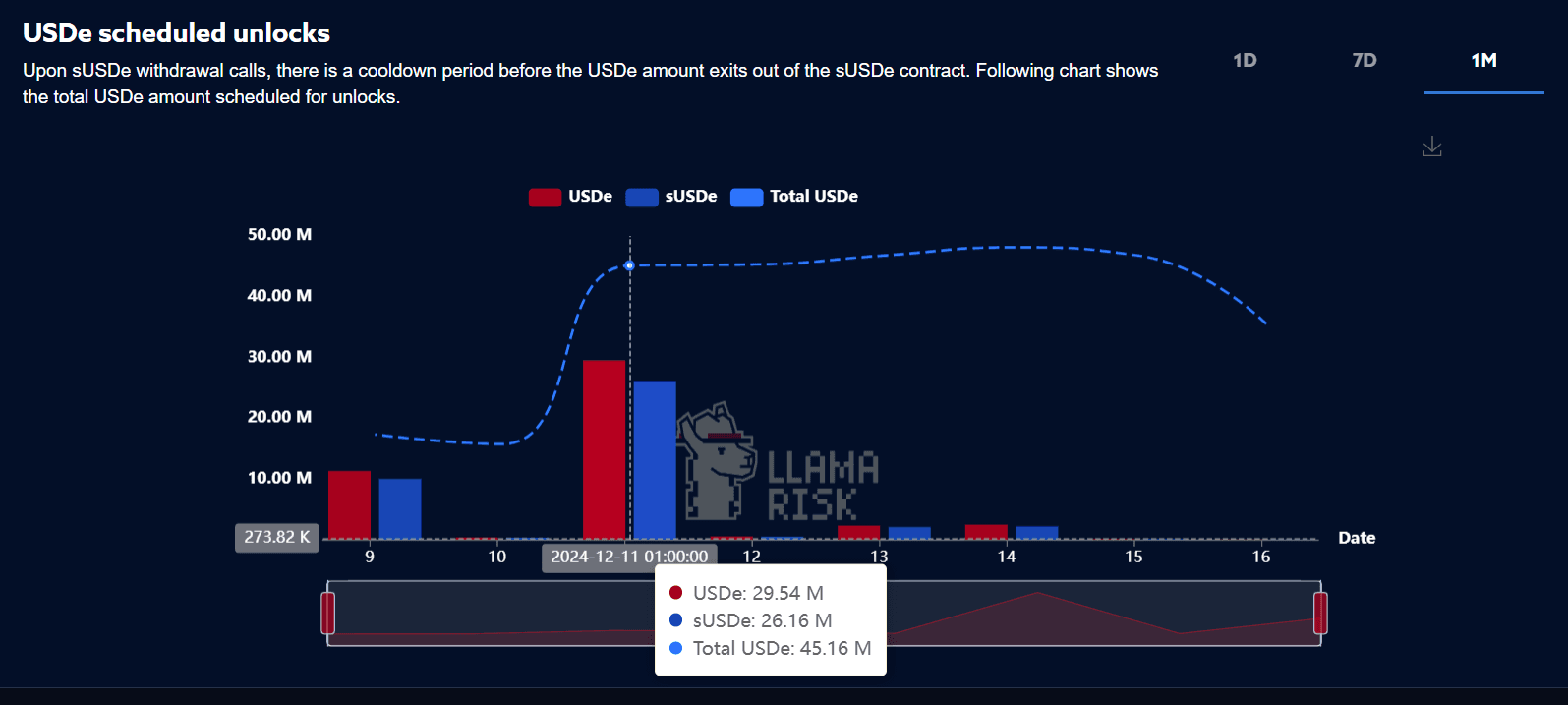

sUSDe

One assumption that we include is that sUSDe secondary market peg should not be sustained by the reserve fund, primarily due to low liquidity levels of sUSDe but also due to the operational flexibility provided by sUSDe redemption cooldowns. The restrictive nature of the cooldown may reduce the utility of holding sUSDe, potentially triggering a secondary market sell-off and a temporary de-peg. However, the peg would likely recover due to the availability of direct redemption.

Nonetheless, Ethena should closely monitor sUSDe unstaking schedules to prepare for potential USDe redemption demands, particularly in cases where significant amounts of sUSDe are expected to exit. The unlock schedules and sUSDe volumes can be tracked using LlamaRisk's Ethena Dashboard:

Source: LlamaRisk's Ethena Risk Dashboard

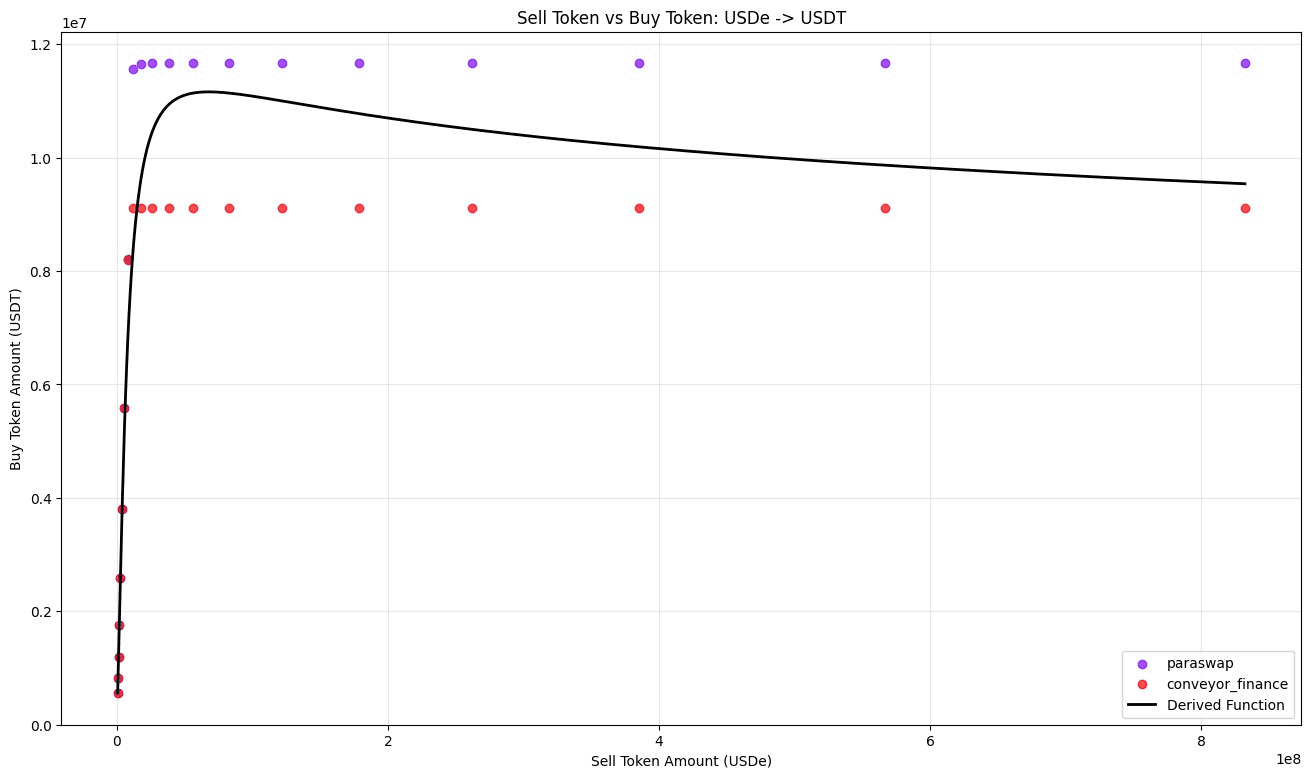

USDe

In order to estimate the potential size of need reserve fund interventions to stabilize the secondary market price of USDe, we must:

-

Estimate the peg stability of USDe and the amount of USDe that can be sold until a secondary market de-peg happens.

-

Evaluate how much capital would need to be injected to restore the peg.

DEX aggregators suggest that USDe liquidity pools can sustain 45M USDe swapped to the most liquid stablecoins (USDT/USDC) until a >1% de-peg happens.

Source: DEX Aggregators

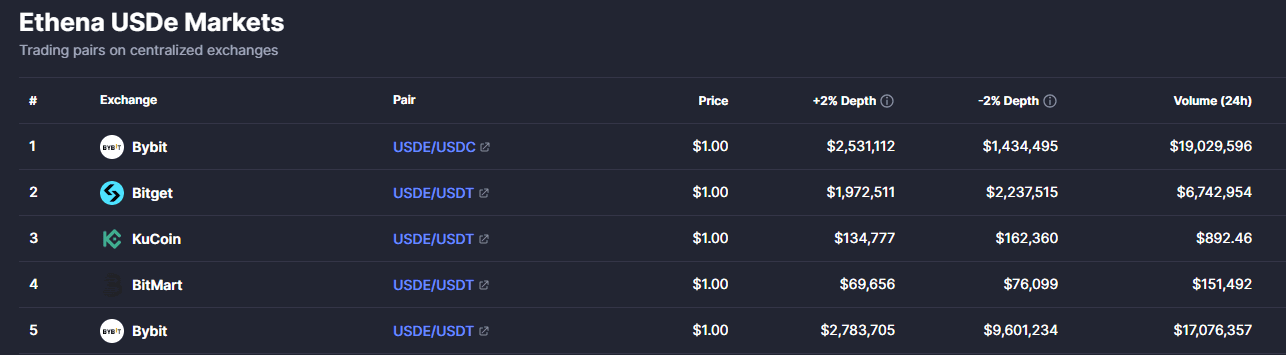

Moreover, Ethena has recently committed to improve CEX adoption of USDe, where USDe is expected to be deployed in 4 out of 5 top CEXs by derivatives volume. This creates an additional secondary market liquidity buffer for Ethena, helping to swap USDe to other stablecoins more efficiently. Currently, ~13.5M USDe can be sold in CEXs under -2% slippage threshold.

Source: CoinMarketCap

On the other hand, if we suppose that: 1) the whitelisted minters are efficient at price arbitrage and can absorb the overflow of USDe and 2) Ethena is pro-active and refills the USDe buffer before USDe price sustains pressure,

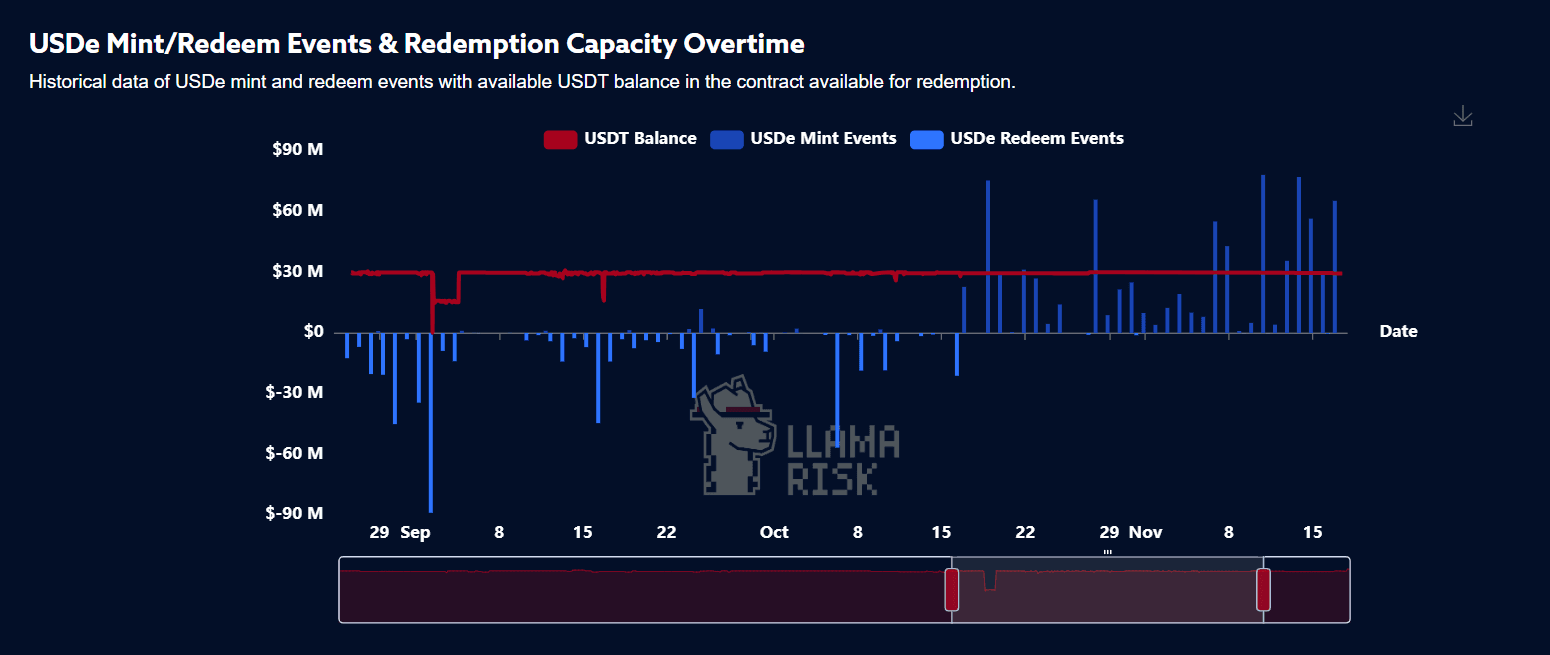

then the reserve fund might not need to be invoked to support secondary market liquidity. While it is hard to verify the assumption on minters, we can inspect the historical redemption buffer size (in USDT) to see that the redemption buffer has generally been capped at 30M with Ethena generally being able to completely refill the exhausted buffer in less than 2 hours on each redemption instance.

Source: LlamaRisk's Ethena Risk Dashboard

On the 2nd of September, 2024 Ethena processed almost $90M of USDe redemptions in one day, leaving the buffer only partially filled before refilling it fully two days later. This particular instance indicates that Ethena could need to process extensive USDe redemptions and therefore must be prepared to deploy capital in a negligible amount of time or potentially face secondary market pricing pressure. Nonetheless, these considerations are also closely tied with the slippage conditions discussed above.

#Combined Risk Scenarios

After considering different risk points in isolation, we can now consider the combined scenarios and therefore evaluate the possible extent of capital deployment that would be needed by the Reserve Fund under elevated short-term market stress. The risk points suggest that under conservative estimates:

-

The reserve fund would need to withstand up to 0.5% negative funding rate drawdowns in a timeline of 24 hours.

-

Up to 75 bps (0.75%) of slippage can be experienced when Ethena winds down the perpetual positions in tranches of $25,000,000.

-

The combined peg strength is around 58M USDe when CEX and DEX liquidity is combined. It can be expected that Ethena would need to cover up to 50% of that amount in other stablecoins to partially restore the peg buffer.

-

Ethena might face large daily redemptions which would prompt the proactive reaction to either 1) refill the USDe redemption buffer or 2) implement measures to support secondary market peg.

We can therefore simulate different potential scenarios based on the assumed strength of these risk factors. This will help us estimate the interval of needed reserve fund capital value. Below are two scenarios with different levels of severity, allowing us to offer a range of recommended reserve fund values that account for different scenarios.

Extreme Negative Funding Rate Scenario (Conservative Recommendation)

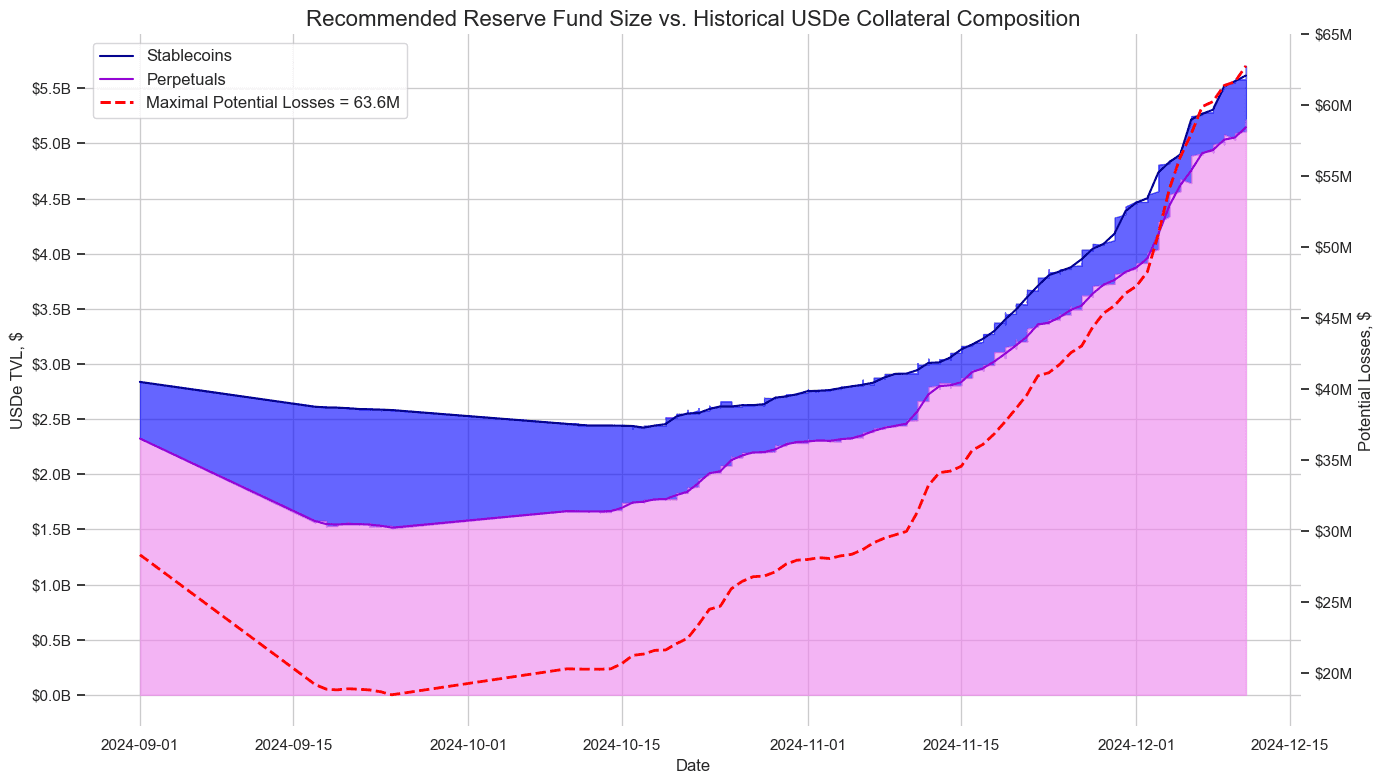

The impact caused by negative funding rates and perpetual exit slippage is only applicable to the portion allocated in perpetual positions. In this case we assume that all positions would need to be closed in the timespan of 24 hours, incurring 0.5% negative funding rate losses as well as 75 bps slippage losses. Adjusting for the stablecoin portion, we can observe the following estimate of the required reserve fund size:

Source: LlamaRisk

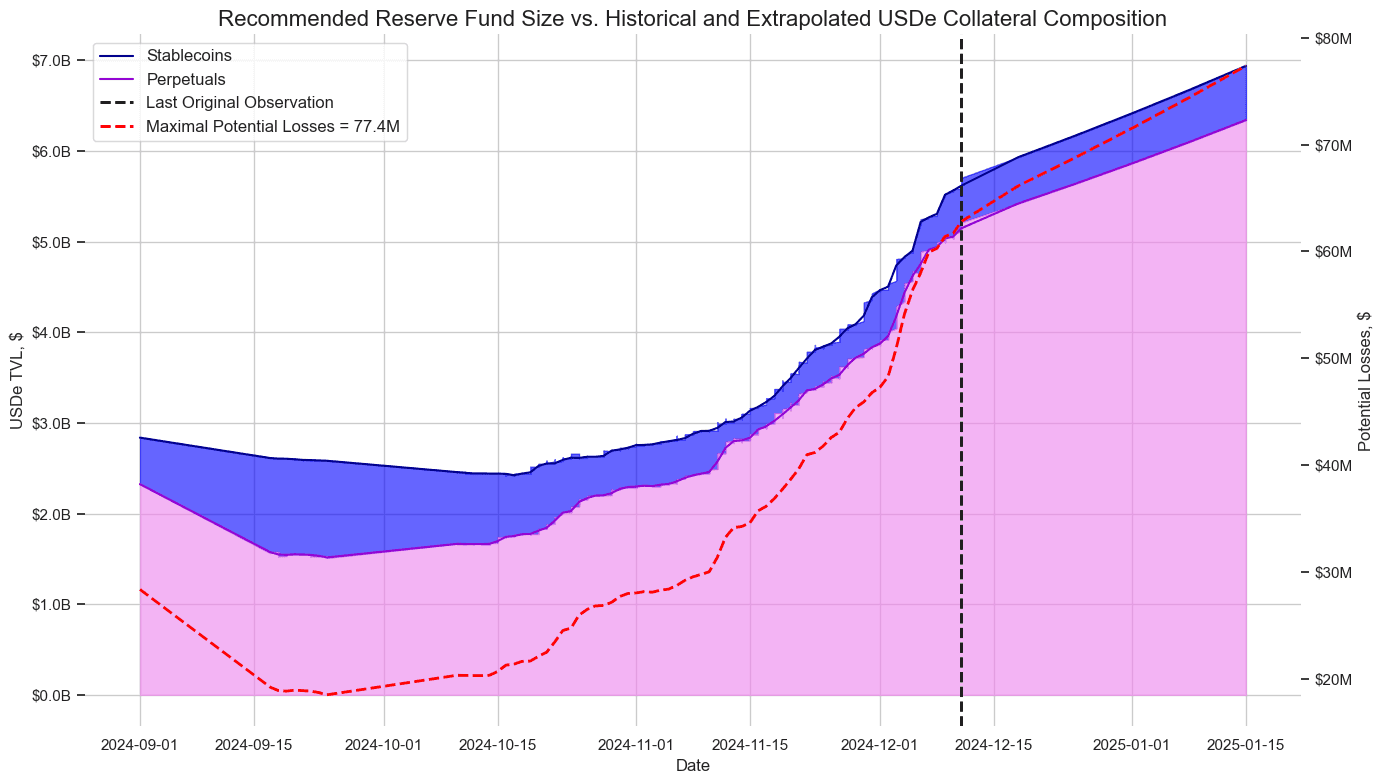

Simulating this short-term risk scenario results in the most conservative reserve fund size estimation of $63.6M. Under this reserve fund size, Ethena would remain solvent and be able to serve all USDe redemptions, even under the worst tail risk scenario that would require to close all perpetual positions in a short timeframe. Applying Ceteris Paribus for the collateral composition of USDe, at a $6B USDe supply the recommended value would reach ~$67M.

Source: LlamaRisk

Maximal Redemption Demand Scenario (Moderate Recommendation)

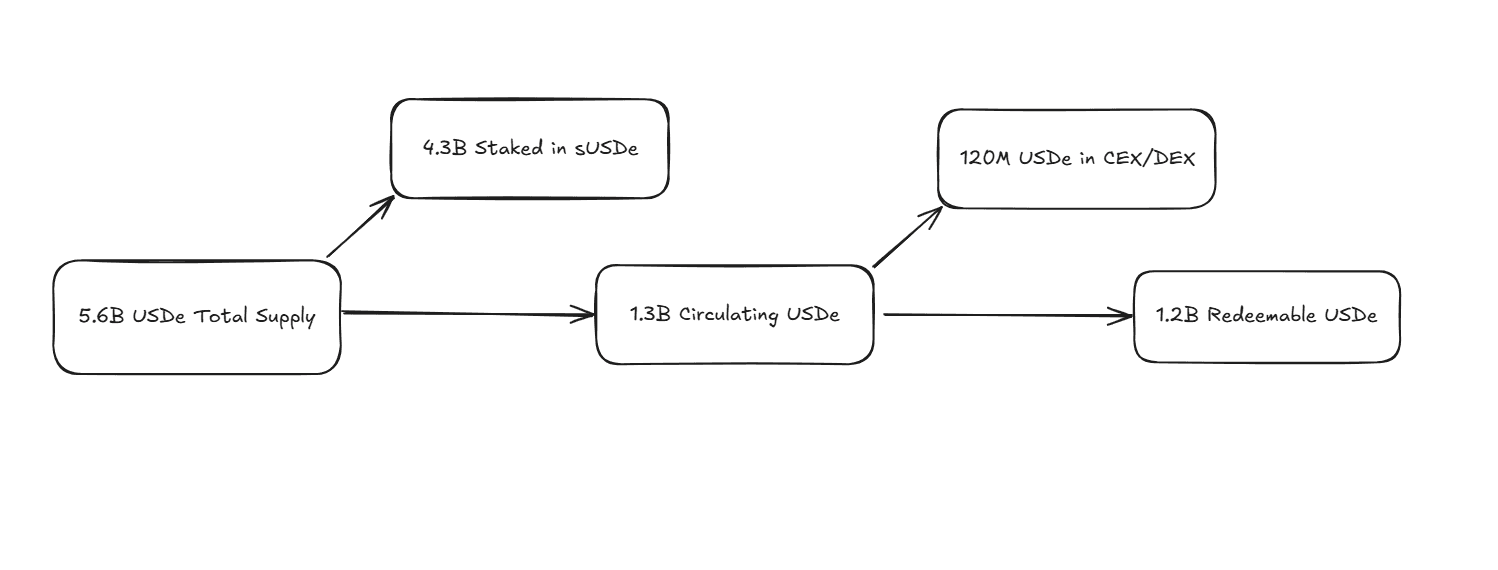

USDe has recently experienced aggressive supply growth, with daily supply inflows reaching up to $350M. In case funding rates experience a sharp decline, it can be expected that sUSDe would enter the unstaking queue, undergoing a withdrawal cooldown of 7 days. This could also result in large USDe redemptions, the amount of which would be limited by the circulating USDe supply. With 77.4% of USDe supply being locked in the sUSDe staking contract, there is currently around 1.3B of USDe in circulation. If we assume that all USDe which is deposited into the liquidity pools would not be redeemed, the maximal redeemable USDe amount would be even lower.

Source: LlamaRisk

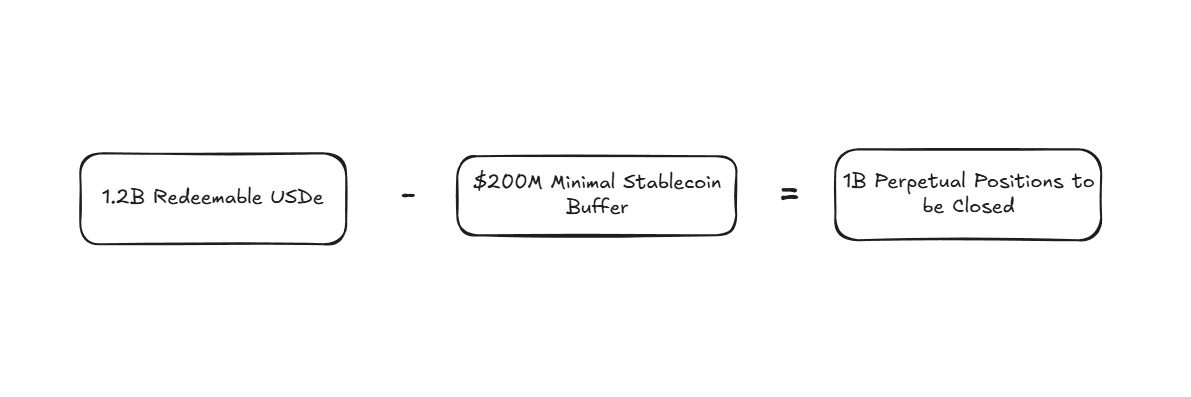

After applying these assumptions, we end up with an estimation of 1.2B USDe that could potentially be redeemed. We can then use the same assumption that Ethena would prefer to service these redemptions in a timely manner so that the secondary market price does not de-peg. Since Ethena possesses a buffer of stablecoins as part of USDe collateral, we can assume that it would be able to process part of these redemptions instantly, with the remainder required to be sourced by closing existing perpetual positions.

Source: LlamaRisk

In addition, under this scenario we assume that:

-

The USDe redemptions to be covered by closing perpetual positions are mitigated within 75 bps slippage level and incur at max 5 bps in funding rate losses.

-

Remaining perpetual positions could incur negative funding rate losses of up to 50 bps before they are started to be winded down lightly, incurring lower 25 bps slippage in the days that follow.

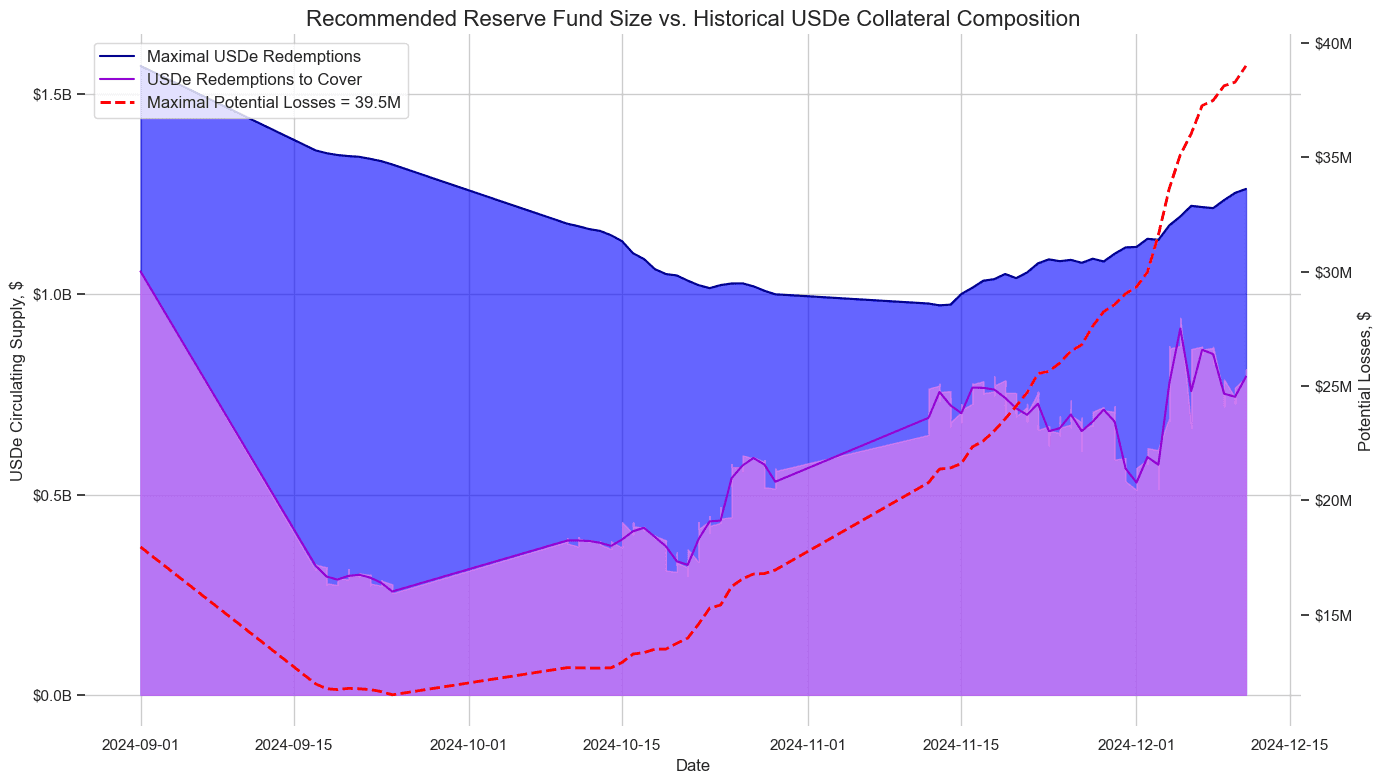

Source: LlamaRisk

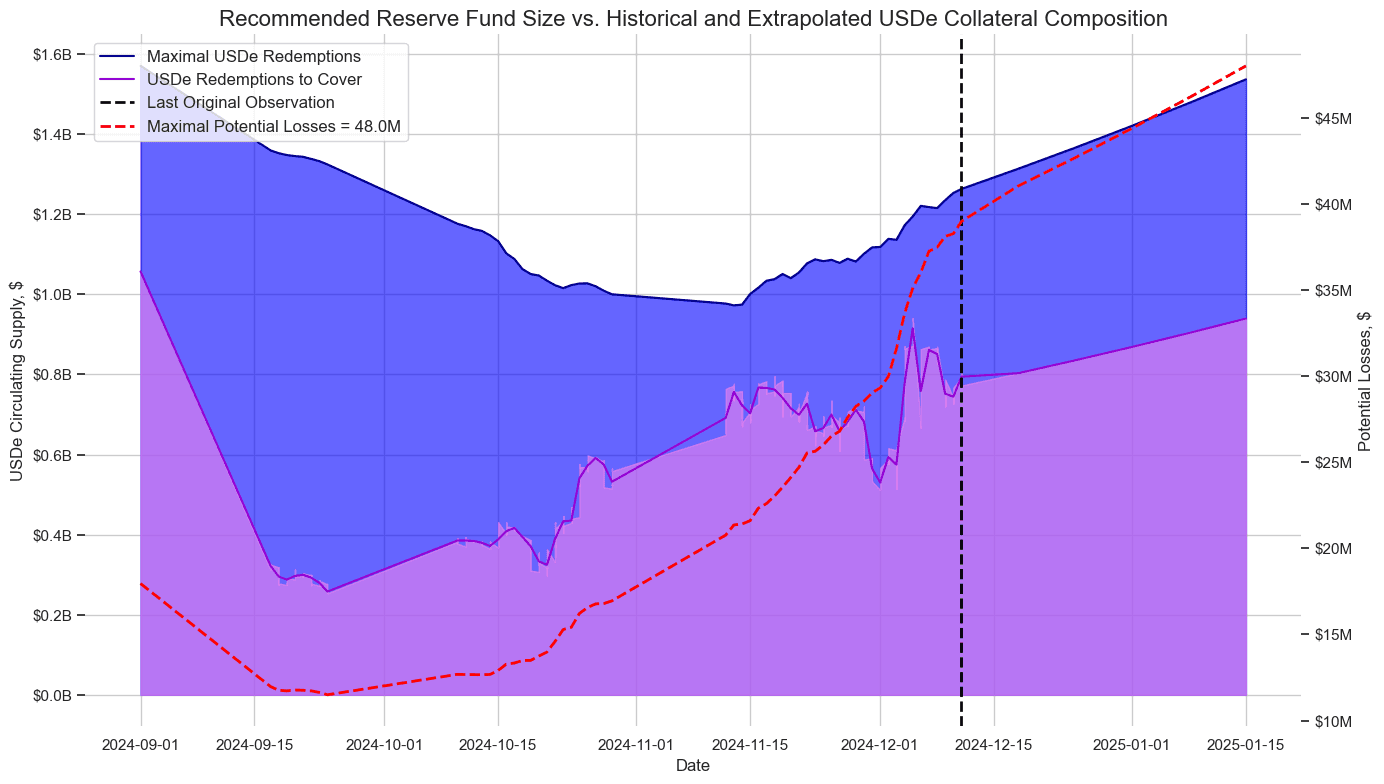

This scenario results in a recommended reserve fund size of $39.5M that may fluctuate based on a changing stablecoin buffer. Under this reserve fund size, Ethena could successfully serve all redemptions of circulating USDe while being able to wind down the perpetual positions more gradually and over a larger time frame, assuming that the funding rates are milder than a tail-risk scenario. Applying Ceteris Paribus by keeping the USDe vs. sUSDe distribution fixed while the total supply of USDe increases, at $6B USDe supply this recommendation would reach ~$43M.

Source: LlamaRisk

#Recommendation Range

At the time of writing, the Drawdown Methodology (V2) results in a currently recommended capitalization of $63.6M for the reserve fund in order to be able to withstand short-term market stress until the perpetual positions are winded down and USDe redemptions are serviced. By comparison, the V1 Methodology results in a more conservative range of at least $79m, reducing our recommended value by ~20%.

We are able to reduce the recommended value with our refined methodology because we incorporate assumptions that Ethena will mitigate exposure to negative funding rate environments to the best of its ability and that stablecoin allocations can mitigate adverse exposure to negative funding rates.

LlamaRisk will continuously monitor the changing recommended level and keep all stakeholders informed in case the reserve fund becomes inadequately funded.