A comprehensive risk analysis of staked Frax (sFRAX) as a potential collateral asset

Useful Links:

-

Website: Frax Staking App | FinresPBC

-

Documentation: Frax v3 Docs | Audits | GitHub

-

Contracts: sFRAX | Frax Mainnet Deployments

-

Markets: Curve sFRAX/crvUSD

-

Dashboards: Frax Facts | DeFiLlama | Dune Dash by Llama Risk

#Introduction

In this report, we will analyze staked Frax (sFRAX) as a potential collateral asset. The objective of this analysis is to comprehensively assess the risks associated with sFrax to determine its suitability for collateral onboarding. Our evaluation will employ both quantitative and qualitative methods, providing insights into the safety of integrating sFrax as collateral and recommending any necessary exposure restrictions.

We will categorize the identified risks into three main areas:

-

Market Risk - Concerns related to market liquidity and volatility.

-

Technology Risk - Considerations pertaining to smart contracts, dependencies, and Oracle price feeds.

-

Counterparty Risk - Aspects concerning governance, centralization potential, and legal/regulatory factors.

These risk categories will be summarized in the final section of this report, providing tokenholders with valuable information to make informed decisions regarding the integration of sFRAX and the establishment of appropriate parameters.

#Section 1: Protocol Fundamentals

This section addresses the fundamentals of the proposed collateral. It is essential to convey (1) the value proposition of sFRAX and (2) the architecture of sFRAX as an asset. This section contains descriptive elements that cannot be quantified and serves as a descriptive introduction to the collateral.

This section is divided into two sub-sections:

-

1.1: Description of the Protocol

-

1.2: System Architecture

#1.1 Description of the Protocol

For the Frax protocol's latest upgrade, Frax v3, the following notable concepts and benchmarks are outlined in the docs:

-

Full exogenous collateralization of FRAX, aiming for a collateralization ratio (CR) of >=100% at all times, composed of protocol owned liquidity deployed to automated market operations (AMO) smart contracts, certain real-world assets (RWAs) held by partner entities approved by the Frax Governance module, and a basket of volatile governance tokens both locked and unlocked.

-

Frax's peg will target USD using a mix of Chainlink oracles and governance-approved reference rates. If the CR drops below 100%, actions should be taken to restore the CR to keep the FRAX price at $1.

-

Utilization of a Federal Reserve Interest on Reserve Balances (IORB) rate oracle for protocol functions like sFRAX staking yield, with dynamic strategies reacting to IORB rate changes that optimize reserves allocation between RWAs and on-chain AMO yield sources.

-

Removal of multisig trust assumptions, ensuring that FRAX v3 smart contracts entirely operate on-chain using the frxGov module.

-

FRAX stablecoins are non-redeemable, similar to fiat currencies, with the protocol's sole responsibility being to stabilize the peg through AMO activity, RWA reserves management, and governance action.

sFRAX (Staked FRAX) is a core component of the Frax v3 system, designed as an ERC4626 staking vault. It facilitates a portion of the Frax Protocol yield to be distributed weekly to stakers, denominated in FRAX stablecoins. The sFRAX token represents pro rata deposits within the vault and is always withdrawable for FRAX stablecoins at the pro rata rate.

With the launch of sFRAX, the aim was to tap into the rise in U.S. Treasury yields. Frax deposited into the system is allocated to a combination of RWAs managed by governance-approved custodial partners and on-chain AMO strategies. Depositors are entitled to a proportional share of the yield produced by the underlying strategies, which targets the Federal Reserve's Interest Rate on Reserve Balances (IORB), although there is no guarantee users will receive the target rate.

sFRAX's primary purpose to FRAX holders is to bridge the gap in the yield curve of FRAX by offering a savings option with low duration risk, facilitating integration into various protocols, bridges, cross-chain applications, and other platforms that can hold sFRAX and earn more FRAX stablecoins passively at the Frax Staking Rate.

The launch of sFRAX was partly a result of FRAX's partnership with FinresPBC, enabling FRAX to connect with Lead Bank, open a brokerage account, and begin purchasing Treasury bills, aiming to bring the Federal Reserve's yield on-chain to complete the design of a dollar-pegged stablecoin.

#1.1.1 Underlying Collateral

The underlying collateral of sFRAX is the FRAX stablecoin. sFRAX is always redeemable for FRAX at the pro rata rate at all times. FRAX in the vault is deployed toward some combination of RWAs managed by governance-approved custodians and on-chain AMOs.

RWAs The RWA portion targets the IORB rate (the risk-free rate set by the Federal Reserve) and seeks to minimize duration risk with the following approved asset types:

-

short-dated United States treasury bills

-

Federal Reserve Overnight Repurchase Agreements

-

USD deposited at Federal Reserve Bank master accounts

-

select shares of money market mutual funds

Finresbc is the first and currently the sole RWA partner for Frax v3. According to the onboarding proposal, they can:

-

Hold US Dollar deposits in FDIC Insured IntraFi savings accounts & earn yield on such accounts.

-

Mint/Redeem Paxos USDP stablecoins & earn yield.

-

Mint/Redeem Circle USDC stablecoins & earn yield.

-

Hold/Purchase/Sell United States Treasury Bills in segregated brokerage accounts & earn yield.

AMOs AMOs are on-chain strategies pioneered by Frax that use pre-programmed monetary policies and make use of protocol-owned liquidity. These strategies earn yields that are passed on to depositors in the sFRAX vault.

-

Curve AMO: Mints FRAX and deploys into Curve pools when FRAX trades above the pool counterpart and burns FRAX when it trades below the pool counterpart.

-

Fraxlend AMO: Lends minted FRAX to FraxLend and earns interest.

-

FraxSwap TWAMM AMO: Loads time-weighted AMM orders to buy collateral with minted FRAX or sell collateral for FRAX over time.

#1.1.2 Yield Accural Mechanism

The yield accrual mechanism for sFRAX is structured to distribute a portion of the Frax Protocol's yield to stakers on a weekly basis, denominated in FRAX stablecoins. The sFRAX APY aims to track the U.S. Federal Reserve's Interest on Reserve Balances (IORB) rate, using an IORB oracle. The oracle is currently managed by the Frax team and they are working with Chainlink to provide a feed for this in the future.

The sFRAX vault’s yield originates from real-world asset (RWA) strategies employed by Frax Protocol partner custodians and by Frax AMO strategies. The strategies attempt to generate yield close to the IORB rate with as little duration risk as possible.

The APY is based on a utilization function governed by the timelockAddress (currently set to a multisig, but will eventually be governed by the fraxGov module).

According to the docs, the yield is added to the sFRAX vault every Wednesday, with newly minted FRAX stablecoins that match the earnings of the Frax Protocol over the preceding week, ensuring a 100% collateralization ratio. This is carried out by the Frax Investor Custodian EOA or the Frax Comptroller multisig.

Employing the soft-target to the IORB rate and distributing rewards based on earnings means that there is never a scenario where the protocol is paying out more FRAX than it has earned the prior week and thus creating an insolvency.

Communication with the Frax Team highlighted that, at present, the yield predominantly derives from sDAI and some fiat/T-bills custodied by FinresPBC. FRAX considers sDAI as an RWA since its yield is passthrough from RWAs.

#1.1.3 Provider Fee

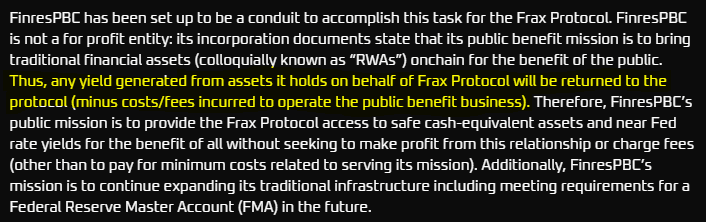

FinresPBC charges fees incurred to operate the public benefit business. According to the onboarding proposal, the cost will be made transparent in monthly reports to the DAO.

Source: FIP-277 | Frax Governance Forum

#1.1.4 Operator Set

Currently the sole RWA provider is FinresPBC. Communciation with the team revealed that additional RWA partners, including Centrifuge, are planned to be onboarded through FinresPBC in the near future.

#1.1.5 Governance Model

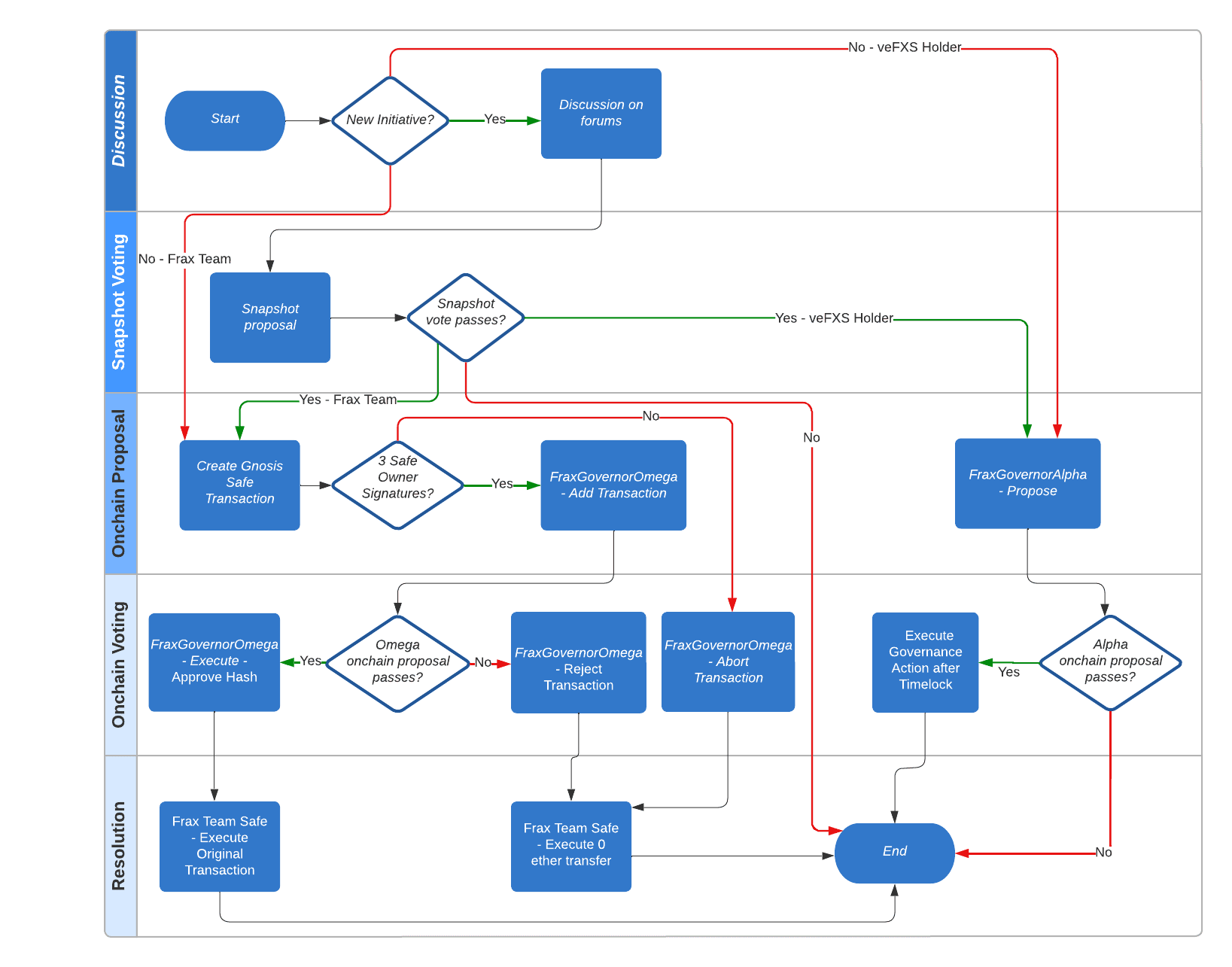

We have previously covered Frax's governance system in a report published September 2022. There is a significant dependence on the Frax Comptroller multisig and other team-controlled addresses to facilitate critical operations within the protocol. There is a governance process involving governance discussion and Snapshot voting that make use of the protocol's veFXS governance token. Frax have been rolling out, frxGov, an onchain governance system, although it has not yet been implemented to core FRAX contracts.

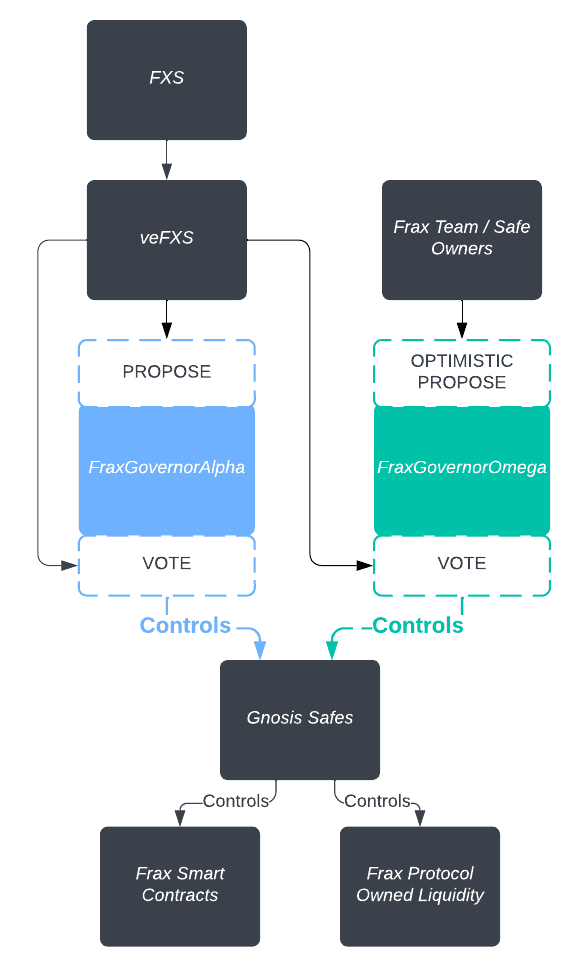

Frax Governance plans to be a decentralized, trustless, and fully on-chain governance system based on the Compound/OpenZeppelin Governor contracts, which control Gnosis Safes. The system will be effectively controlled by veFXS (vote-escrowed FXS tokens) holders. veFXS holders have the final say over all major decisions within the protocol, including voting on proposals and even replacing Frax team members as owners on the underlying Safes if a proposal reaches quorum and passes.

Source: Frax Docs

FrxGov will operate through a dual Governor system comprising FraxGovernorAlpha and FraxGovernorOmega, each with distinct uses and configurations. FraxGovernorOmega has limited control over the underlying Safes and is configured to approve Safe transactions before they can be executed by Safe owners. On the other hand, FraxGovernorAlpha has full control over the underlying Safes, allowing any veFXS holder meeting the proposal threshold to create proposals. This dual system design aims to enhance the security and functionality of the governance process within the Frax Protocol without sacrificing operational efficiency.

Source: Frax Docs

#1.2 System Architecture Diagram

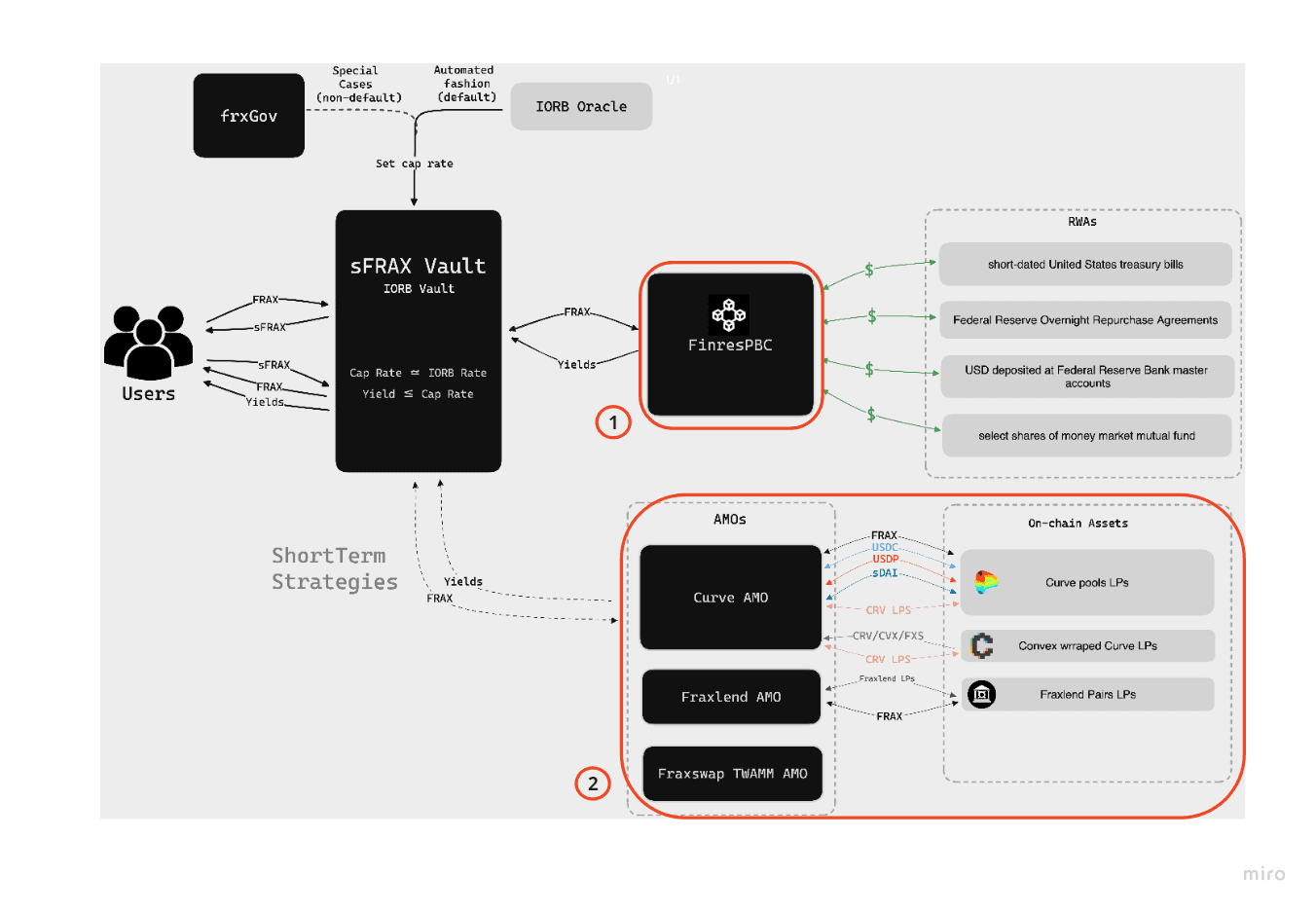

#1.2.1 Network Architecture Overview

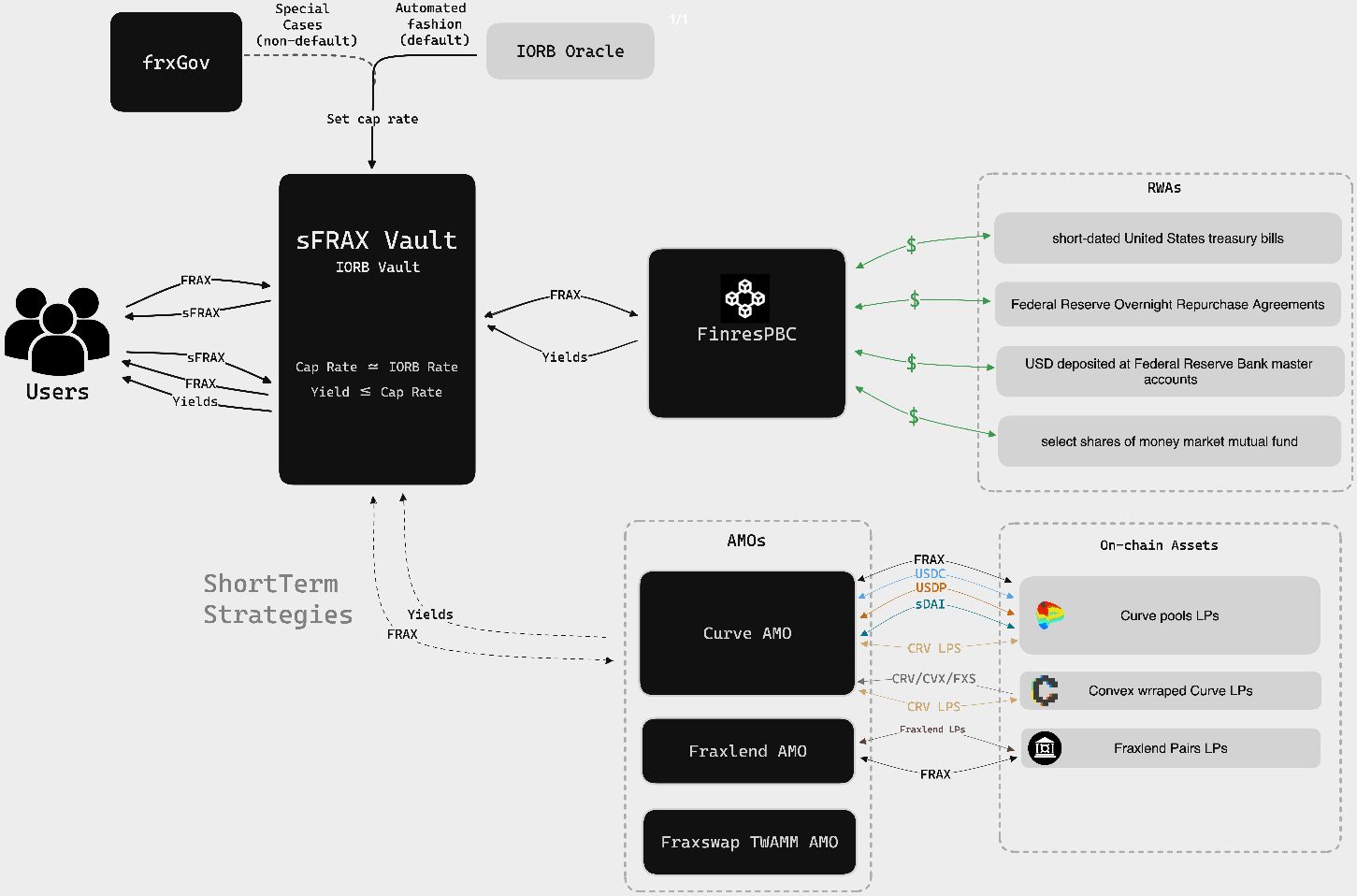

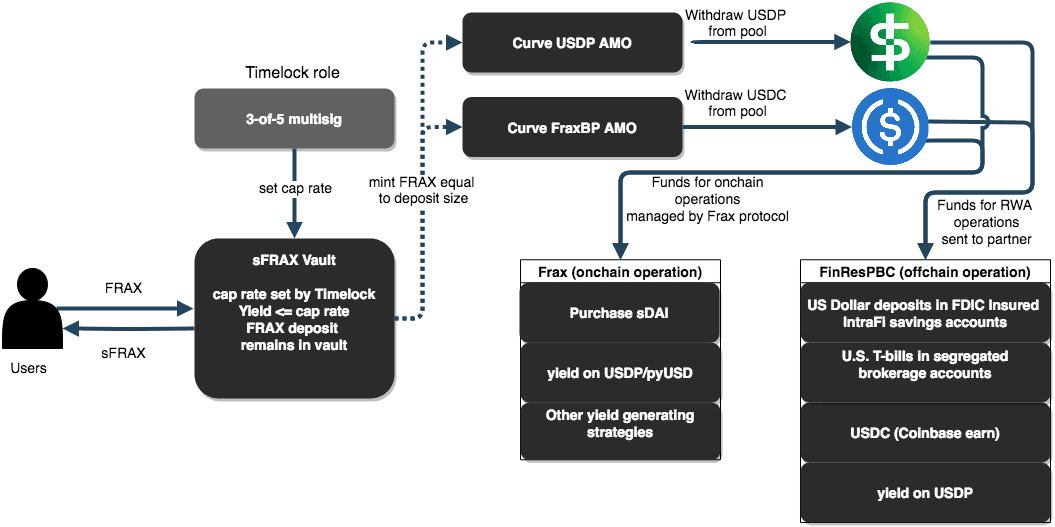

sFRAX (Staked FRAX) is a core component in Frax v3, acting as an ERC-4626 compliant staking vault to distribute a portion of the Frax Protocol yield to stakers weekly, denominated in FRAX stablecoins. sFRAX tokens represent pro rata deposits within the vault and are always redeemable for FRAX stablecoins at the pro rata rate. Depositors effectively act as lenders to FRAX itself and earn interest in FRAX on the provided funds. The protocol utilizes the FRAX toward protocol products (such as RWAs, FraxLend or AMOs) to generate the promised yield.

To facilitate immediate redemptions at all times, FRAX deposits remain in the sFRAX vault at all times. The Frax Comptroller instead mints an equivalent amount of FRAX through the Curve AMO and withdraws the counterparty stablecoin from the Curve pool (e.g. USDC or USDP). These stables are then used either to earn interest from their respective rewards programs or offramped by FinresPBC to purchase U.S. T-bills or other RWAs. When users withdraw from the sFRAX vault, the process reverses such that the Comptroller unwinds the strategy by depositing stables back to the Curve pool and burning the excess FRAX.

The documentation states that the yield generated for the sFRAX predominantly originates from RWAs and from protocol AMO activities whereby yield is produced from onchain sources (i.e. yield farming). The docs describe an IORB rate oracle that automates the division between RWA and AMO deployment to target the risk-free rate set by the Federal Reserve. There is currently not an oracle in place and this appears to be a process managed by the Frax team, although they say they are working with Chainlink to deploy such an oracle.

#1.2.2 System Architecture Diagram

The architecture diagram shown below is provided in the Frax documentation.

Source: Frax.Finance Documentation

There are some notable discrepancies between the architecture as described in the docs versus the deployed contracts.

-

frxGov onchain governance is not yet implemented. The sFRAX contract owner that can set the cap rate is a 3-of-5 Frax team multisig.

-

There is not currently an IORB oracle.

-

FRAX is not directly deployed to strategies. Instead, the AMO mints FRAX against sFRAX deposits.

We have created a modified architecture below that reflects the current architecture.

#1.2.3 Key Components

The diagram in section 1.2.2 outlines the structure and interactions between various components of the sFRAX product. It is designed to illustrate how Automated Market Operations (AMOs), sFRAX Vault, and FinResPBC interact with each other. The key components can be summarised as:

-

sFRAX Vault: Is the core mechanism for users to interact with FRAX, allowing them to deposit FRAX to earn yields. The sFRAX Vault will have a cap rate set by the IORB (Federal Reserve Interest in Reserve Balances) Oracle.

-

AMOs (Automated Market Operations): These are specialized smart contracts with an internal monetary policy that are authorized to mint and burn FRAX. They are designed for different purposes such as Curve AMO for providing liquidity, Fraxlend AMO for lending operations, and Fraxswap TWAMM AMO for swap operations.

-

FinResPBC: This entity is connected with the real-world assets (RWAs), like treasury bills and Federal Reserve bank accounts. It manages the off-chain financial instruments such as short-dated U.S. treasury bills, Federal Reserve Overnight Repurchase Agreements, deposits in Federal Reserve Bank master accounts, and shares of money market mutual funds to provide user with real yields.

-

On-chain Assets: These include various liquidity provider tokens from DeFi protocols like Curve and Convex, as well as FRAX pairs. These on-chain assets are integrated into the FRAX ecosystem, used by the AMOs for various operations (see diagram). The are employed to generate short-term financial strategies to generate yields for user.

-

frxGov: FrxGov is a future upgrade to Frax protocol governance, a governance module that allows veFXS token holders to have ultimate authority over protocol operation. Until the governance upgrade, protocol operations are managed by a team-controlled multisig.

#Section 2: Performance Analysis

This section evaluates sFRAX from a quantitative perspective. It analyzes token usage and competitive metrics and accounts for subsidized economic activity.

This section is divided into three sub-sections:

-

2.1: Usage Metrics

-

2.2: Competitive Analysis Metrics

-

2.3: Subsidization of Economic Activity

#2.1 Usage Metrics

#2.1.1 Total Value Locked (TVL)

Total Value Locked (TVL) is the total amount of cryptocurrency assets locked or deposited within a decentralized finance (DeFi) platform or ecosystem. Given that sFRAX is backed 1:1 by FRAX stablecoin, the sFRAX supply effectively represents the TVL (see direct comparison here).

[Ref Dune]

Since the inception of the contract on the 18th of October, sFRAX has gained a max TVL of 40 Million USD, although it has since declined through the month of November.

#2.1.2 Transaction Volume

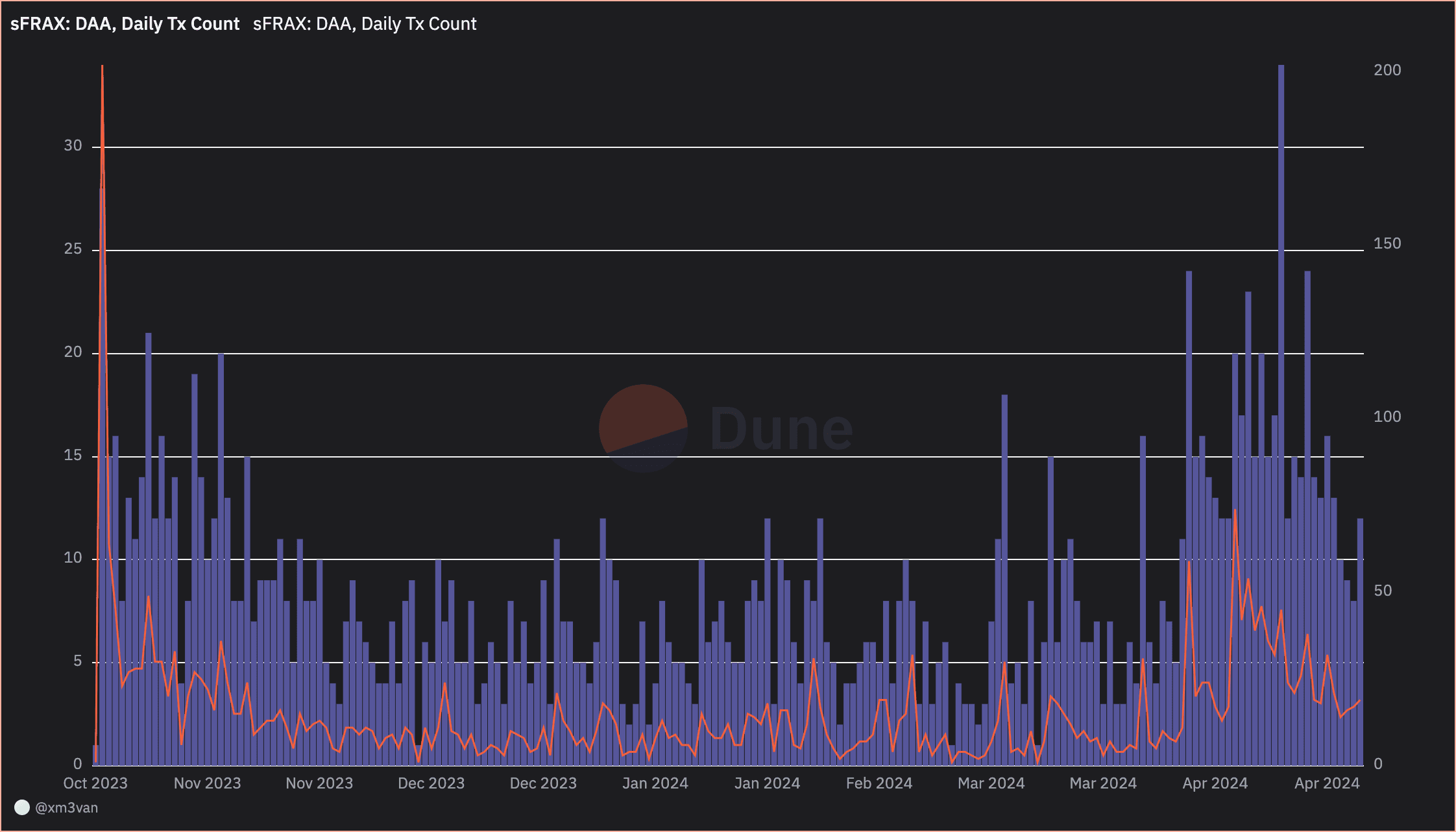

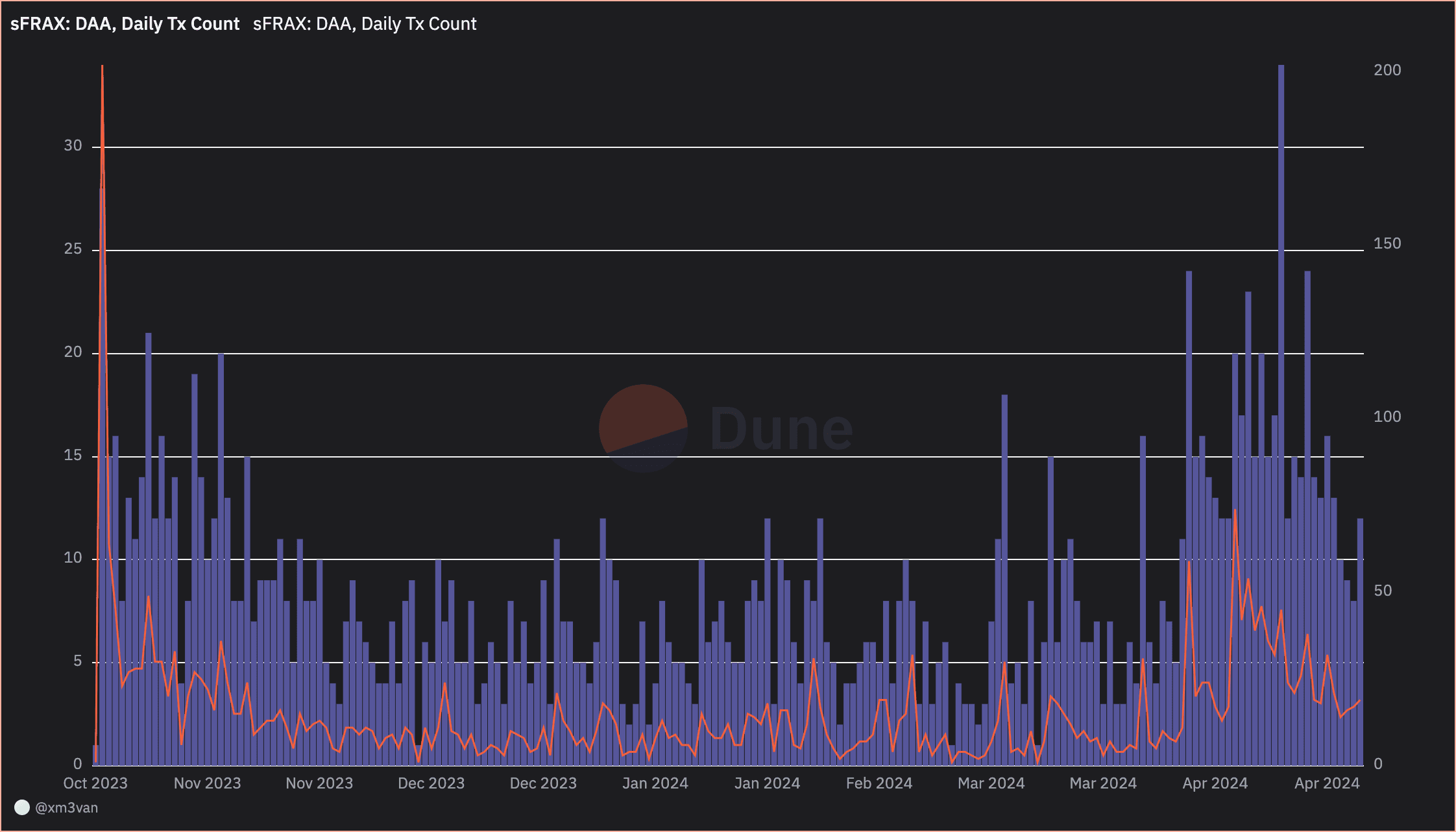

Transaction volume refers to the total number of Transaction executed with the sFRAX contract as gauge of interest with the contract.

In the context of sFRAX, interaction patterns resemble those of an asset initially attracting a surge of users seeking to hold it, followed by reduced contract interactions, primarily limited to occasional redemptions or deposits.

#2.1.3 On-chain Volume

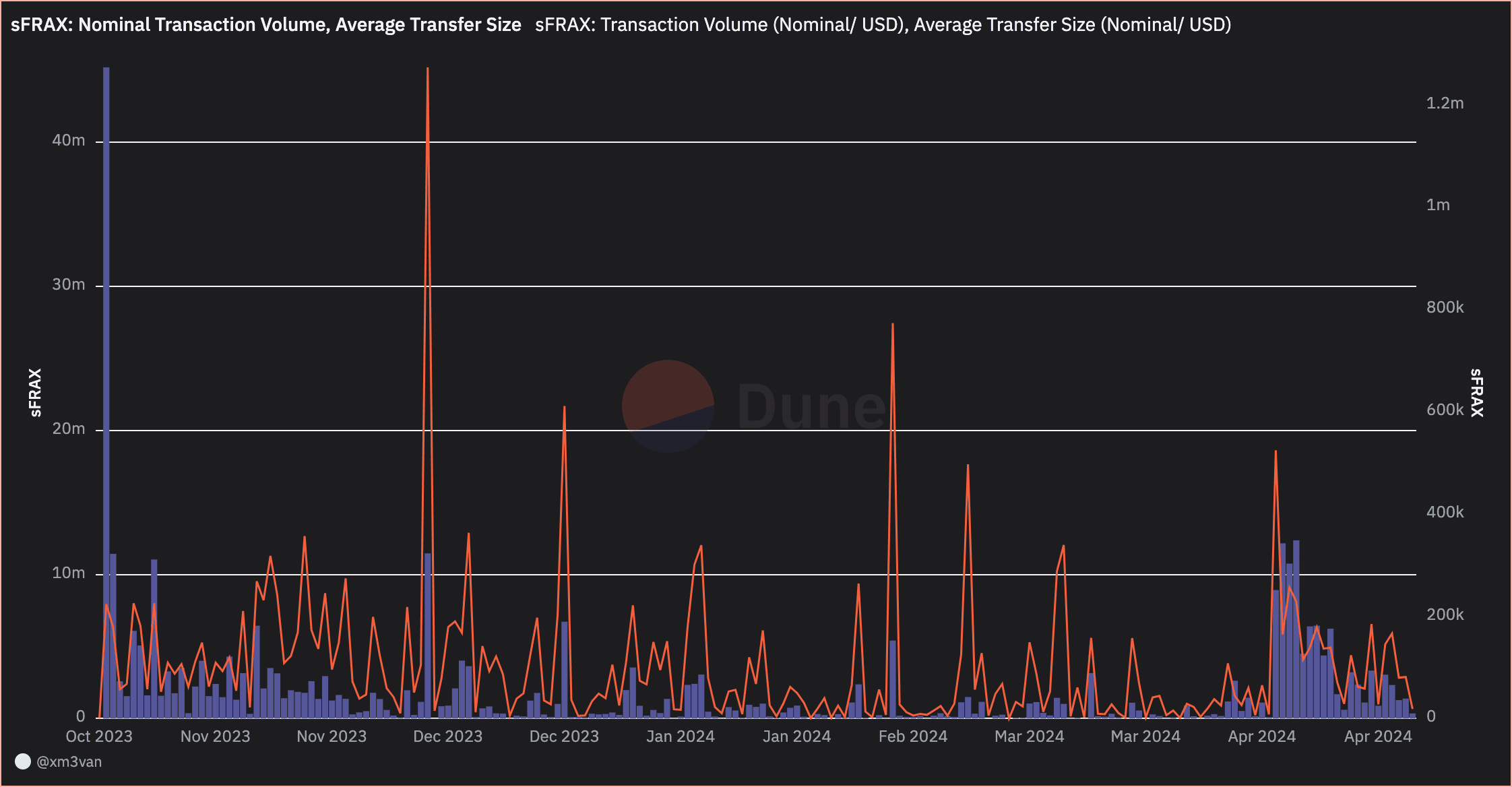

The On-chain Volume refers to the total transfers volume of an asset. This can be measured in dollar volume or nominal units.

#2.1.4 Average Transaction Size

Average Transaction Size refers to the nominal or dollar value of the transfer of a given token executed on-chain. Refer to the orange line in the chart from section 2.1.3 above to see the Average Transaction Size for sFRAX. sFRAX scores a relatively high average transaction size between approximately 50,000 to 200,000 sFRAX/ USD, suggesting the current user base is mostly composed not of retail users, but wealthier individuals or protocols able to deploy capital of size.

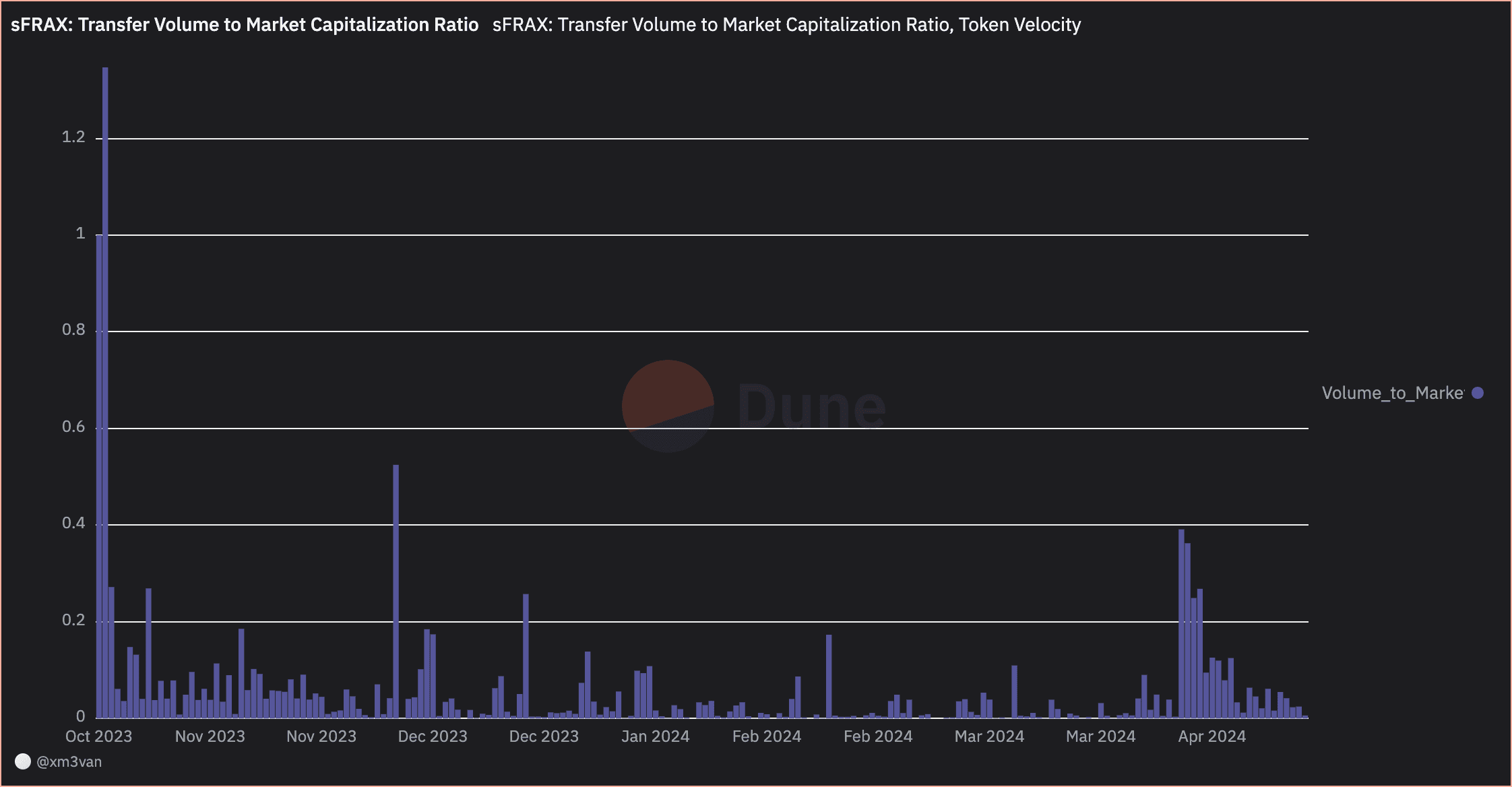

#2.1.5 Volume to Market Capitalization Ratio

Volume to Market Cap Ratio is a normalized metric showing the transfer volume as a share of the sFRAX TVL.

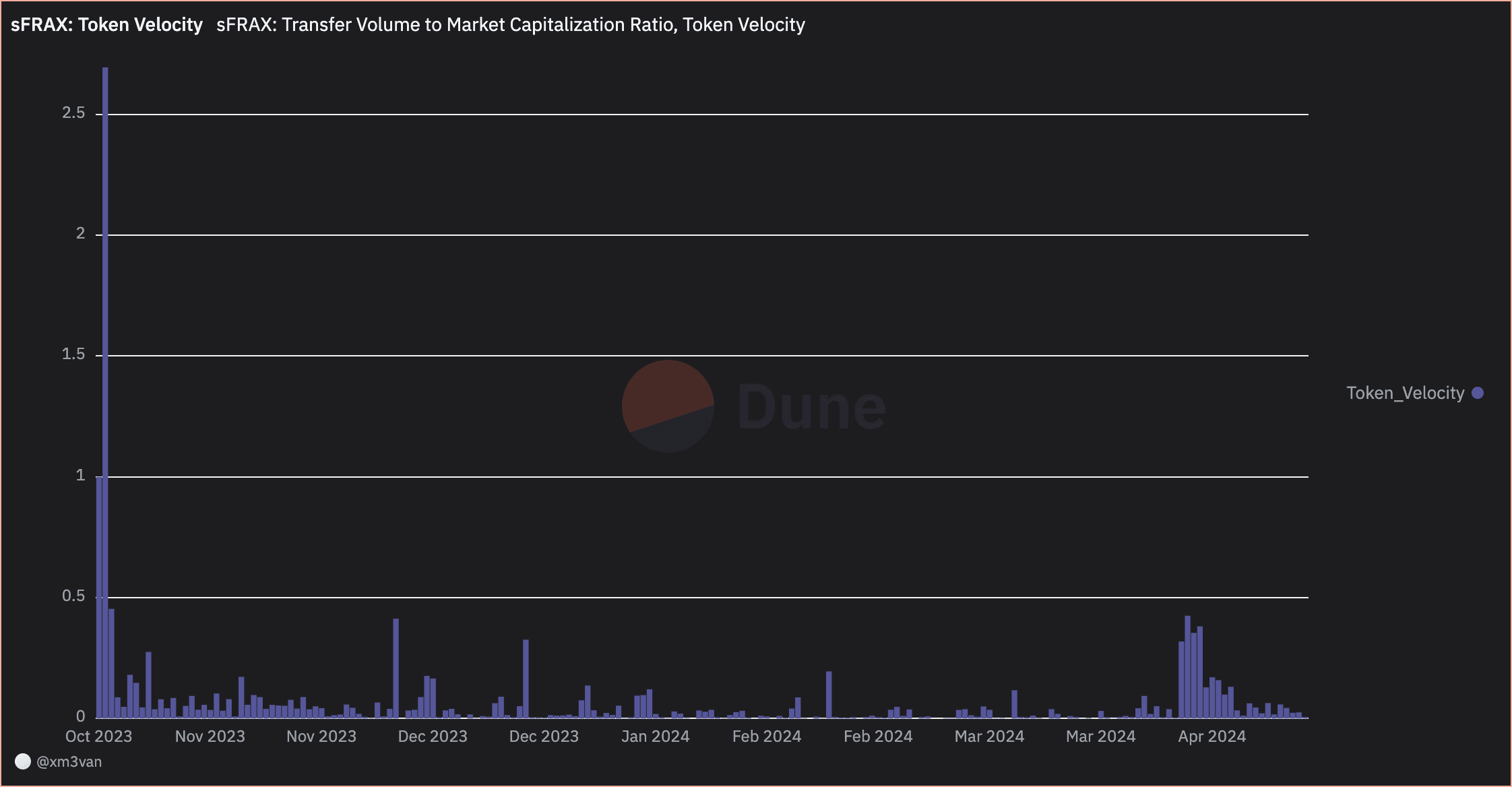

#2.1.6 Token Velocity

Token Velocity is a normalized metric showing the transfer volume as a share of the 7 day moving average token market cap.

#2.1.7 Active Addresses/Users

Daily Active Addresses are the unique addresses that interact with a given Smart Contract in 24h. Refer to the chart in DAA 2.1.2 Transaction Volume. In the month of November, the DAA ranged from 3 to 20 addresses.

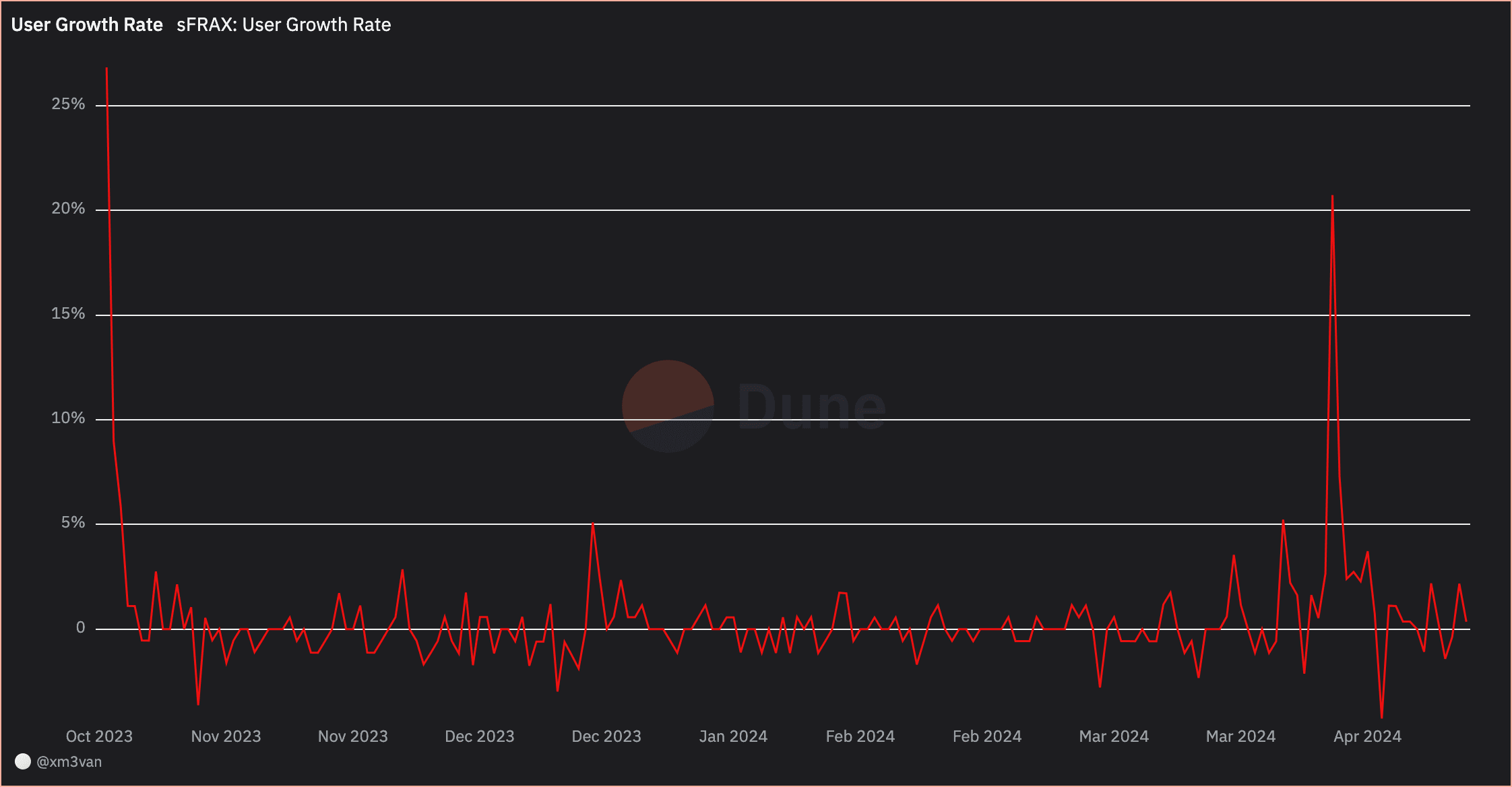

#2.1.8 User Growth Rate

User Growth can be measured by the growth in unique addresses that hold sFRAX.

Excluding the launch date (2023-10-18), sFRAX user growth has been mostly stagnant.

#2.2 Competitive Analysis Metrics

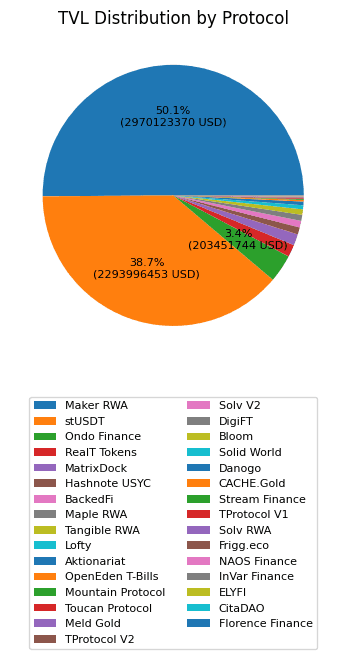

#2.2.1 Market Share

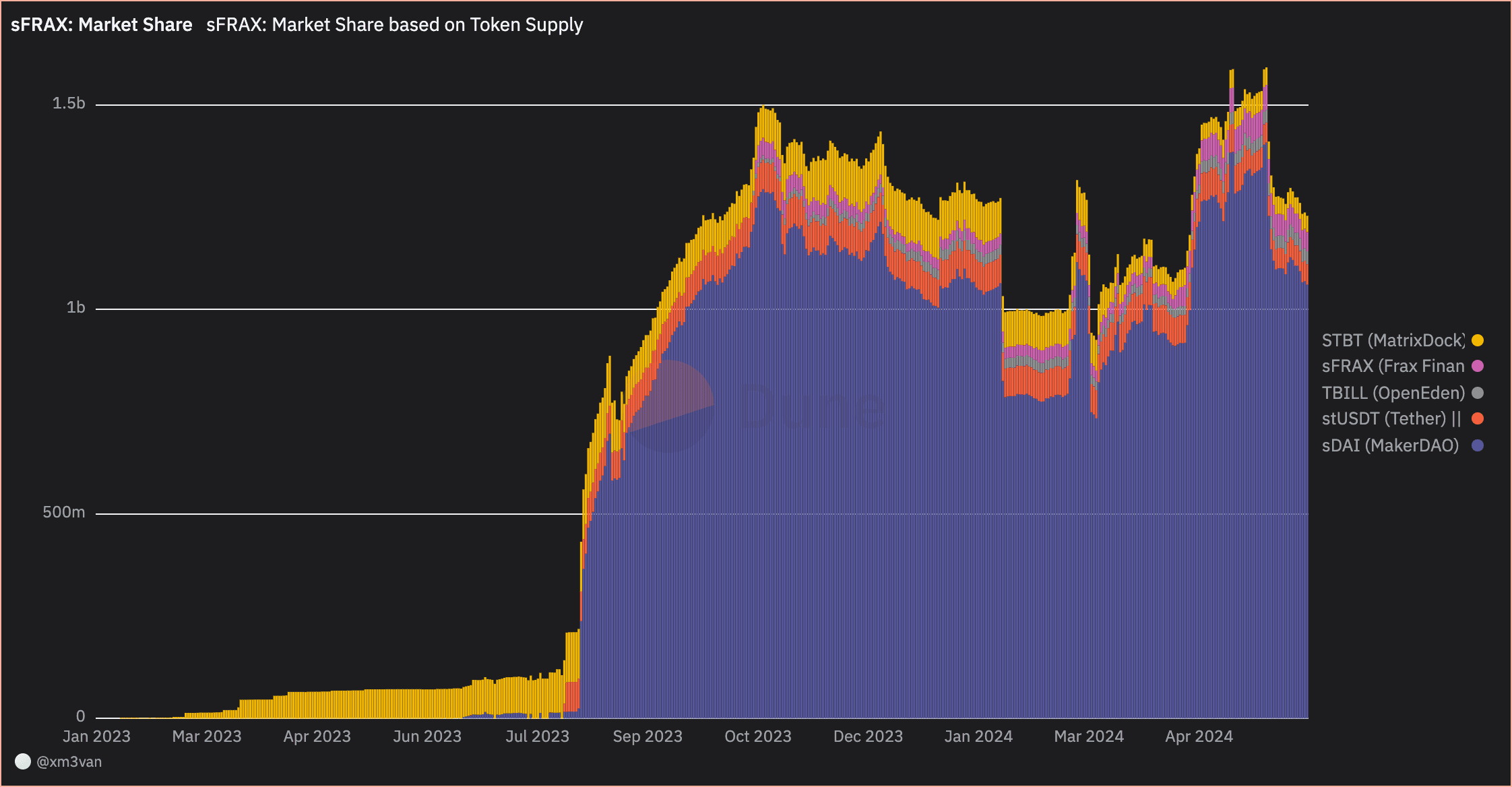

RWA Assets Given that sFRAX yield is intended to be primarily generated from RWA strategies, sFRAX effectively competes with other RWA providers.

Source: DefiLlama | Date: 11/5/2023

At the time of the snapshot above, sFRAX would rank with a TVL of 38,541,890 USD as the 9th RWA protocol by TVL on DefiLlama. In essence, this means that sFRAX captures a minimal value of overall RWA Market Share.

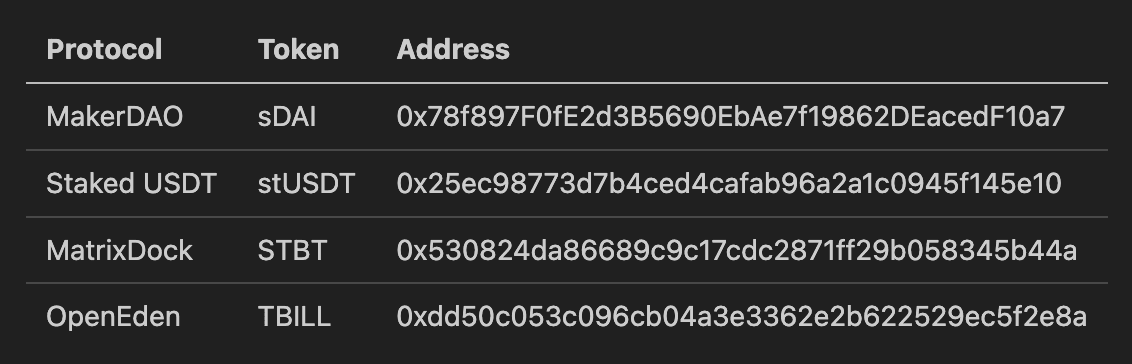

RWA Yield-bearing Stablecoin (or Equivalent) on Ethereum From the user perspective, sFRAX can be categorized as a yield-bearing stablecoin product on Ethereum. Direct competitors operating in this sector include:

Below is an TVL overview of these assets over time:

Note: We filter for competitors that have TVL on DeFiLlama above 10 Million and are Ethereum-based on 6/11/2023. We excluded USDR due to the persistent depeg.

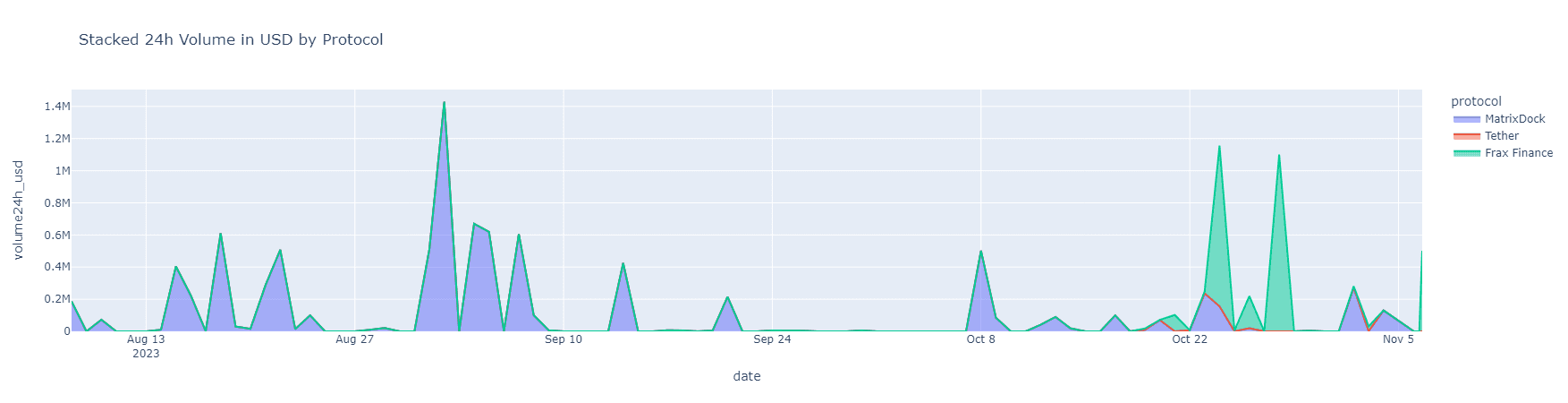

#2.2.2 Trading Volume Share of Total RWA Trading Volume

Most of the staked earning products are not very liquid, thus this metric carries little meaning.Nevertheless, the chart below shows infrequent volume being executed for all assets (including sFRAX) that have a liquid market (this excludes Spark Protocol and Open Eden).

Source: Dex Guru

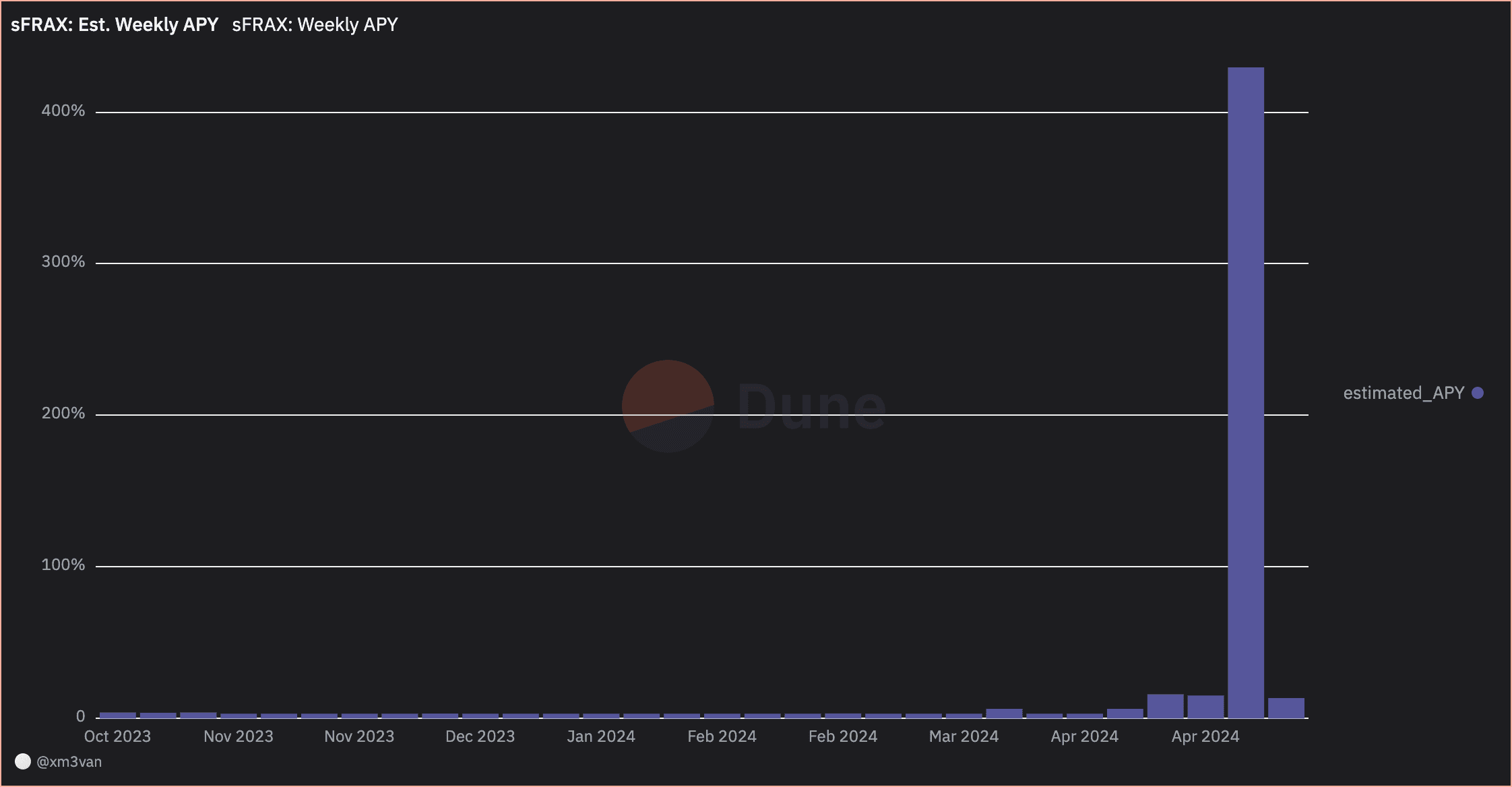

#2.2.3 Protocol Staking Yield

According to the Frax UI, the sFRAX APY as of 12/4/2023 is 5.4%. We have compared this with weekly rewards transfers into the contract. The estimated protocol staking yield being transferred into the contract amount to around 7% APY.

The actual distribution is determined by maxDistributionPerSecondPerAsset, which sets a cap on the rewards distribution per cycle.

By comparison, MakerDAO's sDAI has been set to 5% APY since 8/25/2023.

#2.3 Subsidization of Economic Activity

#2.3.1 Existence of an Incentive Program

There is no incentive program specifically dedicated to sFRAX, although the Frax protocol generally uses an elaborate incentive scheme to drive growth and generate demand for the FRAX stablecoin.

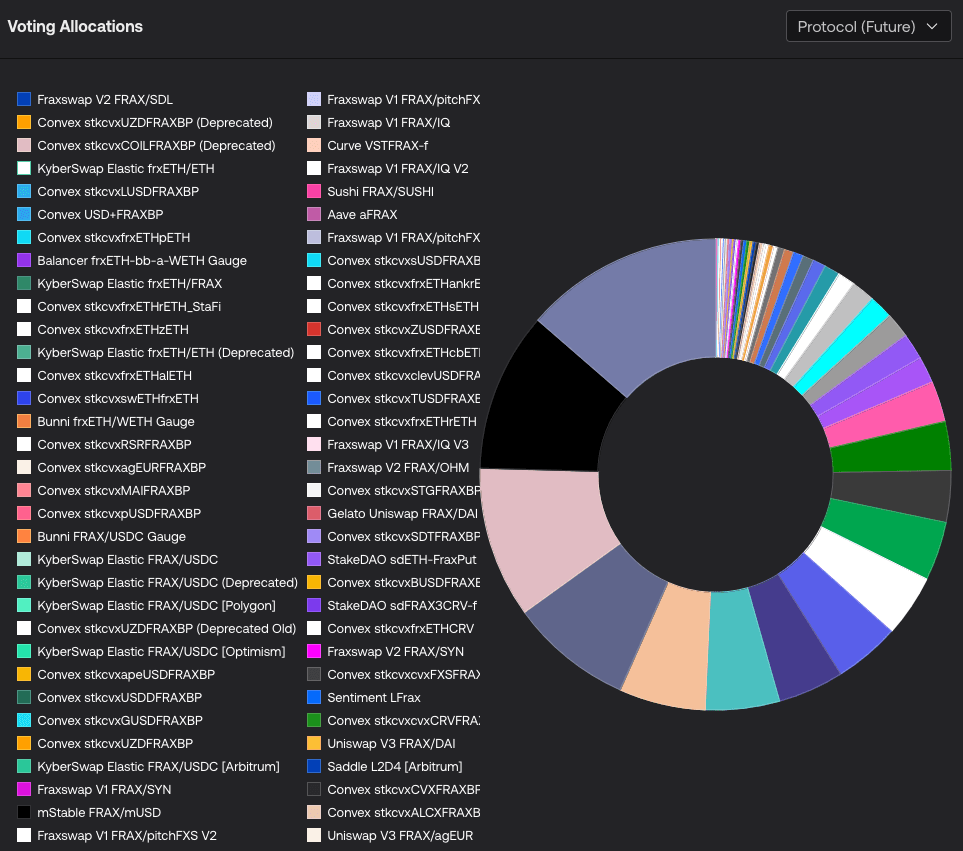

Frax has a gauge system that allows veFXS holders to vote on allocating inflationary FXS rewards to a variety of whitelisted purposes. These may be, for example, FRAX lending deposits (aFRAX in Aave, cFRAX in Compound, fFRAX in Fraxlend), LP tokens (Curve LP tokens or Fraxswap LP tokens), or NFTs (such as Uniswap v3 NFT positions). FXS follows an inflation schedule that halves every year with weekly votes conducted to assign each week worth of inflation.

A significant portion of emissions are currently directed toward Convex gauges. This coincides with Frax's strategy of combining AMO activites with Curve pool incentives to farm rewards and recycle rewards into future epochs. Frax has historically offered vote incentives via Votium in the form of FXS to attract Curve gauge weighting. The protocol earns CRV and CVX which it uses to increase Curve governance power and to earn protocol yield.

Source: Frax Gauges | Date: 12/4/2023

#Section 3 Market Risk

This section addresses the ease of liquidation based on historical market conditions. It seeks to clarify (1) the Closeness-to-Peg Basis & Volatility of sFRAX, and (2) the liquidity profile of the collateral. Market risk refers to the potential for financial losses resulting from adverse changes in market conditions.

This section is divided into 2 sub-sections:

-

3.1: Volatility Analysis

-

3.2: Liquidity Analysis

Note: Given the recent launch of sFRAX, most metrics in the Market Risk section are added to paint an illustrative picture of what is known so far but should not be taken as authoritative. sFRAX is only tradeable in the Curve crvUSD/sFRAX pool at this time.

#3.1 Volatility Analysis

#3.1.1 Closeness to Underlying (c2u)

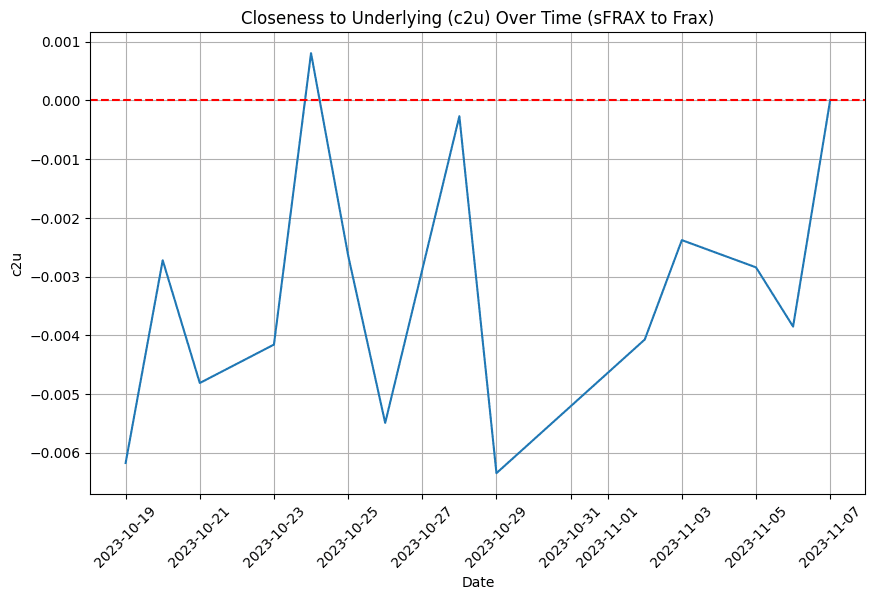

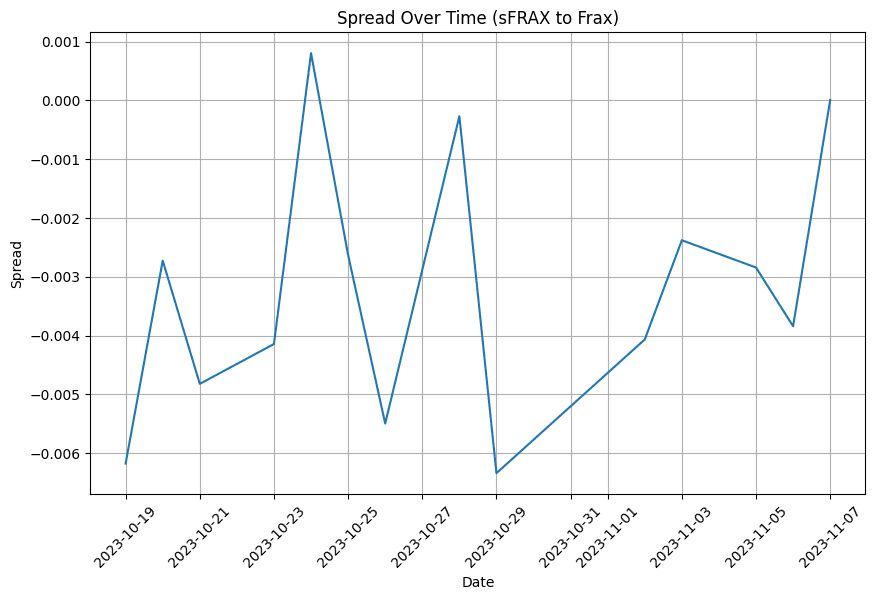

Source: Geckoterminal

The descriptive statistics for the 'Closeness to Underlying' (c2u) between synthetic FRAX (sFRAX) and FRAX from 14 data points indicate that sFRAX generally trades at a slight discount to FRAX, with an average c2u value of -0.00321. The data points are relatively consistent, with a standard deviation of 0.002236. The range of c2u values spans from a minimum of -0.006347 to a maximum of 0.000806, suggesting that while sFRAX typically trades below FRAX, there are instances where it has traded above.

Spread More tangible in this instance is to look at the spread between sFRAX Price and FRAX.

Source: Geckoterminal

On average, sFRAX trades at a slight discount of $0.003208 to FRAX. The spread's standard deviation is $0.002234, indicating modest fluctuations around the mean. The most significant discount observed is $0.006339, while the maximum indicates a slight premium of sFRAX over FRAX at $0.000804. Half of the spreads are less than $0.003341, with the majority of the data (from the 25th to the 75th percentile) ranging between a discount of $0.004651 to $0.002441.

#3.1.2 Volatility

sFRAX and FRAX both show relatively low volatility figures overall. sFRAX exhibits higher volatility than FRAX over all time (0.003925 vs. 0.00215305) and over the past 7 days (0.00393465 vs. 0.00274221), indicating sFRAX prices fluctuate more than those of FRAX both in the long term and short term.

PeriodVolatility (sFRAX)Volatility (FRAX)All Time0.0039250.002153057 days0.003934650.00274221

Source: Geckoterminal

#3.1.3 Yield Volatility

See section 2.2.3 for yeld up until now. Volatility calcuation, given the limited data availability, are meaningless.

#3.2 Liquidity Analysis

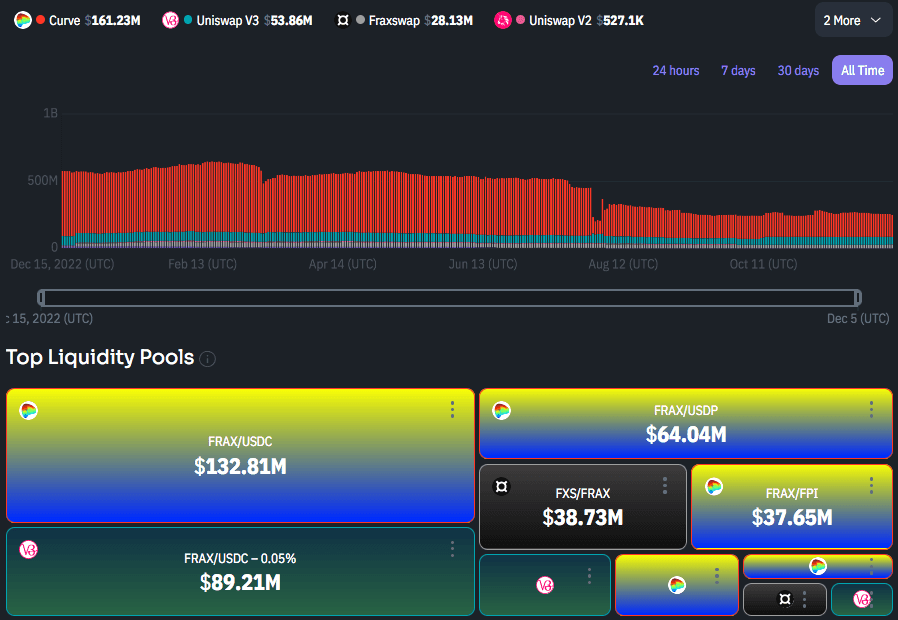

#3.2.1 Supported DEXes and CEXes

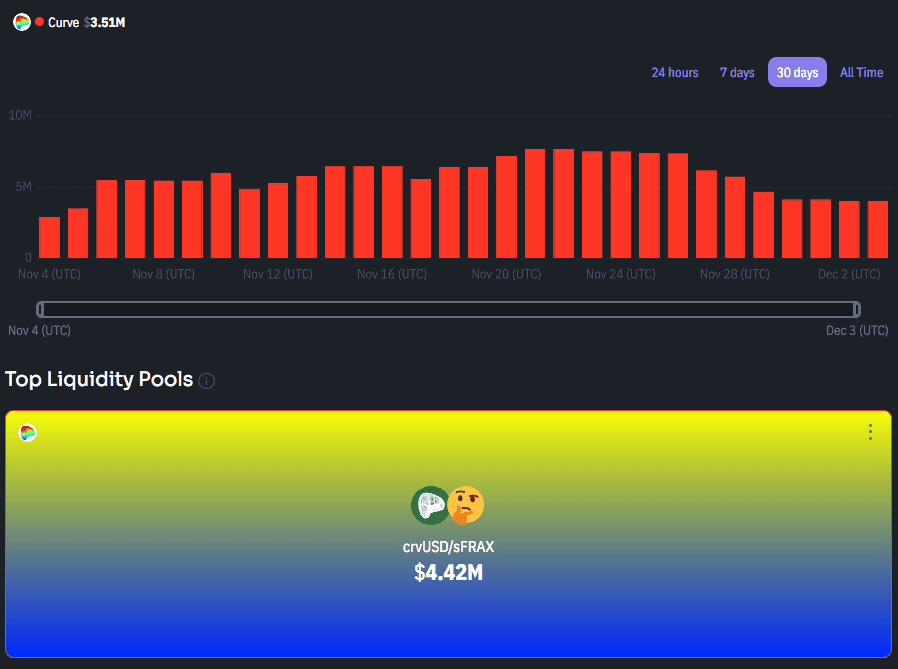

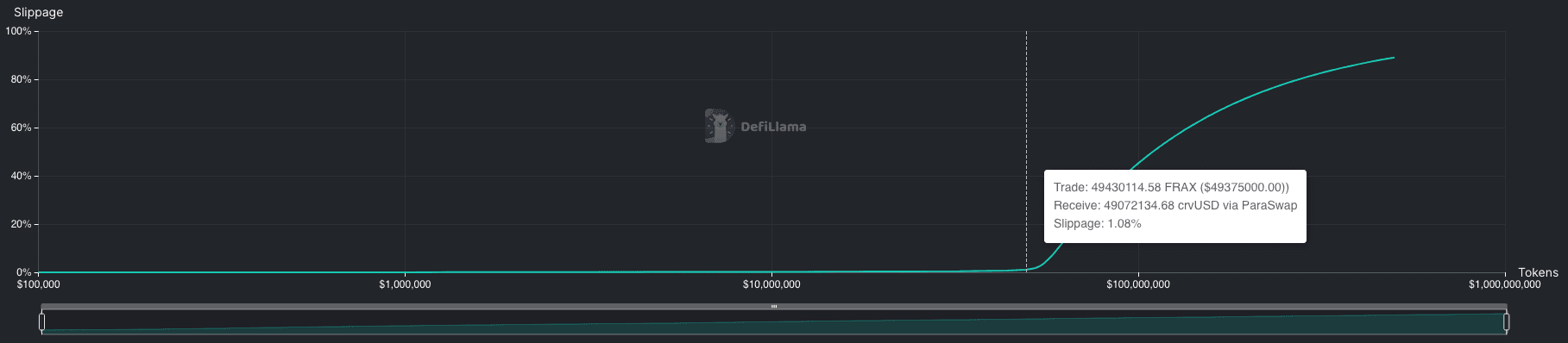

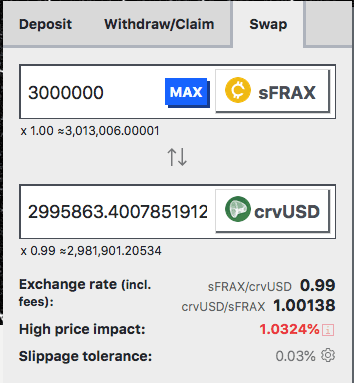

As of now the only available market for sFRAX is the sFRAX/crvUSD pool on Curve.

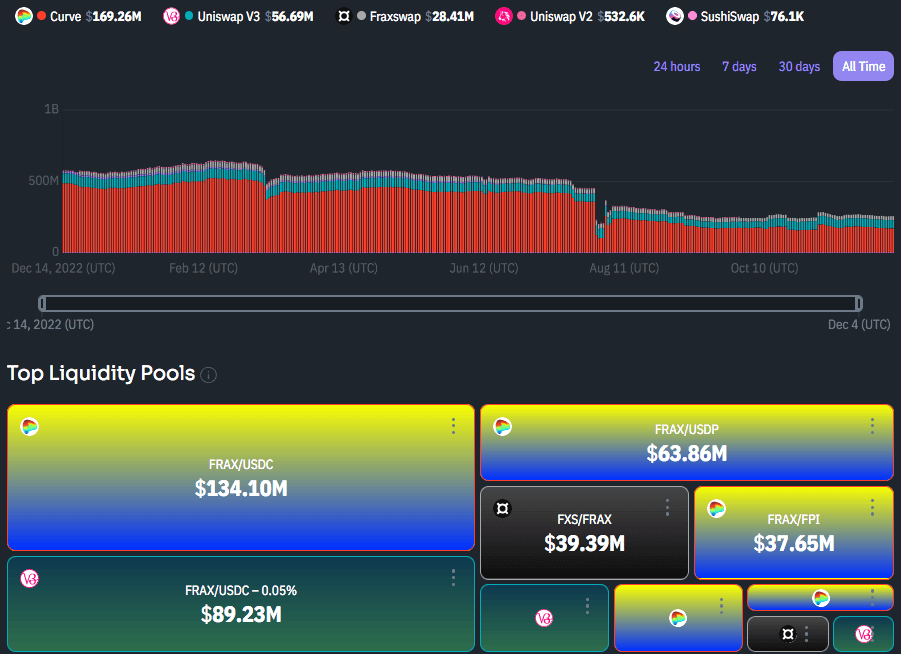

However, because sFRAX is always redeemable 1:1 for FRAX, it has access to the full range of FRAX liquidity. FRAX has liquid markets on Uniswap V3, FraxSwap, and Curve.

#3.2.2 Token Total On-chain Liquidity

The total on-chain liquidity on the 12/4/2023 is 3.5m USD on Curve, down from a max of 7.71m USD in November. Token liquidity is calculated by the quantity of tokens available to swap into, not the quantity of sFRAX in the pool.

Source: DexGuru | Date: 12/4/2023

However, because sFRAX is always redeemable 1:1 for FRAX, it has access to the full range of FRAX liquidity. FRAX has historically maintained strong liquidity across multiple DEXs. A Curve pool hack in late-July was responsible for the sharp drop in Curve liquidity. Frax was unaffected by the hack, but its liquidity has since declined in the second hald of 2023. It remains one of the most liquid DeFi stablecoins, second to DAI.

Source: DexGuru | Date: 12/6/2023

#3.2.3 Liquidity Utilization Rate (LUR)

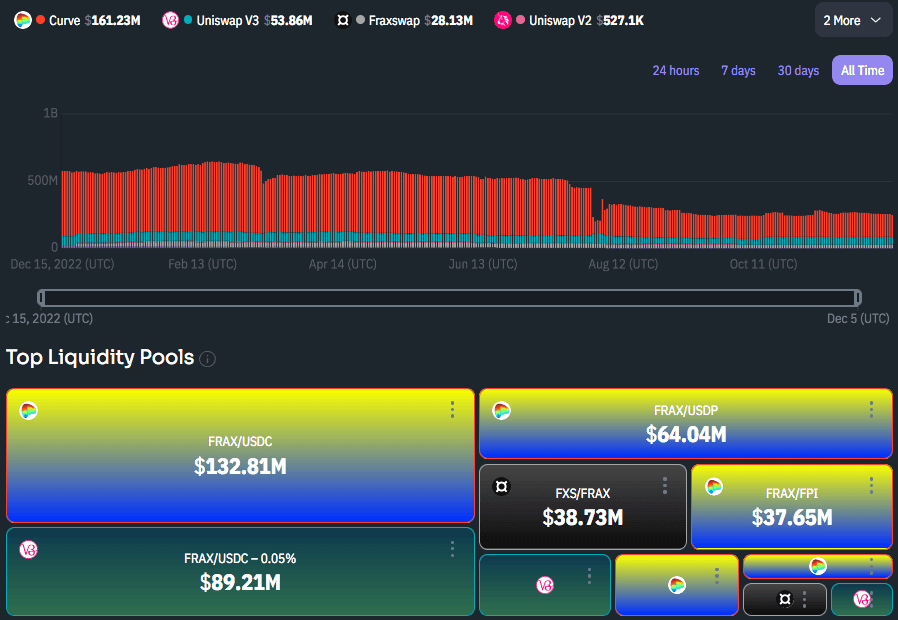

The Liquidity Utilization Rate (LUR) for sFRAX using liquidity from October 19 to November 7, 2023 averaged at 4.65% with considerable variability, as indicated by a high standard deviation of 8.72%. The LUR was often negligible, with no utilization on at least 25% of the days. However, the maximum rate spiked to 31.26%, pointing to occasional days of high trading activity against available liquidity.

Source: Geckoterminal

#3.2.4 Leverage

No leverage is available for sFRAX as of publication date.

#3.2.5 Slippage

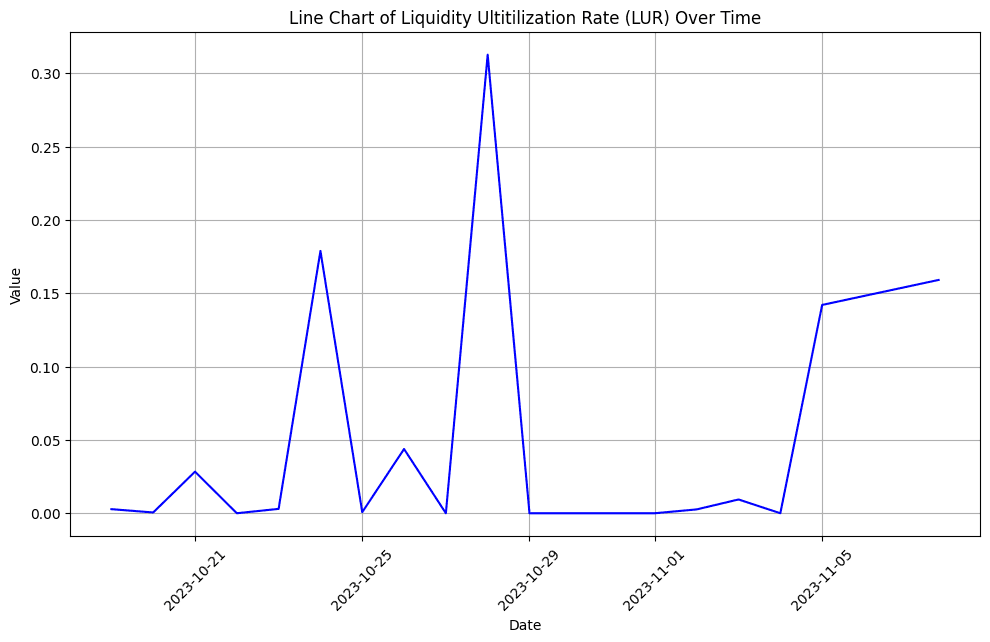

sFRAX is always immediately redeemable for FRAX, making the full depth of FRAX liquidity accessible for liquidation processing. The path sFRAX -> FRAX -> crvUSD can currently support a $49m swap size to produce ~1% slippage, according to the DeFiLlama liquidity tool that aggregates on-chain liquidity sources. This far exceeds all FRAX deposited into the sFRAX vault at this time (27.58m FRAX).

Source: DeFiLlama Liquidity Tool | Date: 12/4/2023

A crvUSD/sFRAX pool althoughs an alternate route, albeit with limited liquidity. With $3.8m TVL in the pool, a 3m sFRAX swap size produces ~1% slippage.

Source: Curve crvUSD/sFRAX pool | Date: 12/4/2023

#Section 4 Technological Risk

This section addresses the persistence of collateral properties from a technological perspective. It aims to convey, (1) where technological risk arises that can change the fundamental properties of the collateral (e.g. unresolved audit issues), and (2) do any composability/dependency requirements present potential issues (e.g. is a reliable pricefeed oracle available?).

This section is divided into 3 sub-sections:

-

4.1: Smart Contract Risk

-

4.2: Product and Layer Composability

-

4.3: Oracle Pricefeed Availability

#4.1 Smart Contract Risk

#4.1.1 Protocol Audits

There are no dedicated audits to sFRAX (see Frax Docs). Yet, given the simplicity of the product and the following of the established ERC-4626 compliant staking vault contract the need for a audit for the product seems very low.

sFRAX depends on the security of the core Frax protocol and various associated products such as FraxSwap, FraxLend, FraxFerry, and the FrxGov module (which has yet to be integrated). These products have also undergone audits between 2020 and 2023, which are linked above in the docs.

#4.1.2 Concerning Audit Signs

Does not apply.

#4.1.3 Bug Bounty

Frax has their bounty program advertised in their docs. The bounty for discovering an exploit is set at the lesser of 10% of the total potential exploit or $10m. The bounty program includes all smart contracts deployed by Frax Deployer. Given that sFRAX has been deployed by the Frax Finance Deployer 2 (labeled on Etherscan), the contract should fall within the scope of the bug bounty program.

Bounty payouts will be provided either immediately or within a maximum of 5 days, taking into account timelock and mitigation processes. The bounty program follows a “no questions asked” policy, encouraging individuals to disclose incidents or promptly return funds without facing inquiries.

#4.1.4 Immutability

The sFRAX smart contract is not upgradeable nor is it a proxy contract.

#4.1.5 Developer Activity

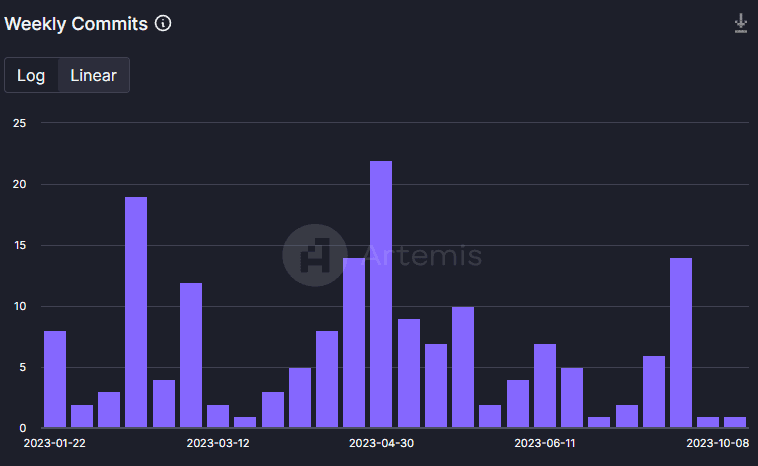

Developer Activity shows the extent to which the project is actively being developed and maintained. Artemis.xyz bases the calculation of Developer Activity on the Electric Capital Developer Report Framework.

Weekly Commits tends to be a good proxy for developer productivity, as it represents the smallest unit of work of a developer. However, it should be noted that the length of a commit can vary significantly.

Source: Artemis

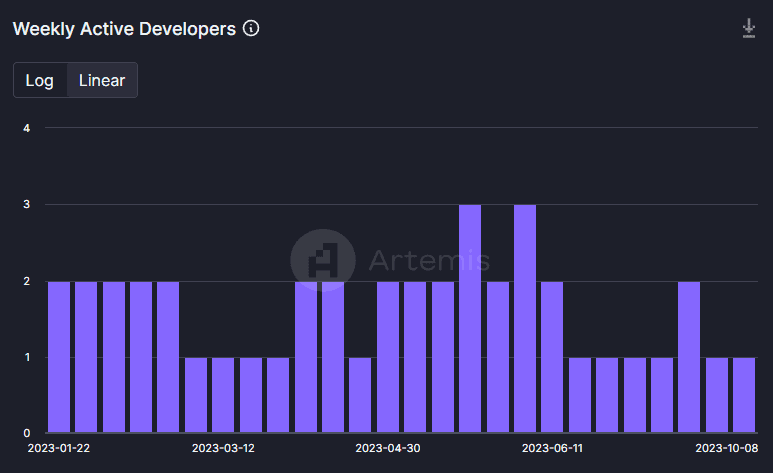

The chart below depicts the Weekly Active Developers. A Developer is considered active if at least one commit has been pushed:

Source: Artemis

Both charts suggest sustained development. However, there are somewhat few weekly active developers (most likely associated with the Core Development Team itself) ranging from 2 to 3 developers.

#4.1.6 SC Maturity

sFRAX contract was deployed on Oct-18-2023 03:19:11 PM +UTC with Block 18378085. However, the ERC-4626 contract schema has been formalized and integrated into the Ethereum Developer Standard in 17 May 2022.

#4.1.7 Previous Incidents

There have been no previous incidents with sFRAX.

#4.2 Product and Layer Composability

#4.2.1 Dependencies

#Contract Dependencies

Based on the provided Solidity contract for StakedFrax, the dependencies are as follows:

-

Timelock2Step: Imported from the

frax-std/access-control/v2/Timelock2Step.sol. The contract uses the 2-step timelock functionality for assigning ownership. -

IERC20: Imported from

@openzeppelin/contracts/token/ERC20/ERC20.sol.IERC20is a standard interface for ERC20 tokens, indicating that this contract interacts with ERC20 tokens. -

SafeCastLib: Imported from

solmate/utils/SafeCastLib.sol. This is a utility library often used for safe type casting in Solidity, helping to prevent overflow and underflow issues. -

LinearRewardsErc4626 & ERC20: Both are imported from the local file

./LinearRewardsErc4626.sol.LinearRewardsErc4626is an implementation of an ERC4626 Vault with linear rewards distribution.ERC20is a reference to the standard ERC20 token implementation.

The contract StakedFrax itself is a combination of a ERC4626 Vault with linear rewards (as per LinearRewardsErc4626) and time-lock functionality (as per Timelock2Step). It uses SafeCastLib for safe type conversions, and interacts with ERC20 tokens as indicated by the IERC20 dependency.

The contract is assocated with a timelockAddress, which is currently set to a 3-of-5 Multisig wallet.

#Layer Dependencies

Source: Frax Documentation [Adapted]

Off-chain Counterparty: FinresPBC Financial Reserves and Asset Exploration, Inc. (FinResPBC) is a public benefit corporation incorporated in Delaware, USA. It operates with a mission to facilitate financial infrastructure for stablecoin issuers and traditional banks, providing services like swap services, reserve custody strategies, and software for integrating stablecoin transactions in banking institutions. Importantly, FinResPBC is an independent, unaffiliated entity and does not claim partnerships with any stablecoin issuers.

Legally, FinResPBC is set up to support the Frax Protocol by holding cash deposits and other low-risk cash-equivalent assets, such as reverse repo contracts and treasury bills. It operates as a non-profit entity, with any yield generated from assets held on behalf of the Frax Protocol being returned to the protocol, minus operational costs. FinResPBC's role with the Frax Protocol is strictly limited to holding cash-equivalent reserves and/or issuing token representation of such reserves. It does not partake in Frax Protocol development, smart contract engineering, or its operations. Additionally, FinResPBC commits to providing a monthly asset breakdown and report of all reserves held for the Frax Protocol. Future growth depends on meeting requirements for a Federal Reserve Master Account (FMA), part of infrastructure expansion.

FinResPBC's current banking partner is Lead Bank, which facilitates compliant traditional financial activity for crypto businesses. The services provided include holding US Dollar deposits, minting/redeeming stablecoins, and handling United States Treasury Bills.

AMO Protocols Algorithmic Market Operations (AMOs) in FRAX Finance are autonomous smart contracts designed to implement pre-programmed monetary policies into specific subprotocols. This implementation can occur internally within the Frax Protocol ecosystem or externally in collaboration with other protocols like Curve. The function of the different types of AMOs can be summarized as follows:

-

Curve AMO: This AMO mints FRAX stablecoins into selected Curve liquidity pools that have been approved by the FRAX governance system. It can also withdraw FRAX from these pools and burn the withdrawn coins to maintain the exchange rate within a specific range as determined by reference oracles.

-

Fraxlend AMO: Operating within the Fraxlend subprotocol—a permissionless, isolated lending market—this AMO allows anyone to lend FRAX stablecoins. Users can deposit collateral to borrow FRAX, paying a dynamic interest rate to lenders. The Fraxlend AMO lends newly minted FRAX into Fraxlend markets approved by the governance process and earns interest from these loans.

-

Fraxswap TWAMM AMO: This AMO uses time-weighted average market maker orders within the Fraxswap AMM to buy or sell collateral over a long period. It helps in expanding or contracting the FRAX balance sheet by purchasing collateral with FRAX or selling assets. It can also repurchase FXS tokens with protocol revenue or fees.

Each AMO has a specific function and interacts with various components of the FRAX ecosystem to maintain stability and ensure the smooth operation of monetary policies. They can execute open market operations, like minting or lending FRAX, based on pre-set conditions or approvals by on-chain governance. This flexibility allows FRAX v3 to adapt and implement various stability mechanisms needed without altering the core protocol.

#IORB Oracle

sFRAX plans to make use of the IORB oracle to map staking yield to the the Federal Reserve Interest on Reserve Balances (IORB) rate (see section 1.2.2). Frax is working with Chainlink to implement a feed for this data. Currently the sFRAX vault’s cap rate is set by the team but will shortly move to frxGov and oracle as that gets deployed.

#4.2.2 Withdrawal Processing

Users can withdraw funds at any time from the contract, as the sFRAX contract does not deploy FRAX directly. Instead, Frax mints FRAX in the Curve AMO equal to the amount deposited into sFRAX, and exchanges it for counterpart stablecoins for use in yield generating strategies.

This activity may extert additional pressure on the FRAX peg in some situations. Large withdraws from sFRAX may immediately put pressure on the peg, necessitating Frax to quickly unwind its positions. As some funds are offramped to purchase U.S. T-bills, there may be settlement times of several days before Frax is able to rebalance the pool. Frax avoids this circumstance by retaining the majority of reserves onchain where they are more readily accessible and by keeping reserves in low risk/low volatility assets.

#4.3 Oracle Pricefeed Availability

#4.3.1 Understanding the Oracle

sFRAX is an ERC4626 vault that represents the share price of the underlying FRAX. FRAX is always redeemable from the vault, allowing sFRAX to take the FRAX/USD feed multiplied by the share price. Chainlink has a FRAX/USD feed available, although it is labeled as "Monitored" or currently under review. The feed has a fairly high 1% deviation threshold, although updates are pushed on a one hour heartbeat.

Curve also has an EMA oracle built into its pools. The current sFRAX/crvUSD pool, however, has been affected by a bug in the pool oracle that necessitates a pool migration before the oracle is safe to use. crvUSD makes use of the pool oracles for its LLAMMA markets, and generally the pool oracles are thoroughly audited. In this case, the bug was disclosed without any loss of user funds, and the EMA oracle may become a suitable option in a future sFRAX pool.

The FRAX/crvUSD pool was unaffected by this bug and may be a suitable oracle for deriving the price of FRAX for use in crvUSD markets.

#4.3.2 Token Liquidity and Distribution

sFRAX at the time of writing is exclusively available in the Curve sFRAX/crvUSD Pool (see 3.2.5 Slippage), making liquidity highly concentrated. Integrating protocols running sFRAX strategies should be mindful of potential market manipulation attacks.

Note, however, that FRAX is readily redeemable 1:1 from the sFRAX vault. FRAX has historically maintained strong liquidity across multiple DEXs thanks to AMO activities, liquidity incentives, and protocol partnerships. The majority of liquidity is in the Curve FRAX/USDC pool followed by the UniV3 FRAX/USDC pool. There is also substantial liquidity on FraxSwap.

Source: Dex Guru

The redeemability of sFRAX allows for efficient arbitrage paths that provide a reasonable assurance that sFRAX can maintain peg with its underlying assets.

#Section 5 Counterparty Risk

This section addresses the persistence of sFRAX properties from an ownership rights perspective (i.e. possession, use, transfer, exclusion, profiteering, control, legal claim). The reader should get a clear idea of (1) who can legitimately change properties of the collateral (e.g. minting additional units) and what their reputation is, (2) the extent that changes can be implemented and the effect on the collateral.

This section is divided into 4 subsections:

-

5.1: Governance

-

5.2: Decentralization of the LSD

-

5.3: Economic Performance

-

5.4: Legal

#5.1 Governance

#5.1.1 Governance Scope

In the sFRAX contract, most functions are permissionless, however the following functions are governed by the timelockAddress:

-

Set the maximum amount of rewards that can be distributed per second per 1e18 asset (

setMaxDistributionPerSecondPerAsset). -

Initiate and complete transfers of its own administrative privileges to a new address (

transferTimelockandacceptTransferTimelock). -

Renounce its administrative privileges, setting the

timelockAddressto a null address (renounceTimelock).

In the Curve AMO contract, certain functions are governed by the owner/timelock addresses with the following functions:

-

Set privileged addresses (i.e.

timelockwhich shares owner privileges andcustodianwhich can withraw reward tokens) -

Set parameters such as borrow cap, max FRAX outstanding, minimum CR ratio, set override collateral balance, set convergence window, set custom floor and discount rate (overriding global_collateral_ratio), set slippages

-

Upgrade contract to new implementation (via proxy owner)

#5.1.2 Access Control

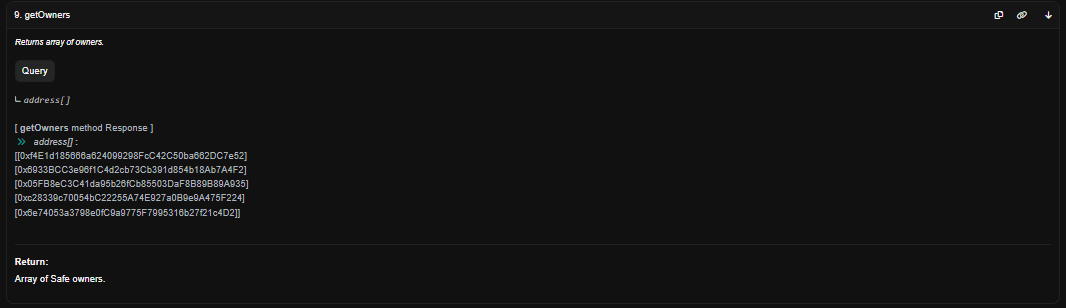

ThetimelockAddress is set to a 3-of-5 Multisig. While the Multisig Wallet is not explicitly listed within the Docs, the signer addresses of the wallet align largely with other signers found on the comptroller multisig.

Source: Etherscan

It is worth pointing out that the following addresses are not listed on any multisig that can be found in the Docs:

-

[0xc28339c70054bC22255A74E927a0B9e9A475F224]

-

[0x6e74053a3798e0fC9a9775F7995316b27f21c4D2]

Overall, the findings suggest that the ultimate control over the sFRAX contract and associated dependencies, such as the Curve AMO, still resides with the team. This is in line with prior investigations we have conducted on Frax-related products.

#5.1.3 Distribution of Governance Tokens

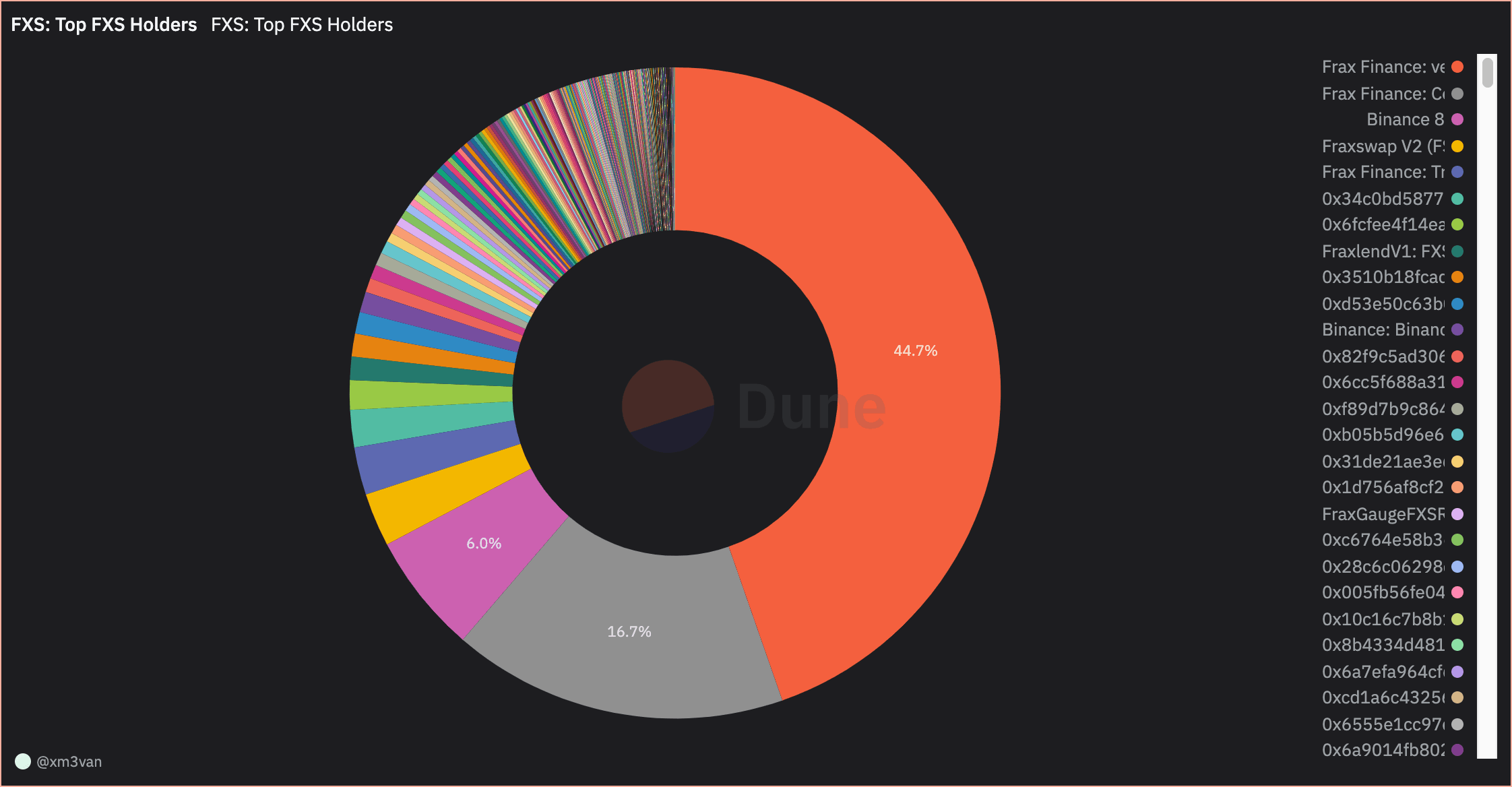

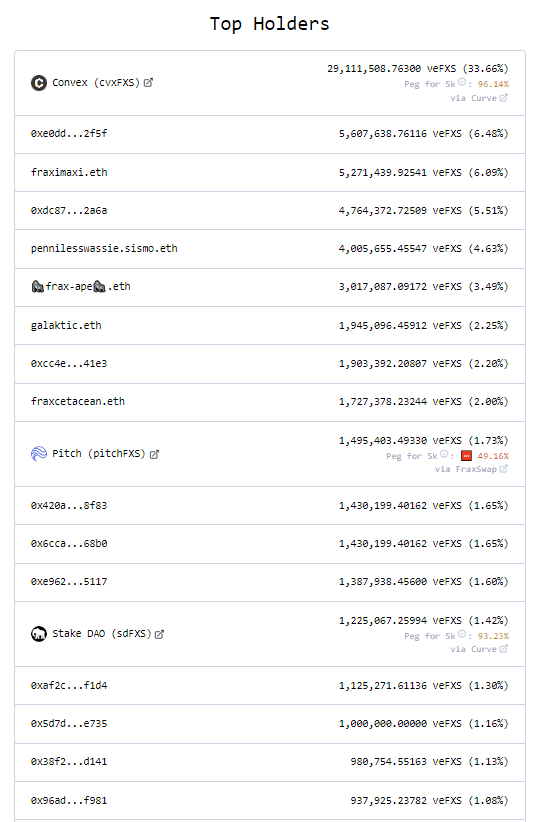

FXS is the native token for the FRAX ecosystem and locked FXS (veFXS) acts as a governance voting power within the protocol. veFXS balance is determined by the duration for which a user locks the FXS token, consistent with the veTokenomic design pioneered by Curve Finance.

FXS Distribution

The following Dune query displays the token distribution of the top 500 FXS token holders across wallets and contracts. This accounts collectively for 97.34% of the token supply.

Heavy concentration can be observed in which is somewhat concern as they can be locked and swayed for governance decision.

veFXS

Looking at the veFXS Deposit and Withdrawal events, we can see a heavy concentration among EOAs (e.g. see fraximaxi.eth, 0xe..f5f, 0xd..a6a, fraxcetacean.eth, fracx-ape.eth, pennilesswassie.sismo.eth).

Source: DefiWars.xyz

Governance power seems quite concentrated in Convex followed by several individuals. This suggests a somewhat decentralized governance control distribution in veFXS.

#5.1.4 Proposals Frequency

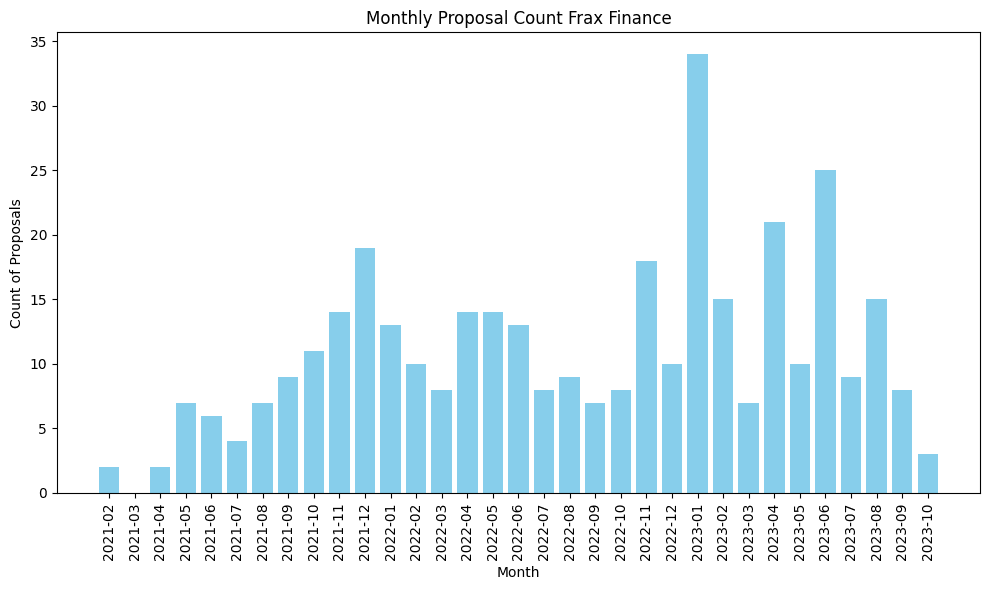

In analyzing Frax Finance's monthly proposal data on Snapshot over 33 months, a significant variability in community engagement is evident. The average monthly proposal count stands at approximately 10.91, with a wide range, as indicated by a standard deviation of 6.94. The data ranged from months with no proposals at all to a peak activity of 34 proposals in a single month.

Source: Snapshot

#5.1.5 Participation

Forum Engagement In order to gauge participation, we analyzed the top 50 users on the governance forum by likes received.

Source: Frax Governance Forum

The summary statistics for user engagement on the platform reveal a diverse range of user activity. Users receive an average of 41.16 likes, with a notably high standard deviation of 61.71, indicating significant variability and the presence of outliers, as the maximum likes received by a user is 324. In contrast, the average likes given is lower at 19.44, with a maximum of 211, suggesting that while users are more conservative in giving likes, there are still some who are quite generous.

Topic creation is relatively infrequent among users, averaging at 5.16 topics with a substantial few creating as many as 61 topics.

Replies posted present a similar pattern; an average user posts 32.32 replies, but the maximum soars to 448, pointing towards a subset of users who are highly conversational.

Viewing habits also vary greatly, with an average of 75.92 topics viewed and a maximum of 524, again highlighting a segment of users who are extensively browsing content.

Lastly, the average days visited stands at 83.5, with a maximum of 473, suggesting a spectrum of engagement from casual visitors to daily users. The high standard deviations across these metrics underscore a community with a broad mix of engagement levels, from occasional participants to highly active contributors.

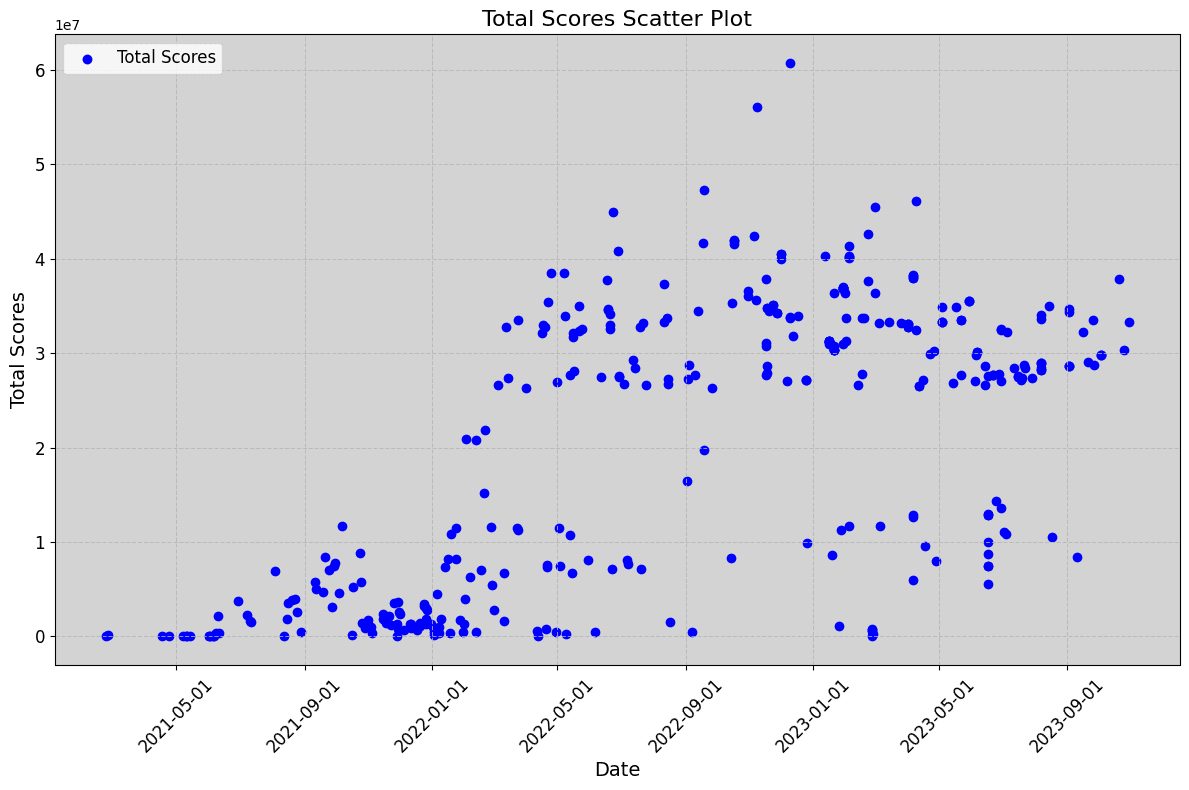

Snapshot voting If we utilize a scatter plot an measure the total score on each snapshot we can see there is a relatively stable voting engagement, with some votes seeing lower engagement. In addition, the total weight of votes increased generally over time suggesting more voting engagment.

Source: Snapshot

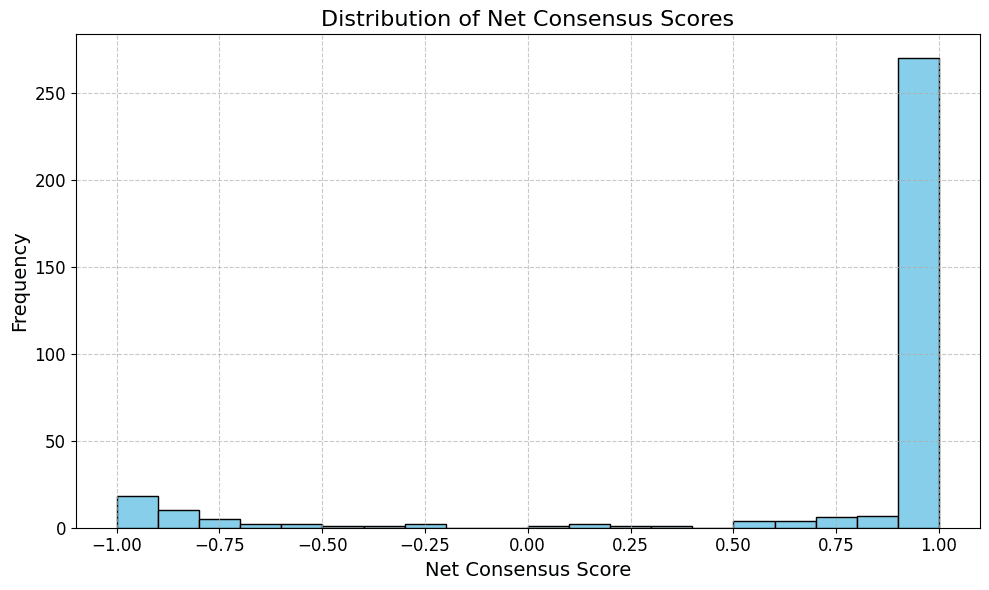

For simplicity we filter all votes that have two voting options (some do not follow this pattern) and then apply the following formula:

net_consensus_score = (total_choice_1 - total_choice_2)/ total_votes

Note: In general, Option 1 is For and and Options 2 is Against

The result is the net consensus score, which shows to what extent the community uniformly decides for one option. As seen in the diagram below, usually the Frax community is universally for Option 1 or Option 2. Minority of choices are controversial.

Source: Snapshot

The net_consensus_score suggests there may be some herding behavior (e.g. Information Cascade) or extended design screening processes that allow community reach consensus before it goes for vote.

#5.2 Economic Performance

#5.2.1 Revenue Source

Revenue Sources are two-fold:

-

Yield generated from RWA Strategies

-

Yield generated from AMOs

Please refer to section 1.2.2 for a visual representation.

#5.2.2 Revenue

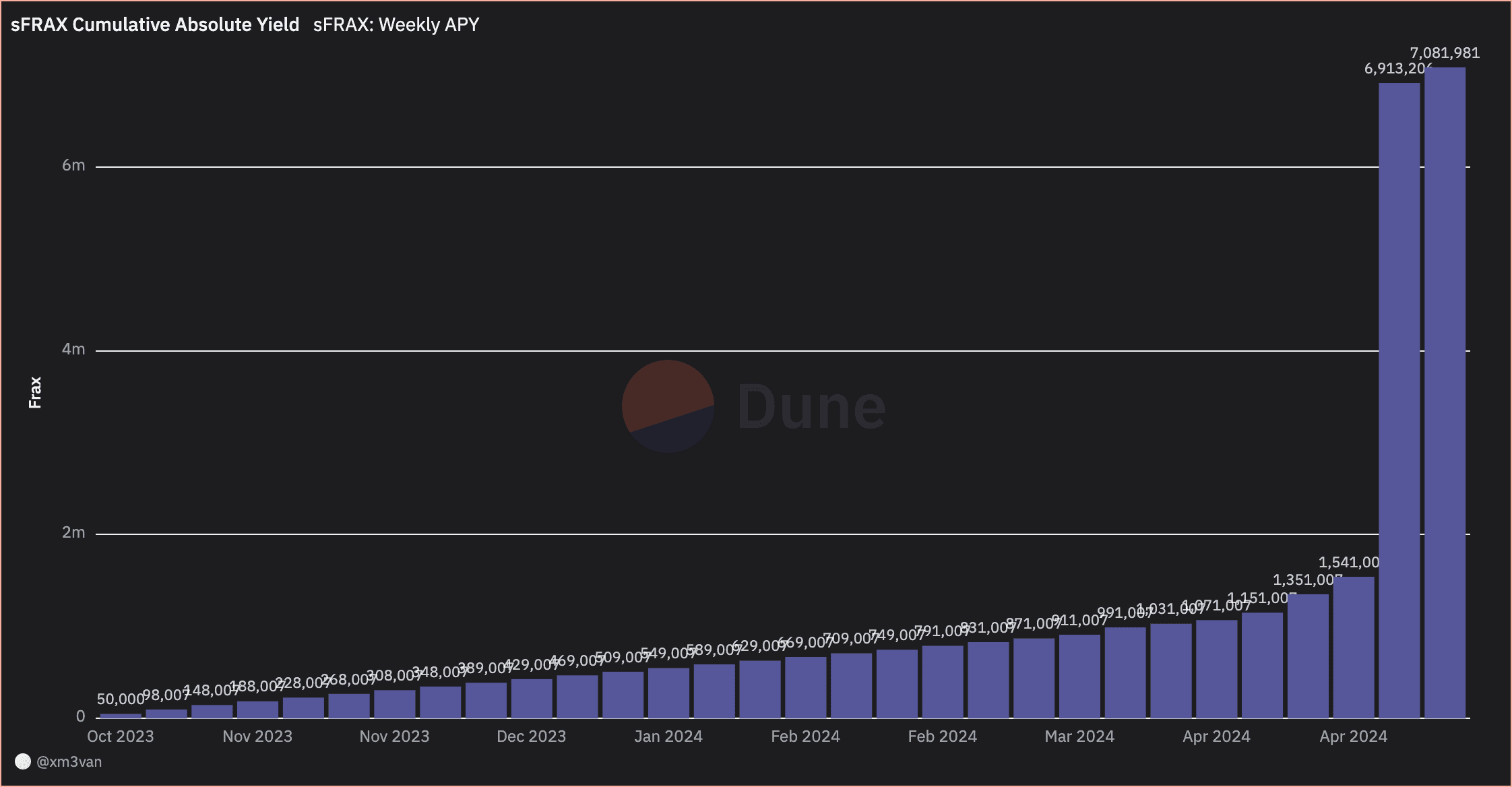

Since deployment, the sFRAX product has generated approximately 308k FRAX in staking yield (from 10/19/2023 - 12/5/2023). This amounts to roughly 2.39m FRAX in annualized revenue distributed to stakers.

#5.2.3 Net Profit

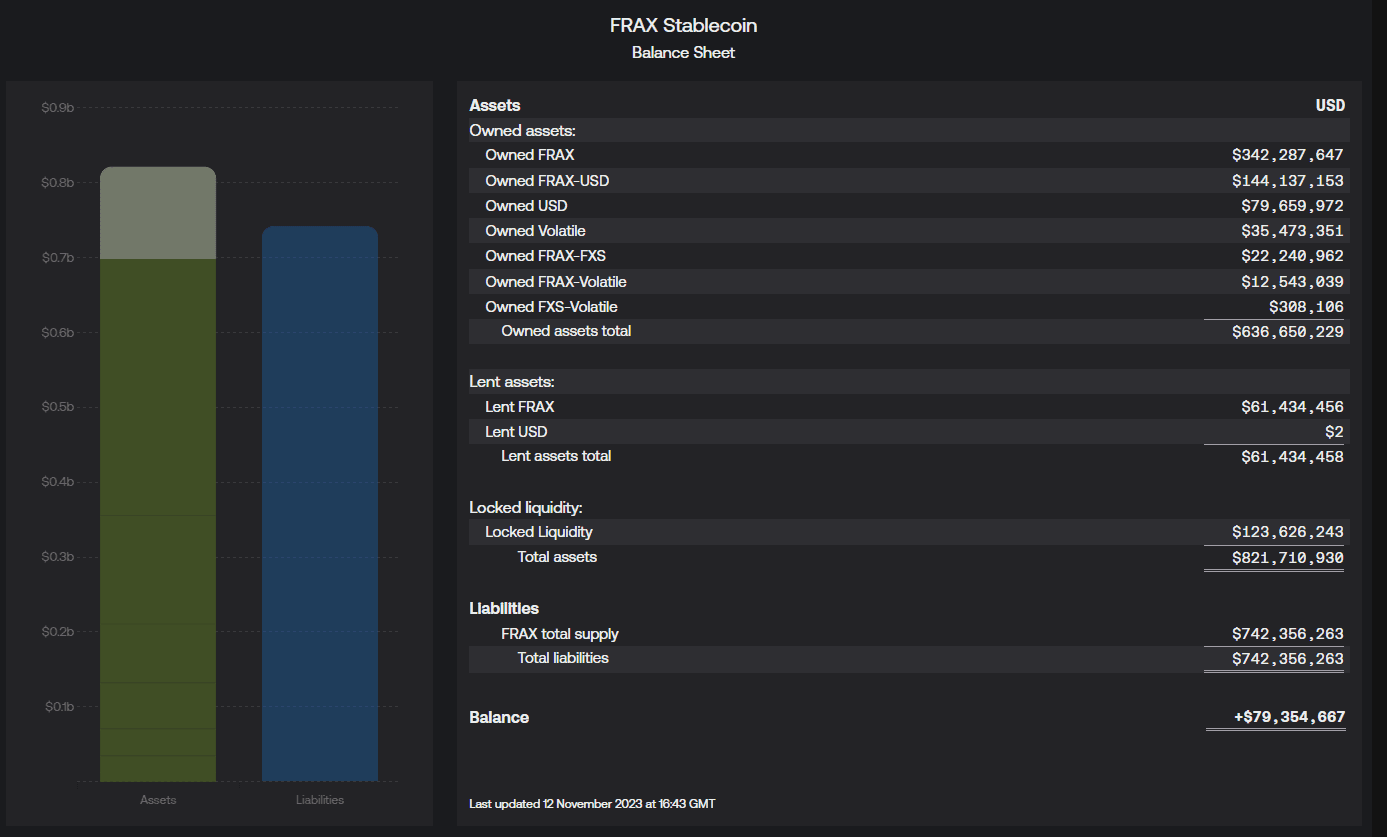

Operational cost at this stage are not fully known for the sFRAX product. However, FinresPBC will full financial report on the Frax Forum as outlined in FIP-277:

Source: FIP-277 | Frax Governance Forum

Based on the balance sheet of the FRAX stablecoin, Frax seems well capitalized with sufficient excess assets in its Stablecoin Balance Sheet to afford to maintain future operations. Note, however, that a relatively large portion of protocol assets are in the form of locked liquidity. There are additonally various volatile assets or LP positions containing volatile counterparts on the balance sheet.

Source: Frax Facts

For the overall Frax Protocol, running costs for 2023-2024 are estimated to 9 Million Frax. Further information can be inquired here.

#5.3 Legal

#5.3.1 Legal Structure

Frax Finances operates primarily in a decentralized, open-source manner without ties to any legal entity. Its development is community-driven, and the protocol functions independently, even hosting its frontend on IPFS. Users interact with Frax under specific terms, granting them a limited, revocable license to use the service. Frax's lack of formal legal structure, common among DAOs, poses potential legal risks, especially regarding liability in unincorporated partnerships. Under FATF guidelines, DeFi applications aren't classified as VASPs, but individuals with substantial control or influence could be. This unregulated status offers flexibility but requires Frax to vigilantly monitor potential regulatory changes and compliance requirements.

Despite this, there seem to be some real world entities that are or have been associated with it.

Financial Reserve & Asset Exploration, Inc. Financial Reserves and Asset Exploration, Inc., also known as FinResPBC, was incorporated on January 6, 2023, with the file number 7222632 as a public benefit C corporation. It is a domestic entity registered in the state of Delaware. The registered agent for this corporation is Legalinc Corporate Services Inc., located at 651 N Broad St, Suite 201, Middletown, New Castle County, Delaware, 19709. Its primary focus is on providing essential financial infrastructure services to two primary sectors: stablecoin issuers and traditional banks. The company offers a range of services, including swap services and reserve custody strategies for stablecoin issuers, as well as critical software solutions to traditional banking institutions.

#5.3.2 Licenses

Fiat money, especially in the context of modern economies, is typically non-redeemable. This means it is not backed by a physical commodity like gold or silver and cannot be exchanged for these commodities. In contrast, stablecoins are often designed to maintain a stable value relative to a national currency or other reference assets, and they are redeemable in that sense. A recent report by the Bank for International Settlements higlights the criteria that fiat-referenced stablecoins should meet, i.e. "by providing a robust legal claim to all users against the issuer and/or underlying reserve assets and guarantee timely redemption", although no statements have been made on the non-redeemability features of particular stablecoin arrangements. The legal framework for stablecoins as a whole is not fully developed in most jurisdictions, and banking regulations are still getting to know the peculiarities of decentralized stablecoin issuance.

General search on Frax Finance Inc. and Financial Reserve & Asset Exploration, Inc. did not yield any information about goverment issued licenses.

The FATF doesn't classify DeFi applications as Virtual Asset Service Providers (VASPs), as their standards target entities, not underlying software. However, individuals with control or significant influence over DeFi arrangements might be considered VASPs, even in seemingly decentralized setups. This includes those with key administrative roles, governance token holders, or anyone significantly impacting the protocol. Frax, operating without legal incorporation and in a vague DeFi regulatory environment, isn't a VASP currently. Yet, this flexibility brings regulatory risks, making it crucial for Frax to continuously evaluate its operations against potential VASP-related regulations.

#5.3.3 Enforcement Actions

As of the date of this document’s latest revision, we can affirm that there are no known enforcement actions or regulatory sanctions in place against Frax Finance or persons associated with the project.

#5.3.4 Sanctions

DeFi protocols typically have clear terms restricting access for individuals or entities under economic sanctions from bodies like OFAC, the U.N. Security Council, the EU, or Her Majesty’s Treasury. However, Frax's terms don't explicitly prohibit access by sanctioned individuals or those in sanctioned countries, creating potential compliance ambiguities and legal risks. Although the Frax team claims no sanctioned parties have accessed their services, they haven't detailed their measures for sanction compliance, leaving uncertainty about their ability to prevent and monitor access from sanctioned addresses.

#5.3.5 Liability Risk

Frax Finance incorporates several disclaimers to limit its liability:

-

Content Disclaimer: Frax is not liable for any inaccurate or objectionable content in its service.

-

No Fiduciary Relationship or Advice: It doesn’t offer financial advice, placing investment decision responsibility solely on the user.

-

Indemnification Clause: Users must indemnify Frax against claims related to their use of its services.

-

Disclaimer of Warranties: Services are provided "as is," without guarantees of accuracy or reliability.

-

Limitation of Liability: Frax’s liability is limited to fees paid by the user, excluding liability for indirect or consequential damages.

-

Mandatory Individual Arbitration: Disputes with Frax must be resolved through individual arbitration, not court trials.

-

Arbitration Clause Ambiguity: The clause lacks specifics on the arbitration body or governing law, creating potential ambiguity.

Litigation assessment by Norton Rose Fullbright states that establishing contractual claims for stablecoins that employ public decentralized blockchains can be challenging, as the relationships between various types of users (developers, oracles, validators, tokenholders) in public blockchains generally do not amount to legal contracts. This situation leads to enforcement issues and uncertainties regarding jurisdiction and governing law.

In terms of tort liability, claims against stablecoin operators could be considered if they owe a duty of care to users, such as not carelessly allowing the peg to break. However, decentralized stablecoins, which operate via smart contracts without ongoing supervision, present challenges in imposing such a duty of care. The question of whether a duty of care or a fiduciary duty is owed by a developer or operator to token holder has been considered by courts, with mixed outcomes. In some cases, courts have ruled that no duty of care or fiduciary duty was owed, but this does not rule out the possibility of duties existing under different circumstances.

#5.3.6 Adverse Media Check

No adverse media reports suggest any involvement of Frax Finance, its associates, or related entities in illegal activities like money laundering, corruption, or threat financing. Our checks found no indications of Frax participating in criminal actions.

#Section 6: Risk Management

This section will summarize the findings of the report by highlighting the most significant risk factors in each of the three risk categories: Market Risk, Technology Risk, and Counterparty Risk.

#6.1.1 Market Risk

LIQUIDITY: Does sFRAX have a liquid market that can facilitate liquidations in all foreseeable market events?

As sFRAX is always immediately redeemable for the pro rata share of underlying FRAX, the asset inherits the liquidity properties of the underlying. Frax has historically placed strategic importance on maintaining highly liquid markets for FRAX paired with fiat-redeemable stablecoins such as USDC. It accomplishes this through its AMOs that deploy protocol-owned liquidity to DEX pools.

The FRAX supply in terms of overall market cap and DEX liquidity has contracted substantially in recent years. Despite the pull back, it remains one of the most highly liquid DeFi stablecoins.

VOLATILITY: Has the sFRAX had any significant depeg events?

sFRAX has a single liquidity pool with the Curve sFRAX/crvUSD pool. In its short history, it has maintained a tight peg it FRAX, trading on average at a slight discount of $0.003208. The standard deviation represents a modest fluctuation with a value of $0.002234. The tight closeness to underlying is attributable to the immediate 1:1 redeemability of sFRAX.

sFRAX is, in turn, dependent on the FRAX peg to USD. There have been occasions when FRAX depegged, most notably during the USDC crisis on March 11 earlier this year when it briefly depegged to $0.88. FRAX is partially collateralized by USDC in the Curve AMO. The USDC insolvency crisis affected the pegs of numerous stablecoins exposed to USDC, including DAI and USDD.

#6.1.2 Technology Risk

SMART CONTRACTS: Does the analysis of the audits and development activity suggest any cause for concern?

sFRAX follows the ERC-4626 Vault standard and has very straightforward functionality, aided by manual operations by the Frax team to fulfill operational needs like funds management and rewards distribution. More broadly, there are numerous smart contract dependencies involved with sFRAX system, including the AMOs, the FRAX stablecoin, and the various suite of products making up the Frax protocol.

While sFRAX has not been specifically audited, there have been multiple audits encompassing the core protocol and specific Frax products. To date, there has not been a substantial security incident resulting in loss of user funds due to smart contract bug. This is a reasonably impressive feat, given FRAX has been on mainnet since December 2020. Nevertheless, Frax is a complex protocol that has a history of aggressively expanding its product offerings, and continuous attention to security is paramount.

DEPENDENCIES: Does the analysis of dependencies (e.g. oracles) suggest any cause for concern?

The major layer dependency involves access to the traditional financial system through Frax's RWA partner, FinResPBC. The process involves offramping crypto assets that are used to purchase U.S. T-bill and other low risk assets. Settlement times in the traditional banking system produce a duration mismatch against sFRAX redemption, which is instantaneous. This may result in pressure on the FRAX peg as assets are onboarded for liquidation.

For integration into lending platforms, there is a Chainlink FRAX/USD pricefeed available, although it is labeled as "Monitored". For crvUSD, there is a FRAX/crvUSD pool oracle that may be suitable for crvUSD market pricing. sFRAX is always redeemable for a pro rata share of its underlying FRAX, so a price can be derived from its share price.

#6.1.3 Counterparty Risk

CENTRALIZATION: Are there any significant centralization vectors that could rug users?

sFRAX is an immutable contract with limited admin privileges. User deposits into the vault cannot be rugged. However, the rewards distribution, both in terms of periodic rewards transfers and setting the weekly distribution cap, are managed by the Frax team.

There is additional custody risk involved with Frax's RWA partner, FinResPBC. Very little information is publicly known about the firm, its members, its operational and security practices, and it has not yet provided attestations about its investment portfolio. Frax users implicitly place a high level of trust in this partner, as a failure of the partner to safely custody user funds would affect not just sFRAX depositors, but all FRAX token holders.

LEGAL: Does the legal analysis of the protocol suggest any cause for concern?

Operating in a decentralized, open-source manner without ties to a legal entity, Frax faces potential legal risks, particularly concerning liability in unincorporated partnerships. The lack of a formal legal structure and the evolving nature of DeFi regulations contribute to a complex landscape. While the protocol is not currently classified as a Virtual Asset Service Provider (VASP) by the FATF, the potential classification of individuals with control or influence over DeFi arrangements as VASPs poses regulatory risks. Additionally, the association with Financial Reserve & Asset Exploration, Inc., a separate entity, raises questions about the nature of their relationship and potential legal implications.

Users should exercise caution regarding the innovative setups and potential legal loopholes utilized by Frax. While these may not constitute direct violations of existing laws at the time of writing, they could be subject to scrutiny under evolving regulatory frameworks. Furthermore, the structure as described may not legally guarantee redemption rights for users at all times, in contrast to the consumer protections typically associated with regulated stablecoins or tokenized securities.

The legal framework for stablecoins is not fully developed, and there is a lack of information on government-issued licenses for the entities involved, introducing compliance uncertainties. Despite these concerns, there are no known enforcement actions or regulatory sanctions against Frax Finance, and no adverse media reports suggest involvement in illegal activities. Continuous monitoring of regulatory changes and compliance requirements is imperative for navigating the dynamic legal landscape in DeFi.

#6.1.4 Risk Rating

Based on the risks identified for each category, the following chart summarizes a risk rating for sFRAX as collateral. The rating for each category is ranked from excellent, good, ok, and poor.

-

We rank sFRAX excellent on liquidity for historically emphasizing liquidity through its AMOs and incentivizing liquidity across multiple venues.

-

We rank sFRAX good in volatility because there is historical emphasis on managing protocol-owned liquidity by maintaining balance in the FRAX pools.

-

We rank sFRAX good in smart contracts for simplicity in the sFRAX design and maturity of the core Frax protocol contracts that have not experienced a significant exploit.

-

We rank sFRAX good in dependencies for having access to several pricefeeds, including a Curve pool oracle that may be suitable for a crvUSD market.

-

We rank sFRAX ok in decentralization because the team manages important protocol operations, including to handle user funds, and there is significant trust placed in its RWA partner.

-

We rank sFRAX ok in legal (caution is advised) due to potential regulatory uncertainties in the evolving DeFi landscape and the lack of clarity on government-issued licenses. While not currently labeled a VASP and with no known legal actions against it, the lack of concrete regulatory guidance for stablecoins and Frax's innovative structure necessitates cautious monitoring for future compliance and legal challenges.

sFRAX exhibits notable strengths in liquidity and peg maintenance thanks to its emphasis on protocol-owned liquidity and AMO activities, but the primary concerns include potential FRAX depegging events during crises, dependencies on the traditional financial system, and the associated custody and legal risks with Frax's RWA partner, FinResPBC. While the immutability of sFRAX reduces direct user deposit risks, centralization in rewards management and onchain protocol operations introduces a nuanced counterparty risk. The legal analysis highlights uncertainties due to Frax's decentralized nature and lack of a formal legal structure.

Curve may eventually consider sFRAX as a contender for a crvUSD market, given Frax's history with Curve, an existing integration with sfrxETH, and the existence of liquid FRAX and (to a lesser extent) sFRAX markets paired with crvUSD. sFRAX is a very new product that may need time to mature before considering it as a reliable RWA. According to the Frax team, most sFRAX reserves are currently in sDAI and USDP/pyUSD yield share onchain and only a few million is in FinresPBC prior to the launch of FXB (a zero-coupon bond redeemable for FRAX).

Monitoring the maturity and adoption of sFRAX is recommended, as Curve may have an opportunity to onboard RWA protocols as collateral to mint crvUSD. Continuous attention to technological security, careful management of dependencies, and thorough monitoring of legal and regulatory landscapes are imperative for mitigating risks in the dynamic DeFi space.