In light of MiCA Regulation and Coinbase's decision to end USDC rewards for EEA customers, LlamaRisk offers this brief legal and market analysis of potential impacts of potential opportunities for Aave DAO and its users.

In light of MiCA Regulation and Coinbase's decision to end USDC rewards for EEA customers, LlamaRisk offers this brief legal and market analysis of potential impacts of potential opportunities for Aave DAO and its users.

#Summary

The European stablecoin landscape is undergoing a significant transformation driven by MiCA's implementation. Coinbase's decision to terminate its USDC rewards program and restrict several stablecoins (USDT, PAX, PYUSD, GUSD, GYEN, and DAI) highlights centralized platforms' regulatory complexity. Only USDC and EURC maintain their compliant status on Coinbase.

This regulatory environment creates opportunities for Aave for three key reasons:

-

Regulatory Positioning: Aave's lending and borrowing activities currently fall outside MiCA's scope, enabling continued yield generation while centralized platforms face restrictions.

-

Competitive Yield Performance: Aave's markets demonstrate strong supply rates for USDC, driven by sustained borrowing demand and healthy utilization.

-

Market Migration: Users holding non-compliant stablecoins may shift to decentralized protocols like Aave, as MiCA's stringent requirements for e-money tokens (EMTs) and asset-referenced tokens (ARTs) limit centralized options.

Current market indicators show users are already repositioning assets, with Aave experiencing steady USDC inflows. The platform's transparent and user-centric approach to yield generation and its regulatory positioning make it well-suited to address the evolving needs of European stablecoin holders seeking alternatives to centralized platforms.

#Recap on Coinbase's Actions

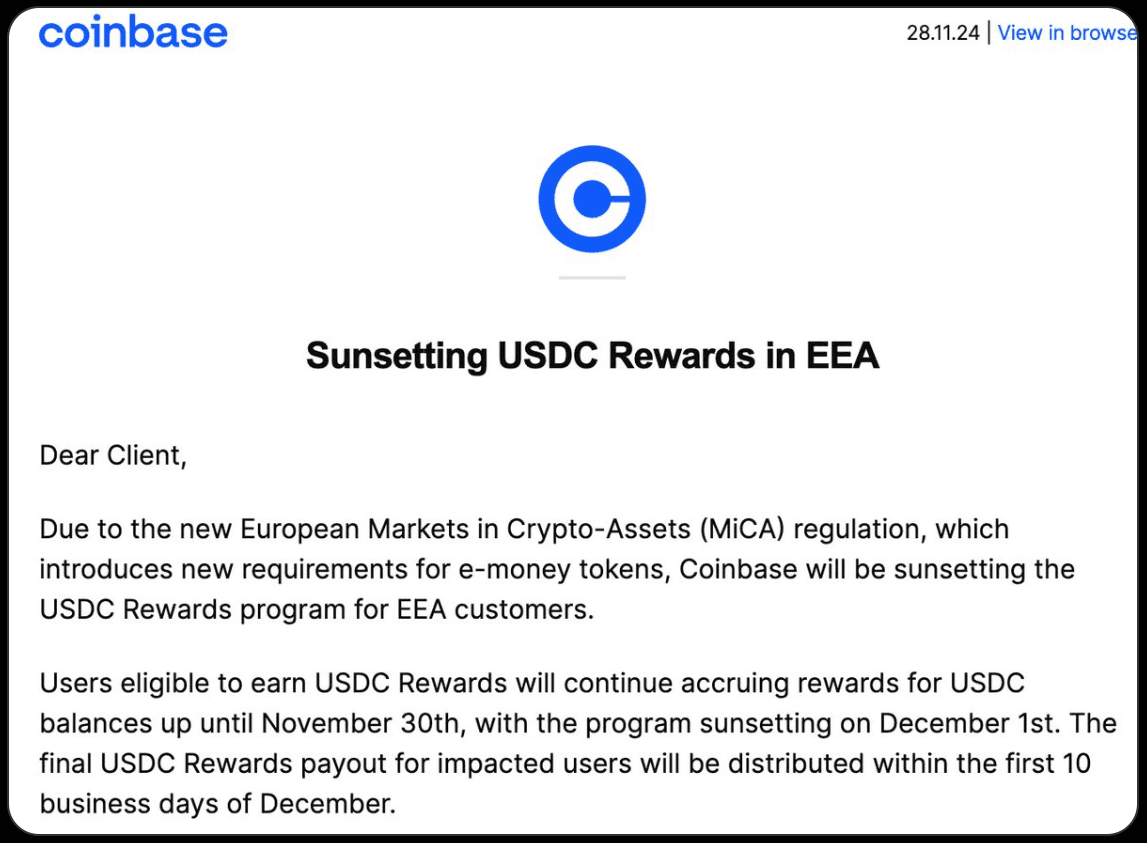

At the end of November, Coinbase announced the termination of its USDC rewards program for EEA customers. The program ended on December 1, 2024, in response to the Markets in Crypto-Assets (MiCA) regulation, which takes effect on December 30, 2024.

Before termination, the USDC rewards yield was determined solely by Coinbase and stood at 4.35%, according to the USDC page on Coinbase. The program, fully funded by Coinbase, was discontinued due to MiCA's Article 50, which prohibits interest payments by e-money token issuers and crypto-asset service providers (CASPs). The regulation specifically targets any remuneration based on token holding duration, including compensation or discounts equivalent to interest.

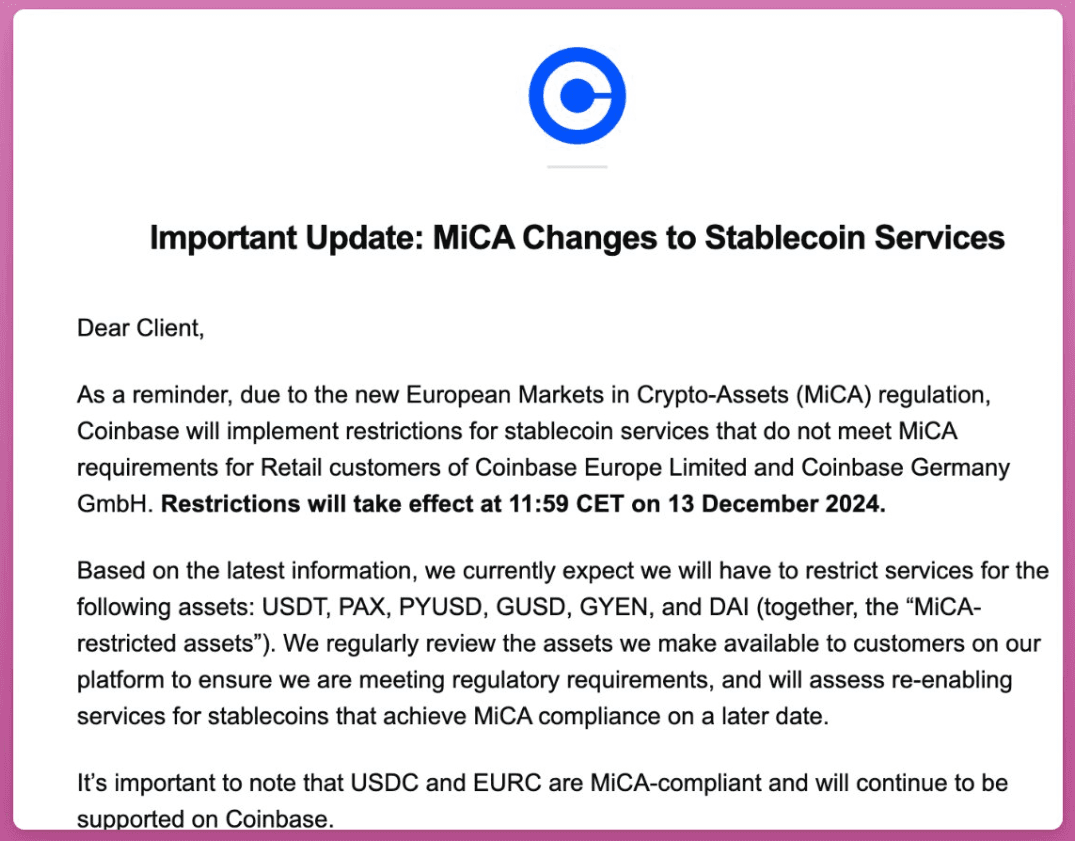

Source: Marina Markezic on X

In a second phase of MiCA compliance, Coinbase announced further restrictions affecting several stablecoins. Starting December 13, 2024, retail users will lose access to USDT (Tether), PAX (Pax Dollar), PYUSD (PayPal USD), GUSD (Gemini Dollar), GYEN, and DAI on Coinbase's platform. Only USDC and EURC remain unaffected, having already achieved compliance status. Coinbase has indicated they may reinstate services for certain stablecoins if they achieve MiCA compliance.

Source: Ignas DeFi on X

These changes reflect a broader trend among centralized exchanges adapting to Europe's evolving regulatory landscape, resulting in reduced options for stablecoin holders within the EEA region through centralized platforms.

#Opportunity for Aave

Aave emerges as a logical alternative for USDC holders seeking yield in Europe's tightening regulatory environment. As the leading decentralized lending protocol, Aave's operations currently fall outside MiCA's scope, specifically regarding lending and borrowing of e-money tokens.

The regulatory position is clear: MiCA has deferred the evaluation of lending and borrowing activities to a future European Commission report, which will be prepared by the European Banking Authority (EBA) and European Securities and Markets Authority (ESMA). While this report is due by December 30, 2024, delays are anticipated.

This regulatory carve-out positions Aave to capture the demand for stablecoin yield generation. The protocol's market-driven yield mechanics and established reputation present a viable alternative for users affected by MiCA's restrictions on centralized platforms.

#Market Dynamics

#Supply

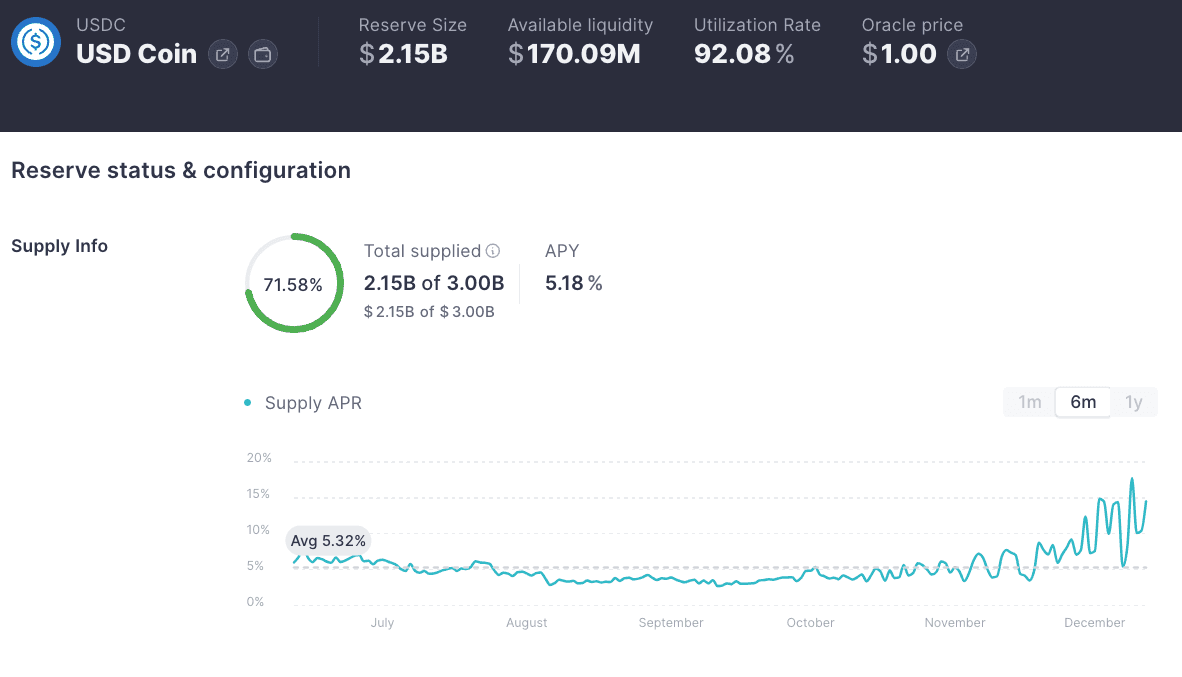

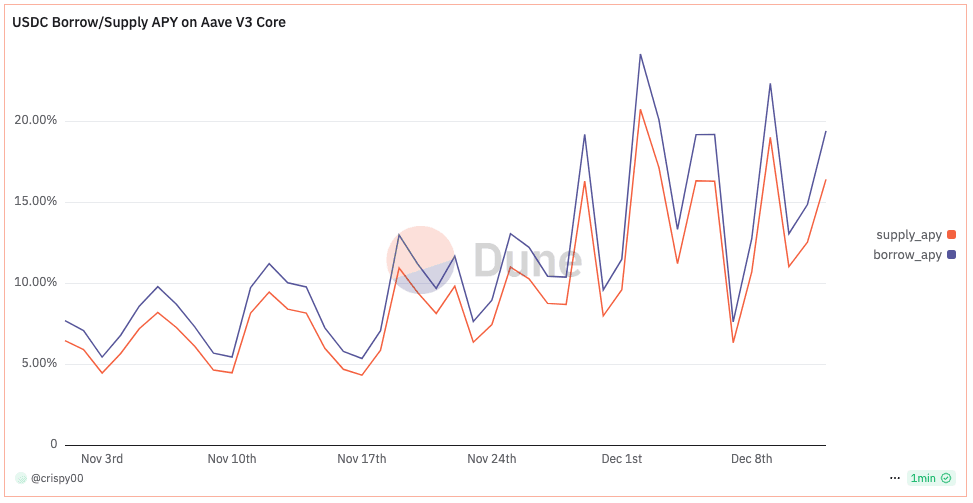

Aave users can earn yields by supplying USDC to lending markets. The APY is determined by USDC supply-demand dynamics and the interest rate model (IRM) parameters set by Aave DAO. The current high utilization rate creates strong incentives for USDC holders to provide liquidity and earn returns on their deposits.

Source: Aave, December 12th, 2024

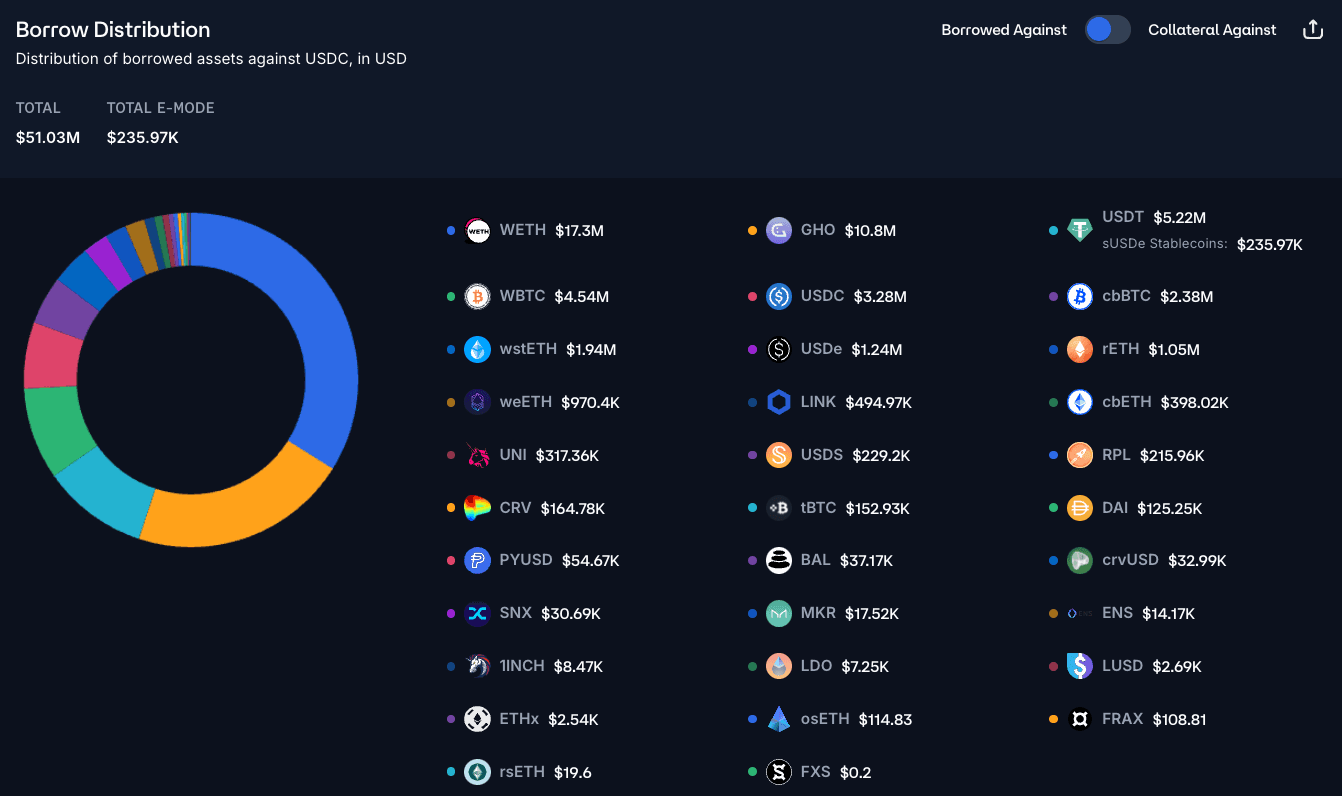

WETH dominates the borrowing activity against USDC collateral on Aave, as shown below:

Source: Chaos Labs, December 12th, 2024

The preference for WETH stems from traders using USDC as stable collateral to short ETH or access DeFi strategies requiring WETH liquidity. Using USDC to borrow volatile tokens like WETH or WBTC reflects a calculated risk-management strategy. Lending market participants can also explore interest rate arbitrage opportunities by borrowing stablecoins at lower rates while earning higher yields from USDC supply positions. These funds can then be deployed across various DeFi protocols, though returns and risks vary based on market conditions.

#Borrow

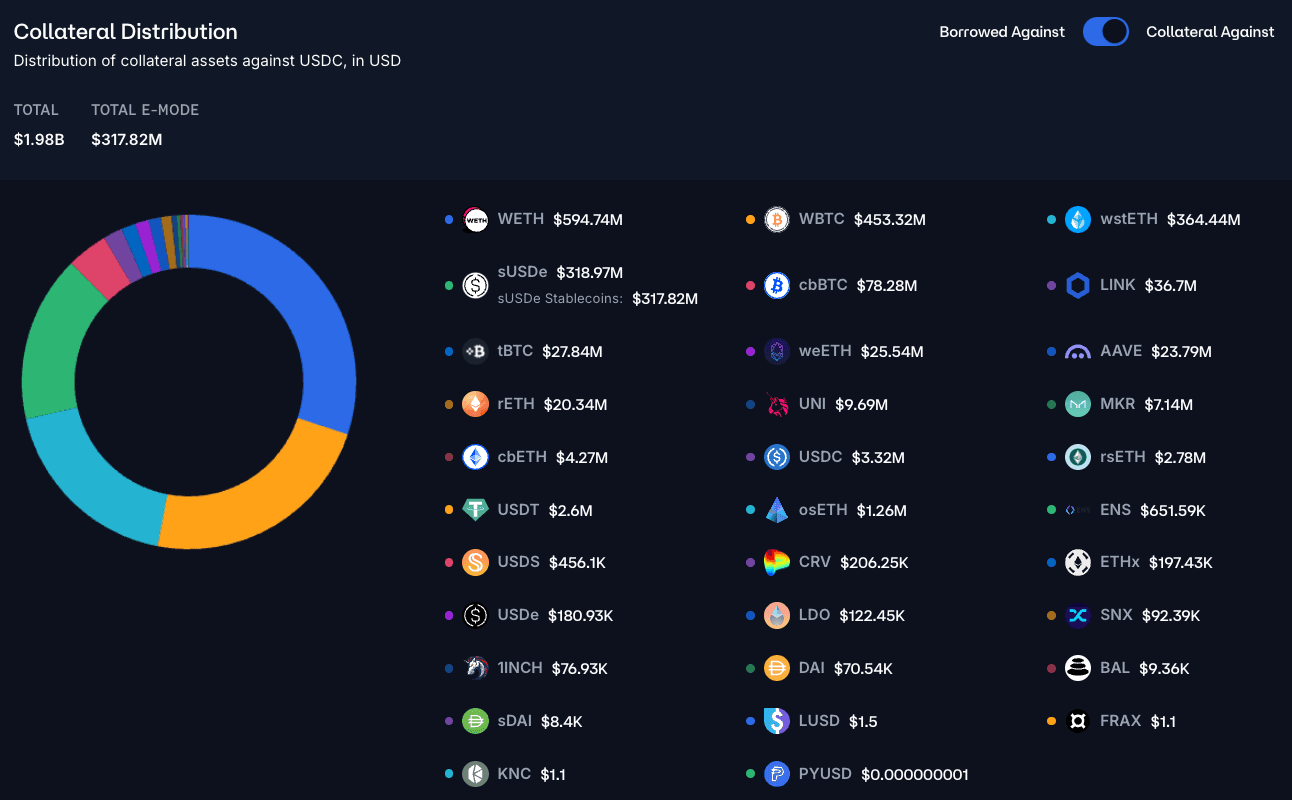

While supply-side strategies offer straightforward yields, borrowing strategies are more complex to execute profitably. Borrowing strategies require yields that exceed borrowing costs plus a safety margin to be profitable. Current market conditions show limited opportunities, with few pools offering high yields to offset USDC borrowing costs on Aave. A more plausible assumption in this environment is that borrowed USDC is deployed to take leveraged positions in volatile assets, amplifying potential returns if the asset's price appreciates. Borrowers primarily use volatile assets (WETH, WBTC, cbBTC) as collateral for leveraged positions. Meanwhile, yield-bearing collateral like wstETH and sUSDe offer additional returns through staking rewards while enabling USDC borrowing.

Source: Chaos Labs, December 12th, 2024

Market data since mid-November shows rising supply and borrow APYs, with borrow rates increasing sharply. Early December saw significant rate volatility, with borrow APY exceeding 20%, indicating high utilization or large withdrawals.

Source: Dune Analytics, December 12th, 2024

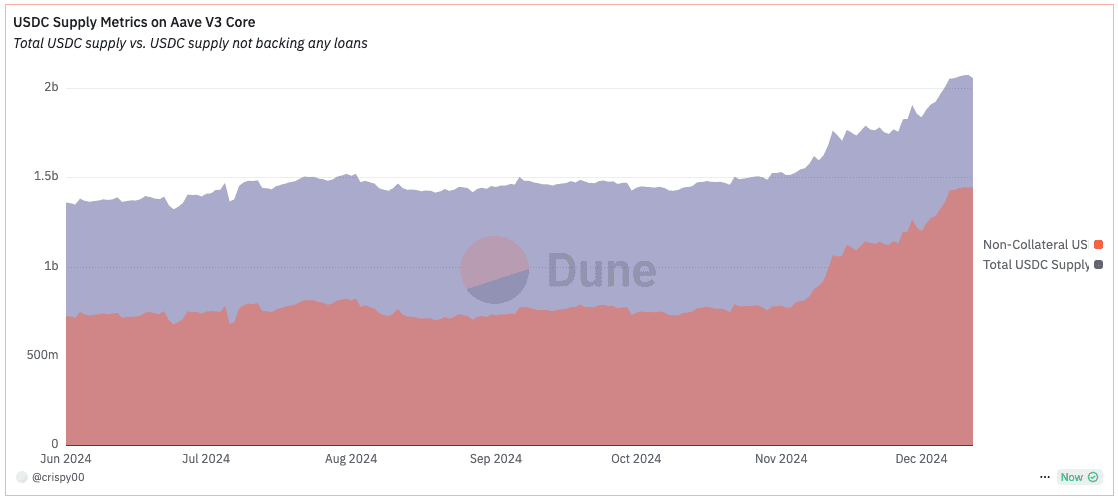

#USDC Inflows

The total USDC supply on Aave shows that most users provide liquidity to earn supply APY rather than using it as collateral. The increase in non-collateralized supply coincides with 15-18% competitive yields. This suggests users are moving funds from lower-yield venues to capture these rates. The timing of increased USDC supply aligns with Coinbase's USDC rewards program ending, though a direct correlation cannot be confirmed.

Source: Dune analytics, December 12th, 2024

#Advice on crypto-assets

This analysis is intended solely to enhance the understanding of Aave users. It is not and should not be construed as legal advice.

While MiCA does not directly apply to decentralized lending protocols, its provisions warrant careful analysis across multiple dimensions:

#Advisory Activities

MiCA defines "providing advice on crypto-assets" as "offering, giving, or agreeing to give personalized recommendations to a client, either at the client's request or on the initiative of the crypto-asset service provider, regarding one or more transactions relating to crypto-assets or the use of crypto-asset services".

MiCA requires a formal client-provider relationship with binding agreements for personalized advice. Decentralized protocols like Aave do not qualify as crypto-asset service providers nor establish such relationships with users.

The data displayed on Aave's UI (supply APY, borrow APY, LTV, and utilization rate) is raw information from smart contracts. Net APY and health factor are calculated based on the user's positions to help manage exposure upon wallet connection. These metrics serve as factual protocol parameters rather than curated recommendations. The displayed information does not suggest specific actions like supplying or withdrawing assets. Users maintain full decision-making autonomy based on their due diligence despite the available financial data and educational content.

Therefore, displaying financial data on Aave's UI falls outside MiCA's definition of "providing advice on crypto-assets."

#Stablecoin Requirements

MiCA establishes strict requirements for stablecoin issuers, categorizing them as either e-money tokens (EMTs) or asset-referenced tokens (ARTs):

EMTs are "a type of crypto-asset that purports to maintain a stable value by referencing the value of one official currency." At the same time, ARTs are "a type of crypto-asset that is not an electronic money token and purports to maintain a stable value by referencing another value or right or a combination thereof."

For ART issuers (Article 16):

-

Must be a legal entity established within the European Union

-

Required to draft a compliant crypto-asset white paper

-

Must notify the competent regulatory authority

-

Need to maintain reserves of underlying assets

-

Must maintain own funds equal to the highest of:

-

EUR 350,000

-

2% of average reserve assets

-

Quarter of previous year's fixed overheads

-

For EMT issuers (Article 48):

-

Must be a credit institution or electronic money institution

-

Required to submit a white paper to authorities

-

Prohibited from granting interest

-

Must maintain initial capital of at least EUR 350,000

-

Required to hold own funds equal to 2% of average outstanding EMTs

-

Must deposit 30% of received funds with credit institutions

-

Remaining funds must be invested in low-risk financial instruments in the same currency

These non-exhaustive requirements present significant challenges for many stablecoin issuers, particularly decentralized ones like DAI, which cannot meet legal personality requirements or comply with reserve asset composition and custody requirements due to their decentralized nature.