A comprehensive risk review of YieldNest Kernel Restaked BTC ynBTCk

Useful Links:

-

Audits

-

ChainSecurity audit of the YieldNest protocol smart contract - April 15, 2024.

-

ChainSecurity audit of the YieldNest protocol smart contract - August 09, 2024

-

Zokyo audit - YieldNest smart contracts review - May 07, 2024

-

Composable Security audit - MAX LRT, ynBTCk & ynBNBx review - Jan 09, 2024

-

Zokyo audit - ynBTCk strategy review - Jan 08, 2025

-

#Section 1: Intro

ynBTCk is a standalone MAX LRT strategy, structured as an ERC-4626 compliant vault. It integrates Bitcoin-connected strategies to deliver optimized yield while serving as a foundational component for future YieldNest products, including ynBTCx, which will be released later. This report provides a detailed risk assessment of the YieldNest ynBTCk product, focusing on its architecture and dependencies. ynBTCk relies on multiple underlying assets and the Kernel restaking framework built on the Karak restaking protocol. The report offers a comprehensive review of the vault's overall structure and its associated dependencies to ensure transparency and mitigate potential risks.

#1.1 ynBTCk Overview

ynBTCk is YieldNest’s BTC-backed liquid restaking token on BNB chain. ynBTCk enables users to restake their BTC-derivative tokens, offering a new asset to earn rewards on BTC. This innovation expands utility by allowing users to unlock rewards on BTC while contributing to the security of emerging applications on BNB chain.

ynBTCk is designed to maximize BTC utility by channeling selected BTC derivatives into the Kernel restaking protocol. Through ynBTCk, users earn auto-compounding rewards while maintaining exposure to the underlying Bitcoin value. In practical terms, users deposit BTC-derived assets (SolvBTC, SolvBTC.BBN, BTCB, and WBTC) into ynBTCk and receive restaking yields generated within Kernel. This structure diversifies a user’s yield sources and contributes to the broader security of emerging BNB Chain applications that rely on Kernel’s restaking model.

(source: YieldNest documentation)

#1.2 Underlying Assets

Users can deposit (allocate) 4 BNB-chain based BTC derivatives into the strategy vault:

-

BTCB is issued by Binance and operates as a custodial model. Users rely on the exchange’s reserves and security to back their tokenized BTC. Its operational process involves centralized minting and redemption, requiring trust in Binance’s custody and solvency.

-

SolvBTC is minted by the decentralized Solv Protocol, which aggregates multiple wrapped BTC assets for a more transparent and trustless approach. Its operational design leverages smart contracts and cross-chain mechanisms, reducing dependence on a single issuer and offering users broader interoperability.

-

SolvBTC.BBN is created by staking SolvBTC within the Babylon chain, inheriting SolvBTC’s decentralized property while incorporating Babylon’s staking mechanisms to generate additional yield. Its peg and liquidity are maintained through cross-chain infrastructure, which aims to balance flexibility with secure on-chain governance.

-

WBTC is a custodial Bitcoin wrapper under the joint purview of US-based BitGo and Hong Kong-based BiT Global. Users rely on effective management of the reserves by the joint custodians and the WBTC DAO composed of various industry stakeholders. Its operational process involves centralized minting and redemption.

Ultimately, users will choose any of these assets depending on their trade-off preferences between a custodial product, a decentralized alternative, or an option that combines staking rewards with a decentralized core.

#1.3 Kernel Protocol Overview

Kernel protocol is a modular restaking framework on BNB Chain, integrating multiple PoS security modules and bridging protocols under one protocol. The Kernel framework is built on the Karak restaking protocol as a solution for deploying LRTs built on Karak's restaked assets, which include a diverse range of assets such as Pendle positions, DEX LPs, and yield-bearing stablecoins.

When users deposit BTC-based assets, Kernel allocates them to various restaking or PoS platforms, subsequently gathering and reinvesting earned rewards back into the Vault. Although Kernel currently lacks slashing features, future enhancements like distributed validator nodes (DVNs) will introduce additional security layers.

#Section 2: ynBTCk Vault Product

This section explains the technical components of the ynBTCk vault, including the overall architecture, smart contracts, audits, access control, and dependencies.

#2.1 ynBTCk Vault Architecture

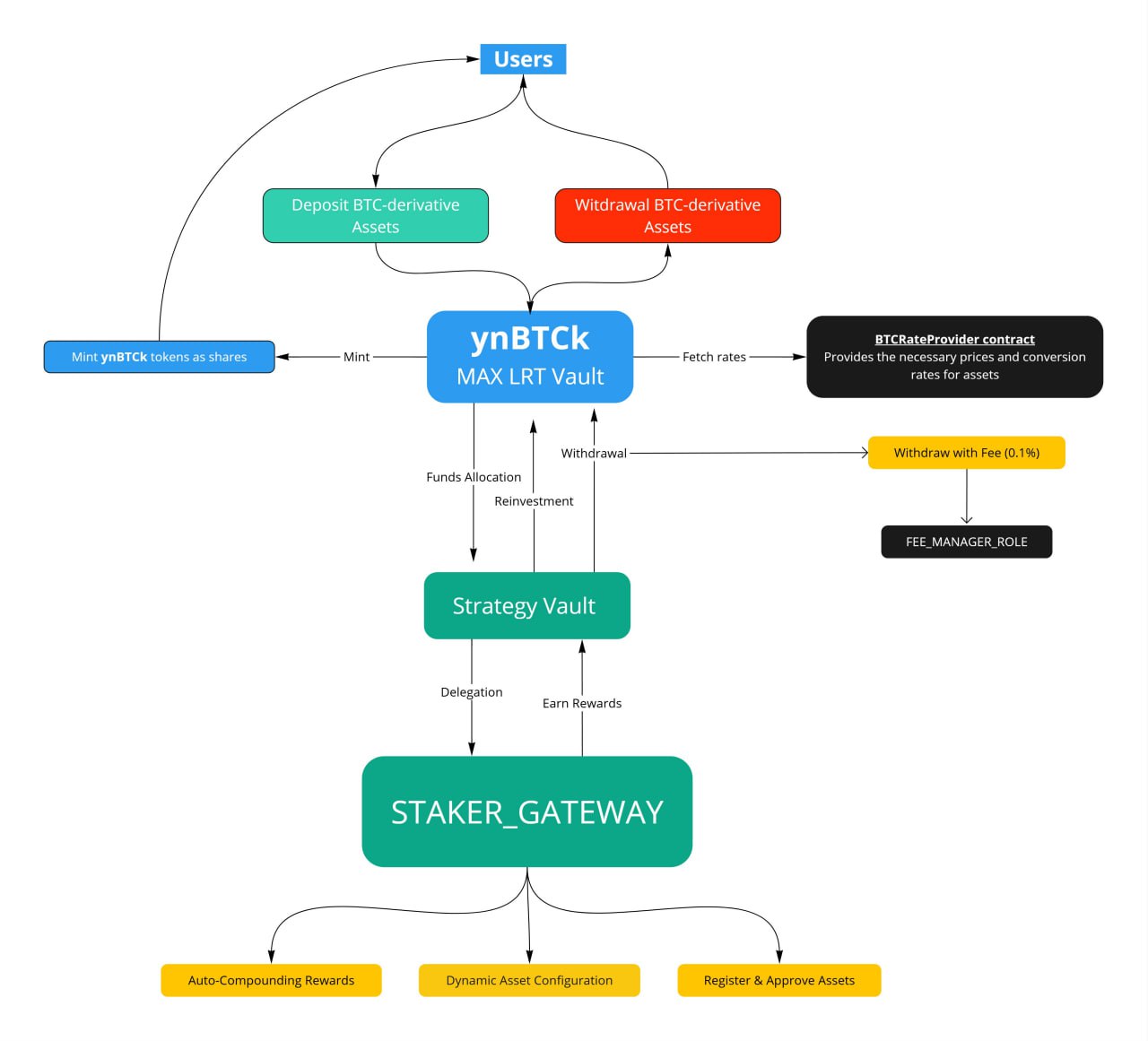

The ynBTCk vault employs a strategy-plus-vault pattern common among yield aggregators, providing a streamlined solution for depositing BTC-derivative assets and automatically compounding staking rewards. Three guiding principles shape this architecture, each contributing to a secure, flexible, and growth-oriented ecosystem. These principles are:

-

Upgradeable (Proxy) Contract Structure

-

Modular Kernel Integration

-

Vault-Strategy Pattern

These principles are described in the following sub-sections and a high-level overview of the overall product architecture is shown below.

Source: YieldNest Risk

#2.1.1 Upgradeable (Proxy) Contract Structure

The ynBTCk token runs on an upgradeable proxy contract deployed on the BNB Chain. This design choice allows developers to introduce improvements or fixes without changing the contract’s address, ensuring minimal disruption for existing depositors. By separating the contract’s logic from its storage, YieldNest can seamlessly upgrade ynBTCk’s functionality in response to user feedback, network upgrades, or new DeFi opportunities—without forcing a complete redeployment of the token.

#2.1.2 Modular Kernel Integration

ynBTCk integrates with the Kernel restaking protocol to manage user deposits in various BNB Chain security mechanisms. When users deposit BTC-derivative tokens into the vault, those assets flow into Kernel, which secures the chain and generates staking rewards. The ynBTCk strategy then retrieves these rewards from Kernel and reinvests them back into the vault. This auto-compounding process continuously boosts depositor returns without requiring manual intervention, while Kernel’s modularity allows the platform to adopt new PoS or restaking solutions as they emerge.

#2.1.3 Vault-Strategy Pattern

YieldNest’s design features separate vaults for initial deposits and for the strategy, effectively separating deposit management from the yield-generation process (yield aggregators).

-

The Vault receives user deposits, mints ynBTCk tokens as a representation of each depositor’s share and processes withdrawals.

-

The ynBTCk strategy contract is where assets are actively put to work: it delegates funds to Kernel, collects staking rewards, and reinvests them. By decoupling these functions, the architecture mitigates risk—isolating the vault’s core logic from protocol-specific complexities—and ensures that updates to the vault or strategy can be made independently.

This multi-layered design delivers several advantages. First, security benefits from isolating and reviewing each component independently, minimizing single points of failure. Second, flexibility is preserved by allowing both the vault and strategy modules to evolve or integrate with new restaking protocols without requiring a complete overhaul. Finally, the auto-compounding mechanism raises the overall yield by automatically reinvesting earned rewards, enabling users to capture compounded returns without additional effort.

#2.2 Smart Contracts

All sensitive contract functions (e.g., fee updates, asset management, and unpausing) are protected by roles, limiting access to privileged users. Role management uses OpenZeppelin’s AccessControlUpgradeable.

Addresses with PAUSER_ROLE / UNPAUSER_ROLE may temporarily halt key operations like deposit, mint, withdraw, and redeem to safeguard assets during emergencies or vulnerabilities, and resume normal operations after issues are resolved.

The admin can grant or revoke any role in the contract using the grantRole and revokeRole:

-

PAUSER_ROLE; -

UNPAUSER_ROLE; -

ASSET_MANAGER_ROLE; -

FEE_MANAGER_ROLE; -

PROCESSOR_ROLE; -

BUFFER_MANAGER_ROLE;

ReentrancyGuardUpgradeable prevents reentrancy attacks on functions like deposit, withdraw, or processor transactions.

Advanced vault features include multi-asset support through functions like depositAsset, previewDepositAsset, and getAssets and conversion functions using IProvider to fetch exchange rates dynamically for asset conversions.

#2.3 Audits

YieldNest has engaged Zokyo to conduct a security audit of its core contracts, in addition to in-house security checks, with the following being the primary focus areas: src/BaseVault.sol, src/module/Guard.sol, src/module/Provider.sol, src/Vault.sol, and src/ynETHxVault.sol. The audit highlighted three critical issues, each addressed in varying ways by YieldNest.

-

A discrepancy was found in that deposits did not result in share minting, leading to potential inconsistencies. YieldNest clarified that this behavior aligns with their design philosophy, as they intend to treat direct deposits as donations and therefore opted not to amend this aspect.

-

The audit flagged a risk of deposit assets being locked in the contract, citing the absence of a mechanism to utilize or withdraw the deposited assets. YieldNest has committed to introducing a function that enables the wrapping of deposit assets, addressing this limitation effectively.

With the current lack of an active bug bounty program, Zokyo emphasized the importance of implementing such to encourage ongoing security analysis and incentivize external contributions to YieldNest’s smart contracts safety. YieldNest is actively working to establish a bug bounty program.

#2.4 Dependencies

A brief overview of the ynBTCk dependencies is given in the following sub-sections. The remainder of this report will be devoted to further examination of these dependencies.

#2.4.1 Kernel Protocol

Kernel DAO is backed by Binance Labs to develop restaking products on BNB Chain. As the foundational protocol for ynBTCk, any associated risks inherent to Kernel must be carefully considered. The protocol has undergone audits by Baisec and Chainsecurity. However, Kernel remains in the nascent stages of its lifecycle, having only recently launched on mainnet.

#2.4.2 BTC Derivative Assets

The accepted BTC derivatives bring diverse risk profiles influenced by their origin. These derivatives can either be sourced from centralized exchanges or minted via DeFi protocols. Each asset introduces a unique layer of risk shaped by its underlying protocol, asset-specific characteristics, market dynamics, and the governance mechanisms surrounding it.

#2.4.3 Distributed Validator Nodes (Future)

DVNs are not yet operational. As a result, the profitability tied to providing security support for these networks cannot be realized in the short term. The ecosystem shows considerable promise, with numerous projects actively building on top of Kernel.

#Section 3: Underlying BTC Products

This section will elaborate on BTC staking products generally and specifically the assets underlying the ynBTCk vault, as these assets constitute critical dependencies of the overall product.

#3.1 BTC Staking Overview

Bitcoin’s status as the original cryptocurrency has propelled it to the top of the market cap rankings, yet its Proof-of-Work (PoW) consensus model and limited programmability have made it difficult for BTC holders to participate in staking.

#3.1.1 BTC Staking Challenges

Below are some of the key obstacles preventing the wider adoption of BTC staking:

-

Cross-Chain Complexity - staking Bitcoin usually requires moving assets across multiple blockchains, introducing technical hurdles and additional risk. This complexity often discourages users from fully exploring yield opportunities.

-

Limited Programmability - unlike Ethereum’s robust smart contract functionality, Bitcoin’s protocol lacks native staking or programmability features. This makes building sophisticated staking solutions more difficult.

-

Liquidity Issues - traditional staking methods often require locking BTC for a set period, limiting accessibility to funds and discouraging broader participation.

-

Consensus Differences - because Bitcoin relies on Proof of Work (PoW) rather than Proof of Stake (PoS), its ecosystem doesn’t natively support staking rewards. As a result, third-party solutions must step in to provide staking-like opportunities.

#3.1.2 Transitioning from Challenges to Solutions

Connecting Bitcoin’s Proof-of-Work model with advanced staking opportunities requires dependable cross-chain tools, pooled liquidity, and straightforward staking frameworks.

These solutions address the friction of moving BTC across multiple networks and unifying disparate staking models into a more cohesive framework. By implementing secure bridging technologies (such as Chainlink’s CCIP) and modular restaking protocols, projects can enable BTC holders to participate in staking and earn yields without sacrificing liquidity. This sets the stage for the Solv Protocol’s Staking Abstraction Layer (SAL), which incorporates these bridging mechanisms to deliver a unified approach for BTC staking solutions.

#3.2 solvBTC: Solv Protocol

Solv Protocol’s Staking Abstraction Layer (SAL) addresses the obstacles above by providing a unified framework for BTC staking across various chains. Instead of forcing users to navigate complex bridging steps, SAL offers a streamlined interface. Through SAL, users can hold a liquid BTC representation (SolvBTC), while still capturing yield from Proof-of-Stake-based networks. This approach preserves flexibility and liquidity, making it easier for BTC holders to participate in staking-like activities without losing control of their underlying assets.

#3.2.1 Staking Abstraction Layer (SAL)

The Staking Abstraction Layer (SAL) enables Bitcoin holders to access more layers of dynamic yield streams without compromising liquidity. By leveraging the cross-chain capabilities, users can unlock various opportunities for yield generation, transforming Bitcoin from a passive store of value into a productive asset within DeFi. Here’s a breakdown of the key yield source layers accessible through SAL:

-

Restaking Yields - BTC holders can earn native token rewards by staking their BTC on restaking protocols as economic security supply, such as Babylon, EigenLayer, Symbiotic, Karak, etc.

-

Validator Rewards - participating in securing Bitcoin Layer 2 networks by operating validator nodes or delegating Bitcoin to other validators. Validator rewards are a key yield stream on platforms like CoreDAO, Stacks, and Botanix.

-

Trading Strategies - participating in yield-generation strategies, mostly engaging in delta-neutral strategies on Defi platforms that mitigate market volatility.

-

Defi Yields - leveraging LSTs in Defi protocols. The combination of staking and providing liquidity positively affects overall yield potential.

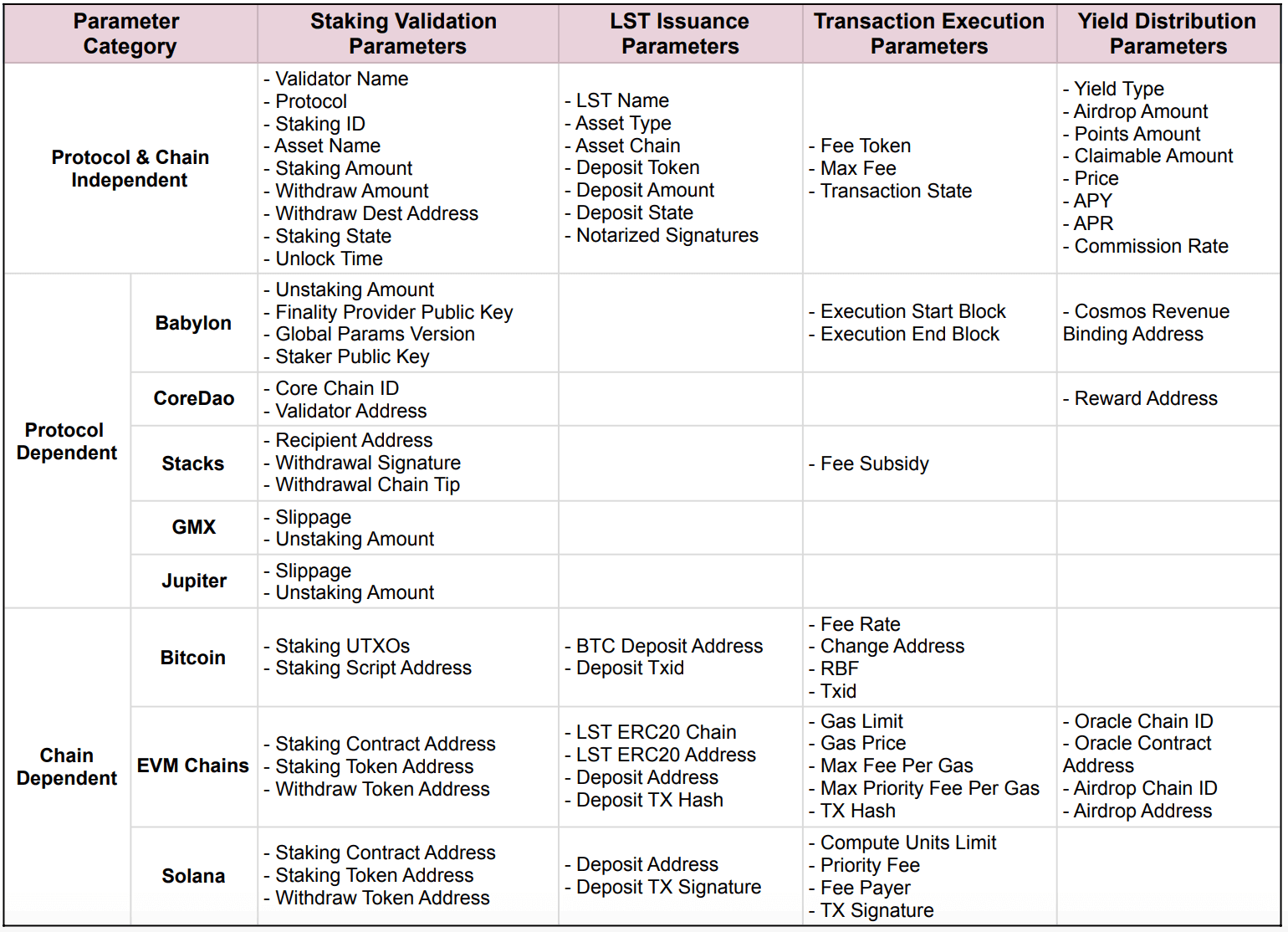

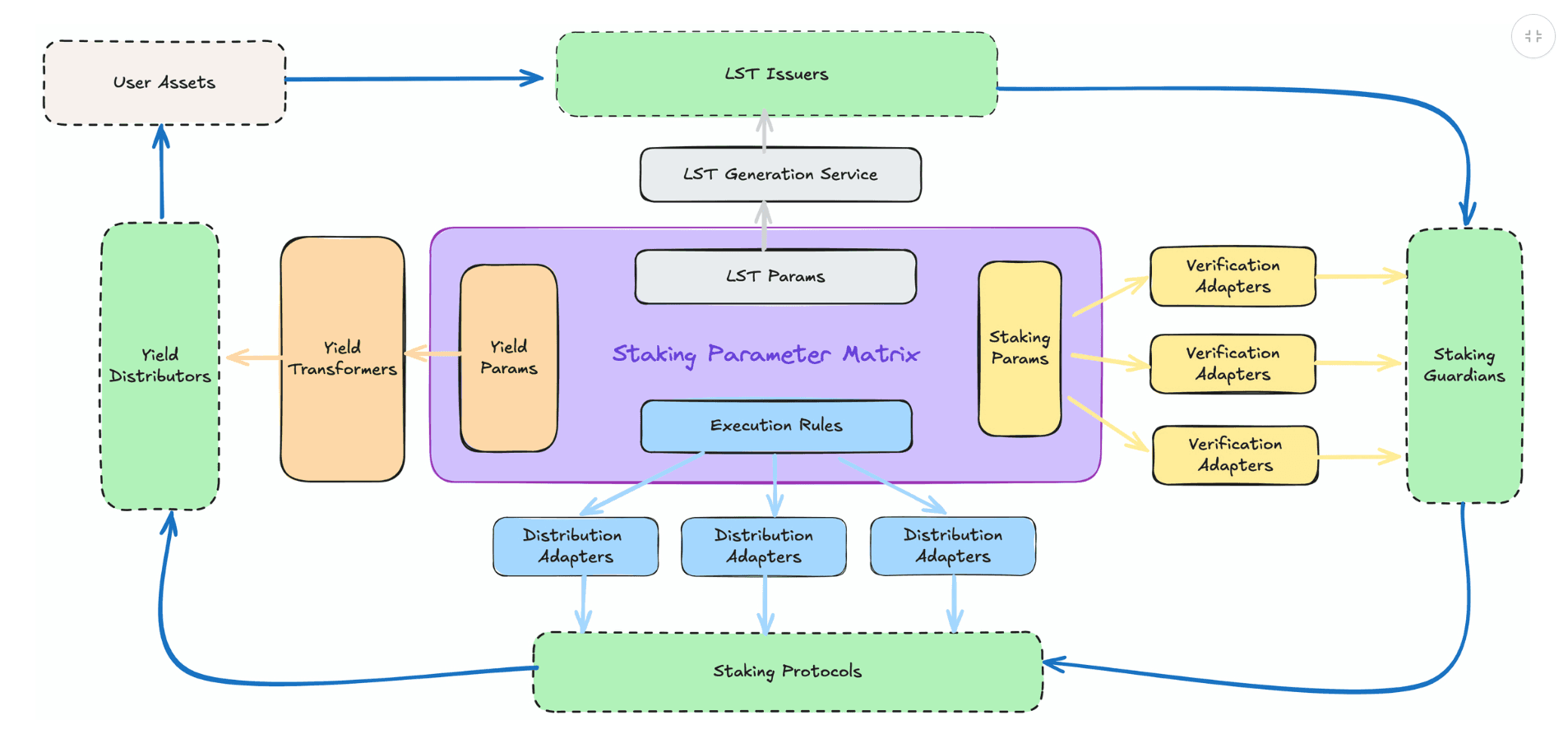

The Staking Abstraction Layer as a modular system streamlines the BTC staking process through multiple services. All components (i.e. set of services) are governed by the Staking Parameter Matrix (SPM), which defines essential rules and parameters to ensure security and transparency. Below are the main components of the SAL system:

-

Staking Parameter Matrix (SPM) consolidates Bitcoin script configurations, LST contract rules, and yield parameters, enabling consistent validation and coordination across the SAL.

-

LST Generation Service manages issuance and redemption of BTC LSTs, making sure minted tokens precisely match the BTC staked.

-

Staking Validation Service uses algorithms executed by staking guardians to verify each staking transaction before sending it to the Bitcoin mainnet, preventing errors or fraud.

-

Transaction Generation Service builds and broadcasts validated transactions, factoring in optimal fees and timing to accommodate various staking protocols.

-

Yield Distribution Service calculates and allocates staking rewards, either embedding them into the LST price or dispersing them directly to users, thus simplifying reward management.

(source: Solv protocol documentation)

#3.2.2 SolvBTC

SolvBTC is a universal Bitcoin reserve token pegged 1:1 to native BTC, built to address the BTC cross-chain liquidity fragmentation problem. It offers a flexible, yield-generating solution for Bitcoin holders who want to move their assets across blockchain ecosystems without dealing with fragmented liquidity or the risks tied to individual wrapped BTC assets. SolvBTC enables BTC holders:

-

Interoperability through Chainlink’s CCIP cross-chain transfer solution users can move their assets between blockchains: Ethereum, BNB Chain, Avalanche, Arbitrum, Base, BOB, Mantle, and Merlin.

-

Stability is achieved by reducing liquidity fragmentation and volatility through a unified cross-chain framework and

-

Yield Generation and Capital Efficiecy by giving access and employing assets across multiple Defi protocols in order to generate yield, access deeper liquidity and increase assets capital efficiency. The aim is to manage assets in an efficient way and with low fees.

#3.2.3 SolvBTC Minting and Redemption

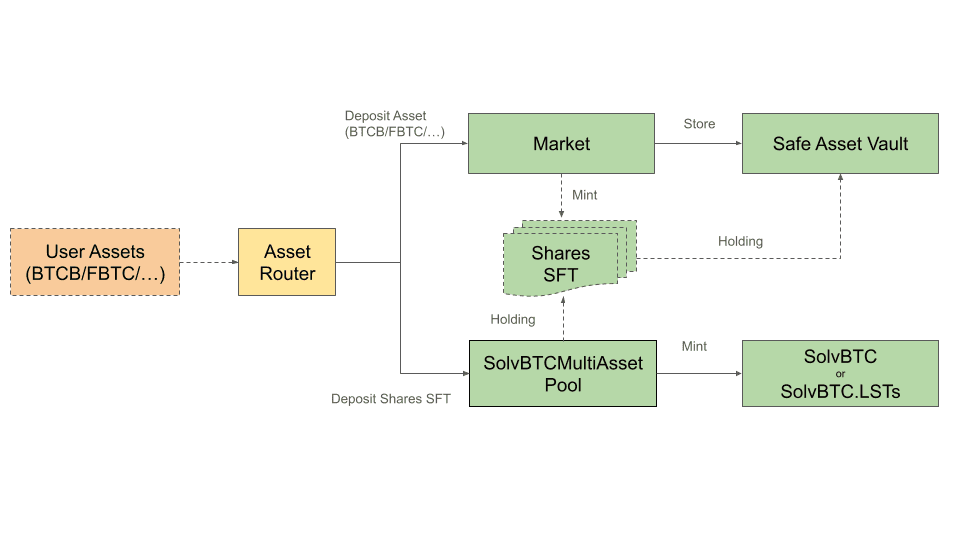

Minting SolvBTC involves depositing Bitcoin (BTC) or wrapped BTC (such as WBTC) into the Solv Protocol SolvBTCRouter contract through the createSubscription function. That function handles user deposits and the issuance of SolvBTC. In return, users receive SolvBTC tokens, which are backed 1:1 by the deposited Bitcoin, ensuring full collateralization.

(source: Solv protocol docs)

Redeeming SolvBTC operates in reverse. Users initiate a redemption request by calling the createRedemption() function in the SolvBTC Router contract, specifying the amount of SolvBTC to redeem. Upon successful initiation, users receive a redemption Semi-Fungible Token (SFT), representing their claim. The actual transfer of Bitcoin or wrapped BTC occurs when the user claims the redemption, facilitated by the claimTo() function.

The redemption process may involve delays, especially for large amounts. For instance, redemptions under $50,000 can often be processed intraday, while larger redemptions may take 1-3 business days, subject to liquidity and operational constraints.

#3.2.4 SolvBTC Staking Process

As part of the Solv Protocol architecture, the staking process for SolvBTC involves coordination among four key components: LST Issuers, Staking Protocols, Staking Validators, and Yield Distributors. Each plays a distinct role in ensuring a seamless, secure user experience.

1. LST Issuers

LST Issuers are responsible for minting and managing Liquid Staking Tokens (LSTs) such as SolvBTC. When users deposit BTC or BTC-derivative assets, the Issuers create SolvBTC to represent the staked amount. This tokenized representation ensures that users maintain liquidity even while their BTC is actively staked, streamlining cross-chain movements and simplifying participation in yield-bearing opportunities. By serving as the on-chain entity that mints and redeems LSTs, these Issuers play a crucial role in making the staking process accessible and efficient.

2. Staking Protocols

Staking Protocols, including solutions like Kernel or Babylon, offer the underlying infrastructure to stake BTC in a manner reminiscent of Proof of Stake (PoS), despite Bitcoin itself being based on Proof of Work (PoW). They handle the complex tasks of securing networks, delegating assets, and integrating with various PoS models without requiring manual navigation of multiple platforms. Through direct coordination with LST Issuers, these protocols abstract away technical intricacies, ensuring that end users can restake or delegate their BTC-derivatives seamlessly and focus on earning yields.

3. Staking Validators

Staking Validators serve as the validators of network transactions, verifying and safeguarding the integrity of the staking process. Operating similarly to validators in PoS systems, they confirm legitimate transactions and maintain overall network security. By working closely with the Staking Protocols, Validators help ensure that staked BTC is properly accounted for and that malicious or invalid transactions are rejected. Their distributed, consensus-driven nature reinforces system security and fosters user trust in the staking lifecycle.

4. Yield Distributors

Yield Distributors are specialized entities that collect and disburse staking rewards to users holding SolvBTC. They receive rewards, which can be denominated in various tokens or even point systems, and convert them into an asset recognized by the vault—often additional SolvBTC. This process facilitates auto-compounding or allows for easy withdrawal, depending on the vault’s strategy. By centralizing reward claims and conversions, Yield Distributors reduce the complexity users would otherwise face in retrieving and managing their staking yields across multiple networks.

(source: Solv protocol documentation)

Together, these four components underpin SolvBTC’s cross-chain staking framework.

#3.2.5 SolvBTC Reserve System

SolvBTC is backed by various wrapped BTC tokens. SolvBTC reserve assets are categorized in the protocol documentaation as "Core" (Native BTC and BTCB) and "Innovative" (WBTC, FBTC, cbBTC, BTC.b, and tBTC) reserves. The underlying principle is to group assets by risk profile, liquidity, and trust level.

The tiered reserve categories are defined as follows:

-

Core Reserve Assets - the foundation of SolvBTC reserves consist of the most secure and most liquid BTC and BTC derivatives - BTC, BTCB, and cbBTC.

-

Observed Reserve Assets - are wrapped BTC assets with a perceived higher risk of potential deppeging, smart contract vulnerabilities, or lower liquidity - WBTC, BTC.b, and M-BTC.

In general, Solv protocol limits exposure and monitors usage of observed assets in order to maintain a secure and reliable value, while providing access to additional liquidity sources.

#3.2.6 SolvBTC Price Feeds

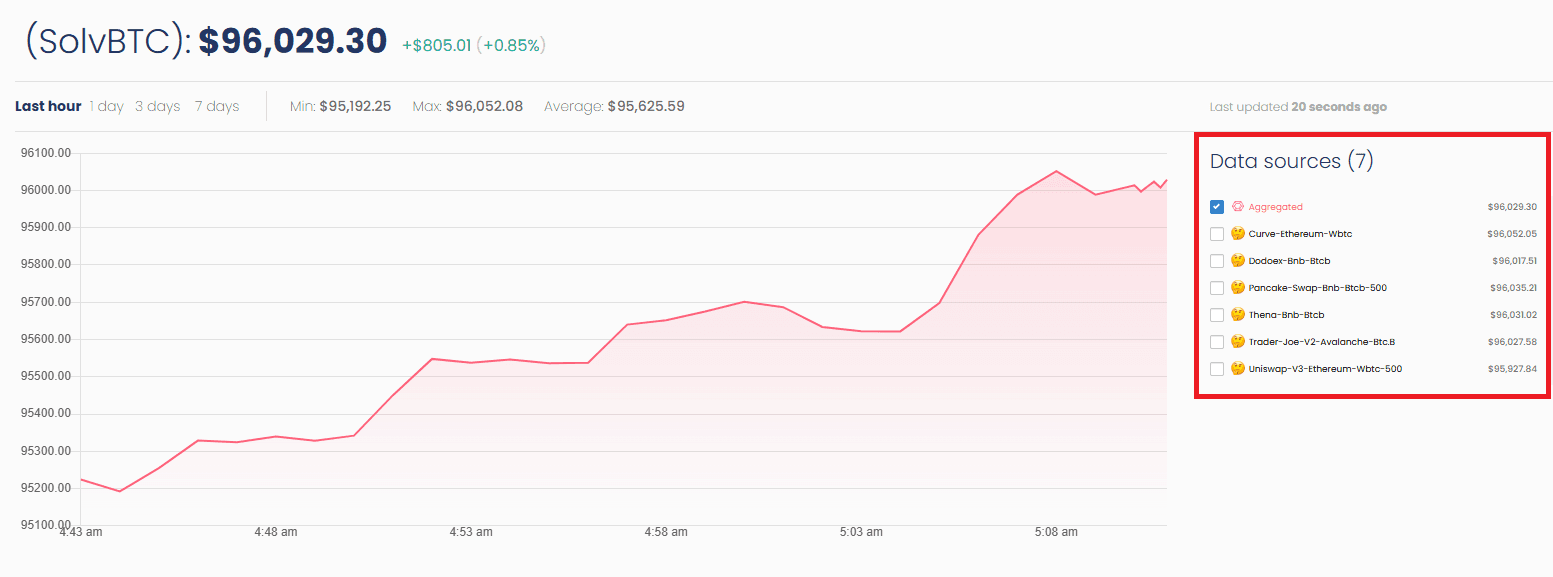

Solv integrates RedStone Oracles to maintain price security for SolvBTC and its Liquid Staking Tokens (LSTs), ensuring their peg to the underlying asset prices.

Solv utilizes the Push model, where data is pushed into on-chain storage via a relayer based on predefined conditions (heartbeat intervals and deviation thresholds).

-

SolvBTC-BTC Market Feed on Ethereum

-

SolvBTC-BTC Market Feed on BNB Chain

-

SolvBTC-BTC Market Feed on Avalanche

-

SolvBTC-BTC Market Feed on Base

RedStone's advantage over other oracle solutions is a modular approach which allows it to employ dedicated pricing methodologies tailored to different classes of assets, such as traditional assets and yield-bearing assets. For example, when pricing yield-bearing assets, RedStone utilizes a slippage-based approach instead of the Volume Weighted Average Price (VWAP) method, striving to improve pricing accuracy. This accuracy is additionally improved by the data sources diversification and the use of median aggregation across data sources.

(source: Redstone app)

#3.2.7 SolvBTC Cross-chain Solution

SolvBTC’s cross-chain functionality leverages Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Free.tech for secure and efficient transactions between blockchains. This setup allows SolvBTC holders to move tokens seamlessly at low cost and minimal delay, ultimately enhancing liquidity and utility across multiple ecosystems.

#3.2.8 Solv Guard and Governance Mechanism

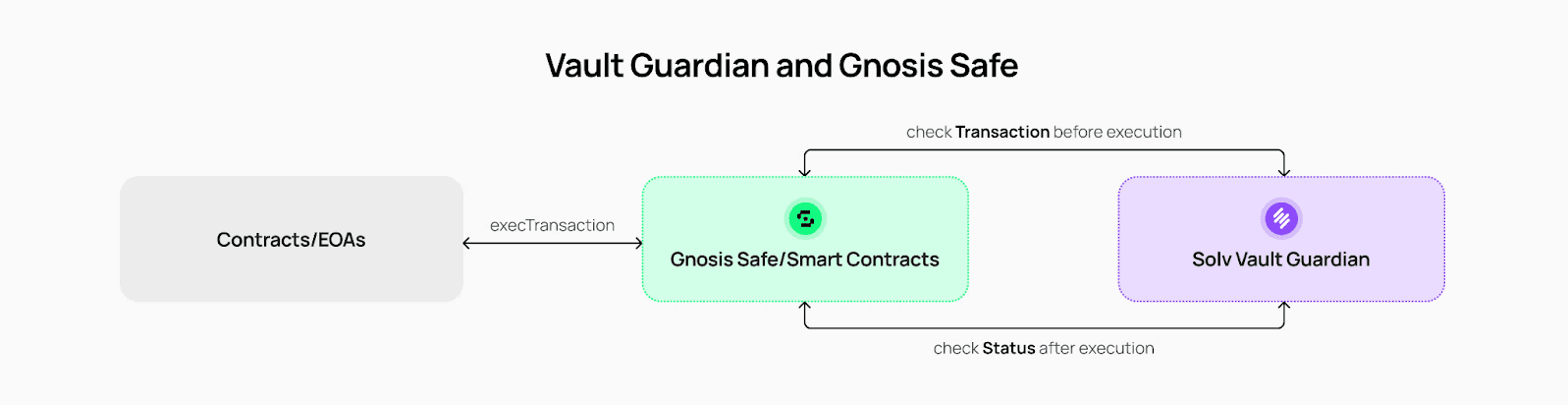

Solv Guard is an intermediary layer that sits atop the “Safe” smart contract wallet, adding an extra layer of security by confining multi-signature operations to a specified scope. It assigns a Vault Guardian to each vault, defining which contracts, functions, and token addresses are permitted, thereby ensuring that asset managers operate within authorized parameters.

(source: Solv protocol documentation)

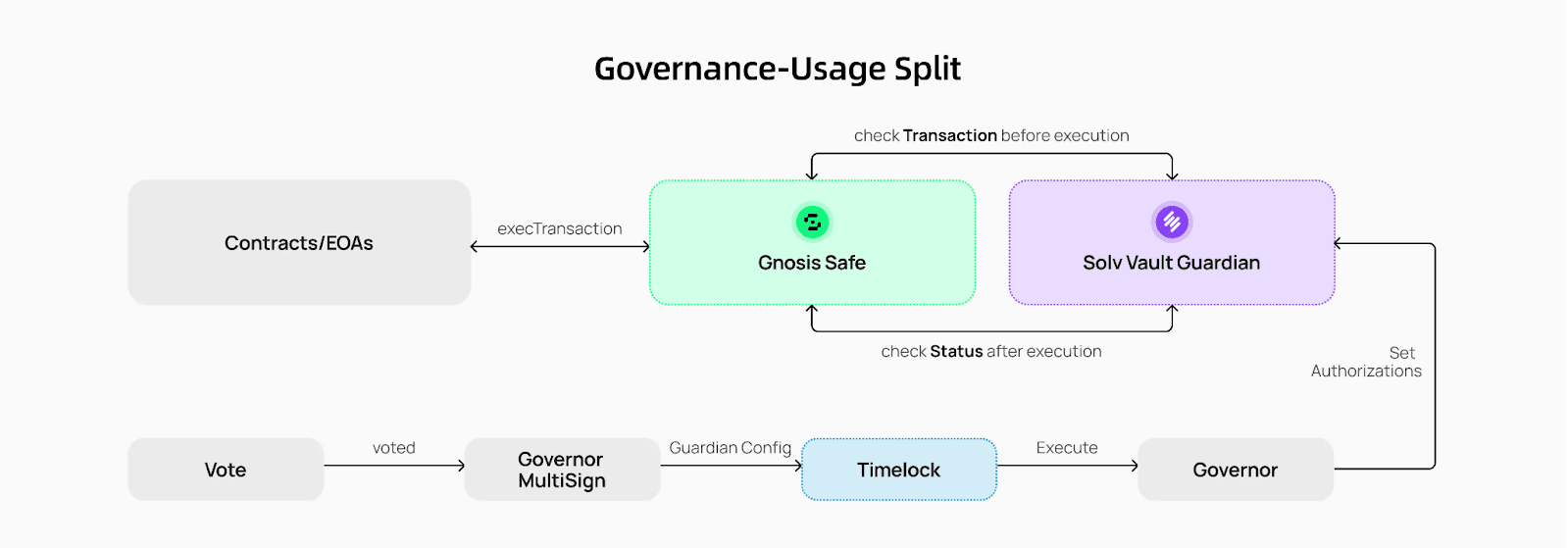

Through this granular permission system, Solv Guard can support a wide range of DeFi protocols, including Uniswap, GMX, Compound, Lido, Ethena, and PancakeSwap. Its governance mechanism separates execution (handled by the Vault Guardian) from broader governance powers (overseen by the Governor), who can manage upgrades, whitelists, and other critical configurations via a timelock. By allowing the Governor to intervene if issues arise with the Guardian, Solv Guard maintains a high level of security and adaptability. This structure ensures that both asset managers and community stakeholders have a clear, transparent framework for protecting and growing user assets.

(source: Solv protocol documentation)

#3.2.9 Contract Administration

Solv Protocol has employed various contracts to govern minting, parameter configuration, and bridging for its tokenized assets. Each contract fulfills a specific function while remaining consistent with the overall Solv governance model.

Contract Administrators

Administrators are the entities or addresses with the highest level of control over Solv Protocol’s smart contracts on BNB Chain. They can grant and revoke roles, upgrade contract parameters, and oversee cross-chain operations.

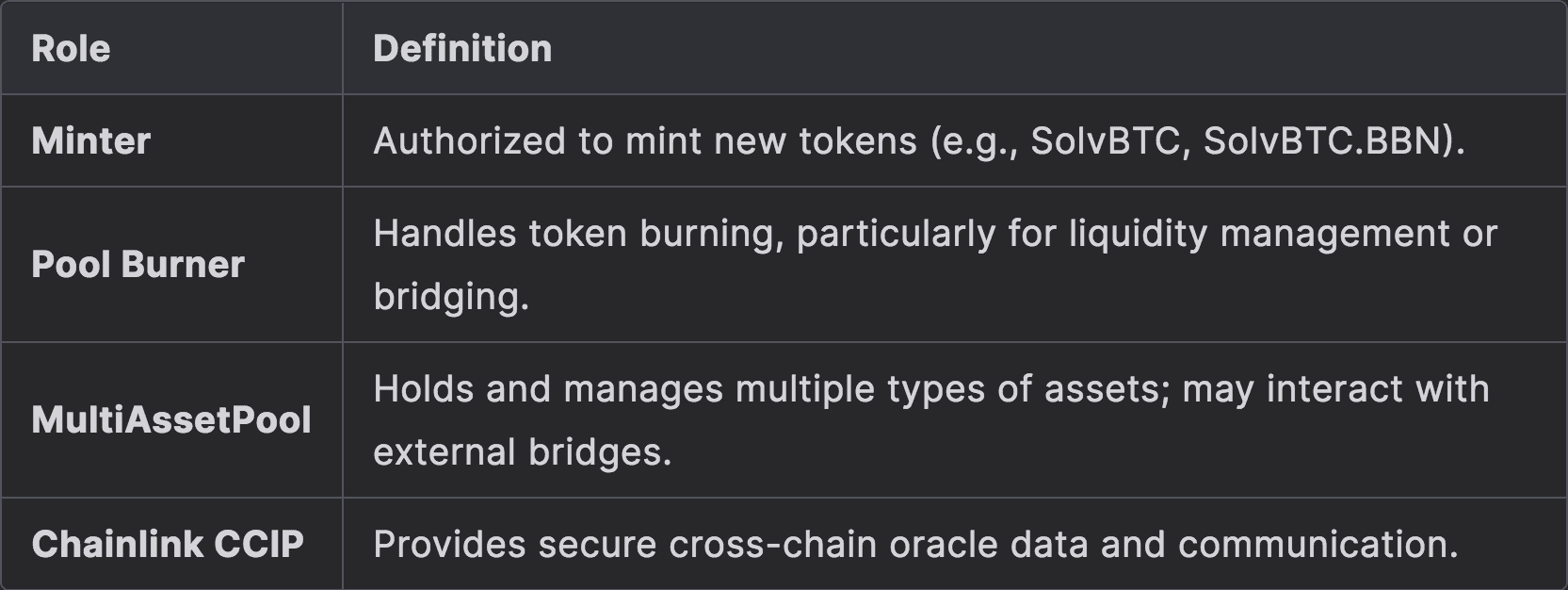

Below is a summary of core roles within Solv’s BNB Chain ecosystem:

Runtime Configuration

Runtime configuration encompasses how parameters are managed, how tokens are minted or burned, and which roles are responsible for these actions. Solv Protocol relies on an Access Control Model to ensure only authorized addresses can modify critical protocol parameters.

Under Solv’s governance, access control is typically implemented via role-based permissions. These roles dictate who can modify parameters, mint/burn tokens, or deploy bridging functions. Assigning roles is critical for maintaining both security and decentralization.

-

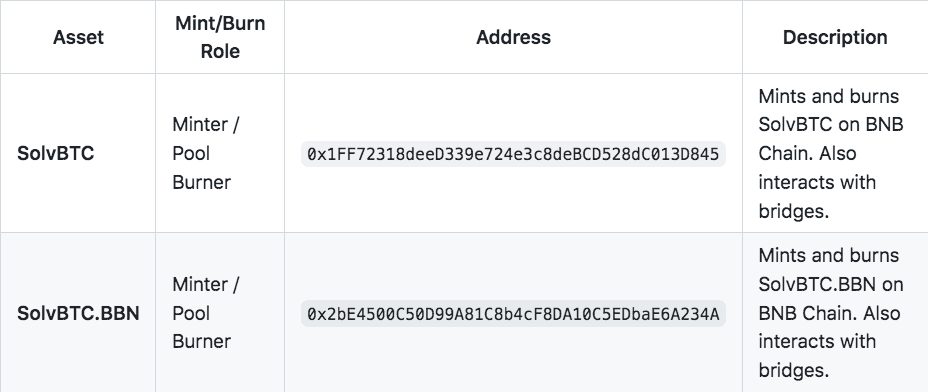

Parameter Configuration - Parameter configuration involves adjusting variables like fees, token supply caps, or any other protocol-specific parameters. Configuration can typically be performed only by addresses assigned to specific “Parameter Configuration” roles.

-

Token Mint/Burn - Token minting and burning are privileged operations that directly affect the token supply. Minting introduces new tokens into circulation, whereas burning removes tokens from circulation, often as part of bridging or liquidity management.

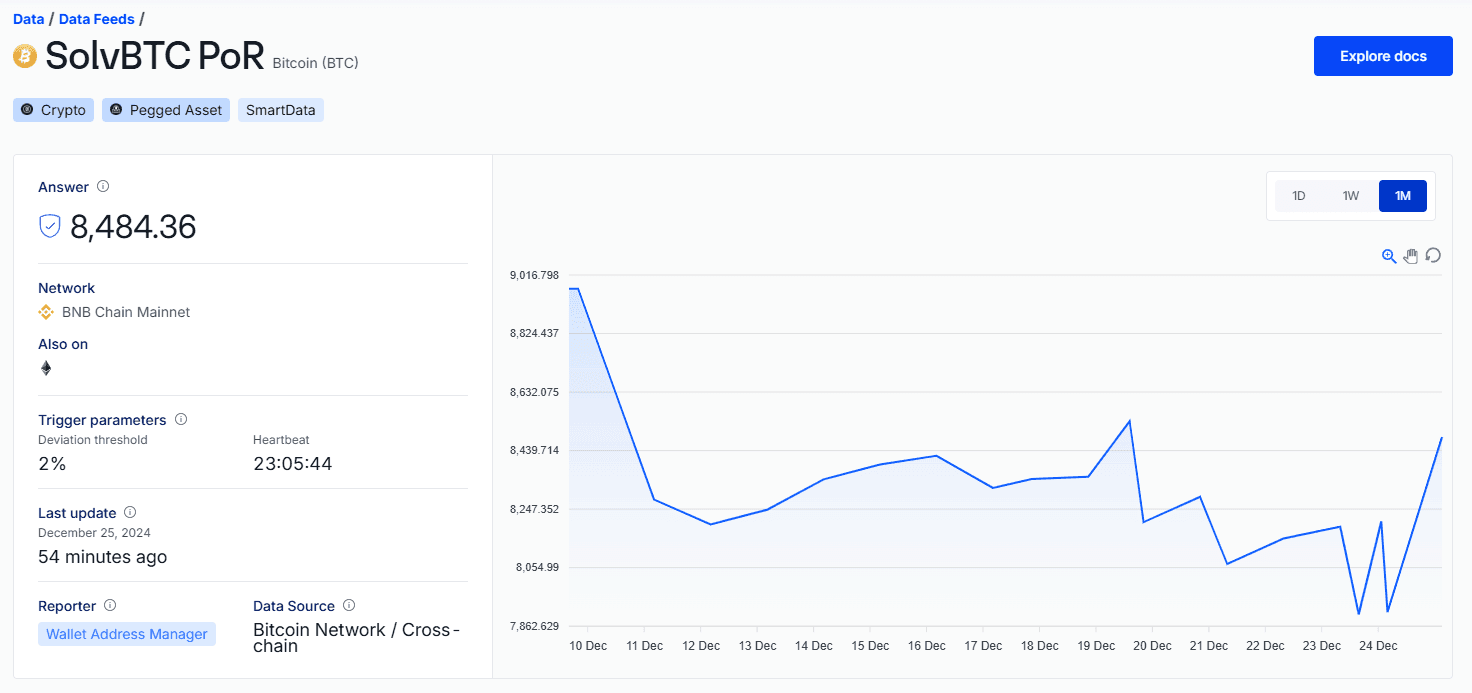

Token supply adjustments are restricted to specific minter and burner addresses. Below is an overview for each asset on BNB Chain:

(source: Solv protocol documentation)

The following addresses hold the authority to configure parameters for the associated tokens and pools:

(source: Solv protocol documentation)

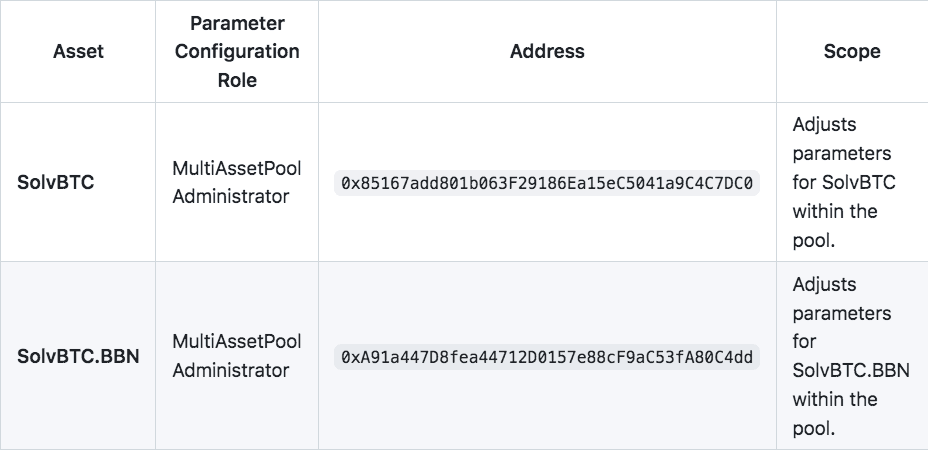

#3.2.10 SolvBTC Proof-of-Reserve

SolvBTC Chainlink Proof-of-Reserve feed uses a wallet address manager contract. The project has self-attested to the addresses they own.

(source: Chainlink Smart Data)

#3.2.11 Smart Contract Audits

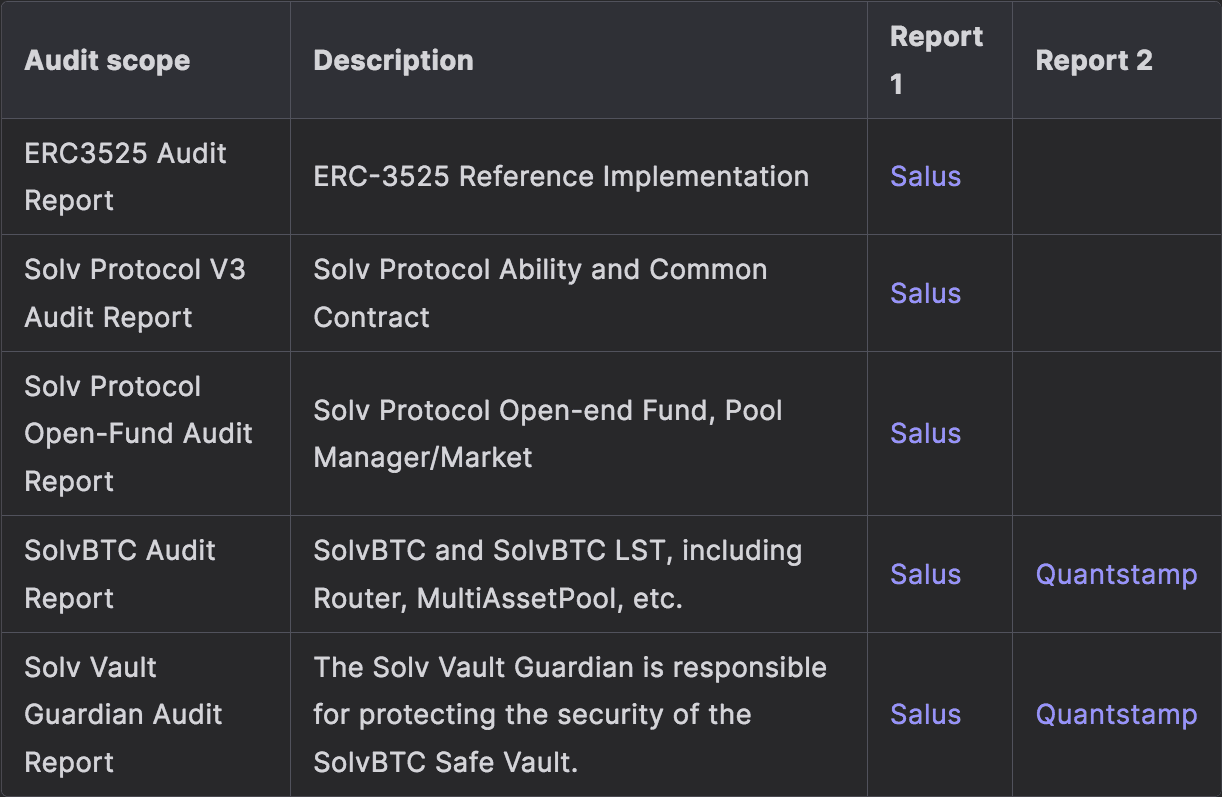

Solv protocol is audited 5 times by 2 auditors - Salus and Quantstamp:

(source: Solv Protocol docs)

All Solv protocol audits can be found in the project Github repo.

#3.2.12 SolvBTC.BBN: Bablyon Protocol

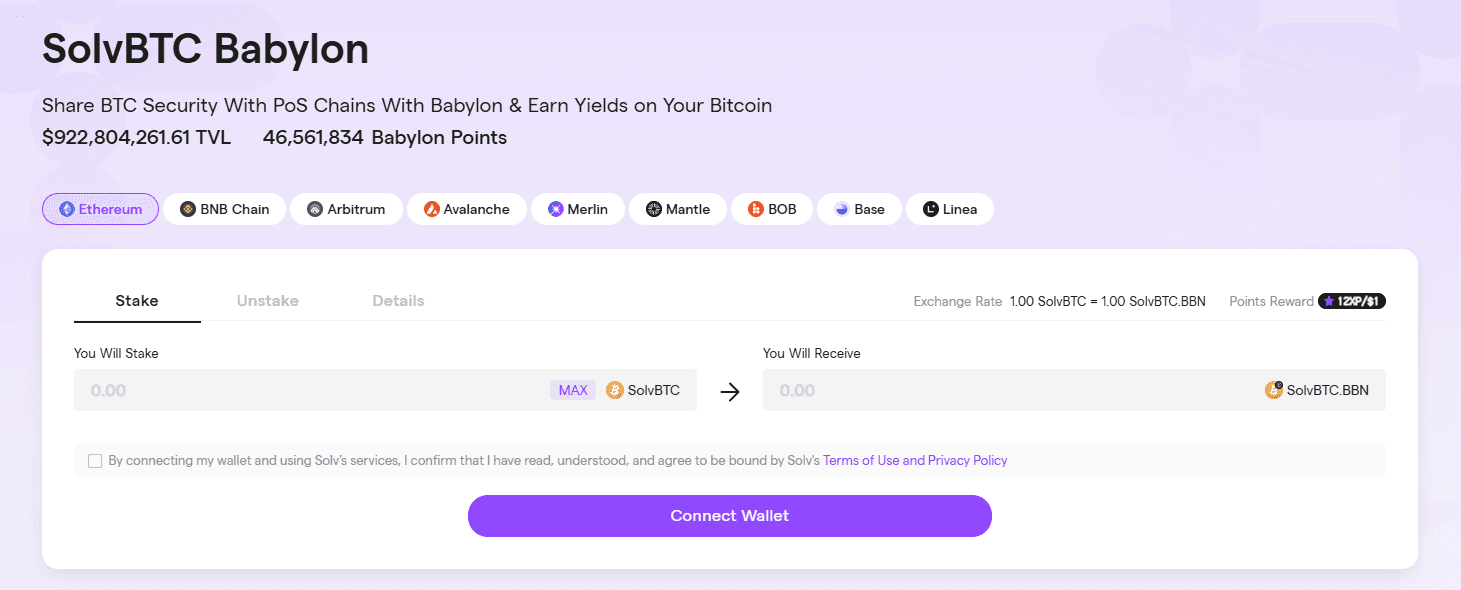

SolvBTC.BBN is the liquid staking token that represents staked SolvBTC, Bitcoin staked within the Babylon ecosystem, which leverages Bitcoin's economic security to secure PoS networks. SolvBTC.BBN, as a yield-bearing token, generates yield from future Babylon staking rewards and Solv Points. It bridges Bitcoin’s liquidity to DeFi through the Solv Protocol, enabling Bitcoin holders to access LSTs and earn yield while maintaining cross-chain liquidity.

SolvBTC.BBN is issued by staking SolvBTC on Babylon chain where users are able to earn staking rewards from Babylon while unlocking liquidity and additional yields in the DeFi ecosystem.

(source: Solv protocol app)

Redemption requests are processed three times each month, only on business days:

-

1st–10th: Processed on the 20th

-

11th–20th: Processed on the 30th, 31th

-

21st–End of Month: Processed on the 10th of the following month

#3.3 BTCB: Binance

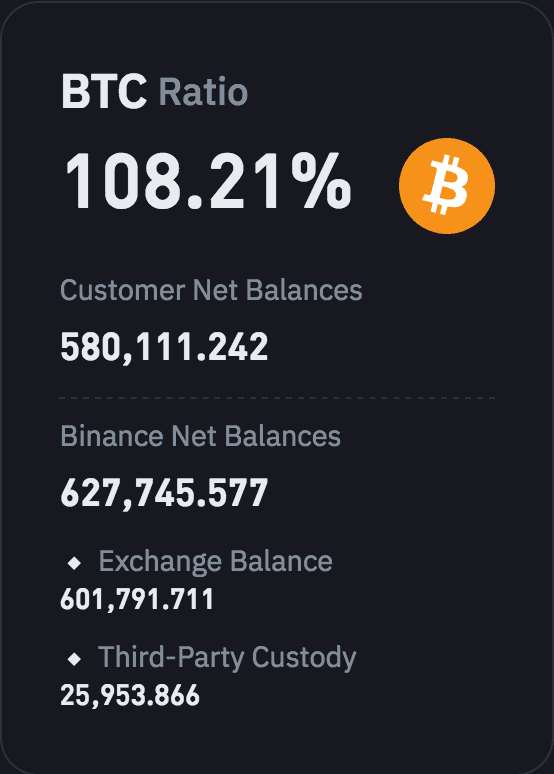

BTCB is a wrapped version of Bitcoin issued by Binance on the Binance Smart Chain (BSC), pegged 1:1 to BTC locked in a transparent address on the Bitcoin network. This setup allows BTC holders to tap into the BSC ecosystem without selling their Bitcoin, preserving their potential upside while gaining access to faster and cheaper transactions. By verifying the locked collateral and minted BTCB supply through Binance’s Proof of Assets page, users can confirm that each BTCB is backed by an equivalent amount of BTC. In this way, BTCB merges Bitcoin’s popularity and perceived stability with BSC’s flexibility and efficiency.

#3.3.1 Integrations

Because BTCB is widely recognized across the BNB Chain ecosystem, holders can leverage it in multiple DeFi applications such as liquidity provision, lending, stablecoin minting, and trading. This opens up yield-farming possibilities on platforms like PancakeSwap or Beefy.finance, where users can deposit BTCB in liquidity pools and earn rewards in various BEP20 tokens.

Additionally, BTCB can be used as collateral on lending protocols to borrow other assets or to mint stablecoins, effectively creating new financial opportunities without forfeiting Bitcoin exposure. Overall, BTCB provides a more versatile way to handle BTC on BSC, enhancing both earning potential and DeFi participation.

#3.3.2 BTCB Minting and Redemption

BTCB (Bitcoin BEP2) is a tokenized version of Bitcoin on the BNB Chain, introduced by Binance to integrate Bitcoin's liquidity into the BNB Chain ecosystem.

The minting process involves the following:

-

Deposit Bitcoin - users deposit BTC into a designated Binance wallet.

-

Custodial Holding - Binance securely holds the deposited BTC in a multi-signature cold storage wallet.

-

Issuance of BTCB - an equivalent amount of BTCB tokens is minted on the BNB Chain, maintaining a 1:1 peg with the deposited BTC.

The redemption process involves the following:

-

Initiate Redemption - users send their BTCB tokens to Binance, signaling a redemption request.

-

Burning BTCB - upon receiving the BTCB tokens, Binance burns them to reduce the circulating supply.

-

Release of Bitcoin - the equivalent amount of BTC is released from Binance's reserves and transferred back to the user's Bitcoin wallet.

#3.3.3 BTCB Proof-of-Reserve

Binance self-attest a PoR of assets underlying BTCB in its custody.

(source: Binance Proof-of-Reserve)

#3.4 WBTC: Wrapped Bitcoin

Wrapped Bitcoin (WBTC) is a tokenized version of Bitcoin (BTC) that exists on the Ethereum blockchain as an ERC-20 token. By being pegged 1:1 to BTC, WBTC enables Bitcoin holders to participate in Ethereum-based decentralized finance (DeFi) activities without sacrificing their exposure to the value of Bitcoin. The peg is maintained through a custodial model, where every WBTC token is backed by an equivalent amount of BTC held by a trusted custodian (a joint custody arrangement between US-based BitGo and Hong Kong-based BiT Global).

#3.4.1 Integrations

WBTC’s compatibility with the Ethereum ecosystem has made it one of the most widely integrated BTC derivatives across DeFi platforms. It serves as a vital liquidity asset for lending protocols like Aave and Compound, decentralized exchanges (DEXs) such as Uniswap and Balancer, and yield-farming platforms like Yearn Finance. These integrations enable users to deploy their Bitcoin holdings in activities such as:

-

Providing liquidity to DEX pools to earn trading fees and incentives.

-

Using WBTC as collateral to borrow stablecoins or other assets.

-

Engaging in staking and farming strategies to generate yield.

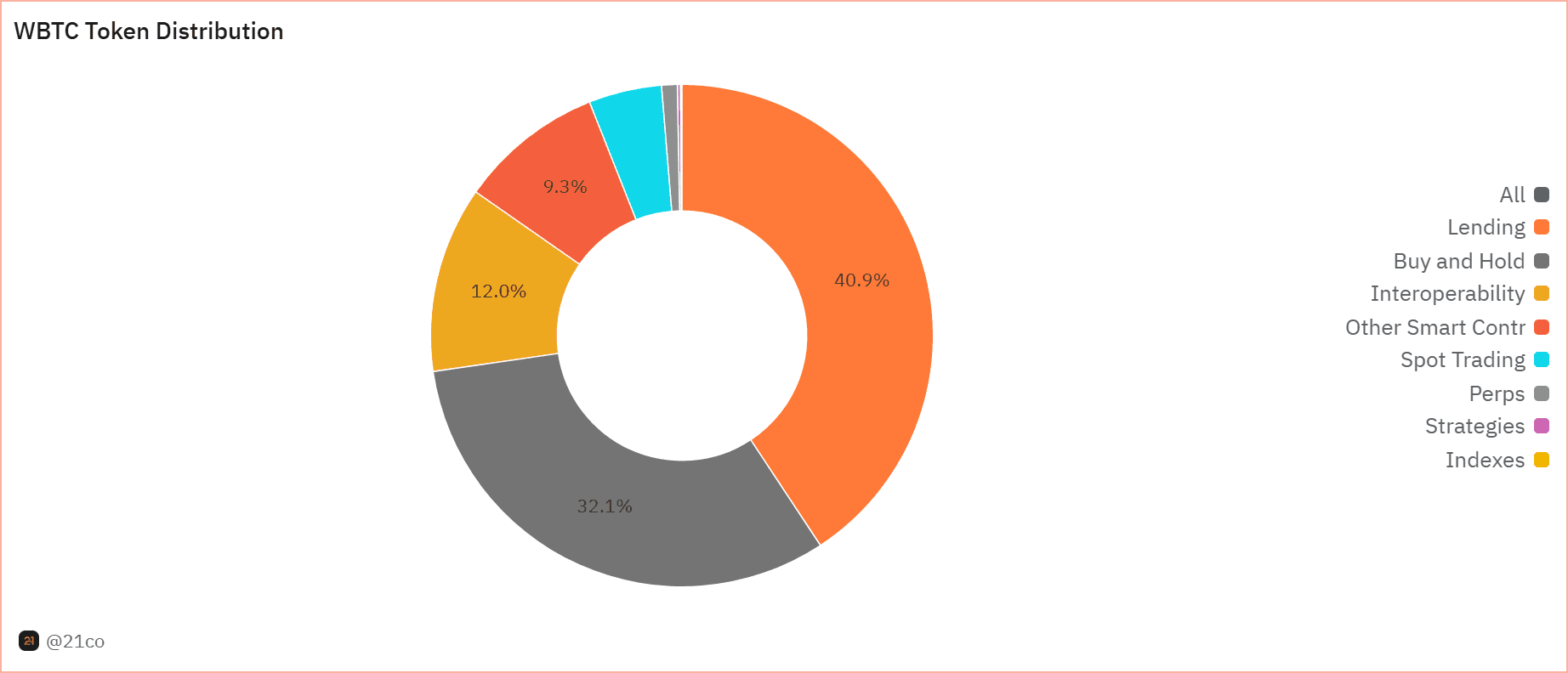

The chart below illustrates the distribution of WBTC on Ethereum, categorized by its various use cases.

(source: Dune Analytics - 21co dashboard)

WBTC is extensively utilized in DeFi protocols, serving as a key component of cross-chain liquidity by bringing Bitcoin's value into Ethereum and its Layer 2 ecosystem.

#3.4.2 Role in SolvBTC Reserves

In the context of ynBTCk, WBTC plays a critical role as one of the key underlying assets in the SolvBTC reserve structure. SolvBTC aggregates various Bitcoin-backed tokens to ensure liquidity, diversification, and efficiency for its holders.

The inclusion of WBTC within SolvBTC reserves offers several advantages:

-

Liquidity Depth - WBTC’s significant market presence and extensive DeFi integrations ensure that it provides deep liquidity to SolvBTC, facilitating seamless swaps, lending, and other financial activities.

-

Market Accessibility - As the most widely adopted Bitcoin derivative on Ethereum, WBTC provides a reliable on-ramp for BTC holders seeking exposure to the ynBTCk ecosystem.

-

Stability - WBTC’s custodial model and proof-of-reserves transparency enhance the stability and trustworthiness of SolvBTC’s asset backing.

By leveraging WBTC as a reserve asset, SolvBTC effectively bridges Bitcoin liquidity with Ethereum's advanced DeFi ecosystem, bolstering the overall value proposition of ynBTCk.

#3.4.3 Minting and Redemption

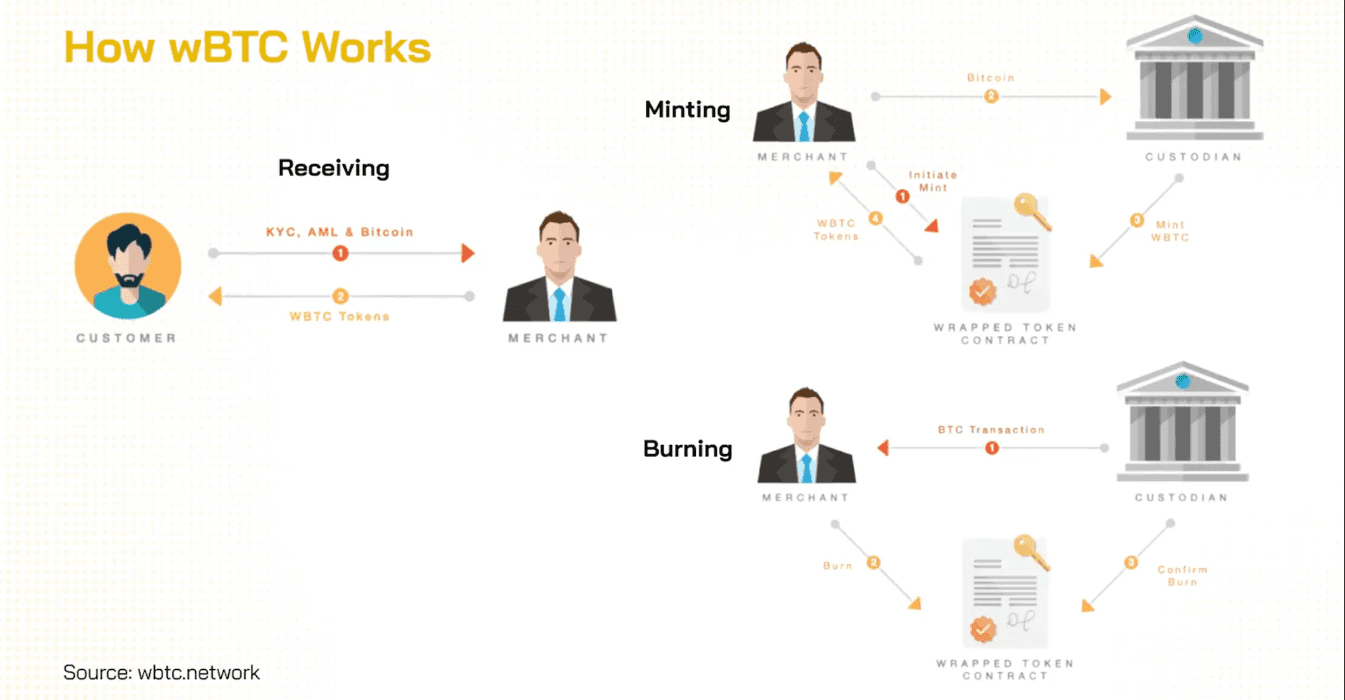

The process of minting and redeeming WBTC is centralized and relies on trusted custodians and merchants.

1. Minting

Bitcoin holders can mint WBTC by transferring BTC to a merchant-approved custodian. Upon receipt of BTC, the custodian mints an equivalent amount of WBTC on the Ethereum blockchain. This process is transparent, with custodian addresses and reserve assets regularly audited to ensure full collateralization.

2. Redemption

WBTC redemption involves burning WBTC tokens and receiving an equivalent amount of BTC from the custodian. The reverse process ensures that WBTC maintains a 1:1 peg to Bitcoin. The image below illustrates the simplified WBTC minting and redemption process:

(source: WBTC Network)

While centralized, this custodial approach has contributed to WBTC’s rapid adoption by simplifying the conversion of Bitcoin into a liquid ERC-20 asset.

#3.4.4 Security and Governance

WBTC is governed by the WBTC DAO, a DAO comprising multiple stakeholders, including custodians, merchants, and DeFi protocols. The DAO collectively decides on operational parameters such as custodian approval, reserve management, and protocol upgrades.

Security is primarily ensured through:

-

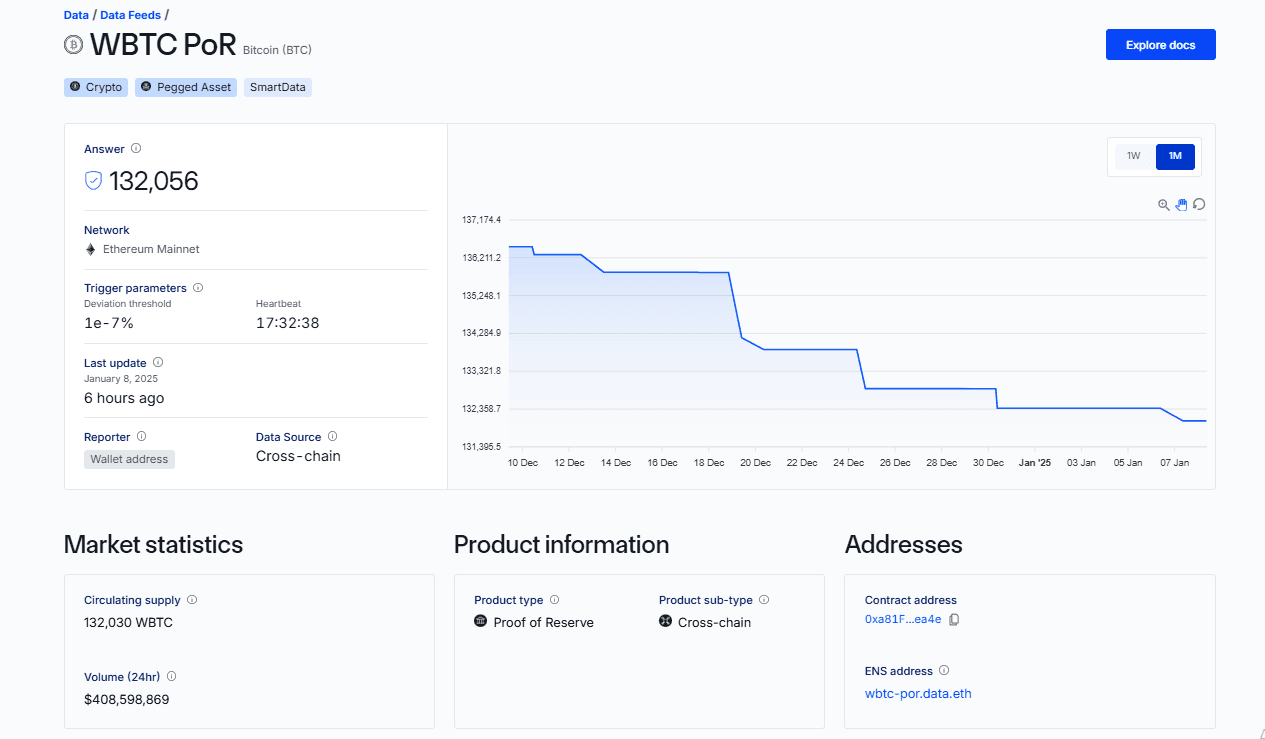

Transparency - custodians provide publicly available proof of reserves, allowing users to verify the backing of WBTC in real-time. The image below shows Chainlink's proof-of-reserve setup for WBTC.

(source: Chainlink WBTC PoR)

-

Multi-Signature Wallet - custodians utilize a multi-sig wallet to safeguard BTC reserves. Currently, WBTC DAO operates using an 8/13 multi-sig contract.

-

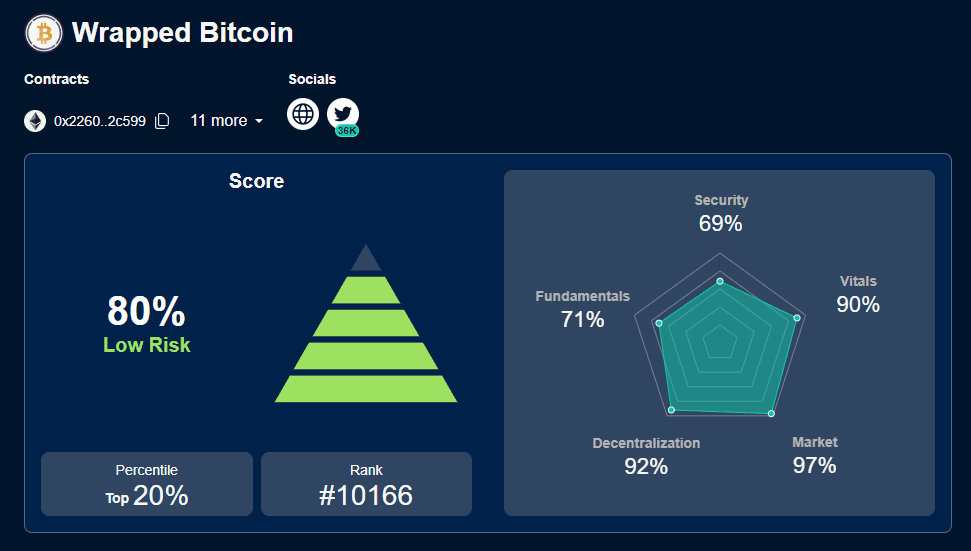

Third-Party Audits- regular audits confirm the solvency and integrity of WBTC’s reserve system, and smart contract security. The WBTC DAO code was audited by 3 independent audit firms: ChainSecurity, Solidified and Coinspect. CyberScope, also a smart contract audit platform, rates WBTC as a low-risk asset from 5 different perspectives:

(source: Cyberscope)

#3.4.5 Limitations and Risks

While WBTC has enhanced Bitcoin's accessibility in DeFi, it comes with certain trade-offs:

-

Centralization - the custodial model introduces counterparty risk, as users must trust custodians to securely hold their BTC.

-

Smart Contract Risks - as an ERC-20 token, WBTC is subject to vulnerabilities within its smart contract and any DeFi platform it integrates with.

Despite these challenges, WBTC remains one of the most effective mechanisms for bringing Bitcoin liquidity to Ethereum, solidifying its role as a bridge between two of the largest cryptocurrency ecosystems. Within the ynBTCk framework, its inclusion as part of SolvBTC reserves underscores its strategic importance in ensuring the system's efficiency and stability.

#3.5 Comparative Market Performance

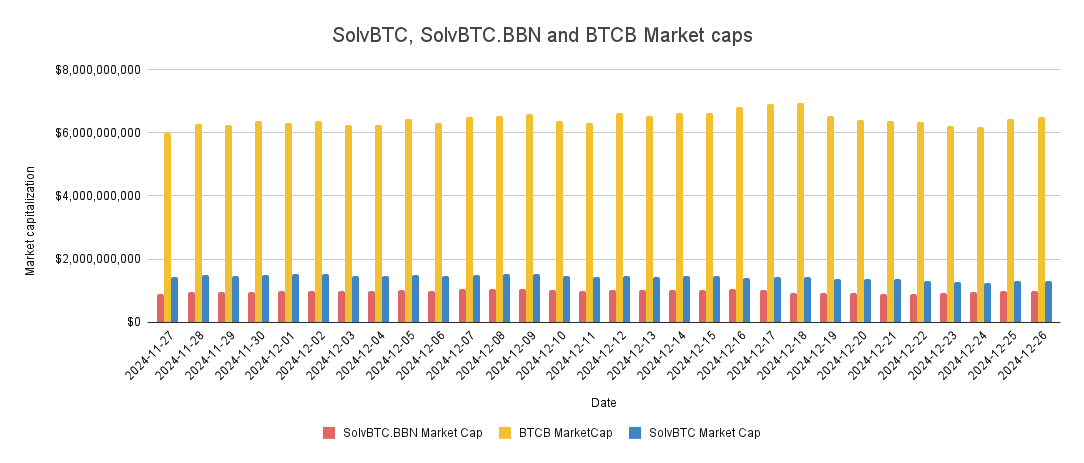

Given below are some historical metrics that cross-compare the relative adoption and utilizations of the aforementioned BTC products solvBTC, solvBTC.BBN, and BTCB.

#3.5.1 Market Cap

(source: CoinGecko) 27-11 - 26-12-2024.

#3.5.2 Trading Volume

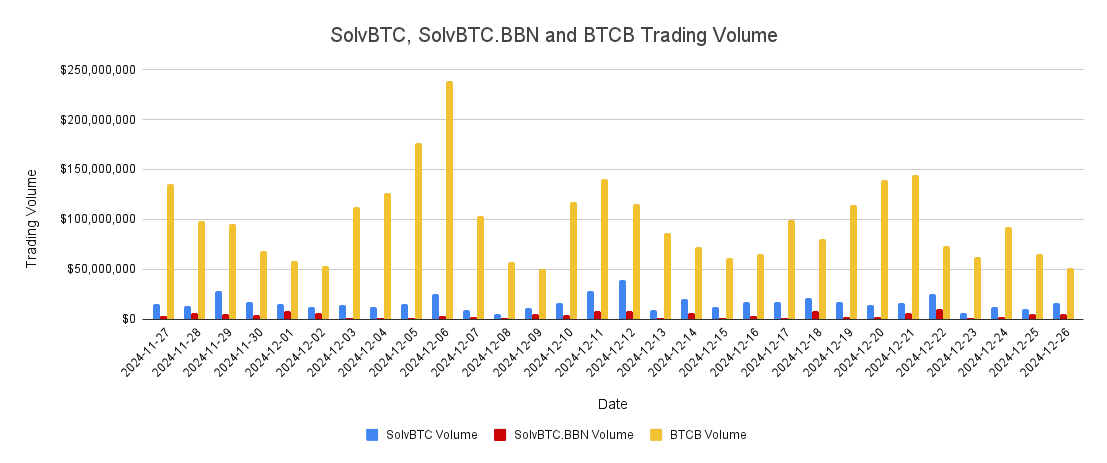

(source: CoinGecko) 27-11 - 26-12-2024.

#3.5.3 Liquidity TVL on BNB Chain

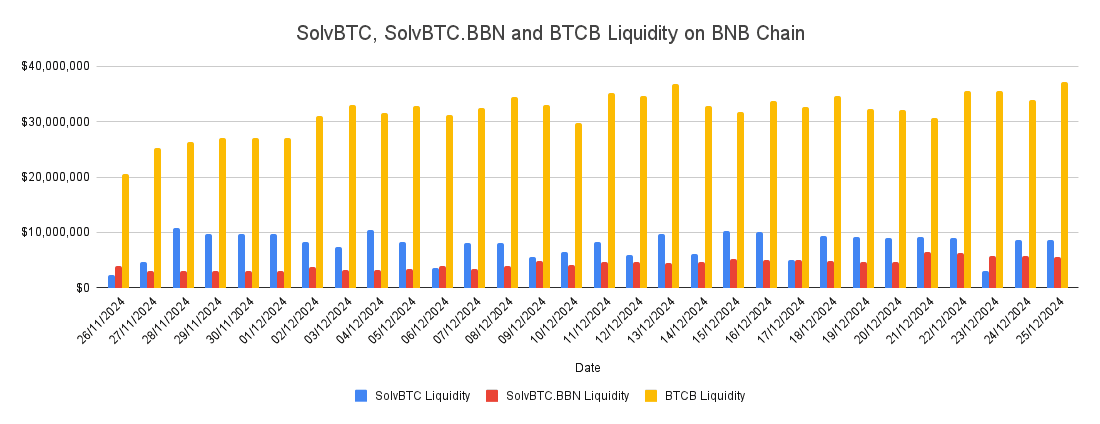

(source: DexGuru)

#Section 4: Conclusion

While the foundational protocol, Kernel, does not currently apply slashing, it is still considered early in its lifecycle. As new features like DVNs (Distributed Validator Nodes) and slashing come online, the risk profile of ynBTCk may evolve.

#4.1 Underlying Assets Risk

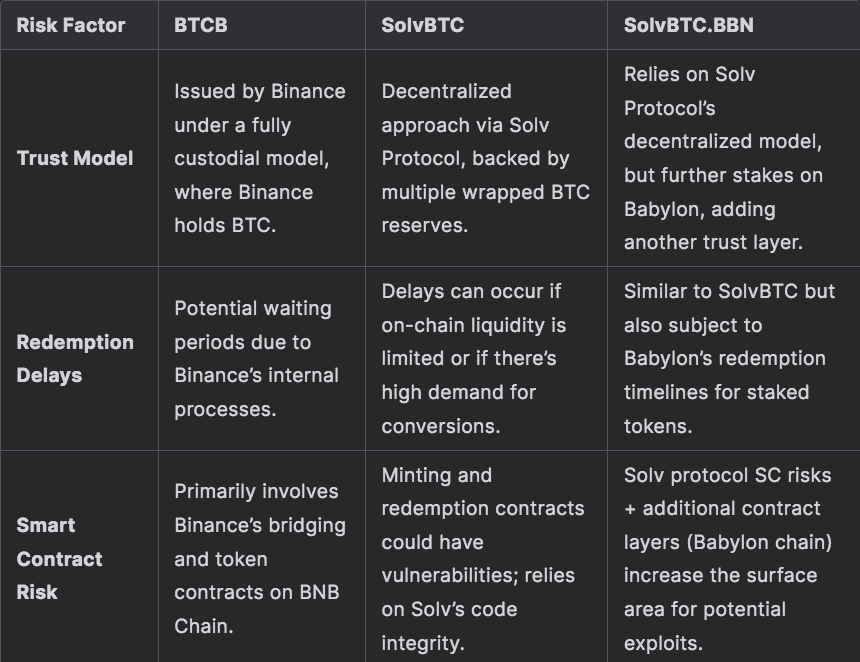

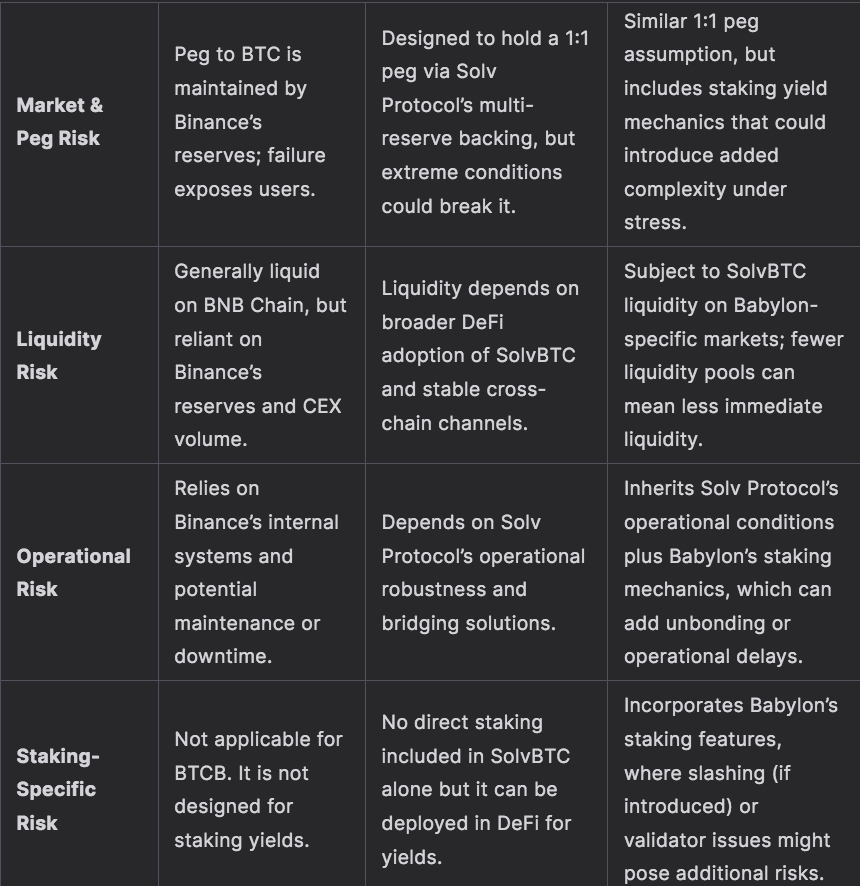

Given below are the ynBTCk underlying BTC derivatives assets, compared across key risk factors:

#4.2 Peg Performance

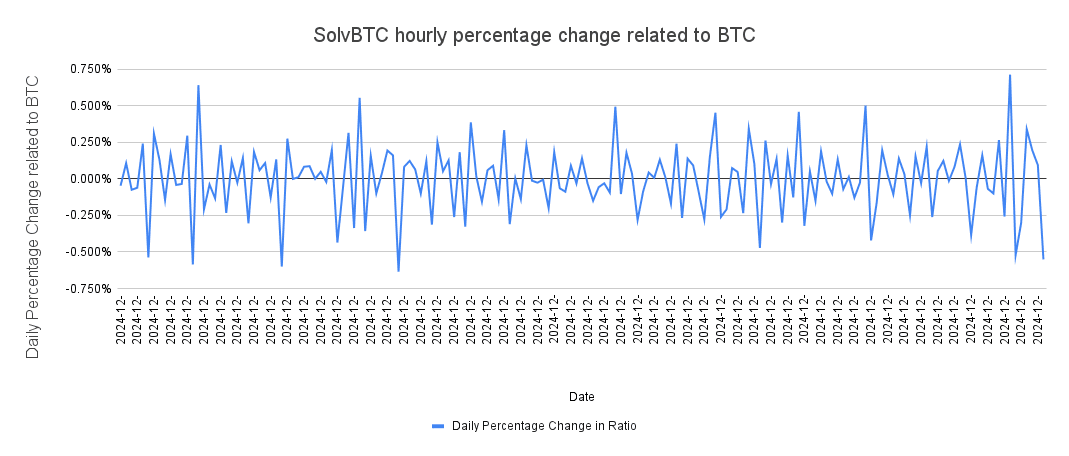

#4.2.1 solvBTC Peg Performance

solvBTC maintains a soft peg to its underlying BTC. Given below is it historical peg performance.

(source: DappRadar)

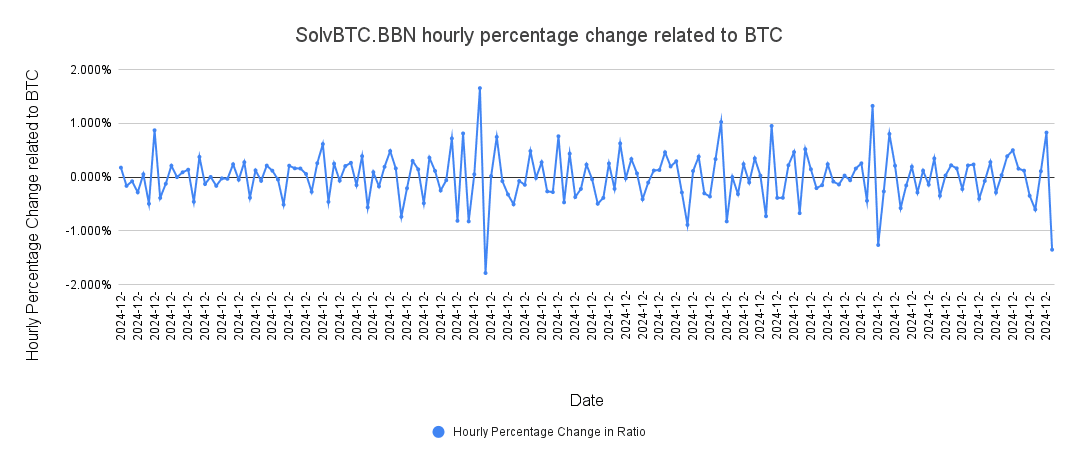

#4.2.2 solvBTC.BNN Peg Performance

Given below is solvBTC.BNN's historical peg performance.

(source: DappRadar)

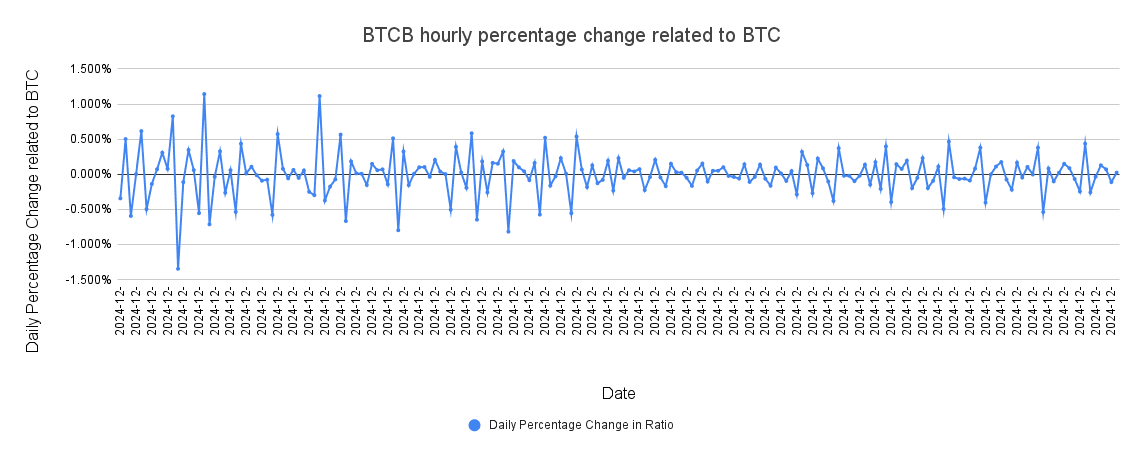

#4.2.3 BTCB Peg Performance

Given below is BTCB's historical peg performance.

(source: DappRadar)

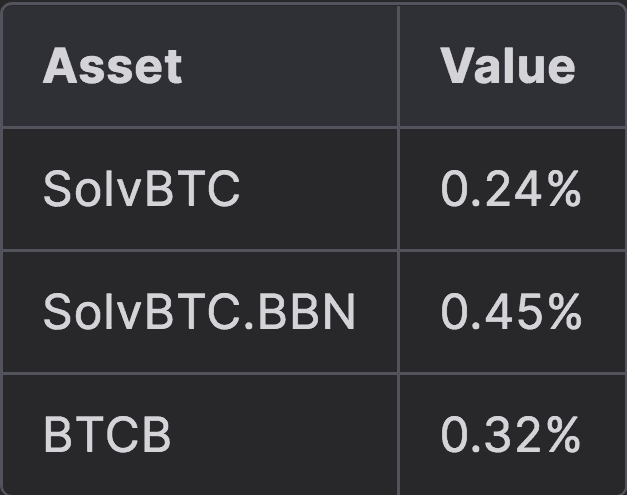

#4.2.4 Standard Deviation (Per Hour for 7 Days)

Below is a comparative snapshot of the hourly standard deviation for selected BTC derivatives over the last seven days. Standard deviation, in this context, is used to measure the volatility or price fluctuations of each asset within that time frame. Higher standard deviation values typically indicate larger swings—either upward or downward—in the asset’s price. Lower standard deviation values suggest relatively more stable pricing during the observed period.

(source: Google Sheet)

From the three BTC derivative assets underlying ynBTCk, SolvBTC exhibits the lowest hourly standard deviation over the observed 7-day period, indicating comparatively smaller price fluctuations relative to the other two assets. SolvBTC.BBN, as a staked version of SolvBTC, introduces an additional risk layer through its involvement in the Babylon Layer 2 solution, where SolvBTC can be restaked as part of the network’s economic security. Meanwhile, BTCB—Binance’s staked BTC derivative with higher liquidity and robust trading pairs on BNB Chain—falls between SolvBTC and SolvBTC.BBN in terms of volatility, balancing stability, and market depth.

#4.3 Conclusion

ynBTCk is a standalone MAX LRT strategy designed to leverage composability with a diverse range of assets, staking mechanisms, and restaking protocols. Users are strongly encouraged to gain a comprehensive understanding of the vault's underlying dependencies to accurately evaluate its overall risk profile. The performance and value of the vault are subject to various risks, including technical failures, operational challenges, and adverse market conditions, which could impact the underlying assets and, in turn, the value of ynBTCk.