A comprehensive risk review of YieldNest's ynBNBx MAX LRT

Useful Links:

#Section 1: Intro

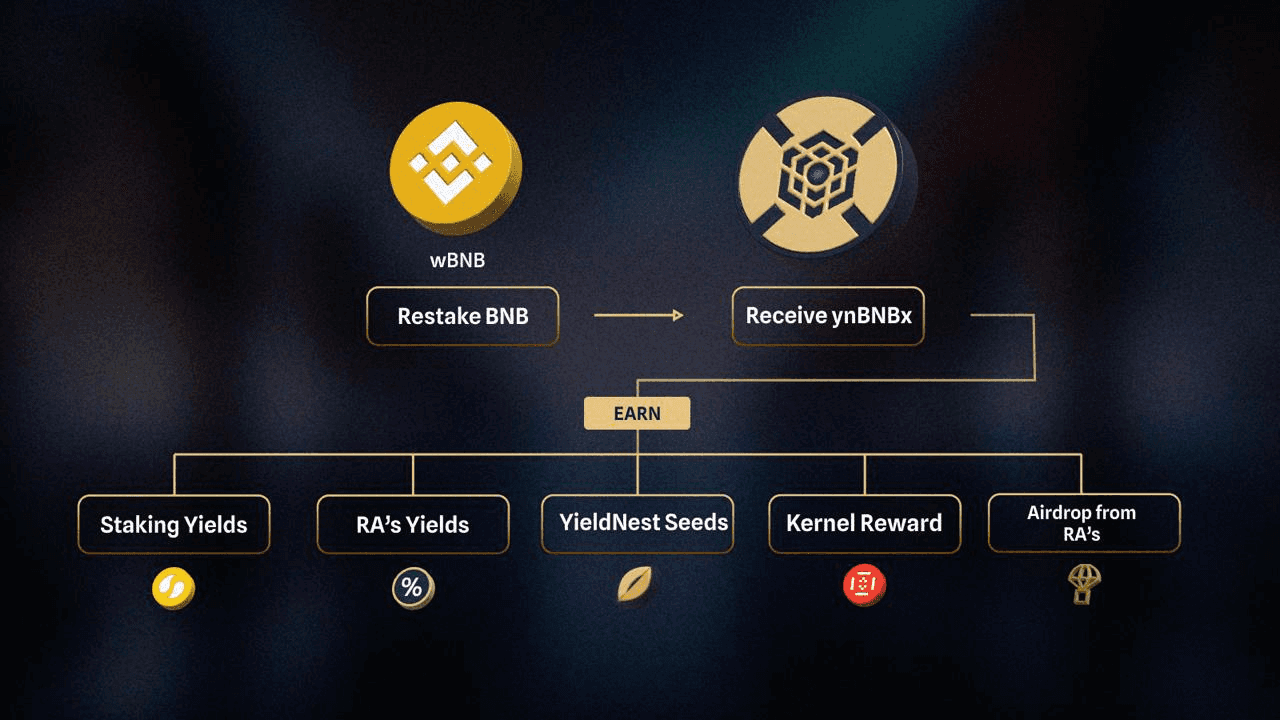

YieldNest ynBNBx is a MAX LRT that settles its accounting on BNB L1, integrating multiple BNB-connected strategies to deliver optimized yield. As a composable and liquid token, ynBNBx simplifies yield management by combining various restaking protocols and DeFi strategies into a single, user-friendly asset. This ensures users benefit from seamless compounding yields without navigating the complexity of individual strategies.

ynBNBx serves as a core component of the YieldNest ecosystem, leveraging reliable Layer 1 settlement guarantees and continuously exploring opportunities across the BNB Chain ecosystem. Its dynamic structure allows for integration with new and evolving DeFi strategies, ensuring users receive the highest risk-adjusted yields available.

This report provides a comprehensive risk assessment of the YieldNest ynBNBx product, focusing on its architecture and dependencies. The review of its structure and associated integrations ensures transparency for users and DeFi integrators, while proactively addressing potential risks to safeguard user assets.

#1.1 ynBNBx Overview

ynBNBx is YieldNest's BNB-backed liquid restaking token, settling on BNB Chain L1. It enables users to optimize their BNB holdings through a multi-strategy system that seamlessly rebalances and integrates various restaking and DeFi strategies into a single, composable, and user-friendly token. ynBNBx simplifies yield management by combining multiple yield sources into one asset, delivering compounding yields with minimal complexity.

As a MAX LRT, ynBNBx not only maximizes risk-adjusted returns but also contributes to the broader BNB Chain ecosystem by leveraging reliable Layer 1 settlement guarantees and continuously adapting to evolving opportunities across the DeFi landscape.

(source: YieldNest documentation)

In practical terms, users deposit BNB into ynBNBx and receive optimized yields generated from various protocols and strategies while maintaining exposure to the underlying BNB denomination. Rewards are auto-compounding, with the MAX LRT automatically optimizing allocations across different strategies. Underlying strategies are modular, meaning they are curated with respect to anticipated yield potential and with consideration for associated risks.

#1.2 Underlying Assets

ynBNBx integrates with multiple BNB derivatives and their restaked variants through its architecture. The asset structure employs a layered approach, where each derivative and strategy builds upon wBNB as its primary underlying asset. In rare cases of asset or strategy risks, assets will always be swapped back into their primary underlying asset (wBNB) and returned to the top-level ynBNBx, minimizing the risk of principal loss. This is made possible through the integration of HyperNative and additional tooling that enable instant incident response operations, ensuring timely ejection from affected strategies or assets within the ynBNBx basket.

-

Base Layer - wBNB (Wrapped BNB)

wBNB serves as the fundamental building block for all strategies and derivatives in the ecosystem. It's a wrapped version of native BNB, maintaining 1:1 parity and providing ERC-20 compatibility for DeFi interactions. Users can deposit either native BNB (which gets automatically wrapped) or wBNB directly.

-

slisBNB

slisBNB is a liquid staking derivative (LSD) token representing staked BNB. It allows users to earn staking rewards while retaining the flexibility to participate in DeFi activities without needing to unstake directly. By holding slisBNB, users can access liquidity, yield opportunities, and risk management tools not typically available to locked staking positions. Its value closely tracks the underlying staked BNB and the quality of the staking infrastructure. This enables capital-efficient strategies and more dynamic use of staked assets across the BNB ecosystem.

-

clisBNB

clisBNB is a “certificate” token minted on a 1:1 basis when users deposit BNB into a Collateralized Debt Position (CDP) on the Lista DAO platform. It allows holders to borrow lisUSD against their BNB collateral and still participate in Binance Launchpool events without closing their debt positions. The token is non-transferable and is automatically destroyed when users withdraw their BNB or its staked derivative (slisBNB), ensuring it always reflects the correct amount of collateral. Users also have the option to mint clisBNB to a secondary address, although once minted, it cannot be moved again. By combining borrowing capabilities with continued participation in new token launches, clisBNB offers flexibility and utility for DeFi users within the Lista DAO ecosystem.

-

asBNB (ynAsBNBk)

asBNB is a liquid staking derivative (LSD) token designed to provide users with exposure to staked BNB while maintaining liquidity for DeFi participation. It allows users to earn staking rewards without locking their assets, enabling seamless integration with various DeFi protocols on the BNB Chain. By holding asBNB, users can access staking yields while leveraging their assets in liquidity pools, lending platforms, and other yield-generating opportunities.

Exposure to these dependencies enables ynBNBx to optimize yield generation by allocating assets across different strategies based on market conditions and yield opportunities. The MAX LRT automatically manages these interactions, providing users with optimized returns through a single token while handling the underlying asset relationships internally.

However, this multi-asset exposure introduces composability risks inherent to the MAX LRT design. Each underlying asset relies on third-party protocols, which may be vulnerable to losses caused by technical bugs or operational mismanagement. Additionally, certain assets may have restrictions on immediate redemption, either during standard operation, adverse market events, or emergency interventions by protocol administrators. These factors may impact the operational capability of ynBNBx and, in extreme cases, result in permanent losses for depositors.

YieldNest seeks to mitigate these risks through the use of HyperNative and robust incident response tools, by ensuring swift action to eject from compromised assets or strategies. Nevertheless, a thorough understanding of the underlying assets and their associated risks is essential to assess the overall risk to the MAX LRT.

#1.3 Kernel Protocol Overview

Kernel protocol is a modular restaking framework on BNB Chain, integrating multiple PoS security modules and bridging protocols under one protocol. The Kernel framework is built on the Karak restaking protocol as a solution for deploying LRTs built on Karak's restaked assets, which include a diverse range of assets such as Pendle positions, DEX LPs, and yield-bearing stablecoins.

When users deposit BNB-based assets, Kernel allocates them to various restaking or PoS platforms, subsequently gathering and reinvesting earned rewards back into the MAX LRT. Although Kernel currently lacks slashing features, future enhancements like distributed validator nodes (DVNs) will introduce additional security layers.

#Section 2: ynBNBx MAX LRT Product

This section explains the technical components of the ynBNBx MAX LRT, including the overall architecture, smart contracts, audits, access control, and dependencies.

#2.1 ynBNBx Architecture

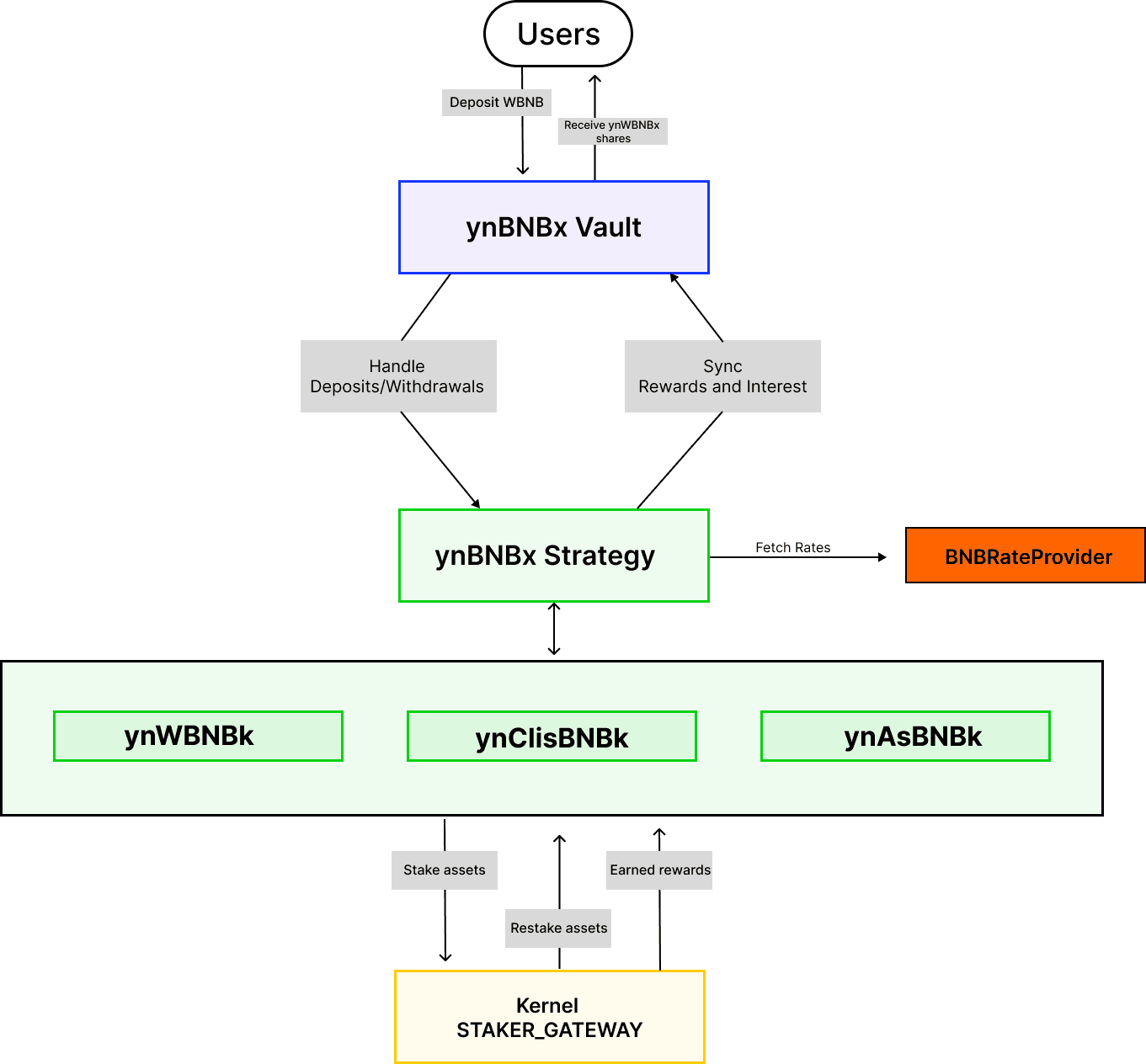

Starting with the basic design: it is denominated in BNB (the primary underlying asset is wBNB), with ERC20 derivatives SlisBNB, BNBx, clisBNB, and ynBTCk supported as underlying assets. Notably, ynBNB (currently live) will transition into a sub-strategy called ynBNBk, which the MAX LRT can accept as deposits but will typically convert into Kernel’s highest-yielding deposit for optimal returns.

(source: YieldNest)

The Buffer Strategy is a 4626-compliant vault designed to provide immediate liquidity for MAX LRT withdrawals. It maintains a portion of the underlying assets in readily accessible yield-generating strategies, ensuring users can instantly withdraw from the MAX LRT without delays. In essence, the Buffer Strategy serves as a liquid reserve that balances efficient capital deployment with the need for rapid, frictionless redemptions.

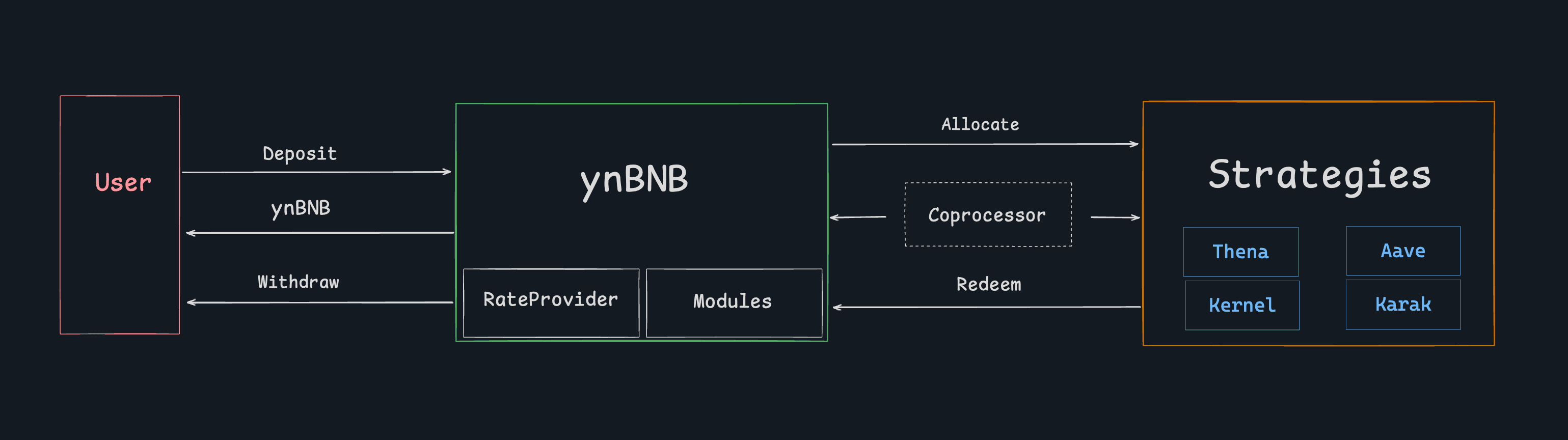

The user deposits ERC20 wBNB or its derivatives as base underlying assets into the ynBNBx MAX LRT and, in return, receives share tokens denominated in a major base asset (wBNB in this case). On the operational side, internal modules like the RateProvider are used to determine accurate pricing and conversions, while a Coprocessor helps manage asset allocation and strategy execution. At present, ynBNBx MAX primarily allocates deposited assets into the Kernel restaking strategy.

While the architecture supports standardized connectors for other DeFi protocols, these are considered future enhancements and are not active at this time. As strategies generate yield, value flows back into the vault, maintaining the vault’s underlying collateral and enabling the user to withdraw their shares, along with the accrued yield.

The diagram below visualizes the relation between the vault and ynBNBx strategies value flow in both directions:

(source: Yieldnest GitHub)

Currently supported strategies include:

-

ynWBNBk

-

ynClisBNBk

-

ynAsBNBk

Strategies incorporate underlying yieldbearing tokens as described in section 1.2 Underlying Assets.

#2.1.1 Smart Contract Architecture

ynBNBx leverages a modular architecture centered around the BaseVault and Vault contracts. These contracts implement the ERC-4626 standard for managing deposits, withdrawals, and conversions between assets and shares. By inheriting from BaseVault, the Vault contract extends functionalities like fee management through integration with FeeMath. Additionally, the architecture employs a TransparentUpgradeableProxy model, which separates logic and storage to enable seamless upgrades without losing historical state data. This robust design ensures flexibility, scalability, and security.

The ynBNBx MAX LRT, implemented through the Vaults.sol contract, introduces an advanced architecture that supports multiple restaking protocols, with Kernel being the initial integration, while maintaining flexibility for future protocol additions. This extensible design allows for customized strategies tailored to different asset types, as demonstrated by specialized implementations like ynClisBNBk for slisBNB, ynWBNBk for wrapped BNB, and ynAsBNBk for asBNB, each optimized for their respective underlying assets while sharing the core vault infrastructure. The modular approach not only ensures robust security and scalability but also facilitates integration of new restaking protocols and asset-specific strategies through standardized interfaces and carefully designed extension points in the contract architecture.

#2.1.2 Upgradeable (Proxy) Contract Structure

The ynBNBx token runs on an upgradeable proxy contract deployed on the BNB Chain. This design choice allows developers to introduce improvements or fixes without changing the contract's address, ensuring minimal disruption for existing depositors. By separating the contract's logic from its storage, YieldNest can seamlessly upgrade ynBNBx's functionality in response to user feedback, network upgrades, or new DeFi opportunities—without forcing a complete redeployment of the token.

#2.1.3 Guard Transaction Validation Engine

The Guard validation engine is a critical security component of the MAX LRT architecture. It ensures that all transactions executed through the generic processor functionality adhere to predefined rules, providing robust on-chain enforcement for safe and transparent operations.

The processor functionality is designed to flexibly support all transaction types within the Max LRT ecosystem—such as deposits, withdrawals, swaps, and more—without requiring further code changes or upgrades. To maintain security within this flexible framework, the Guard engine implements a whitelist-based rule system that precisely defines which transactions are allowed.

Key components of the Guard validation engine include:

-

Target-Level Access Control - Only a predefined set of contracts (internal or external) can act as transaction targets for the vault processor.

-

Function-Level Access Control - Only specific functions on the whitelisted targets can be called on the defined targets.

-

Parameter Validation - the engine validates address parameters of permitted functions against an address whitelist.

-

Custom Validation Logic - for the cases when a transaction needs arbitrary complex validation logic a custom external contract can be configured to run any custom validation logic

The strengths of this approach are:

-

Modular Design: Separation of concerns between core vault functionality and strategy management and business logic which can reside in periphery contracts or coprocessor networks.

-

Unlimited extensibility: Support for custom validators through the IValidator interface

-

Granular Control: Rules can be set per function and parameter

-

Fail-Safe Defaults: Reverts if the rule is not active (whitelist approach).

The Guard.sol contract handles the validation logic and rule management, while the BaseVault.sol contract implements the processor functionality, allowing rules to be added, edited, or removed. To ensure transparency and security, any modifications to these rules are subject to a timelock delay.

#2.1.4 Contract Dependencies

The MAX LRT heavily relies on external integrations for dynamic rate calculations and asset management. It incorporates rate providers via the IProvider interface to fetch real-time exchange rates for supported assets, BNB in this case, and derivative tokens like slisBNB and BNBx. Advanced vault features include multi-asset support through functions like depositAsset, previewDepositAsset, and getAssets and conversion functions using IProvider to fetch exchange rates dynamically for asset conversions.

ReentrancyGuardUpgradeable prevents reentrancy attacks on functions like deposit, withdraw, or processor transactions.

The design also includes dynamic fee computation mechanisms using FeeMath for optimized operations. Native asset counting, where the MAX LRT optionally includes native tokens like BNB in its total assets, enhancing the comprehensiveness of its accounting system. Automated processes ensure that total assets are computed accurately and in real-time, drawing data from all integrated modules. This automation reduces administrative overhead and improves operational efficiency.

#2.1.5 Role-Based Access Control (RBAC)

ynBNBx supports dynamic asset management, allowing administrators to add, activate, and update assets using functions like addAsset and updateAsset. This capability provides flexibility to accommodate new assets and adjust their parameters as needed. The MAX LRT also supports custom withdrawal fee configurations, allowing dynamic fee adjustments while ensuring operational transparency.

All sensitive contract functions (e.g., fee updates, asset management, and unpausing) are protected by roles, limiting access to privileged users. By leveraging role-based access control, ynBNBx ensures both security and operational clarity, preventing unauthorized access while maintaining flexibility for administrators. Role management uses OpenZeppelin's AccessControlUpgradeable.

Roles such as PROCESSOR_MANAGER_ROLE, BUFFER_MANAGER_ROLE, and ASSET_MANAGER_ROLE allow for granular control over asset management, staking, and operational rules. Addresses with PAUSER_ROLE / UNPAUSER_ROLE may temporarily halt key operations like deposit, mint, withdraw, and redeem to safeguard assets during emergencies or vulnerabilities, and resume normal operations after issues are resolved.

The admin role serves as the highest authority, capable of adding or removing assets and configuring policies. The admin can grant or revoke any role in the contract by calling grantRole and revokeRole to the following roles:

-

PAUSER_ROLE; -

UNPAUSER_ROLE; -

ASSET_MANAGER_ROLE; -

FEE_MANAGER_ROLE; -

PROCESSOR_ROLE; -

BUFFER_MANAGER_ROLE; -

EMERGENCY_WITHDRAWAL_ROLE; -

TREASURY_ROLE; -

EXTENSION_MANAGER_ROLE;

Among these roles, only the EXTENSION_MANAGER_ROLE is unique to the core contract, as it's specifically designed to manage extension integrations and configurations.

#2.2 Audits

YieldNest has engaged Zokyo to conduct a security audit of its core contracts, in addition to in-house security checks, with the following being the primary focus areas: src/BaseVault.sol, src/module/Guard.sol, src/module/Provider.sol, src/Vault.sol, and src/ynETHxVault.sol. The audit highlighted one high-risk issue and several low-risk issues, each addressed in varying ways by YieldNest.

The audit reported a decimals issue in the addAsset function whereby the value is directly passed by the caller and is not validated against the actual decimals of the ERC20 token, creating a risk of misconfiguration. The issue was resolved by YieldNest.

With the current lack of an active bug bounty program, Zokyo emphasized the importance of implementing such to encourage ongoing security analysis and incentivize external contributions to YieldNest’s smart contracts safety. YieldNest is actively working to establish a bug bounty program.

Yieldnest's MAX LRT has also undergone audit by Composable Security in December 2024. The report mentions the same decimal issue and confirms it has been removed from the code. 8 medium issues and 5 low issues were found, with all being either resolved or acknowledged.

While the above audit reports specifically addressed the MAX LRT, YieldNest has undergone a number of audits related to its various products. These are cataloged in the protocol docs.

#2.3 Dependencies

A brief overview of the ynBNBx dependencies is given in the following sub-sections. The remainder of this report will be devoted to further examination of these dependencies.

#2.3.1 Liquid Staking Protocols

ynBNBx integrates with multiple liquid staking protocols on BNB Chain to maximize yield generation. The primary protocols include:

Each protocol has undergone security audits and maintains active development teams, though they carry different levels of maturity and market adoption.

#2.3.2 BNB Derivative Assets

The accepted BNB derivatives introduce varying risk profiles based on their respective protocols:

-

wBNB (Wrapped BNB) - The native wrapped version of BNB, widely used across the ecosystem.

-

Liquid staking tokens - Each brings unique characteristics influenced by their underlying protocol's architecture, validator selection, and governance mechanisms.

-

Protocol-specific risks - Including smart contract risks, validator performance, and protocol-specific operational risks related to access control and governance.

#2.3.3 Validator Networks

The underlying BNB Chain validator network directly impacts the performance of integrated liquid staking protocols. Key considerations include:

-

Validator selection processes by each liquid staking protocol

-

Slashing risks and their mitigation strategies

-

Network performance and stability

-

Validator commission rates and their impact on staking returns

The security and reliability of these validator networks are fundamental to the overall risk profile of ynBNBx and its supported assets.

#Section 3: Underlying BNB Products

This section will elaborate on BNB staking products generally and specifically the assets underlying the ynBNBx MAX LRT, as these assets constitute critical dependencies of the overall product.

#3.1 slisBNB/clisBNB: ListaDAO

ListaDAO is a liquidity staking and CDP (LSDFi) protocol built on the BNB Chain. The protocol aims to maximize the utility of staked assets by providing liquid staking derivatives while maintaining the security and decentralization benefits of traditional staking. As one of the leading liquid staking solutions on BNB Chain, ListaDAO has gained significant traction and institutional backing, including investment from Binance.

#3.1.1 slisBNB - Liquid Staking Derivative

ListaDAO's primary liquid staking derivative token is slisBNB, representing staked BNB positions within the protocol. The slisBNB LST is a yieldbearing token. It implements a design where its value gradually increases relative to BNB as staking rewards accumulate over time. This appreciation mechanism is built into the token's core economics, providing users with a representation of both their principal stake and earned rewards.

Each slisBNB token maintains a 1:1 backing with BNB in the protocol, ensuring fundamental value preservation. While users' BNB is staked, slisBNB tokens remain fully liquid and can be utilized across various DeFi protocols on the BNB Chain, enabling participation in lending, borrowing, or yield farming activities while simultaneously earning staking rewards. The token has established itself as a widely recognized liquid staking derivative within the BNB Chain ecosystem, achieving significant integration across major DeFi platforms.

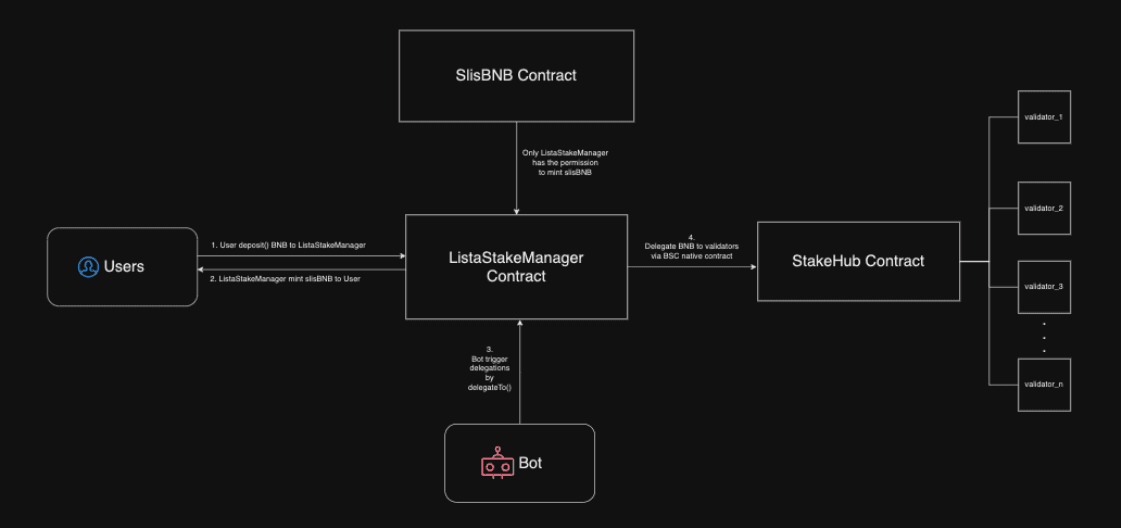

#3.1.2 slisBNB Minting and Redemption Process

The slisBNB token minting and redemption mechanism enables users to participate in liquid staking. In the slisBNB minting process, users deposit their BNB into the ListaDAO protocol (ListaStakeManager contract), which then mints an equivalent amount of slisBNB tokens based on the current exchange rate. This exchange rate is dynamic and reflects the accumulated staking rewards within the system. Once minting is complete, users immediately begin earning staking rewards, which are represented by the gradually increasing value of their slisBNB tokens relative to BNB.

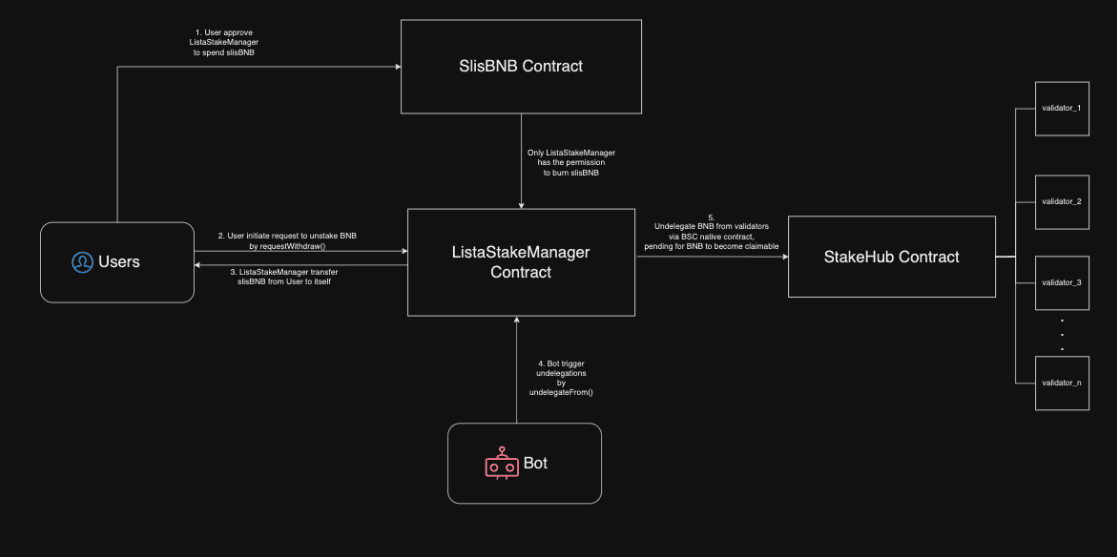

ListaStakeManager functionalities:

(source: ListaDAO documentation)

The redemption process allows users to convert their slisBNB back to the underlying BNB. However, this process includes a mandatory cooldown period, which serves as a security measure and helps maintain protocol stability. When redeeming, users receive BNB at the current exchange rate, which accounts for all accumulated staking rewards during their holding period. This means that the amount of BNB received upon redemption will typically be higher than the initial deposit, reflecting the earned staking rewards.

ListaStakeManager unstaking:

(source: ListaDAO documentation)

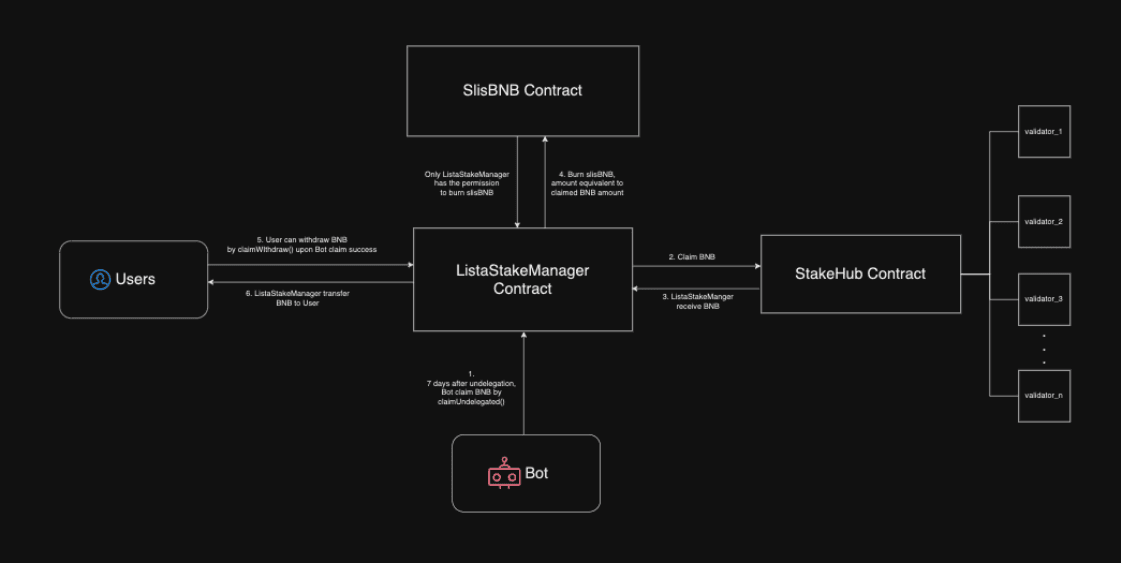

ListaStakeManager withdrawal:

(source: ListaDAO documentation)

#3.1.3 slisBNB Cross-chain Infrastructure

The slisBNB cross-chain infrastructure enables token transfers between different blockchain networks through a system of smart contracts and off-chain services. At its core, the mechanism operates by locking tokens on the source chain and minting equivalent tokens on the destination chain, all secured by a verification network.

The system is built around two main smart contract structures: the ListaOFTAdapter and ListaOFT contracts, which work in conjunction with LayerZero endpoints. The ListaOFTAdapter manages token locking and unlocking operations, implements transfer limits, and includes an emergency switch for risk management. These contracts integrate with LayerZero's infrastructure to facilitate secure cross-chain messaging and token transfers.

Supporting this on-chain infrastructure is a network of off-chain services. The Lista Guardian continuously monitors bridge operations and can trigger emergency halts if needed. LayerZero's Decentralized Verification Network (DVN) provides transaction verification, while the Executor service handles the final transaction processing on destination chains.

The cross-chain transfer process follows a carefully orchestrated sequence. When transferring from BSC to Ethereum, tokens are first locked in the ListaOFTAdapter, verified by the DVN, and then minted on Ethereum through the ListaOFT contract. The reverse process from Ethereum to BSC involves burning tokens on Ethereum, followed by unlocking the equivalent amount on BSC after verification.

Multiple security measures protect the system. Transfer limits prevent excessive token movements, while emergency switches on both chains can immediately halt operations if needed. The Lista Guardian provides continuous monitoring and can trigger these emergency measures proactively. Additionally, the system maintains continuous reconciliation of token supplies across chains to ensure accuracy and prevent supply discrepancies.

#3.1.4 clisBNB - Certificate Token for BNB Deposits

clisBNB serves as a certificate token within the Lista DAO ecosystem, representing BNB deposits in Collateralized Debt Positions (CDPs). When users deposit BNB into the platform, they receive an equivalent amount of clisBNB, which acts as a digital receipt of their deposit. This non-transferable token is specifically designed to enable users to participate in Binance Launchpool activities while maintaining their CDP positions on Lista DAO.

The token incorporates several key features that ensure its security and functionality within the ecosystem. Upon withdrawal of the underlying BNB or slisBNB from the CDP, the corresponding clisBNB is automatically burned to maintain an accurate representation of active deposits. Users have the flexibility to mint clisBNB to a different address during the initial deposit, though this address becomes permanent once selected. This feature is particularly useful for users who want to manage Launchpool activities from a separate wallet while maintaining their CDP position.

Currently, clisBNB operates primarily as a receipt token with focused utility for Binance Launchpool participation. The token allows users to leverage their BNB deposits for borrowing lisUSD on Lista DAO while simultaneously participating in exclusive token launch events through their Binance Web3 MPC wallet. This dual functionality provides users with enhanced utility for their BNB holdings, though the token's features remain relatively limited in the current implementation phase.

#3.1.5 slisBNB - Oracle Mechanism

The SlisBnbOracle contract is a specialized oracle within the ListaDAO ecosystem, designed to calculate the effective price of slisBNB by leveraging both external price feeds and internal ecosystem data. It integrates several key components to achieve this functionality.

The contract imports three essential interfaces: AggregatorV3Interface, which facilitates interaction with Chainlink price feeds to provide accurate market data; ISnBnbStakeManager, which allows interaction with the staking manager to handle staking-related conversions; and IResilientOracle, which ensures robust and reliable price data by fetching asset prices from a resilient oracle.

Several state variables are critical to the contract’s operation. The priceFeed variable represents a Chainlink price feed instance, initialized with an aggregator address. The stakeManagerAddr variable stores the address of the SnBnbStakeManager contract, responsible for managing staking operations and conversions. Similarly, the resilientOracleAddr holds the address of the ResilientOracle contract, which provides reliable token price data. Lastly, the TOKEN variable refers to the address of the wBNB token, the specific asset for which the price is fetched.

The contract is initialized through the initialize function, which links the SlisBnbOracle to a Chainlink price feed aggregator by accepting the aggregator’s address as an input. This setup ensures that the contract can seamlessly integrate external price data into its calculations.

By combining these components, the SlisBnbOracle contract ensures accurate and reliable pricing of slisBNB, making it a vital part of the ListaDAO infrastructure. Its functionality supports various ecosystem operations, including staking, liquidity provision, and price discovery.

#3.1.6 slisBNB Market Performance

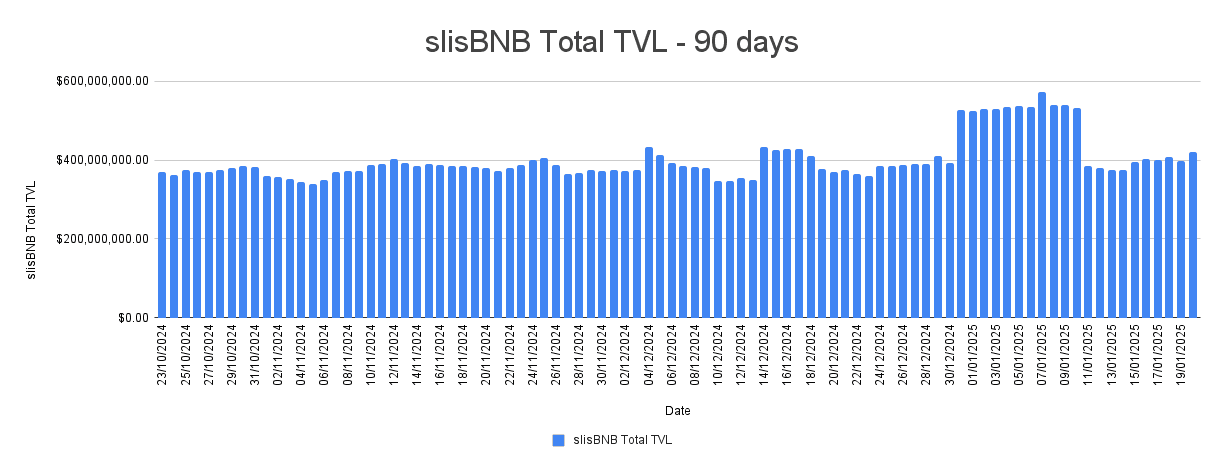

Below is a set of market performance metrics for slisBNB, including historical TVL, peg performance, and secondary market liquidity.

Over the observed 90-day period, ListaDAO has maintained a relatively consistent TVL of staked BNB at approximately $400M.

slisBNB TVL over 90 days

(source: Dune Analytics)

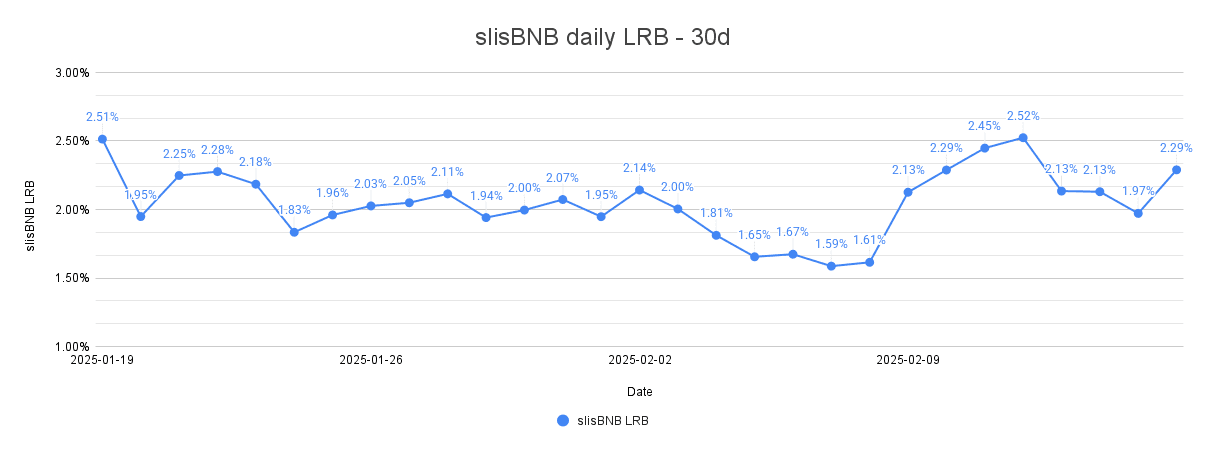

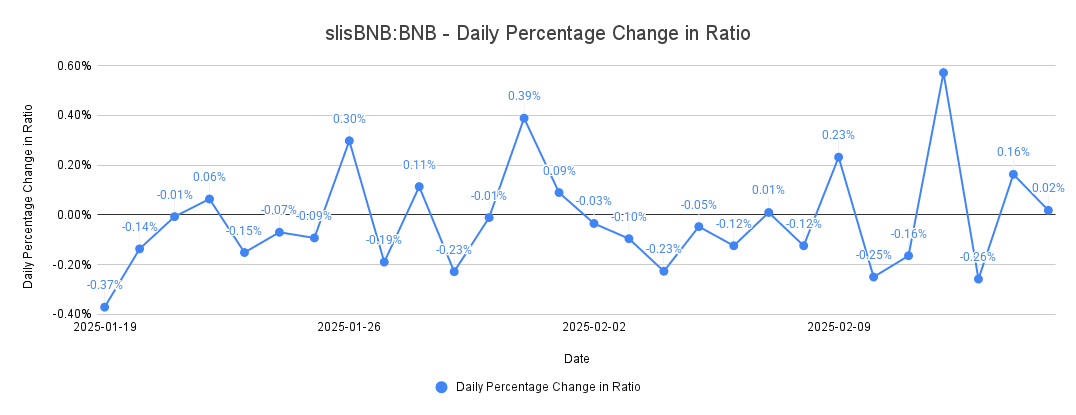

The Liquid Restaking Basis (LRB) references the relative historical market price of slisBNB against the underlying BNB. The LRB demonstrates a stable range between 1.59% and 2.52%, reflecting both accumulated staking rewards and market premium. The metric's consistency above 1.5% indicates healthy market functioning and proper value accrual mechanics.

slisBNB Liquid Restaking Basis

(source: CMC)

Daily price ratio fluctuations contained within a ±0.4% band demonstrate efficient price discovery and healthy market dynamics around the baseline appreciation rate. The tight range of variations, with maximum moves of +0.55% to -0.37%, suggest the market effectively prices both the continuous reward accrual mechanism and short-term supply/demand factors. This stability is particularly noteworthy for a value-accruing asset, as it indicates minimal market friction in the price discovery process.

slisBNB volatility in relation to BNB

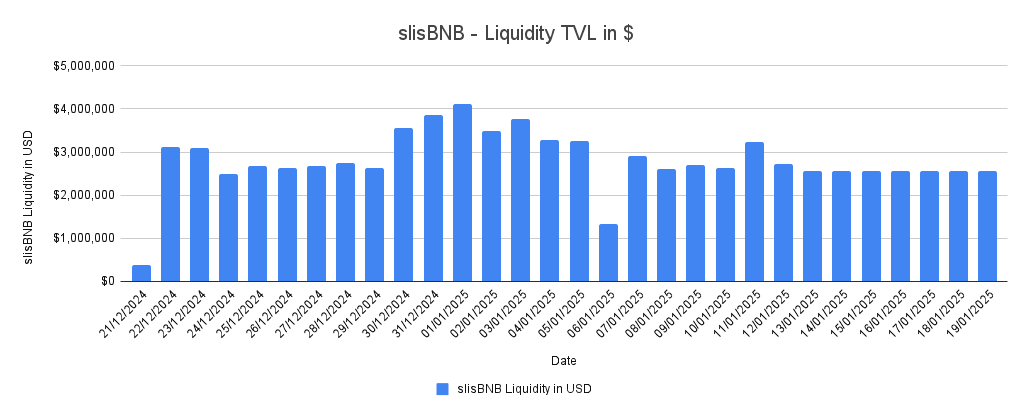

The top 3 slisBNB/BNB liquidity pools by TVL are as follows:

-

Pancakeswap slisBNB/BNB: ~$5.93m

-

Theta Fusion slisBNb/BNB: ~$2.48m

-

Wombat Exchange BNB/slisBNB: $780.8k

Liquidity depth, according to data from DexGuru, track the USD value of tokens available to be swapped into across all DEX venues. This value has remained relatively stable over the past month, with periodic deviations.

slisBNB liquidity TVL

(source: DexGuru)

#3.1.6 Audits and Bug Bounty Program

A full list of ListaDAO third-party audits can be found here.

-

Bailsec - Lista Dao - slisBNB Provider - Final Report - November 2024.

-

BlockSec - Lista Dao - slisBNB Provider and VotingIncentive - November 2024.

-

Salus Security - Emission Voting and ClisBNB Launchpool Distributor - October 2024.

-

BlockSec - Emission Voting and ClisBNB Launchpool Distributor - October 2024.

-

PeckShield - slisBNBOracle - April 2024.

-

PeckShield - ListaStakeManager - May 2024.

-

BlockSec - ListaStakeManager - May 2024.

The ListaDAO bug bounty program is managed by ImmuneFi with a maximum bounty of $1m at the time of writing.

#3.2 asBNB: Astherus

Astherus is a comprehensive multi-asset liquidity hub designed to maximize real yield for crypto assets. The platform stands out by focusing on enhancing digital asset utility while providing DeFi users with sustainable profit opportunities across multiple blockchains. Through its approach, users can leverage their assets for multiple purposes, including trading derivatives, stablecoin yield farming, and various earn strategies, all while maintaining support across different blockchain networks.

Asthereus seeks to address what it considers to be three key challenges in DeFi: limited asset utility, suboptimal returns, and a fragmented ecosystem. It addresses these issues through its comprehensive solution centered on AstherusEarn, a dedicated real yield layer that amplifies returns. This layer combines high-yield DeFi strategies, CeDeFi strategies, native rewards, and ecosystem yield opportunities to maximize benefits for users.

#3.2.1 Protocol architecture: The three layers

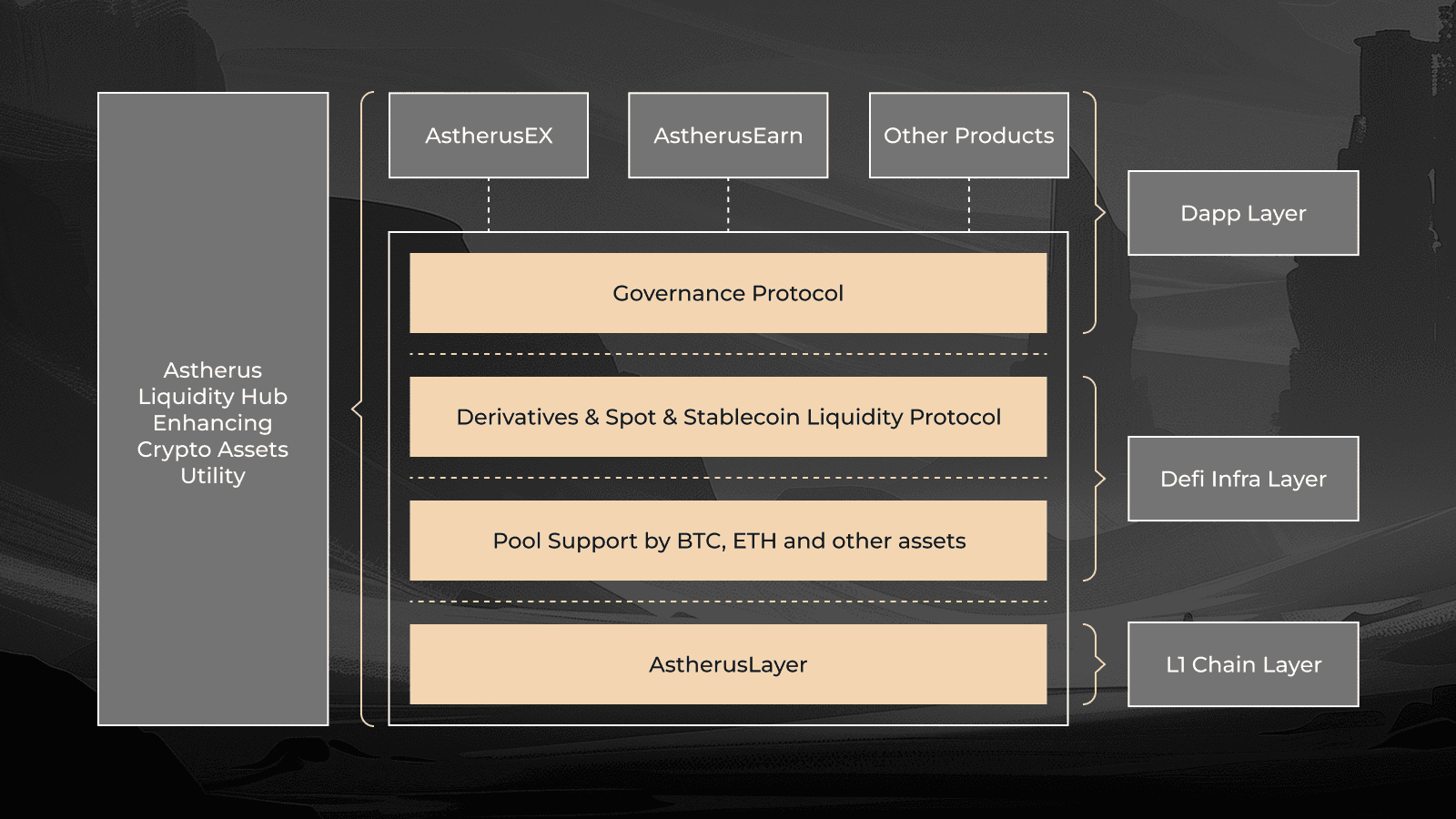

Astherus operates through a three-layer architecture that integrates user-facing applications, DeFi infrastructure, and blockchain technology to deliver a comprehensive ecosystem for digital asset management and yield generation.

-

The dApp Layer serves as the front-facing interface of Astherus, hosting applications like AstherusEX and AstherusEarn that provide direct utility for users' crypto assets. These applications generate APY rewards through various DeFi activities and serve as the primary point of interaction for users engaging with the protocol.

-

The DeFi Infrastructure Layer functions as the backbone of the protocol, aggregating liquidity from multiple asset pools and providing essential infrastructure for the ecosystem. This layer establishes the foundation for Astherus's stablecoin and yield protocol while incorporating an innovative derivatives clearinghouse, enabling developers to build future DApps seamlessly on the platform.

-

The L1 Chain, known as AstherusLayer, represents the protocol's foundational blockchain layer, specifically optimized for DeFi operations. This specialized Layer-1 blockchain supports multi-asset staking capabilities and uniquely integrates BNB as its gas fee mechanism, though further details about this layer are still in development and will be shared in the future.

(source: Astherus documentation)

#3.2.2 AstherusEarn

AstherusEarn represents a real yield layer within the Astherus ecosystem, specifically engineered to amplify user returns. As an automated yield pool, it combines robust security measures with high-yield strategies to maximize user benefits. The platform's intuitive design ensures that complex DeFi operations are accessible to users of all experience levels.

(source: Astherus documentation)

Key Features:

-

Strategic Yield Generation: AstherusEarn implements a combination of DeFi and CeDeFi strategies to optimize returns while maintaining strong security standards. The platform carefully selects and executes strategies that balance risk and reward, targeting sustainable yield generation for users. Through these curated approaches, users can access premium earning opportunities with minimal effort.

-

Security Infrastructure: Security stands as a cornerstone of AstherusEarn, implemented through a strategic partnership with Ceffu for CeDeFi asToken products. The platform maintains risk control measures for DeFi asToken products, with all smart contracts undergoing thorough audits.

-

Real-World Asset Integration: Through collaboration with Ceffu for asset custody, AstherusEarn introduces asUSDF, an innovative stablecoin solution backed by crypto assets and short futures positions. This integration bridges the gap between traditional finance and DeFi, offering users exposure to diverse yield sources. The platform's stablecoin strategy provides an additional layer of stability to the ecosystem.

-

User Experience: AstherusEarn prioritizes user accessibility through its one-click staking feature, removing traditional barriers to entry in DeFi yield farming. The platform's streamlined interface allows users to easily participate in lucrative opportunities without navigating complex protocols. Additionally, users can earn airdrop points, which provide allocation opportunities for the ecosystem's native token.

AstherusEarn's foundation is built upon its asToken system, which includes various assets such as asBTC, asUSDF, and most notably asBNB. While the platform supports multiple assets, our focus is on asBNB, which is part of the ynBNBx MAX LRT.

#3.2.3 asBNB Minting and Redemption

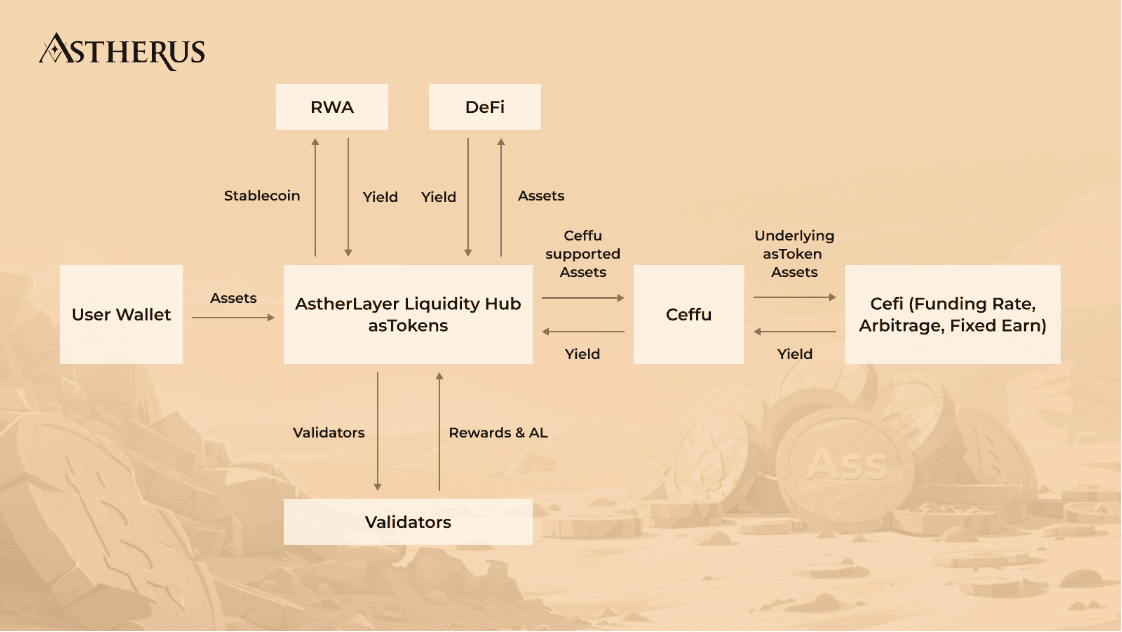

asBNB is one of the AstherusEarn products, a liquid staking derivative minted by slisBNB or BNB deposits. asBNB is essentially slisBNB staked into AstherusEarn, converted into clisBNB (by ListaDAO), and used to participate in Binance Launchpools.

The asBNB minting process involves two primary input methods: direct BNB staking or slisBNB staking. When users provide BNB, it's automatically converted to slisBNB first. The slisBNB is then used to mint asBNB through AstherusEarn. This process enables users to earn multiple rewards, including Binance Launchpool returns, Lista stardust rewards, Au Points for Astherus airdrops, and additional benefits from Binance Hodler and Megadrop rewards. During withdrawals, users always receive slisBNB regardless of their initial input asset.

When Binance Launchpool is active, users will not be able to mint asBNB. asBNB mints will open after the launchpool ends and asBNB NAV is updated. After returns generated from the launchpool are distributed, it may take about 3-5 business days for launchpool rewards to be reflected in the asBNB NAV.

#3.2.4 Smart Contracts Architecture

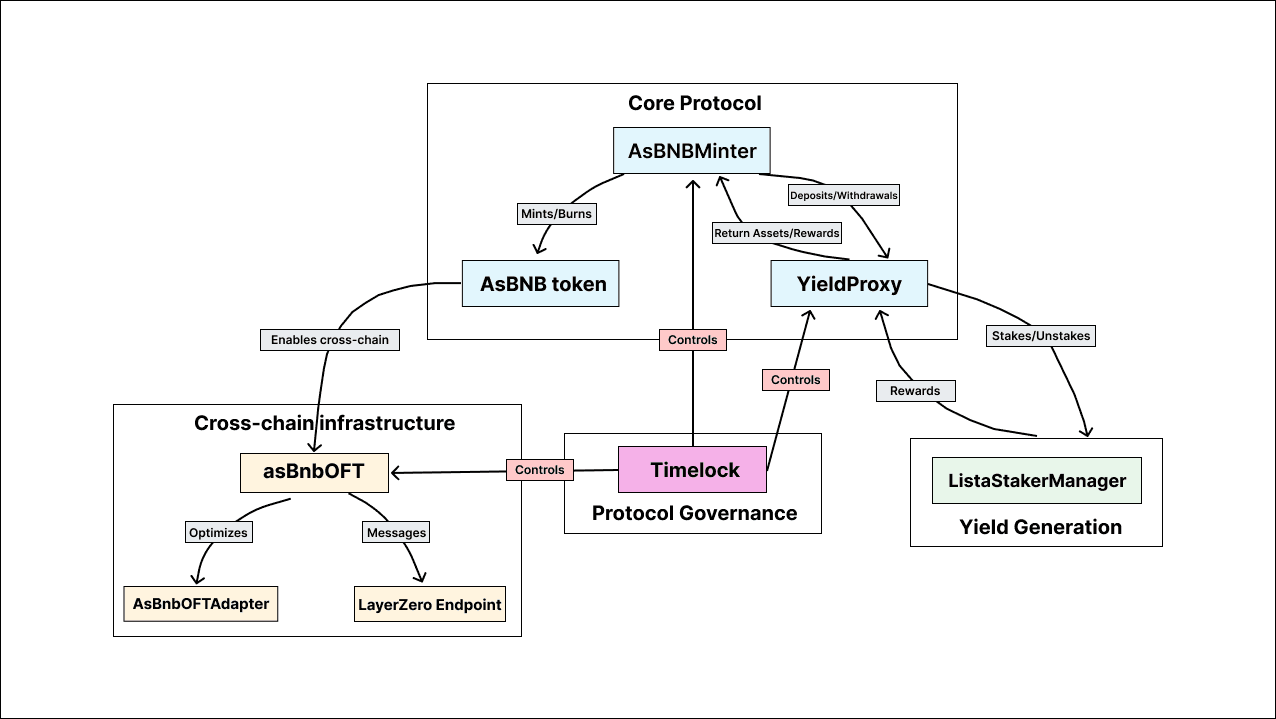

(source: Astherus Github)

AsBNB is the ERC20 yield-bearing BNB derivative that provides essential functionalities such as token standardization, ownership control, and gasless transactions (ERC20 OpenZeppelin). The contract allows only a designated minter to mint or burn AsBNB, ensuring controlled issuance and removal of tokens. The owner of the contract has the ability to update the minter via the setMinter function.

The AsBnbMinter contract handles the minting and burning of AsBNB tokens and integration with underlying yield strategies. The contract uses AccessControl to define various roles such as PAUSER, MANAGER, and BOT. This contract enables users to deposit BNB or slisBNB to mint AsBNB through the mintAsBnb function and allows token holders to burn AsBNB to withdraw the underlying assets using the burnAsBnb function. The contract supports cross-chain transactions by implementing the LayerZero Omnichain Fungible Token (OFT) framework. To handle system loads efficiently, it maintains a mint queue (tokenMintReqQueue) for processing pending requests. The contract also facilitates rewards compounding by reinvesting profits through its compoundRewards functionality.

The YieldProxy contract acts as the central coordinator for managing and optimizing yield generation strategies. It facilitates deposits into a StakeManager to convert BNB into staked BNB derivative slisBNB. Additionally, it integrates with the slisBNBProvider to collateralize derivatives and earn yield. The contract tracks yield-generating activities through an activities array and provides mechanisms for settling these activities while compounding rewards via the settleActivity function. It also supports withdrawals, enabling users to retrieve both native tokens and reward tokens. Governance and administrative controls are built into the contract, allowing authorized administrators to pause or unpause operations, delegate tokens, and configure key parameters such as the stakeManager and mpcWallet.

The Timelock contract implements a governance mechanism to enhance the security and transparency of critical actions within the system. Based on OpenZeppelin’s TimelockController, it enforces a governance delay by requiring a minimum delay (minDelay = 6h) before executing tasks and capping delays with a MAX_DELAY. It uses a role-based access system, where proposers schedule tasks and executors carry them out after the delay. Task management is simplified with functions like scheduleTask for defining tasks and executeTask for executing them post-delay.

AsBnbOFT, AsBnbOFTAdapter and TransferLimiter contracts enable and enhance cross-chain functionality for asBNB by using the LayerZero Omnichain Fungible Token (OFT) framework. AsBnbOFT extends the core functionality of AsBNB to facilitate cross-chain operations, allowing the token to be transferred seamlessly across chains while adhering to the OFT standard.

The AsBnbOFTAdapter contract serves as an adapter that integrates the AsBNB token with the LayerZero framework. It manages the locking and unlocking of tokens for cross-chain transfers, ensuring the token remains interoperable across multiple chains. TransferLimiter adds an additional layer of control by enforcing transfer rate limits for cross-chain transactions. It works in conjunction with both AsBnbOFT.sol and AsBnbOFTAdapter, providing safeguards against excessive or unauthorized transfers.

#3.2.5 Astherus Price Oracle Solution

The Astherus protocol uses a combination of Pyth Oracle, Chainlink, and Binance Oracle where price data from these three oracles is compared to produce the most accurate real-time aggregated prices. Astherus protocol relies on the Pyth Oracle's price as the anchor. For example, if the Pyth Oracle price differs from Chainlink's price by more than 1%, a circuit breaker will be triggered and the transaction will not be completed. For trading pairs where Pyth cannot provide price feeds, Astherus will rely on Binance Oracle as a backup.

#3.2.6 Audits

Astherus has undergone several audits by multiple independent auditors:

-

Salus Security - AstherusVault Audit report - September 2024.

-

Salus Security - Astherus Earn Audit report - September 2024.

-

Salus Security - Astherus asBNB Audit report - December 2024.

-

PeckShield - Astherus asBNB Audit report - December 2024.

A catalog of audit reports is listed in the protocol docs.

#3.2.7 asBNB Market Performance

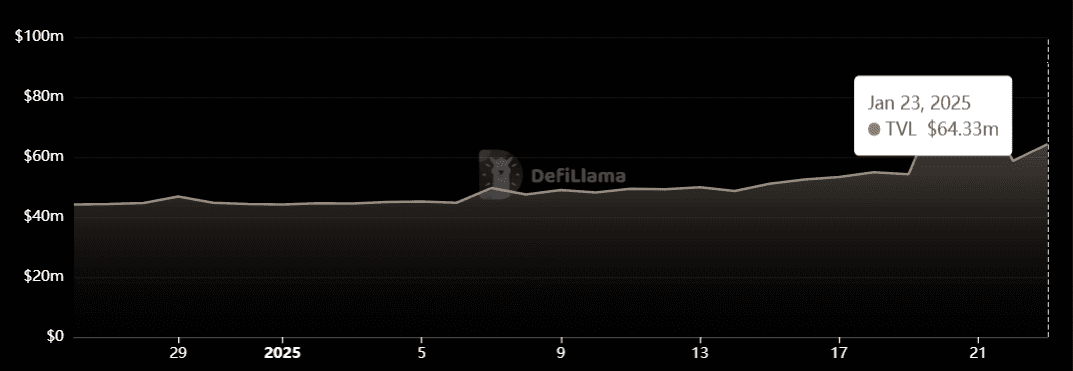

asBNB TVL - 30 days: (source: DefiLlama)

According to DefiLlama, as of January 23, 2025, asBNB holds approximately $64.33 million in Total Value Locked (TVL). The majority of this TVL (95.46%) is comprised of slisBNB, while only 4.54% consists of CAKE tokens.

#Section 4: ynBNBx Strategies

The underlying assets exposure within the ynBNBx MAX LRT is encompassed in several strategies to which it allocates deposited funds. Strategies are modular, meaning that included strategies or allocations to each strategy may change over time. An overview of the existing strategies is given in this section.

#4.1 ynWBNBk Strategy

#4.1.1 Description

ynWBNBk represents a non-yield-bearing tokenized strategy that focuses on the fundamental building block of the BNB Chain ecosystem - wrapped BNB (wBNB). The strategy is designed to provide a secure and efficient way to generate yields through restaking wBNB assets into the Kernel protocol while maintaining a portion in a liquidity buffer to ensure smooth withdrawal operations.

#4.1.2 Advantages & Portfolio Fit

This strategy serves as an excellent foundation for portfolios seeking BNB Chain exposure with minimal risk. By utilizing wBNB as its base asset, it offers one of the most secure positions in the ecosystem, making it particularly attractive for conservative investors. The maintained liquidity buffer ensures that users can access their funds quickly when needed, eliminating concerns about withdrawal delays. This strategy fits well as a core position in diversified portfolios, providing steady returns while maintaining high liquidity and lower risk exposure compared to more complex derivative strategies.

#4.1.3 Mechanism & Asset Features

The strategy operates on wBNB, which is a wrapped version of BNB that maintains a 1:1 peg with the native token. This underlying asset benefits from being the most liquid and widely accepted token on the BNB Chain, with minimal smart contract risk due to its straightforward nature. The strategy implements a sophisticated balancing mechanism that optimally distributes assets between active staking in the Kernel protocol and a liquid reserve. This dual-purpose approach ensures both yield generation through Kernel staking rewards and immediate withdrawal capability through the maintained buffer. The system automatically manages rebalancing operations to maintain optimal ratios between staked and liquid portions, maximizing efficiency while prioritizing security and accessibility.

#4.2 ynClisBNBk Strategy

#4.2.1 Description

ynClisBNBk represents an advanced yield optimization strategy that harnesses the potential of clisBNB (Collateralized Lista Staked BNB) to generate enhanced returns. This strategy uniquely combines the benefits of Lista DAO's staking infrastructure with Kernel protocol integration, creating a sophisticated yield-generating mechanism that operates across multiple protocol layers.

#4.2.2 Advantages & Portfolio Fit

The strategy offers a compelling value proposition for investors seeking moderate risk with enhanced yield potential. By leveraging the Lista DAO ecosystem, it provides exposure to one of the leading protocols on BNB Chain while maintaining a balanced risk profile. This strategy is particularly well-suited for portfolios looking to diversify their yield sources while maintaining a connection to the underlying BNB asset. The dual benefit of Lista DAO rewards and Kernel protocol integration makes it an attractive option for investors who want to optimize their returns without taking on excessive risk.

#4.2.3 Mechanism & Asset Features

At its core, the strategy utilizes clisBNB, a sophisticated derivative asset that represents collateralized positions within the Lista DAO ecosystem. This underlying asset provides unique advantages through its integration with slisBNB, enabling multiple yield-generating opportunities. The strategy's operational mechanism involves a complex interplay between Lista DAO's staking infrastructure and Kernel protocol benefits. It automatically manages reward collection and reinvestment processes, optimizing returns through strategic allocation and compound interest effects. The system carefully balances exposure between different protocols to maximize yield while maintaining the security of the underlying assets, implementing automatic rebalancing when necessary to maintain optimal performance.

#4.3 ynAsBNBk Strategy

#4.3.1 Description

ynAsBNBk represents the most yield-aggressive strategy in the suite, leveraging asBNB (Astherus Staked BNB) to maximize returns through deep integration with both the Astherus ecosystem and Kernel protocol. This strategy is designed to capture multiple layers of rewards and benefits, making it a powerful tool for yield optimization in the BNB Chain ecosystem.

#4.3.2 Advantages & Portfolio Fit

This strategy stands out by offering the highest potential yield among the three options, making it particularly attractive for yield-focused investors who understand and accept higher risk exposure. The deep integration with the Astherus ecosystem provides unique advantages, including enhanced reward multipliers and additional protocol benefits. It's ideally suited for portfolios that prioritize maximizing returns and are comfortable with the additional complexity and risk factors associated with sophisticated DeFi strategies. The strategy's ability to capture multiple reward streams makes it an excellent choice for the yield-seeking portion of a diversified portfolio.

#4.3.3 Mechanism & Asset Features

The strategy is built around asBNB, a liquid staking derivative from the Astherus protocol that offers inherent yield-generating capabilities. A key feature is the Kernel protocol's 2.5x point multiplier for asBNB staking, significantly enhancing the reward potential. The operational mechanism involves sophisticated integration with multiple protocols, capturing rewards from base staking, Kernel points multiplication, and additional protocol incentives. The strategy employs advanced automation for reward harvesting and reinvestment, optimizing compound effects while maintaining efficient capital utilization. This complex system carefully manages the interaction between different protocol layers to maximize returns while maintaining operational security and efficiency.

#Section 5: Conclusion

Having covered the core dependencies that make up the ynBNBx MAX LRT, here we emphasize the risk profile inherent to products that involve multiple layers of composability across various financial applications.

#5.1 Underlying Assets Risk

ynBNBx's underlying asset structure presents a multi-layered risk profile that requires careful consideration. These risks can be categorized into several key areas:

#5.1.1 Technical Risk

-

Restaking protocol risk: Restaking protocols are a relatively recent protocol category within DeFi and undergo continuous development. Protocols may introduce new features that alter their properties and have implications for risk to supplied capital.

-

Protocol complexity: Novel protocol designs with complex yield generating strategies may increase the possibility of unfound bugs that may result in loss of funds.

-

Proxy risk: Even in mature protocols that have undergone audits, additional bugs may be introduced during contract upgrades.

#5.1.2 Operational Risk

-

Liquidity risk: Some protocols may not always allow immediate redemptions, such as unstaking cooldown periods or lending platforms that become temporarily illiquid. If immediate access to capital is a priority, users should understand under what conditions redemptions may be inhibited.

-

Dependency risk: Underlying assets may rely on an oracle as an off-chain service to preserve the proper operation of the protocol and manage accounting processes. Failure or malicious action by oracle services can result in loss of funds.

#5.1.3 Centralization Risk

-

Governance/Access Control Risk: Protocols may depend on an admin to manage protocol operations, which may be an EOA, multisig, or DAO governance. There are risks associated with each type of admin, so users should be aware of who retains admin privileges and what restrictions are placed on their capabilities.

-

Regulatory Risk: Protocols may depend on businesses for proper operation, and those may be subject to scrutiny of local regulatory agencies. Clarity around compliance practices and the proper standing of essential service providers is necessary to ensure there are not disruptions in operation.

#5.2 Strategies Risk

The ynBNBx MAX LRT comprises a balance between risk-reward optimization as reflected in its strategies composition. Exposure to multiple underlying strategies allows flexibility in the yield sources across several underlying protocols. These strategies seek to diversify across categories of yield sources and come with tradeoffs in terms of their risks.

The main purposes of the ynWBNBk strategy are to balance wBNB allocations for immediate use cases, produce optimized yield while preserving baseline stability of pure BNB exposure, and ensure a strong liquidity buffer for the MAX LRT. On the other hand, both ynClisBNBk and ynAsBNBk generate higher yields by taking advantage of Binance's off-chain capabilities via Launchpool in a hybrid way (i.e. on-chain and off-chain yield).

This composition creates a distinct hierarchical risk structure, with wBNB serving as the foundational base asset. wBNB can be directly used for minting either slisBNB or clisBNB liquid staking derivatives. However, slisBNB holds a unique position as a secondary asset, being the only full-featured liquid staking derivative in the ynBNBx ecosystem.

slisBNB is used as collateral for both clisBNB and asBNB assets. More precisely, in clisBNB's case, it acts as an important liquidity component because clisBNB is a non-transferable token but is used as collateral in the CDP protocol (for minting lisUSD). For asBNB, slisBNB is used in both the minting and redemption processes (in the minting process, from the user perspective, WBNB can be used but will be swapped into slisBNB).

#5.3 Conclusion

ynBNBx is a MAX LRT designed to leverage composability with a diverse range of assets, staking mechanisms, restaking protocols, and lending protocols. Users are strongly encouraged to gain a comprehensive understanding of the MAX LRT's underlying dependencies to accurately evaluate its overall risk profile. The performance and value of the MAX LRT are subject to various risks, including technical failures, operational challenges, and adverse market conditions, which could impact the underlying assets and, in turn, the value of ynBNBx.