A brief overview of the Aave IRM and opportunities to merge with TradFi via RWA onboarding

Useful Links:

#Introduction

#Interest Rates in Traditional Finance

In traditional finance (TradFi), interest rates are typically determined by central banks or monetary authorities, such as the Federal Reserve in the United States or the European Central Bank (ECB). These institutions base their decisions on macroeconomic factors, including inflation, economic growth, and employment levels. Central banks set target interest rates to influence borrowing, spending, and investment within the economy. For instance, the ECB's interest rate decisions aim to manage inflation, foster economic growth, and maintain employment levels within the eurozone.

Once an interest rate decision is made, it is implemented through several mechanisms. These include adjustments to the minimum reserve requirements for banks, the execution of open market operations, and setting the discount rate. This complex procedure involves multiple governmental stakeholders acting by a normatively stipulated playbook, ensuring a coordinated approach to monetary policy.

#Consequences of Interest Rate Policies

Whether conventional or negative, interest rate policies have significant effects on various aspects of the economy.

According to the International Monetary Fund (IMF), interest rate cuts are expansionary and lead to increased consumer spending. Lower interest rates encourage borrowing, making mortgages, car loans, and credit more affordable. As a result, consumers are likely to spend more on big-ticket items, boosting economic activity.

Conversely, if interest rates are increased, it becomes more expensive to borrow money. This can decrease consumer spending as borrowing costs rise, making it less attractive to take out loans for purchases. The impact of interest rate increases is contractionary, as highlighted by the IMF.

Changes in interest rates can also influence investment decisions by individuals and businesses. Lower interest rates incentivize businesses to borrow for expansion or investment in new projects. In comparison, higher interest rates may lead to decreased investment due to increased borrowing costs.

However, it is important to note that the full effects of interest rate policies on economic behavior may unfold over time and exhibit delayed effects in certain instances. Factors such as market expectations, the time required for financial institutions to adjust lending rates, and overall economic conditions can contribute to delays in monetary policy transmission. These delays are known as the "long and variable lags" of monetary policy, where the impact of interest rate changes may take time to permeate through the economy and manifest in changes in consumer spending and investment.

#DeFi Interest Rates

Contrary to TradFi, where setting interest rates is a multifaceted process involving governmental entities, interest rates in decentralized finance (DeFi) are determined by the supply and demand of capital according to a predefined algorithmic function. Nevertheless, manual adjustments can also be made without inherently contradicting or hindering the progression of smart contract logic. In the section below, we will examine the intricacies of algorithmic design and the potential for governance intervention and adjustments within the context of AAVE.

Ultimately, the fundamental objective of the interest rate models is to optimally equilibrate lending and borrowing demand within a pooled liquidity paradigm. This must be reconciled with assurances of immediate access to funds by maintaining sufficient liquidity such that depositors can reasonably withdraw at any time.

#Section 1: AAVE IRM Overview

In the AAVE protocol, the interest rate model is specifically designed to manage liquidity dynamically within the system. By adjusting interest rates based on the utilization of available liquidity, the protocol aims to maintain sufficient liquidity in the pool to meet withdrawal demands while optimizing returns for both lenders and borrowers.

#1.1 Utilization Rate

A key metric in AAVE's interest rate model is the utilization rate, calculated as the ratio of borrowed funds to the total available liquidity in the pool. The utilization rate is a critical indicator of borrowing demand relative to the supply of funds. A high utilization rate signifies strong borrowing demand, prompting an increase in interest rates to attract more liquidity into the pool. Conversely, a low utilization rate indicates ample liquidity, resulting in lower interest rates to encourage borrowing.

AAVE offers two distinct interest rate models, Variable and Stable, to accommodate different borrower preferences and risk tolerances.

#1.1.1 Variable Interest Rate Model

The Variable Interest Rate Model is designed to respond dynamically to market conditions, particularly the utilization rate of the liquidity pool. It adjusts interest rates based on the demand for borrowing and the available liquidity, ensuring a responsive and adaptive mechanism.

Optimal utilization is a crucial parameter in AAVE's interest rate model, established through protocol governance. It denotes the utilization rate at which the interest rate curve's slope changes, maintaining an optimal balance between liquidity supply and demand. A gentle slope before reaching Optimal Utilization helps ensure sufficient liquidity for lending and borrowing activities. After reaching Optimal Utilization, higher interest rates attract more lenders by offering higher returns.

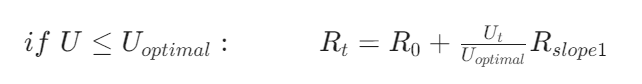

The interest rate in the Variable Interest Rate Model increases in two distinct segments based on the utilization rate:

- Under Optimal Utilization: In this range, the interest rate increases gradually along the utilization range. This slow increase encourages borrowing and liquidity provision, fostering a balanced market environment. The formula used in this segment is designed to gradually adjust the rates to maintain a healthy level of borrowing and liquidity.

Source: Aave Docs

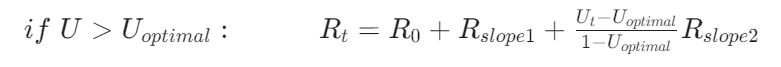

- Above Optimal Utilization: The interest rate increases sharply once the utilization rate surpasses the optimal threshold. This significant rise discourages excessive borrowing and encourages repayments, thereby protecting the liquidity pool from being over-leveraged. The formula for this segment ensures a sharp escalation in interest rates to maintain stability within the liquidity pool.

Source: Aave Docs

slope2 is an integral feature designed to prevent the pool from nearing 100% utilization, which would render the supplied positions illiquid. By increasing the parameters of slope2, the model incentivizes users to respond to high utilization levels more promptly. Any upward adjustment of slope2 would further encourage borrowers to repay their debts more swiftly, facilitating a return to the optimal utilization range.

The Variable Interest Rate Model is particularly suitable for volatile markets where borrowing needs may frequently change. Its flexibility allows for quick responses to market conditions, ensuring that liquidity levels remain optimal without a decline. This model is ideal for users who can tolerate interest rate fluctuations and prefer potentially lower rates during periods of low utilization.

#1.1.2 Stable Interest Rate Model

Note: The Stable Interest Rate Model was fully deprecated in April 2024 due to a critical bug associated with the stable borrow rate. Despite the limited scope of affected assets, the necessity of a comprehensive fix led to halting new borrowings under the stable rate. All existing stable rate positions were moved to the variable rate model in executing V2 Stable Debt Offboarding governance decision.

The model overview below is provided for informative purposes only, offering the readers the opportunity to compare the characteristics of the legacy stable interest model against the currently active variable interest model.

The Stable Interest Rate Model provides borrowers with a fixed interest rate when borrowing, which remains constant until specific rebalancing conditions are met.

The stable rate can be adjusted (rebalanced) under certain conditions to align with current market rates and prevent imbalances. Rebalancing is triggered if the current stable rate is significantly lower than the prevailing variable rate. Specifically, if the current supply rate is less than or equal to 0.9 times the supply rate, assuming all borrows were at the variable rate, the protocol may initiate rebalancing. The validateRebalanceStableBorrowRate function is called to verify the conditions for rebalancing, which include checking if the reserve is active, not paused, and if the current liquidity rate justifies rebalancing.

This rebalancing mechanism ensures that interest rates remain competitive and fair for borrowers and depositors. The protocol maintains a balanced interest rate market by adjusting stable borrow rates when they fall significantly below variable rates.

The Stable Interest Rate Model proved suitable for long-term loans where the predictability of payments was more critical than the potential for lower rates. Assets most exposed to liquidity risk did not offer stable rate borrowing. Additionally, within the stable model framework, the interest rates used to be generally higher than those in the variable rate model to account for the stability and predictability they provide.

#1.2 V3 Asset IR Categories

#1.2.1 Categories Presets

AAVE V3 markets generally utilize three distinct interest rate categories based on the risk profiles of the included assets. These categories cater to different asset characteristics, aiming to ensure liquidity and risk management across the protocol. However, it's important to note that these categories serve as a baseline and can be fine-tuned or adjusted on a per-asset basis to accommodate better the unique properties and market dynamics of individual assets within the protocol.

-

Rate Strategy Volatile One: This strategy is tailored for volatile assets that require constant liquidity, such as AAVE, BAL, CRV, and similar cryptocurrencies. The primary objective is to ensure liquidity availability to support liquidations and mitigate risks associated with price fluctuations. The strategy features a low Optimal Utilization rate of 45%, reflecting the need for higher liquidity. After reaching Optimal Utilization, a high Slope2 of 300% ensures a rapid increase in interest rates, discouraging excessive borrowing and preserving liquidity.

-

Rate Strategy Stable One: This strategy targets low liquidity stablecoins like DAI, which have a higher risk of liquidity crunches but are less volatile than cryptocurrencies in the volatile category. The parameters are set with a high Optimal Utilization rate of 90%, balancing liquidity provision and borrowing costs. The Slope2 parameter is set at 60%, preventing rapid liquidity depletion by moderately increasing interest rates.

-

Rate Strategy Stable Two: This strategy is intended for high liquidity stablecoins, such as USDC and USDT, which are widely used and have a lower risk of liquidity issues. The objective is to encourage borrowing while maintaining liquidity availability. The strategy features a high Optimal Utilization rate of 80%, reflecting these stablecoins' higher liquidity and lower risk. A Slope2 parameter of 75% ensures competitive borrowing costs even at higher utilization rates.

#1.2.2 Parameter Customization

In practice, significant deviations from these predefined boundaries are often observed. The flexibility is necessitated by the freedom granted to risk providers. While detailed rationales are seldom disclosed, risk providers consider various market dynamics, asset-specific characteristics, and the broader economic environment when making these adjustments. For instance, assets that are frequently used for looping may also require customization.

Continuous market monitoring is mandatory for capturing emerging trends that may impact stablecoin interest rates. For instance, a projected decline in the DAI Savings Rate (DSR) could have ripple effects on the stablecoins rates. In line with this, Chaos Labs recommended aligning Aave's Slope1 parameter closely with the DSR, thus mitigating the risks of rate arbitrage and ensuring that Aave’s interest rates remain competitive relative to broader market conditions.

Custom parameterization is also a strategic tool for migrating users from older to newer protocol versions. A relevant example is the adjustments made to Polygon v2 Borrow Rate.

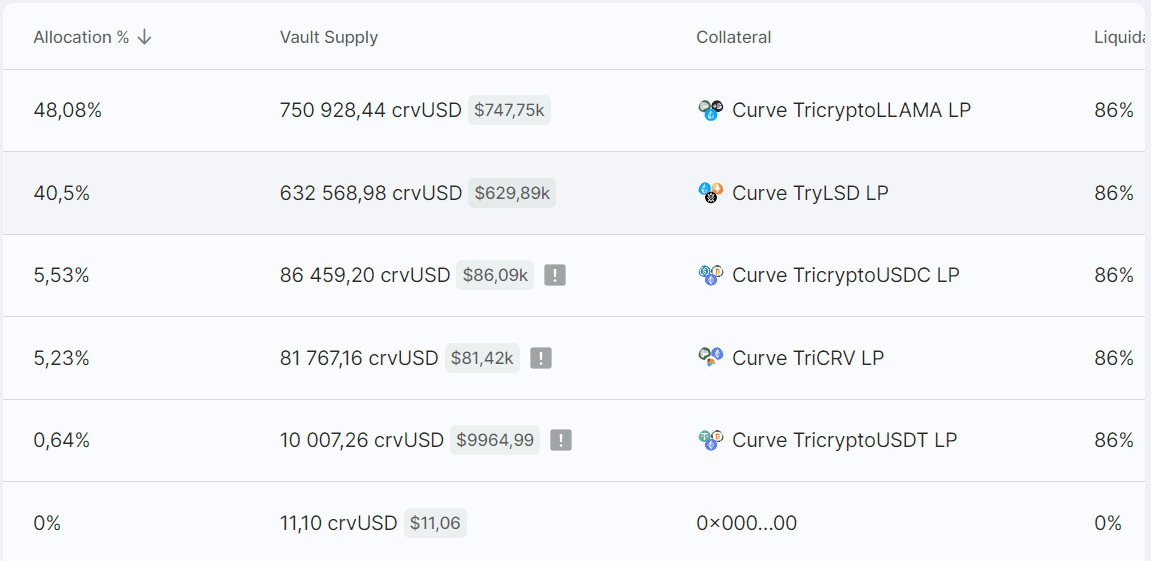

Customizable interest rates offer a flexible approach to managing lending and borrowing markets yet are subjected to governance oversight and implementation. This flexibility is crucial in scenarios where self-adjusting interest rates may fall short. Fully programmatic models may fall short in their ability to provide reasonable user experiences, either through volatile rate adjustment or inability to optimize for changing market conditions. Such shortcomings supposedly have influenced Morpho's design choices, where idle funds should be allocated to a separate market, thereby giving risk curators control over rate adjustments despite an ostensibly fully programmatic IRM.

Source: LlamaRisk crvUSD Vault

#1.3 Supply and Borrow

The supply rate in AAVE is the interest rate earned by users who supply assets to the liquidity pool. This rate is derived from the borrow interest rate paid by borrowers and is influenced by the utilization rate of the liquidity pool. Additionally, the reserve factor, representing a portion of the interest paid by borrowers reserved for the protocol, is considered in supply rate calculations. The supply rate annual percentage yield (APY) for each asset is displayed on the protocol's front end.

AAVE V3 calculates compound interest for deposits based on the platform's algorithm and interest rate curves. When users deposit assets into the AAVE V3 lending pool, they earn interest over time, compounded periodically. Interest compounding occurs when the liquidity index is updated during state-changing transactions such as Supply, Borrow, Repay, or Withdraw. The calculateLinearInterest function updates the liquidity index, ensuring efficient interest calculation and optimization of gas costs.

Borrow interest compounds continuously, accruing every second. The continuous compounding mechanism is implemented through the calculateCompoundedInterest function, balancing accuracy and gas efficiency, making it suitable for long-term borrowing. Variable borrow interest accrues with any borrower's action, while stable borrow interest accrues on specific borrower's actions, ensuring appropriate interest compounding for different borrowing scenarios.

AAVE V3 also imposes certain limitations through Borrow and Supply Caps, configured via AAVE governance. Borrow Caps regulate borrowing limits for each asset, mitigating insolvency risks. Supply Caps limit the amount of a specific asset supplied to the protocol, ensuring overall system stability.

#Section 2: Institutional Reflections

This section includes the reflections of central banks on the behavior of DeFi interest rates and the potential advantages of decentralized lending platforms like Aave. Furthermore, it hints at the convergence of TradFi and DeFi through the adoption of RWAs, most notably tokenized U.S. Treasuries.

#2.1 Banque de France Reflections

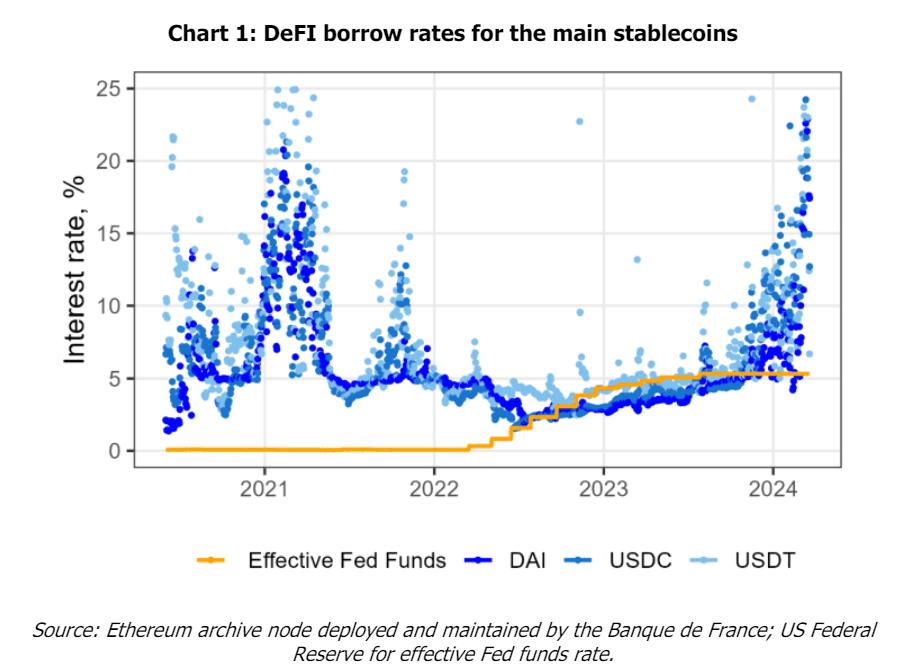

DeFi interest rates have garnered the attention of national authorities. Recently, the French Central Bank observed the mechanics of interest rates within the DeFi ecosystem. In examining historical data on DeFi borrow rates for several stablecoins, the Banque de France highlighted a significant disconnect between DeFi interest rates and those in traditional financial markets. Referencing studies on the impact of monetary tightening, the central bank noted that higher policy rates could incentivize lenders to shift away from DeFi in favor of higher conventional interest rates. Additionally, elevated policy rates may deter borrowers from engaging in risky leveraged positions within DeFi, leading to reduced stablecoin borrowing on DeFi platforms. This shift could cause DeFi interest rates to decline, moving in the opposite direction of central bank rates.

Source: Banque de France Blog

The Banque de France's observations indicate that since the end of 2023, DeFi interest rates have significantly exceeded Federal Reserve rates, likely due to the popularity of Bitcoin ETFs, which has spurred strong demand for leveraged Bitcoin positions. In conclusion, the central bank posits that DeFi rates are primarily driven by demand for crypto assets. Consequently, traditional monetary policy transmission to these rates is limited, rendering it a secondary factor in determining their levels.

#2.2 BIS Reflections

The Monetary and Economic Department of the Bank for International Settlements (BIS) also conducted a study on DeFi lending, particularly examining Aave v2. The report delineates the DeFi lending mechanism, contrasting it with traditional banking, where central banks and regulatory policies influence interest rates. The study underscores that the "low-for-long" interest rate environment in advanced economies has intensified the search for yield among users in DeFi lending pools. Low traditional interest rates drive investors towards DeFi platforms for higher returns.

Findings from the BIS report suggest that DeFi interest rates are highly responsive to market conditions, reflecting real-time supply and demand dynamics. This responsiveness implies that DeFi interest rates can be more flexible and adaptable to market conditions than traditional finance rates, offering a dynamic alternative for investors seeking better returns. The real-time adjustment of interest rates in DeFi presents a compelling case for its potential advantages over traditional financial systems, particularly for investors prioritizing yield optimization.

#2.3 Tokenized T-Bills

The adoption of tokenized T-bills in the DeFi ecosystem demonstrates the significant advancement in yield optimization strategies, particularly in maximizing returns at specific temporal junctures.

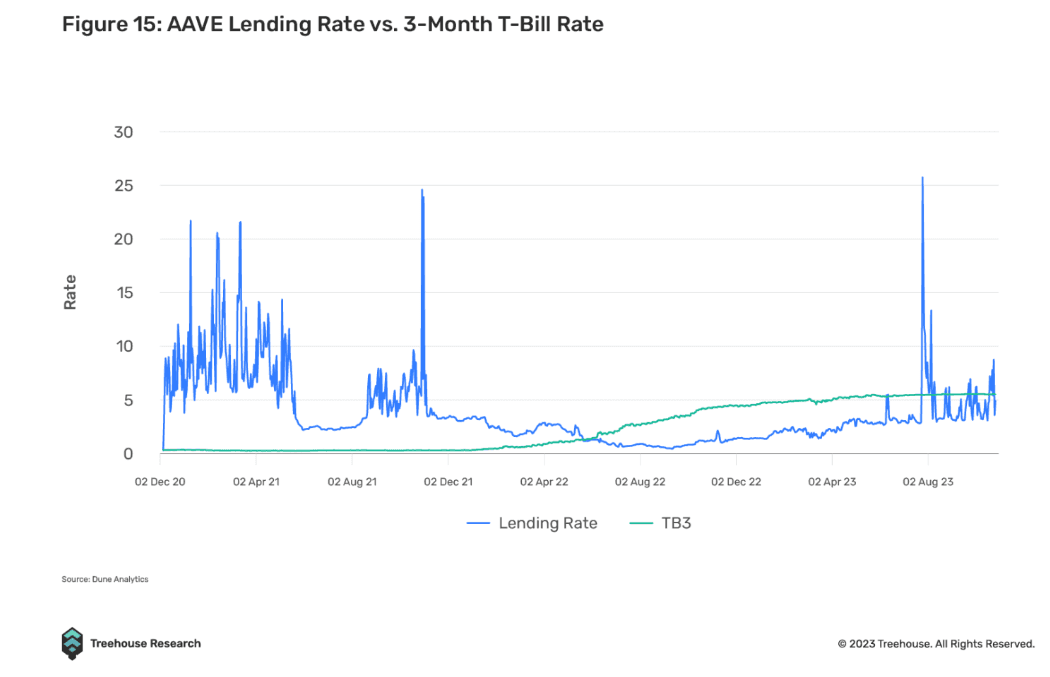

Analyzing market trends in June 2023 reveals a notable shift in the yield landscape. The data indicates a divergence between T-bill yields and the lending rates of major stablecoins such as USDC and USDT. This phenomenon is particularly evident in the comparative performance of the US 3-month Treasury Yield against the lending rates offered for USDC and USDT on AAVE.

Source: TRHX Research

Factors such as the Treasury yield surge further influenced the observed trend. Over $1 billion in U.S. Treasury notes are reportedly being tokenized on public blockchains, which is fueled by the substantial increase in Treasury yields from 1.69% to 4.22%. Moody's has even awarded an investment-grade "A-bf" rating to OpenEden's tokenized T-Bills.

These instruments initially emerged as an attractive option during subdued on-chain yield environments. The appeal of tokenized treasuries in such contexts was rooted in their ability to offer relatively stable returns.

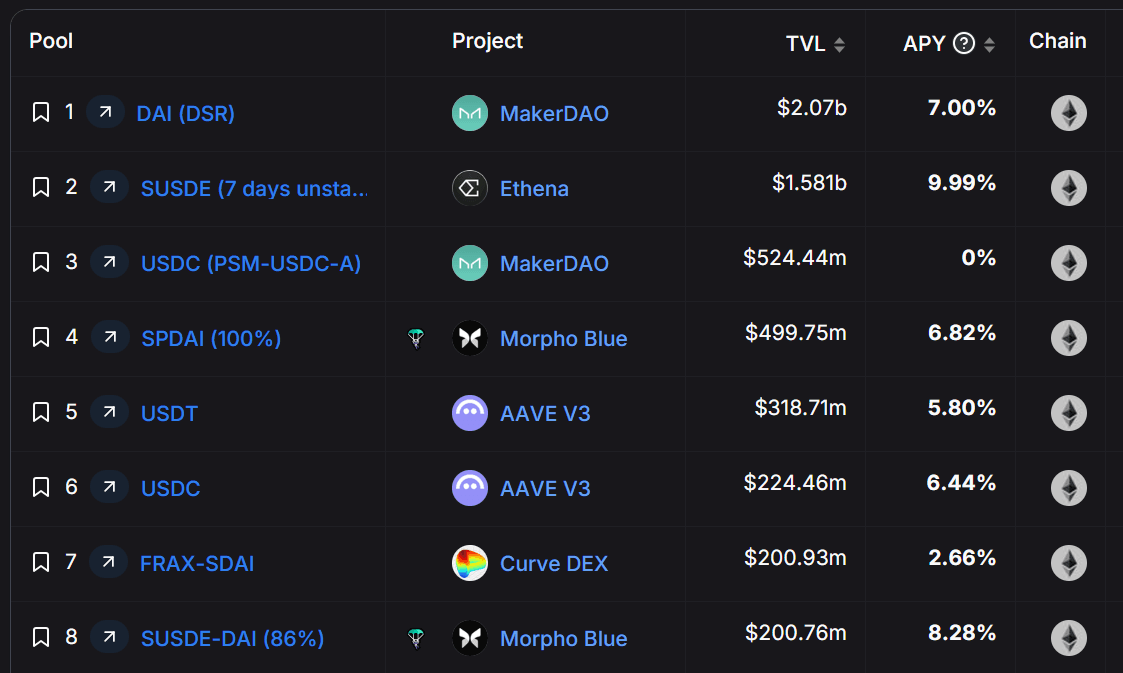

As the broader interest rate environment has evolved, we observe a notable transformation in the yield hierarchy. As a result, tokenized treasuries started losing their competitive edge against more agile and yield-responsive DeFi-native yield sources. Lending protocols or yield-bearing stablecoins currently offer more lucrative APYs.

Source: DefiLlama Yield

The adaptability of DeFi protocols stands as a testament to the sector's innovative capacity and responsiveness to broader financial market dynamics. These protocols have demonstrated a remarkable ability to swiftly adjust to fluctuating interest rates in traditional finance, effectively bridging the gap between conventional monetary policy shifts and decentralized financial systems.

#Conclusion

The evolution of interest rate models in decentralized finance, exemplified by AAVE's sophisticated approach, represents a significant departure from traditional financial systems. While central banks and monetary authorities in TradFi wield considerable influence over interest rates through complex mechanisms and policy decisions, DeFi protocols like AAVE employ algorithmic models that respond dynamically to market conditions and liquidity demands.

The advancements in blockchain technology and the protocols built upon it have enabled responsiveness and flexibility previously unseen in financial systems. With its governance oversight on supply and borrow caps and parameter customization capabilities, AAVE's model demonstrates the crucial role of timely intervention and adjustment in the proper management of lending and borrowing markets.

Observations of the institutional recognition of the AAVE lending model lead to the assumption that the gap between TradFi and DeFi is adequately bridged, paving the way for potential integration and collaboration between these two financial paradigms. The emergence of tokenized T-bills signaled such a possible convergence. AAVE's capacity to integrate T-bill yield strategies showcases an opportunity to merge TradFi with decentralized finance's dynamic nature and competitive edge.

Ultimately, the ongoing development of AAVE's interest rate models represents a significant step towards creating more efficient, transparent, and responsive financial systems. As these models mature and gain institutional recognition, they may shape the future landscape of global finance, offering new paradigms for managing capital flows and economic incentives in an increasingly digital world.