Sep 19, 2024

This is an archive of our post on Aave governance forum. Read the full thread here.

Summary

We want to thank the community for the feedback received so far. Our only objective is to keep Aave safe. As such, we believe action is required. We want to emphasize the following points:

This recommendation is not to offboard WBTC, nor to reduce current exposure.

This proposal seeks to prevent additional loan origination from WBTC during the transition period while minimizing the impact on existing users.

This is a temporary measure that may be relaxed or constrained as needed in light of the transition’s completion.

Setting LTV to 0 does not prevent existing WBTC-collateral borrowers from topping up their account to improve their health factor. We’ve validated this point with @bgdlabs and through this test.

Why we are cautious about WBTC

We believe caution is warranted due to the controversial nature of the upcoming partnership and unresolved questions about BIT Global’s status, joint venture details, and BitGo’s due diligence. While BitGo claims BIT Global cannot divert reserves, the original agreement involved transferring 2/3 of the keys without fully disclosing BIT Global’s licensing status. WBTC has been transparent with public reserves and BitGo’s fiduciary responsibility against rehypothecation. This is promised to continue, but we lack evidence of BIT Global’s custodial legitimacy.

Our previous assessments of Justin Sun-associated assets reaching, at times, multi-billion dollar market caps have revealed an alarming pattern of transparency lapses in major products. These include our risk assessments of TUSD, stUSDT, and USDD. While WBTC isn’t immediately at risk, we lack confidence in maintained standards under the new arrangement.

Implications of setting LTV to 0

Not everyone is expected to immediately grasp the implications of setting LTV to 0. Contributors have diverse priorities, and this is a highly technical detail. We acknowledge our failure to communicate its implications clearly. For clarity, please expand the section below for a worked example. You’re also welcome to join our discussion 2024-09-20T18:00:00Z on Leviathan News.

Imagine you are borrowing USDT against WBTC. Your health factor is at 1.2, so you’re not at risk of liquidation. Suddenly, the bitcoin price decreases, and your health score goes to 1.08, which is too low for your liking. You add more WBTC (or other) collateral without any issue. Your health score is now 1.2 again. You’re not at risk of liquidation.

The price of WBTC rises, so your health score is now 1.35. You decide to borrow more against your WBTC, so your health score is now back to 1.2

After some advanced warning, WBTC Loan To Value is set to 0. This only affects the amount of debt you can take against WBTC collateral.

The price of WBTC goes down. Your health score goes back to 1.08. You can add more WBTC collateral to make the health score 1.2 again. You could also add other collateral to improve your health score (and borrow against it as you wish; only WBTC is affected).

Then, again, the WBTC price rises, and your health score goes to 1.35. You cannot borrow more against your WBTC this time because LTV is set to 0. New users also cannot borrow debt against new WBTC deposits. More WBTC can be supplied to Aave but cannot be borrowed against.

This is the key change under LTV 0. You cannot create new debt. Existing positions can be further collateralized to the original (pre-LTV 0) health score with WBTC collateral.

Alternative options

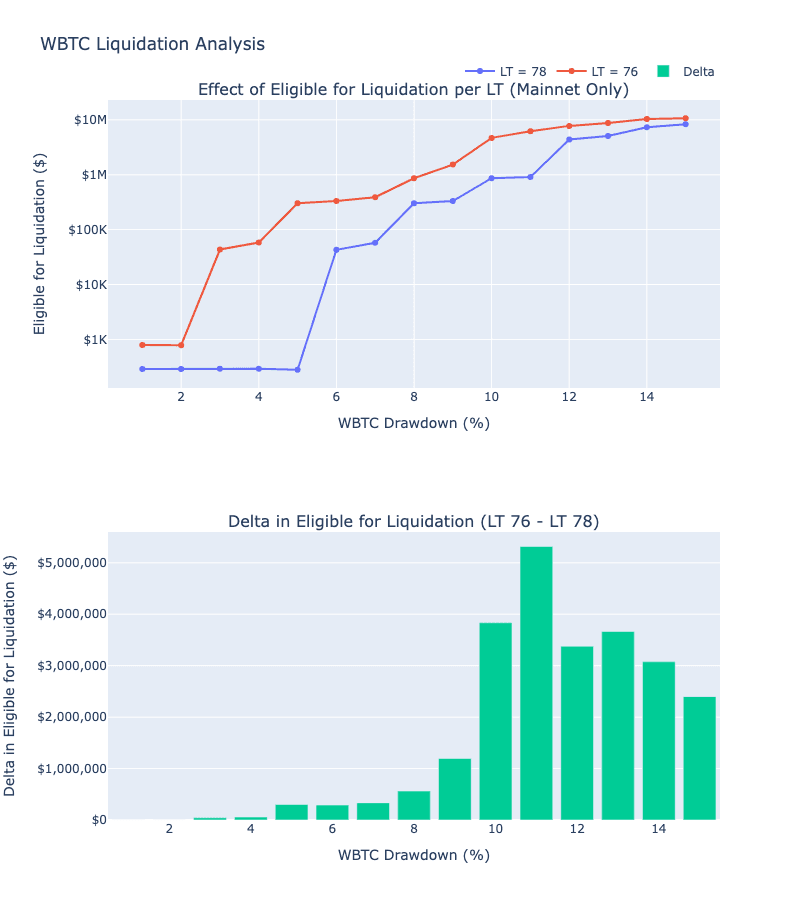

We modeled options like reducing the liquidation threshold (LT) and supply caps. However, these had greater potential adverse effects on users. For example, lowering LT from 78% to 76% on mainnet would significantly increase liquidation risk, especially for small WBTC price drawdowns:

A 5% WBTC drawdown results in an additional $301,588 of positions eligible for liquidation.

The impact is proportionally more pronounced for smaller drawdowns.

Additionally, supply caps would prevent users from adding WBTC to “top up” their loan positions. We concluded that LTV 0 is the lightest touch solution that adequately addresses the risk.

Source: LlamaRisk, September 18th, 2024

Proposed way forward

We will continue to iterate on this recommendation and address the best way forward. To expedite the governance process, we initiated discussions with various service providers and submitted the ARFC before reaching a full consensus. We encourage community members to continue this discussion and welcome any feedback.